REI Agro Limited LEAD MANAGERS TO THE ISSUE - IDBI Capital

REI Agro Limited LEAD MANAGERS TO THE ISSUE - IDBI Capital

REI Agro Limited LEAD MANAGERS TO THE ISSUE - IDBI Capital

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TABLE OF CONTENTSSECTION I - GENERAL ........................................................................................................................... iiiDEFINITIONS AND ABBREVIATIONS .................................................................................................... iiiPRESENTATION OF FINANCIAL INFORMATION AND USE OF MARKET DATA .......................... ixFORWARD LOOKING STATEMENTS ...................................................................................................... xSECTION II – RISK FAC<strong>TO</strong>RS ............................................................................................................... xiSECTION III – INTRODUCTION ............................................................................................................. 1SUMMARY OF FINANCIAL AND OPERATIONAL INFORMATION .................................................... 1<strong>THE</strong> <strong>ISSUE</strong> .................................................................................................................................................... 4GENERAL INFORMATION......................................................................................................................... 6OVERSEAS SHAREHOLDERS ................................................................................................................. 15CAPITAL STRUCTURE ............................................................................................................................. 17OBJECTS OF <strong>THE</strong> <strong>ISSUE</strong> .......................................................................................................................... 30STATEMENT OF TAX BENEFITS ........................................................................................................... 37SECTION IV – ABOUT OUR COMPANY ............................................................................................. 43INDUSTRY OVERVIEW ............................................................................................................................ 43OUR BUSINESS .......................................................................................................................................... 48SECTION V – OUR MANAGEMENT .................................................................................................... 64SECTION VI – FINANCIAL INFORMATION ...................................................................................... 69FINANCIAL STATEMENTS ...................................................................................................................... 69CERTAIN O<strong>THE</strong>R FINANCIAL INFORMATION ................................................................................... 89MARKET PRICE INFORMATION ............................................................................................................ 90MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTSOF OPERATIONS ....................................................................................................................................... 93SECTION VII – LEGAL AND O<strong>THE</strong>R INFORMATION ...................................................................104OUTSTANDING LITIGATIONS AND O<strong>THE</strong>R DEFAULTS .................................................................104GOVERNMENT AND O<strong>THE</strong>R APPROVALS .........................................................................................107MATERIAL DEVELOPMENTS ................................................................................................................110STATU<strong>TO</strong>RY AND O<strong>THE</strong>R INFORMATION .........................................................................................111SECTION VIII – OFFERING INFORMATION ...................................................................................120TERMS OF <strong>THE</strong> <strong>ISSUE</strong> .............................................................................................................................120SECTION IX –STATU<strong>TO</strong>RY AND O<strong>THE</strong>R INFORMATION ..........................................................145MATERIAL CONTRACTS AND DOCUMENTS FOR INSPECTION ....................................................145DECLARATION .......................................................................................................................................147

SECTION I - GENERALDEFINITIONS AND ABBREVIATIONSThe following list of defined terms is intended for the convenience of the reader only and is not exhaustive.Conventional and General TermsTermDescriptionCompanies Act : The Companies Act, 1956, as amendedCopyright Act : The Copyright Act, 1955, as amendedDepository : A depository registered with SEBI under the SEBI (Depository andParticipant) Regulations, 1996, as amended from time to time.Depositories Act : The Depositories Act, 1996, as amended from time to time.Financial Year/Fiscal : The period of 12 months beginning April 1 and ending March 31 of thatparticular year, unless otherwise statedIT Act : The Income Tax Act, 1961, as amendedIndian GAAP : The generally accepted accounting principles in IndiaIndustrial Policy : The industrial policy and guidelines issued by the Ministry of Industry,GoIListing Agreement : The equity listing agreements signed between our Company and theStock ExchangesRupees and Rs. : The lawful currency of IndiaSEBI Act : The Securities and Exchange Board of India Act, 1992, as amendedSEBI Regulations : The Securities and Exchange Board of India (Issue of <strong>Capital</strong> andDisclosure Requirements) Regulations, 2009, as amendedSecurities Act : The United States Securities Act of 1933, as amendedTakeover Code : The Securities and Exchange Board of India (Substantial Acquisition ofShares and Takeovers) Regulations, 1997, as amendedTrademarks Act : The Trademarks Act, 1999Weights & Measures Act : The Standard of Weights & Measures Act , 1976 as amendedIssue Related TermsTermDescriptionAbridged Letter of Offer : The abridged letter of offer to be sent to Eligible Equity Shareholders ofour Company with respect to this Issue in accordance with theprovisions of the SEBI Regulations and the Companies Act.iii

TermDescriptionAllottee(s) : The successful applicant(s) eligible for Allotment of Rights EquityShares pursuant to the IssueAllotment/Allotted : Unless the context otherwise requires, the allotment of Rights EquityShares pursuant to the Issue to the AllotteesBankers to the Issue : The bankers to the Issue being [●]Business Day : Any day, other than Saturday or Sunday, on which commercial banksare open for business.Composite ApplicationForm/CAF: The form used by an Investor to make an application for allotment ofRights Equity Shares pursuant to IssueConsolidated Certificate : In case of holding of Rights Equity Shares in physical form, ourCompany would issue one certificate for the Rights Equity Sharesallotted to one folioDesignated StockExchange/DSE: The Bombay Stock Exchange <strong>Limited</strong>Draft Letter of Offer : This draft letter of offer dated September 30, 2009 filed with SEBI forits commentsEligible EquityShareholder(s): A holder(s) of Equity Shares as on the Record DateFirst and Final Call : First and Final call notice as shall be sent by our Company to each of theInvestors for making a payment of Rs. [●] towards the balance amountpayable under Payment Method 1Issue : The issue of [●] Rights Equity Shares for cash at a premium of Rs. [●]per Rights Equity Share aggregating upto Rs. 11,500 million to theEligible Equity Shareholders on rights basis in the ratio of [●] RightsEquity Shares for every [●] Equity Shares held as on the Record Date,i.e. [●]Issue Closing Date : [●]Issue Opening Date : [●]Issue Price : Rs. [●] per Equity ShareIssue Proceeds : The monies received by our Company pursuant to the Rights EquityShares which are Allotted pursuant to the IssueInvestor(s) : The Equity Shareholders of our Company on the Record Date i.e. [●],Renouncees and any other persons eligible to subscribe to the IssueLead Manager(s) : SBI <strong>Capital</strong> Markets <strong>Limited</strong>, Axis Bank <strong>Limited</strong>, Fortune FinancialServices (India) <strong>Limited</strong> and <strong>IDBI</strong> <strong>Capital</strong> Market Services <strong>Limited</strong>Letter of Offer : The letter of offer dated [●] to be filed with the Stock Exchanges afterincorporating SEBI comments on this Draft Letter of Offeriv

DescriptionCERs : Certified emission reductionsCompliance Officer and CompanySecretary: Mr. Mandan MishraCorporate Office : The corporate office of our Company located at 58A/1, SainikFarm, New Delhi 110 062, IndiaDirector(s) : Any or all director(s) of our Company, as the context may requireEquity Share(s) : The equity share(s) of our Company having a face value of Re. 1,inter alia including such equity shares of our Companyoutstanding and fully-paid up, as on the Record Date, unlessotherwise specified in the context thereofGDR(s)/Global DepositoryReceipts: Global depository receipts issued by our Company representing 1Equity Shares (originally representing 2 Equity Shares each)each aggregating to US $ 7.13 million issued in November 2005Group Entities : Our Group Entities mean companies, firms, ventures, etc.promoted by the Promoters of our Company, irrespective ofwhether such entities are covered under section 370 (1)(B) of theCompanies Act or not.mandis : Organised Government monitored market places for agriculturalproduceMemorandum/Memorandum ofAssociation: Memorandum of Association of our CompanyPromoter(s) : Any or all of the promoter(s) of our Company, as defined in theSEBI Regulations and as the context may require, namely, (a) Mr.Sandip Jhunjhunwala, (b) Mr. Sanjay Jhunjhunwala, (c) Mrs.Koushalaya Devi Jhunjhunwala, (d) Mrs. Sangita Jhunjhunwala,(e) Mrs. Suruchi Jhunjhunwala, (f) Aspective Vanijya Private<strong>Limited</strong>, (g) Snehapushp Barter Private <strong>Limited</strong>, (h) SubhchintakVancom Private <strong>Limited</strong>, (i) Shree Krishna Gyanodaya FlourMills Private <strong>Limited</strong>, (j) <strong>REI</strong> Steel and Timber Private <strong>Limited</strong>,and (k) Jagdhatri Tracon Private <strong>Limited</strong>Promoter Group : The Promoter Group of our Company as defined in the SEBIRegulationspucca artiyas : Third Party procurement representatives and agents of thecompany licensed under the applicable law, operating in mandis<strong>REI</strong> Six Ten : <strong>REI</strong> Six Ten Retail <strong>Limited</strong>Registered Office : The registered office of our Company located at Room No. 15B,Everest House, 46C Chowringhee Road, Kolkata-700 071, WestBengal, Indiavi

