Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TABLE OF CONTENTSSECTION I: GENERAL ..........................................................................................................................................IDEFINITIONS AND ABBREVIATIONS ............................................................................................................. IPRESENTATION OF FINANCIAL, INDUSTRY AND MARKET DATA ...................................................... IXNOTICE TO INVESTORS ................................................................................................................................... XIFORWARD-LOOKING STATEMENTS ........................................................................................................... XIISECTION II: RISK FACTORS ....................................................................................................................... XIIISECTION III: INTRODUCTION ......................................................................................................................... 1SUMMARY OF INDUSTRY OVERVIEW ......................................................................................................... 1SUMMARY OF OUR BUSINESS ........................................................................................................................ 3SUMMARY FINANCIAL INFORMATION ....................................................................................................... 8THE ISSUE .......................................................................................................................................................... 18GENERAL INFORMATION .............................................................................................................................. 19CAPITAL STRUCTURE .................................................................................................................................... 30OBJECTS OF THE ISSUE .................................................................................................................................. 39BASIS FOR ISSUE PRICE.................................................................................................................................. 56STATEMENT OF TAX BENEFITS ................................................................................................................... 59SECTION IV: ABOUT THE COMPANY .......................................................................................................... 60INDUSTRY OVERVIEW ................................................................................................................................... 60OUR BUSINESS .................................................................................................................................................. 76DESCRIPTION OF CERTAIN KEY CONTRACTS ....................................................................................... 109REGULATIONS AND POLICIES ................................................................................................................... 133HISTORY AND CERTAIN CORPORATE MATTERS .................................................................................. 142OUR SUBSIDIARIES ....................................................................................................................................... 148OUR MANAGEMENT ..................................................................................................................................... 153OUR PROMOTERS AND GROUP COMPANIES .......................................................................................... 165RELATED PARTY TRANSACTIONS ............................................................................................................ 184DIVIDEND POLICY ......................................................................................................................................... 185SECTION V: FINANCIAL STATEMENTS .................................................................................................... 186AUDITORS’ REPORT ...................................................................................................................................... 186FINANCIAL STATEMENTS OF <strong>JSW</strong>ERL, RWPL, JPTL AND BLMCL ..................................................... 301MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OFOPERATIONS ................................................................................................................................................... 309FINANCIAL INDEBTEDNESS ....................................................................................................................... 336SECTION VI: LEGAL AND OTHER INFORMATION ............................................................................... 355OUTSTANDING LITIGATION AND MATERIAL DEVELOPMENTS ...................................................... 355GOVERNMENT APPROVALS ....................................................................................................................... 370OTHER REGULATORY AND STATUTORY DISCLOSURES.................................................................... 376SECTION VII: ISSUE INFORMATION ......................................................................................................... 388TERMS OF THE ISSUE .................................................................................................................................... 388ISSUE STRUCTURE ........................................................................................................................................ 391ISSUE PROCEDURE ........................................................................................................................................ 394RESTRICTIONS ON FOREIGN OWNERSHIP OF INDIAN SECURITIES ................................................. 432SECTION VIII: MAIN PROVISIONS OF THE ARTICLES OF ASSOCIATION ................................... 433SECTION IX: OTHER INFORMATION ........................................................................................................ 455MATERIAL CONTRACTS AND DOCUMENTS FOR INSPECTION ......................................................... 455DECLARATION ............................................................................................................................................... 460ANNEXURE ...................................................................................................................................................... 461

SECTION I: GENERALDEFINITIONS AND ABBREVIATIONSTerm“We”, “us”, “our”, “theIssuer”, “the Company”,“our Company” or“<strong>JSW</strong>EL”DescriptionUnless the context otherwise indicates or implies, refers to <strong>JSW</strong> Energy Limited on astandalone basis.Company Related TermsTermArticles/Articles ofAssociationAuditorsBoard of Directors/BoardDirector(s)Group CompaniesIdentified ProjectsJERLJPTLJSLJSLLJSPL<strong>JSW</strong>CL<strong>JSW</strong> Group<strong>JSW</strong>EIPL<strong>JSW</strong>ERL<strong>JSW</strong>EVL<strong>JSW</strong>HL<strong>JSW</strong>IL<strong>JSW</strong>IPL<strong>JSW</strong>PTC<strong>JSW</strong>PTL<strong>JSW</strong>SLKMPMemorandum/Memorandumof AssociationO.P. Jindal GroupRWPLPromotersPromoter GroupPTPUJSBU – ISBU – IISHASIPLSISCOLSubsidiariesDescriptionThe Articles of Association of our CompanyThe statutory auditors of our Company, M/s. Lodha & Co., Chartered AccountantsThe board of directors of our Company or a committee constituted thereofDirector(s) of our Company, unless otherwise specifiedIncludes those companies, firms and ventures promoted by our Promoters,irrespective of whether such entities are covered under section 370(1)(B) of theCompanies Act and disclosed in the section “Our Promoters and Group Companies”on page 165 of this ProspectusProjects as defined in the “Objects of the Issue” on page 39 of the Prospectus.<strong>JSW</strong> Energy (Raigarh) LimitedJaigad PowerTransco LimitedJindal Saw LimitedJSL Limited (Formerly known as Jindal Stainless Limited)Jindal Steel & Power Limited<strong>JSW</strong> Cement LimitedThe group of companies managed by Mr. Sajjan Jindal<strong>JSW</strong> Energy Investments Private Limited<strong>JSW</strong> Energy (Ratnagiri) Limited<strong>JSW</strong> Energy (Vijayanagar) LimitedJindal South West Holdings Limited<strong>JSW</strong> Infrastructure Limited<strong>JSW</strong> Investments Private Limited<strong>JSW</strong> Power Trading Company Limited<strong>JSW</strong> PowerTransco Limited<strong>JSW</strong> Steel LimitedKey Managerial PersonnelThe memorandum of association of our Company.The group of companies managed by Mr. P.R. Jindal, Mr. Sajjan Jindal, Mr. RatanJindal and Mr. Naveen JindalRaj WestPower LimitedMr. Sajjan Jindal, Mr. P.R. Jindal, Mrs. Sangita Jindal, Sun Investments PrivateLimited and <strong>JSW</strong> Investments Private LimitedIncludes such persons and entities constituting our promoter group in terms ofRegulation 2(zb) of the SEBI RegulationsPT Param Utama JayaThe Company’s 2X130 MW operational power project at Vijayanagar, KarnatakaThe Company’s 2X300 MW operational power project at Vijayanagar, KarnatakaShareholder’s AgreementSun Investments Private LimitedSouthern Iron & Steel Company Limited<strong>JSW</strong> Energy (Ratnagiri) Limited, Raj WestPower Limited, Jaigad PowerTranscoLimited, <strong>JSW</strong> Power Trading Company Limited, <strong>JSW</strong> Energy (Raigarh) Limited andi

