2010 - Upper Freehold Township

2010 - Upper Freehold Township

2010 - Upper Freehold Township

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

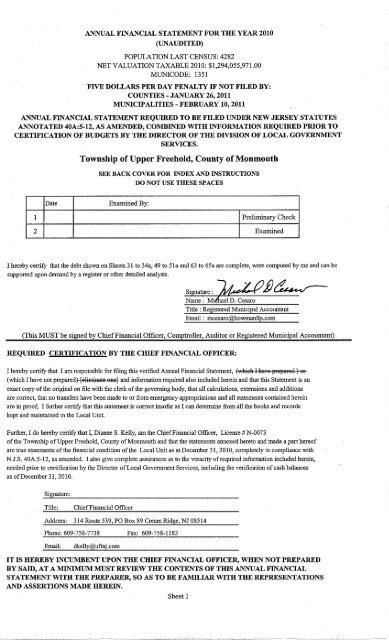

ANNUAL FINANCIAL STATEMENT FOR THE YEAR <strong>2010</strong>(UNAUDITED)POPULATION LAST CENSUS: 4282NET VALUATION TAXABLE <strong>2010</strong>: $1,294,055,971.00MUNICODE: 1351FIVE DOLLARS PER DAY PENALTY IF NOT FILED BY:COUNTIES - JANUARY 26, 2011MUNICIPALITIES - FEBRUARY 10, 2011ANNUAL FINANCIAL STATEMENT REQUIRED TO BE FILED UNDER NEW JERSEY STATUTESANNOTATED 40A:5-12, AS AMENDED, COMBINED WITH INFORMATION REQUIRED PRIOR TOCERTIFICATION OF BUDGETS BY THE DIRECTOR OF THE DIVISION OF LOCAL GOVERNMENTSERVICES.<strong>Township</strong> of <strong>Upper</strong> <strong>Freehold</strong>, County of MonmouthSEE BACK COVER FOR INDEX AND INSTRUCTIONSDO NOT USE THESE SPACESDateExamined By:I2Preliminary CheckExaminedI hereby certify that the debt shown on Sheets 31 to 34a, 49 to 51a and 63 to 65a are complete, were computed by me and can besupported upon demand by a register or other detailed analysis.Signature:Name: Mi,~iJ&~~v--Title : Registered Municipal AccountantEmail: mcesaro@bowmanllp.com(This MUST be signed by Chief Financial Officer, Comptroller, Auditor or Registered Municipal Acconntant)REQUIRED CERTIFICATION BY THE CHIEF FINANCIAL OFFICER:I hereby certify that I am responsible for filing this verified Annual Financial Statement, ("ilieli I Ii ... ,. I'f"flar.Ei ) 8f(which I have not prepared) [.limiaal. 8"oJ and infonnation required also included herein and that this Statement is anexact copy of the original on file with the clerk of the governing body, that all calculations, extensions and additionsare correct, that no transfers have been made to or from emergency appropriations and all statements contained hereinare in proof; I further certify that this statement is correct insofar as I can detemtine from all the books and recordskept and maintained in the Local Unit.Further, I do hereby certify that I, Dianne S. Kelly, am the Chief Financial Officer, License # N-0073of the <strong>Township</strong> of <strong>Upper</strong> <strong>Freehold</strong>, County ofMomnouth and that the statements annexed hereto and made a part hereofare true statements of the financial condition of the Local Unit as at December 31,<strong>2010</strong>, completely in compliance withN.J.S. 40A:5-12, as amended. I also give complete assurances as to the veracity ofreqnired information included herein,needed prior to certification by the Director of Local Govermnent Services, including the verification of cash balancesas of December 31, <strong>2010</strong>.Signature:Title:Chief Financial OfficerAddress: 314 Route 539, PO Box 89 Cream Ridge, NJ 08514Phone: 609-758-7738 Fax: 609-758-1183Email:dkelly@uftnj.comIT IS HEREBY INCUMBENT UPON THE CHIEF FINANCIAL OFFICER, WHEN NOT PREPAREDBY SAID, AT A MINIMUM MUST REVIEW THE CONTENTS OF TIDS ANNUAL FINANCIALSTATEMENT WITH THE PREPARER, SO AS TO BE FAMILIAR WITH THE REPRESENTATIONSAND ASSERTIONS MADE HEREIN.Sheet I

