CLAIM FOR REIMBURSEMENT OF ALLOWABLE EXPENSES ...

CLAIM FOR REIMBURSEMENT OF ALLOWABLE EXPENSES ...

CLAIM FOR REIMBURSEMENT OF ALLOWABLE EXPENSES ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

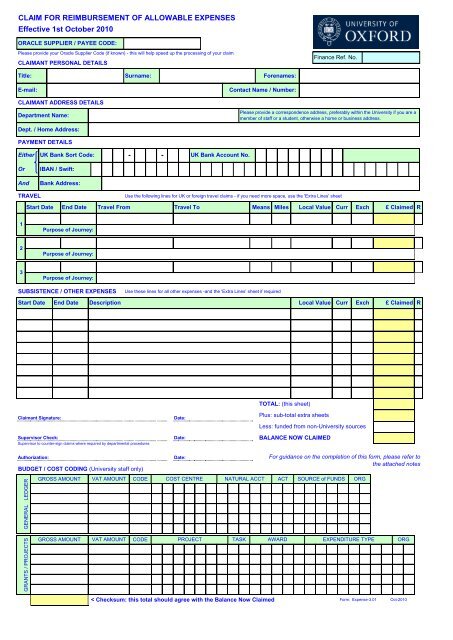

GENERAL LEDGERGRANTS / PROJECTS<strong>CLAIM</strong> <strong>FOR</strong> <strong>REIMBURSEMENT</strong> <strong>OF</strong> <strong>ALLOWABLE</strong> <strong>EXPENSES</strong>Effective 1st October 2010ORACLE SUPPLIER / PAYEE CODE:Please provide your Oracle Supplier Code (if known) - this will help speed up the processing of your claim<strong>CLAIM</strong>ANT PERSONAL DETAILSFinance Ref. No.Title:E-mail:<strong>CLAIM</strong>ANT ADDRESS DETAILSDepartment Name:Dept. / Home Address:PAYMENT DETAILSSurname:Forenames:Contact Name / Number:Please provide a correspondence address, preferably within the University if you are amember of staff or a student, otherwise a home or business address.EitherUK Bank Sort Code:--UK Bank Account No.OrIBAN / Swift:AndBank Address:TRAVELUse the following lines for UK or foreign travel claims - if you need more space, use the 'Extra Lines' sheetStart DateEnd DateTravel FromTravel ToMeansMilesLocal ValueCurrExch£ ClaimedR1Purpose of Journey:2Purpose of Journey:3Purpose of Journey:SUBSISTENCE / OTHER <strong>EXPENSES</strong>Use these lines for all other expenses -and the 'Extra Lines' sheet if requiredStart Date End Date Description Local Value Curr Exch £ Claimed RTOTAL: (this sheet)Claimant Signature:Supervisor Check:Supervisor to counter-sign claims where required by departmental proceduresDate:Date:Plus: sub-total extra sheetsLess: funded from non-University sourcesBALANCE NOW <strong>CLAIM</strong>EDAuthorization:BUDGET / COST CODING (University staff only)Date:For guidance on the completion of this form, please refer tothe attached notesGROSS AMOUNTVAT AMOUNTCODECOST CENTRE NATURAL ACCT ACT SOURCE of FUNDSORGGROSS AMOUNTVAT AMOUNT CODEPROJECTTASK AWARD EXPENDITURE TYPEORG< Checksum: this total should agree with the Balance Now Claimed Form:Expense-3.01Oct-2010

