PDF (2.36MB) - Energy Policy and Planning Office

PDF (2.36MB) - Energy Policy and Planning Office

PDF (2.36MB) - Energy Policy and Planning Office

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Table 4-6 Wood Residue Characteristics ......................................................................4-14Table 4-7 Corncob Characteristics................................................................................4-16Table 4-8 Cassava Residue Characteristics...................................................................4-19Table 4-9 Distillery Slop Characteristics .......................................................................4-21Table 4-10 Coconut Residue Characteristics ................................................................4-24Table 4-11 Sawdust Characteristics ..............................................................................4-26Table 5-1 General Technical Compatibility Ratings (L-Low, M-Medium, H-High) forVarious Fuels <strong>and</strong> Boiler Types ..................................................................5-4Table 5-2 Steam Generator Technology Comparison for Different Plant Sizes 5-5Table 5-3 Steam Generator Technology Ash Characteristics Comparison 5-6Table 10-1 Summary of Financial Analyses 10-6Table 10-2 Summary Results of Proposed New Power Facilities ...............................10-14Table 10-3 Summary Results of Proposed Facility Modifications .............................10-15Table 10-4 Summary Results of Proposed New Power Facilities ..............................10-16Table 11-1 Summary Results Sommai Rice Mill Facility ............................................11-1Table 11-2 Summary Results Sanan Muang Rice Mill Facility....................................11-2Table 11-3 Summary Results Thitiporn Thanya Rice Mill Facility..............................11-3Table 11-4 Summary Results Plan Creations Facility .................................................11-4Table 11-5 Summary Results Chumporn Palm Oil Facility .........................................11-6Table 11-6 Summary Results Karnchanaburi Sugar Industry Facility .........................11-7Table 11-7 Summary Results Woodwork Creation Facility .........................................11-8Table 11-8 Summary Results Mitr Kalasin Sugar Facility ...........................................11-9Table 11-9 Summary Results Liang Hong Chai Facility ............................................11-10Table 11-10 Summary Results Southern Palm Oil Facility ........................................11-11Table 12-1 Power Purchases from Small Power Producers as of February 2000.........12-8November 7, 2000 TC-4 Final Report

List of FiguresFigure 2-1. Aggregate Potential Net Electric Capacity From Most Viable ResiduesAnd C<strong>and</strong>idate Facility Locations..............................................................2-5Figure 3-1. Fresh Oil Palm Bunch At A Thail<strong>and</strong> Palm Oil Mill. ..................................3-7Figure 3-2. Harvesting Of Rubber From A Parawood Plantation...................................3-8Figure 3-3. Industrial <strong>Energy</strong> Use In Thail<strong>and</strong>. ..............................................................3-9Figure 4-1. Aggregate Potential Net Electric Capacity From Most Viable Residues.....4-3Figure 4-2. Rice Husk Distribution.................................................................................4-7Figure 4-3. Palm Oil Residue Distribution....................................................................4-10Figure 4-4. Bagasse Distribution...................................................................................4-12Figure 4-5. Parawood Residue Distribution..................................................................4-15Figure 4-6. Corncob Distribution..................................................................................4-17Figure 4-7. Cassava Residue Distribution.....................................................................4-20Figure 4-8. Distillery Slop Distribution. .......................................................................4-22Figure 4-9. Coconut Residue Distribution. ...................................................................4-25Figure 10-1. C<strong>and</strong>idate Facility Locations....................................................................10-2Figure 10-2. Baht/Us$ Daily Average Interbank Exchange Rate .................................10-3Figure 10-3. Typical Biomass Power Plant Configuration. ..........................................10-5Figure 12-1. Variation In Sugarcane Output Between 1993 And 1999. .....................12-11List Of AnnexesAnnex 1Annex 2Annex 3Annex 4Annex 5Annex 6Annex 7Annex 8Annex 9Annex 10Rice HuskPalm Oil ResiduesBagasseWood ResiduesCorncobCassava ResiduesDistillery SlopCoconut ResiduesBiomass Questionnaire FormMOU FormNovember 7, 2000 TC-5 Final Report

1.0 Executive Summaryรายงานฉบับยอสารบัญ1.1 บทนํา 1-21.1.1 วัตถุประสงค์1-21.1.2 ขอบข่ายการศึกษา1-21.1.3 ภาพรวมของพลังงานชีวมวล1-31.1.4 โครงการรับซื้อไฟฟ้าจากผู้ผลิตรายเล็ก1-31.2 การประเมินแหล่งชีวมวลในประเทศ 1-41.3 เทคโนโลยี่ที่เหมาะสม1.3.1 ข้อพิจารณาเกี่ยวกับเชื้อเพลิงชีวมวล1.3.2 ทางเลือกการเปลี่ยนพลังงานทางเคมีเป็นพลังงานความร้อน1.4 การคัดเลือกโครงการ1.4.1 การสรรหาและคัดเลืิอกโครงการ1.4.2 บันทึกความเข้าใจ1.4.3 การรวบรวมข้อมูล1.4.4 การประเมินผลเบื้องต้น1-61-61-61-61-61-71-71-71.5 การศึกษาความเป็นไปได้อย่างละเอียด 1-81.6 การส่งเสริมพลังงานชีวมวลในอนาคต1-111.6.1 ความคิดเห็นต่อระเบียบการรับซื้อไฟฟ้า ฯ1-111.6.2 องค์ประกอบอื่นๆที่มีผลกระทบต่อการพัฒนาโรงไฟฟ้าชีวมวล1-121.6.3 สิ่งจูงใจ1-12รายละเอียดตารางตาราง 1-1 ศักยภาพการนำชีวมวลในการนำมาผลิตไฟฟ้าตาราง 1-2 สรุปข้อมูลที่สำคัญของแต่ละโครงการรายละเอียดรูปภาพรูปที่ 1-1 แสดงจังหวัดที่ศักยภาพในการผลิตไฟฟ้าและสถานที่ตั้งของโครงการที่ได้ศึกษาความเป็นไปได้ทั้ง 10 โครงการ1-41-141-51-1

1.1 บทนำรายงานการศึกษาโรงไฟฟ้าชีวมวลของภาคอุตสาหกรรมชนบทขนาดเล็ก ได้จัดทำโดย บ.แบล็คแอนด์วิชช์(ประเทศไทย) จำกัด ตามข้อกำหนดของสำนักงานคณะกรรมการนโยบายพลังงานแห่งชาติ (สพช.) คลอบคลุมสาระ-สำคัญต่างๆ ของพลังงานชีวมวลและผลสรุปการศึกษาความเป็นไปได้ของโรงชีวมวล 10 แห่งรายงานฉบับย่อนี้กล่าวถึงข้อคิดเห็นที่สำคัญ และผลการศึกษาซึ่งประกอบด้วยความเป็นมา การประมาณหาศักยภาพชีวมวลแต่ละชนิด เทคโนโลยี่ที่เหมาะสม ผลสรุปการศึกษาความเป็นไปได้โรงไฟฟ้าชีวมวล และการส่ง-เสริมการใช้พลังงานหมุนเวียนในอนาคตของประเทศไทย1.1.1 วัตถุประสงค์วัตถุประสงค์หลักของการศึกษาคือ พัฒนาโครงการโรงไฟฟ้าชีวมวลให้เป็นแหล่งพลังงานไฟฟ้าของประเทศแหล่งหนึ่ง รวมถึงนำชีวมวลมาเป็นเชื้อเพลิงผลิตไอน้ำและไฟฟ้าเพื่อใช้ในอุตสาหกรรมของตนเองซึ่งเป็นการกำจัดชีวมวลในเวลาเดียวกัน และผลดีอีกประการหนึ่งคือลดการนำเข้าเชื้อเพลิงฟอสซิลจากต่าง-ประเทศ” เป้าหมายเฉพาะของการศึกษานี้คือ• ทบทวนสถานภาพพลังงานชีวมวลในประเทศไทย• ศึกษาความเป็นไปได้ในการก่อสร้างโรงไฟฟ้าชีวมวล ในภาคอุตสาหกรรมชนบทขนาดเล็กจำนวน10 แห่ง เพื่อประมาณหาศักยภาพในการผลิตไฟฟ้าและไอน้า• แสดงผลวิเคราะห์ทางด้านการเงิน เพื่อให้เจ้าของโครงการสามารถตัดสินใจในการดำเนินโครงการต่อไป• ช่วยเหลือเจ้าของโครงการสามารถเริ่มโครงการได้ และเข้าร่วมในโครงการรับซื้อไฟฟ้าจากผู้ผลิตราย-เล็กของการไฟฟ้าฝ่ายผลิตแห่งประเทศไทย(กฟผ.)1.1.2 ขอบข่ายการศึกษาการศึกษาได้แบ่งออกเป็น 3 ขั้นตอน ดังนี้ขั้นตอนที่ 1 รวบรวมข้อมูลและศึกษาความเป็นไปได้เบื้องต้นขั้นตอนนี้เป็นการรวบรวมข้อมูลและศึกษาความเป็นไปได้เบื้องต้น เพื่อหาชีวมวลชนิดใดที่มีศักยภาพเป ็นเชื้อเพลิง อุตสาหกรรมหรือโรงงาน และเทคโนโลยี่ที่เหมาะสมกับโรงไฟฟ้าชีวมวล ตลอดจนถึงการ-ร่างบันทึกความเข้าใจระหว่างสพช.กับเจ้าของชีวมวล และทบทวนระเบียบการรับซื้อไฟฟ้าจากผู้ผลิตรายเล็กขั้นตอนที่ 2 ศึกษาความเป็นไปได้บ.แบล็คแอนด์วิชช์ฯได้ศึกษาความเป็นไปได้ในการก่อสร้างโรงไฟฟ้าชีวมวล จำนวน 10 แห่ง (ใช้เชื้อเพลิงอาทิเช่น แกลบ ชานอ้อย เศษไม้ ฯลฯ) ซึ่งกระจายอยู่ทั่วทุกภาคของประเทศ รายงานของการ-ศึกษาฯนี้ได้แนบไว้ต่างหาก ซึ่งมีหัวข้อหลักๆ คือผลการศึกษาด้านเทคนิค เศรษฐกิจ การเงิน การพาณิชย์เศรษฐกิจสังคม สภาพแวดล้อม กฎหมาย และ การเมืองขั้นตอนที่ 3 ช่วยเหลือเจ้าของโครงการในการพัฒนาโครงการบ.แบล็คแอนด์วิชช์ฯได้เสนอผลการศึกษาความเป็นไปได้ และช่วยเหลือในการพัฒนาโครงการเบื้องต้นต่อเจ้าของโครงการ พร้อมกันนี้ได้จัดทำคู่มือการพัฒนาโครงการโรงไฟฟ้าชีวมวลสำหรับผู้ผลิตเอกชนรายเล็กเพื่อเป็นแนวทางในการดำเนินโครงการต่อไป1-2

