Port Waratah Coal Services Limited

Port Waratah Coal Services Limited

Port Waratah Coal Services Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

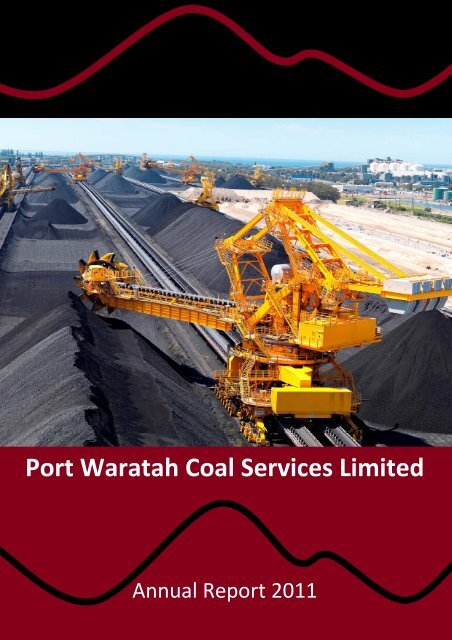

<strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong>Annual Report 2011

<strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong>A.C.N. 001 363 828Financial Report for the year ended 31 December 2011DirectorsChief Executive OfficerM Harvey Chairman S H du PlooyW H ChampionJ M ClelandCompany SecretariesR S LightG V CroweA W MasonJ A OliverY NakataG OkamatsuA E PittJ E RichardsS SaitoContentsPageAuditorDeloitte Touche TohmatsuChartered AccountantsChairman’s Report 2Directors’ Report 3Auditor’s Independence Declaration 9Performance Overview 10Year in Review 11Statement of Comprehensive Income 17Statement of Financial Position 18Statements of Changes in Equity 19Statement of Cash Flows and Notes 20Notes to the Financial Statements 22Directors’ Declaration 38Independent Audit Report 39This financial report covers both <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong> as an individual entity andthe consolidated entity consisting of <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong> and the entity itcontrolled during 2011. <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong> is a company limited by shares,incorporated and domiciled in Australia. Its principal place of business is:<strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong>Curlew StreetKooragang Island, NewcastleNew South Wales, AustraliaTelephone (02) 4907 2000A description of the nature of the company’s operations and its principal activities is included inthe review of operations and activities in the Directors’ Report commencing on page 3. PWCS’annual report is available on PWCS’ website www.pwcs.com.au.1

Chairman’s Report<strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> loaded a record 97.8 million tonnes of coal onto 1,025vessels in 2011, a 2.9% increase on 2010.It was pleasing to note a reduction in both the number of injuries sustained in 2011 andthe lost time injury frequency rate and also that our permanent employee workforceachieved 12 months serious injury free during 2011. Notwithstanding theseimprovements, Management will continue work to improve safety performance throughboth visible leadership and reinforcement of procedures and practices in order that wereach our goal of zero injuries.The $670 million expansion of the Kooragang Terminal, which was approved by theBoard in February 2010, was completed on schedule and budget in December 2011.This expansion included the construction of a fourth shiploading berth and two halfstockpile pads and increases PWCS’ nameplate capacity to 133 million tonnes perannum from 1 January 2012.In April 2011 the Board approved $227 million for the final stage (under PWCS’ existingDevelopment Consent) of coal loading expansion at the Kooragang Terminal. Thisexpansion, known as Project 145, includes the installation of a fourth rail receival stationand is due for completion by the end of 2012, at which time PWCS’ nameplate capacitywill be 145 million tonnes per annum.Work has continued on PWCS’ proposed Terminal 4 (PWCS T4) with the majormilestones in 2011 being the completion of initial prefeasibility study work, lodgement ofthe PWCS T4 environmental assessment with the Department of Planning andcommencement of further PWCS T4 prefeasibility work.In 2012 PWCS T4 prefeasibility and feasibility work will be completed. The PWCS T4project approvals process will also continue throughout 2012 with anticipated projectapproval in early 2013. PWCS T4 is expected to deliver an additional 120 million tonnesper annum of throughput capacity with the project being constructed in stages. The initialstages of PWCS T4 are planned to deliver a combined 70 million tonnes per annum.During 2011, PWCS announced the departure of Graham Davidson as Chief ExecutiveOfficer and appointment of Hennie du Plooy as PWCS’ new Chief Executive Officer. Iwould like to thank Graham for his leadership and contribution to PWCS over six yearsand to wish him well in the future. I am confident that Mr du Plooy will lead all facets ofPWCS’ business over the coming years.In November 2011 PWCS was awarded ‘Australia’s best port or terminal operator’ at the2011 Lloyd’s List Australian Shipping and Maritime Industry awards. This awardrecognises PWCS’ performance and expansion record and is one which all PWCSemployees and stakeholders should be proud of.On behalf of the Board I would like to thank all of our people for their efforts during thepast year.MICHAEL HARVEYCHAIRMAN2

Directors’ ReportIn respect of the financial year the Directors of<strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong> (thecompany) submit the following report:Directors’ DetailsThe Directors of the company in office at thedate of this report are detailed below.Directors holding office for part of the financialyear are detailed in Note 19.M HarveyBachelor of Science (Industrial Studies),HonoursChief Operating Officer, Rio Tinto MarineDirector, Rio Tinto Shipping Pty <strong>Limited</strong>Chairman, Rio Tinto Shipping (Asia) Pte LtdChairman, PWCS since August 2009W H ChampionBachelor of Science (Chemical Engineering),Bachelor of Science (Biological Sciences)Managing Director, <strong>Coal</strong> and Allied Industries <strong>Limited</strong>Managing Director, Rio Tinto <strong>Coal</strong> Australia Pty <strong>Limited</strong>Director, Newcastle <strong>Coal</strong> Shippers Pty <strong>Limited</strong>Director, Queensland Resources CouncilMember, Australian <strong>Coal</strong> AssociationMember, National Carbon Capture and Storage CouncilMember, New South Wales Clean <strong>Coal</strong> CouncilMember, Queensland Clean <strong>Coal</strong> CouncilRepresentative, Sustainable Minerals InstituteDirector, PWCS since February 2009J M ClelandBachelor of EconomicsGraduate Diploma in Financial ManagementHead of Infrastructure, Anglo American Metallurgical<strong>Coal</strong> Pty LtdDirector, Newcastle <strong>Coal</strong> Shippers Pty <strong>Limited</strong>Director, PWCS since January 2012R S LightBachelor of EconomicsDiploma in Applied Finance and InvestmentChartered AccountantAssociate Member, Australian Institute of CompanyDirectorsChief Strategic Development Officer, Rio Tinto <strong>Coal</strong>AustraliaChairman, Dalrymple Bay <strong>Coal</strong> Terminal Pty. Ltd.Chairman, Half-Tide Marine Pty LtdDirector, Black Hill Land Pty LtdDirector, Catherine Hill Bay Land Pty LtdDirector, <strong>Coal</strong> & Allied Industries <strong>Limited</strong>Director, Gwandalan Land Pty LtdDirector, Lower Hunter Land Holdings Pty LtdDirector, Minmi Land Pty LtdDirector, Newcastle <strong>Coal</strong> Shippers Pty LtdDirector, Nords Wharf Land Pty LtdDirector, PWCS since March 2010Chairman, Newcastle <strong>Coal</strong> Shippers Pty <strong>Limited</strong>Director, Oakbridge Pty <strong>Limited</strong> and its relatedcompaniesDirector, OCAL Macquarie Pty <strong>Limited</strong>Director, Resource Pacific Holdings Pty <strong>Limited</strong> andits related companiesDirector, The Wallerawang Collieries <strong>Limited</strong>Director, Ulan <strong>Coal</strong> Mines <strong>Limited</strong>Director, Xstrata <strong>Coal</strong> (NSW) Pty <strong>Limited</strong> and itsrelated companiesDirector, Xstrata Rail (NSW) Pty <strong>Limited</strong>Director, Xstrata Mangoola Pty <strong>Limited</strong>Director, PWCS since February 2008Y NakataBachelor of LawManaging Director, Nippon Steel Australia Pty LtdDirector, PWCS since May 2009G OkamatsuBachelor of EconomicsManaging Director, Toyota Tsusho Investment(Australia) Pty. <strong>Limited</strong>Managing Director, Toyota Tsusho Mining (Australia)Pty. <strong>Limited</strong>Director, Navidale Pty <strong>Limited</strong>Director, RHA Pastoral Company Pty. <strong>Limited</strong>Director, Toyota Tsusho <strong>Coal</strong> (Australia) Pty LtdDirector, Toyota Tsusho Gas E&P Australia Pty LtdDirector, Toyota Tsusho Gas E&P Browse Pty LtdDirector, Toyota Tsusho Gas E&P Trefoil Pty LtdDirector, Toyota Tsusho CBM Queensland Pty LtdDirector, PWCS since November 2009A E PittBachelor of Commerce, HonoursGeneral Manager Commercial, Xstrata <strong>Coal</strong> Pty<strong>Limited</strong>Director, Xstrata Rail (NSW) Pty <strong>Limited</strong>Director, Hunter Valley <strong>Coal</strong> Chain Coordinator <strong>Limited</strong>Director, Newcastle <strong>Coal</strong> Shippers Pty <strong>Limited</strong>Director, The Newcastle Wallsend <strong>Coal</strong> Co Pty LtdDirector, PWCS since January 2010J E RichardsBachelor of Rural Science, Honours 1Managing Director, The Bloomfield Group of companiesDirector, Bloomfield Collieries Pty Ltd and its relatedcompaniesDirector, Bickham <strong>Coal</strong> Company Pty. <strong>Limited</strong>Member, Australian Institute of Company DirectorsMember, Executive Committee New South WalesMinerals Council LtdDirector, PWCS since September 2010S SaitoBachelor of EconomicsDirector, Japan <strong>Coal</strong> Development Co., LtdDirector, J.C.D. Australia Pty <strong>Limited</strong>Director, PWCS since June 2011A W MasonBachelor of ArtsDiploma in Financial ManagementDiploma in Applied Finance and InvestmentGeneral Manager Finance and Commercial, Xstrata<strong>Coal</strong> (NSW) Pty <strong>Limited</strong>Director, Austral <strong>Coal</strong> <strong>Limited</strong> and its related companiesDirector, Bargo Collieries Pty <strong>Limited</strong>Director, Cumnock <strong>Coal</strong> Pty <strong>Limited</strong> and its relatedcompaniesDirector, Liddell Collieries Pty <strong>Limited</strong> and itsrelated companiesDirector, Narama Investments Pty <strong>Limited</strong>3