TermPT Param Utama JayaDescriptionIssue Related TermsTermAllotment/ AllotAllotteeAnchor InvestorAnchor Investor Bid/IssuePeriodAnchor Investor Issue PriceAnchor Investor MarginAmountAnchor Investor PortionApplication Supported byBlocked Amount/ ASBAASBA BidderASBA Bid cum ApplicationForm or ASBA BCAFBanker(s) to the Issue/Escrow Collection Bank(s)Basis of AllotmentBidBid AmountBid /Issue Closing DateBid /Issue Opening DateBid cum Application FormBidderDescriptionUnless the context otherwise requires, the allotment of Equity Shares pursuant to theIssueA successful Bidder to whom the Equity Shares are AllottedA Qualified Institutional Buyer, applying under the Anchor Investor Portion with aminimum Bid of Rs. 100 million.The date, being the date one day prior to the Bid/Issue Opening Date, on which theSyndicate shall accept Bids from Anchor InvestorsThe final price at which Equity Shares will be issued and Allotted to Anchor Investorsin terms of the Red Herring Prospectus and Prospectus, which price will be equal toor higher than the Issue Price but not higher than the Cap Price.An amount representing 25% of the Bid Amount payable by an Anchor Investor at thetime of submission of its BidUp to 30% of the QIB Portion which may be allocated by the Company to AnchorInvestors on a discretionary basis. One-third of the Anchor Investor Portion shall bereserved for domestic mutual funds, subject to valid Bids being received fromdomestic mutual funds at or above the price at which allocation is being done toAnchor InvestorsAn application, whether physical or electronic, used by a Resident Retail IndividualBidder to make a Bid authorising a SCSB to block the Bid Amount in their specifiedbank account maintained with the SCSBAny Resident Retail Individual Bidder who intends to apply through ASBA and (a) isbidding at Cut-off Price, with single option as to the number of shares; (b) is applyingthrough blocking of funds in a bank account with the SCSB; (c) has agreed not to revisehis/her bid; and (d) is not bidding under any of the reserved categoriesThe form, whether physical or electronic, used by an ASBA Bidder to make a Bid,which will be considered as the application for Allotment for the purposes of the RedHerring Prospectus and the ProspectusThe banks which are clearing members and registered with SEBI as Banker to theIssue with whom the Escrow Account will be opened, in this case being HDFC BankLimited, ICICI Bank Limited, <strong>IDBI</strong> Bank Limited, Kotak Mahindra Bank Limited,Punjab National Bank, State Bank of India, Standard Chartered Bank and Yes BankLimitedThe basis on which Equity Shares will be Allotted to Bidders under the Issue andwhich is described in “Issue Procedure – Basis of Allotment” on page 414 of theProspectusAn indication to make an offer during the Bidding Period (including, in the case ofAnchor Investors, the Anchor Investor Bid/Issue Period) by a Bidder pursuant tosubmission of a Bid cum Application Form to subscribe to the Equity Shares of ourCompany at a price within the Price Band, including all revisions and modificationstheretoFor the purposes of ASBA Bidders, it means an indication to make an offer during theBidding Period by a Retail Resident Individual Bidder to subscribe to the EquityShares of the Company at Cut-off PriceThe highest value of the optional Bids indicated in the Bid cum Application Form andwhich is payable by the Bidder (other than an Anchor Investor) on submission of theBid in the Issue. The Anchor Investor Margin Amount shall be payable by an AnchorInvestor on submission of a Bid in the Issue.The date after which the Syndicate and SCSB will not accept any Bids for the Issue,which shall be notified in an English national newspaper, a Hindi national newspaperand a Marathi newspaper, each with wide circulationThe date on which the Syndicate and SCSB shall start accepting Bids for the Issue,which shall be the date notified in an English national newspaper, a Hindi nationalnewspaper and a Marathi newspaper, each with wide circulationThe form used by a Bidder to make a Bid and which will be considered as theapplication for Allotment for the purposes of the Red Herring Prospectus and theProspectusAny prospective investor who makes a Bid pursuant to the terms of the Red HerringProspectus and the Bid cum Application Formii

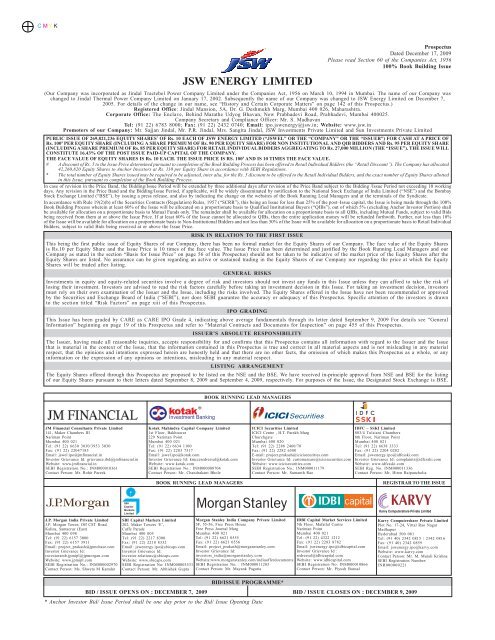

TermBidding/Issue PeriodBook Building Process/MethodBRLMs/Book Running LeadManagersBusiness DayCAN/Confirmation ofAllocation NoteCap PriceCAREControlling BranchesCut-off PriceDesignated BranchesDesignated DateDesignated Stock ExchangeDP IDDraft Red Herring Prospectusor DRHPEligible NRIEquity SharesEscrow AccountEscrow AgreementFirst BidderFloor PriceICICI<strong>IDBI</strong><strong>IDBI</strong> CapsIDFCIDFC - SSKII-SecIssueIssue PriceIssue ProceedsJM FinancialDescriptionThe period between the Bid/ Issue Opening Date and the Bid/ Issue Closing Dateinclusive of both days and during which prospective Bidders can submit their Bids,including any revisions thereofBook building route as provided in Schedule XI of the SEBI Regulations, in terms ofwhich this Issue is being madeJM Financial, Kotak, I-Sec, IDFC – SSKI, JPM, SBICAPS, Morgan Stanley and <strong>IDBI</strong>CapsAny day on which commercial banks in Mumbai are open for businessNote or advice or intimation of allocation of Equity Shares sent to the Bidders whohave been allocated Equity Shares after discovery of the Issue Price in accordancewith the Book Building ProcessThe higher end of the Price Band, above which the Issue Price will not be finalisedand above which no Bids will be acceptedCredit Analysis and Research LimitedSuch branches of the SCSB which coordinate with the BRLMs, the Registrar to theIssue and the Stock Exchanges.Issue Price (net of Retail Discount, as applicable), finalised by the Company inconsultation with the BRLMs. Only Retail Individual Bidders whose Bid Amountdoes not exceed Rs. 100,000 (net of Retail Discount), are entitled to bid at the Cut OffPrice, for a Bid Amount not exceeding Rs. 100,000. QIBs and Non-InstitutionalBidders are not entitled to bid at the Cut-Off Price.Such branches of the SCSBs which shall collect the ASBA Bid cum Application Formused by ASBA Bidders and a list of which is available on http://www.sebi.gov.inThe date on which funds are transferred from the Escrow Account to the Public IssueAccount or the amount blocked by the SCSB is transferred from the bank account ofthe ASBA Bidder to the Public Issue Account, as the case may be, after the Prospectusis filed with the RoC, following which the Board of Directors shall Allot EquityShares to successful BiddersBombay Stock Exchange LimitedDepository Participant’s IdentityThe Draft Red Herring Prospectus issued in accordance with Section 60B of theCompanies Act, which does not contain complete particulars of the price at which theEquity Shares are issued and the size (in terms of value) of the IssueNRIs from jurisdictions outside India where it is not unlawful to make an issue orinvitation under the Issue and in relation to whom the Red Herring Prospectusconstitutes an invitation to subscribe to the Equity Shares Allotted hereinEquity shares of our Company of Rs. 10 each, unless otherwise specifiedAccount opened with the Escrow Collection Bank(s) for the Issue and in whose favourthe Bidder (including Anchor Investor and excluding the ASBA Bidders) will issuecheques or drafts in respect of the Bid Amount when submitting a BidAgreement to be entered into by our Company, the Registrar to the Issue, the BRLMs,the Syndicate Members and the Escrow Collection Bank(s) for collection of the BidAmounts and where applicable, refunds of the amounts collected to the Bidders(excluding the ASBA Bidders) on the terms and conditions thereofThe Bidder whose name appears first in the Bid cum Application Form or RevisionForm or the ASBA Bid cum Application FormThe lower end of the Price Band, at or above which the Issue Price will be finalisedand below which no Bids will be acceptedICICI Bank Limited<strong>IDBI</strong> Bank Limited<strong>IDBI</strong> <strong>Capital</strong> Market Services LimitedInfrastructure Development Finance Company LimitedIDFC - SSKI LimitedICICI Securities LimitedPublic issue of 269,821,236 Equity Shares of Rs. 10 each of <strong>JSW</strong> Energy Limited forcash at a price of Rs. 100 per Equity Share (including a share premium of Rs. 90 perEquity Share) for Non Institutional and QIB Bidders and Rs. 95 per Equity Share(including a share premium of Rs. 85 per Equity Share) for Retail Individual Biddersaggregating up to Rs. 27,000 million.The final price at which Equity Shares will be issued and allotted in terms of theProspectus. The Issue Price will be decided by our Company in consultation with theBRLMs on the Pricing DateThe proceeds of the Issue that are available to the CompanyJM Financial Consultants Private Limitediii