1.1.3 ภาพรวมของพลังงานชีวมวลประมาณ 12 % ของพลังงานของโลกมาจากพลังงานชีวมวล เช่น ขยะ วัสดุเหลือใช้ทางการเกษตร มูลสัตว์และพืชให้พลังงานบางชนิด 1 ในประเทศอุตสาหกรรมเชื้อเพลิงเหล่านี้ ได้ถูกนำมาผลิตไฟฟ้าและไอน้ำใช้ในอุตสาห-กรรมขนาดใหญ่ (เช่นโรงงานกระดาษ และ โรงงานน้ำตาล เป็นต้น) ตรงกันข้ามกับประเทศกำลังพัฒนาส่วนใหญ่ใช้ชีวมวลเป็นเชื้อเพลิงในการหุงต้มและอุตสาหกรรมขนาดเล็กซึ่งยังไม่มีประสิทธิภาพ และสร้างมลภาวะต่อสภาพ-แวดล้อม แต่การเพิ่มขึ้นของรายได้และอุตสาหกรรมจะเป็นตัวผลักดันให้มีการใช้เทคโนโลยี่ชีวมวลที่มีประสิทธิภาพมากขึ้นและสะอาดขึ้นถ้ามองในด้านเศรษฐศาสตร์ เชื้อเพลิงชีวมวลเสียเปรียบเชื้อเพลิงฟอสซิล แต่ถ้านำเรื่องการทำลายสภาวะ-แวดล้อมมาร่วมด้วย เชื้อเพลิงชีวมวลมีข้อได้เปรียบ กล่าวคือ เชื้อเพลิงชีวมวลมีความหนาแน่นน้อยกว่า ให้พลังงานน้อยกว่า มีน้ำหนักเบากว่าเชื้อเพลิงฟอสซิลและยากในการจัดการกว่า แต่เชื้อเพลิงชีวมวลมีข้อดีด้านสิ่งแวดล้อม คือมีขึ้นใหม่ทุกปี ไม่ก่อให้เกิดสภาวะเรือนกระจก (การเผาไหม้ของชีวมวลให้ก๊าซคาร์บอนไดออกไซด์ไม่เกินกว่าที่พืชได้ดูดซับไว้ระหว่างการเจริญเติบโต) มีกำมะถันน้อยกว่า(จึงทำให้เกิดก๊าซซัลเฟอร์ไดออกไซด์น้อยกว่า) และอุณหภูมิเผาไหม้ต่ำกว่า(ช่วยลดก๊าซไนโตรเจนออกไซด์ได้มากกว่า) อย่างไรก็ตามประโยชน์เหล่านี้จะเกิดขึ้นได้ต่อเมื่อชีวมวลถูกใช้ไปอย่างมีประสิทธิภาพและไม่สร้างมลภาวะต่อสภาพแวดล้อมเท่านั้น ด้วยเหตุผลนี้ควรนำเทคโนโลยีใหม่ๆทันสมัยมาทดแทนของเดิมในประเทศไทยมีการใช้ประโยชน์จากชีวมวลเป็นแหล่งพลังงานในอุตสาหกรรมโดยเฉพาะในชนบท และภาคการเกษตร เช่นโรงงานน้ำตาล โรงสีข้าว โรงสกัดน้ำมันปาล์ม และอุตสาหกรรมไม้ยางพารา แปรรูป ถึงแม้พลังงานชีวมวลมีอัตราเพิ่มขึ้น 8 % ต่อปี แต่ยังถือว่าน้อยกว่าอัตราการเพิ่มขึ้นของการใช้พลังงานโดยรวม ส่วนแบ่งการใช้พลังงานชีวมวลที่ถูกใช้ในอุตสาหกรรมตั้งแต่ พ.ศ. 2528 ถึง พ.ศ. 2540 ได้ลดลงอย่างต่อเนื่องจาก 46% เป็น25% สิ่งที่น่าสนใจคือ เมื่อเกิดวิกฤตเศรษฐกิจปีพ.ศ. 2540 การใช้พลังงานในอุตสาหกรรมทั้งหมดมีสัดส่วนลดลงแต่ส่วนแบ่งพลังงานชีวมวลกลับเพิ่มขึ้นเป็น 28 %1.1.4 โครงการการรับซื้อไฟฟาจากผูผลิตรายเล็กอุตสาหกรรมขนาดเล็กที่เกี่ยวของกับการผลิตไฟฟาจากชีวมวล สามารถขายไฟฟาที่เหลือใหแก กฟผ. ตาม ระเบียบการรับซื้อไฟฟาจากผูผลิตรายเล็กโครงการนี้ริเริ่มโดยคณะกรรมการนโยบายพลังงานแหงชาติและดําเนิน- การโดยรัฐวิสาหกิจดานไฟฟา (กฟผ. กฟน. และกฟภ.) ประโยชนที่ไดรับคือเปนการอนุรักษเชื้อเพลิงฟอสซิล ลดการ นําเขาเชื้อเพลิง ประหยัดเงินตราตางประเทศ และทําใหแหลงผลิตไฟฟากระจายตัวออกไป จุดมุงหมายของโครงการ นี้คือใหตระหนักวาผลประโยชนภายนอกดังกลาว มีผลทําใหตนทุนของผูซื้อไฟฟาไมสูงกวาตนทุนจากแหลงอื่นๆโครงการการรับซื้อไฟฟาจากผูผลิตรายเล็กดังกลาวมีเงื่อนไขหลายประการคือ กําหนดปริมาณรับซื้อไมเกิน 60 เมกกะวัตต (อาจสูงถึง 90 เมกกะวัตตในบางพื้นที่) กฟผ. เปนผูรับซื้อแตผูเดียว และการจายเงินมี 2 แบบ แบบแรก จายเฉพาะคาพลังงาน(Non-firm) แบบสองจายทั้งคาพลังงานและพลังไฟฟา (Firm) ซึ่งตองทําสัญญาซื้อขาย 5-25 ป และมีเงื่อนไขอื่นๆเพิ่มเติมอีก ถึงแมแบบสองจะทําใหผูผลิตไฟฟามีรายไดที่แนนอน แตมีเพียง 3 ใน 24 รายเทานั้น ของจํานวนโครงการโรงไฟฟาชีวมวลทั้งหมด 2 นอกจากนี้มีเพียง 6.8 % หรือ 101 เมกกะวัตต จาก 1,491 เมกกะวัตต ที่มาจากพลังงานนอกรูปแบบ 31.2 การประเมินแหล่งชีวมวลในประเทศบ.แบล็คแอนด์วิชช์ฯได้ศึกษาชีวมวล 9 ชนิดคือ แกลบ กากอ้อย กากปาล์ม เศษไม้ กาบมะพร้าว ซังข้าวโพดส่าเหล้า กากมันสำปะหลัง และขี้เลื่อย สิ่งที่ได้ศึกษาคือปริมาณคงเหลือ การกระจายตัว กำลังการผลิต การคาดการณ์-ผลผลิตในอนาคต อุตสาหกรรมที่เกี่ยวข้อง ราคา และความเหมาะสมที่จะนำมาเป็นเชื้อเพลิงเพื่อผลิตไฟฟ้า1 “World <strong>Energy</strong> Council, Renewable <strong>Energy</strong> Resource: Opportunities <strong>and</strong> Constraints 1990-2020, 1993”2 NEPO Website, www.nepo.go.th/power/pw-spp-purch00-02-E.html3 Arthur Anderson, “Thail<strong>and</strong> Power Pool <strong>and</strong> Electricity Supply Industry Reform Study- Phase 1 Final Report,”Volume 5, March 1, 2000.1-3

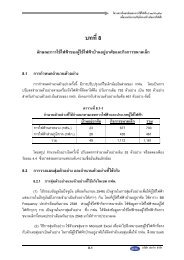

ตาราง 1-1 แสดงข้อมูลศักยภาพของชีวมวลที่นำมาใช้ในการผลิตไฟฟ้า มี แกลบ กากอ้อย กากปาล์ม และเศษไม้(รวมขี้เลื่อย) เชื้อเพลิงอื่นๆไม่ได้ระบุในที่นี้ ได้ตรวจสอบแล้วพบว่าไม่เหมาะสมหลายเหตุผลด้วยกันคือ ซัง-ข้าวโพด และกาบมะพร้าวโดยทั่วไปอยู่กระจัดกระจายยากแก่รวบรวม เหมาะเป็นเชื้อเพลิงเสริมไม่เหมาะเป็นเชื้อ-เพลิงหลักในการผลิตไฟฟ้า ส่วนกากมันสำปะหลังและส่าเหล้ามีความชื้นสูงไม่ค่อยเหมาะนำมาเป็นเชื้อเพลิงปริมาณผลผลิต, ล้านตัน/ปีปริมาณชีวมวลเหลือใช้, ล้านตัน/ปี *ค่าความร้อนสูงสุด, กิโลจูลส์/กก.อัตราการกินเชื้อเพลิง, ตัน/เมกกะวัตต์-ปี**ปริมาณไฟฟ้าที่ผลิตได้, เมกกะวัตต์ตาราง 1-1ศักยภาพของชีวมวลในการนำมาผลิตไฟฟ้าแกลบ กากปาล์ม กากอ้อย เศษไม้202.3-3.714,1009,800234-375หมายเหตุ:* หลักเกณฑในการประเมินปริมาณชีวมวลแตละชนิดมีดังนี้แกลบ - ประเมินจากโรงสีขาวที่มีขนาดกําลังผลิต 100 ตันขาวเปลือก/วันขึ้นไป2.20.41-0.7410,80014,05033-53กากปาลม - ประเมินจากโรงงานสกัดน้ํามันปาลมดิบที่ไดมาตรฐาน จํานวน 17 โรง ประกอบดวยกะลาไฟเบอรและทะลายเปลากากออย - ประเมินจากโรงงานผลิตน้ําตาลทราย จํานวน 46 โรงเศษไม - ประเมินจากเศษไมและขี้เลื่อยของโรงเลื่อยไมทั่วๆ ไป และโรงงานแปรรูปไมยางพาราและจากจํานวนปลายไมของสวนยางพารา** ประเมินจากกำลังการผลิตไฟฟ้าที่ 85%502.25-3.510,00014,100160-2485.81.810,00015,500118ศักยภาพในการผลิตไฟฟ้าจากชีวมวลที่ได้ศึกษามา โดยรวมอยู่ระหว่าง 779 ถึง 1,043 เมกกะวัตต์ ค่าที่ได้คำนวณจากปริมาณชีวมวลที่เหลือ และไม่ได้เผื่อในกรณีที่มีการปรับปรุงเพิ่มประสิทธิภาพเครื่องจักรที่ผลิตไฟฟ้าในปัจจุบัน(เช่นโรงงานน้ำตาล) รูป 1-1 แสดงการกระจายตัวของปริมาณชีวมวล 4 ชนิด จังหวัดที่มีศักยภาพผลิตไฟฟ้าสูงคือ สุราษฎร์ธานี สุพรรณบุรี กาญจนบุรี นครสวรรค์ นครราชสีมา อุดรธานี กำแพงเพชร กระบี่ ตรัง และ นครศรี-ธรรมราช รวมกันแล้วประมาณ 300 เมกกะวัตต์1-4

จ.กําแพงเพชรจ.นครสวรรคจ.ขอนแกนจ.กาฬสินรุจ.รอยเอ็ดจ.อุทัยธานีจ.ชุมพรจ.สุราษฎรธานีจ.กระบี่จ.ตรังรูปที่ 1-1 แสดงจังหวัดที่มีศักยภาพการผลิตไฟฟ้าและสถานที่ตั้งของโครงการที่ได้ศึกษาความเป็นไปได้ ทั้ง 10โครงการ1-5

1.3 เทคโนโลยี่ที่เหมาะสมหัวข้อนี้พิจารณาเทคโนโลยี่หลายแบบที่สามารถนำไปใช้กับโครงการชนิดนี้1.3.1 ข้อพิจารณาเกี่ยวกับเชื้อเพลิงชีวมวลประสบการณ์ที่ผ่านมาพบว่า เชื้อเพลิงชีวมวลทุกชนิดสามารถนำมาเผาโดยใช้เทคโนโลยี่การเผาไหม้ต่างๆได้ ถ้าคุณสมบัติของชีวมวลได้มีการวิเคราะห์และพิจารณาอย่างถูกต้องเพื่อใช้ในการออกแบบเชื้อเพลิงชีวมวลเมื่อเปรียบเทียบกับถ่านหิน มีความหนาแน่นน้อยกว่า ให้พลังงานความร้อนต่ำกว่า และมีความยุ่งยากในการขนส่ง นอกจากนี้ขี้เถ้ายังมีส่วนประกอบของอัลคาไลน์ ซึ่งก่อให้เกิดตะกรัน การจับตัวเป็นก้อนและการทำให้ท่อน้ำในหม้อน้ำชำรุดเสียหาย ถ้าเป็นขี้เถ้าแกลบมีลักษณะคล้ายทรายละเอียดทำให้เกิดการกัดกร่อนได้ปัญหาเกี่ยวกับสารอัลคาไลน์แตกต่างกันไปแล้วแต่ชนิดของชีวมวล การแก้ไขที่ดีที่สุดต้องอาศัยประสบการณ์ เช่นโอกาสท่ี่ขี้เถ้าจับตัวเป็นก้อน แม้ว่าสามารถตรวจสอบได้โดยการนำชีวมวลมาวิเคราะห์คุณสมบัติก่อนก็ตาม การลด-อุณหภูมิเผาไหม้ลงช่วยได้เช่นกัน1.3.2 ทางเลือกการเปลี่ยนพลังงานทางเคมีเป็นความร้อนมีเทคโนโลยี่หลายระบบที่ใช้เผาไหม้ชีวมวลได้ดีดังนี้• Mass burn stoker boiler• Stoker boiler (stationary sloping grate, traveling grate, <strong>and</strong> vibrating grate)• Fluidized bed boiler (bubbling <strong>and</strong> circulating)• Gasification with combustion in a close-coupled boiler• Pulverized fuel suspension fired boilerแตละเทคโนโลยี่ที่กลาวมานี้สามารถใชไดกับชีวมวลทุกชนิด แตจะมีขอดี ขอเสีย แตกตางกันออกไป Stoker boiler เปนที่นิยมมากที่สุด แตไมใชดีที่สุด ยกตัวอยางเชน แกลบจะเผาไหมไดดีใน Fluidized bed และ Gasifier เพราะ อุณหภูมิเผาไหมต่ําชวยลดการจับตัวเปนกอนของขี้เถา เตาเผาแบบ Stoker และ Suspensionfiringสามารถใชไดแต ตองระวังใหการจับตัวเปนกอนของขี้เถามีนอยสุด โดยทั่วไป Fluidized Bed เปนทางเลือกที่ดีที่สุดเพราะสามารถใช กับเชื้อเพลิงที่มีความชื้นสูง และมีหลายขนาด Suspension firing ไม่เหมาะกับชีวมวลเป็นส่วนใหญ่เพราะต้องนำมา- ย่อยก่อน Gasificationอาจเป็นทางเลือกที่น่าสนใจ แต่ติดปัญหาในด้านการยอมรับทางเทคนิคและการค้าการศึกษานี้ไดแนะนํา Stoker boiler เพราะมีใชแพรหลาย ราคาถูก และประสิทธิภาพพอสมควร1.4 การคัดเลือกโครงการบทนี้กล่าวถึงการสรรหาและคัดเลือกโครงการ การร่วมลงนามในบันทึกความเข้าใจ การรวมรวมข้อมูล และการประเมินผลความเป็นไปได้เบื้องต้นของโครงการที่ได้คัดเลือกมา เพื่อการศึกษาความเป็นไปได้อย่างละเอียดต่อไป1.4.1 การสรรหาและคัดเลือกโครงการในการสรรหาโครงการ ทางคณะผู้ศึกษาได้ติดต่อสมาคมต่างๆที่เกี่ยวข้องกับอุตสาหกรรมการเกษตร ตลอด-จนแหล่งผลิตชีวมวล โดยการออกแบบสอบถามและติดต่อโดยตรงเพื่อสอบถามข้อมูลแหล่งผลิตชีวมวลและความสนใจในเรื่องโรงไฟฟ้าชีวมวล แนวทางเบื้องต้นในการคัดเลือกมีดังนี้• ปริมาณเชื้อเพลิงที่มีเหลืออยู่เพียงพอที่จะผลิตไฟฟ้าได้• มีปัญหาในการกำจัดชีวมวล และความตั้งใจในการพัฒนาโรงไฟฟ้าชีวมวล• มีประสบการณ์และความสามารถในการพัฒนาโรงไฟฟ้า1-6