<strong>CLAIM</strong> <strong>FOR</strong> <strong>REIMBURSEMENT</strong> <strong>OF</strong> <strong>ALLOWABLE</strong> <strong>EXPENSES</strong> - GUIDE TO COMPLETIONA. WHEN TO USE THIS <strong>FOR</strong>MUse this form when seeking reimbursement of allowed expenses from the University, as detailed in the University Payments Manual.Any queries on completion should be addressed to the Finance Payments Team, e-mail: payments@admin.ox.ac.uk or telephone (01865) 616112.Do NOT use this form for Payment Requests, or for the payment or reconciliation of Advances - separate forms exist for each of these transactions.Generally claims should be made within two months of the expense being incurred and should always be accompanied by supporting documents orreceipts. Claims older than 12 months will not usually be paid. It is particularly important that claims charged to research projects follow the projectsponsor's rules for proof of expenditure in addition to any rules laid down by the University.B. COMPLETION <strong>OF</strong> THIS <strong>FOR</strong>MThis form has been designed so that information can be input electronically (you may need to ensure that Excel is set to permit macros if you use the 'ExtraLines' button). If you prefer, it may also be printed and completed by hand. In all cases, however, forms must be printed and signed before being sent to theFinance Division Payments Team for processing.1 - <strong>CLAIM</strong>ANT PERSONAL DETAILS:Please complete in full your title, surname and forenames. If you have an active e-mail address then please also provide this: the University will sendnotification of payment via e-mail where possible. If someone other than yourself should be contacted in the event of a query with this claim, please specifytheir name and contact telephone number in the 'Contact' field, otherwise simply provide us with your own contact telephone number.2 - <strong>CLAIM</strong>ANT ADDRESS DETAILS:Please specify the name of the department or college with which you are associated, together with a correspondence address - any printed payment advicedocuments will be sent to this address. It is recommended that a work address is used to avoid the University holding personal address detailsunnecessarily, but you may specify a private address if you prefer.3 - PAYMENT DETAILS:Please provide the details of the bank account to which you would like payment of your expenses to be made. This should be either a UK account if you areliving or working in the UK or a non-UK account if you are overseas. If you do not have a bank account or do not complete this section then a chequepayment will be provided, although reimbursement via cheque will usually take longer than a direct electronic payment.4 - TRAVEL DETAILS:If your claim includes travel costs then please complete this section of the form. For specific guidance on allowable travel claims, please see section 7 of theUniversity Payments Manual.Please specify the date or dates of travel: if the journey took place wholly within a single day then please complete only the 'Start Date' column; if longer, theninsert the date of the outward journey in the 'Start Date' column and the return journey in the 'End Date' column. Use the 'Travel From' column to indicate thestart point of the journey and 'Travel To' to indicate either the destination of a one-way trip, or the end point of the outward leg of the trip - do not put the samelocation in both 'from' and 'to' columns.Next, specify the means of transport ('car', 'train', 'air', etc.) and if you have travelled by private motor vehicle or bicycle and are claiming mileage, then pleaseindicate the distance in miles being claimed. If you complete the form electronically the rates are automatically applied once you specify the means oftransport and the mileage covered. Applicable mileage rates are: 40p / mile for motor cars and vans, 24p / mile for motor cycles and mopeds, 20p / mile forbicycles. You may add 5p / mile for each business passenger up to the vehicle's designed capacity - when completing the form electronically use 'car +1' toindicate one additional passenger, etc.If you complete the sheet manually, put the calculated mileage total, or total claimed, in the 'Local Value' field.The 'Curr' and 'Exch' columns are used for claims incurred in foreign currencies.Indicate the currency code in the 'Curr' field - the attached sheet provides an alphabetical list of all possible codes. For claims in Pounds Sterling use 'GBP' orleave this field blank. Specify the exchange rate used in the 'Exch' field - it is also important to attach to your claim the source of the conversion, e.g. creditcard statement or printout from a website such as www.xe.com. Leave this field blank for claims incurred in Pounds Sterling. For claims incurred and payablein the same foreign currency then specify an exchange rate of '1.0'The total claimed, in the currency in which the claim is to be paid, should be shown in the '£ Claimed' column. If completing the form electronically, the totalwill be automatically calculated for you (as will exchange rate conversions).If you have receipts, travel tickets, etc. in support of the claim, then place a cross in the column marked 'R'. Give a brief description of the purpose of thejourney and if you require extra lines use the 'Extra Lines' button or tab.5 - SUBSISTENCE / OTHER <strong>EXPENSES</strong>:For costs other than travel, please include the details on this section of the form, providing dates and full description of the expense involved. In all otherrespects, complete the remaining amount and currency fields in the same way as detailed above for Travel claims.6 - TOTAL AND BALANCE NOW <strong>CLAIM</strong>EDThe 'Total' box should agree to the sum of individual claims made. If you complete the form electronically then the spreadsheet will calculate the total valuefor you, including any amounts placed on the 'Extra Lines' sheet - otherwise write in the sub-total from any additional sheet(s). If funds have already beenreceived or are due from other sources then the total value of the claim should be reduced accordingly. The 'Balance Now Claimed' should reflect the total netreimbursement that is being sought.7 - BUDGET / COST CODINGIf you are a member of the University, complete the General Ledger and/or Projects section with the coding to which the claim will be charged - for guidanceplease refer to your departmental administration or finance office. The grand total of all amounts in the 'Gross Amount' column should equal the 'Balance NowClaimed'. If you complete the form electronically then this check will be made for you and advice shown on whether the totals match.8 - AUTHORIZATIONOnce all details have been provided, the form must be printed, signed and dated by the claimant. The 'Supervisor Check' field and date should be completedin those departments where departmental procedures require this. If you are uncertain whether this field requires completion, please refer to yourdepartmental administration or finance office. All claims must also be authorized with a signature matching the 'Authorized Signatures Register' held byFinance. Individuals are not permitted to authorize their own claims.For further details on authorization, see section 4.2 of the Payments Manual.Completed and authorized claims must be returned to the Payments Team, Finance Division, 23-38 Hythe Bridge Street, Oxford OX1 2ET.