TermJPMKotak/ KMCCMargin AmountMonitoring AgencyMorgan StanleyMutual Fund PortionMutual FundsNet ProceedsNon-Institutional BiddersDescriptionJ.P. Morgan India Private LimitedKotak Mahindra <strong>Capital</strong> Company LimitedThe amount paid by the Bidder (other than an Anchor Investor) at the time ofsubmission of his/her Bid, being 10% to 100% of the Bid Amount<strong>IDBI</strong> Bank LimitedMorgan Stanley India Company Private Limited5% of the QIB Portion (excluding the Anchor Investor Portion) or such number ofEquity Shares of Rs. 10 each aggregating to Rs. 810 million, (assuming the QIBPortion is for 60% of the Issue Size) available for allocation to Mutual Funds only, outof the QIB Portion (excluding the Anchor Investor Portion)A mutual fund registered with SEBI under the SEBI (Mutual Funds) Regulations,1996The Issue Proceeds less the Issue expenses. For further information about use of theIssue Proceeds and the Issue expenses see “Objects of the Issue” on page 39 of thisProspectusAll Bidders that are not QIBs or Retail Individual Bidders and who have Bid forEquity Shares for an amount more than Rs. 100,000 (but not including NRIs otherthan eligible NRIs)Non-Institutional Portion The portion of the Issue being not less than such number of Equity Shares of Rs. 10each aggregating to Rs. 2,700 million available for allocation to Non-InstitutionalBiddersNon-ResidentPay-in DateA person resident outside India, as defined under FEMA and includes a non-residentIndianBid Closing Date or the last date specified in the CAN sent to Bidders or AnchorInvestors, as applicablePay-in-Period (i) With respect to Bidders whose Margin Amount is 100% of the Bid Amount,the period commencing on the Bid/ Issue Opening Date; and extending untilthe Bid/ Issue Closing Date; andPre-IPO PlacementPrice BandPricing DateProspectus(ii)With respect to Bidders whose Margin Amount is less than 100% of the BidAmount, the period commencing on the Bid/ Issue Opening Date andextending until the closure of the Pay-in DateA pre-placement of Equity Shares to various investors made by the Company prior tothe filing of the Red Herring Prospectus with the RoC.Price band of a minimum price (floor of the price band) of Rs. 100 and the maximumprice (cap of the price band) of Rs. 115 and includes revisions thereof. The price bandwill be decided by the Company in consultation with the Book Running Lead Managerand advertised in the English language, in the Hindi language and in the Marathilanguage at least two working days prior to the Bid/Issue Opening Date.The date on which our Company in consultation with the BRLMs finalizes the IssuePriceThe Prospectus to be filed with the RoC in accordance with Section 60 of theCompanies Act, containing, inter alia, the Issue Price that is determined at the end ofthe Book Building process, the size of the Issue and certain other informationPublic Issue Account Account opened with the Bankers to the Issue to receive monies from the EscrowAccount on the Designated DateQIB Margin Amount An amount representing at least 10% of the Bid Amount, payable by QIB Bidders(other than Anchor Investors) at the time of submission of their BidQIB Portion The portion of the Issue being not less than such number of Equity Shares of Rs. 10Qualified Institutional Buyersor QIBsRefund AccountRefund Banker(s)Refunds through electronictransfer of fundsRegistrar to the IssueRetail Discounteach aggregating to Rs. 16,200 million, to be Allotted to QIBsPublic financial institutions as specified in Section 4A of the Companies Act,scheduled commercial banks, mutual fund registered with SEBI, FIIs and sub-accountregistered with SEBI, other than a sub-account which is a foreign corporate or foreignindividual, multilateral and bilateral development financial institution, venture capitalfund registered with SEBI, foreign venture capital investor registered with SEBI, stateindustrial development corporation, insurance company registered with IRDA,provident fund with minimum corpus of Rs. 25 crores, pension fund with minimumcorpus of Rs. 25 crores and National Investment Fund set up by Government of India.The account opened with Escrow Collection Bank(s), from which refunds, if any, ofthe whole or part of the Bid Amount (excluding to the ASBA Bidders) shall be made.ICICI Bank Limited and <strong>IDBI</strong> Bank LimitedRefunds through electronic transfer of funds means refunds through ECS, DirectCredit, RTGS or the ASBA process as applicableRegistrar to the Issue, in this case being Karvy Computershare Private Limited.The difference of Rs. 5 between the Issue Price and the differential lower price atwhich our Company has decided to allot the Equity Shares to Retail Individualiv

TermDescriptionBiddersRetail Individual Bidder(s) Individual Bidders (including HUFs applying through their Karta and eligible NRIs)who have not Bid for Equity Shares for an amount more than Rs. 100,000 (net ofRetail Discount) in any of the bidding options in the Issue.Retail Portion The portion of the Issue being not less than such number of Equity Shares of Rs. 10each aggregating to Rs. 8,100 million available for allocation to Retail IndividualBidder(s)Revision FormThe form used by the Bidders, excluding ASBA Bidders, to modify the quantity ofEquity Shares or the Bid Price in any of their Bid cum Application Forms or anyprevious Revision Form(s)RHP or Red HerringProspectusSBICAPSSCSB AgreementSelf Certified Syndicate Bankor SCSBStock ExchangesSyndicateSyndicate AgreementSyndicate MembersTRS/ Transaction RegistrationSlipUnderwritersUnderwriting AgreementConventional and General Terms/ AbbreviationsA/cTermAct or Companies ActAGMASAYBIFRBSECAGRCDSLCESTATCompanies ActThe Red Herring Prospectus dated November 20, 2009, filed with the RoC, issued inaccordance with Section 60B of the Companies Act, which does not have completeparticulars of the price at which the Equity Shares are offered and the size of theIssue.SBI <strong>Capital</strong> Markets LimitedThe agreement to be entered into between the SCSBs, the BRLMs, the Registrar tothe Issue and the Company only in relation to the collection of Bids from the ASBABiddersThe Banks which are registered with SEBI under SEBI (Bankers to an Issue)Regulations, 1994 and offers services of ASBA, including blocking of bank account anda list of which is available on http://www.sebi.gov.inBSE and NSEThe BRLMs and the Syndicate MembersThe agreement to be entered into between the Syndicate and our Company in relationto the collection of Bids in this Issue (excluding Bids from the ASBA Bidders)JM Financial Services Private Limited, Kotak Securities Limited, SBICAP SecuritiesPrivate Limited, ICICI Securities Limited, Sharekhan Limited, <strong>IDBI</strong> <strong>Capital</strong> MarketServices LimitedThe slip or document issued by a member of the Syndicate or the SCSB (only ondemand), as the case may be, to the Bidder as proof of registration of the BidThe BRLMs and the Syndicate MembersThe agreement among the Underwriters and our Company to be entered into on orafter the Pricing DateAccountDescriptionCompanies Act, 1956 and amendments made from time to timeAnnual General MeetingAccounting Standards issued by the Institute of Chartered Accountants of IndiaAssessment YearBoard for Industrial and Financial ReconstructionBombay Stock Exchange LimitedCompounded Annual Growth RateCentral Depository Services (India) LimitedCentral Excise and Service Tax Appellate TribunalCompanies Act, 1956 as amended from time to timeDepositoriesNSDL and CDSLDepositories ActThe Depositories Act, 1996 as amended from time to timeDERDebt Equity RatioDINDirector Identification NumberDP/ Depository Participant A depository participant as defined under the Depositories Act, 1996EBITDAEarnings Before Interest, Tax, Depreciation and AmortisationECSEGMEPSElectronic Clearing ServiceExtraordinary General MeetingUnless otherwise specified, Earnings Per Share, i.e., profit after tax for a fiscal yeardivided by the weighted average outstanding number of equity shares during that fiscalyearv

