MARKETBEAT - RECon 2013 - Cushman & Wakefield

MARKETBEAT - RECon 2013 - Cushman & Wakefield

MARKETBEAT - RECon 2013 - Cushman & Wakefield

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>MARKETBEAT</strong>MIDDLE EAST REAL ESTATE REPORTA CUSHMAN & WAKEFIELD RESEARCH PUBLICATION Q2 2010

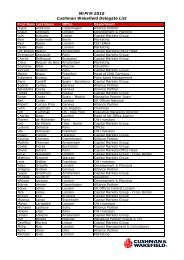

MIDDLE EAST REAL ESTATE REPORT Q2 2010PAGE SUMMARYBAHRAIN 4Economic SnapshotOffi ce SnapshotRetail SnapshotKUWAIT 7Economic SnapshotOffi ce SnapshotRetail Snapshot456789I have great pleasure in presenting our second editionMarketbeat, Q2 2010 to coincide with Abu Dhabi’sCityscape.Although the real estate market has gone through a periodof turmoil over the last 18 months, we have recently seena strong degree of market correction. There is now a returnto some form of stability and underlying confidence,demonstrated by an increase in activity across all sectorsof the market.There are still substantial differences across the Middle Eastregion, predominantly led by the state of the respectiveoccupational markets in each country or city.From our own perspective, we still see great opportunitiesand are already expanding our platform across the region.We have set up a team in Bahrain and are actively workingin Qatar and Kingdom of Saudi Arabia. The UAE,Abu Dhabi and Dubai, remains our base and as theheadquarters for the region, it is strategically positioned bothgeographically and commercially.I trust you find this latest Marketbeat of interest and pleasecontact either myself or one of the <strong>Cushman</strong> & <strong>Wakefield</strong>team if you would like any further information, or wish tojoin our research mailing list.Michael AtwellMiddle East Head of Operations<strong>Cushman</strong> & <strong>Wakefield</strong>, Dubaimichael.atwell@eur.cushwake.comLEBANON 10Economic SnapshotOffi ce SnapshotRetail Snapshot101112OMAN 13Economic SnapshotOffi ce SnapshotRetail Snapshot131415QATAR 16Economic SnapshotOffi ce SnapshotRetail Snapshot161718SAUDI ARABIA 21Economic SnapshotJeddah Offi ce SnapshotRiyadh Offi ce SnapshotRetail Snapshot21222324TURKEY 25Economic SnapshotOffi ce SnapshotRetail Snapshot252627UNITED ARAB EMIRATES 28Economic SnapshotAbu Dhabi Offi ce SnapshotDubai Offi ce SnapshotRetail Snapshot28293031REGIONAL HOSPITALITY SNAPSHOT 32CONTACTS 361

<strong>MARKETBEAT</strong>THE REGIONThroughout history, the Middle East has been a majorcentre of world affairs. In modern times the region remainsstrategically, economically, politically, culturally andreligiously important.Middle Eastern economies are diverse, ranging from the verypoor to the extremely wealthy nations of the Gulf region.The economic structure of Middle Eastern nations aredifferent from other world regions, in that while somenations are heavily dependent on export of only oil and oilrelatedproducts, such as Saudi Arabia, United Arab Emiratesand Kuwait, others have a highly diverse economic base, suchas Cyprus, Turkey and Egypt. Banking is also an importantsector of some economies, especially in the case of the UnitedArab Emirates and Bahrain.Tourism has been a relatively undeveloped area in someregions however, in recent years, countries such as the UnitedArab Emirates, Bahrain, Qatar, Oman and Jordan havebegun to attract greater numbers of international visitors dueto government focus on tourism, improving infrastructureand the expansion of Middle East airlines and airport hubs.GlossaryADR: Average Daily RateCAGR: Compound Annual Growth RateCBD: Central Business DistrictGCC: Gulf Cooperation CouncilGDP: Gross Domestic ProductMICE: Meeting, Incentive, Conference and ExhibitionRevPAR: Revenue per Available RoomUN: United NationsYTD: Year to Date2

MIDDLE EAST REAL ESTATE REPORT Q2 2010Burj Khalifa, United Arab Emirates3

<strong>MARKETBEAT</strong>BAHRAIN ECONOMIC SNAPSHOTECONOMIC BACKGROUNDA group of islands in the Gulf, Bahrain is one of the smallestArab states by population. Although it was the first Gulf stateto discover oil, output has been falling for a number of yearsand the government has encouraged diversification into otherindustries, such as banking, industrial production, retailing,sports and tourism.Oil prices still have an important effect on Bahrain’seconomic performance but with the oil industry’s share ofGDP having fallen below 25%, this is diminishing withtime. Indeed, the finance industry now accounts for thelargest share of GDP at around 27% and has benefitedrecently from exposure to the Islamic finance industry.UNEMPLOYMENT STILL FALLINGAlthough labour market data points to very strongemployment growth, unemployment remains high amongstBahraini nationals. Government policies including levies onforeign labour and Bahrainisation have not yet solved theproblem, although unemployment in general is forecast toreach very low levels during 2010.INFLATION CONTINUES TO MODERATEHaving peaked at 5.1% in the last quarter of 2008, annualinflation dropped back steadily over 2009, reaching a low of1.1% in November 2009. This was primarily aided by lowerfood prices, although weaker domestic demand also played arole.GOVERNMENT LAUNCHES STIMULUSPLANSAs has been the case in many countries, the government hasadopted a number of fiscal stimulus measures to soften thecurrent downturn; including an US$800 million schemeto bolster the residential construction industry. The totalsize of the stimulus measures was limited to around 3%of non-oil GDP in 2008. Bahrain has lower reserves thanother countries in the region, and government income is stillheavily reliant on the weakening oil revenues.ECONOMIC AND POLITICAL BREAKDOWNPopulation 1.05 million (2009)*Labour force 0.49 million (2008)GDP US$ 22.03 billion (2009)GDP per capita US$ 27,849 (2009)Government budget balance -5.2% (2009 E )RulerPrime MinisterElection datesMARKET SUMMARYEconomic Indicators*: 2007 2008 2009 2010 F 2011 FGDP growth % p.a. 8.5 6.3 2.2 3.9 4.2Infl ation (CPI) % p.a. -1.6 3.5 2.8 2.5 2.5Unemployment rate % 4.9 4.5 6.1 6.6 7.3Foreign investmentUS$ billionMARKET OUTLOOKGDP Growth to pick up again in 2010Infl ationInterest rateEmploymentMay now stabilise in the short termTo remain stable for some timeUnemployment, with the exception ofBahraini nationals, remains at low levels86.9 173.5 174.5 183.9 194.9BD/US$ (average) 0.376 0.376 0.376 0.376 0.376King Hamad bin Isa Al KhalifaSheikh Khalifah bin Sulman Al Khalifa2010 (legislative)ECONOMIC ACTIVITYOUTLOOKThe move to diversify away from oil is logical given decliningoutput and is now paying dividends in terms of stability.While lower oil demand dented growth in 2009, no recessionwas seen and a return to growth in 2010 is anticipated. Inthe short term the push into the finance industry has obviousdisadvantages, although ultimately the development of asizeable second industry should provide clear benefits forlong term growth prospects.Source: <strong>Cushman</strong> & Wakefi eld LLP* E Estimate | F ForecastSource: Consensus Economics Inc., Oxford Economics Forecasts4

MIDDLE EAST REAL ESTATE REPORT Q2 2010BAHRAIN OFFICE SNAPSHOTOFFICE OUTLOOKSUPPLYBahrain has historically stood as the GCC’s financial capital,both conceiving and pioneering the concept. Today Bahrainis revitalising its business and financial credentials as itcompetes to regain lost ground to new financial hubs acrossthe Gulf. The majority of the city’s prime office stock islocated across downtown Manama and the Diplomatic Area.Major developments include the iconic fifty storey BahrainWorld Trade Centre along with the partially completedBahrain Financial Harbour (BFH) development, whichhas boosted supply by over 550,000 sq m. Current GradeA supply is located across the Financial Harbour, SeefDistrict and the Diplomatic Area.The Financial Harbour hasbolstered Bahrain’s traditionally strong financial standingby housing a selection of global banks and the BahrainStock Exchange. The overall slowdown has restricted furtherdevelopment, resulting in a number of delays. High profileprojects affected include AYA Tower in Hoora, the WestEnd Tower in Al Seef and the Signal One Tower plannedin Amwaj Island. Because of increasing congestion in thetraditional CBD, the new Bahrain Bay Development andBFH areas are likely to become more sought after once theinfrastructure is complete. However, Bahrain Bay is stillsometime off completion and the existing space in BFHis currently only 40% occupied. Seef District, being moreestablished and developed, has become a popular alternativeto the traditional areas. This is as a result of lower density andmixed use development, making congestion less of an issue.Typical lease lengthBAHRAIN LEASING PRACTICESFrequency of rent payment (in advance)Termination noticeIncrease on lease renewalFrequency of rent increase1-3 years1 year3 months10% maximum increaseor market rentAnnualDEMANDBahrain’s business friendly environment has upheld demandfor office space with a number of multinationals’ maintainingtheir presence in the Kingdom. In line with many emerginghubs in the GCC, infrastructural development remainsbehind urban development. The resulting congestion andutility shortage has compressed rental rates across a numberof prime locations. This has also softened overall demandacross the Diplomatic Area and central Manama considerablywith Al Seef emerging as a key extension to the CBD.RENTSPrime space in the Bahrain World Trade Centre (BWTC)commands rents of approximately BD13 per sq m, permonth, with fitted out space being leased in excess of thisfigure. Rental rates in other buildings around the FinancialHarbour and in the vicinity of the BWTC are at BD9per sq m, per month down slightly from their height in2008.Twin Towers, Bahrain Financial Harbour5