THE REQIDRED CERTIFICATION BY AN RMA IS AS FOLLOWS:Preparation by Registered Municipal Accountant (Statement of Statutory Auditor Only)I have prepared the post-closing trial balances, related statements and analyses included in theaccompauying Annual Financial Statement from the books of account and records madeavailable to me by the <strong>Township</strong> of <strong>Upper</strong> <strong>Freehold</strong> as of December 31, <strong>2010</strong> and have appliedcertain agreed-upon procedures thereon as promulgated by the Division of Local GovernmentServices, solely to assist the Chief Financial Officer in connection with the filing of theAnnual Financial Statement for the year then ended as required by N.J.S. 40A:5-12, as amended.Because the agreed-upon procedures do not constitute an examination of accounts made in accordancewith generally accepted auditing standards, I do not express an opinion on any of the post-closing trialbalances, related statements and analyses. In connection with the agreed-upon procedures, (exeeflt fereireumstanees as set ferth llelew, ne matters) er ( no matters) [e1imiBate enel came to my attentionthat caused me to believe that the Annual Financial Statement for the year ended December 31,<strong>2010</strong> is not in substantial compliance with the requirements of the State of New Jersey,Department of Community Affairs, Division of Local Government Services. Had I performedadditional procedures or had I made an examination of the financial statements in accordance withgenerally accepted auditing standards, other matters might have come to my attention that would havebeen reported to the governing body and the Division. This Annual Financial Statement relatesonly to the accounts and items prescribed by the Division and does not extend to the financialstatements of the municipality/county, taken as a whole.Listing of agreed-upon procedures not performed and/or matters coming to my attention of whichthe Director should be informed:J1~j)~Michael D. Cesaro, RMABOWMAN & COMPANY LLP(Firm Name)601 WHITE HORSE ROAD(Address)VOORHEES, NJ 08043-2493(Address)Certified by meThis 27th day of January 2011(856) 821-6863(phone Number)(856) 782-5013(Fax Number)Sheet la

UNIFORM CONSTRUCTION CODE CERTIFICATIONBY CONSTRUCTION CODE OFFICIALThe undersigned certifies that the municipality has complied with theregulations governing revenues generated by uniform construction codefees and expenditures for construction code operations forfiscal year <strong>2010</strong> as required under N.J.A.C. 5:23-4.17.Printed Name:Ronald GafgenSignature:Certificate # : 003639~~~-------------------Date:Sheet lb",,,.,.~. --'," ""'.~ •.• ,_,~_",,,,_-,-.O,,,.h·,-_-"-_·"_.,,_._~_,_«,,_~._~-_____ -- -~· __ ~~"3~._."T_' 'r_''''_·_c=~'-'':~';;,·~or:;;." .,-,:"~,-:,:",,,-,,;x,·,~; ''-'~',-~C>'~""_oy.,, ,'.'_,,_,_m_· ____ '_

MUNICIPAL :BUDGET LOCAL EXAMINATION QUALIFICATION CERTIFICATIONBYCmEF FINANCIAL OFFICEROne of the following Certifications must be signed by the Chief FinancialOfficer i{vour Municipality is elif{ible for local examinationCERTIFICATION OF QUALIFYING MUNICIPALITY1. The outstanding indebtedness of the previous fiscal year is not in excess of 3.5%;2. All emergencies approved tor the previous tiscal year did not exceed 3% oUotalappropriations;3. The tax collection rate exceeded 90%;4. Total deferred charges did not equal or exceed 4% of the total tax levy5. There were no "procedural deticiencies" noted by the registered municipalaccountant on Sheet la ofthe Annual Financial Statement; and6. There was no operating deficit for the previous fiscal year.7. The municipality did not conduct an accelerated tax sale tor less than 3 consecutiveyears.8. The municipality did not conduct a tax levy sale the previous tiscal year and does notplan to conduct one in the current year9. The current year budget does not contain an appropriation or levy "CAP" wavier.10. The municipality will not apply for the Transitional Aid for 2011.The undersigned certities that this municipality has complied in full in meeting ALL of theabove criteria in determining its qualification for local examination of its Budget inaccordance with N.J.A.C .. 5:30-7.5.Municipality:Chief Financial Officer:<strong>Township</strong> of <strong>Upper</strong> <strong>Freehold</strong>Dianne S. KellySignature:Certificate #: N-0073Date:CERTIFICATION OF NON-QUALIFYING MUNICIPALITYThe undersigned certifies that this municipality does not meet item(s) #_10 __of the criteria above and therefore does not qualify for localexamination of its Budget in accordance with NJ.A.C. 5:30-7.5.Mlll1icipality:Chief Financial Officer:Signature:Certificate #:Date:Sheet 1c