AbbreviationsTermDescriptionAGM : Annual General MeetingAS : Accounting Standards, as issued by the ICAIBPLR : Benchmark Prime Lending RateBSE : The Bombay Stock Exchange <strong>Limited</strong>CAF : Composite Application FormCAGR : Compounded Annual Growth RateCDSL : Central Depository Services (India) <strong>Limited</strong>CER/sCertified Emission Reduction(s)CFO : Chief Financial OfficerDEPB : Duty Entitlement Pass Book SchemeDP : Depository ParticipantEBIDTA : Earnings Before Interest, Depreciation, Taxes & AmortizationECS : Electronic Clearing ServiceECGC : Export Credit Guarantee CorporationEGM : Extraordinary General MeetingEPS : Earnings per shareFDI : Foreign Direct InvestmentFEMA : Foreign Exchange Management Act, 1999, as amended and any circulars,notifications, rules and regulations issued pursuant to the provisions thereofFI : Financial InstitutionFII(s) : Foreign Institutional Investors registered with SEBI under applicable lawsFIPB : Foreign Investment Promotion BoardFY : Financial Year endedGBP or £ : Great Britain PoundGDP : Gross Domestic ProductGoI : Government of IndiaHRD : Human Resource Developmentvii

TermDescriptionHUF : Hindu Undivided FamilyICAI : Institute of Chartered Accountants of IndiaISIN : International Securities Identification NumberITAT : Income Tax Appellate TribunalKwH : Kilowatt hourMICR : Magnetic Ink Character RecognitionMn : MillionMoU : Memorandum of UnderstandingN.A. : Not ApplicableNAV : Net asset valueNEFT : National Electronic Fund TransferNR : Non ResidentNRI(s) : Non Resident Indians, as defined in the Foreign Exchange Management (Deposit)Regulations, 2000, as amendedNSDL : National Securities Depository <strong>Limited</strong>NSE : The National Stock Exchange of India <strong>Limited</strong>OCB(s) : Overseas Corporate Body(ies)PAN : Permanent Account NumberRBI : Reserve Bank of IndiaRoC : Registrar of Companies, West Bengal, located at KolkataRTGS : Real time gross settlementSEBI : Securities and Exchange Board of IndiaSTT : Securities Transaction TaxTPA : Tonne per annumUSD or US$ : United States DollarVAT : Value Added Taxw.e.f. : With effect fromWTG : Wind Turbine Generatorsviii

SECTION II – RISK FAC<strong>TO</strong>RSAn investment in equity and equity related securities involves a high degree of risk. You should carefullyconsider all of the information in this Draft Letter of Offer, including the risks and uncertainties describedbelow, before making an investment. If any of the following risks actually occur, our business, financialcondition, results of operations and prospects could suffer, the trading price of our Equity Shares and theRights Equity Shares could decline and you may lose all or part of your investment. You should also payparticular attention to the fact that we are governed in India by a legal and regulatory environment whichin some material respects may be different from that which prevails in other countries. Our Company’sactual results could differ materially from those anticipated in these forward-looking statements as a resultof certain factors, including the considerations described below and elsewhere in this Draft Letter of Offer.The financial and other implications of material impact of risks concerned, wherever quantifiable, havebeen disclosed in the risk factors mentioned below. However, there are certain risks where the impact isnot quantifiable and hence the same has not been disclosed in such risk factors.Materiality:The risk factors have been determined on the basis of their materiality. The following factors have beenconsidered for determining their materiality:1. Some events may not be material individually but may be found material collectively.2. Some events may have a material impact qualitatively instead of quantitatively.3. Some events may not be material at present but may have material impacts in the future.A. MATERIAL LITIGATIONS WHICH MAY IMPACT OUR BUSINESS AND/ORPROFITABILITY1. SEBI has issued a show cause notice dated September 11, 2009, under Sections 11, 11B and11(4) of the SEBI Act read with Regulation 11 of the SEBI (Prohibition of Fraudulent andUnfair Trade Practices relating to Securities Market) Regulations, 2003, against our Company,(“SEBI Show Cause Notice”). Any unfavourable outcome in connection with the SEBI ShowCause Notice may adversely affect our operations, financial condition and profitability.Pursuant to the SEBI Show Cause Notice, SEBI has alleged that our Company has violatedSection 77 of the Companies Act, 1956 the and Regulation 3(b), (c), (d) and 4(1) of SEBI(Prohibition of fraudulent and unfair trade practices relating to securities market) regulations 2003.SEBI has called upon our Company to show cause as to why action should not be taken againstour Company under Sections 11, 11B and 11(4) of the SEBI Act read with Regulation 11 of theSEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to Securities Market)Regulations, 2003. Our Company responded to the SEBI Show Cause Notice, vide its letter datedSeptember 24, 2009 and has applied to SEBI for passing consent orders in connection with theaforesaid matter, in terms of the SEBI Show Cause Notice and in accordance with the circulardated April 20, 2007 (Circular No. EFD/ED/Cir-1/2007) issued by SEBI. Further, anyunfavourable outcome in connection with the SEBI Show Cause Notice, inter-alia including anyadverse order issued by SEBI could adversely affect our operations, financial condition andprofitability. For further details please refer to the section entitled “Outstanding Litigations andOther Defaults” beginning on page 104 of this Draft Letter of Offer.2. Criminal Proceedings under the Prevention of Food Adulteration Act, 1954, have been initiatedagainst our Company and our Directors.xi

The Government of National <strong>Capital</strong> Territory of Delhi has initiated criminal proceedings (CaseNo. 82/PFA/DA/09) under the Prevention of Food Adulteration Act, 1954, against one Mr. SushilKumar, our Company, our Directors, Mr. Sandip Jhunjhunwala, Mr. Sanjay Jhunjhunwala, Dr.ING. N.K. Gupta, Mr. Asoke Chaterjee, and Mohit Enterprises, before the Hon’ble court of theAdditional Chief Metropolitan Magistrate, New Delhi, on alleged grounds that a sample of one ofthe products purchased by our Company from Mohit Enterprises for sale at the “6Ten” stores(prior to the scheme of arrangement for de-merger of our erstwhile retail undertaking becomingeffective), was found to be adulterated and misbranded by the Public Analyst pursuant to hisreport dated August 25, 2008. Our Company has filed an application to the Hon’ble court of theAdditional Chief Metropolitan Magistrate, New Delhi, seeking that a second counter part of theimpugned sample tested by the Public Analyst be sent to the Director, Central Food Laboratories,for analysis under Section 13(2) of the Prevention of Food Adulteration Act, 1954. Anyunfavourable outcome aforementioned proceedings could subject our officers and Directors tocriminal prosecution and also have a material adverse effect on the operations and profitability ofour Company, the value of which currently can not be quantified.3. A proceeding seeking winding up of our Company is pending final determination and disposalbefore the High Court at Calcutta.SRT Innovation Services Private <strong>Limited</strong> has filed a petition before the Hon’ble High Court atCalcutta, (“High Court”), (Company Petition No. 194 of 2009, under Sections 433, 434 and 439of the Act, seeking the High Court to direct our Company to be wound up, and an officialliquidator to be appointed in connection with our assets and properties. The aforenamed petitionerhas alleged that our Company is indebted to the petitioner for an alleged sum of Rs. 37,56,924/-pursuant to alleged services rendered by the petitioner to our Company. The petitioner has furtheralleged in his petition that our Company is not in a position to honour our liabilities owed to thepetitioner and accordingly, the petitioner has sought that our Company be wound up. Since theabove claim relates to our erstwhile retail undertaking which has been transferred to <strong>REI</strong> Six TenRetail <strong>Limited</strong> pursuant to a scheme of arrangement as approved by the Hon’ble High Court ofCalcutta, our Company has opposed the above petition. As on the date of this Draft Letter ofOffer, our Company has not received any intimation of filing a counter-statement from theaforenamed petitioner. Any unfavourable outcome of the aforementioned proceedings could havea material adverse effect on the operations and profitability of our Company, the value of whichcurrently can not be quantified.B. RISKS IN RELATION <strong>TO</strong> OUR COMPANY AND ITS ON GOING BUSINESSACTIVITIESRISKS INTERNAL <strong>TO</strong> <strong>THE</strong> BUSINESS AND OPERATIONS OF OUR COMPANY4. Our Company’s non compliance with documents executed with and/or in favour of our lenders,(“Financing Agreements”), would adversely affect our operations and financial condition.The Financing Agreements executed by our Company, contain various restrictive and/or financialcovenants and reporting requirements which if breached could also lead to defaults or crossdefaultsof the terms and conditions of the Financing Agreements. Such breaches/defaults/crossdefaultscould also adversely affect our operations and financial condition.A failure to observe the covenants under the Financing Arrangements or to obtain necessaryconsents thereunder may lead to the termination of credit facilities, the acceleration of all amountsdue under the relevant facilities and enforcement proceedings against the movable and immovableassets provided by our Company as security for repayment of the credit facilities. If ourCompany’s indebtedness is accelerated, our Company may not be able to repay its debt or borrowsufficient funds in a timely manner or at all, and/or at commercially favourable terms, which inxii