<strong>MARKETBEAT</strong>BAHRAIN RETAIL SNAPSHOTRETAIL MARKETHistorically prime rents have been circa BD20 per sq m,per month for the best schemes. However, the market hasrepositioned itself with the launch of Bahrain City Centrein 2009, setting new benchmark rental levels of BD30 persq m, per month. Increased rental levels are not supportedby sales turnover and retailers are beginning to put pressureon the mall operators to reduce rents accordingly. Rents innon prime locations in the suburban mall areas tend to be nomore than BD12-15 per sq m, per month for prime units.A sizeable development pipeline is expected, although mostsupply is anticipated to be from smaller, local centres whichwill not challenge Bahrain City Centre. The anticipatedsupply across the Lagoons, Amwaj, Durrat Al Bahrain, A’Aliand East Riffa will raise the retail profile and further shiftoccupier demand away from the existing subprime andageing centres. However, the retail in these locations willlikely target the local lifestyle of the residential populationrather than challenge the main retail malls. The largestcentres currently being constructed are the A’Ali Mall(due to open in early 2011) and the Enma Mall in East Riffa.These will, like most other malls outside the central area,offer a strong food anchor. Because of the central locationand size of the primary malls, any new retail developmentwill find it difficult to compete and therefore, would bethe secondary location for a brand rather than the first orflagship location.Demand in Bahrain is underpinned primarily by Saudiday tourists, who drive across the Saudi Causeway thatlinks Bahrain to Saudi’s Eastern Province (populationfour million). The Friendship Causeway, scheduled forcompletion by 2015, between Bahrain and Qatar will furtherboost Manama’s retail catchment as Bahrain’s liberal lawscontinue to attract young tourists from its more conservativeneighbours. The completion of the Friendship Causewaywill require local malls to offer attractive incentives to fendoff stiff competition from Qatari malls. Similar measureswill be required to retain its Saudi customer base as moredestination malls are proposed in Al Khobar and Saudi’sEastern Province. Nonetheless, Bahrain’s proximity to SaudiArabia and its more liberal culture will continue to translateinto a strong share of retail footfall.RETAIL RENTSCity Location MeasureManamaSeef Malland CityCentre MallBD/sq m,per monthMarch2009March2010AnnualGrowth33 30 -10%Seef Mall, Bahrain6

MIDDLE EAST REAL ESTATE REPORT Q2 2010KUWAIT ECONOMIC SNAPSHOTECONOMIC BACKGROUNDLike many economies in the region, Kuwait is still relativelyundiversified and relies heavily on oil-related revenues. Itis one of the world’s richest countries on a GDP per capitabasis. Despite lower oil prices in recent years, previouslystrong oil revenues have allowed the government to build upa large budget surplus and as a result, the small populationenjoys generous social benefits.The country has enjoyed a relatively stable politicalenvironment since the early 1990s, although recent yearshave seen a number of changes in government. Despiterecent political tensions between parliament and thegovernment, little practical change is expected before the2012 elections.OUTPUT HIT BY WEAKER OIL DEMANDFollowing the OPEC agreement to cut oil production anda fall in oil demand from key trading partners, GDP isthought to have declined by about 3% in 2009 impactingsignificantly on government revenues. However, morefavourable conditions in the oil industry should help boostGDP growth in 2010 to around 4.5%.INFLATION CONTINUES TO MODERATEInflationary pressures eased during 2009, although the latestofficial figures only run to April 2009 when inflation haddropped to 5.2%. Inflation is expected to have averagedabout 4% for the year as a whole and is forecast to fall to anaverage of 3% in 2010.OFFICIAL INTEREST RATES FALL TO 2.5%The reduction in inflationary pressure has allowed the centralbank to take a more relaxed position on monetary policy,with the emphasis on maintaining credit availability for thenon-oil sector. In May 2009, it reduced the interest rate by50 basis points to 3%, and a further cut of 50 basis pointswas seen in February 2010, bringing the base rate to 2.5%.OUTLOOKThe Kuwaiti economy is more reliant on oil than most in theregion and therefore, the slowdown currently underway doesnot come as a surprise. Nevertheless, growth is set to returnin 2010 as oil revenues improve. In the longer term, thegovernment intends to promote diversification away from oilrelated industries, partly through privatisation and increasedeconomic liberalisation.GDPInfl ationInterest rateEmploymentECONOMIC AND POLITICAL BREAKDOWNPopulation 2.72 million (2008)Labour force 1.99 million (2008)GDP US$ 100.9 billion (2009)GDP per capita US$ 33,785 (2009)Government budget balance 24.3% (2009 E )EmirPrime MinisterElection datesECONOMIC ACTIVITYMARKET SUMMARYEconomic Indicators*: 2007 2008 2009 2010 F 2011 FGDP growth % p.a. 4.30 6.26 -2.90 4.40 7.00Infl ation (CPI) % p.a. -3.02 10.58 3.90 2.90 2.30Unemployment rate % 1.36 1.31 1.35 1.32 1.28Foreign investmentUS$ billionMARKET OUTLOOKWeak in 2009 but return to growth in 2010expected, as external revenues improveFalling due to reduced demand and lowerimport pricesStable over the short termVery low levels of unemployment setto remain-9.7 -8.7 -8.5 -8.2 -8.2KWD/US$ (average) 0.284 0.268 0.288 0.285 0.285Emir Sabah Al-Ahmad Al-Jaber Al-SabahPrime Minister Nasser MohammedAl-Ahmed Al-Sabah2012 (legislative)Source: <strong>Cushman</strong> & Wakefi eld LLP* E Estimate | F ForecastSource: Consensus Economics Inc., Oxford Economics Forecasts7

<strong>MARKETBEAT</strong>KUWAIT OFFICE SNAPSHOTOFFICE MARKETSUPPLYCurrent projects in Kuwait are forecast to boost overallsupply by approximately 500,000 sq m over the next five plusyears. The landmark development project at Al Hamra alonewill provide nearly one fifth of the proposed developmentpipeline. The existing CBD is principally centred aroundSharq in the city centre while Salmiya is seeing some majoroffice development and attracting some key occupiers due toit being less congested than the CBD. The Free Trade Zonenext to Shuwaik Port has also emerged as another destinationof choice for many occupiers aiming to avoid the city’sgrowing congestion, although direct access to the free zonecan be difficult at peak times.DEMANDDemand for Grade A supply in Kuwait has always beenstrong, as most prime buildings have historically been builtfor owner occupation. Speculative office development, whenit did occur, was in the city centre and the buildings weregenerally pre-let before completion. It is estimated that theaverage take up of space since 2003 has been 50,000 sqm, per annum. Historically demand emanated from localbranches of international companies, occupyinga satellite office in Kuwait or local companies expanding intoadditional space or relocating. During the last 18 monthsthe three main office requirements have all been serviced– two into Olympia in Salmiya (Viva and Equate) andthe NBK major consolidation into Arraya 2. These threecompanies took over 40,000 sq m, which is unusually highin the Kuwait market.RENTSRental rates have not fallen significantly in Kuwait but itappears that landlords are willing to offer rent free periodsand other incentives to maintain high headline rents. Rentsfor prime space in downtown locations stand at KD15 persq m, per month including typical service charges. Rentsin the Kuwaiti Free Trade Zone remain at around KD9 persq m, per month and rates for quality space in Salmiya areapproximately KD12 – 13 per sq m, per month. Rents forsub prime and second hand space are generally well belowthese figures in all locations. Despite becoming a tenantsmarket, rents are not suffering substantially but the qualityand standard of buildings and its facilities, including theavailability of parking, is the focus for occupiers. Thosebuildings offering substandard amenities are likely to remainempty for some time.Typical lease lengthKUWAIT LEASING PRACTICESFrequency of rent payment (in advance)Termination noticeBasis of rent increaseFrequency of rent increase1-3 years1 year3 monthsRent capAnnualKuwait Harbour, Kuwait8