<strong>CLAIM</strong> <strong>FOR</strong> <strong>REIMBURSEMENT</strong> <strong>OF</strong> <strong>ALLOWABLE</strong> <strong>EXPENSES</strong>Effective 1st October 2010Continuation Sheet<strong>CLAIM</strong>ANT PERSONAL DETAILSTitle: Surname:Forenames:TRAVELStart Date End Date Travel From Travel ToMeans Miles Local Value Curr Exch £ Claimed R4Purpose of Journey:5Purpose of Journey:6Purpose of Journey:7Purpose of Journey:8Purpose of Journey:SUBSISTENCE / OTHER <strong>EXPENSES</strong>Start Date End Date Description Local Value Curr Exch£ Claimed RTOTAL: (All lines this sheet)ADDITIONAL IN<strong>FOR</strong>MATIONForm: Expense-3.01 SUPOct-2010

CURRENCY CODESISO 4217 International Currency Codes for use with Expense Claims and Payment Requests(sorted by currency name)Code Currency Code Currency Code CurrencyAFN Afghanistan, Afghanis GTQ Guatemala, Quetzales PGK Papua New Guinea, KinaALL Albania, Leke GGP Guernsey, Pounds PYG Paraguay, GuaraniDZD Algeria, Algeria Dinars GNF Guinea, Francs PEN Peru, Nuevos SolesAOA Angola, Kwanza GYD Guyana, Dollars PHP Philippines, PesosARS Argentina, Pesos HTG Haiti, Gourdes PLN Poland, ZlotychAMD Armenia, Drams HNL Honduras, Lempiras QAR Qatar, RialsAWG Aruba, Guilders (also called Florins) HKD Hong Kong, Dollars RON Romania, New LeiAUD Australia, Dollars HUF Hungary, Forint RUB Russia, RublesAZN Azerbaijan, New Manats ISK Iceland, Kronur RWF Rwanda, Rwanda FrancsBSD Bahamas, Dollars INR India, Rupees SHP Saint Helena, PoundsBHD Bahrain, Dinars IDR Indonesia, Rupiahs WST Samoa, TalaBDT Bangladesh, Taka IRR Iran, Rials STD São Tome and Principe, DobrasBBD Barbados, Dollars IQD Iraq, Dinars SAR Saudi Arabia, RiyalsBYR Belarus, Rubles IMP Isle of Man, Pounds SPL Seborga, LuiginiBZD Belize, Dollars ILS Israel, New Shekels RSD Serbia, DinarsBMD Bermuda, Dollars JMD Jamaica, Dollars SCR Seychelles, RupeesBTN Bhutan, Ngultrum JPY Japan, Yen SLL Sierra Leone, LeonesBOB Bolivia, Bolivianos JEP Jersey, Pounds SGD Singapore, DollarsBAM Bosnia and Herzegovina, Convertible Marka JOD Jordan, Dinars SBD Solomon Islands, DollarsBWP Botswana, Pulas KZT Kazakhstan, Tenge SOS Somalia, ShillingsBRL Brazil, Brazil Real KES Kenya, Shillings ZAR South Africa, RandBND Brunei Darussalam, Dollars KPW Korea (North), Won LKR Sri Lanka, RupeesBGN Bulgaria, Leva KRW Korea (South), Won SDG