turn could affect our operations, financial condition and profitability. Further under the terms ofcertain Financing Agreements, the relevant lender entitled to change the constitution of our Board,inter-alia including appointment of new directors and/or removal of any existing Director of ourCompany, in the event of any default/cross-default thereunder. The enforcement of any remedyavailable to our lenders in the event of a default/cross-default, could adversely affect ouroperations, credit rating and financial condition.Our Company has failed to comply with certain provisions of the Financing Agreements executedwith Indian Renewable Energy Development Agency <strong>Limited</strong>, Industrial Development FinanceCompany <strong>Limited</strong> and ICICI Bank <strong>Limited</strong>. For further details please refer to the section entitled“Outstanding Litigations and Other Defaults” beginning at page 104 of this Draft Letter of Offer.These failures/breaches could adversely affect the operations, profitability and/or financialcondition of our Company.5. Our Promoters have pledged their Equity Shares as additional/collateral security under variousagreements executed with various lenders in connection with the credit facilities obtained fromthem. In the event of any default/cross default under the said agreements, the lenders mayenforce aforementioned pledges, which could result in a change in control of our Company.As per the disclosures made by our Promoters under the provisions of the Takeover Code inconnection with the details of the Equity Shares held by them, as on June 30, 2009 and July 27,2009 is approximately 33,751,530 Equity Shares, and 33,751,530 Equity Shares of our Companyrepresenting 11.68% and 10.58 %, respectively, of the paid-up equity share capital of ourCompany, held by our Promoters were pledged with banks and financial institutions. In the eventof any default/cross-default under the existing agreements executed in connection with the creditfacilities, the relevant lenders are entitled to seek to enforce the pledge on the Equity Shares heldby our Promoters and could sell such Equity Shares pledged to them in the open market. Suchenforcement of the pledge on the aforementioned Equity Shares could result in our Promoterslosing control of our Company. Any such change of control could significantly influence ourCompany’s business policies, operations and profitability.6. A change in consumption patterns of and the demand for Basmati rice would affect ourCompany’s operations and profitability.A significant portion of our Company’s revenues are generated from the sale of Basmati rice. Outof our total revenues of Rs 17,385.9 million for FY 2008 and Rs 24,520.9 million for FY 2009, thesale of Basmati rice accounted for 98.74% and 98.91% of the total revenue, respectively. OurCompany’s revenues and profitability are dependent upon the demand for Basmati rice in thedomestic and international markets. Any change in consumption patterns of Basmati rice or anyreduction in demand for Basmati rice processed by us could adversely affect our Company’soperations and profitability.7. Any fall in the price of Basmati rice could adversely affect our financial condition andprofitability.There is generally a considerably long period following the processing of the Basmati paddypurchased, before which the Basmati rice can actually be sold in the market. The quality ofBasmati rice after being processed improves with age. The price of Basmati rice would depend onthe quality and maturity of the Basmati rice. Currently, our Company has no means or methods ofhedging the price risk associated with our Basmati rice products. Accordingly, our Company maynot be able to recover its investment in the Basmati paddy if there is any fall in the price ofBasmati rice, which could adversely affect our profitability and financial condition.Further, the wholesale price of Basmati rice has a significant impact on our profitability. Basmatirice is subject to price fluctuations due to weather, natural disasters, domestic and foreign tradepolicies, shifts in supply and demand and other factors beyond our Company’s control. Thexiii

Basmati rice industry in India is highly fragmented and our ability to determine and control theprice of our Basmati rice products is limited. With the global food shortage in early 2008, Basmatirice prices increased from US$1,000 per metric tonne to almost US$2,000 per metric tonne in aspan of a few months. By mid June 2008, Basmati rice prices started to decrease and have sincesettled around US$1,200 to US$1,500 per metric tonne. Any prolonged decrease in Basmati riceprices could have a material adverse impact on our operations and profitability.8. The cultivation of Basmati paddy is seasonal in nature. Accordingly, our Company’s operationsand profitability could be adversely impacted if we are unable to obtain Basmati paddy in atimely manner or at all.The cultivation of Basmati paddy being seasonal in nature, the Basmati rice industry is dependenton the harvest of Basmati paddy, which occurs generally for only six months in the year (normallybetween the months of September to March every year). Although Basmati rice is not entirelydependent upon a successful monsoon, Basmati paddy production can be adversely effected by theconsistent failure of monsoons or by an epidemic or other similar factors. Further, farmerscurrently growing Basmati paddy, may shift their resources and efforts towards the cultivation ofother crops, resulting in a decline in Basmati paddy production. The aforementioned factors couldimpact the availability and current and future cost of Basmati paddy. The future growth of ourCompany‘s business is dependent upon its ability to procure quality Basmati paddy atcommercially viable prices. Our inability to procure desired quality of Basmati paddy, in a timelymanner or at all, and at competitive prices or our inability to pass an increase in the prices ofBasmati paddy on to our customers could adversely affect our operations and profitability.9. Our operations are subject to high working capital requirements. Our inability to obtain and/ormaintain sufficient cash flow, credit facilities and other sources of funding, in a timely manner,or at all, to meet our requirement of working capital or pay our debts, could adversely affect ouroperations, financial condition and profitability.Our operations require a substantial amount of working capital. We are required to obtain and/ormaintain adequate cash flows and funding facilities, from time to time, in order to, inter-alia,finance the purchase of Basmati paddy and other raw materials, upgrade and maintain ourmanufacturing and processing facilities. Basmati rice must be aged for 18 to 24 months from thetime the Basmati paddy is harvested to ensure most premium quality of the processed product. Assuch, our Company needs to maintain a sufficient stock of Basmati paddy and Basmati rice at alltimes , which leads to higher inventory holding costs and increased working capital requirements.Our aggregate working capital requirement for the FY 2009 and the FY 2008 was Rs. 31,804.2million and Rs. 24,622.2 million, respectively.Our Company’s working capital requirements are met principally by short-term debt availed frombanks and financial institutions and the issuance of equity and or debt securities pursuant toprivate or public offerings. Our inability to obtain and/or maintain sufficient cash flow, creditfacilities and other sources of funding, in a timely manner, or at all, to meet our requirement ofworking capital or pay our debts, could adversely affect our operations, financial condition andprofitability.10. Export duties or other export restrictions imposed by the Government of India could adverselyaffect our operations and profitability.During the FY 2008, the Government of India imposed an export duty of Rs. 8,000 per metrictonne on export of Basmati rice. Our Company paid an amount to Rs. 590.0 million of export dutyin FY 2008 which had adversely impacted the profitability of our exports and consequently hadaffected our profitability. While the export duty has since been lifted, any export duty or otherexport restrictions imposed by statutory and/or regulatory authorities in the future could adverselyaffect our operations and profitability.xiv