FDITermForeign Direct InvestmentDescriptionFEMAForeign Exchange Management Act, 1999 read with rules and regulations thereunderand amendments theretoFEMA RegulationsFEMA (Transfer or Issue of Security by a Person Resident Outside India) Regulations,2000 and amendments theretoFII(s)Foreign Institutional Investors as defined under SEBI (Foreign Institutional Investor)Regulations, 1995 registered with SEBI under applicable laws in IndiaFinancial Year/ Fiscal/fiscal/ Period of twelve months ended March 31 of that particular yearFYFIPBForeign Investment Promotion BoardFVCIForeign Venture <strong>Capital</strong> Investor registered under the Securities and Exchange Boardof India (Foreign Venture <strong>Capital</strong> Investor) Regulations, 2000GDPGross Domestic ProductGoI/GovernmentGovernment of IndiaHNIHigh Net worth IndividualHUFHindu Undivided FamilyIFRSInternational Financial Reporting StandardsIncome Tax ActThe Income Tax Act, 1961, as amended from time to timeITInformation TechnologyIT DepartmentIncome Tax DepartmentIndian GAAPGenerally Accepted Accounting Principles in IndiaIPOInitial Public OfferingJVJoint VentureJVAJoint Venture AgreementJVCJoint Venture CompanyMn / mnMillionMoUMemorandum of UnderstandingNANot ApplicableNAVNet Asset ValueNEFTNational Electronic Fund TransferNOCNo Objection CertificateNRNon ResidentNRE AccountNon Resident External AccountNRINon Resident Indian, is a person resident outside India, as defined under FEMA and theFEMA (Transfer or Issue of Security by a Person Resident Outside India) Regulations,2000NRO AccountNon Resident Ordinary AccountNSDLNational Securities Depository LimitedNSEThe National Stock Exchange of India LimitedOCBA company, partnership, society or other corporate body owned directly or indirectly tothe extent of up to 60% by NRIs including overseas trusts in which not less than 60% ofbeneficial interest is irrevocably held by NRIs directly or indirectly and which was inexistence on October 3, 2003 and immediately before such date was eligible to undertaketransactions pursuant to the general permission granted to OCBs under the FEMA.OCBs are not allowed to invest in this Issuep.a.per annumP/E RatioPrice/Earnings RatioPAN Permanent Account Number allotted under the Income Tax Act, 1961PATProfit After TaxPBTProfit Before TaxPIOPersons of Indian OriginPLRPrime Lending RateRBIThe Reserve Bank of IndiaRoCThe Registrar of Companies, Maharashtra located at Everest, 100 Marine Drive, Mumbai400 002vi

RONWRs.RTGSSBARSCRASCRRTermReturn on Net WorthIndian RupeesReal Time Gross SettlementState Bank Advance RateDescriptionSecurities Contracts (Regulation) Act, 1956, as amended from time to timeSecurities Contracts (Regulation) Rules, 1957, as amended from time to timeSEBI The Securities and Exchange Board of India constituted under the SEBI Act, 1992SEBI ActSEBI RegulationsSEBI Takeover RegulationsSec.Securities ActSIASICASLPSecurities and Exchange Board of India Act 1992, as amended from time to timeSEBI (Issue of <strong>Capital</strong> and Disclosure Requirements) Regulations, 2009 as amendedfrom time to timeSecurities and Exchange Board of India (Substantial Acquisition of Shares andTakeovers) Regulations, 1997, as amended from time to timeSectionUS Securities Act, 1933, as amendedSecretariat for Industrial AssistanceSick Industrial Companies (Special Provisions) Act, 1985, as amended from time to timeSpecial Leave PetitionStamp Act The Indian Stamp Act, 1899State GovernmentStock Exchange(s)UINU.S. / USA / USUS GAAPUSD/ US$ / US DollarsVCFsTechnical/Industry Related TermsThe government of a state of IndiaBSE and/ or NSE as the context may refer toUnique Identification NumberUnited States of AmericaGenerally Accepted Accounting Principles in the United States of AmericaUnited States DollarVenture <strong>Capital</strong> Funds as defined and registered with SEBI under the SEBI (Venture<strong>Capital</strong> Fund) Regulations, 1996, as amended from time to timeTermAAIBOOMBOTBOOTBTGCBMCCLCDMCEACERCCERsCFBCCODCSACTADPREIAElectricity ActEMPEPCERCFIFRGoGGoHPGoJGoMGoRDescriptionAirports Authority of IndiaBuild, Own, Operate and MaintainBuild, Operate and TransferBuild, Own, Operate and TransferBoiler, Turbine and GeneratorCoal Bed MethaneCentral Coalfields LimitedClean Development MechanismCentral Electricity AuthorityCentral Electricity Regulatory CommissionCertified Emission ReductionsCirculating Fluidized Bed CombustionCommercial Operation DateCoal Supply AgreementCoal Transportation AgreementDetailed Project ReportEnvironmental Impact AssessmentThe Electricity Act 2003, as amended from time to timeEnvironment Management PlanEngineering, Procurement and ConstructionElectricity Regulatory CommissionFinancial InstitutionsFeasibility ReportGovernment of GujaratGovernment of Himachal PradeshGovernment of JharkhandGovernment of MaharashtraGovernment of Rajasthanvii

GSTAIAIDCIMIPPKERCKPTCLKWkWhLAOLDLOALOCLOIMERCMIDCMmscmdMoEFMoAMPCBMPPMSEBMtpaMWNTPNTPCO&MPCBPCKLPFCPFRPLFPNBPPARERCRfPRfQRLDCRRVPNLSEBsSERCSEZSPVsq. km.UMPPUNFCCCUnitsUPPCLUPSIDCVERsTermDescriptionGas Sale and Transportation AgreementImplementation AgreementInterest During ConstructionInformation MemorandumIndependent Power ProducerKarnataka Electricity Regulatory CommissionKarnataka Power Transmission Corporation LimitedKilo WattKilo Watt HourLand Acquisition OfficerLiquidated DamagesLetter of AllotmentLetter of CreditLetter of IntentMaharashtra Electricity Regulatory CommissionMaharashtra Industrial Development CorporationMillion Metric Standard Cubic Meter Per DayMinistry of Environment and ForestsMemorandum of AgreementMaharashtra Pollution Control BoardMega Power ProjectMaharashtra State Electricity BoardMillion tons per annumMegawattsNotice to ProceedNational Thermal Power Corporation LimitedOperation and MaintenancePollution Control BoardPower Company of Karnataka LimitedPower Finance Corporation LimitedProject Feasibility ReportPlant Load FactorPunjab National BankPower Purchase AgreementRajasthan Electricity Regulatory CommissionRequest for ProposalRequest for QualificationRegional Load Despatch CentreRajasthan Rajya Vidyut Prasaran Nigam LimitedState Electricity BoardsState Electricity Regulatory CommissionSpecial Economic ZoneSpecial Purpose VehicleSquare kilometreUltra Mega Power ProjectUnited Nations Framework Convention on Climate ChangekWhUttar Pradesh Power Corporation LimitedUttar Pradesh State Industrial Development Corporation LimitedVerified Emission Reductionsviii

PRESENTATION OF FINANCIAL, INDUSTRY AND MARKET DATAFinancial DataUnless stated otherwise, the financial data in this Prospectus is derived from our restated financial statements,prepared in accordance with Indian GAAP and the SEBI Regulations, which are included in this Prospectusexcept for any financial information for the year ended March 31, 2005 for which the Company only hasunconsolidated financial statements. Our fiscal year commences on April 1 and ends on March 31 of the nextyear. The Company only has unconsolidated financial statements for the year ended March 31, 2005 as theCompany did not have any subsidiaries during the year ended March 31, 2005.All references to a particular fiscal year unless otherwise indicated, are to the 12 month period ended March 31of that year.There are significant differences among Indian GAAP, IFRS and US GAAP. Although we have presented asummary of significant differences between Indian GAAP, IFRS and the US GAAP, we have not attempted toquantify their impact on the financial data included herein and we urge you to consult your own advisorsregarding such differences and their impact on our financial data. Accordingly, the degree to which the IndianGAAP financial statements included in this Prospectus will provide meaningful information is entirelydependent on the reader’s level of familiarity with Indian accounting practices. Any reliance by persons notfamiliar with Indian accounting practices on the financial disclosures presented in this Prospectus shouldaccordingly be limited.In this Prospectus, any discrepancies in any table between the totals and the sum of the amounts listed are due torounding off.Any percentage amounts, as set forth in “Risk Factors”, “Business”, “Management’s Discussion and Analysis ofFinancial Condition and Results of Operations” and elsewhere in this Prospectus, unless otherwise indicated,have been calculated on the basis of our restated financial statements prepared in accordance with Indian GAAP.Currency of PresentationAll references to “Rupees” or “Rs.” are to Indian Rupees, the official currency of the Republic of India. Allreferences to “US$”, “USD” or “US Dollars” are to United States Dollars, the official currency of the UnitedStates of America.This Prospectus contains translations of certain US Dollar and other currency amounts into Indian Rupees thathave been presented solely to comply with the requirements of the SEBI Regulations. These translations shouldnot be construed as a representation that those US Dollar or other currency amounts could have been, or can beconverted into Indian Rupees, at any particular rate.Unless otherwise stated, the Company has in this Prospectus used a conversion rate of Rs. 48.04 for one USDollar, being the RBI reference rate as of September 30, 2009 (Source: RBI website). Such translations shouldnot be considered as a representation that such U.S Dollar amounts have been, could have been or could beconverted into Rupees at any particular rate, the rates stated above or at all.Industry and Market DataUnless stated otherwise, industry and market data used throughout this Prospectus has been obtained fromindustry publications and Government data. Industry publications generally state that the information containedin those publications has been obtained from sources believed to be reliable but that their accuracy andcompleteness are not guaranteed and their reliability cannot be assured. Although the Company believes thatindustry data used in this Prospectus is reliable, it has not been independently verified. Similarly, internalCompany reports, while believed by us to be reliable, have not been verified by any independent sources.In accordance with the SEBI Regulations, we have included in the section titled “Basis for the Issue Price” inthis Prospectus, information relating to our peer group companies. Such information has been derived frompublicly available sources and the Company has not independently verified such information.The extent to which the market and industry data used in this Prospectus is meaningful depends on the reader’six

