Labour Market Assistance Industry Award 2010

Labour Market Assistance Industry Award 2010

Labour Market Assistance Industry Award 2010

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

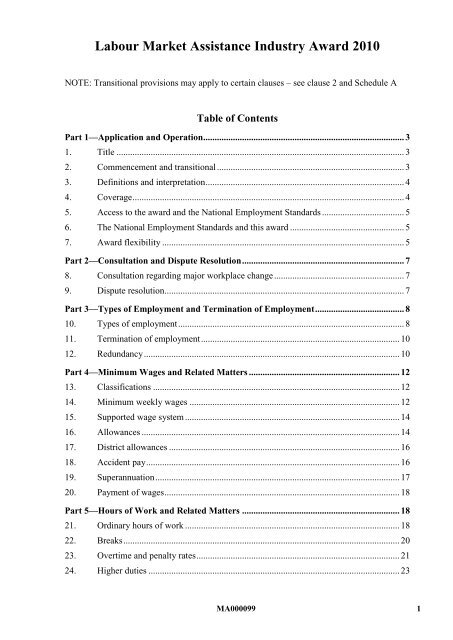

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>Part 1—Application and Operation1. TitleThis award is the <strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>.2. Commencement and transitional2.1 This award commences on 1 January <strong>2010</strong>.2.2 The monetary obligations imposed on employers by this award may be absorbed intooveraward payments. Nothing in this award requires an employer to maintain orincrease any overaward payment.2.3 This award contains transitional arrangements which specify when particular parts ofthe award come into effect. Some of the transitional arrangements are in clauses inthe main part of the award. There are also transitional arrangements in Schedule A.The arrangements in Schedule A deal with: minimum wages and piecework rates casual or part-time loadings Saturday, Sunday, public holiday, evening or other penalties shift allowances/penalties.2.4 Neither the making of this award nor the operation of any transitional arrangementsis intended to result in a reduction in the take-home pay of employees covered by theaward. On application by or on behalf of an employee who suffers a reduction intake-home pay as a result of the making of this award or the operation of anytransitional arrangements, Fair Work Australia may make any order it considersappropriate to remedy the situation.2.5 Fair Work Australia may review the transitional arrangements in this award andmake a determination varying the award.2.6 Fair Work Australia may review the transitional arrangements:(a)(b)(c)(d)on its own initiative; oron application by an employer, employee, organisation or outworker entitycovered by the modern award; oron application by an organisation that is entitled to represent the industrialinterests of one or more employers or employees that are covered by themodern award; orin relation to outworker arrangements, on application by an organisation that isentitled to represent the industrial interests of one or more outworkers to whomthe arrangements relate.MA000099 3

3. Definitions and interpretation<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>3.1 In this award, unless the contrary intention appears:Act means the Fair Work Act 2009 (Cth)agreement-based transitional instrument has the meaning in the Fair Work(Transitional Provisions and Consequential Amendments) Act 2009 (Cth)arrangement or contract with federal or State governments does not include thedelivery of recruitment, outplacement, on-hire or similar services to federal or stategovernments to address its own workforce needsaward-based transitional instrument has the meaning in the Fair Work(Transitional Provisions and Consequential Amendments) Act 2009 (Cth)employee means a national system employee as defined in sections 13 and 30C ofthe Actemployer means a national system employer as defined in sections 14 and 30D ofthe Actenterprise award-based instrument has the meaning in the Fair Work(Transitional Provisions and Consequential Amendments) Act 2009 (Cth)labour market assistance industry means the provision of work placement, jobsearching, personal support, vocational training and related services in the welfaresector, delivered by arrangement or contract with federal and State governments, toassist persons seeking employmenton-hire means the on-hire of an employee by their employer to a client, where suchemployee works under the general guidance and instruction of the client or arepresentative of the clientNES means the National Employment Standards as contained in sections 59 to 131of the Fair Work Act 2009 (Cth)standard rate means the minimum weekly wage for an Administrative assistant—Pay point 2 in clause 14.1transitional minimum wage instrument has the meaning in the Fair Work(Transitional Provisions and Consequential Amendments) Act 2009 (Cth)3.2 Where this award refers to a condition of employment provided for in the NES, theNES definition applies.4. Coverage4.1 This industry award covers employers in the labour market assistance industrythroughout Australia and their employees in the classifications listed in ScheduleB—Classification Definitions to the exclusion of any other modern award.4.2 The award does not cover employers and employees covered by the SupportedEmployment Services <strong>Award</strong> <strong>2010</strong>.4 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>4.3 The award does not cover an employee excluded from award coverage by the Act.4.4 The award does not cover employees who are covered by a modern enterprise award,or an enterprise instrument (within the meaning of the Fair Work (TransitionalProvisions and Consequential Amendments) Act 2009 (Cth)), or employers inrelation to those employees.4.5 The award does not cover employees who are covered by a State reference publicsector modern award, or a State reference public sector transitional award (within themeaning of the Fair Work (Transitional Provisions and Consequential Amendments)Act 2009 (Cth)), or employers in relation to those employees.4.6 This award covers any employer which supplies labour on an on-hire basis in theindustry set out in clause 4.1 in respect of on-hire employees in classificationscovered by this award, and those on-hire employees, while engaged in theperformance of work for a business in that industry. This subclause operates subjectto the exclusions from coverage in this award.4.7 Where an employer is covered by more than one award, an employee of thatemployer is covered by the award classification which is most appropriate to thework performed by the employee and to the environment in which the employeenormally performs the work.NOTE: Where there is no classification for a particular employee in this award it ispossible that the employer and that employee are covered by an award withoccupational coverage.5. Access to the award and the National Employment StandardsThe employer must ensure that copies of this award and the NES are available to allemployees to whom they apply either on a noticeboard which is conveniently located at ornear the workplace or through electronic means, whichever makes them more accessible.6. The National Employment Standards and this awardThe NES and this award contain the minimum conditions of employment for employeescovered by this award.7. <strong>Award</strong> flexibility7.1 Notwithstanding any other provision of this award, an employer and an individualemployee may agree to vary the application of certain terms of this award to meet thegenuine individual needs of the employer and the individual employee. The terms theemployer and the individual employee may agree to vary the application of are thoseconcerning:(a)(b)(c)arrangements for when work is performed;overtime rates;penalty rates;MA000099 5