MIDDLE EAST REAL ESTATE REPORT Q2 2010KUWAIT RETAIL SNAPSHOTRETAIL MARKETLike offices, retail rents have come under pressure as supplyincreased with the opening of Avenues 2 in 2008, 360 in2009 and the opening of Olympia in 2010. Other projectsappear to have stalled mid development as the marketrealises an oversupply with fewer retailers seeking space.Some landlords have been reluctant to drop rents due tohigh initial capital investment. Better cost control and designcould enable a more realistic target rent. Headline rentsare still relatively high but have dropped, from their peakachieved at the end 2008. While the prime headline rent maybe KD35/40 per sq m, per month in certain circumstances,key money is certainly no longer expected by a tenant andlandlord incentives have increased. There has been a declinein overall expansion of most retail brands in Kuwait. Popularand established malls such as Marina Mall and AvenuesPhase 1 still attract shoppers but where retailers are leaving,many leases are being renewed with lower quality brands.The 360 Mall has struggled since opening in summer 2009and while it announces quality names, many are still to open.The 140,000 sq m Avenues Mall continues to dominate themass market of Kuwait’s retail landscape, followed by MarinaMall with Salhia Mall still a strong player at the high end ofthe market. It will, however, be interesting to assess the effectthat the new Harvey Nichols store will have when phases 3and 4 open at The Avenues in 2012 and how this will impacton the existing luxury brand operators in the more matureretail areas.Accessibility and parking are an ongoing concern for retailersand developers. The stringent franchising and partnership/ownership laws remain an expansion barrier for manyinternational brands.RETAIL RENTSCity Location Measure March 2010KuwaitCityOlympia Mall (due toopen Q2 2010)KD/sq m, permonth30 (projected)9

MIDDLE EAST REAL ESTATE REPORT Q2 2010LEBANON OFFICE SNAPSHOTOFFICE MARKETSUPPLYAfter several years of stagnation and inactivity in the officesector, the last 18 months could not have contrasted more.The market in Beirut is characterized by a two tiered system.There is an ample supply of secondary refurbished space buta real shortage of modern Grade A office accommodation.The second class accommodation is generally in olderbuildings constructed between 1930 and 1970. Small floorplates, inefficient design and no underground parking are thestandard features.Typical lease lengthLEBANON LEASING PRACTICESFrequency of rent payment (in advance)Termination notice3-6 years1 year, 6 monthlyor quarterly3 monthsBasis of rent increase Indexation of rent %Frequency of rent increase3 yearsDEMANDThe Grade A space is predominantly located in downtownBeirut. It has been built to conform with the requirementsof the multi-national corporations with large floor plates,parking, advanced building management systems and healthand safety features.Grade A space is in short supply, as there has beeninsufficient construction in the commercial office sector inrecent years. As a consequence, the rental costs have risenin the last year as the landlords have taken advantage of theopportunity to increase their prices. Examples of principlebuildings in the city centre are the Atrium, Nahar andBerytus Park.RENTSFor several years, the market rate for prime office was stuckat US$250 per sq m, per annum. In the last 12-18 monthsrents have risen as high as US$400 per sq m, per annum.Lease renewals in the Atrium have been documented atrents of US$400 per sq m, per annum with several majorcompanies taking space of up to 2,000 sq m. Berytus Park iscurrently attracting rents of US$350 per sq m, per annum.This steep trend is attributable to the shortage of supply andrecent rapid economic growth. The Pavilions, a new buildingnearing completion, has a landlord rent expectancy ofUS$500 per sq m, per annum.We foresee that rents will remain firm this year althoughthere may be some small adjustment in the medium term,as more stock becomes available.Beirut, Lebanon11

<strong>MARKETBEAT</strong>LEBANON RETAIL SNAPSHOTRETAIL MARKETThe retail market in Lebanon has witnessed a major increasein the development of shopping malls and retail zonesacross the country. This activity is a response to the changesin consumer dynamics and expectations. An increase inspending capacity has required larger stores with a widerchoice of multinational brands.The main retail areas in Beirut and its suburbs includeAchrafieh, Verdun, Hamra, Furn el Chebbak, Dora, Dbayehand Kaslik.The central district is the main centre for retail activity as itconstitutes a strategic location for attracting consumers andretailers. In the last quarter of 2009 a 150,000 sq m GLAscheme, Beirut Souks, was launched by Solidere into themarket at rents of between US$1,200-US$1,500 persq m, per annum. This development is attracting major retailoutlets and international franchises into the central district.The project should become a major regional destination forshopping, work and entertainment, particularly once thesecond phase is completed with 15,000 sq m departmentstore. The ABC Mall in Achrafieh remains one of the mostpopular and successful shopping centres, despite being one ofthe first to be developed in the country.RETAIL MALLSName Location Date ofestablishmentOwner/DeveloperGrossLeaseableArea GLA;sq mABC Achrafi eh 2003 Fadel Family 42,000AchrafiehABC DbayehFadel FamilyDbayehCity Mall Dora 2005 Admic 80,000Beirut Mall Tayouneh 2006 Aswad 50,000GroupSouks Beirut CD 2009 Solidere 150,000Le Mall Sin el Fil 2009 AcresHoldingsubsidiaryof AzadeaGroup15,000Le Mall Dbayeh 2010 AcresHoldingLe Mall Saida 2011 AcresHoldingAgora Mall Hazmieh 2011 Majid AlFuttaimGroup17,00012,00070,000Other retail projects in the pipeline for 2010 and 2011include Le Mall at Saida and the Agora Mall in Hazmieh.Beirut, Lebanon.12

MIDDLE EAST REAL ESTATE REPORT Q2 2010OMAN ECONOMIC SNAPSHOTECONOMIC BACKGROUNDAlthough heavily dependent on the fuel industry, Oman hasmuch lower oil reserves than many of its near neighbours.The need to diversify away from oil production has long beenrecognised, with the government initially driving a push intomanufacturing in the 1970s, before later turning to othernatural resources, as well as tourism and light industry.Oman has been ruled by Sultan Qaboos bin Said al Saidsince 1970 and has enjoyed a long period of politicalstability. Although power ultimately rests with the Sultanthere are two consultative bodies, one of which is elected.GDP GROWTH TO REMAIN POSITIVEIN 2010GDP surged in 2008, largely as a result of a period of veryhigh oil prices although the non-oil economy also recordedstrong growth. However, despite worsening global economicconditions, oil output actually increased for much of 2009and GDP growth was 3.7% over the year according tothe Ministry of Economy. Furthermore, current forecastsenvisage growth of up to 6% in 2010.INFLATION TO STABILISE IN 2010Inflation has moderated sharply since the start of 2009,falling from over 10% in January to 0.8% in November.However, for 2010 inflation is expected to edge back upslightly, averaging at around 3% for the year.GOVERNMENT TO INCREASE SPENDINGAlthough improving oil prices have helped the economyto avoid recession in 2009, government stimulus packagesare still necessary to maintain growth. The 2010 budgetenvisages a 12% increase in government spending, focusingon education and improvements to the labour market.OUTLOOKForecasts for growth in 2010 are impressive, even by localstandards. Nevertheless, this will, to a large extent be drivenby increased public spending with the implication that thegovernment may be less generous in future years particularlyas government revenues have been weakened by falling oilprices in recent years. However, the current situation is likelyto give cause for a renewed effort to diversify away from theoil industry and continue with privatisation programmes.This is likely to benefit the long term stability of theeconomy.GDPECONOMIC AND POLITICAL BREAKDOWNPopulation 2.79 million (2008)Labour force 0.98 million (2008)GDP US$ 51.9 billion (2009)GDP per capita US$ 18,270Government budget balance -0.8% (2009 E )SultanChancellorElection datesMARKET SUMMARYEconomic Indicators*: 2007 2008 2009 2010 F 2011 FGDP growth % p.a. 7.7 11.8 3.7 5.7 4.6Infl ation (CPI) % p.a. 4.1 12.1 3.7 2.8 3.0Unemployment rate % 5.0 3.2 3.3 3.3 3.4Foreign investmentUS$ billionMARKET OUTLOOKRecession avoided, helped by stronggovernment spendingInfl ation Infl ation to stabilise in 2010Interest rateEmploymentTo remain stable for some timePossibility for moderate rise inunemployment in the short termECONOMIC ACTIVITY2.9 2.6 2.3 2.5 2.6OMR/US$ (average) 0.38 0.38 0.38 0.38 0.38Sultan Qaboos bin Said Al SaidFahad bin Mahmood Al Said2011 (legislative)Source: <strong>Cushman</strong> & Wakefi eld LLP* E Estimate | F ForecastSource: Consensus Economics Inc., Oxford Economics Forecasts13

<strong>MARKETBEAT</strong>OMAN OFFICE SNAPSHOTOFFICE MARKETSUPPLYMuscat has traditionally suffered with traffic congestion andshortage of office supply in the older established businessareas east of the city. An emerging trend among occupiersis the relocation to West Muscat where new office buildingsand investment parks are currently being developed. Thisis demonstrated by the impending move of Bank Muscatheadquarters to the Airport Heights complex which is part ofthe development zone around the airport.Over the next 12 months 200,000 sq m of new office spaceis scheduled for delivery within greater Muscat and is focusedaround the Azaiba Business Park and Al Qurum City Centre.Several new developments are likely to cement this locationas a leading commercial hub including the expansion andredevelopment of Seeb International Airport and the newConvention Centre development alongside the PolyglotBusiness Park.DEMANDDemand in Muscat has been relatively strong in recentyears due to the lack of viable stock in the market, ensuringrents have remained competitive. However, despite growingdemand, Muscat has struggled to offer a defined commercialbusiness district and the impact of new commercialdevelopments have yet to be seen.RENTSCommercial rents have reduced from the peak in 2008 andhave returned to mid 2007 levels. Central Muscat commandsa figure of OMR4.5 per sq m, per month; Qurum OMR8per sq m, per month; Azaiba OMR8 per sq m, per monthand the highest rentals achieved are those seen in Shati alQurum district at OMR12 per sq m, per month. There hasbeen little provision in the serviced office sector however,Regus are due to launch in Oman in 2010.Typical lease lengthOMAN LEASING PRACTICESFrequency of rent payment (in advance)Termination noticeBasis of rent increaseFrequency of rent increase1-3 years1 year3 monthsRent capAnnualMuscat, Oman14