11. A significant portion of our export sales in the last Financial Year and the current FinancialYear are derived from certain customers from United Arab Emirates for which shipment wasmade to Iran.Since December, 2008, at the request of one of our customer in the United Arab Emirates, we havealso shipped Basmati rice to Iran. All the billings, however, for both the FY 2009 and the currentFinancial Year are conducted with the customer in the United Arab Emirates. In the FY 2009,Basmati rice shipped to Iran accounted for 17 % of our Company‘s total exports and 6.94% of ourCompany‘s total income. In the current Year, on a request of our customer(s) in the United ArabEmirates, for the period from April 1, 2009 to May 31, 2009, Basmati rice shipped to Iranaccounted for 19 % of our Company’s total exports and 3.96 % of our Company’s total income.We are required to ship our products to Iran, on orders placed by our customers in the United ArabEmirates. There can be no assurance that our Company would continue to procure orders forshipment of our products to Iran. Our failure to procure such orders and in sufficient quantities ina timely manner or at all in the future could adversely affect our profitability.12. Our Company’s business faces the prospect of increased competition if there is moreconsolidation in the fragmented Basmati rice sector which may reduce our Company’s marketshare and income.Increased consolidation and a more organised Basmati market could significantly increasecompetition to our Company and thereby reduce its market share and earnings.Basmati rice has historically been predominantly grown in the Indian states of Haryana, UttarPradesh, Uttaranchal and Punjab and in a part of the Punjab region located in Pakistan on accountof favourable climatic and geographic conditions required in connection with the agriculture ofBasmati rice. India’s Basmati rice production is significantly more than that of Pakistan. Thoughpresently Pakistani Basmati Rice generally does not compete directly with Indian Basmati Rice onaccount of its lower quality, our company may face increased competition from Pakistani BasmatiRice in future.13. Our Company relies on various agents for the procurement of sufficient Basmati paddy of thedesired quality for its production requirements. Any failure on the part of such agents toprocure Basmati paddy of desired quality and in sufficient quantities in a timely manner or atall may affect our operations and profitability.Our Company is dependent on agents traditionally called ‘pucca artiyas’ who are authorised by usto make purchases of raw material in local agricultural commodities markets called ‘mandis’.Inability on the part of such agents to procure the required quantities and/or the desired quality ofBasmati paddy, in a timely manner, or at all, could adversely affect our operations andprofitability. Further, our Company typically enters into oral agreements with such agents andaccordingly, we can not assure you that our Company would be able to enforce the obligations ofsuch agents under such oral agreements or be able to maintain these arrangements on substantiallythe same terms, if at all, which could have an adverse effect on our Company’s operations andprofitability.14. Our Company does not enter into any long term supply contracts with our Basmati ricecustomers.Our Company does not, as a matter of practice, enter into long-term supply contracts with ourcustomers for the sale of our Basmati rice products. Our Company carries on business with ourcustomers on the basis of purchase orders raised from time to time, and does not have any longtermcommitments from our customers to make purchases from our Company of our Basmati riceproducts. , There is no assurance that our Company will continue to receive purchase orders forxv

our Basmati rice products either on substantially the same terms or at all, which could have anadverse effect on our Company’s operations and profitability.15. Our operations and profitability is dependent upon the availability of timely transportation ofBasmati paddy and finished products.Our Company relies on a network of third party transporters for the transportation of Basmatipaddy to our processing facilities. Our Company purchases Basmati paddy from local marketsand suppliers deliver procured Basmati paddy to our Company. Our Company’s raw materials andfinished products are transported primarily in trucks to and from our Company’s processingfacilities. Failure to obtain adequate transportation facilities and in a timely manner or at all couldadversely affect our operations and profitability. Transportation strikes by members of variousIndian truckers’ unions have had in the past, and could again have in the future, an adverse affecton supplies and deliveries to and from our customers and suppliers. In addition, raw materials andproducts maybe lost or damaged in transit for various reasons including occurrence of accidents ornatural disasters. There may also be delay in delivery of raw materials and products which mayalso affect our business and results of operation negatively. An increase in the freight costs orunavailability of freight for transportation of products to export markets may have an adverseeffect on our business and results of operations.16. Our profitability may be adversely affected in the event any investments made by our Company,other than in connection with the business of processing Basmati rice, may not yield favourableresults.Our Company has and may continue to invest in businesses other than those in connection withthe business of processing Basmati rice and matters incidental thereto. The total investments madeby our Company as at March 31, 2009 aggregated to approximately 2.86% of the total assets ofour Company. We cannot assure that such investments made by us would yield desired results.Our Company from time to time invests in the equity securities of unlisted and listed companies.Our investment in such companies are subject to a number of significant risks that arise from thenature of their businesses. Further, our Company typically holds a minority shareholding in suchcompanies and consequently does not exercise control over the affairs of such companies. OurCompany’s investment in listed equity securities of companies are subject to fluctuations of themarket price of such securities and, therefore, a significant decline in the market price of suchequity securities could adversely affect our profitability. If our Company is unable to benefit fromthe synergies or efficiencies expected from these investments, or if such investments do not yielddesired results, our profitability may be adversely affected.17. Our inability to procure and/or maintain adequate insurance cover in connection with ourprocessing facilities and other assets may adversely affect our operations and profitability.Our operations in connection with Basmati rice business are subject to inherent risks, such asburglary and house break-ins, defects, malfunctions and failures of equipment, fire and naturaldisasters. Our insurance may not be adequate to completely cover any or all our liabilities. Further,there is no assurance that the insurance premiums payable by us will be commercially justifiable.Our inability to procure and/or maintain adequate insurance cover in connection with our business/assets may adversely affect our operations and profitability.18. Any prolonged business interruption at our manufacturing facilities could have a materialadverse effect on our business.Irregular or interrupted supply of power or water, electricity shortages or government intervention,particularly in the form of power rationing are factors that could adversely affect our operations.xvi

If there is an insufficient supply of electricity or water to satisfy our requirements or a significantincrease in electricity prices, we may need to limit or delay our production, which could adverselyaffect our business, financial condition and results of operations. There is no assurance that wewill always have access to sufficient supplies of electricity in the future to accommodate ourproduction requirements and planned growth.19. Our success significantly depends on our management and operational teams and other skilledprofessionals. If we fail to retain, motivate and/or attract such personnel, our business may beunable to grow and our revenues could decline, which may decrease the value of our EquityShares.We are dependent on the senior members of our management and operational team for ourcontinued success and growth. Our ability to procure orders and to obtain new clients depends inlarge part on our ability to attract, train, motivate and retain highly skilled professionals. If wecannot hire and retain the qualified personnel, our ability to continue to expand may be impairedand our revenues could decline. Further, we may not be able to redeploy and retrain our employeesto keep pace with continuing changes, evolving standards and changing client preferences.20. An inability to manage our Company’s growth could disrupt its business, results of operationsand financial condition.Our Company has experienced significant growth in terms of production, income, and expandingits customer base. In the FY 1999, our Company’s Basmati rice production was 27,499 metrictones generating a total income of Rs. 827.6 million. By FY 2009, our Company’s Basmati riceproduction increased to 4,29,889 metric tonnes, with total income of Rs. 24,520.9 million. OurCompany also plans to penetrate new markets and increase its export sales. Our Company’scontinued growth places significant demands on our management and resources. In the event thatwe decide to implement any expansion strategies in the future, there can be no assurance that ourCompany will be able to execute such expansion strategies in a timely manner or at all. Anyfailure to do so could adversely affect our operations and profitability.21. We may be affected by labour strikes or other disruptions in connection with labor that couldadversely affect our operations, profitability and financial condition.There can be no assurance that we will not experience labour unrest in the future, which may delayor disrupt our operations. If work stoppages, work slow-downs or lockouts at our facilities occuror continue for a prolonged period of time, our results of operations and financial condition couldbe adverse affected.22. We are exposed to foreign exchange fluctuations and other exchange control risks.We have material exposure to foreign exchange related risks since a portion of our revenueearnings and expenses are in foreign currencies. Approximately, 18.40% and 41.20% of our totalsales for FY 2008 and FY 2009 were in foreign currency. Approximately 6.58% and 0.49 % ofour total assets were in foreign currencies for FY 2009 and FY 2008, respectively andapproximately 1.82% and 3.24% of our liabilities were in foreign currency, for FY 2009 and FY2008, respectively. Any appreciation or depreciation of the Indian Rupee against these currenciescan impact the profitability of the business. Translation differences arising out of conversion ofthese assets into Indian Rupees can also impact the profitability for that period. We may from timeto time be required to make provisions for foreign exchange fluctuation in accordance withaccounting standards.Devaluation or depreciation of the Rupee against other currencies may increase the cost of ourborrowings and repayment of indebtedness and reduce our net income. Further, we havexvii

