Report to Donors 2009 - University of Melbourne

Report to Donors 2009 - University of Melbourne

Report to Donors 2009 - University of Melbourne

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

REPORT TO DONORS » <strong>2009</strong><br />

Investment <strong>Report</strong> <strong>2009</strong> »<br />

Investment Fund<br />

Strategy & Aims<br />

The fund is an accumulation <strong>of</strong><br />

endowments from a significant<br />

number <strong>of</strong> trusts, and <strong>University</strong><br />

funds surplus <strong>to</strong> immediate<br />

operating requirements.<br />

The fund aims <strong>to</strong> meet the intergenerational<br />

requirements <strong>of</strong> the<br />

<strong>University</strong>. This includes providing<br />

funding for large capital projects or<br />

property acquisitions and <strong>to</strong> enable<br />

trust funds <strong>to</strong> fulfill obligations as per<br />

their trust deed, whilst at the same<br />

time ensuring the Fund’s perpetuity.<br />

This is achieved by selecting a<br />

portfolio structure that provides long<br />

term capital growth, riding through<br />

short-medium term fluctuations, as<br />

well as reliable income streams <strong>to</strong><br />

fulfill current obligations.<br />

The <strong>University</strong> has outsourced its<br />

Long Term Fund management <strong>to</strong><br />

the Vic<strong>to</strong>rian Funds Management<br />

Corporation (VFMC), an external<br />

“Manager <strong>of</strong> Managers”.<br />

page 6 »<br />

Portfolio Highlights<br />

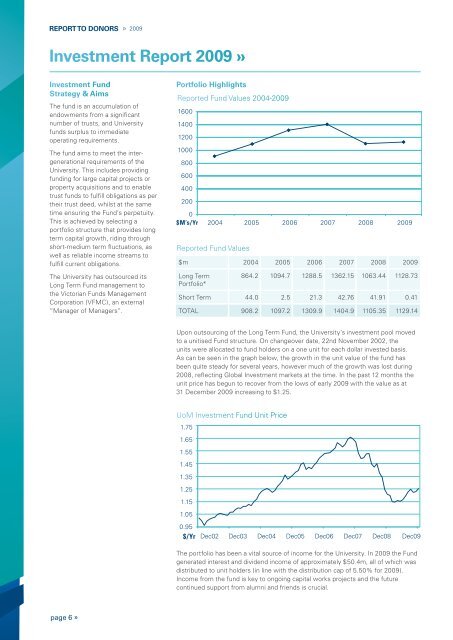

<strong>Report</strong>ed Fund Values 2004-<strong>2009</strong><br />

1600<br />

1400<br />

1200<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

$M’s/Yr<br />

<strong>Report</strong>ed Fund Values<br />

$m 2004 2005 2006 2007 2008 <strong>2009</strong><br />

Long Term<br />

Portfolio*<br />

2004 2005 2006 2007 2008 <strong>2009</strong><br />

864.2 1094.7 1288.5 1362.15 1063.44 1128.73<br />

Short Term 44.0 2.5 21.3 42.76 41.91 0.41<br />

ToTAL 908.2 1097.2 1309.9 1404.9 1105.35 1129.14<br />

Upon outsourcing <strong>of</strong> the Long Term Fund, the <strong>University</strong>’s investment pool moved<br />

<strong>to</strong> a unitised Fund structure. on changeover date, 22nd november 2002, the<br />

units were allocated <strong>to</strong> fund holders on a one unit for each dollar invested basis.<br />

As can be seen in the graph below, the growth in the unit value <strong>of</strong> the fund has<br />

been quite steady for several years, however much <strong>of</strong> the growth was lost during<br />

2008, reflecting Global Investment markets at the time. In the past 12 months the<br />

unit price has begun <strong>to</strong> recover from the lows <strong>of</strong> early <strong>2009</strong> with the value as at<br />

31 December <strong>2009</strong> increasing <strong>to</strong> $1.25.<br />

UoM Investment Fund Unit Price<br />

1.75<br />

1.65<br />

1.55<br />

1.45<br />

1.35<br />

1.25<br />

1.15<br />

1.05<br />

0.95<br />

$/Yr<br />

Dec02 Dec03 Dec04 Dec05 Dec06 Dec07 Dec08 Dec09<br />

The portfolio has been a vital source <strong>of</strong> income for the <strong>University</strong>. In <strong>2009</strong> the Fund<br />

generated interest and dividend income <strong>of</strong> approximately $50.4m, all <strong>of</strong> which was<br />

distributed <strong>to</strong> unit holders (in line with the distribution cap <strong>of</strong> 5.50% for <strong>2009</strong>).<br />

Income from the fund is key <strong>to</strong> ongoing capital works projects and the future<br />

continued support from alumni and friends is crucial.