Sudan, PoundsBIF Burundi, Francs KWD Kuwait, Dinars SRD Suriname, DollarsKHR Cambodia, Riels KGS Kyrgyzstan, Soms SZL Swaziland, EmalangeniCAD Canada, Dollars LAK Laos, Kips SEK Sweden, KronorCVE Cape Verde, Escudos LVL Latvia, Lati CHF Switzerland, FrancsKYD Cayman Islands, Dollars LBP Lebanon, Pounds SYP Syria, PoundsCLP Chile, Pesos LSL Lesotho, Maloti TWD Taiwan, New DollarsCNY China, Yuan Renminbi LRD Liberia, Dollars TJS Tajikistan, SomoniCOP Colombia, Pesos LYD Libya, Dinars TZS Tanzania, ShillingsX<strong>OF</strong> Communauté Financière Africaine BCEAO, Francs LTL Lithuania, Litai THB Thailand, BahtXAF Communauté Financière Africaine BEAC, Francs MOP Macau, Patacas TOP Tonga, Pa'angaKMF Comoros, Francs MKD Macedonia, Denars TTD Trinidad and Tobago, DollarsXPF Comptoirs Français du Pacifique Francs MGA Madagascar, Ariary TND Tunisia, DinarsCDF Congo/Kinshasa, Congolese Francs MWK Malawi, Kwachas TRY Turkey, New LiraCRC Costa Rica, Colones MYR Malaysia, Ringgits TMM Turkmenistan, ManatsHRK Croatia, Kuna MVR Maldives (Maldive Islands), Rufiyaa TVD Tuvalu, Tuvalu DollarsCUP Cuba, Pesos MTL Malta, Liri (expires 2008-Jan-31) UGX Uganda, ShillingsCYP Cyprus, Pounds (expires 2008-Jan-31) MRO Mauritania, Ouguiyas UAH Ukraine, HryvniaCZK Czech Republic, Koruny MUR Mauritius, Rupees AED United Arab Emirates, DirhamsDKK Denmark, Kroner MXN Mexico, Pesos GBP United Kingdom, PoundsDJF Djibouti, Francs MDL Moldova, Lei USD United States of America, DollarsDOP Dominican Republic, Pesos MNT Mongolia, Tugriks UYU Uruguay, PesosXCD East Caribbean Dollars MAD Morocco, Dirhams UZS Uzbekistan, SumsEGP Egypt, Pounds MZN Mozambique, Meticais VUV Vanuatu, VatuSVC El Salvador, Colones MMK Myanmar (Burma), Kyats VEB Venezuela, Bolivares (expires 2008-Jun-30)ERN Eritrea, Nakfa NAD Namibia, Dollars VEF Venezuela, Bolivares FuertesEEK Estonia, Krooni NPR Nepal, Nepal Rupees VND Viet Nam, DongETB Ethiopia, Birr ANG Netherlands Antilles, Guilders (also called Florins) YER Yemen, RialsEUR Euro Member Countries, Euro NZD New Zealand, Dollars ZMK Zambia, KwachaFKP Falkland Islands (Malvinas), Pounds NIO Nicaragua, Cordobas ZWD Zimbabwe, Zimbabwe DollarsFJD Fiji, Dollars NGN Nigeria, NairasGMD Gambia, Dalasi NOK Norway, KroneGEL Georgia, Lari OMR Oman, RialsGHS Ghana, Cedis PKR Pakistan, RupeesGIP Gibraltar, Pounds PAB Panama, Balboa