MIDDLE EAST REAL ESTATE REPORT Q2 2010OMAN RETAIL SNAPSHOTRETAIL MARKETThe Oman retail market is dominated by three destinationcomplexes. The main centre is the 60,000 sq m Muscat CityCentre which commands an average rent of circa OMR30-32 per sq m, per month. The other major competitorsare Markaz Al Bahjaa and Qurum City Centre whichpredominantly focus on the local catchment area. Overallprovisions are very localised and secondary in nature. TheOmani socio-economic make up is distinctively differentfrom the remainder of the GCC with far less emphasis onretail as a leisure pursuit.Over shadowed by its United Arab Emirates neighbours,Oman’s lower GDP per capita has resulted in a sophisticatedbut more traditional customer with less disposableincome than their GCC counterparts. Contrary to otherMiddle Eastern capitals, Oman harbours no intention oftransforming itself into a financial hub but instead, theSultanate continues to capitalise on its cultural heritage incontrast to its mass marketed neighbours. Oman’s inherentbeauty and favourable weather, places little emphasis onMega Malls.Overall, Muscat’s total stock is approximately 300,000 sq mwith a potential development pipeline of 40,000 sq m subjectto market conditions. Generally, demand is for hypermarketled developments. In terms of pricing, as with office space,secondary retail rental rates fell slightly in 2009 and by thethird quarter of the year were averaging about OMR10 toOMR15 per sq m, per month.RETAIL RENTSCity Location MeasureMuscatMuscat CityCentreOMR/sq m,per monthMarch2009March2010AnnualGrowth30 30 0%Old Town, Oman15

<strong>MARKETBEAT</strong>QATAR ECONOMIC SNAPSHOTECONOMIC BACKGROUNDAn absolute monarchy, Qatar is one of the smallest countrieswithin the GCC. As was the case elsewhere in the region, oilwas the catalyst for growth in the 1970s, but the economyhas since diversified, with investment in liquefied natural gas(LNG) projects proving especially fruitful.Government investment has played a crucial role in thetransformation of the economy, driving the output to doubleover the past five years and helping to turn Qatar into oneof the wealthiest countries in the world on a GDP per capitabasis.RAPID GDP GROWTH TO BE MAINTAINEDIn spite of the global economic slowdown, Qatar saw anotheryear of strong economic growth during 2009, largely as aresult of an increase in LNG production. Growth in 2010will be supported by extra capacity in LNG production, aswell as on-going government financed infrastructure projects,such as the Friendship Causeway to Bahrain.INFLATION FALLS FURTHERInflation data for Qatar can suffer from a lack of timelinessbut it appears that price pressure fell back quite rapidlyduring 2009, resulting in deflation of about 5%. One reasonfor the fall has been the gradual alleviation of the housingshortages which emerged following rapid immigration overthe past few years. However, a return to inflation is expectedfor 2010.GOVERNMENT SPENDING TO INCREASEDespite falling revenues from the oil sector due to lowerprices, the government has announced another expansionarybudget for 2010 following on from measures launched in2009.OUTLOOKThe rapid rate of growth seen in the fuel sector has been asignificant factor in the recent economic success but in thelonger term it will be important that other sources of growthcan be found. It is therefore encouraging that other sectorsof the economy including tourism, MICE, sport and financealso continue to show steady expansion and that growth willnot rely entirely on government spending.It is also important to recognise that the rates of expansionseen in recent years are unlikely to be sustainable over thelonger term.Nevertheless, in the short term, Qatar is set to see one of thebest rates of growth in the region.GDPECONOMIC AND POLITICAL BREAKDOWNPopulation 1.45 million (2008)Labour force 0.76 million (2008)GDP US$ 93.1 billion (2009)GDP per capita US$ 79,862Government budget balance 1.5% (2009)EmirPrime MinisterMARKET SUMMARYEconomic Indicators*: 2007 2008 2009 2010 F 2011 FGDP growth % p.a. 14.2 15.5 9.5 16.8 12.7Infl ation (CPI) % p.a. -5.9 15.0 -4.9 2.8 5.2Unemployment rate % 0.5 0.5 0.6 0.6 0.6Foreign investmentUS$ billionMARKET OUTLOOKFalling in the medium term but still far higherthan most economies in the regionInfl ation Modest infl ation to return in 2010Interest rateEmploymentStableUnemployment set to remain very low2.4 3.3 2.8 3.0 3.3QAR/US$ (average) 3.64 3.64 3.64 3.64 3.64 H.H. Sheikh Hamad bin KhalifaAl ThaniSheikh Hamad bin Jassim Al ThaniECONOMIC ACTIVITYSource: <strong>Cushman</strong> & Wakefi eld LLP* E Estimate | F ForecastSource: Consensus Economics Inc., Oxford Economics Forecasts16

MIDDLE EAST REAL ESTATE REPORT Q2 2010QATAR OFFICE SNAPSHOTOFFICE MARKETSUPPLYStrong demand from the oil and gas industry as well asgovernment institutions, led to a significant expansion inoffice stock in Doha over the last decade. However, despiteQatar’s strong economic fundamentals the global slowdownalong with the completion of new supply has swung theoffice market into over supply. This, coupled with a markedfall in registered requirements for new space, has broughtDoha’s rapid rental growth to an end.The majority of Doha’s existing Grade A supply is located inWest Bay and the Diplomatic District, Doha’s new CBD.Secondary premises are predominantly located along GrandHamad Street (Bank Street), Salwa Road, Al Sadd and the Cand D-Ring Roads. The development pipeline includes 20more towers scheduled for completion in West Bay over thenext two years alone, with further supply expected in 2014with the phased delivery of a number of projects in Qatar’sflagship development at Lusail.DEMANDThe Doha office market is strongly tied to the occupationaltrend of government offices, along with other publiclyowned and affiliated companies who tend to lease ratherthan buy, or custom build their own premises. The othertwo components of demand for prime space is the QatarFinancial Centre (QFC) which continues to attract newinternational companies working in the development of thefinancial services market in Qatar and global corporations,either relocating from secondary and converted residentialpremises, or new entrants to the market. Recent reportssuggest that Qatar’s financial sector is expected to add5,200 jobs this year, taking the number of people workingfor Qatar’s financial companies to 20,100 by the year end.Companies who were previously deterred by high rentallevels or the lack of suitable accommodation, are nowreconsidering prime locations such as the DiplomaticDistrict. This has consequently led to a drop in demand foroffice space in secondary and tertiary locations.A recently announced change in land law has meantcompanies currently operating out of villas in residentialdistricts have until September 2010 to move into officespace. In September 2007 a number of firms were grantedthe opportunity to work from residential villas due to alack of available office space. This law expired in September2009 but businesses were granted an additional year to findalternative premises.RENTSThe market witnessed an initial flux of tenants exercisinglease breaks to take advantage of improved rental termsand upgrade from their current premises. This trend hasnow witnessed a marked slowdown as occupiers wait ina belief that rental rates will fall further. Prime locationssuch as West Bay continue to command a premium, withcurrent rents approximately QAR240 per sq m, per monthmarking a drop of over 26% from Doha’s prime rental peakof QAR325 per sq m, per month. Rental rates in secondaryand tertiary locations have witnessed the greatest reduction,with rental rates now ranging from QAR100 to 150 persq m, per month. The cap on residential rents has recentlybeen removed, with the passing of a new law ending thetwo year freeze which was imposed amid spiralling inflationin 2008. However in January 2010, the Advisory Councilrecommended extending the rent freeze for commercialproperties for a further two years. New legislation has alsobeen drafted to regulate unlicensed property brokers andcompanies. The regulations will include the launch of aregistered real estate association. If the law is adopted, onlycompanies owned by Qataris will be permitted a licence tooperate real estate agencies.Typical lease lengthQATAR LEASING PRACTICESFrequency of rent payment (in advance)1-5 years1 yearA decline in demand has led to an introduction of a numberof landlord concessions. Many landlords, particularly withinWest Bay, have traditionally held out for single occupiers.However, they are now considering leasing parts of theirbuildings to multiple tenants. Additionally, there is increasingflexibility within the market to accommodate demand forsmaller space. Discounts are being offered on prime rentalswhere occupiers have larger space requirements and are ableto commit to longer lease terms. Once again, occupier trendshave been characterized by a general ‘flight to quality’.Termination noticeBasis of rent increaseFrequency of rent increase3 monthsRent capAnnual17