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(d)(e)allowances; andleave loading.7.2 The employer and the individual employee must have genuinely made the agreementwithout coercion or duress.7.3 The agreement between the employer and the individual employee must:(a)(b)be confined to a variation in the application of one or more of the terms listedin clause 7.1; andresult in the employee being better off overall than the employee would havebeen if no individual flexibility agreement had been agreed to.7.4 The agreement between the employer and the individual employee must also:(a)(b)(c)(d)(e)be in writing, name the parties to the agreement and be signed by the employerand the individual employee and, if the employee is under 18 years of age, theemployee’s parent or guardian;state each term of this award that the employer and the individual employeehave agreed to vary;detail how the application of each term has been varied by agreement betweenthe employer and the individual employee;detail how the agreement results in the individual employee being better offoverall in relation to the individual employee’s terms and conditions ofemployment; andstate the date the agreement commences to operate.7.5 The employer must give the individual employee a copy of the agreement and keepthe agreement as a time and wages record.7.6 Except as provided in clause 7.4(a) the agreement must not require the approval orconsent of a person other than the employer and the individual employee.7.7 An employer seeking to enter into an agreement must provide a written proposal tothe employee. Where the employee’s understanding of written English is limited theemployer must take measures, including translation into an appropriate language, toensure the employee understands the proposal.7.8 The agreement may be terminated:(a)(b)by the employer or the individual employee giving four weeks’ notice oftermination, in writing, to the other party and the agreement ceasing to operateat the end of the notice period; orat any time, by written agreement between the employer and the individualemployee.7.9 The right to make an agreement pursuant to this clause is in addition to, and is notintended to otherwise affect, any provision for an agreement between an employerand an individual employee contained in any other term of this award.6 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>Part 2—Consultation and Dispute Resolution8. Consultation regarding major workplace change8.1 Employer to notify(a)(b)Where an employer has made a definite decision to introduce major changes inproduction, program, organisation, structure or technology that are likely tohave significant effects on employees, the employer must notify the employeeswho may be affected by the proposed changes and their representatives, if any.Significant effects include termination of employment; major changes in thecomposition, operation or size of the employer’s workforce or in the skillsrequired; the elimination or diminution of job opportunities, promotionopportunities or job tenure; the alteration of hours of work; the need forretraining or transfer of employees to other work or locations; and therestructuring of jobs. Provided that where this award makes provision foralteration of any of these matters an alteration is deemed not to have significanteffect.8.2 Employer to discuss change(a)(b)(c)The employer must discuss with the employees affected and theirrepresentatives, if any, the introduction of the changes referred to in clause 8.1,the effects the changes are likely to have on employees and measures to avertor mitigate the adverse effects of such changes on employees and must giveprompt consideration to matters raised by the employees and/or theirrepresentatives in relation to the changes.The discussions must commence as early as practicable after a definite decisionhas been made by the employer to make the changes referred to in clause 8.1.For the purposes of such discussion, the employer must provide in writing tothe employees concerned and their representatives, if any, all relevantinformation about the changes including the nature of the changes proposed,the expected effects of the changes on employees and any other matters likelyto affect employees provided that no employer is required to discloseconfidential information the disclosure of which would be contrary to theemployer’s interests.9. Dispute resolution9.1 In the event of a dispute about a matter under this award, or a dispute in relation tothe NES, in the first instance the parties must attempt to resolve the matter at theworkplace by discussions between the employee or employees concerned and therelevant supervisor. If such discussions do not resolve the dispute, the parties willendeavour to resolve the dispute in a timely manner by discussions between theemployee or employees concerned and more senior levels of management asappropriate.MA000099 7

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>9.2 If a dispute about a matter arising under this award or a dispute in relation to the NESis unable to be resolved at the workplace, and all appropriate steps under clause 9.1have been taken, a party to the dispute may refer the dispute to Fair Work Australia.9.3 The parties may agree on the process to be utilised by Fair Work Australia includingmediation, conciliation and consent arbitration.9.4 Where the matter in dispute remains unresolved, Fair Work Australia may exerciseany method of dispute resolution permitted by the Act that it considers appropriate toensure the settlement of the dispute.9.5 An employer or employee may appoint another person, organisation or association toaccompany and/or represent them for the purposes of this clause.9.6 While the dispute resolution procedure is being conducted, work must continue inaccordance with this award and the Act. Subject to applicable occupational healthand safety legislation, an employee must not unreasonably fail to comply with adirection by the employer to perform work, whether at the same or anotherworkplace, that is safe and appropriate for the employee to perform.Part 3—Types of Employment and Termination of Employment10. Types of employment10.1 Employment categories(a)Employees under this award will be employed in one of the followingcategories:(i)(ii)full-time employment;part-time employment;(iii) casual employment; or(iv) sessional employment.(b)At the time of engagement, an employer must, for each new employee (excepta casual employee), specify:(i)(ii)an outline of the main duties of the position;the employee’s regular hours of work and the employee’s normal span ofhours for ordinary duty in accordance with clause 21—Ordinary hours ofwork;(iii) the employee’s classification and rate of pay; and(iv) the nature of the engagement in accordance with clause 10.1(a).10.2 Full-time employmentA full-time employee is one who is engaged to work 38 hours per week or anaverage of 38 hours per week.8 MA000099

10.3 Part-time employment<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(a)(b)(c)(d)A part-time employee is one who is engaged to work a specified number ofregular hours being less than 38 hours per week or an average of 38 hours perweek.A part-time employee’s hours of work may be temporarily varied up to amaximum of 38 hours per week by agreement between the employer and anindividual employee.The terms of this award will apply to part-time employees as provided tofull-time employees on a pro rata basis.By mutual agreement between the employer and employee, a part-timeemployee may be paid a loading of 25% on their hourly rate and not have anentitlement to annual leave, personal/carers’ leave or payment for publicholidays. Such agreement will not alter the employee’s status as a part-timeemployee.10.4 Casual employment(a)(b)(c)(d)A casual employee means an employee who is engaged intermittently by thehour for work of an unexpected or casual nature and does not include anemployee who could properly be engaged as a full-time, part-time or sessionalemployee.An employee engaged as a casual employee will be engaged for a minimumperiod of two consecutive hours per engagement.A casual employee will be paid for each hour worked during the ordinary hoursof work provided in clause 21—Ordinary hours of work, a rate equal to 1/38thof the weekly rate appropriate to the employee’s classification. In addition, aloading of 25% of that rate will be paid.Where a casual employee is employed outside of the ordinary span of hoursprovided in clause 21—Ordinary hours of work, the hourly rate (exclusive ofthe 25% loading) will be increased by the penalty rates provided in clause 23—Overtime and penalty rates.10.5 Sessional employment(a)(b)(c)(d)An employee may be engaged on a sessional basis to provide training sessionsto clients.A sessional employee will be engaged for a minimum of two consecutive hoursin any one day.A sessional employee will be paid the minimum casual hourly rate equivalentto the casual hourly rate of pay for a Training and placement officer grade 1Pay point 3.In addition, a sessional employee will be paid for preparation and associatednon-teaching/training tasks. This payment can be paid by either:(i)incorporating a loading of 33.3% into the hourly rate, provided that thisrate is separately expressed; orMA000099 9