• failure by our Company to fulfill our obligations under any of the Power PurchaseAgreements or obtaining and maintaining relevant permissions/approvals/certifications and/orconsents for operating our wind energy turbines and in connection with the generation ofwind energy;• inadequate wind velocity to generate power; or• failure of the corporate entity leasing the Gujarat wind power project in paying its leasecharges; or• failure on our part to operate and maintain our wind turbines in a cost effective manner26. If we are unable to obtain the necessary funds for our growth plans, our business andoperations will be adversely affected.Our funding requirements for expanding our operations are substantial, and our ability to financethese plans is subject to a number of risks, contingencies and other factors, some of which arebeyond our control, including general economic and capital markets conditions and our ability toobtain financing on acceptable terms.There can be no assurance that debt or equity financing or our internal accruals will be available orsufficient to meet the funding of our growth plans.Our ability to obtain required capital on acceptable terms is subject to a variety of uncertainties,including:• limitations on our ability to incur additional debt, including as a result of prospective lenders’evaluations of our creditworthiness and pursuant to restrictions on incurrence of debt in ourexisting and anticipated credit facilities;• investors' and lenders' perception of, and demand for, debt and equity securities of Basmatirice processing companies, wind farms, as well as the offerings of competing financing andinvestment opportunities in India by our competitors;• whether it is necessary to provide credit support or other assurances from our Promoter onterms and conditions and in amounts that are commercially acceptable to them;• limitations on our ability to raise capital in the capital markets and conditions of the Indian,U.S. and other capital markets in which we may seek to raise funds; and• our future results of operations, financial condition and cash flows.Any inability to raise sufficient capital to fund our growth plans could have a material adverseeffect on our business and results of operations. For details, please refer to the section entitled“Objects of the Issue” beginning on page 30 of this Draft Letter of Offer.27. We have contingent liabilities of Rs. 8.4 million as at March 31, 2009As on March 31, 2009, the contingent liabilities of our Company are as under:xix

35. Our Company’s ability to raise foreign capital may be constrained by Indian law.As an Indian company, our Company is subject to exchange controls that regulate borrowing inforeign currencies. Such regulatory restrictions limit our Company’s financing sources and hencecould constrain its ability to obtain financing on competitive terms and refinance existingindebtedness. In addition, our Company cannot assure you that the required approvals will begranted to it without onerous conditions, if at all. Limitations on raising foreign debt may have anadverse effect on our Company’s business growth, financial condition and results of operations.36. Shareholders will bear the risk of fluctuations in the price of our Equity Shares.The price of our Equity Shares on the Indian stock exchanges may fluctuate after this offering as aresult of several factors, including: volatility in the Indian and global securities market; operationsand performance of our Company; performance of our competitors; adverse media reports on ourCompany; changes in the estimates of our Company’s performance or recommendations byfinancial analysts; significant developments in India’s economic liberalization and deregulationpolicies; and significant developments in India’s fiscal and environmental regulations. There canbe no assurance that the prices at which our Equity Shares are initially traded will correspond tothe prices at which our Equity Shares will trade in the market subsequently.37. There are restrictions on daily movements in the price of our Equity Shares, which mayadversely affect a shareholder’s ability to sell, or the price at which it can sell Equity Shares at aparticular point in timeOur Company is subject to a daily circuit breaker imposed by all stock exchanges in India whichdoes not allow transactions beyond certain volatility in the price of our Equity Shares. This circuitbreaker operates independently of the index-based market-wide circuit breakers generally imposedby SEBI on Indian Stock Exchanges. The percentage limits on our Company’s circuit breakers areset by the BSE and the NSE. The BSE and the NSE does not inform our Company of thepercentage limit of such circuit breakers and may change it without our Company’s knowledge.This circuit breaker effectively limits the upward and downward movements in the price of ourEquity Shares. As a result of this circuit breaker, there can be no assurance regarding the ability ofour Company’s Equity Shareholders to sell our Equity Shares or the price at which shareholdersmay be able to sell their Equity Shares at a particular point in time.38. Fluctuation in the exchange rate between the Rupee and any other currency could have amaterial adverse effect on the value of our Equity Shares, independent of our Company’soperating results.Our Equity Shares are quoted in Rupees on the BSE and the NSE. Any dividends in respect of ourEquity Shares will be paid in Rupees and may subsequently be converted into other currencies forrepatriation to any non-resident Shareholder. Any adverse movement in exchange rates during thetime it takes to undertake such conversion may reduce the net dividend to investors. In addition,any adverse movement in exchange rates during a delay in repatriating outside India the proceedsfrom a sale of Equity Shares, for example, because of a delay in regulatory approvals that may berequired for the sale of Equity Shares may reduce the net proceeds received by shareholders.Further any fluctuations in the exchange rates between the Rupee and any other currency mayadversely affect the value of our Equity Shares.xxii

39. Future issuances or sales of our Equity Shares could significantly affect the trading price ofour Equity Shares, and may dilute your shareholding in our Company.The future issuances of Equity Shares by our Company or the disposal of Equity Shares by any ofthe major shareholders of our Company or the perception that such issuance or sales may occurmay significantly affect the trading price of our Equity Shares. Further, any issuance of any EquityShares pursuant to the conversion or exchange of securities of our Company, or otherwise, maydilute your shareholding in our Company.There can be no assurance that our Company will not issue further Equity Shares or that ourPromoters will not dispose of, pledge or otherwise encumber their Equity Shares.40. Foreign investors are subject to foreign investment restrictions under Indian law that limit ourCompany’s ability to attract foreign investors, which may adversely impact the market price ofour Equity Shares.Under the foreign exchange regulations currently in force in India, transfers of Equity Sharesbetween non-residents and residents are freely permitted (subject to certain restrictions) if theycomply with the pricing guidelines and reporting requirements specified by the RBI. If the transferof Equity Shares, which are sought to be transferred is not in compliance with such pricingguidelines or reporting requirements or falls under any of the exceptions referred to above, thenthe prior approval of the RBI will be required. Additionally, shareholders who seek to convert theRupee proceeds from a sale of Equity Shares in India into foreign currency and repatriate thatforeign currency from India will require a no objection/ tax clearance certificate from the incometax authority. Our Company cannot assure investors that any required approval from the RBI orany other statutory and/or regulatory authority or agency can be obtained on any particular termsor at all.C. RISKS IN CONNECTION WITH <strong>THE</strong> <strong>ISSUE</strong> AND <strong>THE</strong> OBJECTS OF <strong>THE</strong> <strong>ISSUE</strong>41. The requirement and proposed utilisation of proceeds of the Issue have not been appraised byany bank, financial institution or other independent agency.The fund requirement and utilisation of the proceeds of the Issue as specified in the sectionentitled “Objects of the Issue” beginning on page 30 of this Draft Letter of Offer are based oninternal management estimates and has not been appraised by any bank, financial institution orother independent agency. The actual operations may be different from management estimates andour Company may not be able to deploy funds as planned. Accordingly, the management will havesignificant flexibility in applying the proceeds received by us from the Issue. This may affect ourresults of operation. For details please refer to the section entitled “Objects of the Issue” beginningon page 30 of this Draft Letter of Offer.42. Our inability to obtain consents/no-objections from our lenders for an enhanced issue size, in atimely manner or at all could adversely affect the Issue, our operations and financialconditions.Our Company is required to obtain prior no-objection/consents from some of theinstitutions/banks who have lent money/sanctioned loans to our Company. Our Company hasobtained no-objection/consents from the relevant lenders in connection with the Issue. However,some of these no objection/consents are subject to a maximum issue size of Rs. 7,500 million. Wehave reapplied to the aforesaid lenders for obtaining a no-objection/consent for raising more thanRs. 7,500 million pursuant to the Issue, (“NOCs for Enhanced Limits”) in light of our estimatedrequirement of funds and the proposed objects of the Issue. We are awaiting receipt of such NOCsfor Enhanced Limits. Our inability to obtain such NOCs for Enhanced Limits in a timely manneror at all, may adversely affect our operations, financial condition and our ability to raise sufficientxxiii

