Using Data Analysis to Detect Fraud - IIA Dallas Chapter

Using Data Analysis to Detect Fraud - IIA Dallas Chapter

Using Data Analysis to Detect Fraud - IIA Dallas Chapter

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

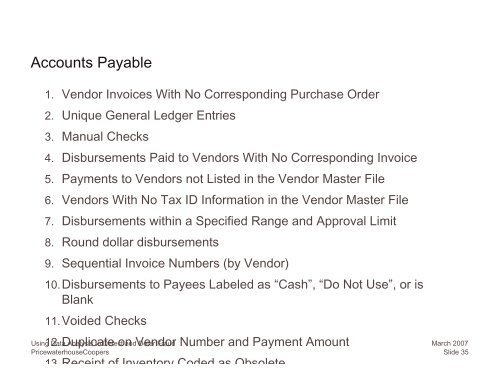

Accounts Payable1. Vendor Invoices With No Corresponding Purchase Order2. Unique General Ledger Entries3. Manual Checks4. Disbursements Paid <strong>to</strong> Vendors With No Corresponding Invoice5. Payments <strong>to</strong> Vendors not Listed in the Vendor Master File6. Vendors With No Tax ID Information in the Vendor Master File7. Disbursements within a Specified Range and Approval Limit8. Round dollar disbursements9. Sequential Invoice Numbers (by Vendor)10.Disbursements <strong>to</strong> Payees Labeled as “Cash”, “Do Not Use”, or isBlank11.Voided Checks12.Duplicate on Vendor Number and Payment Amount<strong>Using</strong> <strong>Data</strong> <strong>Analysis</strong> <strong>to</strong> <strong>Detect</strong> and Deter <strong>Fraud</strong>PricewaterhouseCoopers13.Receipt of Inven<strong>to</strong>ry Coded as ObsoleteMarch 2007Slide 35