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(ii) paying the employee one hour’s preparation/associatednon-teaching/training tasks for every three hours’ teaching up to amaximum of five additional hours per week.(e)(f)(g)An employer who employs a sessional employee under the terms ofclause 10.5(d)(i) will not be obliged to pay the preparation loading in respect ofany period involving staff training or staff meetings.Upon engagement, in addition to the requirements specified for contracts ofemployment provided in clause 10.1 of this award, the employer will providewritten advice to the employee setting out the particular arrangements forpreparation and associated non-teaching/training tasks which will apply inrespect of the employee.Cancellation provisionsIf a training course is cancelled and the employer no longer requires theservices of a sessional employee engaged for the course, the employer willprovide the sessional employee with two weeks’ notice of termination orpayment instead of notice equivalent to two weeks’ pay (inclusive ofpreparation loading or preparation time).11. Termination of employment11.1 Notice of termination is provided for in the NES.11.2 Notice of termination by an employeeThe notice of termination required to be given by an employee is the same as thatrequired of an employer except that there is no requirement on the employee to giveadditional notice based on the age of the employee concerned. If an employee fails togive the required notice the employer may withhold from any monies due to theemployee on termination under this award or the NES, an amount not exceeding theamount the employee would have been paid under this award in respect of the periodof notice required by this clause less any period of notice actually given by theemployee.11.3 Job search entitlementWhere an employer has given notice of termination to an employee, an employeemust be allowed up to one day’s time off without loss of pay for the purpose ofseeking other employment. The time off is to be taken at times that are convenient tothe employee after consultation with the employer.12. Redundancy12.1 Redundancy pay is provided for in the NES.12.2 Transfer to lower paid dutiesWhere an employee is transferred to lower paid duties by reason of redundancy, thesame period of notice must be given as the employee would have been entitled to ifthe employment had been terminated and the employer may, at the employer’s10 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>option, make payment instead of an amount equal to the difference between theformer ordinary time rate of pay and the ordinary time rate of pay for the number ofweeks of notice still owing.12.3 Employee leaving during notice periodAn employee given notice of termination in circumstances of redundancy mayterminate their employment during the period of notice. The employee is entitled toreceive the benefits and payments they would have received under this clause hadthey remained in employment until the expiry of the notice, but is not entitled topayment instead of notice.12.4 Job search entitlement(a)(b)An employee given notice of termination in circumstances of redundancy mustbe allowed up to one day’s time off without loss of pay during each week ofnotice for the purpose of seeking other employment.If the employee has been allowed paid leave for more than one day during thenotice period for the purpose of seeking other employment, the employee must,at the request of the employer, produce proof of attendance at an interview orthey will not be entitled to payment for the time absent. For this purpose astatutory declaration is sufficient.(c) This entitlement applies instead of clause 11.3.12.5 Transitional provisions(a)Subject to clause 12.5(b), an employee whose employment is terminated by anemployer is entitled to redundancy pay in accordance with the terms of anotional agreement preserving a State award:(i)(ii)that would have applied to the employee immediately prior to 1 January<strong>2010</strong>, if the employee had at that time been in their current circumstancesof employment and no agreement-based transitional instrument orenterprise agreement had applied to the employee; andthat would have entitled the employee to redundancy pay in excess of theemployee’s entitlement to redundancy pay, if any, under the NES.(b)(c)The employee’s entitlement to redundancy pay under the notional agreementpreserving a State award is limited to the amount of redundancy pay whichexceeds the employee’s entitlement to redundancy pay, if any, under the NES.This clause does not operate to diminish an employee’s entitlement toredundancy pay under any other instrument.(d) Clause 12.5 ceases to operate on 31 December 2014.MA000099 11

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>Part 4—Minimum Wages and Related Matters13. Classifications13.1 All employees covered by this award must be classified according to the structureand definitions set out in Schedule B—Classification Definitions.13.2 Progression(a)At the end of each 12 months’ continuous employment, an employee will beeligible for progression from one pay point to the next within a classification if:(i)(ii)the employee has demonstrated competency and satisfactory performanceover a minimum of 12 months at each pay point within the classification;andthe employee has acquired and satisfactorily used new or enhanced skillsif required by the employer.(b)(c)Competency and satisfactory performance is deemed to be satisfactory by theemployer in accordance with its employment policies and procedures.Movement to a higher classification will only occur by way of promotion orreclassification.13.3 Salary packagingWhere agreed between the employer and a full-time or part-time employee, anemployer may introduce remuneration packaging in respect of salary, as provided forin clause 14—Minimum weekly wages. The terms and conditions of such a packagemust not, when viewed objectively, be less favourable than the entitlementsotherwise available under this award.14. Minimum weekly wages14.1 Administrative assistantPer week$Pay point 1 619.51Pay point 2 630.26Pay point 3 654.05Pay point 4 675.7314.2 Administrative officerPer week$Pay point 1 717.10Pay point 2 733.7812 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>Per week$Pay point 3 750.08Pay point 4 771.7614.3 Training and placement officer grade 1Per week$Pay point 1 695.42Pay point 2 717.10Pay point 3 733.7814.4 Training and placement officer grade 2Per week$Pay point 1 750.08Pay point 2 771.76Pay point 3 793.44Pay point 4 815.12Pay point 5 834.8114.5 Training and placement co-ordinatorPer week$Pay point 1 834.81Pay point 2 856.49Pay point 3 876.18Pay point 4 897.8614.6 Manager grade 1Per week$Pay point 1 834.81Pay point 2 856.49Pay point 3 876.18Pay point 4 897.86Pay point 5 919.54Pay point 6 941.22MA000099 13

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>14.7 Manager grade 2Per week$Pay point 1 962.92Pay point 2 984.60Pay point 3 1006.28Pay point 4 1027.96Pay point 5 1049.6415. Supported wage systemSee Schedule C16. Allowances16.1 Meal allowanceEmployees will be entitled to a meal allowance of $11.80 in the followingcircumstances:(a)(b)where the employee works overtime in excess of two hours on any of the daysupon which ordinary hours are worked; orwhere the employee works five hours or more on a day which is not anordinary working day.16.2 First aid allowanceAn employee who is required by their employer to perform first aid duty at theirworkplace who holds a current first aid certificate issued by St John Ambulance orthe Australian Red Cross Society or equivalent qualification will be paid a weeklyallowance of 1.67% of the standard rate.16.3 Vehicle allowance(a)(b)(c)Where an employee is required to use their own motor vehicle on theemployer’s business, the employee is entitled to be reimbursed at the rate of$0.74 per kilometre.An employee required to travel by other means in connection with their workwill be reimbursed all reasonable travelling expenses so incurred withreasonable proof of such expenses to be provided by the employee to theemployer.Where an employee is called on duty at night or other than their normal hours,or on any non-working day, they will be reimbursed their fares, or if using theirown vehicle to travel between home and the place of work, receive a vehicleallowance, as provided in clause 16.3(a).14 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(d)(e)Where an employee is required to use their own motor vehicle on theemployer’s business and, by reason of that use, the employee is required, underthe law in force in the State or Territory in which the motor vehicle isregistered, to pay a fee for the registration of the motor vehicle that exceeds thefee that they would otherwise have been required to pay under that law for theregistration of the motor vehicle, the employee is entitled to be paid, by way ofreimbursement, an amount equal to the amount of the excess.Where an employee is required to use their own motor vehicle on theemployer’s business and, by reason of that use, the employee is required to payan amount by way of full comprehensive insurance premium that exceeds theamount that the employee would otherwise have been required to pay by wayof full comprehensive insurance premium, the employee is entitled to be paidby way of reimbursement an amount equal to the amount of the excess.16.4 Travelling expensesAn employee required to stay away from home overnight will be reimbursed the costof reasonable board, lodging and meals. Reasonable proof of costs so incurred is tobe provided by the employee to the employer.16.5 ExcursionsWhere an employee is required to supervise clients in excursion activities involvingovernight stays away from home, the following provisions will apply:(a)(b)payment at ordinary rates of pay for time worked between the hours of 8.00 amto 6.00 pm Monday to Sunday up to a maximum of eight hours per day; andin addition, payment of a sleepover allowance of 7.76% of the standard ratewill be made for every night spent away from home while on excursions.16.6 Adjustment of expense related allowances(a)(b)At the time of any adjustment to the standard rate, each expense relatedallowance will be increased by the relevant adjustment factor. The relevantadjustment factor for this purpose is the percentage movement in the applicableindex figure most recently published by the Australian Bureau of Statisticssince the allowance was last adjusted.The applicable index figure is the index figure published by the AustralianBureau of Statistics for the Eight Capitals Consumer Price Index (Cat No.6401.0), as follows:AllowanceMeal allowanceVehicle allowanceApplicable Consumer Price Index figureTake away and fast foods sub-groupPrivate motoring sub-groupMA000099 15