.~.-"""=~"-","~-_.-~"'>O"."·",.~T~~_~~_·____ ~ __ ·_~______· ,"~m~"'~.n.·_'.. C".,"~"h~."r" ,,, ,-" .--. '-" '~'.-_," •.-.-..•-. -'-'," > .••- oc-_.,~_,«~~ __'__' __'21-6001322Fed. LD.#<strong>Township</strong> of <strong>Upper</strong> <strong>Freehold</strong>MUiiicipalilYCounty of MonmouthCountyReport of Federal and State Financial AssistanceExpenditures of AwardsFiscal Year Ending: December 31, <strong>2010</strong>(1) (2) (3)StateOther FederalFederal Programs Expended Programs Programs(administered by the state) Expended ExpendedTotal$169,246.65 $465,440.18Type of Audit required by OMB A-133 and OMB 04-04:__Single AuditProgram Specific AuditFinancial Statement Audit Perfonned in Accordance With....!... Government Auditing Standards (Yellow Book)Note: All local governments, who are recipients of federal and state awards (financial assistance), mustreport the total amount of federal and state funds expended during its fiscal year and the type of auditrequired to comply with OMB A-133 (Revised 6/27/03) and OMB 04-04. The single audit threshoid hasbeen increased to $500,000 beginning with the fiscal Year ending after 12/31/03. Expenditures are defmedin Section 205 ofOMB A-133.(1) Report expenditures from federal pass-through programs received directly from state government.Federal pass-through funds can be identified by the Catalog of Federal Domestic Assistance (CFDA)number reported in the State's grant/contract agreements.(2) Report expenditures from state programs received directly from the state government or indirectlyfrom pass-through entities. Exclude state aid (i.e., CMPTRA, Energy Receipts tax, etc.) since there areno compliance requirements.(3) Report expenditures from federal programs received directly from the federal government orindirectly from entities other than the state government.Signature Of Chief Financial OfficerDateSheet ld

IMPORTANT!READ INSTRUCTIONSINSTRUCTIONThe following certification is to be used ONLY in the event there is NO municipally operated utility.If there is a utility operated by the municipality or if a "utility fund" existed on the books of account,do not sign this statement and do not remove any of the UTILITY sheets from the document.CERTIFICATIONI hereby certifY that there was no "utility fund" on the books of account and there was no utilityowned and operated by the <strong>Township</strong> of <strong>Upper</strong> <strong>Freehold</strong>, County of Monmouth during the year <strong>2010</strong> and thatsheets 40 to 68 are unnecessary.I have therefore removed from this statement the sheets pertaining only to utilitiesName: Jr~£l~~Michael D. CesaroTitle: Registered Municipal Accountant(This must be signed by the Chief Financial Officer, Comptroller, Auditor, Or Registered Municipal Accountant)NOTE:When removing the utility sheets, please be sure to refasten the "index" sheet ( the last sheetin the statement) in order to provide a protective cover sheet to the back of the document.MUNICIPAL CERTIFICATION OF TAXABLE PROPERTY AS OF OCTOBER 1, <strong>2010</strong>Certification is hereby made that the Net Valuation Taxable of property liable to taxation for the tax year 2011and filed with the County Board of Taxation on January 10,2011 in accordance with the requirement ofN.J.S.A 54:4-35,was in the amount of$SIGNATURE OF TAX ASSESSOR<strong>Township</strong> of <strong>Upper</strong> <strong>Freehold</strong>MUNICIPALITYMonmouthCOUNTYSheet 2

Cash Liabilities:NOTE THAT A TRIAL BALANCE IS REQUIRED AND NOT A BALANCE SHEETPOST CLOSINGTRIAL BALANCE - CURRENT FUNDAS AT DECEMBER 31,<strong>2010</strong>Cash Liabilities Must Be Subtotaled and Subtotal Must Be Marked With "C" -Title of AccountTaxes Receivable Must Be SubtotaledIEDebitIIAppropriation Reserves 214,712.21Due to State of New Jersey" Senior Citizens & Veteran Deductions 6,192.82Local District School Tax PayableMunicipal Open Space TaxRegional School Tax PayableRegional High School Tax PayableCounty Taxes PayableDue County for Added and Omitted Taxes 51,410.49Special District Taxes PayableState Library Aid (See Sheet 16 )Reserve for Encumbrances 52,010.78Tax Overpayments 14,678.09Prepaid Taxes 143,159.27Contracts Payable 57,699.20Due State of New Jersey" State Training Fees 3,323.87Accounts Payable 8,925.00Due to Federal/State Grant Fund 41,117.33Due to General Capital Fund 2,500.00Reserve for Special Road Work 6,000.00Reserve for Garden State Preservation Fund 7,090.00Reserve for Preparation and Revision of the Master Plan 154,516.90Reserve for Soil Witnessing Fees 4,522.62Reserve for Polling Places 800.00Reserve for Reassessment 220.00Reserve for Payment of Debt Service 290,321.00Snbtotal Cash Liabilities C 1,059,199.58Reserve for Receivables 773,153.66School Taxes Deferred (See Sheets 13 & 14 ) 9,266,913.12Fund Balance 2,482,955.84TOTAL 1 13,582,222.2011 13,582,222.20Do not crowd" add additional sheetsSheet 3a

