You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

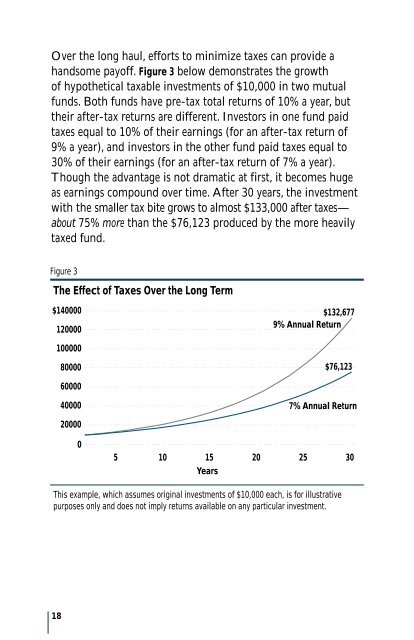

Over the long haul, efforts to minimize taxes can provide a<br />

h<strong>and</strong>some payoff. Figure 3 below demonstrates the growth<br />

of hypothetical taxable investments of $10,000 in two mutual<br />

funds. Both funds have pre-tax total returns of 10% a year, but<br />

their after-tax returns are different. Investors in one fund paid<br />

taxes equal to 10% of their earnings (for an after-tax return of<br />

9% a year), <strong>and</strong> investors in the other fund paid taxes equal to<br />

30% of their earnings (for an after-tax return of 7% a year).<br />

Though the advantage is not dramatic at first, it becomes huge<br />

as earnings compound over time. After 30 years, the investment<br />

with the smaller tax bite grows to almost $133,000 after taxes—<br />

about 75% more than the $76,123 produced by the more heavily<br />

taxed fund.<br />

Figure 3<br />

The Effect of <strong>Taxes</strong> Over the Long Term<br />

$140000<br />

120000<br />

100000<br />

18<br />

80000<br />

60000<br />

40000<br />

20000<br />

0<br />

$132,677<br />

9% Annual Return<br />

$76,123<br />

7% Annual Return<br />

5 10 15<br />

Years<br />

20 25 30<br />

This example, which assumes original investments of $10,000 each, is for illustrative<br />

purposes only <strong>and</strong> does not imply returns available on any particular investment.