17. District allowances17.1 Northern Territory<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>An employee in the Northern Territory is entitled to payment of a district allowancein accordance with the terms of an award made under the Workplace Relations Act1996 (Cth):(a) that would have applied to the employee immediately prior to 1 January <strong>2010</strong>,if the employee had at that time been in their current circumstances ofemployment and no agreement-based transitional instrument or enterpriseagreement had applied to the employee; and(b)that would have entitled the employee to payment of a district allowance.17.2 Western AustraliaAn employee in Western Australia is entitled to payment of a district allowance inaccordance with the terms of a notional agreement preserving a State award or anaward made under the Workplace Relations Act 1996 (Cth):(a) that would have applied to the employee immediately prior to 1 January <strong>2010</strong>,if the employee had at that time been in their current circumstances ofemployment and no agreement-based transitional instrument or enterpriseagreement had applied to the employee; and(b)that would have entitled the employee to payment of a district allowance.17.3 This clause ceases to operate on 31 December 2014.18. Accident pay18.1 Subject to clause 18.2, an employee is entitled to accident pay in accordance with theterms of:(a)(b)a notional agreement preserving a State award that would have applied to theemployee immediately prior to 1 January <strong>2010</strong> or an award made under theWorkplace Relations Act 1996 (Cth) that would have applied to the employeeimmediately prior to 27 March 2006, if the employee had at that time been intheir current circumstances of employment and no agreement-based transitionalinstrument or enterprise agreement had applied to the employee; andthat would have entitled the employee to accident pay in excess of theemployee’s entitlement to accident pay, if any, under any other instrument.18.2 The employee’s entitlement to accident pay under the notional agreement preservinga State award or the award is limited to the amount of accident pay which exceedsthe employee’s entitlement to accident pay, if any, under any other instrument.18.3 This clause does not operate to diminish an employee’s entitlement to accident payunder any other instrument.18.4 This clause ceases to operate on 31 December 2014.16 MA000099

19. Superannuation19.1 Superannuation legislation<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(a) Superannuation legislation, including the Superannuation Guarantee(Administration) Act 1992 (Cth), the Superannuation Guarantee Charge Act1992 (Cth), the Superannuation <strong>Industry</strong> (Supervision) Act 1993 (Cth) and theSuperannuation (Resolution of Complaints) Act 1993 (Cth), deals with thesuperannuation rights and obligations of employers and employees. Undersuperannuation legislation individual employees generally have the opportunityto choose their own superannuation fund. If an employee does not choose asuperannuation fund, any superannuation fund nominated in the awardcovering the employee applies.(b)The rights and obligations in these clauses supplement those in superannuationlegislation.19.2 Employer contributionsAn employer must make such superannuation contributions to a superannuation fundfor the benefit of an employee as will avoid the employer being required to pay thesuperannuation guarantee charge under superannuation legislation with respect tothat employee.19.3 Voluntary employee contributions(a)(b)(c)Subject to the governing rules of the relevant superannuation fund, anemployee may, in writing, authorise their employer to pay on behalf of theemployee a specified amount from the post-taxation wages of the employeeinto the same superannuation fund as the employer makes the superannuationcontributions provided for in clause 19.2.An employee may adjust the amount the employee has authorised theiremployer to pay from the wages of the employee from the first of the monthfollowing the giving of three months’ written notice to their employer.The employer must pay the amount authorised under clauses 19.3(a) or (b) nolater than 28 days after the end of the month in which the deduction authorisedunder clauses 19.3(a) or (b) was made.19.4 Superannuation fundUnless, to comply with superannuation legislation, the employer is required to makethe superannuation contributions provided for in clause 19.2 to anothersuperannuation fund that is chosen by the employee, the employer must make thesuperannuation contributions provided for in clause 19.2 and pay the amountauthorised under clauses 19.3(a) or (b) to any superannuation fund to which theemployer was making superannuation contributions for the benefit of its employeesbefore 12 September 2008, provided the superannuation fund or its successor is aneligible choice fund.MA000099 17

19.5 Absence from work<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>Subject to the governing rules of the relevant superannuation fund, the employermust also make the superannuation contributions provided for in clause 19.2 and paythe amount authorised under clauses 19.3(a) or (b):(a)(b)Paid leave—while the employee is on any paid leave;Work-related injury or illness—for the period of absence from work (subjectto a maximum of 52 weeks) of the employee due to work-related injury orwork-related illness provided that:(i)(ii)the employee is receiving workers compensation payments or isreceiving regular payments directly from the employer in accordancewith the statutory requirements; andthe employee remains employed by the employer.20. Payment of wagesAll wages will be paid weekly, fortnightly, four weekly or monthly by cash, cheque orelectronic transfer in accordance with the arrangements determined by the employer and notmore than five days following the end of the pay period.Part 5—Hours of Work and Related Matters21. Ordinary hours of work21.1 Ordinary hours of workThe ordinary hours of work will be no more than an average of 38 hours per week tobe worked over 152 hours within a work cycle not exceeding 28 days and notexceeding 10 hours in any one day.21.2 Span of hoursThe ordinary hours of work will be worked between 6.00 am and 8.00 pm Monday toFriday.21.3 Flexible hours(a)Accrued days/time offThe following arrangements will apply in respect of full-time employeesworking in accordance with the working hours option specified in 21.1:(i)(ii)Within each workplace there will be a written roster which providesfull-time employees with at least two weeks’ notice of the accrueddays/time off in accordance with the working hours arrangements underthis option.Except in unforeseen circumstances, in any workplace where more thanone employee is employed, accrued days/time off will be rostered in such18 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>a manner that the service will not be closed on any weekday on which theservice would normally be open.(iii) Accrued days/time off will be taken in accordance with the roster.However, on the initiative of either the employer or the employee, and byagreement between the employer and the employee, or in exceptional oremergency situations, such time off may be deferred, in which case itmust be taken off as soon as possible thereafter.(iv) Where possible, an accrued day off will be taken in conjunction withnormal weekend days off.(b)Accrued days off falling on public holidaysWhere an employee’s accrued day off falls on a public holiday, another daywill be determined by mutual agreement of the employee and the employer tobe taken instead, such day to be taken within the same or next four weeklywork cycle.21.4 Hours of work—flexible working hours option(a)Flexible working hours option—limitationsNotwithstanding the provisions of clause 21—Ordinary hours of work, anemployer may offer and an employee may agree to accept to work flexibleworking hours (flexitime). Such agreement will be recorded and signed by theemployee and employer and filed with the relevant wage and time records.(b)Definitions(i)(ii)Flexible working hours (flexitime) means a system which allowsemployees to set their own patterns of attendance at work subject to theprovisions of this award and the requirements of the workplace.Standard day means seven hours and 36 minutes per day worked in acontinuous shift at any time within a designated 12 hour spread of hours,such designated spread being between 6.00 am and 8.00 pm Monday toFriday.(iii) Bandwidth means the span of any time on any day within which anemployee may work as part of a flexible working hours arrangementsubject to this award.(iv) Core time means the period during the day when all employees willperform ordinary duty unless absent upon approved leave or core timeleave. Unless otherwise agreed in a workplace, core time will be betweenthe hours of 9.30 am and 12 noon as well as between 2.00 pm and4.30 pm.(v)Core time leave means any approved absence during core time otherthan approved leave.(vi) Approved leave means any leave of absence other than core timeapproved by the employer.MA000099 19