POST CLOSINGTRIAL BALANCE - PUBLIC ASSISTANCE FUNDACCOUNTS #1 AND #2 *AS AT DECEMBER 31, <strong>2010</strong>Cash - Public Assistance # 1Title of AccountIIDebitI~Cash - Public Assistance #2.TOTALDo not crowd - add additional sheetsII* To be prepared in compliance with Department of Human Services Municipal Audit Guide, Public Welfare, General Assistance ProgramSheet 4

POST CLOSING TRIAL BALANCEFEDERAL AND STATE GRANTSAS AT DECEMBER 3L <strong>2010</strong>Title of AccountIIDebitIECashFederal and State Grants ReceivableDue from Current Fund207,057.0641,117.33Appropriated Reserves for Federal and State GrantsUnappropriated Reserves for Federal and State GrantsCash Liabilities236,683.013,164.81Reserve for Encumbrances8,326.57Subtotal Cash Liabilities8,326.57TOTALDo not crowd - add additional sheets248,174.39 248,174.39Sheet 5

POST CLOSINGTRIAL BALANCE - TRUST FUNDS(Assessment Section Must Be Separately Stated)AS AT DECEMBER 31, <strong>2010</strong>Title of AccountIIDebitIETRUST - OTHERCash4,292,034.11Deferred ChargesDue Current Fund - Trust OtherPayroll Deductions PayableReserve for UnemploymentReserve for Escrow DepositsReserve for Encumbrances - Escrow DepositsReserve for Open Space, Recreation, Farmland and Historic PreservationReserve for Encumbrances - Open SpacePremiums Received at Tax SaleReserve for TTL RedemptionReserve for Municipal AllianceReserve for COAH Development FeesReserve for Encumbrances - CO AH Development FeesReserve for Public Defender FeesReserve for Snow RemovalReserve for Encumbrances - Snow RemovalReserve for RecreationDue to Current Fund - Open Space21,368.1610,493.2122,266.321,340,111.8753,878.79142,560.53185,072.72106,900.0055,197.008,250.282,121,457.52725.33330.0083,550.1525,000.0049,767.1165,105.12--.Do not crowd - add additional sheetsSheet 6

TRUST - DOG LICENSEPOST CLOSINGTRIAL BALANCE - TRUST FUNDS(Assessment Section Must Be Separately Stated)Title of AccountIAS AT DECEMBER 31, <strong>2010</strong>DebitIE--------- ------Cash 3,240.17Deferred ChargesReserve for Animal Control Fund Expenditnres 3,240.17Total 3,240.171 3,240.1711--Do not crowd - add additional sheetsSheet 6ii

Schedule of Trust Fund ReservesAmountPurpose Dec. 31, 2009 Receipts Disbursements Balanceper Auditas atReport Dec. 31. <strong>2010</strong>1. Escrow Deposits $ 1,147,396.72 $ 600,764.41 $ 408,049.26 $ 1,340,111.872. Snow Removal Trust 126,250.15 42,700.00 83,550.153. COAH DeveloEment Fees 2,033,695.02 127,445.84 39,683.34 2,121,457.524. Public Defender Fees 2,430.00 2,100.00 330.005. Open Space 45,837.34 789,533.54 692,810.35 142,560.536. Recreation 55,355.25 51,189.00 56,777.14 49,767.117. MuniciEa1 Alliance 12,557.82 12,085.76 16,393.30 8,250.288.9.10.11.12.13.14.15.16.17.18.19.20.21.22.23.24.25.26.27.28.29.30.Totals: $ 3,421,092.30 $ 1,583,448.55 $ 1,258,513.39 $ 3,746,027.46Sheet6b

••ANALYSIS OF TRUST ASSESSMENT CASH AND INVESTMENTS PLEDGED TOLIABILITIES AND SURPLUSTitle of Liability to which Cash Audit RECEIPTSand Investments are PledgedBalance Dec. 31, Assessments and2009 LiensCurrent BudgetDisbursementsAssessment Serial Bond Issues: XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXBalanceDec. 31,<strong>2010</strong>XXXXX,,~'"--.JAssessment Bond Anticipation Note Issues:XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXIOther Liabilities•Trust Surplus*Less Assets"Unfmanced" XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX.... L .... _. _______ ----XXXXX* Show as Red Figure