familiarity with and understanding of the methodologies used in compiling such data.x

NOTICE TO INVESTORSThe Equity Shares have not been recommended by any US federal or state securities commission or regulatoryauthority. Furthermore, the foregoing authorities have not confirmed the accuracy or determined the adequacyof this Prospectus. Any representation to the contrary is a criminal offence in the United States.The Equity Shares have not been and will not be registered under the US Securities Act of 1933, as amended(the “Securities Act”) and, unless so registered, may not be offered or sold within the United States exceptpursuant to an exemption from, or in a transaction not subject to, the registration requirements of the SecuritiesAct. Accordingly, the Equity Shares are being offered and sold (a) in the United States only to personsreasonably believed to be “qualified institutional buyers” (as defined in Rule 144A under the Securities Act andreferred to in this Prospectus as “U.S. QIBs”, for the avoidance of doubt, the term U.S. QIBs does not refer to acategory of institutional investor defined under applicable Indian regulations and referred to in the Prospectus as“QIBs”) in transactions exempt from the registration requirements of the Securities Act and (b) outside theUnited States in compliance with Regulation S and the applicable laws of the jurisdiction where those offers andsales occur.This Prospectus has been prepared on the basis that all offers of Equity Shares will be made pursuant to anexemption under the Prospectus Directive, as implemented in Member States of the European Economic Area(“EEA”), from the requirement to produce a prospectus for offers of Equity Shares. The expression “ProspectusDirective” means Directive 2003/71/EC of the European Parliament and Council and includes any relevantimplementing measure in each Relevant Member State (as defined below). Accordingly, any person making orintending to make an offer within the EEA of Equity Shares which are the subject of the placementcontemplated in this Prospectus should only do so in circumstances in which no obligation arises for theCompany or any of the Underwriters to produce a prospectus for such offer. None of the Company and theUnderwriters have authorised, nor do they authorise, the making of any offer of Equity Shares through anyfinancial intermediary, other than the offers made by the Underwriters which constitute the final placement ofEquity Shares contemplated in this Prospectus.xi

FORWARD-LOOKING STATEMENTSThis Prospectus contains certain “forward-looking statements”. These forward-looking statements generally canbe identified by words or phrases such as “aim”, “anticipate”, “believe”, “expect”, “estimate”, “intend”,“objective”, “plan”, “project”, “shall”, “will”, “will continue”, “will pursue” or other words or phrases of similarimport. Similarly, statements that describe our strategies, objectives, plans or goals are also forward-lookingstatements. All forward-looking statements are subject to risks, uncertainties and assumptions about us thatcould cause actual results to differ materially from those contemplated by the relevant statement.Actual results may differ materially from those suggested by the forward looking statements due to risks oruncertainties associated with our expectations with respect to, but not limited to, regulatory changes pertainingto the industries in India in which we have our businesses and our ability to respond to them, our ability tosuccessfully implement our strategy, our growth and expansion, technological changes, our exposure to marketrisks, general economic and political conditions in India which have an impact on our business activities orinvestments, the monetary and fiscal policies of India, inflation, deflation, unanticipated turbulence in interestrates, foreign exchange rates, equity prices or other rates or prices, the performance of the financial markets inIndia and globally, changes in domestic laws, regulations and taxes and changes in competition in our industry.Important factors that could cause actual results to differ materially from our expectations include, but are notlimited to, the following:1. Our inability to effectively manage our growth or to successfully implement our business plan andgrowth strategy;2. Unavailability of fuel for our power plants;3. Limited operating history;4. Inability to enter into financing/ off-take arrangements for the proposed projects;5. Inability to set up projects within the estimated time frame;6. Certain inherent construction, financing and operational risks in relation to our projects;7. The monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interestrates;8. Foreign exchange rates, equity prices or other rates or prices;9. The performance of the financial markets in India;10. General economic and business conditions in India;11. Changes in laws and regulations that apply to our clients, suppliers and the power generation andtrading and construction and property development sectors;12. Increasing competition in and the conditions of our clients, suppliers and the power generation andtrading and construction and property development sectors; and13. Changes in political conditions in India.For further discussion of factors that could cause our actual results to differ from our expectations, see “RiskFactors”, “Our Business” and “Management’s Discussion and Analysis of Financial Condition and Results ofOperations” on pages xiii, 76 and 309 of this Prospectus. By their nature, certain market risk disclosures areonly estimates and could be materially different from what actually occurs in the future. As a result, actualfuture gains or losses could materially differ from those that have been estimated. Neither our Company, ourDirectors, nor any of the Underwriters nor any of their respective affiliates has any obligation to update orotherwise revise any statements reflecting circumstances arising after the date hereof. In accordance with SEBIrequirements our Company and the BRLMs will ensure that investors in India are informed of materialdevelopments until the time of the grant of listing and trading permission by the Stock Exchanges.xii

SECTION II: RISK FACTORSAn investment in the Company’s Equity Shares involves a high degree of risk. You should carefully consider therisks described below as well as other information in this Prospectus before making an investment in theCompany’s Equity Shares. The risks described in this section are those that we consider to be the mostsignificant to the offering of our Equity Shares. If any of the following events occur, our business, financialcondition, results of operations and prospects could materially suffer, the trading price of the Company’s EquityShares could decline, and you may lose all or part of your investment. Unless specified or quantified in therelevant risk factors below, we are not in a position to quantify the financial or other implication of any of therisks mentioned herein.Unless otherwise stated, the financial information of the Company used in this section is derived from ourrestated consolidated financial statements.In this section, a reference to the “Company” means <strong>JSW</strong> Energy Limited. Unless the context otherwiserequires, references to “we”, “us”, or “our” refers to <strong>JSW</strong> Energy Limited and its Subsidiaries, taken as awhole.RISKS RELATED TO OUR BUSINESS OPERATIONS1. Our projects under development require various approvals from various government entities. Anydelay in obtaining or inability to obtain these approvals could have a material adverse effect on ourfinancial results and business prospects.We currently have four projects aggregating 7,740 MW of capacity under development which issignificantly more than the 3,650 MW of capacity that is operational, under construction orimplementation. Even before we achieve financial closure or can begin construction, we need certainkey approvals and/or documents from various government entities at the Indian central and stategovernment level. These include memoranda of understanding; letters of intent; approvals for landacquisition, environmental clearances; entering into fuel supply, plant and equipment procurement, orfinancing agreements. For example:• We have either not yet commenced or are still in the process of acquiring land for some of theprojects under development;• We have not yet obtained approval to develop 2 x 800 MW coal based power project, whichwe propose to develop as a CPP to meet the entire power requirement of the steel plant to bedeveloped by <strong>JSW</strong>SL in West Bengal. We currently only have approval to develop a powerplant with 990 MW of capacity for this project;• We have not yet obtained final approval to increase the capacity of our power plant in Raipur,Chhattisgarh currently under development from 1,100 MW to 1,320 MW;• We do not have environmental approvals nor have achieved financial closure nor havedetailed project reports for any of our projects under development; and• We cannot assure you that we will obtain these approvals, consents, MoU, LoI or enter intothese documents or enter into binding documentation which means that all our projects underdevelopment are at risk of being delayed, derailed or not proceeding at all, any of which couldhave a material adverse effect on our financial results and business prospects.2. It may be difficult for investors to evaluate the probable impact of our current and proposeddevelopment activity on our financial performance.Substantially all of the Company’s revenue has been derived from our 260 MW power plant inKarnataka and from our newly operational 600 MW power plant in Karnataka in the three monthsended September 30, 2009. Due to the high levels of current and proposed development activity anddue to the long gestation periods before projects achieve commercial operation, the Company’shistorical financial results may not accurately predict its future performance. The total amountxiii