Alternate DirectorsS R Bridger (for A W Mason andA E Pitt)Bachelor of Engineering (Civil), HonoursMaster of Engineering Science (ProjectManagement)Executive General Manager, Wandoan Project,Xstrata <strong>Coal</strong>Director, Longstride Pty. <strong>Limited</strong>Director, Newcastle <strong>Coal</strong> Shippers Pty <strong>Limited</strong>Director, Surat Basin Rail Pty LtdDirector, Wicet Holdings Pty <strong>Limited</strong>Director, Wiggins Island <strong>Coal</strong> Export Terminal Pty<strong>Limited</strong>K Fukamachi (for G Okamatsu)Bachelor of LawMaster of Business AdministrationAlternate Director, Mitsui <strong>Coal</strong> Holdings Pty LtdAlternate Director, BHP Billiton Mitsui <strong>Coal</strong> Pty LtdN Kushibuchi (for Y Nakata)Bachelor of Social ScienceManaging Director, JFE Steel Australia ResourcesPty LtdB F Lewis (for J E Richards)Bachelor of Engineering (Electrical),HonoursMaster of Business AdministrationGeneral Manager (Marketing), Bloomfield CollieriesPty LtdDirector, Bloomfield Collieries Pty Ltd and its relatedcompaniesDirector, Corky’s Carbon and Combustion Pty LtdDirector, Hunter Valley <strong>Coal</strong> Chain Coordinator<strong>Limited</strong>A Taniguchi (for S Saito)Bachelor of LawMaster of Business AdministrationManaging Director, J.C.D. Australia Pty <strong>Limited</strong>Director, Blair Athol <strong>Coal</strong> Pty <strong>Limited</strong>Director, Clermont <strong>Coal</strong> Mines <strong>Limited</strong>G J Walker (for R S Light)Bachelor of Engineering (Mechanical),Honours Master of Business AdministrationGeneral Manager <strong>Coal</strong> Chain and Operations Support,Rio Tinto <strong>Coal</strong> AustraliaP A Wilkes (for A W Mason and A E Pitt)Bachelor of Business (Accounting)Financial Controller, Xstrata <strong>Coal</strong> (NSW) Pty <strong>Limited</strong>Director, Oceanic <strong>Coal</strong> Australia Pty <strong>Limited</strong>Director, Ravensworth <strong>Coal</strong> Terminal Pty <strong>Limited</strong> and itsrelated companiesDirector, Resource Pacific Holdings Pty <strong>Limited</strong>Director, Resource Pacific Pty <strong>Limited</strong>Director, Tahmoor <strong>Coal</strong> Pty <strong>Limited</strong>Director, Xstrata Cumnock Management Pty <strong>Limited</strong>Director, Xstrata Mangoola Pty <strong>Limited</strong>Alternate Director, <strong>Port</strong> Kembla <strong>Coal</strong> Terminal <strong>Limited</strong>R H McCullough (for G Okamatsu)Bachelor of Engineering (Civil), HonoursMaster of Business AdministrationDirector, Astron <strong>Limited</strong>Director, Greenpower Energy <strong>Limited</strong>Director, Oakbridge Pty <strong>Limited</strong>K Nakazato (for Y Nakata)Bachelor of CommerceManaging Director, Sumitomo Metal Australia Pty<strong>Limited</strong>S Ogake (for S Saito)Bachelor of Business and CommerceDirector and Secretary, J.C.D. Australia Pty <strong>Limited</strong>T Okada (for G Okamatsu)Bachelor of Business AdministrationCompany Secretary, Navidale Pty. <strong>Limited</strong>Company Secretary, RHA Pastoral Company Pty LtdCompany Secretary, Toyota Tsusho Group and itsrelated companiesT J S Renwick (for W H Champion)Bachelor of Engineering (Mechanical),Honours Master of Business AdministrationGeneral Manger Infrastructure, Rio Tinto <strong>Coal</strong> AustraliaDirector, Integrated Logistics Company Pty LtdDirector, Hunter Valley <strong>Coal</strong> Chain Coordinator <strong>Limited</strong>Alternate Director, Dalrymple Bay <strong>Coal</strong> Terminal Pty<strong>Limited</strong>Alternate Director, Half-Tide Marine Pty <strong>Limited</strong>C Robertson (for J M Cleland)Bachelor of Engineering (Electrical)Master of Business AdministrationGeneral Manager (Drayton mine),Anglo American Metallurgical <strong>Coal</strong> Pty Ltd4

Directors’ MeetingsThe number of meetings of the company’s Boardof Directors and Sub-Committees of the Board ofDirectors held during the financial year were:Board of Directors 9HSE Committee 3Audit & Risk Committee 4Financing Committee 1The attendance details of Directors at Boardmeetings and Sub-Committees of the Board ofDirectors held throughout the financial year areas follows:Board of DirectorsMeetings heldwhilst in officeMeetingsattendedDirectorsM Harvey 9 9M Allen 9 9W H Champion 9 5J M Cleland - -M Iwami 5 -R S Light 9 7A W Mason 9 7Y Nakata 9 8G Okamatsu 9 5A E Pitt 9 8J E Richards 9 8S Saito 4 -Alternate DirectorsH Asada 5 -S R Bridger 9 -K Fukamachi 4 -A Hasumoto 9 7M Heaton 2 -N Kushibuchi 5 1B F Lewis 9 1T Maeno 4 -R H McCullough 9 4K Nakazato 9 -T Okada 9 -T Renwick 8 3C Robertson - -A Taniguchi 9 2G Walker 7 1P A Wilkes 9 2Health, Safety and Environment CommitteeM Harvey 3 3D McLachlan 3 3J E Richards 3 3Meetings heldwhilst in officeMeetingsattendedFinancing CommitteeR S Light 1 1A W Mason 1 1G Okamatsu 1 1Company SecretariesThe company secretaries are:Mr G V Crowe. Mr Crowe was appointed tothe position of company secretary in July 2008.Mr Crowe is a member of CPA Australia.Mr J A Oliver. Mr Oliver was appointed to theposition of company secretary in February 2008.Mr Oliver is a member of the Institute ofChartered Accountants in Australia and CPAAustralia.Principal ActivitiesThe principal activities of the company were theprovision of coal receival, blending, stockpilingand shiploading services in the <strong>Port</strong> of Newcastle.Trading ResultsThe net profit of the consolidated entity for thefinancial year was $107.9 million after an incometax expense of $44.4 million.DividendsTotal dividends paid during the financial yearwere as follows:$Importer & Exporter ClassSharesFinal 2010 dividend and FirstInterim 2011 dividend paid29 March 2011. Fully Franked $14,900,000Importer & Exporter ClassSharesSecond Interim 2011 dividendpaid 28 September 2011.Fully Franked $15,000,000$29,900,000Audit & Risk CommitteeA W Mason 4 4M Harvey 4 3R S Light 4 4P C Taylor 4 35