ANALYSIS OF TRUST ASSESSMENT CASH AND INVESTMENTS PLEDGED TOLIABILITIES AND SURPLUSTitle of Liability to which Cash Audit RECEIPTSand Investments are Pledged Balance December Assessments and DisbursementsCurrent Budget31,2009 LiensAssessment Bond Anticipation Note Issnes:XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXBalanceDecember 31,<strong>2010</strong>XXXXX[-.}'"-Other LiabilitiesTrust Surplus* Less: Assets nUnfmanced ll XXXXX XXXXX XXXXX XXXXX XXXXX XXXXX XXXXXXXXXXTotal* Show as Red FIgare

POST CLOSINGTRIAL BALANCE - GENERAL CAPITAL FUNDAS AT DECEMBER 31,<strong>2010</strong>Title of AccountIEDebitIIEst. Proceeds Bonds and Notes Authorized 1,345,668.45 XXXXXXXXBonds and Notes Authorized but Not IssnedXXXXXXXX 1,345,668.45Cash 5,956,292.80InvestmentsDeferred ChargesFunded 22,575,000.00Unfunded 1,345,668.45Due from Current Fund 2,500.00Due from <strong>Township</strong> of Washington 100,000.00New Jersey Transportation Trust Fund Receivable 160,000.00General Capital BondsAssessment Serial BondsBond Anticipation NotesAssessment NotesImprovement Authorizations - FundedImprovement Authorizations - UnfundedCapital Improvement FundDown Payments on ImprovementsCapital SurplusReserve for Payment of BondsReserve for EncumbrancesReserve for Stone Hill Road PavingReserve for Emergency Vehic1es and AppurtenancesReserve for Acquisition of Office Equipment and Computers22,575,000.001,038,923.241,343,168.45944,777.52162,488.291,234,035.222,578,653.5310,000.00241,915.0010,500.00Total 31,485,129.70Do not crowd - add additional sheets31,485,129.70Sheet 8

CASH - . - RECONCILIATION - _. - --- DECEMBER 31.<strong>2010</strong>ICASH. * ON HAND ON DEPOSIT7 -LESS CHECKSOUTSTANDINGCASHBOOKBALANCECurrent 36,437.25 3,402,595.88 41,877.71 3,397,155.42Trust - AssessmentTrust - Dog License 3,240.17 3,240.17Trust - Other 50.00 4,303,834.65 11,850.54 4,292,034.11Capital -General 6,202,881.80 246,589.00 5,956,292.80Water - OperatingWater - CapitalSewer Utility - Oper.Utility Assessment - TrustSewer Utility Assess. - TrustSewer Utility - CapitalFederal and State GrantsPublic Assistance #1 *-Public Assistance #2 *-Garbage DistrictTotal 36,487.25 13,912,552.50 300,317.25 13,648,722.50* Include Deposits in Transit** Be sure to include a Public Assistance Account reconciliation and trial balance if the municipality maintains such a bankaccount.REQUIRED CERTIFICATIONI hereby certify that all the amounts shown in the "Cash on Deposit" column on Sheet 9 and 9(a) have been verified with tapplicable bank statements, certificates, agreements or passbooks at December 31, <strong>2010</strong>.I also certify that all amounts, if any, shown for Investments in Savings and Loan Associations on any trial balance havebeen verified with the applicable passbooks at December 31, <strong>2010</strong>.All "Certificates of Deposit" "Repurchase Agreements" and other investments must be reported as cash and included inthis certification.(THIS MUST BE SIGNED BY THE REGISTERED MUNICIPAL ACCOUNTANT (STATUTORY AUDITOR) ORCHIEF FINANCIAL OFFICER) depending on who prepared this Annual Financial Statement as certified to on Sheet 1 or l(a)Signature: )4~LJ~ Title: Registered Municipal AccountantSheet 9

CASH RECONCILIATION DECEMBER 31,<strong>2010</strong> (CONT'D)LIST BANKS AND AMOUNTS SUPPORTING "CASH ON DEPOSIT"BeneficialPayroll TrustUnemployment Compensation TrustGeneral TrustGeneral Capital FundOpen Space, Recreation, Farmland and Historic PreservationDevelopers Escrow TrustAnimal Control TreasurerPublic Defender TrustCurrent AccountCOAH Development Fee AccountRecreationSnow Removal.Tax Title Lien Redemption AccountTax CollectorMunicipal Alliance22,012.1022,266.32121,616.736,202,881.80392,738.371,294,073.743,240.17330.003,141,684.072,122,182.8549,767.11108,550.15162,097.00260,911.818,200.28.--13,912,552.50NOTE: Sections NJ.S. 40A:4-61, 40A:4-62 and 40A:4-63 of the Local Budget Law require thatseparate bank accounts be maintained for each allocated fund.Sheet 9a