ประเด็นที่สำคัญประเด็นหนึ่งคือ ถึงแม้เจ้าของโครงการจะมีความตั้งใจในการพัฒนาโครงการโรงไฟฟ้าชีวมวล แต่เนื่องจากขณะที่เริ่มการสรรหาโครงการเกิดภาวะเศรษฐกิจตกต่ำ ผู้สนใจหลายรายไม่พร้อมที่จะลงทุนในโครงการขนาดใหญ่โดยเฉพาะในธุรกิจโรงไฟฟ้าซึ่งแตกต่างจากธุรกิจเดิมที่ทำอยู่ ด้วยเหตุนี้ทางคณะผู้ศึกษาประสบความยากลำบากในการสรรหาผู้สนใจร่วมโครงการมากกว่าที่คาดคะเนไว้ในตอนแรก1.4.2 บันทึกความเข้าใจหลังจากคัดเลือกผู้ที่สนใจในโครงการได้แล้ว ขั้นตอนต่อไปเป็นการลงนามบันทึก ความเข้าใจระหว่างสพช. ผู้สนใจหรือเจ้าของโครงการ และบ.แบล็คแอนด์วิชช์ฯ สาระสำคัญในบันทึกความเข้าใจระบุว่าถ้าผลการศึกษาความเป็นไปได้มีความเหมาะสมทางด้านเทคนิค สิ่งแวดล้อม และการเงิน (มีผลตอบแทนต่อเงินลงทุนไม่ต่ำกว่า 23%) เจาของโครงการตองพัฒนาโรงไฟฟาตอไปจนสําเร็จ ถาไมดําเนินตอเจาของโครงการอาจจะตองออกคาใชจาย ของการศึกษานี้จํานวนครึ่งหนึ่งใหแก สพช. ถาไมแจงเหตุผลที่เพียงพอตอการไมปฏิบัติตามขอผูกพันตอสพช.อยางไรก็ตามไดมีผูสนใจในโครงการนี้จํานวนหลายราย แตคัดเลือกเหลือเพียง 10 รายดวยกันคือ• หจก.โรงสีข้าวสมหมาย จ.ร้อยเอ็ด• โรงสีข้าวสนั่นเมือง จ.กำแพงเพชร• หจก.โรงสีไฟฐิติพรธัญญา จ.นครสวรรค์• บ.แปลนครีเอชั่นส์ จำกัด จ.ตรัง• บ.ชุมพรอุตสาหรรมน้ำมันปาล์ม จำกัด (มหาชน) จ.ชุมพร• บ.อุตสาหกรรมน้ำตาลกาญจนบุรี จำกัด จ.อุทัยธานี• บ.วู้ดเวอร์คครีเอชั่น จำกัด จ.กระบี่• บ.นำ้ตาลมิตรกาฬสินธุ์ จำกัด จ.กาฬสินธุ์• บ.โรงสีเลียงฮงไชย จำกัด จ.ขอนแก่น• บ.ทักษิณอุตสาหกรรมน้ำมันปาล์ม (1993) จำกัด จ.สุราษฎร์ธานี1.4.3 การรวบรวมข้อมูลขั้นตอนต่อไปทางคณะผู้ศึกษาจะขอข้อมูล รายละเอียดต่างๆจากเจ้าของโครงการ เช่น ประเภทของอุตสาห-กรรม ชนิดของชีวมวล ปริมาณที่มีอยู่ ความแน่นอนของผลผลิต และลักษณะอื่นๆของชีวมวล ซื่งเป็นตัวกำหนดขนาดและรูปแบบโรงไฟฟ้า สามารถนำมาวิเคราะห์ความเป็นไปได้เบื้องต้น และผลประโยชน์ทางอ้อมที่เจ้าของโครงการได้รับ นอกจากนี้ยังมีข้อมูลประกอบเพิ่มเติมอีกคือ แหล่งน้ำ ขบวนการผลิต แผนผังโรงงาน แผนที่ตั้งโรงงาน จำนวนพนักงาน วิธีการกำจัดของเสียในปัจจุบันเป็นอย่างไร ค่าใช้จ่ายค่าไฟฟ้า จำนวนชั่วโมงทำงานต่อวัน ความต้องการใช้-ไอน้ำและโครงการขยายงานในอนาคต เป็นต้น1.4.4 การประเมินผลเบื้องต้นจากข้อมูลเบื้องต้น คณะผู้ศึกษาเดินทางไปดูสถานที่ผลิตชีวมวล ซึ่งจะเป็นสถานที่เดียวกับโรงไฟฟ้าทบทวนข้อมูลที่มีอยู่ แลกเปลี่ยนข้อมูลกับผู้ปฏิบัติงานและรวบรวมข้อมูลอื่นๆที่เกี่ยวข้องกับโรงไฟฟ้า เพื่อนำมาประ-เมินผลความเป็นไปได้เบื้องต้นว่าควรสร้างโรงไฟฟ้าใหม่หรือปรับปรุงโรงไฟฟ้าที่ใช้อยู่ในปัจจุบัน และพบว่าทั้ง 10โครงการ มีความเหมาะสมที่จะดำเนินการศึกษาอย่างละเอียดต่อไป1.5 การศึกษาความเป็นไปได้อย่างละเอียด1-7

ในหัวข้อนี้ได้สรุปผลของการศึกษาความเป็นไปได้ทั้ง 10 โครงการ และการนำเสนอผลของการศึกษาต่อเจ้าของโครงการ รูป 1-1 แสดงถึงสถานที่ตั้งของทั้ง 10 โครงการและตาราง 1-2 แสดงถึงผลสรุปข้อมูลที่สำคัญทั้ง 10โครงการเนื่องจากระยะเวลาการศึกษาค่อนข้างใช้เวลานาน ทำให้สมมติฐานสองข้อของรายงานการศึกษาความเป็นไปได้ 4 โครงการแรก จะแตกต่างกับรายงานการศึกษาความเป็นไปได้ 6 โครงการหลังคืออัตราแลกเปลี่ยน และต้นทุนโครงการ ทั้งนี้ในการศึกษา 4 โครงการแรกเริ่มเดือนมิถุนายน 2541 ซึ่งอยู่ในช่วงวิกฤตทางการเงิน อัตราแลกเปลี่ยนเงินมีความผันผวนตลอดเวลา กำหนดไว้ที่ 43.53 บาท/เหรียญสหรัฐ จากนั้นอัตราแลกเปลี่ยนได้ลดลงมาเรื่อยๆ จนถึง 37.15 บาท/เหรียญสหรัฐ ซึ่งได้นำมาใช้ในการศึกษา 6 โครงการหลังประการที่สองในส่วนของต้นทุนโครงการ ต้นทุนของ 6 โครงการหลัง สูงกว่า 4 โครงการแรกเพราะ• ได้มีการเปลี่ยนแปลงแหล่งผู้ผลิตอุปกรณ์ เครื่องมือ เครื่องจักร จากฝั่งแปซิฟิค (เช่นประเทศจีน) เป็นยุโรปและสหรัฐอเมริกา ซึ่งมีราคาแพงกว่า ทำให้ต้นทุนโครงการสูงขึ้น• 6 โครงการหลังมีขนาดเล็กกว่าเดิม เป็นผลให้มีต้นทุนต่อหน่วยสูงขึ้นผลการศึกษาความเป็นไปได้สรุปว่าทั้ง 10 โครงการมีความเหมาะสมทั้งทางด้านเทคนิคและสิ่งแวดล้อม ใน10 โครงการนี้มีทั้งโครงการสร้างใหม่ และโครงการปรับปรุงเครื่องจักรเดิมประกอบด้วยโรงไฟฟ้าที่ใช้แกลบ 4 โครงการ เศษไม้ 2 โครงการ กากปาล์ม 2 โครงการ และกากอ้อย 2 โครงการ นอกจากนี้ยังมีชีวมวลอื่นๆ อีกเป็นเชื้อเพลิงเสริมคือ กาบมะพร้าว ก๊าซชีวภาพ และซังข้าวโพด ขนาดกำลังการผลิตอยู่ระหว่าง 1.9 ถึง 8.8 เมกกะวัตต์ และในส่วนการวิเคราะห์ทางด้านการเงิน ได้มีการเปลี่ยนตัวแปรต่างๆ เช่น เพิ่มขนาดโรงไฟฟ้าจนถึง 30 เมกกะวัตต์ และกำหนดว่าไอน้ำที่ผลิตเพิ่มมีมูลค่าโดยเฉพาะโรงงานน้ำมันปาล์ม เป็นต้น เพื่อดูแนวโน้มของผลตอบแทนการเงินว่าเปลี่ยนไปอย่างไรผลการศึกษาและความเห็นของเจ้าของแต่ละโครงการได้สรุปไว้ตามรายละเอียดข้างล่างนี้• หจก.โรงสีข้าวสมหมายโครงการโรงไฟฟ้าโรงสีข้าวสมหมาย เป็นโครงการใหม่ ตั้งอยู่ที่จ.ร้อยเอ็ด ปัจจุบันโรงสีข้าวสมหมายได้ขยายกำลังการผลิตเป็น 1,300 ตันข้าวเปลือก/วัน จึงมีแกลบเหลือจากการสีข้าว 100,000 ตัน/ปี สามารถนำมาผลิตไฟฟ้าได้ 10 เมกกะวัตต์ (สุทธิ 8.8 เมกกะวัตต์) ผลการศึกษาความเป็นไปได้สรุปว่า มีความเหมาะสมทั้งทางด้านเทคนิค สิ่งแวดล้อมและการเงิน (ผลตอบแทนต่อเงินลงทุน 32.6 %)ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโรงสีข้าวสมหมาย ซึ่งได้ตัดสินใจดำเนินโครงการต่อโดยได้ร่วมทุนกับบ.ผลิตไฟฟ้า จำกัด (มหาชน) ปัจจุบันอยู่ในขั้นตอนประกวดราคาหาผู้รับเหมาทำการก่อสร้างโครงการ• โรงสีข้าวสนั่นเมืองโครงการโรงไฟฟ้าโรงสีข้าวสนั่นเมืองจะเป็นโครงการโรงไฟฟ้าใหม่ตั้ง อยู่ในโรงสีข้าวสนั่นเมือง จ.กำแพงเพชร มีกำลังการผลิต 250 ตันข้าวเปลือก/วัน มีแกลบเหลือจาการสีข้าว 13,800 ตัน/ปี และเมื่อรวมกับส่วนของโรงสีใกล้เคียง อีก 5 โรง ประมาณ 65,200 ตัน/ปี สามารถนำมาผลิตไฟฟ้าได้ 9.1 เมกกะวัตต์1-8