<strong>MARKETBEAT</strong>QATAR RETAIL SNAPSHOTRETAIL MARKETDoha’s retail market, like elsewhere in the GCC, isdominated by large scale malls. It has grown significantlyin recent years and so far remained resilient with high rentsmaintained by robust demand. Qatar however, is nowentering a new phase with a significant number of large-scaleprojects scheduled to open in the next few years. VillagioMall is considered by many to be Doha’s prime centre andhas recently been extended to add a 13-screen cinema anda luxury retail section, Via Domo. However, its leisurecredentials remain limited in comparison to the Mega Mallsof neighbouring Bahrain and Dubai. The dated LandmarkMall and City Centre are the only other notable shoppingdestinations in Doha – however, both are expected to sufferas retailers and consumers are drawn to the new high qualitymalls scheduled to open in the next few years. City Centreis responding to the threat by incorporating five new luxuryhotels with the mall, providing 1,300 keys.to hand back units. Retailers are also capitalising onopportunities to serve the mid and low market of Doha’seconomic diverse population, with a variety of fringe mallscatering for the state’s growing labour force scheduled toopen soon.Porto Arabia, the first phase of the retail component of ThePearl was launched at the end of 2008 with a number ofhigh end retail and food and beverage outlets. Porto Arabia isexpected to be fully operational by the end of this year, witha second phase to follow in 2011. Other significant openingsscheduled for this year include Lagoona Mall, 53,000 sqm, located beneath the Zig-Zag towers in West Bay andThe Gate, 24,000 sq m. Over the medium term, thereare a number of other key retail projects which have beenannounced including the Heart of Doha, Al Wa’ab City Malland a number of varied retail offerings within Lusail.New retail units in Qatar’s malls command rents of upto QAR225 per sq m, per month with the highest rentsachieved in Villaggio, Landmark and City Centre. However,few transactions take place. With new supply yet to hit themarket and vacancy rates across existing malls representingless than 1% vacancy. In a few instances, surrender premiumshave been paid by landlords to encourage existing retailersRETAIL RENTSCity Location MeasureDohaVillagio MallQAR/sq m,per monthMarch2009March2010AnnualGrowth260 255 -2%Souk Waqif in Doha, Qatar18

West Bay Business District, Doha, Qatar

Kingdom Tower, Riyadh, Saudi Arabia

MIDDLE EAST REAL ESTATE REPORT Q2 2010SAUDI ARABIA ECONOMIC SNAPSHOTECONOMIC BACKGROUNDAs one of the world’s leading oil producers, Saudi Arabia’seconomy is dominated by the oil industry which accounts foraround 40% of economic output and makes up the majorityshare of government revenue. Consequently, economicperformance is quite dependent on fluctuations in oil pricesand demand for oil.For many years the political situation has been largelystable under the rule of the Al Saud family, with successivemonarchs promoting Saudi Arabia’s role as a regional power.In 2005, Saudi Arabia became a member of the World TradeOrganisation, aiding the gradual process of diversifying awayfrom oil-related industries.GDP GROWTH FALLING BUT REMAINSPOSITIVERecession was narrowly avoided in 2009, with the SaudiArabian Monetary Authority reporting GDP growth of just0.15% for the year. However, while oil-related GDP fell, therest of the economy managed to record growth of around3%. Current forecasts envisage a fairly strong recovery inoverall GDP growth in 2010.INFLATION REBOUNDS FROM LOW POINTInflation reached a low point of 3.5% in October 2009 andhas begun to climb since. 2010 could see a gradual furtherrise in inflation as economic growth improves and currencyweakness persists.GOVERNMENT PROJECTS BACK ON TRACKThe government postponed a number of spending plans atthe end of 2008 but after having negotiated discounts onmany of the projects, a significant amount have since beenreinstated. The schemes include contracts for infrastructure,health and education.ECONOMIC AND POLITICAL BREAKDOWNPopulation 24.7 million (2008)Labour force 7.3 million (2008)GDP US$ 467.6 billion (2009)GDP per capita US$ 13,614 (2009)Government budget balance -2.9% (2009)KingMARKET SUMMARYEconomic Indicators*: 2007 2008 2009 2010 F 2011 FGDP growth % p.a. 3.31 4.45 0.10 5.30 6.90Infl ation (CPI) % p.a. 3.39 9.87 5.00 4.20 3.00Unemployment rate % 5.60 5.00 4.91 4.80 4.74Foreign InvestmentUS$ billionMARKET OUTLOOKGDP Growth to rebound in 2010Infl ationInterest rateEmploymentA return to higher inflation from its lowpoint in October 2009StableUnemployment high, but may see falls oncegrowth resumes-8.1 1.2 1.3 1.5 1.6SAR/US$ (average) 3.75 3.75 3.75 3.75 3.75King Abdullah bin Abdul Aziz Al SaudOUTLOOKWith output now on the rise and government projectsresuming, there are hopes that the economy will see a strongrecovery in 2010. The price of oil will clearly have a directimpact on the strength of any recovery and while pricesmay not rise back to the highs seen in 2008, the currentgovernment budget is based on lower oil prices providingsome stability for government finances. In the longer term,the push away from oil related revenues should serve toreduce the impact of oil prices on economic growth.Crown Prince Sultan bin Abdul Aziz Al SaudECONOMIC ACTIVITYSource: <strong>Cushman</strong> & Wakefi eld LLP* E Estimate | F ForecastSource: Consensus Economics Inc., Oxford Economics Forecasts21

<strong>MARKETBEAT</strong>SAUDI ARABIA – JEDDAH OFFICE SNAPSHOTOFFICE MARKETSUPPLYThe office market of Saudi Arabia’s second largest city islocated predominantly along the Al Tahlia and Al Madinahstreets. New major developments expected to come onlineover the next three years are the Jeddah Towers and LamarDevelopments which are expected to boost supply by over200,000 sq m. This will raise overall office supply to circa550,000 sq m. Supply is predominantly in mixed use projectswith very limited dedicated Grade A space. The majority ofexisting prime space tends to be owner occupied.Typical lease lengthJEDDAH LEASING PRACTICESFrequency of rent payment (in advance)Termination noticeBasis of rent increaseFrequency of rent increase1-5 yearsHalf yearly3-6 monthsFixed uplifts, subject tocontractAnnualThe well-publicised, partially opened King AbdullahEconomic City (KAEC), currently under development,will also be located within reasonable proximity of Jeddah.The KAEC is one of the largest Private Public Partnershipsin the history of Saudi Arabia, covering 168 million squaremeters of land area on completion. The phased developmentof KAEC will increase supply over the next decade as thecompleted development will provide an autonomous legaland regulatory structure.DEMANDTraditional owner occupier markets with strata ownershipcontinue to be offered on most developments. Vacancy ratesare generally low at between 6% and 8%. This is partlydue to municipality regulations banning the conversion ofresidential villas into commercial office space along with ageneral shortage of prime office space which characterises theJeddah office market.Jeddah’s poor market transparency has also restricted thedevelopment of many otherwise suitable plots.RENTSThe majority of rentals fluctuate between SAR750 andSAR1,000 per sq m, per annum. Newly completed goodquality buildings will continue to be absorbed at the cost ofexisting secondary premises.Makkah Gate, Jeddah, Saudi Arabia22

MIDDLE EAST REAL ESTATE REPORT Q2 2010SAUDI ARABIA – RIYADH OFFICE SNAPSHOTOFFICE MARKETSUPPLYRiyadh is in the spotlight as it is set to headquarter the GCCCentral Bank and Monetary Union. Riyadh has historicallybeen characterised with an oversupply of secondary space,coupled with a shortage of Grade A stock but recently therehas been a increase in available Grade A offices which hasled to an oversupply. This has resulted in a decline in rentallevels in prime locations. Prime space is presently centred inthe landmark Kingdom Tower and Al Faisaliyah along withlocations situated predominantly across the arterial KingFahad and Al Oulayah roads. A further major boost of GradeA office supply is scheduled to enter the market over thenext five years. The phased completion of the King AbdullahFinancial District alone will add over 1,200,000 sq m ofoffice space to the CBD by <strong>2013</strong>.Typical lease lengthRIYADH LEASING PRACTICESFrequency of rent payment (in advance)Termination noticeBasis of rent increaseFrequency of rent increase1-5 yearsHalf yearly3-6 monthsFixed uplifts, subject tocontractAnnualDEMANDCurrent demand was stimulated with the announcementthat Riyadh will host the GCC Central Bank. Demandand absorption rates in Riyadh remain higher than otherregions in Saudi Arabia. Another factor that has boosted themarket is an increase in landlord flexibility as a result of amore balanced landlord and tenant relationship. The rentalincentives offered have attracted more tenants and led to areduced vacancy rate of 7%.RENTSOver the past year, the office market in Riyadh suffered fromthe effect of the global economic downturn. Office rentalrates have been declining and fell to SAR1,300 per sq m, perannum in December 2009 down from SAR1,750 per sq m,per annum in June 2009. Premium rents in the capital arebetween SAR1,300 and SAR1,500 per sq m, per annum forClass A.A large component of the country’s office demand is locatedon Saudi’s Eastern Province in the cities of Al Khobar andAl Dammam. These have 85% of total office supply in theEastern Province and host the headquarters of the majorcorporations Saudi Aramco and SABIC.Al Faisaliah Tower, Riyadh, Saudi Arabia23

