fxcm-traits-of-successful-traders-guide

fxcm-traits-of-successful-traders-guide

fxcm-traits-of-successful-traders-guide

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

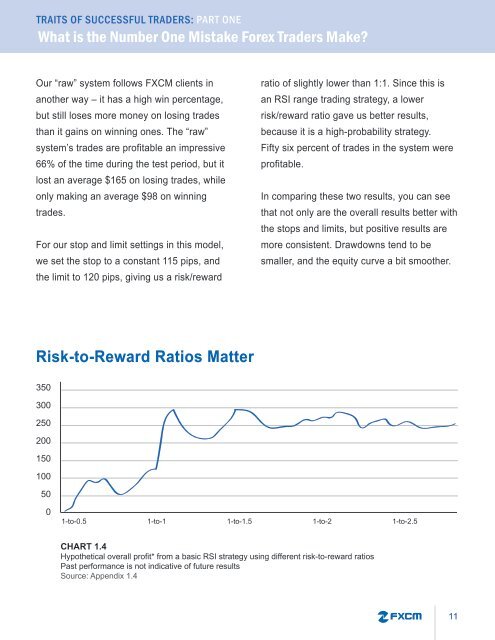

TRAITS OF SUCCESSFUL TRADERS: PART ONEWhat is the Number One Mistake Forex Traders Make?Our “raw” system follows FXCM clients inanother way – it has a high win percentage,but still loses more money on losing tradesthan it gains on winning ones. The “raw”system’s trades are pr<strong>of</strong>itable an impressive66% <strong>of</strong> the time during the test period, but itlost an average $165 on losing trades, whileonly making an average $98 on winningtrades.For our stop and limit settings in this model,we set the stop to a constant 115 pips, andthe limit to 120 pips, giving us a risk/rewardratio <strong>of</strong> slightly lower than 1:1. Since this isan RSI range trading strategy, a lowerrisk/reward ratio gave us better results,because it is a high-probability strategy.Fifty six percent <strong>of</strong> trades in the system werepr<strong>of</strong>itable.In comparing these two results, you can seethat not only are the overall results better withthe stops and limits, but positive results aremore consistent. Drawdowns tend to besmaller, and the equity curve a bit smoother.Risk-to-Reward Ratios Matter3503002502001501005001-to-0.5 1-to-1 1-to-1.5 1-to-2 1-to-2.5CHART 1.4Hypothetical overall pr<strong>of</strong>it* from a basic RSI strategy using different risk-to-reward ratiosPast performance is not indicative <strong>of</strong> future resultsSource: Appendix 1.411