(สุทธิ 8.0 เมกกะวัตต์) ผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสมทั้งทางด้านเทคนิค สิ่งแวดล้อมและการเงิน (ผลตอบแทนต่อเงินลงทุน 25.5 %)ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโรงสีข้าวสนั่นเมือง ซึ่งมีความสนใจมากและต้องการร่วมทุนกับนักลงทุนที่สนใจ ที่จะทำโครงการ• หจก.โรงสีไฟฐิติพรธัญญาโครงการโรงไฟฟ้าโรงสีไฟฐิติพรธัญญาเป็นโครงการใหม่ตั้งอยู่ที่ จ.นครสวรรค์ โรงสีไฟฟ้าฐิติพรธัญญามีกำลังการผลิต 500 ตันข้าวเปลือก/วัน มีแกลบเหลือจากการสีข้าว 27,600 ตัน/ปี และเมื่อรวมกับส่วนของโรงสีใกล้เคียง อีก 7 โรง ประมาณ 51,400 ตัน/ปี สามารถนำมาผลิตไฟฟ้าได้ 9.1 เมกกะวัตต์ (สุทธิ8.0 เมกกะวัตต์) ผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสมทั้งทางด้านเทคนิค สิ่งแวดล้อม และการเงิน (ผลตอบแทนต่อเงินลงทุน 26.4 %)ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโรงสีไฟฐิติพรธัญญา ซึ่งมีความสนใจและพร้อมที่จะลงทุนกับนักลงทุนภายนอก อย่างไรก็ตามทางเจ้าของโรงสีแสดงความกังวลเพราะโรงไฟฟ้านี้ต้่องพึ่งพาแกลบจากโรงสีอื่น• บ.แปลนครีเอชั่นส์ จำกัดโครงการโรงไฟฟ้าบ.แปลนครีเอชั่นส์ เป็นโครงการใหม่ ตั้งอยู่ที่จ.ตรัง บ.แปลนครีเอชั่นส์ ผลิตของ-เล่นเด็กโดยใช้ไม้ยางพาราเป็นวัตถุดิบ มีเศษไม้ เหลือประมาณ 4,000 ตัน/ปี และเมื่อรวมกับ เศษไม้จากโรงเลื่อยใกล้เคียง และจากสวนยางพารา เป็น 134,000 ตัน/ปี สามารถนำมาผลิตไฟฟ้าได้ 10 เมกกะวัตต์(สุทธิ 8.8 เมกกะวัตต์) ผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสมทั้งทางด้านเทคนิค และสิ่งแวด-ล้อม แต่ด้านการเงินมีผลตอบแทนต่อเงินลงทุน 7.95 % ถ้าโครงการนี้ขยายให้ใหญ่ขึ้น เช่นประมาณ 28เมกกะวัตต์ ผลตอบแทนต่อเงินลงทุนจะสูงขึ้นเป็น 38.5 %ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโครงการ ซึ่งมีความสนใจมากแต่มีความสนใจลงทุนโรงไฟฟ้าชีวมวลขนาดเล็ก (2 เมกกะวัตต์) ขณะนี้อยู่ระหว่างการขอราคาของโครงการจากผู้จำหน่ายอุปกรณ์อยู่• บ.ชุมพรอุตสาหรรมน้ำมันปาล์ม จำกัด (มหาชน)โครงการโรงไฟฟ้าบ.ชุมพรอุตสาหรรมน้ำมันปาล์ม เป็นโครงการปรับปรุงโรงไฟฟ้าเดิม ตั้งอยู่ที่จ.ชุมพร บ.ชุมพรอุตสาหรรมน้ำมันปาล์ม เป็นโรงสกัดน้ำมันปาล์มดิบ และน้ำมันปาล์มบริสุทธิ์ มีโรงไฟฟ้าขนาด 3.5 เมกกะวัตต์ แต่ผลิตได้จริง 2.4 เมกกะวัตต์ ใช้กากปาล์มคือ กะลา ไฟเบอร์ ทะลายเปล่าและก๊าซชีวภาพเป็นเชื้อเพลิง จากการศึกษาพบว่าถ้านำเชื้อเพลิงจากภายนอกมาเสริม คือ กาบมะพร้าว และกะลา-ปาล์มจากโรงงานอื่น จะผลิตไฟฟ้าได้ถึง 3.7 เมกกะวัตต์ และถ้าติดตั้งกังหันไอน้ำแบบมีคอนเดนเซอร์ต่อจากกังหันปัจจุบันและปรับปรุงระบบบำบัดน้ำดี เป็นต้น จะผลิตไฟฟ้าได้สูงถึง 5.4 เมกกะวัตต์ ขายไฟฟ้าแก่ภายนอกได้ประมาณ 2.5 เมกกะวัตต์ผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสมทั้งทางด้านเทคนิค สิ่งแวดล้อม และการเงิน มีผล-ตอบแทนต่อเงินลงทุน 20.4 % ถ้ารวมผลประโยชน์ที่ได้รับจากการผลิตไอน้ำที่เพิ่มขึ้น ทำให้กำลังการผลิตเพิ่มมากขึ้นด้วย ผลตอบแทนต่อเงินลงทุนจะสูงขึ้นเป็น 39 ถึง 69 % ตามค่าไอน้ำ 5 ถึง 15 US ดอลลาร์ต่อ-ตัน1-9

ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโครงการซึ่งมีความสนใจมาก แต่มีความเป็นห่วงความผัน-ผวนของราคากะลาปาล์มที่ซื้อจากภายนอก อย่างไรก็ตามทางบ.ชุมพรฯ มีโครงการที่จะขยายกำลังการผลิตในอนาคต ซึ่งจะต้องทำการปรับปรุงทั้งระบบการผลิตไฟฟ้าและไอน้ำ• บ.อุตสาหกรรมน้ำตาลกาญจนบุรี จก.โครงการโรงไฟฟ้าบ.อุตสาหกรรมน้ำตาลกาญจนบุรี เป็นโครงการปรับปรุงโรงไฟฟ้าเดิม ตั้งอยู่ที่จ.อุทัยธานี บ. อุตสาหกรรมน้ำตาลกาญจนบุรีเป็นโรงงานผลิตน้ำตาล ซึ่งต้องใช้ทั้งไอน้ำและไฟฟ้าเพื่อการผลิต กำลังการผลิตไฟฟ้าสูงสุดในปัจจุบัน 17.5 เมกกะวัตต์ เนื่องจากในขบวนการผลิตมีไอน้ำและไฟฟ้าเหลืออยู่จำนวนหนึ่ง มีกากอ้อยเหลือเมื่อเสร็จสิ้นฤดูการผลิต และมีซังข้าวโพดเหลือมากมายใน จ.อุทัยธานีสิ่งเหล่านี้เมื่อนำมารวบรวมจะผลิตไฟฟ้าได้ 2 เมกกะวัตต์ (สุทธิ 1.85 เมกกะวัตต์) ประมาณ 6 เดือน โดยต้องทำการปรับปรุง และเพิ่มเติมเครื่องจักรบางส่วนผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสมทั้งทางด้านเทคนิค สิ่งแวดล้อมและการเงิน (ผลตอบแทนต่อเงินลงทุน 18.9 %) จากการศึกษาเพิ่มเติมพบว่า ถ้ามีการเพิ่มประสิทธิภาพหม้อน้ำทั้ง 5 ชุด จะทำให้มีกากอ้อยเหลือเพิ่มขึ้น ซึ่งสามารถทดแทนซังข้าวโพดได้โดยไม่ต้องซื้อ ผลตอบแทนต่อเงินลงทุนเพิ่มขึ้นเป็น 27.5 %ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโครงการ ซึ่งมีความสนใจมากและต้องการที่จะดำเนินโครงการต่อไป• บ.วู้ดเวอร์คครีเอชั่น จำกัดโครงการโรงไฟฟ้า บ.วู้ดเวอร์คครีเอชั่น เป็นโครงการใหม่ ตั้งอยู่ที่จ.กระบี่ บ.วู้ดเวอร์คครีเอชั่น เป็นโรงเลื่อยไม้ยางพารา มีเศษไม้เหลือประมาณ 31,680 ตัน/ปี หลังขยายกำลังการผลิตและเมื่อรวมเศษไม้จากโรงเลื่อยใกล้เคียง และจากสวนยางพารา อีก 23,000 ตัน/ปี สามารถนำมาผลิตไฟฟ้าได้ 3.55 เมกกะวัตต์(สุทธิ 3.1 เมกกะวัตต์) ผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสม ทั้งทางด้านเทคนิค และสิ่งแวด-ล้อม แต่ด้านการเงินมีผลตอบแทนต่อเงินลงทุน 4.4 % ถ้าโครงการนี้ขยายให้ใหญ่ขึ้น เช่น ประมาณ 30เมกกะวัตต์ ผลตอบแทนต่อเงินลงทุนจะสูงขึ้นเป็น 25 %ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโครงการ ซึ่งขอศึกษารายละเอียดเพิ่มเติมก่อนตัดสินใจ• บ.นำ้ตาลมิตรกาฬสินธุ์ จำกัดโครงการโรงไฟฟ้า บ.นำ้ตาลมิตรกาฬสินธุ์ เป็นโครงการตั้งโรงไฟฟ้าใหม่ ตั้งอยู่ในบริเวณโรงน้ำตาลปัจจุบันที่จ.กาฬสินธ์ุ บ.นำ้ตาลมิตรกาฬสินธุ์ ใช้กากอ้อยที่เหลือ 76,000 ตัน/ปี สามารถนำมาผลิตไฟฟ้าโดยใช้หม้อน้ำแรงดันสูง ได้ 6.1 เมกกะวัตต์ (สุทธิ 5.6 เมกกะวัตต์) ในส่วนของโรงไฟฟ้าปัจจุบัน ยังดำเนิน-การอยู่โดยผลิตไฟฟ้าและไอน้ำใช้ในการผลิตน้ำตาล ผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสมทั้งทางด้านเทคนิค สิ่งแวดล้อมและการเงิน (ผลตอบแทนต่อเงินลงทุน 13.3 %) แนวทางศึกษาอีกทางหนึ่งถ้าดัดแปลงและเพิ่มเติมเครื่องจักรบางส่วนของโรงน้ำตาลปัจจุบันจะสามารถผลิตไฟฟ้าได้ 3.2 เมกกะวัตต์แต่ผลตอบแทนต่อเงินลงทุนเพิ่มขึ้นเป็น 46 %ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโครงการซึ่งมีความสนใจมาก และพร้อมที่จะดำเนินโครงการต่อไป1-10

• บ.โรงสีเลียงฮงไชย จำกัดโครงการโรงไฟฟ้าโรงสีเลียงฮงไชย เป็นโครงการใหม่ ตั้งอยู่ที่จ.ขอนแก่น โรงสีเลียงฮงไชย เป็นโรง-สีข้าว มีแกลบเหลือจาการสีข้าว 33,000 ตัน/ปี สามารถนำมาผลิตไฟฟ้าได้ 3.8 เมกกะวัตต์ (สุทธิ 3.3 เมกกะ-วัตต์) ผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสมทั้งทางด้านเทคนิค และสิ่งแวดล้อม แต่ผลตอบ-แทนต่อเงินลงทุนเท่ากับ 7.6 % ถ้ามีการขยายกำลังการผลิตเพิ่มขึ้นเป็น 13.4 เมกกะวัตต์ ผลตอบแทนต่อเงินลงทุนเพิ่มขึ้นเป็น 29 %ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโรงสี ซึ่งขอศึกษารายละเอียดเพิ่มเติม• บ.ทักษิณอุตสาหกรรมน้ำมันปาล์ม (1993) จำกัด จ.สุราษฎร์ธานีโครงการโรงไฟฟ้าบ.ทักษิณอุตสาหกรรมน้ำมันปาล์ม เป็นโครงการใหม่ ตั้งอยู่ที่ จ.สุราษฎร์ธานีบ.ทักษิณฯ เป็นโรงสกัดน้ำมันปาล์มดิบ จากการศึกษาพบว่าถ้านำเชื้อเพลิงเฉพาะกะลาและไฟเบอร์ รวมทั้งก๊าซชีวภาพจากบ่อบำบัดน้ำเสียที่จะสร้างในอนาคตจะสามารถผลิตไฟฟ้าได้ถึง 7.0 เมกกะวัตต์ (สุทธิ 6.2เมกกะวัตต์) โดยโรงไฟฟ้าขนาด 0.88 เมกกะวัตต์ที่มีอยู่ จะคงไว้เพื่อเป็นแหล่งผลิตสำรอง ผลการศึกษาความเป็นไปได้สรุปว่ามีความเหมาะสมทั้งทางด้านเทคนิค สิ่งแวดล้อม และการเงิน (ผลตอบแทนต่อเงินลง-ทุน 11.6 %)จากการศึกษาเพิ่มเติมพบว่าถ้ารวมผลประโยชน์ที่ได้รับจากการขยายกำลังการผลิตในอนาคต การนำทะลายปาล์มเปล่ามาใช้และหาเชื้อเพลิงเสริมอีกจำนวนหนึ่ง จะผลิตไฟฟ้าเพิ่มขึ้น 28.3 เมกกะวัตต์ และผล-ตอบแทนต่อเงินลงทุนจะสูงขึ้นเป็น 25 %ผลของการศึกษาฯได้นำเสนอต่อเจ้าของโครงการซึ่งมีความสนใจเพราะมีโครงการขยายกำลังการผลิตในอนาคต ซึ่งจำเป็นต้องปรับปรุงระบบการผลิตไฟฟ้าและไอน้ำในปัจจุบัน1.6 การส่งเสริมพลังงานชีวมวลในอนาคตตามที่ได้กล่าวมาแล้ว โรงไฟฟ้าชีวมวลในโครงการผู้ผลิตไฟฟ้าเอกชนรายเล็ก มีสัดส่วนกำลังการผลิตน้อย-มาก และส่วนมากมีการทำสัญญาซื้อขายแบบ Non-firm มีสาเหตุหลายประการ ส่วนหนึ่งเกี่ยวข้องกับระเบียบการรับซื้อไฟฟ้าจากผู้ผลิตรายเล็ก เฉพาะการผลิตไฟฟ้าจากพลังงานนอกรูปแบบ ฉบับมกราคม พศ. 2541 ของกฟผ. ดังรายละเอียดต่อไปนี้1.6.1 ความคิดเห็นต่อระเบียบการรับซื้อไฟฟ้าฯค่าพลังไฟฟ้าและพลังงานไฟฟ้าที่จ่ายให้แก่โรงไฟฟ้าชีวมวลที่มีสัญญาแบบ Firm คำนวณจากต้นทุนที่หลีก-เลี่ยงได้ในระยะยาวของโรงไฟฟ้าใช้น้ำมันเป็นเชื้อเพลิง ซึ่งโรงไฟฟ้าชีวมวลไม่สามารถแข่งขันได้ตามหลักทางเศรษฐศาสตร์ ต่อไปนี้• เนื่องจากเชื้อเพลิงชีวมวลอยู่กระจัดกระจาย โรงไฟฟ้าชีวมวลจึงมีขนาดเล็ก (ประมาณ 5-30 เมกกะวัตต์) ซึ่งเมื่อเปรียบเทียบกับโรงไฟฟ้าใช้น้ำมันเป็นเชื้อเพลิง โรงไฟฟ้าชีวมวลจะมีต้นทุนการก่อสร้างสูงกว่า• การจ่ายค่าพลังงานไฟฟ้าอ้างอิงกับ ค่าความสิ้นเปลืองในการใช้เชื้อเพลิงเพื่อผลิตพลังงานไฟฟ้า (Netplant heat rate) กำหนดไว้เท่ากับ 8,600 บีทียู/กิโลวัตต์-ชม. ซึ่งใช้สำหรับโรงไฟฟ้าพลังความร้อน แต่สำหรับโรงไฟฟ้าชีวมวล บวกกับเทคโนโลยี่ที่ทันสมัย ตัวเลขดังกล่าวจะสูงกว่ามากจึงไม่สามารถแข่งขันกับโรงไฟฟ้าทั่วไปได้1-11