Review of OperationsDuring the financial year the company handled 97.8 million tonnes of coal through itsCarrington and Kooragang Terminals (2010, 95.1 million tonnes), representing increasedtonnage of 2.9% on the previous year. The above mentioned tonnage was loaded aboard1,025 vessels (2010, 1,067 vessels).Steaming coal exports increased by 7.9% with shipments for the year totalling 82.2 milliontonnes (2010, 76.2 million tonnes). Coking coal exports decreased by 17.5% with shipmentsfor the year totalling 15.6 million tonnes (2010, 18.9 million tonnes).The charge for coal handling services remained at $4.05 per tonne throughout 2011 andincreased to $4.50 effective 1 January 2012.At the end of the financial year there were 402 people (31 December 2010, 394 people)employed by the company.Changes in State of AffairsThere have been no significant changes in the state of affairs of the company during thefinancial year.Future Developments and ResultsThe company has continued to expand its coal handling facilities in the <strong>Port</strong> of Newcastle inorder to meet continued demand for Hunter Valley export coal. Kooragang Terminalexpansion works continued on Project Master Plan Completion (“MPC”) during 2011, withthese works increasing nameplate capacity to 133 Mtpa for 2012.Prefeasibility work for the PWCS T4 development is progressing on schedule. TheEnvironmental Assessment for PWCS T4 was lodged with the Department of Planning inNovember 2011.In the opinion of Directors, there are no other developments likely to significantly affect thefuture results of the company.Directors’ InterestsEach of the Directors has given a standing notice under sub-section 192(1) of theCorporations Act 2001 stating that he is a Director or member of certain specifiedcorporations and as such is to be regarded as having an interest in any contract which maybe made between the company and those corporations. Other than contracts of a routinenature between the company and associated corporations no Director has an interest in anycontract or proposed contract made with the company since 22 March 2011 (being the dateof the previous year’s Directors’ Report) and the date of this report.No Director holds shares in the company or related bodies corporate as at the date of thisreport.6

Environmental RegulationThe NSW State Government has Acts and Regulations that the company’s operations aresubject to. They are principally covered by the requirements of the:Environmental Planning and Assessment Act (1979) and Regulations; andProtection of the Environment Operations Act (1997) and Regulations.The NSW Department of Planning and Infrastructure and the NSW Office of Environment andHeritage are the primary Government authorities responsible for the issuing of andadministration of approvals, licences and permits in accordance with the requirements of theActs and Regulations and in relation to the company’s operation.During the financial year the company complied with all environmental requirements. Allexternal reporting requirements associated with the National Greenhouse and EnergyReporting Act (2007) and other legislation were undertaken.Directors’ BenefitsNo Director of the company has, since the end of the previous financial year, received orbecome entitled to receive a benefit (other than a benefit included in the total amount ofemoluments received or due and receivable by Directors shown in the financial report) byreason of a contract made by the company or a related body corporate with a Director or witha firm of which he or she is a member, or with an entity in which he or she has a substantialfinancial interest.Indemnities and InsuranceDuring the financial year, the company paid a premium for an insurance policy insuring anypast or present Director, Secretary, Executive Officer or employee of the company againstcertain liabilities. The insurance policy prohibits disclosure of the terms of the policy includingthe nature of the liability insured against and the amount of the premium.In accordance with the Constitution of the company, the company must indemnify on a fullindemnity basis, and to the full extent permitted by law, the following persons:(a) Each person who is or has been a Director, Alternate Director, Chief Executive Officer,General Manager or Secretary of the company;(b) Other officers or former officers of the company or of its related bodies corporate as theDirectors in each case determine; andThe indemnities so provided apply for all losses or liabilities incurred by the person as anofficer or Auditor of the company or of a related body corporate including, but not limited to, aliability for negligence or for reasonable costs and expenses incurred:(a) in defending proceedings in which judgement is given in favour of the person or in whichthe person is acquitted; or(b) in connection with an application, in relation to such proceedings, in which the Courtgrants relief to the person under the Corporations Act 2001.The indemnities so provided operate only to the extent that the loss or liability is not coveredby insurance.7

Proceedings on behalf of the companyNo person has applied to the Court under section 237 of the Corporations Act 2001 forleave to bring proceedings on behalf of the company, or to intervene in any proceedingsto which the company is a party, for the purpose of taking responsibilities on behalf of thecompany for all or part of those proceedings.No proceedings have been brought or intervened in on behalf of the company with leaveof the Court under section 237 of the Corporations Act 2001.Auditor’s independence declarationThe auditor’s independence declaration is included on page 9 of the annual report.Rounding of AmountsThe company is a company of the kind referred to in Class Order 98/0100 issued by theAustralian Securities and Investments Commission, relating to the “rounding off” ofamounts in the Directors’ Report and financial report. Amounts in the Directors’ Reportand financial report have been rounded off to the nearest thousand dollars in accordancewith that Class Order unless otherwise stated.Dated at Newcastle this 27th day of March 2012.Signed in accordance with a resolution of the Directors.M HarveyDirector8

Deloitte Touche TohmatsuABN 74 490 121 060Grosvenor Place225 George StreetSydney NSW 2000PO Box N250 Grosvenor PlaceSydney NSW 1219 AustraliaThe Directors<strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong>Curlew StreetKooragang IslandNEWCASTLE NSW 2294DX: 10307SSETel: +61 (0) 2 9322 7000Fax: +64 (0)2 9322 7001www.deloitte.com.au27 March 2012Dear Directors<strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong>In accordance with section 307C of the Corporations Act 2001, I am pleased to provide thefollowing declaration of independence to the directors of <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong><strong>Limited</strong>.As lead audit partner for the audit of the financial statements of <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong><strong>Limited</strong> for the financial year ended 31 December 2011, I declare that to the best of myknowledge and belief, there have been no contraventions of:(i) the auditor independence requirements of the Corporations Act 2001 in relationto the audit; and(ii) any applicable code of professional conduct in relation to the audit.Yours sincerelyDELOITTE TOUCHE TOHMATSUR G SaaymanPartnerChartered AccountantsLiability limited by a scheme approved under Professional Standards Legislation.Member of Deloitte Touche Tohmatsu <strong>Limited</strong>9

PerformanceOVERVIEWShiploading in millions of tonnesREVIEWThroughput2006 79.82007 84.82008 91.42009 92.82010 95.12011 97.8Export DestinationsVessels Loaded2006 9182007 9732008 1,0562009 1,0772010 1,0672011 1,02510

Year inREVIEWSafetyThe PWCS Journey to ZERO INJURIES saw a reduction in the number of injuries for 2011 incomparison to the previous year. A total of eight injuries were sustained during 2011. Theseinjuries comprised four lost time injuries (five LTI’s in 2010) and four medical treatmentinjuries (five MTI’s in 2010).Key Health and Safety initiatives and highlights for 2011 include:• Carrington Terminal Shift 2 Operators achieved ten years LTI/MTI free on 12 July 2011.This team remains injury free;• Kooragang Terminal Daywork Operations achieved ten years LTI/MTI free on 12January 2012. This team remains injury free;• Both Terminals participated in 21 emergency drills for the year - 6 EmergencyEvacuations and 15 Initial Response Drills were conducted;• A gap analysis was undertaken in preparation for the commencement of the Safe WorkLegislation;• An audit on the PWCS mooring operations with reference to the new Rio Tinto MarineSafety Standard was completed. Corrective actions were developed during November.These actions will be commenced with a Mooring Operations risk assessment inFebruary 2012;• Occupational, heat, dust, noise, welding, diesel particulate and vibration samplingacross both Terminals was undertaken, with over 400 samples collected; and• Risk analysis for the development of a PWCS rail risk register as part of PWCS’ PrivateSiding Accreditation was completed.In addition to the above initiatives, wages employee participation in planned job observationsand the Take 5 process increased in comparison to 2010.PWCS continued the safety suggestion scheme which was instigated in 2007. Approvedsafety suggestions allow an employee to nominate a charity of their choice to receive adonation. PWCS donated $16,400 to charities in 2011 as a result of employee safetysuggestions.11

