fxcm-traits-of-successful-traders-guide

fxcm-traits-of-successful-traders-guide

fxcm-traits-of-successful-traders-guide

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

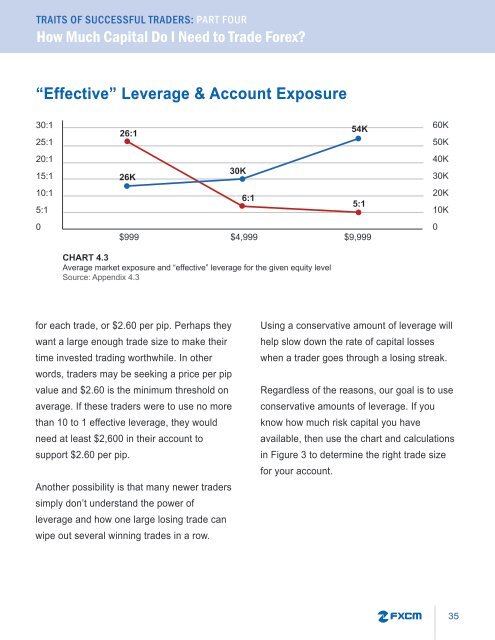

TRAITS OF SUCCESSFUL TRADERS: PART FOURHow Much Capital Do I Need to Trade Forex?“Effective” Leverage & Account Exposure30:125:120:115:110:15:1026:126K30K$999 $4,999 $9,999CHART 4.3Average market exposure and “effective” leverage for the given equity levelSource: Appendix 4.36:154K5:160K50K40K30K20K10K0for each trade, or $2.60 per pip. Perhaps theywant a large enough trade size to make theirtime invested trading worthwhile. In otherwords, <strong>traders</strong> may be seeking a price per pipvalue and $2.60 is the minimum threshold onaverage. If these <strong>traders</strong> were to use no morethan 10 to 1 effective leverage, they wouldneed at least $2,600 in their account tosupport $2.60 per pip.Another possibility is that many newer <strong>traders</strong>simply don’t understand the power <strong>of</strong>leverage and how one large losing trade canwipe out several winning trades in a row.Using a conservative amount <strong>of</strong> leverage willhelp slow down the rate <strong>of</strong> capital losseswhen a trader goes through a losing streak.Regardless <strong>of</strong> the reasons, our goal is to useconservative amounts <strong>of</strong> leverage. If youknow how much risk capital you haveavailable, then use the chart and calculationsin Figure 3 to determine the right trade sizefor your account.35