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(vii) Flex credit means the accumulated amount of time worked by anemployee in excess of the standard days in the settlement period,including any carry-over, provided that any such time worked asovertime will not be taken into account.(viii) Flex debit means the difference between the sum of the standard days ina settlement period and the aggregate amount of time worked by anemployee where the total time worked is less than the sum of thestandard days in the settlement period after any necessary adjustment hasbeen made for an absence of approved paid leave and includes any carryover.(ix) Carry over means the aggregate of flex credit or flex debit which anemployee has accumulated during a settlement period which, subject tothis award, the employee may carry over to the next settlement period.(x)Settlement period means the ordinary working days over whichcalculations are made to determine flex credit or flex debit carry over andwill be a fixed period of 10 working days aligned with the fortnightly payperiod operating in the workplace.(c)(d)(e)(f)Under flexible working hour’s arrangements, the times of commencement andcessation of duty will be subject to agreement between the employer and theemployee.An employee’s attendance outside the hours of a standard day will be subjectto the availability of work and the approval, which may be general or specific,of the employer.Where it is reasonable to do so because an employee has failed to comply withthe provisions of flexible working hours (flexitime), an employer may for aspecified period require that an employee will revert to working an average38 hour week prescribed in clause 21.1.BandwidthUnless otherwise agreed in a workplace, a bandwidth will commence at8.00 am and will conclude at 6.00 pm.22. Breaks22.1 Meal breaksAn employee will not work more than five hours without being entitled to an unpaidmeal break of not less than 30 minutes and not more than 60 minutes duration.22.2 Rest breaksA paid rest period of 10 minutes will be allowed each morning between the time ofcommencing work and the usual meal interval.20 MA000099

23. Overtime and penalty rates<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>23.1 Entitlement to payment for overtime(a)(b)(c)(d)A full-time employee will be entitled to overtime where the employee worksmore than 152 hours in any 28 day period or where the employee worksoutside of the spread of ordinary hours provided for in clause 21—Ordinaryhours of work.A part-time employee will be entitled to overtime where they work in excess oftheir prescribed hours of duty provided that overtime will not be paid where theemployer and employee have agreed to a temporary variation of working hoursin which case overtime will apply for work in excess of the mutually agreedvaried working hours. A part-time employee will be entitled to overtime if theywork in excess of 38 hours in any one week on greater than 10 hours in anyone day .A casual employee will be entitled to overtime if they work in excess of38 hours in any one week or greater than 10 hours in any one day.Overtime will only be worked with the prior approval of the employer exceptin emergency situations where prior approval has not been obtained.23.2 Overtime rates(a)(b)(c)An employee who is required to work overtime will be paid at the rate of timeand a half for the first two hours of overtime worked and double time thereafterfor overtime worked Monday to Saturday.An employee who is required to work overtime will be paid double time for allovertime worked on Sundays.An employee who, with the approval of the employer, works on a publicholiday will be paid, in addition to the payment for the public holiday, at thefollowing rates:(i)(ii)time and a half for work performed during ordinary hours of work;and/ordouble time and a half for work performed outside ordinary hours ofwork.23.3 Time off instead of payment for overtime(a)(b)(c)Where there is agreement between the employer and employee, time offinstead of payment for overtime may be taken at the appropriate penaltyequivalent.Such agreement may be discontinued by mutual consent of both parties or atthe request of one party.By mutual agreement, where an employee has accumulated time off instead ofpayment for overtime the employee may take the time off in conjunction withannual leave. In such circumstances the time off instead of payment forovertime will not attract the annual leave loading.MA000099 21

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(d)(e)(f)If accumulated time off instead of payment for overtime has not been takenwithin two pay periods and there is no agreement in accordance withclause 23.3(a), payment for the overtime worked will be made in the next payperiod, unless otherwise agreed between the employer and the employee.Time off instead of payment for overtime will be calculated by converting totime the amount of overtime worked together with the amount in time of theapplicable overtime penalty.No employee will be entitled to payment for overtime or to time off instead ofpayment for overtime for a meal break not taken by the employee unless theemployee was the only staff member on duty at the workplace at that time.23.4 Rest period after overtime(a)(b)(c)When overtime is worked it will, wherever reasonably practicable, be soarranged that employees have at least 10 consecutive hours off duty betweenwork on successive shifts.An employee who works so much overtime between the termination of theirlast previous rostered ordinary hours of duty and the commencement of thenext succeeding rostered period of duty that they would not have at least10 consecutive hours off duty between those times, will, subject to thissubclause, be released after completion of such overtime until they have had 10consecutive hours off duty without loss of pay for rostered ordinary hoursoccurring during such absence.If, on the instructions of the employer, such an employee resumes or continueswork without having had such 10 consecutive hours off duty they will be paidat the rate of double time until released from duty for such rest period and willthen be entitled to be absent until they have had 10 consecutive hours off dutywithout loss of pay for rostered ordinary hours occurring during such absence.23.5 Recall to work overtime(a)(b)An employee recalled to work overtime after leaving the employer’s businesspremises (whether notified before or after leaving the premises) will be paid fora minimum of four hours’ work at the appropriate rate for each time they arerecalled or be granted equivalent time off instead of payment for overtime inaccordance with clause 23.3.Except, in the case of unforeseen circumstances, the employee will not berequired to work the full four hours if the job they were recalled to perform iscompleted within a shorter period.23.6 Penalty rates for ordinary hours of work(a)An employee will receive the following payment for working any of theirordinary hours outside the normal spread of hours provided in clause 21.1:(i)a loading of 20% on their ordinary rate of pay for work performedbetween 8.00 pm and midnight Monday to Friday inclusive;22 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(ii)a loading of 35% on their ordinary rate of pay for work performedbetween the hours of midnight and 6.00 am from Sunday to Fridayinclusive;(iii) a loading of 75% on their ordinary rate of pay for work performedbetween midnight Friday and midnight Saturday; and(iv) a loading of 100% on their ordinary rate of pay for work performedbetween midnight Saturday and midnight Sunday.(b)(c)(d)(e)An employee will be rostered so as to provide two consecutive days off in anyseven day period.An employee required to work between midnight Saturday and midnightSunday as part of their ordinary hours of duty will be provided with aminimum of two hours ordinary time on each occasion so engaged.By mutual agreement, employees who work between midnight Saturday andmidnight Sunday may take the equivalent time off instead of payment of theloading.The loadings payable in clause 23.6(a) will be in substitution of and notcumulative on overtime and time off instead of payment for overtime asprovided for in clauses 23.1 and 23.3.24. Higher dutiesAn employee who is called upon by the employer to perform the duties of another employeein a higher classification for five consecutive working days or more will be paid for the periodfor which duties are assumed at a rate not less than the minimum rate prescribed for the higherclassification. Where the minimum rate of the higher classification is the same as the relievingemployee’s current rate, the relieving employee will be paid at the higher classification at thefirst pay point above their current rate.Part 6—Leave and Public Holidays25. Annual leave25.1 Annual leave is provided for in the NES. This clause contains additional provisions.25.2 Annual leave loadingIn addition to their ordinary pay, an employee will be paid an annual leave loading of17.5% of their ordinary rate of pay.25.3 Illness or injury during annual leaveWhere an employee falls ill or suffers an injury while on annual leave and providesto their employer a medical certificate to show that they are or were incapacitated tothe extent that they would be unfit to perform their normal duties, they will begranted, at a time convenient to the employer, additional leave equivalent to theperiod of incapacity falling within the said period of annual leave provided that theMA000099 23