1.6.2 องค์ประกอบอื่นๆที่มีผลกระทบต่อการพัฒนาโรงไฟฟ้าชีวมวลนอกจากระเบียบการรับซื้อไฟฟ้าฯยังมีองค์ประกอบเหตุผลอื่นๆอีกที่ทำให้โรงไฟฟ้าชีวมวลในประเทศไทยที่ทำสัญญาซื้อขายไฟฟ้าแบบ Firm กับกฟผ. มีเพียง 2-3 ราย และสาเหตุที่โรงไฟฟ้าชีวมวลในประเทศไทยมีน้อยคือ• ราคาของพลังงานไม่สะท้อนถึงต้นทุนทางสังคม เช่น มลภาวะทางอากาศ การปล่อยก๊าซคาร์บอนได-ออกไซด์ ผลกระทบต่อสังคมและเศรษฐกิจ และการนำเข้าเชื้อเพลิงจากต่างประเทศ• นักลงทุนและหรือผู้ให้กู้เงินเน้นที่จะลดความเสี่ยงโครงการมากกว่าการบริหารความเสี่ยง โดยทำสัญญาจัดหาเชื้อเพลิงในระยะยาว ซึ่งค่อนข้างยากที่จะประสบผลสำร็จ• เจ้าของชีวมวลส่วนใหญ่ไม่คุ้นเคยธุรกิจการผลิตไฟฟ้า จึงมีความกังวลที่จะมีการลงทุนขนาดใหญ่ในธุรกิจที่ตนเองไม่ถนัด• ค่าใช้จ่ายเบื้องต้นในการพัฒนาโรงไฟฟ้าชีวมวล มีค่าใกล้เคียงกับโรงไฟฟ้าขนาดใหญ่ ทั้งๆที่กำลังการผลิตน้อยกว่ามากจากเหตุผลดังกล่าวข้างต้น ทำให้การกู้เงินของโครงการโรงไฟฟ้าชีวมวลมีความยุ่งยาก และมีค่าใช้จ่ายที่สูง-กว่าโรงไฟฟ้าทั่วๆไป ผลลัพธ์คือโรงไฟฟ้าชีวมวลที่สร้างขึ้นใหม่ไม่สามารถผลิตไฟฟ้าขายในอัตราเดียวกับโรงไฟฟ้าปัจจุบันได้1.6.3 สิ่งจูงใจมาตรการจูงใจต่างๆได้นำมาใช้ทั่วโลก เพื่อการสนับสนุนแหล่งพลังงานชีวมวลและพลังงานทดแทนอื่นๆในส่วนของประเทศไทย นอกจากการเพิ่มค่าพลังไฟฟ้าและพลังงานไฟฟ้าแล้ว ควรมีมาตรการอื่นมาเสริมอีกดังนี้• ตั้งเป้าหมาย 10 ปีข้างหน้าสำหรับการผลิตไฟฟ้าจากพลังงานนอกรูปแบบ• จัดตั้งแผนการช่วยเหลือ เพื่อส่งเสริมการพัฒนาโรงไฟฟ้าที่ใช้พลังงานนอกรูปแบบมากขึ้น• ส่งเสริมการใช้พลังงานนอกรูปแบบเป็นพลังงาน “สีเขียว” เพื่อให้สาธารณะชนสนับสนุน• รวมมือกับอุตสาหกรรมที่มีศักยภาพสูง (เชน โรงงานน้ําตาล) ในการเพิ่มประสิทธิภาพเครื่องจักรและ สนับสนุนใหมีการผลิตไฟฟาจากชีวมวลมากขึ้น• ศึกษาทางเลือกอื่นๆเกี่ยวกับกลไกการจัดหาแหล่งเงินกู้ระยะยาว อัตราดอกเบี้ยต่ำ สำหรับโรงไฟฟ้าชีวมวลการให้สิ่งจูงใจใดๆ ควรอยู่ในกรอบของการแข่งขันเสรีในการผลิตไฟฟ้า และมีความยึดหยุ่นเพียงพอต่อสภาพของตลาดที่มีการเปลี่ยนแปลงอยู่เสมอสพช.มีความสำเร็จในการรณรงค์ การสนับสนุนพลังงานนอกรูปแบบ โดยมีโครงการตั้งเป้าหมายการผลิตไฟฟ้าจากพลังงานนอกรูปแบบ 300 เมกกะวัตต์ และจัดหาเงินช่วยเหลือไว้จำนวนหนึ่ง โดยนำมาจากกองทุนน้ำมันโครงการดังกล่าวจะเปิดให้มีการแข่งขันอย่างเสรี ซึ่งถือว่าเป็นขั้นตอนสำคัญของการนำไปสู่เป้าหมายของนโยบายด้านพลังงานในระยะยาวของประเทศ1-12

ตาราง 1-2สรุปข้อมูลที่สำคัญของแต่ละโครงการรายงานความก้าวหน้าครั้งที่ 2 รายงานความก้าวหน้าครั้งที่ 3โครงการ โรงสีสมหมาย โรงสีสนั่นเมือง โรงสีฐิติพร บ.แปลนฯ บ.ชุมพรฯ บ.กาญจนบุรีฯ บ.วู้ดเวอร์คฯ บ.มิตรกาฬสินธุ์ โรงสีเลียงฮงไชย บ.ทักษิณฯธุรกิจ โรงสีข้าว โรงสีข้าว โรงสีข้าว ผลิตภัณฑ์ไม้ โรงสีข้าว น้ำตาล โรงเลื่อยไม้ยางฯ น้ำตาล โรงสีข้าว โรงสีข้าวลักษณะโครงการ ใหม่ ใหม่ ใหม่ ใหม่ ปรับปรุง ปรับปรุง ใหม่ ใหม่ ใหม่ ใหม่ปริมาณชีวมวลที่เหลือ, ตัน/ปี 98,670 13,800 27,600 4,000 89,100 20,834 31,680 76,000 33,000 73,500ปริมาณชีวมวลที่ใช้, ตัน/ปี 86,900 79,000 79,000 134,000 111,860 34,216 54,000 76,000 33,000 73,500ชนิดของชีวมวล แกลบ แกลบ แกลบ เศษไม้ยางพารา กากปาล์ม, กากอ้อย, เศษไม้ยางพารา กากอ้อย แกลบ กากปาล์ม,ก๊าซชีวภาพ ซังข้าวโพด a ก๊าซชีวภาพ aพลังงานความร้อน, จิกะจูลส์/ปี 1,225,868 1,113,900 1,113,900 1,380,200 1,564,000 b 406,980 510,300 725,040 465,300 1,072,932 bอัตราการใช้พลังงานความร้อนสุทธิ, กิโลจูลส์/กิโลวัตต์- ชม. 18,708 18,708 18,708 21,015 49,500 c 47,205 c d 21,900 17,400 18,700 21,700 eพลังไฟฟ้าสุทธิ, กิโลวัตต์ 8,800 8,000 8,000 8,800 4,550 1,850 3,100 5,600 3,300 6,200พลังไฟฟ้าที่ขายกฟผ., กิโลวัตต์ 8,800 8,000 8,000 8,800 2,520 1,850 3,100 5,600 3,300 5,366ปริมาณไอน้ำ, ตัน/ชม. ไม่มี ไม่มี ไม่มี ไม่มี 31.85 ไม่มี ไม่มี ไม่มี ไม่มี 13.9 eราคาโครงการโดยประมาณ, ล้านเหรียญสหรัฐ 9.71 9.27 9.27 10.59 5.0 1.95 8.65 13.4 9.73 14.6ผลตอบแทนโครงการ, % 32.6 25.5 26.4 7.95 20.4 18.9 4.4 13.3 7.6 11.6ผลตอบแทนโครงการ ที่อัตราแลกเปลี่ยน 43 ฿/US$, % – – – – 15.8 15.9 2.1 9.8 5.1 8.4ผลตอบแทนโครงการ เมื่อลดต้นทุน 20 %, % – – – – 29.4 26.7 8.5 20.1 12.6 17.9ผลตอบแทนโครงการ กรณีทางเลือกอื่นๆ, % – – – 38.5 39-69 27.5 25 46 13-29 13-25หมายเหตุ :a บ.ชุมพรฯใช้เชื้อเพลิง กากปาล์ม ( กะลา, ไฟเบอร์ และทะลาย) , ก๊าซชีวภาพ และกาบมะพร้าว ส่วนบ.ทักษิณ ใช้กากปาล์ม (กะลา และ ไฟเเบอร์) และก๊าซชีวภาพb บ.ชุมพรฯ ใชกาซชีวภาพ 6,000,000 ลบ.เมตร/ป สวนบ.ทักษิณ ใช 3,570,000 ลบ.เมตร/ปc อางอิงจากประสิทธิภาพของโรงไฟฟาในโรงงานปจจุบันd รวมสวนที่เปนกําลังไฟฟาสวนเกินของโรงงานน้ําตาลชวงเปดหีบe เปนคาโดยเฉลี่ย เนื่องจากอัตราการใชมีการเปลี่ยนแปลงตามฤดูกาล1-13

or cogeneration. A st<strong>and</strong>ard Memor<strong>and</strong>um of Underst<strong>and</strong>ing (MOU) betweenNEPO, the facility owner/developer, <strong>and</strong> Black & Veatch was developed <strong>and</strong>the regulations of the SPP program were reviewed.Task 2Task 3Feasibility StudiesBlack & Veatch performed feasibility studies for ten power plants burningbiomass fuels (rice husks, bagasse, wood, etc.) at sites throughout Thail<strong>and</strong>.The feasibility studies are contained in a separate report to the Final Report.The studies assess feasibility in the following areas: technical, economic,financial, commercial, socioeconomic, ecological, juridical, <strong>and</strong> political.Assist Development of Biomass-Based Power GenerationOwners were presented the results of their respective feasibility studies <strong>and</strong>then assisted in initial project implementation activities. A h<strong>and</strong>book wasdeveloped outlining the procedure for entering the SPP program, including allresponsibilities <strong>and</strong> performance st<strong>and</strong>ards for the SPP.2.1.3 Biomass <strong>Energy</strong> OverviewAbout 12 percent of the world's energy comes from the use of biomass fuels,which include items as diverse as residential yard waste, manure, agricultural residues,<strong>and</strong> dedicated energy crops. 1 In industrialized nations, bioenergy facilities typically usebiomass fuels in large industrial cogeneration applications (pulp <strong>and</strong> paper production,sugar cane milling, etc.). Conversely, developing nations largely rely on biomass forrural cook stoves or small industries. Such applications are relatively inefficient <strong>and</strong>dirty. Increasing industrialization <strong>and</strong> household income are driving the economies ofdeveloping nations to implement cleaner <strong>and</strong> more efficient biomass technologies.Environmental concerns may help make biomass an economically competitivefuel. Because biomass fuels are generally less dense, lower in energy content, <strong>and</strong> moredifficult to h<strong>and</strong>le than fossil fuels, they usually do not compare favorably to fossil fuelson an economic basis. However, biomass fuels have several important environmentaladvantages. Biomass fuels are renewable, <strong>and</strong> sustainable use is greenhouse gas neutral(biomass combustion releases no more carbon dioxide than absorbed during the plant’sgrowth). Biomass fuels contain little sulfur compared to coal (reduced sulfur dioxideemissions) <strong>and</strong> have lower combustion temperatures (reduced nitrogen oxide emissions).However, unless biomass is efficiently <strong>and</strong> cleanly converted to a secondary energy form,the environmental benefits are only partially realized, if at all. For this reason, efficient,modern biomass utilization must be favored over traditional applications.The use of biomass as an energy source is widely practiced throughout Thail<strong>and</strong>industries, particularly in rural <strong>and</strong> agricultural areas. Major industrial users of biomassenergy include sugar cane milling, rice milling, palm oil production, <strong>and</strong> the wood1 World <strong>Energy</strong> Council, “Renewable <strong>Energy</strong> Resources: Opportunities <strong>and</strong> Constraints 1990-2020,” 1993.January 5, 2001 2-2 Final Report