IGrantMUNICIPALITIES AND COUNTIESFEDERAL AND STATE GRANTS RECEIVABLEIBalance <strong>2010</strong> BndgetJan. 1,<strong>2010</strong> Revenue Realized ReceivedBalanceAccrued Cancelled Dec. 31, <strong>2010</strong>g~-o!See totals on attached statementTOTALS:--217,744.93 72,162.33217,744.93 72,162.33- -------61,823.22 -348.76 207,057.0661,823.22 -348.76 207,057.06

TOWNSHIP OF UPPER FREEHOLDFEDERAL AND STATE GRANT FUNDStatement of Federal, State and Other Grants ReceivableFor the Year Ended December 31,<strong>2010</strong>ProgramBalanceDec. 31.2009AccruedBalanceReceived Canceled Dec. 31. <strong>2010</strong>Federal Grants:Community Block Development GrantN.J. Transportation Trust Fund Authority$ 180,439.0020,923.56$ 20,923.56$ 180,439.00C/l:::TCDCDTotal Federal Grants201,362.5620,923.56 180,439.00-~0OJState Grants:Alcohol Education and Rehab. FundClean Communities GrantGovConnect GrantRecycling Tonnage GrantMunicipal Alliance on Alcoholism and Drug Abuse$ 251.3718,713.04500.003,164.8113,532.37 39,694.00$ 251.3718,713.04500.003,164.8129,109.55 $ 348.76 23,768.06Total State Grants14,032.37 61,823.2251,238.77 348.76 24,268.06Other Grants:Monmouth County Historical Grant2,350.002,350.00Total Federal, State and Other Grants$ 217,744.93 $ 61,823.22$ 72,162.33 $ 348.76 $ 207,057.06

IGrantSCHEDULE OF APPROPRIATED RESERVES FORFEDERAL AND STATE GRANTSTransferred from <strong>2010</strong> BudgetBalanceADDroDriationsI Jan. 1,<strong>2010</strong> Budget AppropriatiouBy40A:4-87ExpendedBalanceCancelled Dec. 31, <strong>2010</strong>[~-See totals on attached statementTOTALS:----398,559.00 62,316.31 251.37 224,094.91398,559.00 62,316.31 ..251.37 224,094.91- -- -- - - -----348.76 236,683.01-348.76 236,683.01

TOWNSHIP OF UPPER FREEHOLDFEDERAL AND STATE GRANT FUNDStatement of Reserve for Federal, State and Other Grants -- AppropriatedForthe Year Ended December 31,<strong>2010</strong>BalanceDec. 31, 2009Encumbered ReservedTransferredfrom 2009BudgetAppropriationCanceledExpendedPaid orCharged EncumberedBalanceDec. 31, <strong>2010</strong>en:::TCDCD-~~OJFederal Grants:Community Block Development GrantN.J. Transportation Trust Fund Authority$ 179,838.00169,246.65 $ 169,246.65349,084.65 169,246.65State Grants:Drunk Driving Enforcement GrantClean Communities GrantGovConnect GrantNJDEP Environmental Service ProgramRecycling Tonnage GrantStormwater Regulation Grant2,280.4325,020.90502.204,500.002,183.53349.57$ 18,713.043,909.279,785.70Alcohol Education and Rehabilitation1,105.35 251.37 $ 180.00Municipal Alliance on Alcoholism and Drug Abuse $ 3,044.58 10,487.79 39,694.00 $ 348.76 36,735.99 8,146.57$ 179,838.00179,838.002,280.4333,948.24502.204,500.006,092.80349.571,176.727,995.05Total State Grants 3,044.58 46,429.77 62,567.68 348.76 46,521.69 8,326.57Total Federal and State Grants $ 3,044.58 $ 395,514.42 $ 62,567.68 $ 348.76 $ 215,768.34 $ 8,326.5756,845.01$ 236,683.01

IGrantSCHEDULE OF UNAPPROPRIATED RESERVES FORFEDERAL AND STATE GRANTSTransferred to <strong>2010</strong> BudgetBalance Annror riations GrantsI Jan. 1,<strong>2010</strong> Budget Appropriation Receivable ReceivedBv40A:4-87BalanceDec. 31, <strong>2010</strong>!ft~III-NSee totals on attached statementTOTALS:3,909.27 61,823.22 -62,567.683,909.27 61,823.22 -62,567.683,164.813,164.81

TOWNSHIP OF UPPER FREEHOLDFEDERAL AND STATE GRANT FUNDStatement of Reserve for Federal and State Grants -- UnappropriatedFor the Year Ended December 31,<strong>2010</strong>Realized asFederal and MiscellaneousBalance State Grants Revenue inProgram Dec. 31.2009 Receivable 2009 BudgetBalanceDec. 31. <strong>2010</strong>(J)::::rCDCD...........NIIIState Grants:Alcohol Education and Rehabilitation $ 251.37 $ 251.37Clean Communities Grant 18,713.04 18,713.04Recycling Tonnage Grant $ 3,909.27 3,164.81 3,909.27Municipal Alliance on Alcoholism and Drug Abuse 39,694.00 39,694.00Total State Grants 3,909.27 61,823.22 62,567.68Total Federal and State Grants $ 3,909.27 $ 61,823.22 $ 62,567.68$ 3,164.813,164.81$ 3,164.81