EnvironmentPWCS’ operations were conducted in compliance with licence and consent conditionsduring the year. Independent certification of the PWCS Environmental ManagementSystem to the ISO 14001 standard was maintained throughout 2011.PWCS was nominated as an industry representative on the newly formed NewcastleCommunity Consultative Committee for the Environment.Recent improvements to the dust management system at the Carrington Terminal wererecognised with PWCS awarded (in a joint submission with DuPont) the EnvironmentalProject of the Year at the Australian Bulk Handling Awards.PeopleThe total number of PWCS employees remained steady throughout 2011 with 394 at thebeginning of the year compared to 402 employees at the end of 2011. There was aturnover of 40 employees, which equates to a turnover rate of 10.1%. This turnover rateincludes employees leaving PWCS as a result of resignation, redundancy and terminationof employment.PWCS conducted an extensive review of the PWCS Organisational Structure to ensure itwas well positioned as it enters a period of unprecedented expansion. As a result, PWCSrestructured the organisation into four Streams, namely Operations, Commercial,Development and Implementation. The review also undertook a thorough examination ofthe way PWCS was delivering operational, maintenance and engineering functions and toensure it was structured for the future when PWCS Terminal 4 (‘PWCS T4’) is operational.The Operations Stream now incorporates four departments, being Logistics, Assets,Kooragang and Carrington.The first Work Performance Reviews for Enterprise Agreement employees were conductedby team leaders in the first quarter of 2011. This will continue on an annual basis.Extensive employee training programs were conducted throughout 2011 to further enhanceand develop employee skills and meet Enterprise Agreement training requirements.PWCS continued its Apprenticeship Scheme hosting a total of 14 Apprentices during 2011.The High School and University Scholarship programs also continued throughout 2011.PWCS also continues to support Traineeships in the areas of accounting and informationtechnology.CommercialPWCS continues to embark on an unprecedented capacity expansion program to meet thelong term contracted demand of <strong>Coal</strong> Producers in accordance with the long termcommercial framework. Industry demand was again underlined through strong demand forgrowth tonnes in the 2011 Annual Nomination and Allocation Process with substantialadditional tonnages being contracted at PWCS and underpinning its future construction ofTerminal 4. Significant work to give effect to the contractual alignment principles in the longterm commercial framework was undertaken in 2011 and will be ongoing in 2012.Financing arrangements were finalised during 2011 to fund the final stage of the coalloading expansion at the Kooragang Terminal.PWCS continued to be an active member of the community throughout 2011, donating$514,000 to charities and local community organisations. Significant donations were madeto Firstchance, Harry Meyn Memorial Foundation, Supporters of Cancer, Westpac RescueHelicopter Service, Newcastle Surf Lifesaving Club, Salvation Army, BCS Life Care Hunter<strong>Services</strong> Group, Hunter Prostate Cancer Alliance, Newcastle Seafarers Mission,OzHarvest and Soul Cafe. PWCS remains committed to being an active member of thelocal community during 2012.12

OperationsThroughput for 2011 was 97.8 Mtpa, against a budget of 106.5 Mtpa and nameplatecapacity of 113 Mtpa. This result represented an increase of 2.9% on the 2010 yearresult of 95.1 Mtpa. The difference between actual throughput and nameplate capacityrepresents interface and performance issues associated with the operation of the HunterValley <strong>Coal</strong> Chain.Kooragang TerminalFavourable operational performance measures for Kooragang Terminal were achievedthroughout the year. A summary of terminal performance achieved follows:Measure Target ActualTrain cancellations % 2.40% 0.90%Gross Unload Rate tonnes per hour 7,000 6,076Gross Load Rate tonnes per hour 4,800 5,190Integration of capital expansion equipment at the terminal progressed throughout the year.The coordination between the Terminal Operations and Maintenance teams and theKooragang Expansion Project team resulted in successful asset handover.Significant projects undertaken at Kooragang Terminal during 2011 include the upgrade topower and fibre optic networks, painting of plant and equipment and consolidation of controllogic systems.Carrington TerminalFavourable operational performance measures for Carrington Terminal were achievedthroughout the year. A summary of terminal performance achieved follows:Measure Target ActualTrain cancellations % 2.40% 0.90%Gross Unload Rate tonnes per hour 2,950 3,092Gross Load Rate tonnes per hour 1,970 2,294The Terminal Operations and Maintenance teams continued to maintain a focus on ensuringcoal dust and noise was kept to a minimum throughout the year. The environmental processand system improvements made to date, along with the proactive involvement of allCarrington Terminal team members are critical to continuing our environmental performance.Significant projects undertaken at Carrington Terminal during 2011 include the upgrade tocontrol logic systems and fibre optic networks, painting and upgrade of plant and equipmentand building refurbishment.LogisticsDuring 2011 the Logistics team contributed to the implementation of the Vessel Cycle Ratesystem for measuring the consumption of PWCS loading capacity, a vital system whichsupports the Long Term Commercial Framework. The Logistics team also assisted with thedevelopment of a planning strategy for Kooragang Terminal to maximise the effectiveness ofthe extended stockyard and additional berth which was put into operation in December 2011.ExpansionExpansion of PWCS’ coal terminal infrastructure continued during the year. The $670 Millionexpansion of the Kooragang Terminal, known as Project MPC, which was approved by theBoard in February 2010, was completed in December 2011. This expansion included theconstruction of a fourth shiploading berth and two half stockpile pads and has resulted inPWCS’ nameplate capacity increasing to 133 million tonnes from 1 January 2012.13

In April 2011 the Board approved $227 Million for the final stage of coal loading expansionat the Kooragang Terminal. This expansion, known as Project 145, includes theinstallation of a fourth rail receival station and an upgrade of the reclaim system’s peakthroughput to 9,500 tonnes per hour. This work is due for completion by the end of 2012,at which time PWCS’ nameplate capacity will be 145 million tonnes.DevelopmentPWCS continues to progress future expansion to meet the coal industry capacityrequirements. The Prefeasibility Study for PWCS T4 was completed in September 2011and a short additional Prefeasibility Study will be completed prior to the Feasibility Study,which will commence in April 2012.Engineering studies and investigation of the environmental, commercial and marketrelated issues concerning the development of PWCS T4 have been undertaken in 2011and will continue in 2012. Extensive terminal and port modelling has been conducted toestablish possible tonnage and stockpile options.Rio Tinto’s Project Development and Implementation group has been engaged by PWCSto assist the PWCS owner’s team and draw on relevant capability and expertise.The Initial Report for PWCS T4 was lodged with Newcastle <strong>Port</strong> Corporation in 2011 withapproval received in November 2011. The Environmental Assessment for PWCS T4 waslodged with the Department of Planning in November 2011. Work to date on PWCS T4remains on schedule and within budget.HENNIE DU PLOOYCHIEF EXECUTIVE OFFICER14

PWCS in theCOMMUNITYPWCS proudly supportslocal communityorganisations and charitiesDuring 2011 the PWCS Boardapproved a three year $150,000sponsorship arrangement for“Harry’s House”, named in memoryof Harry Meyn of East Maitland.Harry’s House, which is located inStockton, is a family retreat forchildren living with cancer. Harry’shouse was renovated in 2011 andopened in December.The sponsorship partnershipbetween the AutismSpectrum Australia (Aspect)Hunter School and PWCS hasenabled the school topurchase smartboards andcomputer equipment to assisttheir students.The Chuck Duck and RoosterCluck Breakfast Club providesbreakfasts at school for needykids in our region. PWCS hassupported Chuck Duck for sevenyears, donating over $40,000during that period. In 2011PWCS donated in excess of$10,000 to this local charity.15

PWCS – industryLEADERPWCS won a number of awardsduring 2011 being testimony toPWCS’ commitment to providesufficient coal loading capacity forthe Hunter Valley coal industry whilstsetting industry best practice workstandards.PWCS was recognisedas Australia’s best portor terminal operator atthe 2011 Lloyd’s ListAustralian Shipping andMaritime Industry awardsin November 2011.In October 2011 PWCS and DuPontAustralia jointly won theEnvironmental Project of the Yearcategory at the 2011 Bulk Handlingawards for work on dustminimisation at CarringtonTerminal. The award recognisesPWCS’ work which sets the industrybenchmark for controlling andminimising dust emisions.FutureFOCUSPWCS is committed to itsexpansion program to meetthe long term contracteddemand of <strong>Coal</strong> Producers.16

Statement of Comprehensive Incomefor the financial year ended 31 December 2011ConsolidatedCompanyContinuing operationsNote 31-Dec-11 31-Dec-10 31-Dec-11 31-Dec-10$'000 $'000 $'000 $'000Revenue 2 438,678 360,803 438,678 360,803Other income 2 2,885 8,422 3,188 8,422Share of profits of associates accounted for 25 - 303 - -using the equity methodEmployee benefit expenses (63,301) (74,964) (63,301) (74,964)Depreciation and amortisation expenses 2 (79,553) (72,025) (79,553) (72,025)Finance costs 2 (40,921) (37,999) (40,921) (37,999)Materials and services (81,032) (77,134) (81,032) (77,134)Other expenses (24,810) (21,581) (24,810) (21,581)Profit before income tax expense 151,946 85,825 152,249 85,522Income tax expense 3 (44,370) (25,612) (44,370) (25,612)Profit for the year 18 107,576 60,213 107,879 59,910Other comprehensive income 17 164 - 164 -Total comprehensive income for the year 107,740 60,213 108,043 59,910Notes to the financial statements are included on pages 22 to 37.17