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>period of incapacity is of at least five working days’ duration. Subject to accruedpersonal/carer’s leave, the period of certified incapacity will be paid for and debitedas personal/carer’s leave.25.4 Additional annual leave(a)This applies to a full-time or part-time employee stationed in any locality:(i)(ii)in Queensland, north of the 21st parallel of south latitude or west of the144th meridian of east longitude;in Western Australia, north of the 24th parallel of south latitude and inCarnarvon; and(iii) in the Northern Territory.(b)After each 12 months’ continuous service, a full-time or part-time employee isentitled to:(i)(ii)for full-time employees, 38 hours annual leave in addition to thatprescribed in the NES; orfor part-time employees, one week’s annual leave calculated on the basisof the average weekly number of hours worked over the previous twelvemonths.(c) Clause 25.4 applies until 31 December 2014.26. Personal/carer’s leave and compassionate leavePersonal/carer’s leave and compassionate leave are provided for in the NES.27. Community service leaveCommunity service leave is provided for in the NES.28. Public holidays28.1 Public holidays are provided for in the NES. This clause contains additionalprovisions.28.2 Payment for working on a public holidayAn employee who works on a public holiday will be paid at the rate of double timeand a half of their ordinary rate of pay for all time worked.28.3 Public holiday substitution(a)(b)An employer and the majority of employees may agree to substitute anotherday for any provided for in the NES.An employer and an individual employee may agree to substitute a publicholiday specified in the NES for the National Aboriginal Day of Celebration,without loss of pay, on the day it is celebrated in the State in which the24 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>employee is employed. Provided that by mutual agreement instead of this daybeing taken as a substituted public holiday it may be taken as an annual leaveday or a flexitime day.29. Aboriginal and Torres Strait Islander ceremonial leave29.1 An employee who is legitimately required by the employee’s Aboriginal or TorresStrait Islander tradition to be absent from work for ceremonial purposes will beentitled to up to 10 working days unpaid leave in any one year. The employee mustbe able to establish to the employer that they have an obligation under Aboriginal orTorres Strait Islander custom and/or traditional law to participate in ceremonialactivities in order to be granted such leave without pay for a maximum period of 10days per year, or for such extension granted by the employer. Such leave will notaffect the employee’s entitlement to personal/carer’s leave and compassionate leaveprovided by the NES.29.2 Approval of all Aboriginal and Torres Strait Islander ceremonial leave will besubject to the employer’s convenience and will not unreasonably affect the operationof the work concerned but will not be unreasonably withheld.MA000099 25

Schedule A—Transitional ProvisionsA.1 General<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>A.1.1A.1.2The provisions of this schedule deal with minimum obligations only.The provisions of this schedule are to be applied:(a)(b)(c)(d)when there is a difference, in money or percentage terms, between a provisionin a relevant transitional minimum wage instrument (including the transitionaldefault casual loading) or award-based transitional instrument on the one handand an equivalent provision in this award on the other;when a loading or penalty in a relevant transitional minimum wage instrumentor award-based transitional instrument has no equivalent provision in thisaward;when a loading or penalty in this award has no equivalent provision in arelevant transitional minimum wage instrument or award-based transitionalinstrument; orwhen there is a loading or penalty in this award but there is no relevanttransitional minimum wage instrument or award-based transitional instrument.A.2 Minimum wages – existing minimum wage lowerA.2.1The following transitional arrangements apply to an employer which, immediatelyprior to 1 January <strong>2010</strong>:(a)(b)(c)was obliged,but for the operation of an agreement-based transitional instrument or anenterprise agreement would have been obliged, orif it had been an employer in the industry or of the occupations covered by thisaward would have been obligedby a transitional minimum wage instrument and/or an award-based transitionalinstrument to pay a minimum wage lower than that in this award for anyclassification of employee.A.2.2In this clause minimum wage includes:(a)(b)(c)a minimum wage for a junior employee, an employee to whom trainingarrangements apply and an employee with a disability;a piecework rate; andany applicable industry allowance.A.2.3A.2.4Prior to the first full pay period on or after 1 July <strong>2010</strong> the employer must pay no lessthan the minimum wage in the relevant transitional minimum wage instrument and/oraward-based transitional instrument for the classification concerned.The difference between the minimum wage for the classification in this award andthe minimum wage in clause A.2.3 is referred to as the transitional amount.26 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>A.2.5A.2.6A.2.7From the following dates the employer must pay no less than the minimum wage forthe classification in this award minus the specified proportion of the transitionalamount:First full pay period on or after1 July <strong>2010</strong> 80%1 July 2011 60%1 July 2012 40%1 July 2013 20%The employer must apply any increase in minimum wages in this award resultingfrom an annual wage review.These provisions cease to operate from the beginning of the first full pay period on orafter 1 July 2014.A.3 Minimum wages – existing minimum wage higherA.3.1The following transitional arrangements apply to an employer which, immediatelyprior to 1 January <strong>2010</strong>:(a)(b)(c)was obliged,but for the operation of an agreement-based transitional instrument or anenterprise agreement would have been obliged, orif it had been an employer in the industry or of the occupations covered by thisaward would have been obligedby a transitional minimum wage instrument and/or an award-based transitionalinstrument to pay a minimum wage higher than that in this award for anyclassification of employee.A.3.2In this clause minimum wage includes:(a)(b)(c)a minimum wage for a junior employee, an employee to whom trainingarrangements apply and an employee with a disability;a piecework rate; andany applicable industry allowance.A.3.3A.3.4Prior to the first full pay period on or after 1 July <strong>2010</strong> the employer must pay no lessthan the minimum wage in the relevant transitional minimum wage instrument and/oraward-based transitional instrument for the classification concerned.The difference between the minimum wage for the classification in this award andthe minimum wage in clause A.3.3 is referred to as the transitional amount.MA000099 27

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>A.3.5A.3.6A.3.7From the following dates the employer must pay no less than the minimum wage forthe classification in this award plus the specified proportion of the transitionalamount:First full pay period on or after1 July <strong>2010</strong> 80%1 July 2011 60%1 July 2012 40%1 July 2013 20%The employer must apply any increase in minimum wages in this award resultingfrom an annual wage review. If the transitional amount is equal to or less than anyincrease in minimum wages resulting from the <strong>2010</strong> annual wage review thetransitional amount is to be set off against the increase and the other provisions ofthis clause will not apply.These provisions cease to operate from the beginning of the first full pay period on orafter 1 July 2014.A.4 Loadings and penalty ratesFor the purposes of this schedule loading or penalty means a: casual or part-time loading; Saturday, Sunday, public holiday, evening or other penalty; shift allowance/penalty.A.5 Loadings and penalty rates – existing loading or penalty rate lowerA.5.1The following transitional arrangements apply to an employer which, immediatelyprior to 1 January <strong>2010</strong>:(a)(b)(c)was obliged,but for the operation of an agreement-based transitional instrument or anenterprise agreement would have been obliged, orif it had been an employer in the industry or of the occupations covered by thisaward would have been obligedby the terms of a transitional minimum wage instrument or an award-basedtransitional instrument to pay a particular loading or penalty at a lower rate than theequivalent loading or penalty in this award for any classification of employee.A.5.2A.5.3Prior to the first full pay period on or after 1 July <strong>2010</strong> the employer must pay no lessthan the loading or penalty in the relevant transitional minimum wage instrument oraward-based transitional instrument for the classification concerned.The difference between the loading or penalty in this award and the rate inclause A.5.2 is referred to as the transitional percentage.28 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>A.5.4A.5.5From the following dates the employer must pay no less than the loading or penaltyin this award minus the specified proportion of the transitional percentage:First full pay period on or after1 July <strong>2010</strong> 80%1 July 2011 60%1 July 2012 40%1 July 2013 20%These provisions cease to operate from the beginning of the first full pay period on orafter 1 July 2014.A.6 Loadings and penalty rates – existing loading or penalty rate higherA.6.1The following transitional arrangements apply to an employer which, immediatelyprior to 1 January <strong>2010</strong>:(a)(b)(c)was obliged,but for the operation of an agreement-based transitional instrument or anenterprise agreement would have been obliged, orif it had been an employer in the industry or of the occupations covered by thisaward would have been obligedby the terms of a transitional minimum wage instrument or an award-basedtransitional instrument to pay a particular loading or penalty at a higher rate than theequivalent loading or penalty in this award, or to pay a particular loading or penaltyand there is no equivalent loading or penalty in this award, for any classification ofemployee.A.6.2A.6.3A.6.4A.6.5Prior to the first full pay period on or after 1 July <strong>2010</strong> the employer must pay no lessthan the loading or penalty in the relevant transitional minimum wage instrument oraward-based transitional instrument.The difference between the loading or penalty in this award and the rate inclause A.6.2 is referred to as the transitional percentage. Where there is no equivalentloading or penalty in this award, the transitional percentage is the rate in A.6.2.From the following dates the employer must pay no less than the loading or penaltyin this award plus the specified proportion of the transitional percentage:First full pay period on or after1 July <strong>2010</strong> 80%1 July 2011 60%1 July 2012 40%1 July 2013 20%These provisions cease to operate from the beginning of the first full pay period on orafter 1 July 2014.MA000099 29