products industry. Although biomass energy use has been increasing at 8 percent annualgrowth recently, this rate has not been as fast as the overall growth in industrial energyuse. Consequently, the share of biomass energy used in industrial processes has steadilydropped from 46 percent in 1985, to 25 percent in 1996. Interestingly, although overallindustrial energy use declined when the financial crisis started in 1997, use of agricultural<strong>and</strong> wood residues actually climbed, increasing the share of biomass energy to 28 percent.2.1.4 Small Power Producers (SPP) Program OverviewSmall rural industries engaged in biomass power production may sell excessgeneration back to the grid through the SPP program. The SPP program was initiated bythe National <strong>Energy</strong> <strong>Policy</strong> Council <strong>and</strong> is implemented by Thail<strong>and</strong> electricity authorities(EGAT, PEA, MEA). Benefits of the program include conservation of fossil fuels,reduced fuel imports, conservation of foreign hard currency, <strong>and</strong> distributed generation.The intent of the program is to realize these external benefits, yet result in a direct cost toratepayers that is no higher than supplying electricity without SPP projects.The SPP regulations establish several conditions for purchases from SPPs. Theseinclude a purchased capacity limitation of 60 MW (up to 90 MW in certain locations) <strong>and</strong>the stipulation that EGAT be the sole purchaser of electricity. Payments to the SPP canconsist of an energy-only payment for electricity delivered (kWh) or an energy <strong>and</strong> acapacity payment. Capacity payments are made for contracts that are 5 to 25 years(“firm”) <strong>and</strong> that meet certain other requirements. Although capacity payments providesubstantial revenue to power projects, only three out of the 24 biomass projects acceptedso far into the SPP program receive such payments. 2 Furthermore, only 6.8 percent(101 MW) of the total SPP capacity connected to the EGAT system (1,491 MW) involveswaste or renewable resources. 32.2 Thail<strong>and</strong> Biomass Resource AssessmentBlack & Veatch conducted a biomass fuel supply review for Thail<strong>and</strong>. Thereview investigated nine types of biomass as possible fuel for power <strong>and</strong> cogenerationplants: rice husk, oil palm residues, bagasse, wood residues, corncob, cassava residues,distillery slop, coconut residues, <strong>and</strong> sawdust. Availability, distribution, production rates<strong>and</strong> forecasts, involved industries, prices, <strong>and</strong> the general suitability of the fuels for powerproduction were assessed. This section provides a summary of the investigation.2 NEPO website, www.nepo.go.th/power/pw-spp-purch00-02-E.html3 Arthur Anderson, “Thail<strong>and</strong> Power Pool <strong>and</strong> Electricity Supply Industry Reform Study-Phase 1 FinalReport,” Volume 5, March 1,2000.January 5, 2001 2-3 Final Report

Table 2-1 provides basic information on the most viable fuels identified: rice husk,palm oil residues, bagasse (from sugar cane milling), <strong>and</strong> wood residues. Other fuelsexamined are not considered as viable for various reasons. Corncobs <strong>and</strong> coconutresidues are generally left scattered, making collection difficult. They are suitablesupplementary fuels but are not a significant source of energy for power generation.Because of their high moisture content, cassava residues <strong>and</strong> distillery slop are not likelyto find widespread implementation as fuels.FuelTable 2-1Most Viable Biomass Fuels in Thail<strong>and</strong>Rice huskPalm OilResiduesBagasseWoodResiduesSource output, 10 6 tonne/yr 20 2.2 50 5.8Available residue, 10 6 tonne/yr a 2.3-3.7 0.41-0.74 2.25-3.5 1.8Higher heating value, kJ/kg 14,100 10,800 10,000 10,000Fuel consumption, tonne/yr/MW b 9,800 14,050 14,100 15,500Aggregate power generation potential, MW 234-375 33-53 160-248 118Notes:aEach biomass was estimated based on the following assumptions.Rice-husk –Based on rice mills of capacity minimum 100 tonnes of paddy/day.Palm Oil Residues – Based on the 17 crude palm oil extracting facilities. Residues consistof shells, fibre, <strong>and</strong> empty fruit bunch.Bagasse – Based on the 46 Sugar mills.Wood Residues – Included discarded processed wood <strong>and</strong> sawdust from general sawmills<strong>and</strong> parawood processing facilities <strong>and</strong> small logs from parawood plantation forest.bA uniform 85 percent capacity factor is assumed in this study.Aggregate power generation potential from all residues surveyed in this studyranges from 779 to 1,043 MW. This value is for residues not already in use <strong>and</strong> does notaccount for generation gains by increases in existing process or power generationefficiency (e.g., sugar cane milling). Figure 2-1 shows distribution of capacitydevelopable from the four most viable fuels. The most promising provinces account forabout 300 MW of developable capacity <strong>and</strong> include Suratthani, Suphan Buri,Kanchanaburi, Nakhon Sawan, Nakhon Ratchasi, Udon Thani, Kamphaeng Phet, Krabi,Trang, <strong>and</strong> Nakhon Sri Thammarat.January 5, 2001 2-4 Final Report

Kamphaeng PhetNakorn SawanUthai ThaniKhon KaenRoi EtKalasinChumpornSurat ThaniKrabiTrangFigure 2-1.Aggregate Potential Net Electric Capacity from Most Viable Residues <strong>and</strong>C<strong>and</strong>idate Facility Locations.January 5, 2001 2-5 Final Report

2.4.1 Identification <strong>and</strong> Screening of C<strong>and</strong>idate FacilitiesTo identify potential sites, the study team contacted various agro-industrialassociations, approached sites that generate large amounts of residues, <strong>and</strong> developed aquestionnaire to solicit facility information <strong>and</strong> interest in project development. Initialsite selection guidelines for identification of suitable facilities included:• Availability of biomass supply for power generation or cogeneration.• Biomass disposal concerns <strong>and</strong> the intention to develop a power plant.• Capability <strong>and</strong> experience of the facility owner(s) in developing power plants.One of the most important aspects in site selection was owner willingness toproceed with a power project. Because of the downturn in the economy, many facilitieswere uncomfortable with making large investments, especially in power generation, afield outside their regular business. For this reason, the study team had more difficultythan expected locating c<strong>and</strong>idate facilities.2.4.2 Memor<strong>and</strong>um of Underst<strong>and</strong>ing (MOU) DevelopmentHaving identified potential sites <strong>and</strong> established a desire in the facility owners toproceed with the study, the next step in the process was to develop a MOU between theowner, NEPO, <strong>and</strong> Black & Veatch. The MOU outlines the commitment of the owner topursue development of a biomass power facility if the feasibility study determines theproposed facility to be technically, environmentally, <strong>and</strong> financially viable. Throughexecution of the MOU, it is understood that NEPO is financing the study under theassumption that the facility owner will pursue further development of a viable project orrefund half the cost of the study unless acceptable reasons are provided to NEPO inwriting. The MOU defines the internal rate of return (IRR) for determining financialviability at 23 percent.The study team eventually received signed MOUs from each of the ten facilities:• Sommai Rice Mill Co., Ltd. Facility in Roi Et Province• Sanan Muang Rice Mill Co., Ltd. in Kamphaeng Phet Province• Thitiporn Thanya Rice Mill Co., Ltd. in Nakorn Sawan Province• Plan Creations Co., Ltd. in Trang Province• Chumporn Palm Oil Industry Plc., in Chumporn Province• Karnchanaburi Sugar Industry Co., Ltd. in Uthai Thani Province• Woodwork Creation Co., Ltd. in Krabi Province• Mitr Kalasin Sugar Co., Ltd. in Kalasin Province• Liang Hong Chai Rice Mill Co., Ltd. in Khon Kaen Province• Southern Palm Oil Industry (1993) Co., Ltd. in Surat Thani Province2.4.3 Data CollectionFollowing identification <strong>and</strong> initial screening of prospective facilities, Black &Veatch provided detailed data requests to facility owners. Data requests were facilityJanuary 5, 2001 2-7 Final Report

specific <strong>and</strong> were used to help Black & Veatch identify the optimal configuration of thepower facility, evaluate project feasibility, <strong>and</strong> identify other benefits of the project. Ofparticular importance was the quantity of biomass fuel available to the project, reliabilityof supply, <strong>and</strong> other characteristics of the fuel. Other information collected includedwater resource data, process descriptions, plant layouts, maps, labor requirements, currentwaste disposal practices, cost of electricity purchases, process steam needs, hours ofoperation, <strong>and</strong> plans for future expansion.2.4.4 Preliminary AssessmentWhen review of this information indicated a favorable potential for development,facility site visits were arranged to perform a preliminary assessment of the selectedfacility. The assessment was accomplished through review of the existing facilities,discussions with the staff, <strong>and</strong> gathering of other pertinent facility information.Each assessment addresses the facility’s potential for power plant development ormodification. None of the assessments completed identified any obvious developmentproblems that would preclude further investigation in a feasibility study.2.5 Facility Feasibility StudiesThis section summarizes the feasibility studies for the ten facilities <strong>and</strong> thepresentations made to facility owners. Figure 2-1 shows the location of the facilities <strong>and</strong>Table 2-2 summarizes results of the studies.Due to the length of the project <strong>and</strong> other factors, two major assumptions werechanged during the course of the study. These are the exchange rate for financialevaluation <strong>and</strong> the capital cost basis. Because the study commenced near the start of thefinancial crises, the Baht to US dollar exchange rate has fluctuated significantly over thecourse of this study. Evaluation of the first four sites was initially issued in June 1998<strong>and</strong> used an exchange rate of 43.53 Baht/US$. Since that time the exchange rate hasdropped significantly. The financial analysis for the last six sites reflects this drop <strong>and</strong>assumes an exchange rate of 37.15 Baht/US$.Secondly, there is an overall increase in project costs for facilities. This increaseis due to two factors.• Assumed equipment sourcing changed from Pacific Rim (e.g. Chinese)suppliers to higher cost European <strong>and</strong> US suppliers. These suppliersprovided higher cost information.• The last six sites were smaller resulting in higher specific costs due toeconomies of a scale.January 5, 2001 2-8 Final Report

FacilitySommaiRice MillSananMuangRice MillThitipornThanyaRice MillTable 2-2Facility SummaryPlanCreationsFacility type Rice mill Rice mill Rice mill WoodproductsChumpornPalm OilPalm oilmillKarnchanaburiSugar MillSugar millWoodworkCreationWoodproductsMitrKalasinSugar MillLiangHong ChaiRice MillSouthernPalm OilSugar mill Rice mill Palm oilmillNew plant or modifications? New New New New Mods. Mods. New New New NewResidue available from facility, t/yr 98,670 13,800 27,600 4,000 89,100 20,834 31,680 76,000 33,000 73,500Total residue use, t/yr 86,900 79,000 79,000 134,000 111,860 34,216 54,000 76,000 33,000 73,500Residue type Rice husk Rice husk Rice husk WoodwastePalm oilres. others aBagasse,corncobWoodwasteBagasse Rice husk Palm oilres. others aAnnual heat available, GJ/yr 1,225,868 1,113,900 1,113,900 1,380,200 1,564,000 b 406,980 510,300 725,040 465,300 1,072,932 bNet plant heat rate, kJ/kWh 18,708 18,708 18,708 21,015 49,500 c 47,205 c d 21,900 17,400 18,700 21,700 eNet plant output, kW 8,800 8,000 8,000 8,800 4,550 1,850 3,100 5,600 3,300 6,200Output sold to EGAT, kW 8,800 8,000 8,000 8,800 2,520 1,850 3,100 5,600 3,300 5,366Cogeneration? Steam flow, tonne/hr No No No No Yes, 31.85 No No No No Yes, 13.9 eEst. total project cost, US$ mil 9.71 9.27 9.27 10.59 5.0 1.95 8.65 13.4 9.73 14.6IRR (base case), percent 32.6 25.5 26.4 7.9 20.4 18.9 4.4 13.3 7.6 11.6IRR at 43.5 Baht/US$ exchange rate – – – – 15.8 15.9 2.1 9.8 5.1 8.4IRR at 20% reduced capital cost – – – – 29.4 26.7 8.5 20.1 12.6 17.9IRR for alternative study (seewriteup)– – – 38.5 39-69 27.5 25 46 13-29 13-25Notes:aChumporn Palm: palm oil residues (fiber, shells, empty fruit bunch), biogas, coconut husks; Southern Palm: palm oil residues (fiber <strong>and</strong> shells only), biogas.bChumporn Palm: includes biogas use of 6,000,000 m 3 /yr (136,000 GJ/yr); Southern Palm: includes biogas use of 3,570,000 m 3 /yr (80,682 GJ/yr).cBased on existing power facility performance information considering proposed modifications.dIncludes credit for surplus power generated by the existing sugar mill during the on-season.eAverage value. Southern Palm Oil requires varying amounts of process steam depending on the season.January 5, 2001 2-9 Final Report

