The Global Currency Investor A Quarterly Analysis of 50 World ...

The Global Currency Investor A Quarterly Analysis of 50 World ...

The Global Currency Investor A Quarterly Analysis of 50 World ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

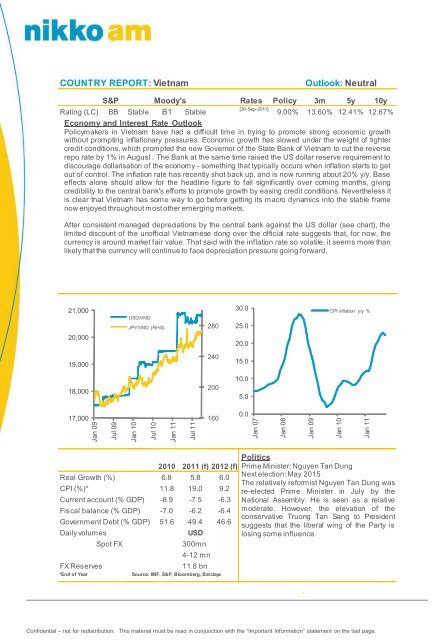

Jan 09Jul 09Jan 10Jul 10Jan 11Jul 11Jan 07Jan 08Jan 09Jan 10Jan 11COUNTRY REPORT: VietnamOutlook: NeutralS&P Moody's Rates Policy 3m 5y 10y[30-Sep-2011]Rating (LC) BB Stable B1 Stable9.00% 13.60% 12.41% 12.67%Economy and Interest Rate OutlookPolicymakers in Vietnam have had a difficult time in trying to promote strong economic growthwithout prompting inflationary pressures. Economic growth has slowed under the weight <strong>of</strong> tightercredit conditions, which prompted the new Governor <strong>of</strong> the State Bank <strong>of</strong> Vietnam to cut the reverserepo rate by 1% in August . <strong>The</strong> Bank at the same time raised the US dollar reserve requirement todiscourage dollarisation <strong>of</strong> the economy - something that typically occurs when inflation starts to getout <strong>of</strong> control. <strong>The</strong> inflation rate has recently shot back up, and is now running about 20% y/y. Baseeffects alone should allow for the headline figure to fall significantly over coming months, givingcredibility to the central bank's efforts to promote growth by easing credit conditions. Nevertheless itis clear that Vietnam has some way to go before getting its macro dynamics into the stable framenow enjoyed throughout most other emerging markets.After consistent managed depreciations by the central bank against the US dollar (see chart), thelimited discount <strong>of</strong> the un<strong>of</strong>ficial Vietnamese dong over the <strong>of</strong>ficial rate suggests that, for now, thecurrency is around market fair value. That said with the inflation rate so volatile, it seems more thanlikely that the currency will continue to face depreciation pressure going forward.21,00020,000USD/VNDJPY/VND (RHS)28030.025.020.0CPI inflation y/y %19,00024015.018,00020010.05.017,0001600.02010 2011 (f) 2012 (f)Real Growth (%) 6.8 5.8 6.0CPI (%)* 11.8 19.0 9.2Current account (% GDP) -8.9 -7.5 -6.3Fiscal balance (% GDP) -7.0 -6.2 -6.4Government Debt (% GDP) 51.6 49.4 46.6Daily volumesFX Reserves*End <strong>of</strong> YearSpot FXUSD300mn4-12 mn11.8 bnSource: IMF, S&P, Bloomberg, BarclaysPoliticsPrime Minister: Nguyen Tan DungNext election: May 2015<strong>The</strong> relatively reformist Nguyen Tan Dung wasre-elected Prime Minister in July by theNational Assembly. He is seen as a relativemoderate. However, the elevation <strong>of</strong> theconservative Truong Tan Sang to Presidentsuggests that the liberal wing <strong>of</strong> the Party islosing some influence.27Confidential – not for redistribution. This material must be read in in conjunction with the “Important Information” statement provided on the last herein. page.