Microfinance Banana Skins 2009 Microfinance Banana Skins 2009 - Le ...

Microfinance Banana Skins 2009 Microfinance Banana Skins 2009 - Le ...

Microfinance Banana Skins 2009 Microfinance Banana Skins 2009 - Le ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

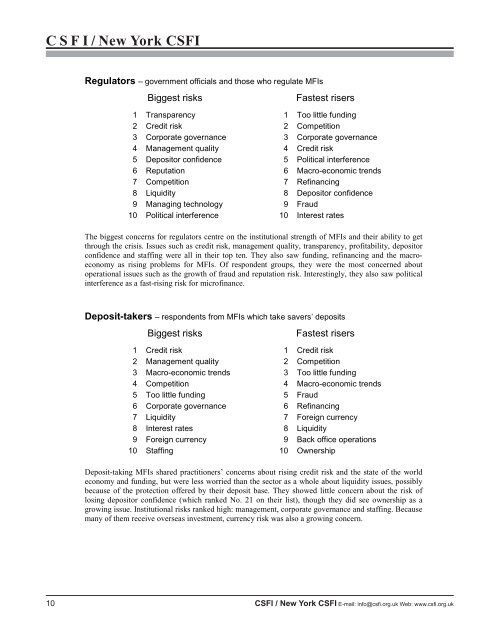

C S F I / New York CSFIRegulators – government officials and those who regulate MFIsBiggest risksFastest risers1 Transparency 1 Too little funding2 Credit risk 2 Competition3 Corporate governance 3 Corporate governance4 Management quality 4 Credit risk5 Depositor confidence 5 Political interference6 Reputation 6 Macro-economic trends7 Competition 7 Refinancing8 Liquidity 8 Depositor confidence9 Managing technology 9 Fraud10 Political interference 10 Interest ratesThe biggest concerns for regulators centre on the institutional strength of MFIs and their ability to getthrough the crisis. Issues such as credit risk, management quality, transparency, profitability, depositorconfidence and staffing were all in their top ten. They also saw funding, refinancing and the macroeconomyas rising problems for MFIs. Of respondent groups, they were the most concerned aboutoperational issues such as the growth of fraud and reputation risk. Interestingly, they also saw politicalinterference as a fast-rising risk for microfinance.Deposit-takers – respondents from MFIs which take savers’ depositsBiggest risksFastest risers1 Credit risk 1 Credit risk2 Management quality 2 Competition3 Macro-economic trends 3 Too little funding4 Competition 4 Macro-economic trends5 Too little funding 5 Fraud6 Corporate governance 6 Refinancing7 Liquidity 7 Foreign currency8 Interest rates 8 Liquidity9 Foreign currency 9 Back office operations10 Staffing 10 OwnershipDeposit-taking MFIs shared practitioners’ concerns about rising credit risk and the state of the worldeconomy and funding, but were less worried than the sector as a whole about liquidity issues, possiblybecause of the protection offered by their deposit base. They showed little concern about the risk oflosing depositor confidence (which ranked No. 21 on their list), though they did see ownership as agrowing issue. Institutional risks ranked high: management, corporate governance and staffing. Becausemany of them receive overseas investment, currency risk was also a growing concern.10 CSFI / New York CSFI E-mail: info@csfi.org.uk Web: www.csfi.org.uk