funds for the purposes as stated in the section entitled “Objects of the Issue” beginning on page 30of this Draft Letter of Offer.43. There is no guarantee that the Rights Equity Shares issued pursuant to the Issue will be listedon the BSE and the NSE in a timely manner or at all.In accordance with Indian law and practice, permission for listing and trading of the Rights EquityShares issued pursuant to the Issue will not be granted until after such Rights Equity Shares havebeen issued and allotted. Such approval will require all other relevant documents authorising theissuing of Rights Equity Shares to be submitted. There could be a failure or delay in listing theRights Equity Shares on the BSE and the NSE. Any failure or delay in obtaining the approvalwould restrict your ability to dispose of your Rights Equity Shares. Further, historical tradingprices, therefore, may not be indicative of the prices at which the Rights Equity Shares will tradein the future.44. Investors choosing Payment Method 1 in the Issue are exposed to certain risks.The Issue Price of our Rights Equity Shares is Rs. [●] per Rights Equity Share. The Investors havethe option, to pay 100% of the Issue Price on application or pay [●] % of the Issue Price onapplication, and the balance [●]%of the Issue Price on the First and Final Call. The partly paid-upRights Equity Shares offered under the Issue will be traded under separate ISINs for the period asmay be applicable prior to the record date for the First and Final Call. An active market for tradingmay not develop for the partly paid-up Rights Equity Shares and, therefore, the trading price of thepartly paid-up Rights Equity Shares (for Investors who opt for Payment Method 1) may be subjectto greater volatility than our fully-paid Rights Equity Shares. Further, Investors in this Issue willbe required to pay the money due on the First and Final Call even if, at that time, the market priceof our Rights Equity Shares is less than the Issue Price. If the Investor fails to pay the balanceamount due with any interest that may have accrued thereon after notice has been delivered by ourCompany, then any of our Rights Equity Shares in respect of which such notice has been givenmay, at any time thereafter, before payment of the call money and interest and expenses due inrespect thereof, be forfeited by a resolution of our Board to that effect. Such forfeiture shallinclude all dividends declared in respect of such forfeited Rights Equity Shares and actually paidbefore such forfeiture.45. The offer, issuance and allotment of Rights Equity Shares, including any unsubscribed and/orrenounced Rights Equity Shares would be subject to our Company obtaining appropriateclarifications/approval from the RBI in connection with (a) the offer, issuance and allotment ofunsubscribed and/or renounced Rights Equity Shares to Non Residents, and (b) the issuanceand allotment of partly-paid up Rights Equity Shares to Non Residents.Pursuant to a letter dated September 29, 2009 our Company has sought a clarification/ approvalfrom the RBI in connection with (a) the offer, issuance and allotment of Rights Equity Shareswhich remain unsubscribed and/or are renounced by the Eligible Equity Shareholders, to NonResidents, and, (b) the issuance and allotment of Rights Equity Shares carrying an option toreceive payments in relation to the Rights Equity Shares, through multiple calls under PaymentMethod 1. Accordingly, the offer, issuance and allotment of Rights Equity Shares which remainunsubscribed and/or are renounced by the Eligible Equity Shareholders, to Non Residents, will besubject to our Company obtaining the aforesaid clarification/approval from the RBI in this regardprior to the date of the Final Letter of Offer. Further, Non Residents can opt for subscription ofRights Equity Shares under Payment Method 1 only if our Company has obtained theaforementioned clarification/approval from the RBI in connection with the issuance and allotmentof partly-paid up Rights Equity Shares to Non Residents prior to the date of the Letter of Offer tobe filed with the Designated Stock Exchange.xxiv

46. Persons resident outside India subscribing to the Rights Equity Shares offered pursuant to theIssue are subject to risks in connection with (i) exchange control regulations, and, (ii)fluctuations in foreign exchange rates.Various statutory and regulatory requirements and restrictions apply in connection with the EquityShares including Rights Equity Shares held by persons resident outside India, (“ExchangeControl Regulations”). Amounts payable to persons resident outside India holding the EquityShares, on dividend paid/payable in connection with such Equity Shares would accordingly besubject to prevailing Exchange Control Regulations. Any change in the Exchange ControlRegulations may adversely affect the ability of such persons resident outside India to convert suchamounts into other currencies, in a timely manner or at all. Further, fluctuations in the exchangerates between the Indian rupee and other currencies could adversely affect the amounts realized bypersons resident outside India on payment of dividend on the Equity Shares held by them.47. Our Board of Directors shall have the discretion to allot Rights Equity Shares to persons whoare not Eligible Equity Shareholders if the Issue is under-subscribed.After taking into account allotment to be made to Eligible Equity Shareholders in accordance withthe terms of this Draft Letter of Offer if there is any unsubscribed portion in the Issue, anyadditional Rights Equity Shares shall be disposed off by the Board, in such manner as they thinkmost beneficial to our Company and the decision of the Board in this regard shall be final andbinding. For further details please refer to “Basis of Allotment - Terms of the Issue” beginning onpage 133 of this Draft Letter of Offer.48. The Underwriters to the Issue may not be able to honor their underwriting commitments.Our Company is currently contemplating entering into an Underwriting Agreement with theUnderwriters for underwriting the Rights Equity Shares offered through this Issue upto anaggregate amount of Rs [●] million. Although our Company shall ensure that the Underwritersappointed shall have sufficient resources to enable them to discharge their underwritingobligations in full, there can be no assurance that the Underwriters to the Issue will be able to fulfiltheir entire underwriting obligations in connection with the Issue.Prominent Notes• Our net worth was Rs. 6,022.3 million, as per the audited financial statements of our Company asat March 31, 2009 disclosed in the section titled “Financial Statements” beginning on page 69 ofthis Draft Letter of Offer.• For details of transactions between our Company and our Group Entities in the last one yearpreceding the date of filing this Draft Letter of Offer with SEBI please refer to the section entitled“Financial Statements” beginning on page 69 of this Draft Letter of Offer.• There are no financing arrangements whereby our Promoter Group, the Directors of companiesforming a part of our Promoters, our Directors and their relatives, (“Financier”), have financedthe purchase by any other person of securities of our Company other than in the normal course ofthe business of the Financier during the period of six months immediately preceding the date offiling this Draft Letter of Offer with SEBI.• All information shall be made available by the Lead Managers and our Company to the existingshareholders of the company and no selective or additional information would be available only toa section of the investors in any manner whatsoever.• The lead manager and our Company shall update this Draft Letter of Offer and keep theshareholders and the public informed of any material changes till the listing and tradingxxv

commencement, and our Company shall continue to make all material disclosures as per the termsof the listing agreement.• Investors may contact Compliance Officer or the Lead Managers for any complaints pertaining tothe Issue.xxvi

SECTION III – INTRODUCTIONSUMMARY OF FINANCIAL AND OPERATIONAL INFORMATIONThe following table set forth below indicates a summary of the financial information derived from outstandalone financial statements as of and for FY 2009. Our Financial Statements have been prepared inaccordance with the Indian GAAP and are presented in the section titled “Financial Statements” beginningon page 69 of this Draft Letter of Offer. The summary financial information presented below should beread in conjunction with the financial statements and the notes thereto.A. ASSETS AND LIABILITIES AS AT MARCH 31, 2008 AND MARCH 31, 2009Rs. in millionsParticularsAs at March31, 2008As at March31, 2009A FIXED ASSETSGross Block 4,196.13 4,261.29Less: Depreciation 568.98 774.70Net Block 3,627.15 3,486.59Less: Revaluation Reserve - -Net Block after adjustment for Revaluation Reserve 3,627.15 3,486.59<strong>Capital</strong> Work in Progress 236.54 269.83Total Fixed Assets (A) 3,863.69 3,756.42B INVESTMENT (B) 1,037.93 1,107.93C CURRENT ASSETS, LOANS AND ADVANCESInventories 16,522.75 23,100.80Sundry Debtors 4,490.74 5,891.62Cash and Bank Balance 125.34 178.52Loans and Advances 4,205.12 4,680.39Total (C) 25,343.95 33,851.33D LIABILITIES AND PROVISIONSSecured Loans 20,361.99 24,498.37Unsecured Loans 2,798.40 5,250.00Current Liabilities 411.28 1,649.34Provisions 310.51 397.83Deferred Tax Liabilities 910.59 897.89Total (D) 24,792.77 32,693.43E NET WORTH (A+B+C-D) 5,452.80 6,022.25F REPRESENTED BYA Share <strong>Capital</strong> 689.03 689.03Share Application MoneyReserve & Surplus~ Securities Premium 1,989.58 2,002.28~ General Reserve 2,600.00 3,300.00~ Surplus 174.19 30.94Less : Revaluation Reserve - -B NET RESERVE & SURPLUS (Net of Revaluation Reserve) 4,763.77 5,333.22C Miscellaneous Expenditure - -NET WORTH (A+B-C) 5,452.80 6,022.251