<strong>MARKETBEAT</strong>SAUDI ARABIA RETAIL SNAPSHOTRETAIL MARKETRents in key locations have decreased, particularly for themost popular shopping centres. Nationally, rents continuedto fall over the latter months of 2009 and early 2010. WhilstSaudi Arabia is a large market, it is very price sensitive anda number of new malls have been hit hard to include theMall of Arabia (MOA) in Jeddah and Riyadh Galleria. Thiscombined with retailer cash flow issues is causing uncertaintyin the market and landlords are reacting by creating flexiblerental deals. Incentives include, extended rent free periods forlong lease commitment or reduced rental rates for upfrontrental payment. A number of retail chains have failed in theKingdom of Saudi Arabia and many units remain empty.JEDDAHBoth of Jeddah’s premier malls, the Red Sea Mall and Mallof Arabia have failed to achieve full occupancy since theircompletion in 2008, averaging a vacancy rate of 10%. Thiscould be viewed as an initial sign of market saturation whichis likely to cap any steep rental growth. The development ofthe King Abdullah Economic City (KAEC) with its massiveBay La Sun Shopping Mall on the outskirts of Jeddah,should provide a boost to local incomes, both as an employerand as retailers in sub-prime malls cater to the needs of thegrowing workforce. A factor that will continue to impactJeddah’s retail market is its strategic location at the gatewayto the Holy city of Mecca. The birth place of Islam attractsabout four million religious tourists annually.RIYADHDestination malls in Riyadh still lag behind other GCCcities, with the Kingdom Mall, Al Faisaliyah Mall and therecently delivered Riyadh Galleria leading the market. Thesethree malls supply a variety of retail offerings to mixedsocio-economic groups. The iconic Kingdom Tower Malldominates the luxury segment and retail space here is alwaysin high demand. Trading conditions for many retailers in thecity are still challenging and in some cases foreign operatorshave made the decision to withdraw from the Riyadh marketaltogether. The outlook remains unstable with consolidationamongst operators likely to increase.RETAIL RENTSCity Location MeasureJeddahRiyadhMall ofArabiaKingdomMallSAR/sq m,per annumSAR/sq m,per annumMarch2009March2010AnnualGrowth1,300 1,300 0%2,300 2,500 8%Mall of Arabia, Jeddah, Saudi Arabia24

MIDDLE EAST REAL ESTATE REPORT Q2 2010TURKEY ECONOMIC SNAPSHOTECONOMIC BACKGROUNDWhile not as sharp as the rebound seen in the secondquarter, the third quarter of 2009 still saw a relativelystrong performance, with annual GDP declines easingback from -7.9% to -3.3%. One of the main reasons forthe improvement was an end to the de-stocking process,although government expenditure also played a strong role,rising by 5.2%.CONSUMER DEMAND STAYS STRONGPrivate consumption saw a significant upturn during thesecond and third quarters, aided by a temporary reductionin VAT from 18% to 8% which ended in October 2009,and relatively low rates of inflation. By the end of the thirdquarter, the effects of the government’s car scrappage schemeappeared to have kicked in which resulted in a strong end to2009 for the consumer sector.INFLATION SPIKES AT YEAR ENDInflation rose quite sharply at the end of 2009, reaching6.5% as the effects of a fall in energy prices waned. However,over the past year or so, there appeared to be a downwardshift in inflation expectations to more reasonable levels,making the inflation targeting job of the Central Banksomewhat easier.INTEREST RATES COME TO RESTBank lending began to increase during the last few monthsof 2009, and some have taken this as a sign that the CentralBank’s loosening of monetary policy over the past year hascome into effect. The Central Bank had cut the base ratefrom 16.75% in October 2008 to 6.5% in November 2009,but left the rate unchanged at its December meeting.OUTLOOKDevelopments in recent months have done little to alter theview that Turkey is set for a fairly strong recovery in 2010.While government policy may cease to be as expansionary inrecent quarters, monetary policy could stay loose for sometime, aiding the recovery in bank lending. The industrialrecovery is likely to gain momentum as the year progresseswhich in turn will support employment levels and consumerspending.GDPInfl ationInterest rateEmploymentECONOMIC AND POLITICAL BREAKDOWNPopulation 73.9 million (2008)Labour force 23.8 million (2008)GDP US$ 620.7 billion (2009)GDP per capita US$ 8,270 (2009)Government budget balance -6.3% (2009)PresidentPrime MinisterElection datesMARKET SUMMARYEconomic Indicators*: 2007 2008 2009 2010 F 2011 FGDP growth % p.a. 4.6 1.0 -5.9 4.0 4.3Infl ation (CPI) % p.a. 8.2 10.4 6.3 8.1 6.3Unemployment rate % 9.9 11.0 14.4 14.2 14.2Foreign investmentUS$ billionMARKET OUTLOOKSolid recovery now underwayShort term upward pressure, beforestabilisationThe base rate has settled and looks toremain stable for sometimeUnemployment is forecast to remainrelatively high in the short term.ECONOMIC ACTIVITY19.9 15.8 6.0 7.7 12.0TL/US$ (average) 1.30 1.30 1.55 1.49 1.49Abdulla GulRecep Tayyip Erdogan2011 (parlimentary)2012 (presidential)Source: <strong>Cushman</strong> & Wakefi eld LLP* E Estimate | F ForecastSource: Consensus Economics Inc., Oxford Economics Forecasts25

<strong>MARKETBEAT</strong>TURKEY OFFICE SNAPSHOTOFFICE MARKETSUPPLYAs the finance and business centre of Turkey, Istanbuldominates the Turkish office market with 80% of thecountry’s overall office stock. The office district in Istanbulis concentrated on the European side of Istanbul aroundthe Büyükdere Axis in the Levent area. The European sidein general and the Zincirlikuyu-Levent-Maslak axis inparticular, serves as the Central Business District of the city.Due to the limited land availability and high prices, certaindistricts on the Asian side have started to develop commercialbusiness areas. The current existing office stock in Istanbulis around 2.6 million sq m. There has been a decrease inavailable stock due to the slowing of the developmentmarket. However, rents remain stable.DEMANDTraditional owner occupier markets continue withstrata ownership. Demand for office space has started toincrease, although occupiers are still driven by cost. Assuch, peripheral CBD areas and secondary submarkets areincreasingly important. The office market in Turkey hasclearly been affected by the global economic downturn andlandlords are increasingly having to offer incentives to attracttenants. Whilst the outlook remains positive, the recovery isexpected to be gradual over 2010.RENTSPrime office space in the CBD on the European side ofIstanbul commands rents of approximately US$25-35 per sqm, per month and on the Anatolian side US$20 per sq m,per month. Despite rental values falling by as much as 12%in 2009, rents are expected to stabilise in 2010.Typical lease lengthTURKEY LEASING PRACTICESFrequency of rent payment (in advance)Termination noticeBasis of rent increaseFrequency of rent increase3-10 yearsMonthly3-6 monthsFor rents paid inTurkish Lira, annualindexation is linked tothe published rategiven by thegovernment.AnnualIstanbul, Turkey26

MIDDLE EAST REAL ESTATE REPORT Q2 2010TURKEY RETAIL SNAPSHOTRETAIL MARKETWhilst Turkey has experienced a shopping centredevelopment boom in recent years, the sector remainsrelatively immature with a low density of 70.7sq m, per1,000 inhabitants, with a poor geographical spread anddevelopment largely restricted to the main cities. The firstmodern shopping centres appeared in Turkey in the mid-1990s. Development started to pick up in the late 1990s andremained relatively stable up till 2005. In the last few yearsdevelopment activity has accelerated, with shopping centreprovision doubling in three years to stand at approximatelyfive million sq m, as at March 2010. The 1.3 million sq m inthe pipeline is significant and combined with the challengingTurkish economic environment, some new schemes mayexperience difficulties attracting tenants.International retailers still show interest but are cautiousabout expansion. As in a number of other markets, retailersare concentrating on profitability and closing or relocatingunder-performing stores. Demand is still heavily polarisedtowards the absolute top locations in the major cities. Thereare still new brands looking to enter the Turkish marketand they are actively looking for flagship stores in primelocations. Recently, there has been a marked shift towardsshorter and more flexible lease contracts as retailers seekto reduce risks and landlords are more flexible regardingincentives. Prime retail rental values are unchanged fromSeptember 2009 in most locations. Current shopping centreprime rents in Istanbul are US$1,200 per sq m, per annum.Istanbul’s traditional retail areas are located around theGrand Bazaar and other district markets for fresh food, runby the Municipal Government. Both the Grand Bazaar andmore historic markets represent an urban form which is theforerunner of the modern enclosed shopping centres. Inaddition to these, the traditional shopping streets are still amajor draw, rather than the enclosed shopping malls. Themajor high-street areas in Istanbul accommodating both localand international retailers are Istiklal, Nisantasi and Bakirkoyon the European side and Bagdat Avenue and Bahariye onthe Asian side.Istiklal Street, Istanbul, Turkey27