Based on the assumptions noted in each study, the results of the studies indicatethat all ten of the c<strong>and</strong>idate facilities are technically <strong>and</strong> environmentally viable. Avariety of biomass fuels were examined in the studies including rice husk (4 facilities),wood waste (2), palm oil residues (2), <strong>and</strong> bagasse (2) as primary fuels <strong>and</strong> coconut husks(1), biogas (2), <strong>and</strong> corncobs (1) as supplementary fuels. Both entirely new powerfacilities <strong>and</strong> modifications to existing plant power facilities were examined.The power outputs examined ranged from 1.9 MW to 8.8 MW net for the basecase analyses. In support of financial sensitivity analyses, some preliminaryinvestigations were done for facilities sized up to 30 MW. Cogeneration of steam was avery significant design factor for the two palm oil mills <strong>and</strong> played a lesser role for theother facilities. In general, the studies found relatively few technical or environmentalobstacles.In base case analyses, the financial viability of the facilities was mixed. Three ofthe facilities identified (Sommai, Sanan Muang, <strong>and</strong> Thitiporn Thanya rice mills)surpassed the financial IRR hurdle of 23 percent in the base case analyses. Black &Veatch investigated alternative scenarios aimed at improving the financial rating of theother facilities. These studies, which are preliminary in nature, indicate that severalfactors could change to raise the IRR above 23 percent for these projects. In some cases,such as simply accounting for the value of cogenerated steam at the Chumporn Palm OilMill, the improvement in IRR can be dramatic <strong>and</strong> is compelling from an investmentst<strong>and</strong>point.The results of the studies for each site <strong>and</strong> owner reaction to the studies are brieflydiscussed below.• Sommai Rice Mill Co., Ltd.A new power facility was studied at the Sommai Rice Mill Co., Ltd. located inRoi Et. After an expansion that would raise the facility milling capacity to 1,300 tonnesof paddy per day, it is estimated that 100,000 tonne/year of rice husk could be availablefor power production. The proposed rice husk power plant would have a gross output of10.0 MW (8.8 MW net). The feasibility study concludes that the proposed developmentis technically, environmentally, <strong>and</strong> financially viable (IRR of 32.6 percent).The study results were presented to the facility owner who decided to pursuefurther project development. The development is proceeding well as a joint venturebetween Sommai <strong>and</strong> EGCO (Electricity Generating Plc.), <strong>and</strong> has reached the step atwhich a contractor is being selected to provide engineering, procurement, <strong>and</strong>construction services for the project.• Sanan Muang Rice Mill Co., Ltd.A new power facility was studied at the Sanan Muang Rice Mill Co., Ltd. inKamphaeng Phet. Rice husk from the 250 tonne paddy per day mill would beJanuary 5, 2001 2-10 Final Report

supplemented with husks from five other area mills. Total husks available for powerproduction are estimated to be 79,000 tonne/year. The proposed power plant would havea gross output of 9.1 MW (8.0 MW net). The study concludes that the proposeddevelopment is technically, environmentally, <strong>and</strong> financially viable (IRR of 25.5 percent).The study results were presented to the facility owner. The owner is interested infurther project development through a joint venture with other interested investor(s).• Thitiporn Thanya Rice Mill Co., Ltd.A new power facility was studied at the Thitiporn Thanya Rice Mill Co., Ltd.located in Nakorn Sawan. Rice husk from the 500 tonne paddy per day mill would besupplemented with husks from seven other area mills. Total husks available for powerproduction are estimated to be 79,000 tonne/year. The proposed power plant would havea gross output of 9.1 MW (8.0 MW net). The study concludes that the proposeddevelopment is technically, environmentally <strong>and</strong> financially viable (IRR of 26.4 percent).The study results were presented to the facility owner who is interested in furtherproject development through a joint venture with interested investor(s). However, theowner has exhibited some hesitancy since the plant would depend on outside fuel sources.• Plan Creations Co., Ltd.A new power facility was studied at the Plan Creations Co., Ltd. parawoodprocessing plant located in Trang. Only about 4,000 tonne/year of wood waste would beavailable from the facility. Additional residues could be obtained from other area mills<strong>and</strong> a large forestry residue collection operation. Total wood waste would be about134,000 tonne/year, which is sufficient to power a facility with a gross output of10.0 MW (8.8 MW net). The feasibility study concludes that the proposed developmentis technically <strong>and</strong> environmentally viable, but financially marginal (IRR of 7.95 percent)in the base case analysis. If a larger facility could be built, the project may be moreviable. Black & Veatch investigated the economics at a plant size of 28 MW <strong>and</strong> foundthat the IRR would increase to 38.5 percent at this size. The owner was presented thestudy results but is interested in implementation of a small (about 2 MW) system at thesite. At present the owner is soliciting project price information from a vendor.• Chumporn Palm Oil Industry Plc.Power facility modifications were studied at the Chumporn Palm Oil Industry Plc.palm oil mill located in Chumporn. Preliminary technical <strong>and</strong> economic analysis foundthat combustion of additional fuels using existing equipment for power generation up to3.7 MW is viable. The fuels used include facility wastes of palm shell, fiber, <strong>and</strong> emptyfruit bunch (EFB); biogas produced by the processing facility; <strong>and</strong> coconut husk <strong>and</strong>additional palm shell procured from the surrounding area. In addition, modifications tothe facility to allow greater power production were studied. The configuration selectedJanuary 5, 2001 2-11 Final Report

utilizes a low pressure condensing turbine to capture <strong>and</strong> generate power from the exhaustof the existing back pressure steam turbine, a condenser to recover turbine <strong>and</strong> processexhaust steam, an improved makeup water treatment system, <strong>and</strong> other modifications.The average gross plant output under this configuration would be approximately 5.4 MW(3.0 MW increase over the current capacity).The feasibility study concluded that the proposed development is technically <strong>and</strong>environmentally viable, <strong>and</strong> financially viable under certain conditions (base case IRR of20.4 percent). The new power plant will allow CPOI to operate at a higher palm oilproduction capacity because of increased steam cogeneration. It was found that inclusionof this benefit would make the project very attractive financially (IRR ranging from 39 to69 percent for steam value of 5 to 15 US$/tonne, respectively).Study results were presented to the facility, who generally concurred with thestudy but expressed some concern over recent fluctuations in the price of outsidesupplementary fuel. The facility would like to exp<strong>and</strong> their processing capabilities in thenear future. This will likely require some sort of upgrade to the power <strong>and</strong> steamsystems.• Karnchanaburi Sugar Industry Co., Ltd.Power facility modifications were studied at the Karnchanaburi Sugar IndustryCo., Ltd. located in Uthai Thani. The sugar mill currently operates a cogeneration facilitywith a maximum gross electrical output of 17.5 MW. Depending on the steam needs ofthe sugar mill, there is unused <strong>and</strong> unsold electrical capacity averaging about 455 kW atthe plant. In addition, excess bagasse <strong>and</strong>/or supplemental corncobs could be burned inthe off-season to provide power to the grid on a firm basis. The combination of theexcess existing power production, excess bagasse fuel, <strong>and</strong> supplemental corncob fuel canprovide a total of 1,850 kW net (capacity factor: 53.2 percent). Minor plant modifications<strong>and</strong> new equipment additions would be required. The feasibility study concludes that theproposed development is technically <strong>and</strong> environmentally viable, <strong>and</strong> financially viableunder certain conditions (IRR of 18.9 percent). Additional analysis found that increasesin sugar milling efficiency would allow enough bagasse to be produced so thatcombustion of supplemental corncob fuel would not be required. The IRR under thisscenario increases significantly to 27.5.Study results were presented to the facility owner who is interested <strong>and</strong> agreed tofurther development.• Woodwork Creation Co., Ltd.A new power facility was studied at the Woodwork Creation Co., Ltd. parawoodprocessing plant located in Krabi. A total of 31,680 tonne/yr of wood residue will beavailable at the facility after an upcoming expansion. In the base case analysis, a smallamount of fuel from the surrounding are is used, bringing the total fuel consumption toJanuary 5, 2001 2-12 Final Report

54,000 tonne/year <strong>and</strong> allowing a plant with a gross output of 3.55 MW (3.1 MW net).The analysis for this case was financially marginal (IRR of 4.4 percent). If a largerfacility (about 30 MW) could be built at the site or in the area, more favorable economicswould be achieved. Black & Veatch estimates an IRR of 25 percent that at this size,subject to the assumptions presented in the full report. The study results are under furtherconsideration by the owner.• Mitr Kalasin Sugar Co., Ltd.A new power facility was studied at the Mitr Kalasin Sugar Co., Ltd. sugar milllocated in Kalasin. The high pressure boiler for the proposed power plant would befueled with 76,000 tonne/yr of excess bagasse produced by the sugar mill. The newpower plant would have a gross output of 6.1 MW (5.6 MW net) <strong>and</strong> would operate yearround.The existing power facility (16.4 MW gross) would remain <strong>and</strong> would supply theprocessing operations with the required steam <strong>and</strong> power. The feasibility study concludesthat the proposed development is technically <strong>and</strong> environmentally viable, but financiallymarginal (base case IRR of 13.3 percent). An alternative option utilizes the existingequipment with minor additions <strong>and</strong> modifications to produce about 3.2 MW. Thispreliminary option has a much higher IRR of 46 percent. Both options were presented tothe facility, which is considering further development.• Liang Hong Chai Rice Mill Co., Ltd.A new power facility was studied at the Liang Hong Chai Rice Mill Co., Ltd.located in Khon Kaen. Liang Hong Chai owns two rice mills that together could supplyapproximately 33,000 tonne/yr of rice husk for power production. This level of residuewould allow a power plant of 3.8 MW gross (3.3 MW net). At this size, the financialfeasibility of the site is marginal (IRR of 7.6 percent). If a larger facility (about13.4 MW) could be built at the site, more favorable economics would be achieved. Black& Veatch estimates an IRR of 29 percent that at this size, subject to assumptionspresented in the full report. The study results are under further consideration by theowner.• Southern Palm Oil Industry (1993) Co., Ltd.A new power facility was studied at the Southern Palm Oil Industry (1993) Co.,Ltd. mill located in Surat Thani. The boiler for the proposed power plant would be fueledwith fiber, shells, <strong>and</strong> biogas produced by the processing facility. The power plant wouldhave a gross output of 7.0 MW (6.2 MW net) <strong>and</strong> would generate process steam. Theexisting power facility (880 kW) would remain <strong>and</strong> would be used for backup purposes.The feasibility study concludes that the proposed development is technically <strong>and</strong>environmentally viable, but financially marginal (IRR of 11.6 percent) in the base case.January 5, 2001 2-13 Final Report

However, due to increased steam production, the new power plant will allowSPOI to operate at a higher palm oil production capacity. If this benefit is included in thefinancial analysis <strong>and</strong> a larger plant size (28.3 MW) is assumed, significantly higherfinancial returns are attainable. Black & Veatch estimates that IRR of about 25 percentare possible under this scenario.The study results were presented to the facility owner. Although the financialperformance of the power project is marginal under base case assumptions, the facilitywould like to exp<strong>and</strong> their palm oil processing capabilities in the near future. This willlikely require some sort of upgrade to the mill power <strong>and</strong> steam systems.2.6 Promotion of Biomass in Thail<strong>and</strong>’s <strong>Energy</strong> FutureAs discussed previously, the percent of biomass capacity in the SPP program issmall <strong>and</strong> mostly contracted on a non-firm basis. Black & Veatch feels that there areseveral reasons for this relating to the current SPP program regulations (datedJanuary 1998) <strong>and</strong> other factors.2.6.1 Black & Veatch Comments on the SPP Program RegulationsThe present SPP regulations for biomass were established for payment of capacity<strong>and</strong> energy based on the long-term avoided cost of electricity from a fuel oil plant.However, biomass plants cannot be economically competitive on this basis:• Due to dispersed fuel, most biomass plants are small (about 5-30 MW)compared to fuel oil based plants. Thus, the capital cost per megawatt of abiomass power plant is usually higher than that for fuel oil power plants.• The fixed rate for the energy payment is based on the net plant heat rate for acombined cycle power plant, which is 9,070 kJ/kWh (8,600 Btu/kWh). Evenwith leading edge technology, biomass plants cannot achieve this level ofefficiency <strong>and</strong> are thus less competitive.2.6.2 Other Factors Impacting Biomass Project DevelopmentOwing to the existing regulations <strong>and</strong> other factors, very few biomass powerplants have sold electricity to the grid through firm contracts. Other reasons for the lackof biomass-based power generation in Thail<strong>and</strong> include:• <strong>Energy</strong> prices do not reflect external social costs such as air pollution, carbondioxide emissions, socioeconomic impacts, fuel imports, etc.• Investors or lenders would like to minimize biomass fuel supply risk simplyby establishing long term supply contracts, but these are very difficult toachieve. Alternative methods of risk management are often not explored.• Host facilities are often not familiar with the power generation business <strong>and</strong>are wary of making large investments in businesses outside their coreexperience.January 5, 2001 2-14 Final Report