deployed by the Company in projects comprising RWPL and <strong>JSW</strong>ERL as of October 31, 2009 wasRs. 68,265.50 million. Further, we do not expect the two projects currently under construction, totaling2,280 MW to achieve commercial operation until April 2011; the two projects under implementationtotaling 510 MW to achieve commercial operation until January 2013 – December 2015; and the fourprojects under development totaling 7,740 MW to achieve commercial operation between August 2014and August 2015. It may therefore be difficult for investors to evaluate the probable impact of thecompleted power plants on our financial performance or make meaningful comparisons betweenreporting periods until we have operating results for a number of reporting periods for these facilitiesand assets. As the development of power plants becomes, as anticipated, an important part of theCompany’s overall business, the Company’s financial condition and results of operations willincreasingly depend on the performance of these new power plants.Also, the viability of our power projects under construction, implementation, and development arebased on assumptions and estimates regarding continuing deficit of power in India over the foreseeablefuture. However, the significant investment in power generation assets across India coupled with thelong gestation period before power plants achieve commercial operation means that by the time ourpower projects achieve commercial operation there may, as some commentators believe, be a surplus ofpower in certain regions of India. As a result, we may not realize the returns we originally estimated inour models nor can we predict the competition nor the environment in which we may then be requiredto operate.3. We do not have government approval to increase the capacity for two of our projects and if we do notreceive such approval, we may not be able to develop these projects to the extent of our proposedexpansion which may impact our financing.We have entered into a MoU with the Government of Maharashtra to set up a 1,000 MW power projectat Ratnagiri. We intend to expand the capacity of this project to 1,200 MW. We also intend to developan additional 270 MW power project at Barmer, Rajasthan on the same parcel of land as RWPL’s1,080 MW power project at that location. Although we have applied to the respective governments forapproval, we cannot assure you that these governments will grant these capacity expansions.If the same is delayed or not received, we may be in breach of these agreements and we may not beable to develop these projects to the extent of our proposed expansion which may impact our financing.4. The construction and operation of our power projects or mines may face opposition from localcommunities and other parties which may also adversely affect our results of operations andfinancial condition.The construction and operation of power projects and mines have, in the past, and future projects may,become politicised and face opposition from the local communities where these projects are locatedand from special interest groups. In particular, the public may oppose the acquisition or lease of landand/or mining operations due to the perceived negative impact it may have on such communities or onthe environment. For example, writ petitions have been filed by certain persons challenging theacquisition of land for our RWPL project. The resettlement of local communities and rehabilitationprogram is developed on a project by project basis and is included in our budget for each project.However, the state government is ultimately responsible for disbursing compensation funded by us tothose individuals that are displaced due to our projects. There can be no assurance that there will not beany objection to or dispute in relation to such resettlement, including litigation which may require us tosuspend mining operations until any such dispute is resolved. We may incur significant expenditure onany such resettlement which may adversely affect our financial condition and results of operation. Wemay face significant opposition to the construction of our power projects from local communities, nongovernmentorganizations and other parties which may also adversely affect our results of operationsand financial condition.5. The operation of our power plant at Ratnagiri and its integration with the power grid is subject tothe order of the High Court of Delhi and in case of an adverse order, our results of operation andfinancial condition will be adversely affected.The Ministry of Environment and Forests, GoI, had granted environmental clearance for our 4x300MWpower plant at Ratnagiri. A petition was filed in the National Environment Appellate Authorityxiv

(“NEAA”) challenging the environmental clearance granted to us by the MoEF. Upon the dismissal ofthe case by the NEAA, a petition was filed before the High Court of Delhi against the order of theNEAA. The High Court by its order dated September 18, 2009 directed the Expert AppraisalCommittee (“EAC”) to re-examine its environmental approval granted to us for our 1,200 MW powerplant, at Ratnagiri preferably within a period of three months from the date of the order. The HighCourt by its order has restricted our ability to make our 1,200 MW power plant operational andintegrating it with the power grid till EAC completes the process of re-examination of the environmentapproval already granted for the power plant. The High Court has however permitted the Company toundertake tests and operational trials at this power plant and also integrate the power plant with thepower grid for these purposes. We have incurred substantial costs for the construction of this powerplant. If the EAC does not complete the process of re-examination of its approval in a timely manner,or if the EAC does not grant us the environmental approval for this power plant, we may not be able tocommence commercial operations of the power plant and link the power plant with the power grid, andconsequently our results of operation and financial condition will be adversely affected. For furtherdetails refer, “Outstanding Litigation and Material Developments” on page 355 of the Prospectus.6. Delays in the completion of our current power projects under construction or implementation couldhave adverse effects on our financial results; all of our power projects, with two exceptions, areeither in the construction, implementation or development phase and we cannot assure you thatthese projects will reach commercial operation as expected on a timely basis, if at all.Only two of our power projects and a portion of another project are operational or have beencommissioned. Three projects and a significant portion of another project are either in the constructionor implementation phase, and another four projects are in the development stage. Each project isrequired to achieve commercial operation no later than the scheduled commercial operations datespecified under the implementation agreement or power purchase agreement, subject to certain limitedexceptions. The scheduled completion dates for our projects are estimates and are subject to the risksarising from contractor performance shortfalls. Any of which could give rise to delays, cost overruns orthe termination of a project’s development.Although a third party contractor may be liable to us for payment of liquidated damages and/or penaltyamounts if the project fails to achieve commercial operation by the scheduled commercial operationsdate, we may nevertheless still be liable for liquidated damages under implementation agreements,regardless of whether we have recourse to the contractor for the delay. Further, the liquidated damagespayable by a contractor to the relevant project company may not be sufficient to cover the amountowed by us or commensurate with the range of remedies available to our customers.Delays may also result in forfeiture of security deposits, performance guarantees being invoked, costoverruns, lower or no returns on capital, erosion of capital and reduced revenue for the projectcompany, as well as failure to meet scheduled debt service payment dates. The failure by our projectcompanies to make timely debt service payments could result in a loss on our investment in suchproject companies if lenders trigger the security under the financing agreements due to a projectcompany’s payment default. Moreover, any loss of goodwill could adversely affect our ability to prequalifyfor future projects.7. We may not be able to raise additional capital to fund the balance of costs for Identified Projectswhich may have a material adverse impact on our project costs and schedules and in turn on ourbusiness, financial condition and results of operations.The Net Proceeds we expect to receive from the Issue only cover part of the estimated cost to completethe Identified Projects. We may have to raise an additional amount (including undisbursed debtamounts) of approximately Rs. 99,795.00 million to fund the balance of costs for such Projects. Wehave entered into Loan Agreements and/or have obtained letters of intent from various banks for up toRs. 99,795.00 million. The letters of intent require us to enter into definitive agreements within fourmonths of the dates of these letters. We may not be able to reach agreement with these banks andfinancial institutions in the given time period, in which case they would have no obligation to arrangesuch loans for us. Our sanction letters with ICICI Bank relating to our projects under development inRajasthan and Himachal Pradesh have expired and we have applied for new sanction letters. Howeveruntil such renewed sanction letters are received, ICICI Bank has no obligation to arrange such loans forus. For more details, see “Objects of the Issue – Means of Finance” on page 41 of this Prospectus.xv

