Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Tax-managed funds<br />

Some funds are managed to keep taxable gains <strong>and</strong> income low.<br />

Among the strategies these funds employ are indexing (to hold down<br />

turnover), carefully selecting which shares to sell (so that capital<br />

losses offset most capital gains), <strong>and</strong> encouraging long-term<br />

investing (for example, by assessing fees on shareholders who<br />

redeem their shares soon after buying them).<br />

Investing for tax-exempt income<br />

Interest on most municipal bonds is exempt from federal income<br />

tax <strong>and</strong>, in some cases, from state <strong>and</strong> local income taxes as well.<br />

However, municipal bond funds (which pay lower yields than<br />

taxable bond funds as the trade-off for their tax advantage) are not<br />

for everyone. Generally, investors in lower tax brackets do not<br />

benefit from owning municipal bond funds. The box below explains<br />

how to compare yields on tax-exempt <strong>and</strong> taxable bond funds.<br />

22<br />

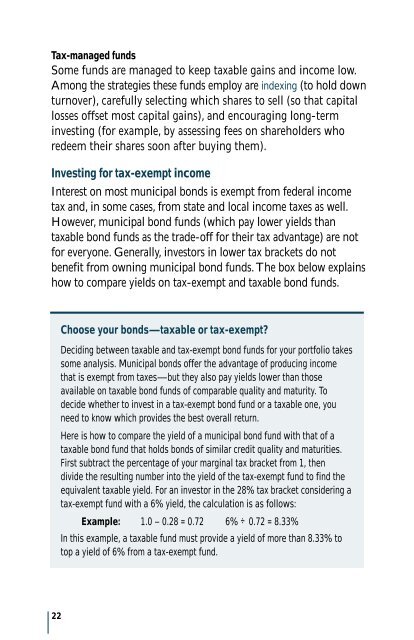

Choose your bonds—taxable or tax-exempt?<br />

Deciding between taxable <strong>and</strong> tax-exempt bond funds for your portfolio takes<br />

some analysis. Municipal bonds offer the advantage of producing income<br />

that is exempt from taxes—but they also pay yields lower than those<br />

available on taxable bond funds of comparable quality <strong>and</strong> maturity. To<br />

decide whether to invest in a tax-exempt bond fund or a taxable one, you<br />

need to know which provides the best overall return.<br />

Here is how to compare the yield of a municipal bond fund with that of a<br />

taxable bond fund that holds bonds of similar credit quality <strong>and</strong> maturities.<br />

First subtract the percentage of your marginal tax bracket from 1, then<br />

divide the resulting number into the yield of the tax-exempt fund to find the<br />

equivalent taxable yield. For an investor in the 28% tax bracket considering a<br />

tax-exempt fund with a 6% yield, the calculation is as follows:<br />

Example: 1.0 – 0.28 = 0.72 6% ÷ 0.72 = 8.33%<br />

In this example, a taxable fund must provide a yield of more than 8.33% to<br />

top a yield of 6% from a tax-exempt fund.