Statement of Financial Positionas at 31 December 2011ConsolidatedCompanyNote31-Dec-11 31-Dec-10 31-Dec-11 31-Dec-10$'000 $'000 $'000 $'000CURRENT ASSETSCash and cash equivalents 4 6,560 2,331 6,560 2,331Trade and other receivables 5 19,529 19,378 19,529 19,378Inventories 6 6,886 7,462 6,886 7,462Other 7 2,523 3,726 2,523 3,726TOTAL CURRENT ASSETS 35,498 32,897 35,498 32,897NON-CURRENT ASSETSOther financial assets 8 15,591 3,138 15,591 2,835Property, plant and equipment 9 1,592,334 1,382,849 1,592,334 1,382,849Other 10 5,920 2,287 5,920 2,287TOTAL NON-CURRENT ASSETS 1,613,845 1,388,274 1,613,845 1,387,971TOTAL ASSETS 1,649,343 1,421,171 1,649,343 1,420,868CURRENT LIABILITIESTrade and other payables 11 43,548 45,398 43,548 45,398Borrowings 12 391,458 71,396 391,458 71,396Current tax payables 3 10,763 9,165 10,763 9,165Provisions 13 33,675 28,715 33,675 28,715TOTAL CURRENT LIABILITIES 479,444 154,674 479,444 154,674NON-CURRENT LIABILITIESBorrowings 14 607,847 791,328 607,847 791,328Deferred tax liabilities 3 93,966 88,600 93,966 88,600Provisions 15 37,472 46,386 37,472 46,386TOTAL NON-CURRENT LIABILITIES 739,285 926,314 739,285 926,314TOTAL LIABILITIES 1,218,729 1,080,988 1,218,729 1,080,988NET ASSETS 430,614 340,183 430,614 339,880EQUITYIssued capital 16 139,868 139,868 139,868 139,868Reserves 17 164 - 164 -Retained earnings 18 290,582 200,315 290,582 200,012TOTAL EQUITY 430,614 340,183 430,614 339,880Notes to the financial statements are included on pages 22 to 37.18

Statements of Changes in Equityfor the financial year ended 31 December 2011NoteConsolidatedShare Capital Reserves Retained Earnings Total$'000 $'000 $'000 $'000Balance at 31 December 2010 16, 17, 18 139,868 - 200,315 340,183Profit for the period - - 107,576 107,576Adjustment to opening retained earnings for fair valueof equity instruments18 - - 12,591 12,591Fair value of equity instruments movement for the year 17 - 164 - 164Dividends paid 18 - - (29,900) (29,900)Balance at 31 December 2011 16, 17, 18 139,868 164 290,582 430,614CompanyShare Capital Reserves Retained Earnings Total$'000 $'000 $'000 $'000Balance at 31 December 2010 16, 17, 18 139,868 - 200,012 339,880Profit for the period - - 107,879 107,879Adjustment to opening retained earnings for fair valueof equity instruments18 - - 12,591 12,591Fair value of equity instruments movement for the year 17 - 164 - 164Dividends paid 18 - - (29,900) (29,900)Balance at 31 December 2011 16, 17, 18 139,868 164 290,582 430,614ConsolidatedShare Capital Reserves Retained Earnings Total$'000 $'000 $'000 $'000Balance at 31 December 2009 16, 17, 18 139,868 - 169,302 309,170Profit for the period - - 60,213 60,213Dividends paid 18 - - (29,200) (29,200)Balance at 31 December 2010 16, 17, 18 139,868 - 200,315 340,183.CompanyShare Capital Reserves Retained Earnings Total$'000 $'000 $'000 $'000Balance at 31 December 2009 16, 17, 18 139,868 - 169,302 309,170Profit for the period - - 59,910 59,910Dividends paid 18 - - (29,200) (29,200)Balance at 31 December 2010 16, 17, 18 139,868 - 200,012 339,880Notes to the financial statements are included on pages 22 to 37.19

Statement of Cash Flowsfor the financial year ended 31 December 2011ConsolidatedCompanyNote 31-Dec-11 31-Dec-10 31-Dec-11 31-Dec-10$'000 $'000 $'000 $'000CASH FLOWS FROM OPERATING ACTIVITIESReceipts from customers 483,600 397,049 483,600 397,049Payments to suppliers and employees (218,806) (201,385) (218,806) (201,385)Dividends received 994 967 1,296 967Interest received 797 5,489 797 5,489Interest and other costs of finance paid (51,681) (39,071) (51,681) (39,071)Income tax paid (37,406) (35,440) (37,406) (35,440)NET CASH FLOWS FROMOPERATING ACTIVITIES (iii) 177,498 127,609 177,800 127,609CASH FLOWS FROM INVESTING ACTIVITIESPayments for property, plant and equipment (281,475) (296,771) (281,475) (296,771)Proceeds from sale of property, plant and equipment 200 1,088 200 1,088Proceeds from sale of associate 302 - - -NET CASH FLOWS USED ININVESTING ACTIVITIES (280,973) (295,683) (281,275) (295,683)CASH FLOWS FROM FINANCING ACTIVITIESRepayment of borrowings (71,396) (72,313) (71,396) (72,313)Proceeds from borrowings 209,000 65,000 209,000 65,000Dividends paid 19 (29,900) (29,200) (29,900) (29,200)NET CASH FLOWS FROMFINANCING ACTIVITIES 107,704 (36,513) 107,704 (36,513)NET INCREASE/(DECREASE) IN CASH AND CASH EQUIVALENTS 4,229 (204,587) 4,229 (204,587)CASH AND CASH EQUIVALENTS AT THE BEGINNING OF THEFINANCIAL YEAR 2,331 206,918 2,331 206,918CASH AND CASH EQUIVALENTS AT THE END OF THEFINANCIAL YEAR (i) 6,560 2,331 6,560 2,331Included in the $51,681,000 disclosed as 'Interest and other costs of finance paid' is $17,138,000 of interest which has been capitalised in plant andequipment.Notes to the financial statements are included on pages 22 to 37.20

Notes to the Statement of Cash Flowsfor the financial year ended 31 December 2011Consolidated Company31-Dec-11 31-Dec-10 31-Dec-11 31-Dec-10$'000 $'000 $'000 $'000(i)CASH AT THE END OF THE FINANCIAL YEARFor the purposes of the Statement of Cash Flows, cashincludes cash on hand and in banks and investments inmoney market instruments for the parent entity only,net of outstanding bank overdrafts.Cash and cash equivalents at the end of the financial year asshown in the cashflow statement is reconciled to the relateditems in the Statement of Financial Position as follows:Cash and cash equivalents 6,560 2,331 6,560 2,331(ii)FINANCING FACILITIESThe parent entity has access to:Secured bank loan facilities with various maturityAmount usedAmount unused1,004,458 866,855 1,004,458 866,855356,000 335,000 356,000 335,0001,360,458 1,201,855 1,360,458 1,201,855(iii)RECONCILIATION OF PROFIT FOR THE PERIOD TONET CASH FLOWS FROM OPERATING ACTIVITIESProfit for the period 107,576 60,213 107,879 59,910Depreciation expense 79,553 72,025 79,553 72,025Amortisation of borrowing costs 887 399 887 399Profit on sale of plant & equipment (15) (345) (15) (345)Share of profits of associates not received as dividends or distributions - (303) - -Capitalised interest (17,138) (9,085) (17,138) (9,085)Provision for restoration and rehabilitation movement for the year - 7,000 - 7,000Interest unwinding on rehabilitation provision 3,820 3,560 3,820 3,560Changes in assets & liabilities:Increase/(decrease) in income tax payable 1,598 (7,574) 1,598 (7,574)(Increase)/decrease in trade debtors (151) 1,970 (151) 1,970(Increase)/decrease in other assets, prepayments and deferredborrowing costs (4,339) (8,053) (4,339) (8,053)(Increase)/decrease in inventory 576 672 576 672Increase/(decrease) in deferred taxes 5,366 (2,253) 5,366 (2,253)Increase/(decrease) in trade creditors &provisions (234) 9,383 (234) 9,383Net cash flows from operating activities 177,498 127,609 177,800 127,60921