We cannot assure you that we will be able to arrange financing on terms that would be acceptable to us,or at all. Other sources of financing may not be available and we may not be able to obtain the capitalnecessary to fund our projects.The implementation of the Identified Projects is also subject to a number of variables and the actualamount of capital requirements to implement the Identified Projects may differ from our estimates. Ifwe experience a significant increase in capital requirements as we have with our hydroelectric powerproject in Himachal Pradesh or delays with respect to the implementation of the Identified Projects, wemay need additional financing and we cannot assure you that such financing source will be available tous on commercially acceptable terms, or at all. Failure to raise all the necessary capital will have amaterial adverse impact on the implementation of the Identified Projects, project costs and schedulesand in turn on our business, financial condition and results of operations.8. Merchant power projects are subject to regulatory and tariff risks which may affect our results ofoperations.There is limited history of merchant power plants in India. Risks related to merchant power projectsinclude:• Payment risks due to steep increases in fuel cost. In India, state utilities have in the pastexperienced heavy losses and have not had the resources to absorb extra costs and have beenunable to pass-on fuel cost increases without the regulator’s consent;• Competition risk from state owned generating companies with low target returns. Actualgeneration tariffs may be lower than expected due to competition from state owned utilities;and• Regulatory and/or political risk. Competition is designed to achieve lower generation tariffs tobenefit the general public. Under this regulated scenario, if merchant power plants are able toachieve higher returns for an extended period of time, regulators may then seek ways toreduce generation tariffs, either by cost-based bidding, price caps, or state-owned utilitiesbidding irrationally. Further, on December 30, 2008 the Government of Karnataka has issuedan order whereby in any case of severe shortage of power in the state of Karnataka, theGovernment may require that all power generated in the state be sold only within the State ofKarnataka. Further, the power can be sold only to the Government and the cost at which thepower is sold may be decided by the Government. The Government has imposed this order onour Vijayanagar plant from December 2008 to May 2009. The order of the Government ofKarnataka is currently under challenge in the High Court of Karnataka. There is no assurancethat the High Court of Karnataka will issue a judgment against the State Government or thatthe order will not be enforced against us again in the future.9. Land in connection with the RWPL mines project has not been transferred to our joint venture andthe costs of acquisition for the land may be substantially higher than we originally expected.The RWPL project requires a large parcel of land in connection with the Jalipa and Kapurdi mines tobe transferred by the Government of Rajasthan to our joint venture, BLMCL. This land still needs to beacquired and transferred.The approved cost of land for the Kapurdi mine was Rs. 342.08 million by RERC however, the LandAcquisition Officer (“LAO”), RSMML issued an order dated September 14, 2009 increasing the totalcost of the land acquisition for the Kapurdi mine to Rs. 2,675.44 million. The land acquisition forJalipa land is at the initial stages. We expect the cost of acquisition of the land at Jalipa to exceed theamount approved by the RERC. The actual acquisition cost of lands for both the Kapurdi and Jalipamines cannot be ascertained until the land acquisition process is complete and it is possible that theactual acquisition cost may be higher than these estimated amounts. Based on the RERC Orderapproving project cost, Industrial Development Finance Corporation has appraised the project at a debtto equity ratio of 70:30 and has sanctioned debt of Rs. 3,270 million. If the actual acquisition costs ofthe land for the mines are significantly greater than the original land acquisition amount approved byRERC, our overall cost for this project will correspondingly increase and may have an adverse effecton our cash flows and results of operations. Our ability to fund any such increase in acquisition costs isxvi

subject to risks. See “ ─ 40. Our plans require significant capital expenditures and if we are unable toobtain the necessary funds on acceptable terms for expansion, we may not be able to fund our projectsand our business may be adversely affected”.10. Some of our Group Companies have incurred losses in the last year.Some of our Group companies have incurred losses during their last financial year (as per their standalone financial statements), as set forth in the table below:Loss-making Group Companies:S. No. Name of the company (Rs. inMillion)1. Renuka Financial Services Limited (9.57)2. Manjula Finances Limited (13.22)3. Goswamis Credits and Investments Limited (17.21)4. Rohit Tower Building Limited (0.88)5. <strong>JSW</strong> Steel (Netherlands) B.V. (783.60)6. <strong>JSW</strong> Steel Holding (USA) Inc. (396.10)7. <strong>JSW</strong> Steel (USA) Inc. (2,276.50)8. <strong>JSW</strong> Steel (UK) Limited (4.30)9. Argent Independent Steel (Holdings) Limited (0.12)10. <strong>JSW</strong> Steel Service Centre (UK) Limited (358.90)11. Inversiones Eurosh Limitada (31.90)12. Santa Fe Mining (37.10)13. Santa Fe Purto SA (0.73)14. <strong>JSW</strong> Natural Resources Limited (1.00)15. <strong>JSW</strong> Natural Resources Mozambique Lda (59.10)16. <strong>JSW</strong> Bengal Steel Limited (17.68)17. Barbil Beneficiation Company Limited (0.03)18. <strong>JSW</strong> Jharkhand Steel Limited (3.13)19. <strong>JSW</strong> Steel Processing Centres Limited (72.11)20. <strong>JSW</strong> Building Systems Limited (1.20)21. Argil Properties Private Limited (0.24)22. Bir Plantations Private Limited (0.08)23. OPJ Investments and Holdings Limited (0.01)24. Jindal Mansarover Investments Private Limited (0.01)25. Sun Fintrade Private Limited (0.01)26. Stainless Finance and Investments Private Limited (0.01)27. Hisar Fincap Private Limited (0.01)28. Jindal South West Finance Investments Private Limited (0.01)29. Vrindavan Fintrade Limited (0.01)30. Nalwa Fincap Limited (0.01)31. Jindal Synergy Investments Limited (0.01)32. Salasar Finvest Limited (0.01)33. Nalwa Financial Services Limited (0.004)34. Supreme Metals Limited (0.003) #35. Banabridge Holdings Limited (0.17)36. Portview Investments Limited (0.49)37. IUP Jindal Metals and Alloys Limited (103.68)38. Jindal SAW USA LLC (246.00)39. Jindal ITF Limited (3.79)40. Jindal Intellicom Private Limited (15.71)41. Jindal Urban Infrastructure Limited (1.54)42. Jindal Shipyards Limited (0.64)43. Jindal Waterways Limited (149.94)44. Jindal Infralogistics Limited (0.02)45. Jindal ESIPL CETP Limited (0.11)46. Nalwa Chrome Private Limited (0.03)47. Maharashtra Sponge Iron Limited (0.01)48. Portfolio Fashions Private Limited (25.01)49. Jindal Coated Steel Private Limited (0.05)50. Musuko Trading Private Limited (0.14)xvii

S. No. Name of the company (Rs. inMillion)51. Art India Publishing Company Private Limited (1.86)52. <strong>JSW</strong> Projects Limited (0.02)53. SKJ Investments Limited (0.01) #54. Dorelan Holdings Limited (0.01) ## USD in Million11. Estimates of our coal and lignite reserves and water flow are subject to assumptions, and if theactual quantities of such reserves or water flows are less than estimated, our results of operationsand financial condition may be adversely affected.Our lignite mining joint venture, BLMCL, in which we have a 49% interest for supply of lignite to theRWPL power plant, has been awarded lignite blocks with estimated reserves, that we believe aresufficient to meet the total fuel requirement to generate the contracted capacity over the 30-year term ofthe power purchase agreement for this power plant. Estimates of lignite reserves by MineralExploration Corporation Limited in these mines are subject to probabilistic assumptions. We have a11% interest in a consortium that has been allotted a coal block from the Utkal A ─ Gopalprasad Westmines near Talcher, Orissa which has estimated thermal reserves of 951.68 MT with mineable coalreserves of 673.09 MT over an area of 1,357 hectares of land. These estimates are based oninterpretations of geological data obtained from sampling techniques and projected volume ofproduction in the future. Actual reserves and production levels may therefore differ significantly fromestimates, particularly estimates made for a 30 year period, and we cannot assure you that there aresufficient reserves to meet our total fuel requirements. If the quantity or quality of our coal or lignitereserves has been overestimated, the joint venture or consortium would deplete their reserves morequickly than anticipated and we may then have to source the required coal or lignite from alternatesources. Prices and supply for coal or lignite from alternate sources may exceed the cost andavailability of extracting coal or lignite ourselves, which would cause our costs to increase andconsequently adversely affect our financial condition, results of operations and business prospects.While we have selected our hydroelectric site on the basis of output projections, there can be noassurance that the water flows will be consistent with our projections, or that the water flow required togenerate the projected outputs will exist or be sustained after construction of the projects is completed.We cannot assure you that the long-term historical water availability will remain unchanged in thefuture or that no material hydrological or seismological event will impact the hydrological conditionsthat currently exist at our project sites.12. Our power plants require diverse types of fuel to generate electricity and require significantquantities of such fuels. In the future, we may not have secured long-term fuel supply arrangementsfor our projects and we may not be able to secure long-term fuel arrangements at competitive prices.The most critical feedstock required by power plants to generate electricity is fuel. With the exceptionof one hydroelectric project, all of our projects under construction, implementation or development areplanned to be coal-fired or lignite-fired. A key factor in the success of these projects is the ability tosource fuel at competitive prices and in sufficient quantities necessary to generate the contractedcapacity under power purchase agreements. Fuel linkages to meet all the fuel requirements for ourdomestic projects in Chhattisgarh (to the extent of 11% interest in the coal block) and Jharkhand arestill to be secured and we expect significant competition for captive coal mines for these and otherfuture projects. Also, for our future projects, we cannot assure you that we will always be able to securelong-term fuel arrangements on competitive terms, if at all. Fuel requirements for our power projectsare based on a certain PLF and if we operate our power projects at higher PLFs, we will need additionalcoal. We will not be able to source this additional coal from our fuel linkages and will need to obtainthis additional coal from other sources, which may not be available on terms that are commerciallyacceptable to us, or at all. We are also dependent on imported coal for fuel supply and hence anyfluctuations in fuel prices or renegotiation will impact us.Moreover, coal allocations are regulated by the Government of India. We cannot assure you that wewill be allocated an adequate quantity of coal at competitive prices to satisfy the necessary fuel suppliesfor these power plants or that we will be able to obtain the necessary additional fuel supplies from othersources on competitive terms.xviii