IBalance January I, <strong>2010</strong>* LOCAL DISTRICT SCHOOL TAXIEx:xxxxxxxx x:xxxxxxxxDebitSchool Tax Payable # 85001-00 x:xxxxxxxxSchool Tax Deferred (Not in excess of 50%of Levy -2009-<strong>2010</strong>)Levy School Year July I, 20 I 0, June 30, 20 IILevy Calendar Year <strong>2010</strong>PaidBalance December 31,<strong>2010</strong>85002-00 x:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxx x:xxxxxxxxSchool Tax Payable # 85003-00 x:xxxxxxxxSchool Tax Deferred (Not in excess of 50% of Levy - <strong>2010</strong>-2011). 1'10t mcmomg 1 ype 1 scnOOI oeot servIce, emergency aumonzauons-scnOOls, tranSIerto Board of Education for use oflocal schools.# Must include unpaid requisitions.85004-00 x:xxxxxxxxIMUNICIPAL OPEN SPACE TAXDebit~Balance January I, 20 I 0 85045-00 x:xxxxxxxx 45,837.34II<strong>2010</strong> Tax Levy 81105-00 x:xxxxxxxx 786,822.72Encumbrances Cancelled 845.98Interest Earned x:xxxxxxxx 1,864.84Expended692,810.35 x:xxxxxxxxBalance December 31, <strong>2010</strong>85046-00 142,560.53 x:xxxxxxxx835,370.88 835,370.88Sheet 13

~ ~ ~. ~ ____....____REGIONAL SCHOOL TAXI~_____ ... "'_"'''' .. _ ...... " .... ~a__ ~... ~I..... _... --- --- . .,. ... ,--Debit~Balance January I, 20 I 0 XXXXXXXXX XXXXXXXXXSchool Tax Payable # 85031-00 XXXXXXXXXSchool Tax Deferred (Not in excess of 50% of Levy - 2009-20 I 0)85032-00 XXXXXXXXX 8,713,935.87Levy School Year July I, 201O-June 30, 2011 XXXXXXXXX 18,533,826.83Levy Calendar Year 20 I 0PaidXXXXXXXXX17,980,849.58 XXXXXXXXXBalance December 31, 20 I 0 XXXXXXXXX XXXXXXXXXSchool Tax Payable # 85033-00 XXXXXXXXXSchool Tax Deferred (Not in excess of 50% of Levy - <strong>2010</strong>-2011)85034-00 9,266,913.12 XXXXXXXXX# Must include unpaid requisitions 27,247,762.70 27,247,762.70REGIONAL HIGH SCHOOL TAXIIIDebitI~Balance January 1, <strong>2010</strong> XXXXXXXXX XXXXXXXXXSchool Tax Payable # 85041-00 XXXXXXXXXSchool Tax Deferred (Not in excess of 50% of Levy - 2009-20 I 0)Levy School Year July I, 201O-June 30, 2011Levy Calendar Year <strong>2010</strong>85042-00 XXXXXXXXXXXXXXXXXXXXXXXXXXXPaidXXXXXXXXXBalance December 31, 20 I 0 XXXXXXXXX XXXXXXXXXSchool Tax Payable # 85043-00 XXXXXXXXXSchool Tax Deferred (Not in excess of 50% of Levy - <strong>2010</strong>-2011)85044-00 XXXXXXXXX# Must include unpaid requisitionsSheet 14

ICOUNTY TAXES PAYABLE18DebitIIBalance January I, 20 I 0 XXXXXXXXX XXXXXXXXXCounty Taxes 80003-01 XXXXXXXXXDueCounty for Added and Omitted Taxes 80003-02 XXXXXXXXX 38,203.97.<strong>2010</strong> Levy XXXXXXXXX XXXXXXXXXGeneral County 80003-03 XXXXXXXXX 3,122,806.06County Library 80003-04 XXXXXXXXX 178,856.93County HealthXXXXXXXXXCounty Open Space Preservation XXXXXXXXX 194,744.49Due County for Added and Omitted Taxes 80003-05 XXXXXXXXX 51,410.49Paid3,534,611.45 XXXXXXXXXBalance December 31, 20 I 0 XXXXXXXXX XXXXXXXXXCounty TaxesXXXXXXXXXDue County for Added & Omitted Taxes51,410.49 XXXXXXXXX3,586,021.94 3,586,021.94SPECIAL DISTRICT TAXESI IIDebitIEBalance January 1, 20 I 0 80003-06 XXXXXXXXX<strong>2010</strong> Levy: (List Each Type of District Tax Separately - see Footnote) XXXXXXXXX XXXXXXXXXFire - 81108-00 XXXXXXXXX XXXXXXXXXSewer - 81111-00 XXXXXXXXX XXXXXXXXXWater - 81112-00 XXXXXXXXX XXXXXXXXXGarbage - 81109-00 XXXXXXXXX XXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXX XXXXXXXXXXXXXXXXXX XXXXXXXXXTotal <strong>2010</strong> Levy 80003-07 XXXXXXXXXPaid 80003-08 XXXXXXXXXBalance December 31, <strong>2010</strong> 80003-09 XXXXXXXXXFoo1note: Please state the number of districts in each instance.Sheet 15--.. -~~~"~_~~