Notes to the financial statementsfor the financial year ended 31 December 2011NOTE 1 SUMMARY OF ACCOUNTING POLICIES USED IN THE FINANCIAL STATEMENTSSummary of Accounting PoliciesStatement of ComplianceThe financial report is a general purpose financial report which has been prepared in accordance with the Corporations Act 2001,Accounting Standards and Interpretations, and complies with other requirements of the law.The financial report includes the separate financial statements of the company and the consolidated financial statements of theGroup.In the current year, the company has adopted all of the new and revised standards and interpretations issued by the AustralianAccounting Standards Board (the AASB) that are relevant to it’s operations and effective for the company’s annual reportingperiod.New and revised standards and interpretations effective for the current reporting period that are relevant to the company included:• AASB 124 Related Party Disclosures• AASB 9 Financial Instruments (adopted in advance of effective date of 1 January 2013)Accounting Standards include Australian Accounting Standards. Compliance with Australian Accounting Standards ensuresthat the financial statements and notes of the company and the consolidated entity comply with International ReportingStandards (IFRS).The financial statements were authorised for issue by the Directors on 27 March 2012.Basis of PreparationThe financial report has been prepared on the basis of historical cost, except for the revaluation of certain non-current assetsand financial instruments. Cost is based on the fair values of the consideration given in exchange for assets. All amounts arepresented in Australian dollars, unless otherwise noted.The company is of a kind referred to in Class Order 98/0100, issued by the Australian Securities and Investments Commission,relating to the "rounding off" of amounts in the financial report. Amounts in the financial report have been rounded off inaccordance with that Class Order to the nearest thousand dollars, or in certain cases, to the nearest dollar.The preparation of financial statements requires management to make judgements, estimates and assumptions that affect theapplication of accounting policies and the reported amounts of assets, liabilities, income and expenses. Actual results maydiffer from these estimates.The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates arerecognised in the period in which the estimate is revised if the revision affects only that period, or in the period of the revision andfuture periods if the revision affects both current and future periods. Refer to Note 12 for Management’s assessment of thecompany’s ability to refinance current borrowings.Accounting policies are selected and applied in a manner which ensures that the resulting financial information satisfies theconcepts of relevance and reliability, thereby ensuring that the substance of the underlying transactions or other events isreported.The principal accounting policies adopted in preparing the financial report of the parent entity, <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong><strong>Limited</strong>, and the consolidated financial report of the consolidated entity comprising the parent entity, and the entities itcontrolled, are stated to assist in a general understanding of these financial reports. These policies have been consistentlyapplied by entities in the consolidated entity except as otherwise noted.Early adoption of Standards and InterpretationsThe Directors have elected under s.334(5) of the Corporations Act 2001 to apply AASB 9 'Financial Instruments' in advance of itseffective date. The standard is not required to be applied until annual reporting periods beginning 1 January 2013. The impact ofthe adoption of this standard results in a reclassification of $2,835,000 disclosed as shares at cost - other corporations toshares at fair value - other corporations on 1 January 2011. An increase to opening retained earnings at 1 January 2011 of$12,591,032 and an increase to shares held at fair value - other corporations of $12,591,032 to reflect the fair value adjustment inthe equity instrument at 1 January 2011. In addition, a fair value in equity instruments reserve recognised an increment of$164,536 reflecting the fair value movement of shares at fair value for the year ended 31 December 2011.22

Notes to the financial statementsfor the financial year ended 31 December 2011NOTE 1 SUMMARY OF ACCOUNTING POLICIES USED IN THE FINANCIAL STATEMENTS (continued)Standards and Interpretations in issue not yet adoptedInitial application of the following Standards and Interpretations is not expected to have any material impact to the financial report ofthe consolidated entity and the company:Standard/InterpretationAASB 2010-6 'Amendments to Australian AccountingStandards - Disclosures of Transfers of FinancialAssets'AASB 2010-8 'Amendments to Australian AccountingStandards - Deferred Tax: Recovery of UnderlyingAssets'Effective for annual reportingperiods beginning on or after1 July 20111 January 2012Expected to be initially appliedin the financial year ending31 December 201231 December 2012The Directors anticipate that the adoption of these Standards and Interpretations in future periods will have no material financialimpact on the financial statements of the company or the Group, as the issue of the above noted Interpretations do not affect itspresent policies and operations.These Standards and Interpretations will be first applied in the financial report of the Group that relates to the annual reportingperiod beginning after the effective date of each pronouncement, which in all cases will be the Company’s annual reportingperiod beginning on 1 January 2012 or later.Principles of ConsolidationThe consolidated financial statements are prepared by combining the financial statements of all the entities that comprise theconsolidated entity, being <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong> (the parent entity) and its subsidiaries as defined in AccountingStandard AASB 127 ‘Consolidated and Separate Financial Statements’. A list of subsidiaries appears in Note 26 to thefinancial statements. Consistent accounting policies are employed in the preparation and presentation of the consolidatedfinancial statements.On acquisition, the assets, liabilities and contingent liabilities of a subsidiary are measured at their fair values at the date ofacquisition. Any excess of the cost of acquisition over the fair values of the identifiable net assets acquired is recognised asgoodwill. If, after reassessment, the fair values of the identifiable net assets acquired exceeds the cost of acquisition, thedeficiency is credited to profit and loss in the period of acquisition.The consolidated financial statements include the information and results of each subsidiary from the date on which thecompany obtains control and until such time as the company ceases to control such entity. Control is achieved where thecompany has the power to govern the financial and operating policies of an entity so as to obtain benefits from its activities.In preparing the consolidated financial statements, all intercompany balances and transactions, and unrealised profits arisingwithin the consolidated entity are eliminated in full.Financial AssetsInvestments are recognised and derecognised on trade date where purchase or sale of an investment is under a contract whoseterms require delivery of the investment within the timeframe established by the market concerned, and are initially measured atfair value, net of transaction costs.Subsequent to initial recognition, investments in subsidiaries are measured at fair value. Subsequent to initial recognition,investments in associates are accounted for under the equity method in the consolidated financial statements and the costmethod in the company financial statements.Other financial assets are classified into the following specified categories:- loans and receivables- financial assets at cost.Loans and receivablesTrade receivables, loans, and other receivables are recorded at amortised cost less impairment.Interest and dividendsInterest and dividends are classified as expenses or as distributions of profit consistent with the Statement of Financial Positionclassification of the related debt or equity instruments.Shares at fair valueThe company has an investment in an unlisted entity whose shares are not traded in an active market. This investment hasbeen classified as 'shares at fair value - other corporations' (because the Directors consider that the fair value can be reliablymeasured). Fair value has been determined in accordance with generally accepted pricing models based on discountedcashflows. Gains and losses arising from changes in fair value are recognised in other comprehensive income and accumulatedin the fair value of equity instruments reserve. Where the investment is disposed of or is determined to be impaired, thecumulative gain or loss previously accumulated in the fair value of equity instruments reserve is not reclassified to profit or loss.Dividends on shares held at fair value are recognised in profit or loss when the company's right to receive dividends isestablished.23

Notes to the financial statementsfor the financial year ended 31 December 2011NOTE 1 SUMMARY OF ACCOUNTING POLICIES USED IN THE FINANCIAL STATEMENTS (continued)Income TaxCurrent taxCurrent tax is calculated by reference to the amount of income taxes payable or recoverable in respect of the taxable profit ortax loss for the period. It is calculated using tax rates and tax laws that have been enacted or substantively enacted by thereporting date. Current tax for current and prior periods is recognised as a liability (or asset) to the extent that it is unpaid (orrefundable).Deferred taxDeferred tax is accounted for using the Statement of Financial Position liability method. Temporary differences are differencesbetween the tax base of an asset or liability and its carrying amount in the Statement of Financial Position. The tax base of anasset or liability is the amount attributed to that asset or liability for tax purposes.In principle, deferred tax liabilities are recognised for all taxable temporary differences. Deferred tax assets are recognised to theextent that it is probable that sufficient taxable amounts will be available against which deductible temporary differences orunused tax losses and tax offsets can be utilised. However, deferred tax assets and liabilities are not recognised if thetemporary differences giving rise to them arise from the initial recognition of assets and liabilities (other than as a result of abusiness combination) which affects neither taxable income nor accounting profit.Deferred tax liabilities are recognised for taxable temporary differences arising on investments in subsidiaries and associatesexcept where the consolidated entity is able to control the reversal of the temporary differences and it is probable that thetemporary differences will not reverse in the foreseeable future. Deferred tax assets arising from deductible temporary differencesassociated with these investments and interests are only recognised to the extent that it is probable that there will be sufficienttaxable profits against which to utilise the benefits of the temporary differences and they are expected to reverse in theforeseeable future.Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period(s) when the asset andliability giving rise to them are realised or settled, based on tax rates (and tax laws) that have been enacted or substantivelyenacted by reporting date. The measurement of deferred tax liabilities and assets reflects the tax consequences that wouldfollow from the manner in which the consolidated entity expects, at the reporting date, to recover or settle the carrying amount ofits assets and liabilities.Current and deferred tax for the periodCurrent and deferred tax is recognised as an expense or income in the Statement of Comprehensive Income, except when itrelates to items credited or debited directly to equity, in which case the deferred tax is also recognised directly in equity, orwhere it arises from the initial accounting for a business combination, in which case it is taken into account in the determinationof goodwill or excess.Tax consolidationThe company and all its wholly-owned Australian resident entities are part of a tax-consolidated group under Australian taxationlaw. <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong> is the head entity in the tax-consolidated group. Tax expense/income, deferred taxliabilities and deferred tax assets arising from temporary differences of the members of the tax-consolidated group arerecognised in the separate financial statements of the members of the tax-consolidated group using the ‘separate taxpayerwithin group’ approach. Current tax liabilities and assets and deferred tax assets arising from unused tax losses and tax creditsof the members of the tax-consolidated group are recognised by the company (as head entity in the tax-consolidated group).PayablesTrade payables and other accounts payable are recognised when the consolidated entity becomes obliged to make futurepayments resulting from the purchase of goods and services.BorrowingsBorrowings are recorded initially at fair value, net of transaction costs.Subsequent to initial recognition, borrowings are measured at amortised cost with any difference between the initial recognisedamount and the redemption value being recognised in profit and loss over the period of the borrowing using the effective interestrate method.Borrowing CostsBorrowing costs directly attributable to the acquisition, construction or production of a qualifying asset, which are assets thatnecessarily take a substantial period of time to get ready for their intended use or sale, are added to the cost of those assets,until such time as the assets are substantially ready for their intended use or sale.All other borrowing costs are recognised in the profit and loss in the period in which they are incurred.Cash and Cash EquivalentsCash and cash equivalents comprise cash on hand, cash in banks (including short term deposits) and investments in moneymarket instruments, net of outstanding bank overdrafts.24

