fxcm-traits-of-successful-traders-guide

fxcm-traits-of-successful-traders-guide

fxcm-traits-of-successful-traders-guide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

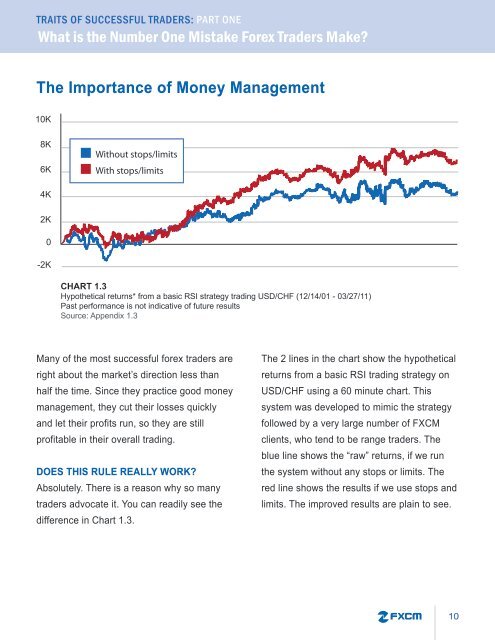

TRAITS OF SUCCESSFUL TRADERS: PART ONEWhat is the Number One Mistake Forex Traders Make?The Importance <strong>of</strong> Money Management10K8K6KWithout stops/limitsWith stops/limits4K2K0-2KCHART 1.3Hypothetical returns* from a basic RSI strategy trading USD/CHF (12/14/01 - 03/27/11)Past performance is not indicative <strong>of</strong> future resultsSource: Appendix 1.3Many <strong>of</strong> the most <strong>successful</strong> forex <strong>traders</strong> areright about the market’s direction less thanhalf the time. Since they practice good moneymanagement, they cut their losses quicklyand let their pr<strong>of</strong>its run, so they are stillpr<strong>of</strong>itable in their overall trading.DOES THIS RULE REALLY WORK?Absolutely. There is a reason why so many<strong>traders</strong> advocate it. You can readily see thedifference in Chart 1.3.The 2 lines in the chart show the hypotheticalreturns from a basic RSI trading strategy onUSD/CHF using a 60 minute chart. Thissystem was developed to mimic the strategyfollowed by a very large number <strong>of</strong> FXCMclients, who tend to be range <strong>traders</strong>. Theblue line shows the “raw” returns, if we runthe system without any stops or limits. Thered line shows the results if we use stops andlimits. The improved results are plain to see.10