<strong>MARKETBEAT</strong>UNITED ARAB EMIRATES ECONOMIC SNAPSHOTECONOMIC BACKGROUNDThe United Arab Emirates (UAE) is a federation of sevenEmirates. Each Emirate maintains a high degree of autonomyand the Federal Supreme Council is composed of the Emirsof the seven Emirates. Although elected by the SupremeCouncil, the President and Prime Minister are essentiallyhereditary. The Emir of Abu Dhabi holds the Presidency andthe Emir of Dubai is Prime Minister.As elsewhere in the region, oil is a major driver of theeconomy, although there has long been a policy of reinvestingpart of the proceeds in numerous infrastructure projects. Therise of the oil industry has also been behind a large increasein the foreign labour force which now accounts for around75% of the population. However, a successful diversificationpolicy means that many of the jobs are now outside the oilindustry, in sectors such as finance and tourism.A RETURN TO GROWTH IN 2010While the fate of the Dubai World debt continues to hangover the economic outlook in the UAE, 2010 is expected tosee a return to growth of about 3% following a modest fall inGDP during 2009.AIDED BY GOVERNMENT MEASURESDespite the difficulties facing the Emirates at present, thepast few months has seen optimism return to the market.The government has dipped into its reserves to providea fiscal boost and has also had some success in loweringinterbank lending rates. In addition, oil prices have graduallyclimbed back from lows at the start of 2009, helping to boostconfidence.MARKET FUNDAMENTALSThe impact of the real estate correction and global economicdownturn has impacted on Dubai more significantly than theneighbouring Emirate of Abu Dhabi. This may be partiallya result of the importance that oil plays in Abu Dhabi’seconomy but is also certainly due to the more cautiousapproach Abu Dhabi has taken to the real estate developmentsector and its more limited exposure to inward foreign andspeculative investment.OUTLOOKFollowing a weak performance in 2009, there are now signsthat the economic outlook is beginning to improve. Whileprospects for the different Emirates have diverged overthe short term, the government has committed significantresources to cushioning the fall. Furthermore, althoughproperty markets are currently experiencing a correction,some construction activity continues and in the longerterm the exodus of foreign labour is likely to be reversed aseconomic activity picks up.ECONOMIC AND POLITICAL BREAKDOWNPopulation 4.39 million (2008)Labour force 3.00 million (2008)GDP US$ 209.5 billion (2008)GDP per capita US$ 45,559Government budget balance -2.2% (2009)President of United Arab EmiratesVice President and Prime Ministerof United Arab Emirates, andRuler of Dubai MARKET SUMMARYEconomic Indicators*: 2007 2008 2009 2010 F 2011 FGDP growth % p.a. 7.7 7.4 -0.7 3.0 6.5Infl ation (CPI) % p.a. 11.1 12.3 1.5 2.2 2.5Unemployment rate % 3.5 3.7 4.0 3.9 3.8Foreign InvestmentUS$ billionMARKET OUTLOOKGDP Rebound expected in 2010Infl ation Infl ation to return in 2010Interest rateEmploymentECONOMIC ACTIVITY-0.4 -2.1 -1.7 -1.1 -0.7UAE/US$ (average) 3.67 3.67 3.67 3.67 3.67Source: <strong>Cushman</strong> & Wakefi eld LLPLikely to remain stable for some timeEmployment may show temporary fall as theforeign labour force declines* E Estimate | F ForecastSource: Consensus Economics Inc., Oxford Economics ForecastsH.H Sheikh Khalifa bin Zayed AlNahyanH.H. Sheikh Mohammed binRashid Al Maktoum28

MIDDLE EAST REAL ESTATE REPORT Q2 2010UNITED ARAB EMIRATES – ABU DHABI OFFICE SNAPSHOTOFFICE MARKETSUPPLYSimilar to the other regional real estate markets, Abu Dhabiis experiencing a major slow down. Even though the officemarket can still be characterised by a chronic shortage ofGrade A supply, this is soon to change with the advent ofsome large scale Grade A developments due for completionbetween now and 2012. Until recently, corporate occupiershad been forced to take office space in converted residentialbuildings. The future availability of Grade A space willbenefit from existing ‘flight to quality’ demand.The nature of supply in Abu Dhabi is not conventionallystreamlined in the sense that build quality varies significantlybetween neighbouring buildings in the same location.The majority of international occupiers continue to belocated along the East Corniche, Al Bateen and AirportRoad, with smaller, more regional businesses occupying spacein secondary locations such as Salam Street and DefenceRoad.At present, the capital’s infrastructure is benefiting frommajor governmental investment which, once complete, willtransform the physical environment of the CBD. However,these medium to long term planning policies have createdsignificant congestion in the short term.In line with Abu Dhabi’s 2030 Vision, the majority of newoffice supply entering the market is centred on SowwahIsland which is designated to become the capital’s new CBD.Sowwah Island will house the capital’s new financial districtand stock exchange. Over the next four years, these newdevelopments are scheduled to add nearly three million sq ftof office space to Abu Dhabi. In addition to Sowwah Island,future Grade A developments include Central Market,Etihad Towers, Capital Gate, Masdar City, TDIC and theAldar HQ building, as well as several developments on ReemIsland.RENTSAt present, average headline rents stand at AED2,000-2,250per sq m, per annum. Some recently completed Grade Abuildings are still quoting primes rents up to AED3,250 persq m, per annum. Most new buildings are being offered asCat A whilst previously rentals were based on shell and core.Law No. 4 of 2010, an amendment to Abu Dhabi Law No20 of 2006, will make it easier for landlords to evict tenantsat the end of the five year protection period as the automaticright of renewal has been removed. Under the new lawwhich comes into effect in November, landlords will beable to evict tenants at the end of the five year lease period,subject to a three months notice period for commercialproperty, and take on new tenants at a renegotiated rent.Typical lease lengthABU DHABI LEASING PRACTICESFrequency of rent payment (in advance)Termination noticeBasis of rent increaseFrequency of rent increase1-5 years1 year3 monthsRent capAnnualDEMANDCorporate occupiers continue to struggle with shortages ofavailable capital which has obvious impact on demand. Untilrecently, the Abu Dhabi office market has shown resilienceto the global economic decline. However, competition fromDubai, with vastly discounted rents and an abundance ofsupply, is beginning to have an adverse effect on the Capital.We forecast an increase in relocation activity in Abu Dhabiover the next three years with occupiers exercising their leasebreaks to upgrade and improve their real estate position.Corniche Road, Abu Dhabi, United Arab Emirates29

<strong>MARKETBEAT</strong>UNITED ARAB EMIRATES – DUBAI OFFICE SNAPSHOTOFFICE MARKETSUPPLYIn 2009 we saw a dramatic change from Dubai’s previouslylandlord led market to a market heavily in favour of tenants.This trend will continue in 2010 as vacancy rates, currentlyaround 30%, continue to rise with the completion of largescale developments. Consequently, rents remain under severepressure with landlords being forced to review the conditionsin which they market their product.Even though a more sustainable level of construction hasnow emerged, we anticipate between 16-20 million sq ftof commercial space will enter the market this year. Supplyat Dubai’s iconic Dubai International Financial Centre(DIFC) has been boosted with the completion of CurrencyHouse, Liberty House and also Index Tower which is due forcompletion later in 2010. This extension aims to broadenthe DIFC’s occupier base, with space in these new buildingsbeing traded at a 30% discount to that of The Gate Districtand Gate Village.RENTSRents have continued to fall across all sectors of the officemarket with average headline rents in prime locations,excluding the DIFC, currently standing at AED225-250 persq ft, per annum. DIFC remains the exception with rentsstill being achieved of between AED375-400 per sq ft, perannum. The average rent in secondary locations has fallento AED100-150 per sq ft, per annum. Even though we haveseen a slow down in rent reductions, we will continue to seethis downward trend for the foreseeable future.Typical lease lengthDUBAI LEASING PRACTICESFrequency of rent payment (in advance)Termination notice1-3 yearsQuarterly3 monthsAs the Dubai real estate market continues to mature, we willbegin to see a bigger difference between prime and secondarylocations. In secondary locations, we have seen rents fall upto 60% with vacancy rates settling at 60-70%, whilst primelocation rents have been more resilient, falling between 25-40%, and vacancy settling at 15-20%. For example, vacancyrates in the traditionally resilient first phase of DIFC remainsomewhat unchanged, whilst other prime districts have beengreatly affected by the downturn. Respective vacancy ratesin Emaar Square have risen to nearly 30%, while rates of upto 80% are registered in the newly opened DIFC extension.Stagnant absorption rates were also registered across Tecom,Dubai Media City and Dubai Internet City, considered bymany as Dubai’s second most popular free zone.DEMANDDemand is being driven by those occupiers wishing totake advantage of the market and improve their real estateposition. Whilst achieving savings against their corporatebudgets is the main objective, we are also seeing occupiersreview the way they use their space with a drive to becomemore efficient and thus reduce their area requirements. This‘flight to quality’ and efficiency has further established a twotier market and has widened the gap between Grade A andGrade B/C office space. Lease lengths have also changedwhereby tenants are securing longer term, fixed leases tosecure their advantage in the current climate.Basis of rent increaseFrequency of rent increaseDubai at night, United Arab EmiratesRent capAnnual30