Notes to the financial statementsfor the financial year ended 31 December 2011NOTE 1 SUMMARY OF ACCOUNTING POLICIES USED IN THE FINANCIAL STATEMENTS (continued)Property, Plant and EquipmentLand is recognised at cost.Buildings, plant and equipment and leasehold improvements are stated at cost less accumulated depreciation and impairment.Cost includes expenditure that is directly attributable to the acquisition of the item. In the event that settlement of all or part ofthe purchase consideration is deferred, cost is determined by discounting the amounts payable in the future to their presentvalue as at the date of acquisition.Depreciation is provided on property, plant and equipment, including freehold buildings but excluding land. Depreciation iscalculated on a straight line basis so as to write off the net cost or other revalued amount of each asset over its expected usefullife to its estimated residual value. Leasehold improvements are depreciated over the period of the lease or estimated useful life,whichever is the shorter, using the straight line method. The estimated useful lives, residual values and depreciation method isreviewed at the end of each annual reporting period.The following estimated useful lives are used in the calculation of depreciation:Buildings10 - 25 yearsPlant and equipment 1 - 25 yearsProperty, plant and equipment consolidated lives are limited to 25 years reflecting commercial obsolescence.InventoriesMaintenance stores are valued at the lower of cost and net realisable value. Costs are assigned to inventory on hand by themethod most appropriate to each particular class of inventory, with the majority being valued on a first in first out basis. Netrealisable value represents the estimated selling price less all estimated costs of completion and costs to be incurred inmarketing, selling and distribution.Major spares purchased specifically for particular items of plant and equipment are included in the cost of plant and equipment.Employee BenefitsProvision is made for benefits accruing to employees in respect of wages and salaries, short term incentive payments, annualleave, long service leave, and sick leave when it is probable that settlement will be required and they are capable of beingmeasured reliably.Provisions made in respect of employee benefits expected to be settled within 12 months, are measured at their nominal valuesusing the remuneration rate expected to apply at the time of settlement.Provisions made in respect of employee benefits which are not expected to be settled within 12 months are measured as thepresent value of the estimated future cash outflows to be made by the consolidated entity in respect of services provided byemployees up to reporting date.Defined contributions plansContributions to defined contribution superannuation plans are expensed when employees have rendered service entitling themto the contributions.Revenue RecognitionRevenue from operating activities represents revenue from coal handling and related activities and includes accrued income inrelation to coal remaining on stockpiles at the end of the financial year. Revenue from outside the operating activities includesdividends received from other corporations, interest income, and proceeds from the disposal of property, plant and equipment.Revenue from operating activities is recognised when the services are provided and includes accrued income in relation to coalremaining on stockpiles and partly loaded coal at the end of the financial year.Revenue from Ship or Pay charges received is recognised when the Long Term Ship or Pay Agreement conditions forqualification are met.Prepaid revenue is not recognised as revenue until the coal handling services have been performed.Dividend and interest revenueDividend revenue is recognised on a receivable basis. Interest revenue is recognised on a time proportionate basis that takesinto account the effective yield on the financial asset.Goods and <strong>Services</strong> TaxRevenues, expenses and assets are recognised net of the amount of goods and services tax (GST), except:i.ii.where the amount of GST incurred is not recoverable from the taxation authority, it is recognised as part of the cost ofacquisition of an asset or as part of an item of expense; orfor receivables and payables which are recognised inclusive of GST.The net amount of GST recoverable from, or payable to, the taxation authority is included as part of receivables or payables.Cash flows are included in the Statement of Cash flows on a gross basis. The GST component of cash flows arising frominvesting and financing activities which is recoverable from, or payable to, the taxation authority is classified as operating cashflows.25

Notes to the financial statementsfor the financial year ended 31 December 2011NOTE 1 SUMMARY OF ACCOUNTING POLICIES USED IN THE FINANCIAL STATEMENTS (continued)Impairment of AssetsAt each reporting date, the consolidated entity reviews the carrying amounts of its tangible and intangible assets to determinewhether there is any indication that those assets have suffered an impairment loss. If any such indication exists, the recoverableamount of the asset is estimated in order to determine the extent of the impairment loss (if any). Where the asset does notgenerate cash flows that are independent from other assets, the consolidated entity estimates the recoverable amount of thecash-generating unit to which the asset belongs.Recoverable amount is the higher of fair value less costs to sell and value in use. In assessing value in use, the estimated futurecash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of thetime value of money and the risks specific to the asset for which the estimates of future cash flows have not been adjusted.If the recoverable amount of an asset (or cash-generating unit) is estimated to be less than its carrying amount, the carryingamount of the asset (cash-generating unit) is reduced to its recoverable amount. An impairment loss is recognised in profit orloss immediately, unless the relevant asset is carried at fair value (in which case the impairment loss is treated as a revaluationdecrease).Where an impairment loss subsequently reverses, the carrying amount of the asset (cash-generating unit) is increased to therevised estimate of its recoverable amount, but only to the extent that the increased carrying amount does not exceed thecarrying amount that would have been determined had no impairment loss been recognised for the asset (cash-generating unit)in prior years. A reversal of an impairment loss is recognised in profit or loss immediately.Leased AssetsOperating lease payments are recognised as an expense on a straight-line basis over the lease term, except where anothersystematic basis is more representative of the time pattern in which economic benefits from the leased asset are consumed.ProvisionsProvisions are recognised when the consolidated entity has a present obligation (legal or constructive) as a result of a pastevent, the future sacrifice of economic benefits is probable, and the amount of the provision can be measured reliably.The amount recognised as a provision is the best estimate of the consideration required to settle the present obligation atreporting date, taking into account the risks and uncertainties surrounding the obligation. Where a provision is measured usingthe cashflows estimated to settle the present obligation, its carrying amount is the present value of those cashflows.When some or all of the economic benefits required to settle a provision are expected to be recovered from a third party, thereceivable is recognised as an asset if it is virtually certain that recovery will be received and the amount of the receivable can bemeasured reliably.Provision for restoration and rehabilitationA provision for restoration and rehabilitation is recognised when there is a present obligation as a result of port operationsundertaken, it is probable that an outflow of economic benefits will be required to settle the obligation, and the amount of theprovision can be measured reliably. The estimated future obligations include the costs of removing facilities and restoring theaffected areas at the expiry of the relevant land operating leases. The provision for the future restoration costs is the bestestimate of the present value of the expenditure required to settle the restoration obligation at the reporting date, based onindependent cost estimates. Future restoration estimates are reviewed periodically and any changes in the estimate arereflected in the present value of the restoration provision at each reporting date.The initial estimate of the restoration and rehabilitation provision relating to removing facilities and restoring the affected areas iscapitalised into the related asset and amortised over the expected life of plant. Changes in the estimate of the provision forrestoration and rehabilitation are treated in the same manner, except that the unwinding of the effect of discounting on theprovision is recognised as a finance cost rather than being capitalised into the cost of the related asset.ReservesThe company has an investment in an unlisted entity whose shares are not traded in an active market. This investment hasbeen classified as 'shares held at fair value' (because the directors consider that the fair value can be reliably measured). Fairvalue has been determined in accordance with generally accepted pricing models based on discounted cashflows. Gains andlosses arising from changes in fair value are recognised in ether comprehensive income and accumulated in the fair value ofequity instruments reserve, with the exception of impairment losses which are recognised in the profit or loss. Where theinvestment is disposed of or is determined to be impaired, the cumulative gain or loss previously accumulated in the fair value ofequity instruments reserve is reclassified to profit or loss.Dividends on shares held at fair value are recognised in profit or loss when the company's right to receive dividends isestablished.Foreign currencyThe financial statements are presented in the entity's functional currency, being Australian dollars. Transactions in currenciesother than the entity's functional currency are recorded at the rates of exchange prevailing on the dates of the transactions. Ateach Statement of Financial Position date, monetary items denominated in foreign currencies are retranslated at the ratesprevailing at the Statement of Financial Position date.26