• In addition to relatively high specific capital costs, development costs forbiomass plants are similar to larger plants, even though the capacities aremuch smaller.The combination of high up-front capital costs, unfamiliar technology, <strong>and</strong>unmanageable fuel supply risk, makes financing of biomass projects more difficult <strong>and</strong>expensive than conventional energy plants. The result is that those plants that are builtmay not be able to produce electricity at rates as low as conventional technologies.2.6.3 IncentivesA variety of incentive measures have been implemented around the world toencourage biomass <strong>and</strong> other renewable energy sources. Beyond direct increases incapacity <strong>and</strong> energy prices, Thail<strong>and</strong> should examine several measures:• Set a target for biomass <strong>and</strong> other renewable power plant generating capacityfor the next 10 years.• Establish a competitive subsidy scheme to encourage development of newrenewable energy power plants.• Promote marketing of biomass <strong>and</strong> other renewable energy sources as“green” energy to encourage public support of projects.• Collaborate with specific high potential industries (e.g., sugar cane milling) topromote higher efficiency plants <strong>and</strong> exp<strong>and</strong>ed biomass power generation.• Investigate alternative funding mechanisms to provide long-term loans withlow interest rates to biomass projects.Any incentive offered should be cognizant of the liberalization of the electricitysupply industry <strong>and</strong> flexible enough to respond to changing market conditions.NEPO has begun a successful campaign to promote renewable energy. This effortwill be further strengthened by the recent commissioning of an initiative to subsidize upto 300 MW of renewable energy projects through the <strong>Energy</strong> Conservation PromotionProgram (ENCON) fund. The capacity, which will be bid on a competitive basis, will bean important step to further the long-term energy policy goals of Thail<strong>and</strong>.January 5, 2001 2-15 Final Report

3.0 IntroductionThis Final Report has been prepared by Black & Veatch according to the Terms ofReference (TOR) for the “Biomass-Based Power Generation <strong>and</strong> Cogeneration WithinSmall Rural Industries” study commissioned by the National <strong>Energy</strong> <strong>Policy</strong> <strong>Office</strong>(NEPO) of Thail<strong>and</strong>. NEPO is promoting the use of biomass, such as wood waste,bagasse, rice husks, <strong>and</strong> oil palm residues, as fuel for electricity <strong>and</strong> steam production insmall rural industries. The benefits of this policy include reduction of petroleum imports,conservation of natural resources, <strong>and</strong> strengthening of rural economies. Under the SmallPower Producers (SPP) program, electricity generated by such plants can be sold to theElectricity Generating Authority of Thail<strong>and</strong> (EGAT). NEPO has commissioned Black &Veatch to perform a study of biomass power <strong>and</strong> cogeneration projects <strong>and</strong> to prepare thisFinal Report to summarize the results of the project. This report presents many aspectsrelated to biomass energy <strong>and</strong> includes summaries of ten biomass power plant feasibilitystudies done for sites around Thail<strong>and</strong>.This section of the report provides a description of the study objective, scope ofwork, <strong>and</strong> approach. The section also includes a brief overview of biomass energy.3.1 Study ObjectiveThe ultimate objective of this study is to develop biomass-based power generationas a source of electricity in Thail<strong>and</strong>. Using biomass agricultural residues in powergeneration <strong>and</strong> cogeneration schemes have the benefits of helping the involved facility tobe self-sufficient in meeting its own electricity <strong>and</strong> process heat dem<strong>and</strong>s, whileeliminating the problem of waste disposal. Developing the biomass energy resource willalso benefit Thail<strong>and</strong>’s economy because it helps the country to become less dependenton imported fossil fuels. The specific goals of this study are as follows:• To review the existing status of biomass fuels in Thail<strong>and</strong>.• To conduct feasibility studies on 10 small rural industries inorder to assess their potential for biomass-based powergeneration <strong>and</strong> cogeneration.• To demonstrate the financial viability of biomass-based powergeneration or cogeneration at the facilities in order toencourage investment decisions of the owners towardsimplementing the projects.• To assist the facilities to implement power generation <strong>and</strong>cogeneration, <strong>and</strong> to enter EGAT’s SPP Program.3.2 Study Scope of WorkThis subsection details the scope of work for the project.January 5, 2001 3-1 Final Report

3.2.1 Task DetailsTask 1 – Data Collection <strong>and</strong> Prefeasibility Study1. Review the existing status of biomass fuels in Thail<strong>and</strong>, including types, availability,production rates, forecasts, <strong>and</strong> the specific industry involved. Review the potentialof each type of biomass resource for electricity generation, the prices of each type ofbiomass resource in the existing market, <strong>and</strong> other uses of the biomass resources.Geographical location of the biomass resources is also important.2. Gather background information regarding the existing small rural industriesproducing agricultural residues which can be used as biomass fuels in Thail<strong>and</strong>.Review technical aspects of the industries including the process energy requirements<strong>and</strong> energy consumption. Review the st<strong>and</strong>ards <strong>and</strong> regulations of the Small PowerProducers Program.3. Locate a minimum of 10 facilities which have potential for biomass-based powergeneration or cogeneration. Touch base with personnel of the identified facilities inorder to initiate a working relationship.4. Develop a Memor<strong>and</strong>um of Underst<strong>and</strong>ing (MOU). The MOU will commit thefacility owners to pursue project implementation if the project provides to becommercially viable. The Consultant should seek to sign MOUs with 10 facilities.Projects with MOUs will have the highest priority for subsequent feasibility studies.5. Conduct detailed data collection of the 10 facilities which have signed MOUs. Thismay include field surveys of the actual site. The data collected in this step will beused in the detailed feasibility study of Task 2, therefore the data should includetechnical, economic, <strong>and</strong> ecological information.6. Evaluate the collected data <strong>and</strong> make preliminary assessment of biomass-based powergeneration <strong>and</strong> cogeneration in specific small rural industries. Complete otherappropriate pre-feasibility tasks.7. Compile a list of local <strong>and</strong>/or foreign suppliers of biomass-based power generation<strong>and</strong> cogeneration equipment. Locate contractors capable of installation of theequipment. Obtain prices of the equipment, installation costs, operations <strong>and</strong>maintenance costs, etc.Task 2 – Feasibility StudyThe tasks to be undertaken are identical for each of the 10 small rural industrieswhich are capable of implementing biomass-based power generation or cogenerationprojects <strong>and</strong> have signed MOUs. A project to be suitably evaluated is the to be placedwithin the system to which it belongs, <strong>and</strong> therefore, the evaluation is to consider theinterrelationships of the project <strong>and</strong> the other natural <strong>and</strong> socioeconomic components ofthe project system. The basic components of a detailed feasibility study are:1. Technical Feasibility: Determine the present status <strong>and</strong> future prospects of the localtechnological capacity, <strong>and</strong> requirement for foreign technology. Conduct preliminaryJanuary 5, 2001 3-2 Final Report

designs. Assess human <strong>and</strong> material requirements. Evaluate topographical <strong>and</strong>geological conditions, etc.2. Economic Feasibility: Establish costs <strong>and</strong> benefits related to the project from anoverall economic <strong>and</strong> social point of view. Assess indirect effects <strong>and</strong> evaluate theproject economic attractiveness.3. Financial Feasibility: Establish costs <strong>and</strong> benefits related to the project from the pointof view of the beneficiary of the project. Assess the financial attractiveness throughthe use of financial indicators. Establish a financing plan for the project. Assess thepast financial performance of the beneficiary of the project <strong>and</strong> potential for futuresound financial performance.4. Commercial Feasibility: Assess the status <strong>and</strong> prospects for the project product(s) tomeet dem<strong>and</strong>s of the current market. Survey the suitability of commercial systems fordistribution of the project product(s), <strong>and</strong> of the systems to supply raw materials <strong>and</strong>other inputs.5. Socioeconomic Feasibility: Evaluate the effects of the project with regard to thesociety involved, for instance creation or reduction of employment, etc.6. Ecological Feasibility: Asses the impacts <strong>and</strong> benefits of the project to the ecologicalenvironment. Check st<strong>and</strong>ards on ecological pollution.7. Juridical Feasibility: Check existing laws <strong>and</strong> other juridical constraints, <strong>and</strong>obligations favoring (or discouraging) the development <strong>and</strong> operation of the project.8. Political Feasibility: Evaluate the regional <strong>and</strong> sectoral planning, policy, <strong>and</strong>objectives. Determine whether the project implementation is consistent with relevantsectoral/energy policies.Task 3 – Assist Facility Owners to Invest in Biomass-Based Power Generation <strong>and</strong>CogenerationOnce biomass-based power generation <strong>and</strong> cogeneration has proved to be feasible,the next step is to assist the facilities to implement the project. The details of this workare as follows:1. Present the results of the feasibility studies to the respective facility owner. Thepresentation should emphasize how implementing cogeneration can help the ownerssave operation costs by producing electricity on-site <strong>and</strong> negating the cost ofdisposing biomass residue.2. Demonstrate the commercial viability of implementing biomass-based powergeneration <strong>and</strong> cogeneration to the facility owners. This includes briefing the ownerson EGAT’s SPP Program, <strong>and</strong> how owners can sell excess electricity back to the grid.Substantial economic <strong>and</strong> financial data should be presented to the owners in order topersuade them to invest in cogeneration projects are their facilities.3. Produce a h<strong>and</strong>book for facility owners in Thai <strong>and</strong> English explaining the procedurefor entering EGAT’s SPP Program, including all relevant implications concerned suchJanuary 5, 2001 3-3 Final Report

as commercial <strong>and</strong> juridical aspects. The h<strong>and</strong>books should also identify financingsources for the project implementation.3.2.2 Activities by TaskThis section describes the task activities undertaken by Black & Veatch(corresponding sections of this report are given to the right of the task title). Details onthese tasks are provided in the Detailed Work Plan <strong>and</strong> Methodology document preparedby Black & Veatch.Task 1Data Collection <strong>and</strong> Prefeasibility StudyBlack & Veatch collected data <strong>and</strong> conducted prefeasibility studies to identifypotential fuels, facilities, <strong>and</strong> technology for biomass-based power generationor cogeneration. The following subtasks were performed.Task 1.1 Status of Fuel Supply Section 4The existing status of biomass fuels in Thail<strong>and</strong> was reviewed. Fuels reviewedincluded rice husk, palm oil residues, bagasse, wood residues, corncobs,cassava residues, distillery slop, coconut residues, <strong>and</strong> sawdust. Availability,location, production rates, forecasts, industries involved, prices, <strong>and</strong> the generalsuitability of the fuel for power production were assessed.Task 1.2 Identification of C<strong>and</strong>idate Facilities Section 6 <strong>and</strong> 12C<strong>and</strong>idate industries <strong>and</strong> specific facilities with good potential for biomasspower generation were identified (Section 6). Such facilities included ricemills, sugar mills, palm oil mills, etc. This task also reviewed the regulations<strong>and</strong> requirements of the SPP program (Section 12).Task 1.3 Screening of C<strong>and</strong>idate Facilities Section 6A screening approach was used to select ten preferred facilities for furtheranalysis. A key consideration in light of the economic crisis was ownerwillingness to proceed with the project.Task 1.4 Development of a Memor<strong>and</strong>um of Underst<strong>and</strong>ing Section 7A generic Memor<strong>and</strong>um of Underst<strong>and</strong>ing (MOU) was developed. The MOUcommits facility owners to pursue project implementation in the event theproject proves to be financially viable. An MOU was signed with each of theten selected facilities <strong>and</strong> is included with the site feasibility studies.Task 1.5 Detailed Data Collection for Selected Facilities Section 8Site visits followed by continued dialog were used to collect data from theselected facilities for use in the feasibility studies.Task 1.6 Preliminary Assessment of Selected Facilities Section 9Black & Veatch made a preliminary evaluation of each of the biomass facilitiesbased on data collected in Task 1.5. Topics covered generally included currentoperations, power potential, proposed facility features, environmental aspects,January 5, 2001 3-4 Final Report