MIDDLE EAST REAL ESTATE REPORT Q2 2010UNITED ARAB EMIRATES RETAIL SNAPSHOTRETAIL MARKETDUBAIThe continued slowdown in international tourism, coupledwith a weakening demand has severely affected Dubai’s retailsector. The drop in footfall and household consumption hascompressed prime rents by 30% from their Q4 2008 peakto Q4 2009. This decline will continue in 2010. Flagshipdestination shopping centres continue to command highrents as their strong leisure credentials attract a higher footfallthan traditional malls. However, they have become moretenant orientated offering more favourable lease terms. Theaverage retail rent currently stands at AED250-275 per sq ft,per annum with flagship destination malls commanding a35-45% higher rent.Part of Dubai’s steadily growing stock of destination mallsis the recently opened 130,000 sq m Mirdif Mall with its‘iFly’ indoor skydiving centre. This underlines a continuingtrend recreational development within retail malls, as itcompliments and competes with existing ski resorts and walkthrough aquariums.With GDP and consumer spending further retracting inline with the global economic slowdown, most of Dubai’splanned projects have been delayed significantly. This islikely to stabilise existing retail GLA at approximately 2.5million sq m and cushion rents from falling much further,while maintaining current absorption rates. For newretailers looking to enter the market, business partnershiprequirements and sponsorship laws affecting initial marketentry should be accounted for. The traditional slowdownthrough summer and the ensuing holy month of Ramadanshould be taken into consideration, with Eid holidaysand the Dubai Shopping Festival historically boosts retailactivity. The still high disposable incomes enjoyed by manyhouseholds in the region have ranked the United ArabEmirates strongly, in terms of attractiveness to retailers.The introduction of the Gulf’s first Metro is a notableinfrastructure advancement which will continue to positivelyimpact footfall if the centre benefits from a nearby Metrostation. Prime annual retail footfall is forecasted at 21 millionin Deira City Centre and 25 million in the Mall of theEmirates.ABU DHABIDespite initial resilience to the global slowdown, averageretail rents have dropped by nearly 25% from their peak inQ4 2008 at AED3,500 per sq m, per annum to AED2,600per sq m, per annum at Q4 2009. Abu Dhabi’s currentretail stock stands at around 700,000 sq m with the MarinaMall, Abu Dhabi Mall and Al Wahda Mall being the mostestablished. The outdated retail scene is set to be revampedwith the expected arrival of the 296,000 sq m Yas Mall by2010/2011 and Aldar’s Central Market by 2011. The retailpipeline is estimated to more than double the Abu Dhabi’sstock to two million sq m by 2012. Both new additions willbecome the Capitals first destination malls with Yas Malloffering a significant entertainment component. Despitebuoyant demand, the anticipation of this new supply will capany further rental growth in the early generation shoppingcentres. Rental reductions have been reflected in a number ofways with tenants securing rental breaks and grace periods.Abu Dhabi is notably under supplied in terms of recreationalmega malls, leaving Dubai to dominate the field. The capital’smalls are endeavouring to raise and broaden their tenant mixand profile. The economic downturn has reportedly forcedluxury retailers to stock lower-priced items to cater for asavvier consumer. The Capital’s sustainable approach is set toprevent an oversupply of mega malls as the Urban PlanningCouncil has restricted permits to master planned ‘communityshopping centres’.RETAIL RENTSCity Location MeasureAbuDhabiDubaiAbu DhabiMallMall of theEmiratesAED/sq m,per annumAED/sq ft,per annumMarch2009March2010AnnualGrowth3,000 2,750 -8.3%400 400 -0%31

<strong>MARKETBEAT</strong>REGIONAL HOSPITALITY SNAPSHOTSBAHRAINA reduction in tourism numbers in 2009 is expected to bereversed in 2010 with a return to growth in visitor numbersto Bahrain. The total number of international visitors toBahrain is forecast to exceed eight million in 2010 with anexpectation that this will increase to over 10 million visitorsby 2014, according to the latest forecast by World Travel andTourism Council (WTTC).Almost 40% of international visitors to Bahrain are sameday tourists, crossing the Saudi border via the King FahadCauseway. This creates several issues including a low averagespend per visitor and traffic problems during the peakweekend periods. In order to decrease its dependence onthe Saudi tourism market, Bahrain is investing heavily inimproved transport links to encourage visitors from otherareas of the GCC as well as further afield.The US$300 million upgrade of the International Airportwill increase capacity to 15 million passengers by late 2010,while the ‘Friendship Causeway’ to Qatar will boost regionaltourism further. Bahrain is also encouraging cruise tourism.Infrastructure improvements include a dedicated cruise linerterminal at the Khalifa bin Salman Port.Bahrain continues to be a strong player in the Meeting,Incentive, Conference and Exhibition market (MICE),fuelled by its strong financial services sector. Majorinvestments in this sector include the expansion of theBahrain International Exhibition & Convention Centre andthe new 150,000 sq m conference complex in Sakhir.The hotel sector in Bahrain experienced a sharp decline of16% in occupancy levels from 72% in 2008 to just 56% in2009. Average room rates stabilised towards the end of theyear with a strong finish up 11.9% on the previous year atUS$253. Operators of four star hotels or less, have expressedconcern at the removal of liquor licences and how this mayaffect their revenue.KUWAITThe numbers of international visitors to Kuwait hasfluctuated considerably over the last decade, reaching a peakin 2008 at 3.8 million. Although visitor numbers showeda slight decline in 2009, by around 3.5%, data issued bythe WTTC projected that growth will return in 2010.Both international visitor numbers and average spend willcontinue to grow at an increasing rate, reaching in excess offive million visitors by 2020.Where Kuwait differs from many of its Middle Eastneighbours, is that 92% of its visitors don’t stay overnightwith the vast majority of these being business travellers fromother GCC countries. As a result, average travel spend inKuwait is comparatively low at below US$100 per trip. Boththe government and the private sector have been active inimproving the country’s tourism infrastructure, as well astheir hotel and leisure facilities.In common with many of its GCC neighbours, Kuwait hasannounced a number of major development projects whichit hopes will attract international tourism. These include themassive City of Silk development, projected to fully openin 2030 which will include hotels, spas, parks, business/conference venues and Failaka Island which is planned toinclude 20 hotels, a golf course and marine park. Kuwaithas a number of international hotels under construction andprojected to open by 2011. These include the Four SeasonsHotel Kuwait City (2011), Jumeirah Messilah Beach Hotel(2011) and the Ritz Carlton Kuwait (2011).Kuwait’s hotel occupancy rates fell by 6% from 61% in 2008to 55% at the end of 2009. Average room rates increased by8% to US$271.32

MIDDLE EAST REAL ESTATE REPORT Q2 2010LEBANONThe political stability that reigned over the country duringthe past year has led Beirut to witness a radical increase inhotel occupancy in 2009 along with a significant rise inroom rates and yield. The average occupancy rate for 2009was around 70% up from 55% in 2008 and 37% in 2007.RevPar peaked in 2009 at US$234, an increase of US$69from 2008 figures.Tourism income makes up 23% of Lebanon’s revenue andcontributed an estimated US$7 billion to the economy in2009. This is forecast to increase in 2010 with recordedtourism data showing that the number of visitors rose by39% in 2009.The current supply of hotel beds in the country is notsufficient to meet this increased demand and the qualityof hotel accommodation needs to be improved to meetinternational standards and visitor expectations. A number ofexciting new investment projects are taking place in Beirut.Developers are taking advantage of the increased confidencewithin the hospitality sector and are beginning to plan anddevelop projects that were previously delayed or suspended.A number of foreign investment companies includingKingdom, Khourafi and Istithmar Groups are developingnew five star hotels and there are 20 international hotelscurrently under construction in the capital. The Four SeasonsHotel has recently opened and the much delayed GrandHyatt is due for completion by 2012 adding 500 keys.The new US$200 million Summerland Kempinski is alsounderway.These hotels, among others, will correct the lack of supply inthe current market and increase Beirut’s profile as a desirabletourist destination in the region.OMANThe number of visitors to Oman has been rising rapidlyover the last decade driven by the governments support ofinternational marketing and the worldwide tourism mediaattention given to the country as the ‘undiscovered jewel ofthe Middle East’. In an effort to increase tourist awareness,Oman’s Tourism Body collaborated with Oman Air andlaunched the ‘Partnership Oman’ initiative in 2009. Part ofthe focus of this project is to raise awareness of Oman as theperfect short break destination.In common with many leisure destinations around theworld, Oman experienced a dip in both visitor numbers andaverage spend in 2009. The Sultanate received 1.6 millionvisitors with an average spend of US$400 per trip. This trendis expected to continue in 2010 with signs of a return togrowth in late 2010, according to the WTCC. By the end ofthe year, many of Omans current projects ranging from hoteldevelopments to the expansion of Seeb International Airportwill be further advanced and able to take advantage of thereturn to growth.The contribution of travel and tourism to GDP is expectedto rise from 7.6% in 2010 to 9.2% by 2020.The supply of hotel rooms in Oman has traditionally beendominated by the five star sector accounting for nearly 40%of the market. Of the country’s total hotel rooms, 68% are inMuscat. Planned hotel developments include the Kempinskiand the Fairmont hotels at The Wave and a new beach resorthotel in Muscat by the Oberoi Group. The Rezidor Group,who already have four hotels in Oman recently announcedthe development of the luxury branded Hotel Missoni, dueto open in 2012. Hotel projects currently under constructionin Oman are valued at US$300 million according to researchby Proleads. Occupancy rates fell in 2009 by 8% to 63% andaverage room rate fell 4.7% to US$245 according to figuresreleased by Ernst & Young. However, RevPAR fell by nearly20% to US$141.33