B. STATEMENT OF PROFIT AND LOSS AS AT MARCH 31, 2008 AND MARCH 31, 2009Rs. in millionsParticularsYear EndedMarch 31,2008Year EndedMarch 31,2009INCOMESALESOf Product manufactured by the Company 17,350.12 21,235.18Of Product traded by the Company - 3,247.09Increase / (Decrease) in Stock 874.20 1,830.64Other Income 35.78 38.61Total 18,260.10 26,351.52EXPENDITURERaw Material Consumed 13,821.36 19,780.24Manufacturing Expenses 461.04 577.66Personnel Expenses 118.89 127.73Other Operating Expenses 652.97 1,371.53Excise Duty - -Misc. and Deferred Revenue Exp. W/off - -Total 15,054.26 21,857.16Profit before Interest, Depreciation and Tax 3,205.84 4,494.36Depreciation 199.07 212.86Profit before Interest and Tax 3,006.77 4,281.50Interest and Finance Charges 1,773.73 3,328.32Loss on Sale of Investment / Asset 0.06 -Net Profit Before tax and extra ordinary Items 1,232.98 953.18Provision for TaxationCurrent Tax~ Income Tax 200.00 336.00~ Fringe Benefit Tax 0.95 0.80Tax for Earlier Years 1.50 7.10Deferred Tax - -Net Profit After Tax and before extra ordinary items 1,030.53 609.28Proposed Dividend & Tax Thereon & Depreciation WrittenBack 103.26 52.53Prior Period ItemExtra ordinary ItemNet Profit after Tax after adjusting prior period item and Extraordinary Item 927.27 556.75Note :The Hon’ble Kolkata High Court vide its order dated 20 .06.2007 has allowed the company toutilize the Securities Premium Account towards meeting Deferred Tax Liability / Assets computedas per the Accounting Standard (AS-22) “ Accounting of Taxes on Income” prescribed by TheICAI. Accordingly the Securities Premium Account has been utilized towards adjustment ofDeferred Tax thereafter from the Financial Year 2006-2007.2

C. CASH FLOW STATEMENT ANNEXED <strong>TO</strong> <strong>THE</strong> BALANCE SHEET AS AT MARCH 31,2008 AND MARCH 31, 2009As at March 31,2008Rs. in millionsAs at March 31,2009CASH FLOW FROM OPERATING ACTIVITIESNet Profit Before Tax and Extraordinary Items 1,232.99 953.18Adjustments for:Depreciation 199.07 212.86Other Income (2.83) (4.58)Loss on Sale of Assets 0.06 -Interest Paid 1,773.73 3,328.32Operating Profits before Working <strong>Capital</strong> Changes 3,203.03 4,489.79Adjustments For:Inventories (7,308.07) (6,578.04)Trade & Other Receivables 2.87 (1,400.88)Loan and Advance (2,937.32) (372.40)Trade and other Payable 32.23 1,240.25Cash Generated From Operations (7,007.26) (2,621.29)Income Tax Paid (201.70) (310.92)Cash Flow Before Extraordinary Items (7,208.96) (2,932.21)Extraordinary items (Prior Year Adjustments) -Net Cash From Operating Activities (A) (7,208.96) (2,932.21)CASH FLOW FROM INVESTING ACTIVITIES<strong>Capital</strong> Work in Progress 401.16 (33.28)Sale / ( Purchase ) of Fixed Assets (915.93) (72.30)Sale / (Purchase) of Investment (1,032.10) (70.00)Other Income 2.83 4.58Deferred Revenue ExpenditureNet Cash used for Investing Activities (B) (1,544.04) (171.01)CASH FLOW FROM FINANCING ACTIVITIESNet Proceeds / Repayments of long term loans 10,640.45 6,587.97Interest Paid (1,773.73) (3,328.32)Dividend including Dividend tax (18.72) (103.26)Net Cash from Financing Activities (C) 8,848.00 3,156.39Net Increase in Cash and Cash Equivalents (A+B+C) 95.00 53.18Cash and Cash Equivalents at beginning of the Year 46.30 125.34Less : Transferred to resulting Co. on account of Demerger 15.96 -Cash and Cash Equivalents at end of the Year 125.34 178.523

<strong>THE</strong> <strong>ISSUE</strong>The Board of Directors of our Company has pursuant to a resolution passed at their meeting held onSeptember 9, 2009, authorised this offer of Rights Equity Shares on a rights basis.The following is a summary of the Issue. This summary should be read in conjunction with, and is qualifiedin it’s entirely by, more detailed information in the chapter titled “Terms of the Issue” beginning on page121 of this Draft Letter of Offer.Rights Equity Shares beingoffered by our CompanyRights Entitlement for RightsEquity SharesRecord DateFace Value per Rights EquitySharesIssue Price per Rights EquityShareEquity Shares outstandingprior to the IssueEquity Shares outstanding afterto the IssueTerms of the Issue[●] Rights Equity Shares[●] Rights Equity Shares for every [●] Equity Shares held on theRecord Date[●]Re. 1Rs. [●] at a premium of Rs. [●] per Rights Equity Share318,975,920 Equity Shares[●] Equity SharesFor more information, please refer to the section entitled “Terms ofthe Issue” beginning on page 121 of this Draft Letter of Offer.Payment terms 1The payment terms available to the Investors are as follows:Amount payable per Rights Payment Method 1 2 Payment Method 2Equity Share (Rs.)Face Value Premium Total Face Value Premium Total (Rs.)(Re.) (Rs.)(Re.) (Rs.)On Application [●] [●] [●] 1.00 [●] [●]First and Final [●] [●] [●] - - -Call 3Total 1.00 [●] [●] 1.00 [●] [●]The investors shall be required to make the balance payment towards the First and Final Call by the duedate which shall be separately notified by our Company.1 No applicant can select both payment methods. For details on the payments methods see the sectionentitled “Terms of the Issue” beginning on page 121 of this Draft Letter of Offer.2Non Residents can opt for subscription of Rights Equity Shares under Payment Method 1 only if ourCompany has obtained a clarification/approval from the RBI in connection with the issuance and allotmentof partly-paid up Rights Equity Shares to Non Residents prior to the date of the Letter of Offer to be filedwith the Designated Stock Exchange. For further details please refer to risk factors no. 44 and 45 asdetailed in the section entitled “Risk Factors” beginning on page xi of this Draft Letter of Offer.3Since our Company will be appointing a monitoring agency in terms of Regulation 16 of the SEBIRegulations, our Company is not required to call the outstanding subscription monies within 12 months4

from the date of allotment of the Rights Equity Shares pursuant to this Issue. The call shall be structured insuch a manner that the entire call money is called and will be payable within 24 months from the date ofallotment of Rights Equity Shares in this Issue. If the Investors fail to pay the call money within 24 months,the application money already paid shall be forfeited.The Investors should indicate the manner of payment, i.e., Payment Method 1 or Payment Method 2in the CAF. No Investor can select both payment methods in a CAF. In case no payment method isselected, then the default payment method shall be Payment Method 2.Payment Method 11. Non Residents can opt for subscription of Rights Equity Shares under Payment Method 1 only ifour Company has obtained a clarification/approval from the RBI in connection with the issuanceand allotment of partly-paid up Rights Equity Shares to Non Residents prior to the date of theLetter of Offer to be filed with the Designated Stock Exchange. All other Investors/categories ofInvestors can opt for this method.2. While making an application, the Investor shall make a payment of Rs. [●] per Rights EquityShare.3. Out of the amount of Rs. [●] paid on application, Rs. [●] would be adjusted towards the face valueof the Rights Equity Shares and Rs. [●] shall be adjusted towards the share premium of the RightsEquity Shares. Out of the amount of Rs. [●] paid on the First and Final Call, Rs. [●] would beadjusted towards the face value of the Rights Equity Shares and Rs. [●] shall be adjusted towardsthe share premium of the Rights Equity Shares.4. Notices for the payment of call money for the First and Final Call shall be sent by our Company tothe Eligible Equity Shareholders of the partly paid-up Shares on the record dates fixed for therespective call. The calls shall be structured in such a manner that the entire call money is calledand will be payable within 24 months from the date of allotment of Rights Equity Shares in thisIssue. If the investors fail to pay the call money within 24 months, the application money alreadypaid shall be forfeited.5. The Rights Equity Shares in respect of which the balance amount payable remains unpaid shall beforfeited, at any time after the due date for payment of the balance amount due.6. Our Company reserves the right to adjust the amount received over and above the Applicationmoney towards the call money if such adjustment makes the total Rights Equity Shares allotted byour Company is fully paid up Rights Equity Shares.Payment Method 21. Investors under all categories can opt for this method.2. Investors shall have to make full payment of the Issue Price of Rs. [●] per Rights Equity Share atthe time of making an application.For further details, please refer to “Terms of the Issue” beginning on page 121 of this Draft Letter of Offer.5