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>A.7 Loadings and penalty rates – no existing loading or penalty rateA.7.1A.7.2A.7.3A.7.4The following transitional arrangements apply to an employer not covered byclause A.5 or A.6 in relation to a particular loading or penalty in this award.Prior to the first full pay period on or after 1 July <strong>2010</strong> the employer need not pay theloading or penalty in this award.From the following dates the employer must pay no less than the followingpercentage of the loading or penalty in this award:First full pay period on or after1 July <strong>2010</strong> 20%1 July 2011 40%1 July 2012 60%1 July 2013 80%These provisions cease to operate from the beginning of the first full pay period on orafter 1 July 2014.30 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>Schedule B—Classification DefinitionsB.1 Administrative assistantB.1.1B.1.2Administrative assistant means a person engaged to perform a range of clearlydefined administrative, including financial and clerical duties, under the directsupervision of the Manager or another employee with delegated supervisoryresponsibility. The duties will be clearly defined. Once familiar with the workplace,an Administrative assistant may be expected to exercise limited discretion and solveminor problems arising in the course of their duties and within clearly definedprocedures, guidelines and policies of the service. Instruction and assistance will bereadily available.Requirements(a)A person employed as an Administrative assistant will be able to:(i)(ii)satisfactorily perform a range of routine general office duties of a clericaland/or support nature including, but not limited to, filing and themaintenance of existing records systems;perform general reception and telephonist duties including the accurateprovision of information;(iii) demonstrate proficiency in the straightforward operation of keyboardequipment including data input and basic word processing; and(iv) demonstrate proficiency in the use of available office technology.(b)(c)(d)(e)With experience, an Administrative assistant will be able to perform programsupport and/or more complex administrative duties including, but not limitedto, petty cash control, ordering and invoicing under the direction of the projectmanager or another employee with delegated supervisory responsibility. Suchan employee may also provide limited direct support to clients of the serviceundertaking self-paced instructional packages and/or limited pre-employmentactivities and services which do not require a level of skill and/or responsibilitymore properly exercised by a more senior employee. Such duties may alsoinclude provision of assistance to more senior employees in client selection andreferral activities, and preparation and maintenance of client records undersupervision.An Administrative assistant performing these duties will receive payment at noless than Pay point 2 within this classification.An Administrative assistant will not be required to supervise other staff orvolunteers.No formal qualifications are required.B.2 Administrative officerB.2.1Administrative officer means a person engaged to perform and be responsible to theManager of a service for a range of administrative duties and including, but notMA000099 31

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>limited to financial, accounting and clerical duties ranging from the simple to thecomplex, for office management and for supervision of other administrative andsupport employees including trainees. In keeping with the nature of client servicesoffered by the employer, an Administrative officer will also liaise from time to timewith clients of the service and other service providers.B.2.2RequirementsA person employed as an Administrative officer will, in addition to any of the dutiesof an Administrative assistant, be able to:(a)(b)set up and administer a bookkeeping and/or accounting system including achart of accounts for the organisation and each of its programs and services;produce a range of accurate and timely financial reports, which clearly reflectthe financial position of the organisation and each of its programs and servicesand which will enable cross-program financial management, including:(i)(ii)profit and loss statements; andcash flow analysis reports;(c)(d)(e)(f)(g)(h)under the direction of the Manager, assist in the preparation of budgets for theorganisation or for individual programs and services;supervise and provide necessary office-based training to administrative or othersupport employees;operate purchasing, inventory, asset control, payroll and other administrativeprocedures;set up and maintain a full range of personnel, client data base and othermanagement and administrative records required by the employer;be computer literate and demonstrate expertise in the use of financial and othersoftware packages; andset up and maintain statistical information systems.B.3 Training and placement officer grade 1B.3.1Training and placement officer grade 1 means a person engaged to deliver trainingor placement support where the employee exercises a lower range of skills andresponsibilities than an employee classified as a Training and placement officergrade 2. A person engaged to perform training duties under a formal trainingprogram would be limited to one vocational area of training at this level.(a)(b)A person engaged to perform training duties as part of placement support willnot be limited to one vocational area but will operate within clearly definedguidelines under the direction of the Manager or another more senioremployee.An employee who undertakes training or placement support duties andperforms a wider range of duties than the following will be classified as aTraining and placement officer grade 2 and not as a Training and placementofficer grade 1.32 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>B.3.2Requirements(a)In respect of an employee engaged primarily to deliver training to clients of theservice, the employee may be expected to perform the following duties:(i)(ii)participate in the client selection and assessment of client needs orsuitability for the area in which they provide instruction or placementsupport;assist in following up client outcomes for their area of instruction orplacement support;(iii) liaise with employers to organise work experience, work placement andindustry support in their area of instruction or placement support; and(iv) undertake necessary planning and evaluation under supervision.(b)(c)(d)(e)In respect of an employee engaged primarily to provide placement support toclients of the service, the employee may be expected to provide on-the-jobtraining, placement and support to clients according to the individual clientservice program under the direction of a more senior employee. While theemployee may assist a more senior officer to carry out client selection,assessment and/or preparation of individual client service programs, theywould not exercise sole or principal responsibility for such functions.An employee classified as an Administrative assistant who temporarilyperforms duties at the Training and placement officer grade 1 level will be paida higher duties allowance equivalent to the difference between their ordinaryrate of pay and the rate of pay of a Training and placement officer grade 1 Paypoint 1 for any day in which all or a substantial part of the functions of aTraining and placement officer grade 1 are performed.To assist in the facilitation of career advancement of Administrative assistants,employers may structure the job of an Administrative assistant to incorporatesome functions of a Training and placement officer grade 1 should they wish todesign a mixed function job incorporating duties normally performed in bothclassifications. In such instances, the higher duties allowance provided for inclause 24—Higher duties will apply in respect to any Administrative assistantwho performs a mixed function job.Provided that where a substantial part of the mixed function job incorporatesthe functions of a Training and placement officer grade 1 the Administrativeassistant will be re-classified to that classification and be deemed to be aTraining and placement officer grade 1.B.4 Training and placement officer grade 2B.4.1Training and placement officer grade 2 means a multi-functioned employee who isengaged to provide direct services to participants in training courses, placement orsupport services and other programs and activities provided by the employer.MA000099 33