13. Our thermal power plants generally rely on a small number of fuel suppliers with limited trackrecords and who are located in Indonesia and Mozambique where enforcement of our rights underfuel supply agreements may be difficult. If fuel suppliers fail to perform their obligations, ourfinancial condition and results of operation could be adversely affected.With the exception of the RWPL power project, the West Bengal power project, the Kutehr powerproject and the Chhattisgarh power project (to the extent of 11% interest in the coal block), wecurrently do not have any captive fuel sources for our thermal power projects. Rather, these projectsdepend on long-term fuel supply arrangements with only two fuel suppliers, at most. These suppliershave a limited history of mining, unknown experience in delivering coal in the large volumes requiredfor our projects, nor a track record of honouring commitments. Thus, our power plant operationscurrently are, and will continue to be, vulnerable to disruptions due to weather, or labour relations anddelivery of fuel, including shipping and transportation delays in the case of imported fuel, delays due todifficulties enforcing our rights under the fuel supply agreements in countries such as Indonesia orMozambique. If a fuel supplier fails, or is unable to deliver fuel as scheduled or contracted for, or if thefuel supply to one or more power plants is otherwise disrupted, we may not be able to make alternativearrangements in a timely manner, if at all, and any such alternative arrangements may be more costly tous. As a result, disruption could materially disrupt the normal operations of the thermal power plantsand could have an adverse effect on our financial condition, results of operations, and businessprospects. In addition, a recent news article suggests that the Government of Indonesia is consideringimposing a cap of 150 million tons per year. In the event that such a cap is imposed, the price of coaland the quantity of coal we are able to import from Indonesia may be affected. There can be noassurance that such coal will be available to us on commercially acceptable terms, or at all.14. Some of our off-take and fuel supply arrangements are long-term in nature which may restrict ouroperational and financial flexibility.Typically, power projects involve agreements that are long-term in nature. In our case these includelong-term power purchase agreements and fuel supply agreements with terms ranging from 10 to 30years. Such long-term arrangements have inherent risks because they restrict our and the relevantproject company’s operational and financial flexibility. These risks may not necessarily be within ourcontrol.For example, we may not be able to take advantage of market or sector dynamics and businesscircumstances may materially change over the life of one or more of our power projects. We may nothave the ability to modify our agreements with government entities, financial institutions, or customersto reflect these changes or negotiate satisfactory alternate arrangements. Further, being committed tothese projects may restrict our ability to implement changes to our business plan. For example, loanagreements for these projects restrict our ability to sell, transfer or divest our interests in the relevantproject companies. This limits our business flexibility, exposes us to an increased risk of unforeseenbusiness and industry changes and could have an adverse effect on our financial results and businessprospects.In addition, we will need to enter into other off-take agreements for the balance of the power to begenerated by our other power projects. As power plants are currently not permitted to sell electricitydirectly to retail power consumers, the consumer base for our power projects without PPAs is limited tostate utility companies, electricity boards, industrial consumers and licensed power traders. We cannotassure you that we will be able to enter into off-take arrangements on terms that are favourable to us, orat all. Failure to enter into off-take arrangements in a timely manner and on terms that arecommercially acceptable to us could adversely affect our business, financial condition and results ofoperations.15. We have no experience in building and operating hydro projects which may affect our ability toeffectively manage and operate our hydro projects and adversely affect our results of operations andfinancial condition.The Company and its Promoters have no experience in building and operating a hydroelectric powerplant. Furthermore, we have no experience operating a peaking facility which has different powerscheduling requirements, and operating and maintenance practices vis-à-vis the base load facilities ofxix

all our other power projects. Accordingly any inability to effectively manage and operate this powerplant could adversely affect our results of operations and financial conditions.16. We do not have permission to develop additional two units at RWPL of 135 MW each and if we arenot given approval to develop these projects, our results of operation and financial conditions maybe adversely affected.In relation to RWPL Phase II, the bidding process for the RWPL project, award of the project, theimplementation agreement, the mining plan and the RERC order all provide for a 1,000 MW project.We propose to establish additional units at RWPL of 135 MW each. The establishment of twoadditional units of 135 MW each would result in a change in the plant and project specifications, andthere would be a change in the “Project” as contemplated in the Implementation Agreement for thisproject, and the other provisions. If this is implemented, this would result in the Project land being usedfor the new units and the mines being used for supply of fuel to the new units as well. Any such changewould require the prior approval of the Government of Rajasthan.Presently, we do not intend to use lignite as fuel for this project, however in the event we are not ableto source alternate fuel such as coal, we would also require additional approval in this regard.Also, we do not intend to set up a SPV to establish this project. However, if we do, then we requireapproval from RERC for capital cost/tariff determination. Also, if the new SPV is granted access to theRWPL Phase II’s site and mines for the purposes of the additional capacity, there could be legalchallenges to such proposed use. Additionally, consents from the existing lenders to RWPL for accessto land have to be obtained, as well as, security to the fresh set of lenders to a SPV would also have tobe arranged.In the event, we are not given approval to develop these projects, our results of operation and financialconditions will be affected.17. Delays in the acquisition of land may adversely affect the timely performance of our obligationsunder implementation agreements, power purchase agreements, and financing agreements.A key condition precedent under implementation agreements and power purchase agreements for newprojects is the acquisition or lease of, or securing right of way over, tracts of land for a project site.While we have acquired land for certain projects, we are still acquiring or leasing land required forothers. Also, we do not currently own, nor in the future do we expect to own, the land for all of ourprojects. Although these projects may have long-term leases, there is a risk these leases may not berenewed or could be terminated early in the event of a default.Even when the Government of India and/or state governments are required to facilitate the acquisitionor lease of, or secure rights of way over, tracts of land under implementation agreements or powerpurchase agreements, we cannot assure you that all requisite approvals related to, and the acquisitionof, or lease of, or right of way over land or the registration of land will be completed in a timelymanner and on terms that are commercially acceptable to us, if at all. If we are unable to complete theforegoing in a timely manner, this may delay financial closure, delay locking-in interest rates, andcause construction delays. A delay in achieving financial closure could in turn be a breach and an eventof default under implementation agreements or power purchase agreements leading to possible disputeswith concerned parties.18. We depend on various contractors to construct and develop our projects, some of whom supplysophisticated and complex machinery to us. We may face execution risks relating to the quality ofthe services, equipment and supplies provided by contractors and may no be able to recover from acontractor or suppliers the full amount owed to us.As we are the project manager of most of our projects, we depend on the availability and skills of thirdpartycontractors for the construction and installation of our power projects and the supply of certainkey plant and equipment. We may only have limited control over the timing or quality of services,equipment or supplies provided by these contractors and are highly dependent on some of ourcontractors who supply specialized services and sophisticated and complex machinery. We may beexposed to risks relating to the quality of the services, equipment and supplies provided by contractorsxx