Notes to the financial statementsfor the financial year ended 31 December 2011ConsolidatedCompany31-Dec-11 31-Dec-10 31-Dec-11 31-Dec-10$'000 $'000 $'000 $'000NOTE 2 Profit from Operations(a) RevenueRevenue from continuing operations consisted of thefollowing items:Revenue from the rendering of <strong>Coal</strong> Handling <strong>Services</strong> 438,678 360,803 438,678 360,803(b) Other IncomeDividends from other corporations 993 967 1,296 967Interest received 837 5,975 837 5,975Other 1,040 1,135 1,040 1,135Gain on disposal of property, plant and equipment15 345 15 3452,885 8,422 3,188 8,422Total Revenue and Other Income 441,563 369,225 441,866 369,225(c) Profit before income taxProfit before income tax has been arrived at aftercharging the following expenses. The line items belowcombine amounts attributable to continuingoperations:Depreciation of property, plant and equipment 79,553 72,025 79,553 72,025Borrowing costs:Interest and finance charges paid/payable 37,101 34,439 37,101 34,439Amount capitalised - -Interest unwinding on rehabilitation provision 3,820 3,560 3,820 3,56040,921 37,999 40,921 37,999Defined contribution superannuation expense - 4 - 4Rental expense relating to operating leases and access 5,641 3,271 5,641 3,271agreementsNOTE 3 INCOME TAX(a) Income tax recognised in profit or lossTax expense comprises:Current tax expenseDeferred tax expense relating to the origination andreversal of temporary differencesTotal tax expenseThe prima facie income tax expense on pre-taxaccounting profit from operations reconciles to theincome tax expense in the financial statements asfollows:Profit from continuing operationsIncome tax expense calculated at 30%39,006 27,865 39,006 27,8655,364 (2,253) 5,364 (2,253)44,370 25,612 44,370 25,612151,946 85,825 152,249 85,52245,584 25,747 45,675 25,656Add/(Less)Capital loss- 458 - 458Non-deductible expenses175 144 175 144Share of profit from associate- (91) - -Investment allowance- (232) - (232)Research and development tax concessions (928) - (928) -Franking credits(465) (415) (556) (415)Adjustments recognised in the currentyear in relation to current tax of prioryears4 - 4 -44,370 25,612 44,370 25,61227

Notes to the financial statementsfor the financial year ended 31 December 2011ConsolidatedCompany31-Dec-11 31-Dec-10 31-Dec-11 31-Dec-10$'000 $'000 $'000 $'000NOTE 3 INCOME TAX (continued)(b) Current tax payables:Income tax payable attributable to:Parent entity and entities in the tax consolidatedgroup(c) Deferred tax balancesDeferred tax assets comprise:Temporary differencesSetoff to deferred tax liabilities10,763 9,165 10,763 9,16514,077 11,051 14,077 11,051(14,077) (11,051) (14,077) (11,051)- - - -Deferred tax liabilities comprise:Temporary differencesSetoff from deferred tax assets(108,043) (99,651) (108,043) (99,651)14,077 11,051 14,077 11,051Taxable and deductible temporary differences arisefrom the following:(93,966) (88,600) (93,966) (88,600)Consolidated and CompanyBalance at Charged to Balance at Charged to Balance at31-Dec-09 income31-Dec-10 income31-Dec-11$'000 $'000 $'000 $'000 $'000Gross deferred tax liabilities:Inventories(2,440) 201 (2,239) 173 (2,066)Work in progress(495) (199) (694) (146) (840)Other receivables(70) 58 (12) 2 (10)Property, plant and equipment(97,236) 1,268 (95,968) (4,311) (100,279)Other assets(140) (599) (739) (1,041) (1,781)Research and development tax concessions - - - (3,067) (3,067)(100,381) 730 (99,651) (8,390) (108,043)Gross deferred tax assets:Provisions6,569 (116) 6,453 1,251 7,703Other accruals59 (24) 35 (7) 28Rehabilitation asset and interest unwinding 2,900 1,663 4,563 1,782 6,3459,528 1,523 11,051 3,026 14,077(90,853) 2,253 (88,600) (5,364) (93,966)Relevance of tax consolidation to the consolidated entityThe company and its wholly-owned Australian resident entity have formed a tax-consolidated group with effect from 1 January2003 and are therefore taxed as a single entity from that date. The head entity within the tax-consolidated group is <strong>Port</strong><strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong>. The members of the tax-consolidated group are identified at Note 26.As a consequence, <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong>, as the head entity in the tax consolidated group, recognises currentand deferred tax amounts relating to transactions, events and balances of controlled entities in this group as if those transactions,events and balances were its own, in addition to the current and deferred tax amounts arising in relation to its own transactions,events and balances.28

Notes to the financial statementsfor the financial year ended 31 December 2011ConsolidatedCompany31-Dec-11 31-Dec-10 31-Dec-11 31-Dec-10$'000 $'000 $'000 $'000NOTE 4 CASH AND CASH EQUIVALENTSCash on hand and short term deposits 6,560 2,331 6,560 2,331NOTE 5 TRADE AND OTHER RECEIVABLESTrade debtors and accrued income 19,285 17,068 19,285 17,068Other debtors 244 2,310 244 2,31019,529 19,378 19,529 19,378The average credit period for customers is 14 days. No interest is charged on trade debtors for the first 14 days from the date of invoice. Thereafter,interest is charged at an appropriate overdraft indicator rate on the outstanding balance. In determining the recoverability of trade debtors thecompany considers any change in the credit quality of the trade debtor from the date credit was initially granted up to the reporting date. TheDirectors believe that there is no doubtful debt provision required for trade debtors.NOTE 6 INVENTORIESMaintenance stores and supplies 6,886 7,462 6,886 7,462NOTE 7 OTHER CURRENT ASSETSPrepayments 2,523 3,726 2,523 3,726NOTE 8 NON CURRENT - FINANCIAL ASSETSShares at fair value - other corporations 15,591 - 15,591 -Shares at cost - other corporations - 2,835 - 2,835Shares in associates (Note 25) - 303 - -15,591 3,138 15,591 2,835Shares at fair value represent investment in:Newcastle <strong>Coal</strong> Shippers Pty <strong>Limited</strong> (NCS), a company which is not quoted on a stock exchange. The principal activity ofNCS during the year was investment in <strong>Port</strong> <strong>Waratah</strong> <strong>Coal</strong> <strong>Services</strong> <strong>Limited</strong>. In the prior year this investment was shown at cost.At 31 December 2011 the parent entity held 2,835,000 (31 December 2010: 2,835,000) ordinary shares in NCS whichrepresented 8.964% of the issued capital of NCS.For the year ended 31 December 2011 NCS contributed an amount of $1 million in dividends (31 December 2010: $1 million) tothe pre tax profit of the parent entity and the consolidated entity.29

Notes to the financial statementsfor the financial year ended 31 December 2011NOTE 9 PROPERTY, PLANT AND EQUIPMENTLandBuildingsPlant andequipmentTotalConsolidated Entity and Company $'000 $'000 $'000 $'000Gross carrying amountBalance at 1 January 2010AdditionsUnder construction at costDisposalsBalance at 1 January 2011AdditionsUnder construction at costDisposalsBalance at 31 December 2011Accumulated depreciationBalance at 1 January 2010DisposalsDepreciation expenseBalance at 1 January 2011DisposalsDepreciation expenseBalance at 31 December 2011Net book valueAs at 31 December 2010As at 31 December 20118,161 20,149 1,954,100 1,982,41012,752 684 218,481 231,917- - 73,939 73,939- (174) (55,037) (55,211)20,913 20,659 2,191,484 2,233,055113 552 402,869 403,534- - (104,921) (104,921)- (211) (10,805) (11,016)21,026 21,000 2,478,627 2,520,652- 10,124 822,525 832,649- (174) (54,294) (54,468)- 1,004 71,021 72,025- 10,954 839,252 850,206- (75) (1,365) (1,440)- 1,286 78,266 79,553- 12,165 916,154 928,31820,913 9,705 1,352,232 1,382,84921,026 8,835 1,562,473 1,592,334ConsolidatedCompany31-Dec-11 31-Dec-10 31-Dec-11 31-Dec-10$'000 $'000 $'000 $'000Aggregate depreciation allocated, whether recognisedas an expense or capitalised as part of the carryingamount of other assets during the year:Buildings 1,286 1,004 1,286 1,004Plant and Equipment 78,266 71,021 78,266 71,02179,553 72,025 79,553 72,025NOTE 10 NON-CURRENT ASSETS - OTHERCapitalised borrowing costs 6,058 2,289 6,058 2,289Less Accumulated Amortisation (138) (2) (138) (2)5,920 2,287 5,920 2,287NOTE 11 CURRENT TRADE AND OTHER PAYABLESTrade payables 24,887 28,656 24,887 28,656Accruals 18,661 16,742 18,661 16,74243,548 45,398 43,548 45,398The average credit period on purchases of goods and services is 45 days.30