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>B.4.2Requirements(a)Such employees would be required to assist in the development andadministration of programs. This may include arranging and conductingtraining courses, preparation of training curriculum and plans, clientassessment activities, preparation of individual client service programs, theconduct of employment placement and/or support services and other activities.They may exercise some organising functions in respect of sessionalemployees, Training and placement officers grade 1 and/or Administrativeassistants. They may be expected to participate in processes:(i)(ii)to evaluate course and program effectiveness and relevance;to monitor and review individual client service programs;(iii) to monitor, report and advise on client outcomes; and/or(iv) to carry out case management functions and duties.(b)A Training and placement officer grade 2 is required to exercise professionaljudgment within the policy parameters of the employer and may also berequired to:(i)(ii)write reports and assist in the preparation of funding proposals;liaise with and market to employers, industry and the community;(iii) participate in co-ordination activities with other agencies;(iv) refer clients to appropriate agencies and programs; and(v)carry out client placement activities.(c)An employee engaged to conduct job clubs and/or primarily to market servicesand/or clients to employers would normally be engaged as a Training andplacement officer grade 2 however the size of the organisation and the level ofcomplexity within their role may see them placed within the Training andplacement co-ordinator definition and classification. Where a job club leader isresponsible for the management and co-ordination of the service they will beengaged in accordance with the Training and placement co-ordinatorclassification.B.5 Training and placement co-ordinatorB.5.1B.5.2Training and placement co-ordinator means a person engaged to assist theManager of a larger and more complex service in the management of all or part ofthe service and whose responsibilities primarily involve management/co-ordinationfunctions.Requirements(a)A Training and placement co-ordinator will in all cases report to the Managerof the organisation.34 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>(b)(c)(d)Such officers will be required to assist in the management of the service withinthe policy parameters of the employer and may also be required to developpolicy proposals and other reports for consideration by the employer and/orfunding authorities. They may also be expected to assist the Manager todevelop and implement strategies to ensure community and business supportfor the service.Such employees may be required to co-ordinate the development,implementation and evaluation of programs and/or services of the employerincluding the preparation of funding proposals and budgets on behalf of theemployer and the monitoring of program performance and budgets. Theywould be expected to exercise a staff leadership role and supervise otheremployees of the service. This may include the co-ordination of induction ofnew employees, training and other human resource development strategies andco-ordination of work tasks and responsibilities. They may be expected torepresent the employer in dealings with local employers, government andcommunity agencies and in dealings with local media.A Training and placement co-ordinator may also be expected to delivertraining courses for clients of the service or to undertake placement support orother operational duties though these responsibilities would not form the majorpart of the employee’s job.B.6 Manager grade 1B.6.1B.6.2Manager grade 1 means a person engaged to manage the operations of a small tomedium size service where the total weekly staffing of the service is less than285 hours.Requirements(a)(b)(c)(d)A Manager grade 1 may directly exercise delegated management functions ofthe employer.Such employees will be required to manage the service within the policyparameters set by the employer and may be required to develop policyproposals and other reports for consideration by the employer and/or fundingauthorities. They may also be expected to develop and implement strategies toensure community and business support for the service.Such employees may be required to co-ordinate the development,implementation and evaluation of programs and/or services of the employerincluding the preparation of funding proposals and budgets on behalf of theemployer and the monitoring of program performance and budgets. Theywould be expected to exercise a staff leadership role and supervise otheremployees of the service. This may include the co-ordination of induction ofnew employees, training and other human resource development strategies andco-ordination of work tasks and responsibilities. They would be expected torepresent the employer in dealings with local employers, government andcommunity agencies and in dealings with local media.No Manager grade 1 of a service with total weekly staffing of up to andincluding 190 staffing hours may advance beyond Pay point 4.MA000099 35

B.7 Manager grade 2<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>B.7.1Manager grade 2 means:(a)(b)an employee engaged to manage a single service or multiple projects sponsoredby the same employer with total weekly staffing in excess of 285 staffinghours; ora person engaged to manage a SkillShare Disability Access and Support Unit.B.7.2RequirementsFunctions would generally be similar to a Manager grade 1 except that their positionwould involve significantly increased responsibility as a result of the size andcomplexity of the service(s) which they manage. They may also be required tosupervise the work of Managers grade 1 and/or Training and placement co-ordinatorswhere such employees are employed by the same employer.36 MA000099

<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>Schedule C—Supported Wage SystemC.1 This schedule defines the conditions which will apply to employees who because ofthe effects of a disability are eligible for a supported wage under the terms of thisaward.C.2 In this schedule:approved assessor means a person accredited by the management unit establishedby the Commonwealth under the supported wage system to perform assessments ofan individual’s productive capacity within the supported wage systemassessment instrument means the tool provided for under the supported wagesystem that records the assessment of the productive capacity of the person to beemployed under the supported wage systemdisability support pension means the Commonwealth pension scheme to provideincome security for persons with a disability as provided under the Social SecurityAct 1991 (Cth), as amended from time to time, or any successor to that schemerelevant minimum wage means the minimum wage prescribed in this award for theclass of work for which an employee is engagedsupported wage system (SWS) means the Commonwealth Government system topromote employment for people who cannot work at full award wages because of adisability, as documented in the Supported Wage System Handbook. The Handbookis available from the following website: www.jobaccess.gov.auSWS wage assessment agreement means the document in the form required by theDepartment of Education, Employment and Workplace Relations that records theemployee’s productive capacity and agreed wage rateC.3 Eligibility criteriaC.3.1C.3.2Employees covered by this schedule will be those who are unable to perform therange of duties to the competence level required within the class of work for whichthe employee is engaged under this award, because of the effects of a disability ontheir productive capacity and who meet the impairment criteria for receipt of adisability support pension.This schedule does not apply to any existing employee who has a claim against theemployer which is subject to the provisions of workers compensation legislation orany provision of this award relating to the rehabilitation of employees who areinjured in the course of their employment.MA000099 37

C.4 Supported wage rates<strong>Labour</strong> <strong>Market</strong> <strong>Assistance</strong> <strong>Industry</strong> <strong>Award</strong> <strong>2010</strong>C.4.1Employees to whom this schedule applies will be paid the applicable percentage ofthe relevant minimum wage according to the following schedule:Assessed capacity (clause C.5)%Relevant minimum wage%10 1020 2030 3040 4050 5060 6070 7080 8090 90C.4.2C.4.3Provided that the minimum amount payable must be not less than $71 per week.Where an employee’s assessed capacity is 10%, they must receive a high degree ofassistance and support.C.5 Assessment of capacityC.5.1C.5.2For the purpose of establishing the percentage of the relevant minimum wage, theproductive capacity of the employee will be assessed in accordance with theSupported Wage System by an approved assessor, having consulted the employerand employee and, if the employee so desires, a union which the employee is eligibleto join.All assessments made under this schedule must be documented in an SWS wageassessment agreement, and retained by the employer as a time and wages record inaccordance with the Act.C.6 Lodgement of SWS wage assessment agreementC.6.1C.6.2All SWS wage assessment agreements under the conditions of this schedule,including the appropriate percentage of the relevant minimum wage to be paid to theemployee, must be lodged by the employer with Fair Work Australia.All SWS wage assessment agreements must be agreed and signed by the employeeand employer parties to the assessment. Where a union which has an interest in theaward is not a party to the assessment, the assessment will be referred by Fair WorkAustralia to the union by certified mail and the agreement will take effect unless anobjection is notified to Fair Work Australia within 10 working days.38 MA000099