Delaware County Probate Court Local Rules - Delaware County, Ohio

Delaware County Probate Court Local Rules - Delaware County, Ohio

Delaware County Probate Court Local Rules - Delaware County, Ohio

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

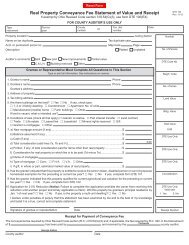

commissioner upon filing of the report and shall be collected as costs upon filing of theapplication. A case number shall be assigned to the application. The Application to Enter SafeDeposit Box form (Loc. F. 75.7A) and the Report of Entry of Safe Deposit Box form (75.7B)may be used for these purposes.LOC.R. 75.7MARRIAGE LICENSE APPLICANTSPursuant to R.C. 3101.05, any applicant for a marriage license who is a minor mustprovide proof of having received a minimum of three (3) hours of marriage counseling prior toapplying for the license. The counselors shall be either clergy or a person licensed to providecounseling. Proof of counseling may be in the form of a letter from the counselor on thecounselor’s letterhead, addressed to this <strong>Court</strong>.LOC.R. 75.8OHIO ESTATE TAX RETURN (for persons dying prior toJanuary 1, 2013)For every estate (administered, released or summarily released) for a decedent dyingprior to January 1, 2013, an <strong>Ohio</strong> Estate Tax Form 22 shall be filed. If a pre-2013 estate isreopened to administer additional real property, an additional <strong>Ohio</strong> Estate Tax Form 22 isrequired. If the only filings in a case are the estate tax returns, a copy of the death certificate isnot required.The <strong>Court</strong> will not deliver <strong>Ohio</strong> Estate Tax filings or payments to the <strong>County</strong> Auditor orTreasurer. Filing with those offices and the tendering of the taxes due is the responsibility of thefiling party.60