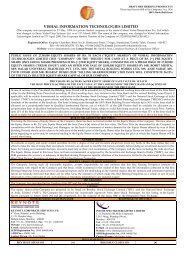

GENERAL INFORMATIONDear Eligible Equity Shareholder(s),Pursuant to the resolution passed by the Board of Directors of our Company at its meeting held onSeptember 9, 2009 it has been decided to make the following offer to the Eligible Equity Shareholders ofour Company, with a right to renounce:<strong>ISSUE</strong> OF [●] RIGHTS EQUITY SHARES OF RE. 1 EACH FOR CASH AT A PREMIUM OF RS.[●] PER RIGHTS EQUITY SHARE AGGREGATING <strong>TO</strong> AN AMOUNT UP<strong>TO</strong> RS. 11,500MILLION <strong>TO</strong> <strong>THE</strong> ELIGIBLE EQUITY SHAREHOLDERS ON RIGHTS BASIS IN <strong>THE</strong> RATIOOF [●] RIGHTS EQUITY SHARES FOR EVERY [●] EQUITY SHARES HELD ON <strong>THE</strong>RECORD DATE i.e. [●] (<strong>THE</strong> “<strong>ISSUE</strong>”). <strong>THE</strong> <strong>ISSUE</strong> PRICE OF EACH RIGHTS EQUITYSHARE IS [●] TIMES <strong>THE</strong> FACE VALUE OF EACH RIGHTS EQUITY SHARE.For details in payment methods please refer to “Terms of the Issue” beginning on page 121 of this DraftLetter of Offer.Registered Office of our Company<strong>REI</strong> <strong>Agro</strong> <strong>Limited</strong>46C Chowringhee Road,Room No. 15B,Everest House,Kolkata-700 0071,West Bengal, India.Telephone: +91 11 3290 6030Fax: +91 11 2955 2403Website: www.reiagro.comEmail: mandan@reiagro.comCorporate Office of our Company58A/1, Sainik Farm,New Delhi 110 062,IndiaRegistration No. : 21-104573Corporate Identity No.: L14200WB1994PLC104573Address of the RoCNizam Palace2 nd MSO Building, 2 nd Floor,234/4, A.J.C. Bose RoadKolkata - 700020The Equity Shares of our Company are listed on the Stock Exchanges, namely the BSE and the NSE. TheGDRs of our Company are listed on the London Stock Exchange.6

Board of DirectorsNameMr. Sanjay JhunjhunwalaMr. Sandip JhunjhunwalaDr. ING Narpinder Kumar GuptaMr. Asoke ChatterjeeMr. Krishna Dayal GhoshCategory/DesignationChairmanVice Chairman and Managing DirectorNon- Executive Independent DirectorNon- Executive Independent DirectorNon- Executive Independent DirectorFor further details of our Directors, please refer to the section entitled “Our Management” beginning onpage 64 of this Draft Letter of Offer.Company Secretary and Compliance OfficerMr. Mandan Mishra58A/1, Sainik Farm,New Delhi 110 062,IndiaTelephone: +91 11 3290 6030Fax: +91 11 2955 2403Website: www. reiagro.comEmail: mandan@reiagro.comLead Managers to the Issue:SBI <strong>Capital</strong> Markets <strong>Limited</strong>202, Maker Tower ‘E’,Cuffe Parade,Mumbai – 400 005Tel: +91 22 2217 8300Fax: +91 22 2218 6367Email: project.agro@sbicaps.comInvestor grievance email:investor.relations@sbicaps.comWebsite: www.sbicaps.comContact Person: Ritwik MohapatraSEBI Registration No.: INM000003531Fortune Financial Services (India) <strong>Limited</strong>K. K. Chambers2nd Floor, Sir P. T. Marg,Fort, Mumbai 400001Tel: +91 22 2207 7931Fax: +91 22 2207 2948Email: project.agro@ffsil.comInvestor grievance email: invrelation@ffsil.comWebsite: www.ffsil.comContact Person: Mr. Vinay Rane/ Mr. Chintan HefaSEBI Registration No.: INM000000529Axis Bank <strong>Limited</strong>Central Office: 111Maker Tower ‘F’, Cuffe Parade, Mumbai 400 005Tel: +91 22 6707 4407;Fax: +91 22 2216 2467/6707 1264Email: project.agro@axisbank.comInvestor grievance email: axbmbd@axisbank.comWebsite: www.axisbank.comContact Person: Ms. Sonica AgarwalSEBI Registration No.: INM000006104<strong>IDBI</strong> <strong>Capital</strong> Market Services <strong>Limited</strong>5th Floor, Mafatlal CentreNariman Point,Mumbai - 400 021Tel: +91 22 4322 1212Fax: +91 22 2283 8782Email:project.agro@idbicapital.comInvestor grievance email:redressal@idbicapital.comWebsite: www.idbicapital.comContact Person: Ms. Navdeep Kaur / Mr. SubodhMallyaSEBI Registration No.: INM0000108667

Bankers of the Issue:[●]Legal Advisor to the IssueJ Sagar AssociatesVakils House,18, Sprott RoadBallard EstateMumbai- 400 001Tel: +91 22 6656 1500Fax: +91 22 6656 1515Contact Person: Mr. Avik Sen GuptaAuditors of our CompanyP.K. Lilha & Co., Chartered Accountants5 and 6, Pannalal Banerjee Lane,(Fancy Lane) 5th Floor,Kolkata — 700 001,West Bengal, IndiaTel: +91 33 22109201/22484439Fax: +91 33 22485858Email: pklilha@yahoo.co.inContact Person: Mr P.K. LilhaICAI Registration No: 11092Registrar to the IssueMaheshwari Datamatics Private <strong>Limited</strong>6, Mangoe Lane, Kolkata – 700 001, IndiaTel: + 91 33 22482248/22435029;Fax: +91 33 2248 4787;Email: mdpl@cal.vsnl.net.inContact Person: Mr. S. Rajagopalan;SEBI Registration No.: INR 000000353Note: Investors are advised to contact the Registrar to the Issue/Compliance Officer in case of any pre-Issue/post-Issue related problems such as non-receipt of the Letter of Offer/abridged letter ofoffer/CAF/allotment advice/share certificate(s)/refund orders.Inter-se Allocation of Responsibilities between the Lead ManagersThe responsibilities and co-ordination roles for various activities in this Issue have been distributedbetween SBI <strong>Capital</strong> Markets <strong>Limited</strong>, (“SBICAPS”), Axis Bank <strong>Limited</strong>, (“AXIS”), Fortune FinancialServices (India) <strong>Limited</strong>, (“FFSIL ”), and <strong>IDBI</strong> <strong>Capital</strong> Market Services <strong>Limited</strong>, (“<strong>IDBI</strong> CAPS ”), and asthe Lead Managers as under:Sr.Activities Responsibility CoordinatorNo.1. <strong>Capital</strong> structuring with the relative ALLAXIScomponents and formalities such as thecomposition of debt and equity, type ofinstruments, etc.8

Sr.Activities Responsibility CoordinatorNo.2. Liaison with Stock Exchanges and SEBI, ALLSBICAPSincluding obtaining in-principle listingapproval and completion of prescribedformalities with the Stock Exchanges and SEBI3. Due diligence of our Company’s operations / ALLSBICAPSmanagement /legal/ business plans etc.4. Drafting & design of the offer document. The ALLFFSILdesignated Lead Manager shall ensurecompliance with stipulated requirements andcompletion of prescribed formalities (includingfinalization of Letter of Offer) with StockExchanges, the Registrar of Companies andSEBI.5. Drafting and approval of all publicity material ALL<strong>IDBI</strong>CAPSincluding statutory advertisement, corporateadvertisement, brochure, corporate film, etc.6. Marketing of the Issue, which will cover, inter ALLFFSILalia, formulating marketing strategies,preparation of publicitybudget, arrangements for selection of(i) ad-media,(ii) centres of holding conferences(iii) collection centres,(iv) distribution of publicity and issue materialincluding application form, Letter of Offer,Abridged Letter of Offer; and(v) brochure and deciding on quantum of issuematerial.7. Selection of various agencies connected with ALLAXISthe issue, namely Registrars to the Issue,Bankers to the Issue, printers and advertisementagencies.8. Follow-up with Bankers to the Issue to get ALLAXISestimates of Collection and advising the Issuerabout closure of the Issue, based on correctfigures.9. The post Issue activities will involve essential ALL<strong>IDBI</strong>CAPSfollow up steps, which must includefinalization of basis of allotment / weeding outof multiple applications, listing of instrumentsand dispatch of certificates and refunds, withthe various agencies connected with the worksuch as Registrar to the Issue, Bankers to theIssue and the bank handling refund business.Lead Managers shall be responsible forensuring that these agencies fulfill theirfunctions and enable them to discharge thisresponsibility through suitable agreements withthe Issuer Company.9