MIMOS Annual Report 2007

MIMOS Annual Report 2007

MIMOS Annual Report 2007

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

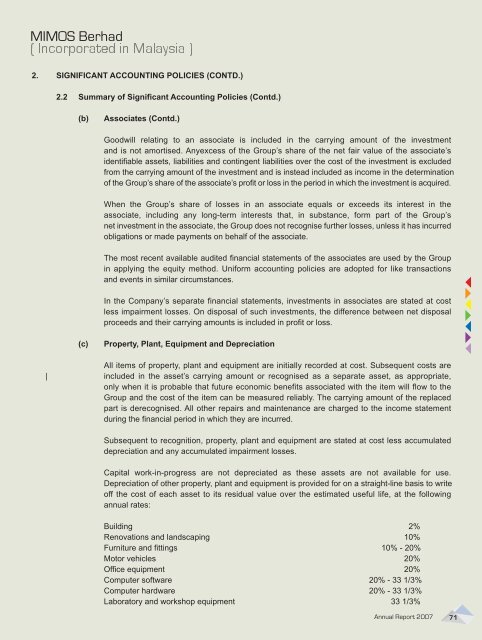

<strong>MIMOS</strong> Berhad2. SIGNIFICANT ACCOUNTING POLICIES (CONTD.)2.2 Summary of Significant Accounting Policies (Contd.)(b)Associates (Contd.)Goodwill relating to an associate is included in the carrying amount of the investmentand is not amortised. Anyexcess of the Group’s share of the net fair value of the associate’sidentifiable assets, liabilities and contingent liabilities over the cost of the investment is excludedfrom the carrying amount of the investment and is instead included as income in the determinationof the Group’s share of the associate’s profit or loss in the period in which the investment is acquired.When the Group’s share of losses in an associate equals or exceeds its interest in theassociate, including any long-term interests that, in substance, form part of the Group’snet investment in the associate, the Group does not recognise further losses, unless it has incurredobligations or made payments on behalf of the associate.The most recent available audited financial statements of the associates are used by the Groupin applying the equity method. Uniform accounting policies are adopted for like transactionsand events in similar circumstances.In the Company’s separate financial statements, investments in associates are stated at costless impairment losses. On disposal of such investments, the difference between net disposalproceeds and their carrying amounts is included in profit or loss.(c)Property, Plant, Equipment and DepreciationAll items of property, plant and equipment are initially recorded at cost. Subsequent costs are| included in the asset’s carrying amount or recognised as a separate asset, as appropriate,only when it is probable that future economic benefits associated with the item will flow to theGroup and the cost of the item can be measured reliably. The carrying amount of the replacedpart is derecognised. All other repairs and maintenance are charged to the income statementduring the financial period in which they are incurred.Subsequent to recognition, property, plant and equipment are stated at cost less accumulateddepreciation and any accumulated impairment losses.Capital work-in-progress are not depreciated as these assets are not available for use.Depreciation of other property, plant and equipment is provided for on a straight-line basis to writeoff the cost of each asset to its residual value over the estimated useful life, at the followingannual rates:Building 2%Renovations and landscaping 10%Furniture and fittings 10% - 20%Motor vehicles 20%Office equipment 20%Computer software 20% - 33 1/3%Computer hardware 20% - 33 1/3%Laboratory and workshop equipment 33 1/3%<strong>Annual</strong> <strong>Report</strong> <strong>2007</strong> 71