STATE LIBRARY AIDRESERVE FOR MAINTENANCE OF FREE PUBLIC LffiRARY WITH STATE AIDIIDebit18Balance January I, <strong>2010</strong> 80004-01 XXXXXXXXXXState Library Aid Received in <strong>2010</strong> 80004-02 XXXXXXXXXXExpended 80004-09 XXXXXXXXXBalance December 31, 20 I 0 80004-10- - -------~--RESERVE FOR EXPENSE OF PARTICIPATION IN FREE COUNTY LffiRARY WITH STATE AIDBalance January I, 20 I 0 80004-03 XXXXXXXXXXState Library Aid Received 20 I 0 80004-04 XXXXXXXXXXExpended 80004-11 XXXXXXXXXBalance December 31, 20 I 0 80004-12---RESERVE FOR AID TO LffiRARY OR READING ROOM WITH STATE AID (N.J.S.A. 40:54-35)Balance January 1,<strong>2010</strong> 80004-05 XXXXXXXXXXState Library Aid Received in <strong>2010</strong> 80004-06 XXXXXXXXXXIExnended 80004-13 XXXXXXXXXBalance December 31, 20 I 0 80004-14RESERVE FOR LIBRARY SERVICES WITH FEDERAL AIDBalance January I, 20 I 0 80004-07 XXXXXXXXXXState Library Aid Received in <strong>2010</strong> 80004-08 XXXXXXXXXXExpended 80004-15 XXXXXXXXXBalance December 31, <strong>2010</strong> 80004-16---- --IISheet 16

---_._---~STATEMENT OF GENERAL BUDGET REVENUES <strong>2010</strong>ISource II Budget -01 I Realized -02Surplus Anticipated 80101- 1,740,000.00 1,740,000.00Excess orDeficit* -03Surplus Anticipated with Prior WrittenConsent of Director of Local Government 80102-Miscellaneous Revenue Anticipated: XXXXXXXXX XXXXXXXXX XXXXXXXXXAdopted Budget 1,153,932.97 1,290,524.81 136,591.84Added by N.J.S. 40A:4-87:(List on 17a) XXXXXXXXX XXXXXXXXX XXXXXXXXX251.37 251.37Total Miscellaneous Revenue Anticipated 80103- 1,154,184.34 1,290,776.18 136,591.84Receipts from Delinquent Taxes 80104- 375,000.00 392,898.18 17,898.18Amount to be Raised by Taxation: XXXXXXXXX XXXXXXXXX XXXXXXXXX(a) Local Tax for Municipal Purposes 80105- 1,915,067.03 XXXXXXXXX XXXXXXXXX(b) Addition to Local District School Tax 80106- XXXXXXXXX XXXXXXXXXTotal Amount to be Raised by Taxation 80107- 1,915,067.03 2,598,245.93 683,178.905,184,251.37 6,021,920.29 837,668.92ALLOCATION OF CURRENT TAX COLLECTIONSI I Debit BCurrent Taxes Realized in Cash (Total ofItem 10 or 14 on Sheet 22) 80108-00 XXXXXXXXX 24,594,140.76Amount to be Raised by Taxation XXXXXXXXX XXXXXXXXXLocal District School Tax 80109-00 XXXXXXXXXRegional School Tax 80119-00 18,533,826.83 XXXXXXXXXRegional High School Tax 80110-00 XXXXXXXXXCounty Taxes 80111-00 3,496,407.48 XXXXXXXXXDue County for Added and Omitted Taxes 80112-00 51,410.49 XXXXXXXXXSpecial District Taxes 80113-00 XXXXXXXXXMunicipal Open Space Tax 80120-00 786,822.72 XXXXXXXXXReserve for Uncollected Taxes 80114-00 XXXXXXXXX 872,572.69Deficit in Required Collection of Current Taxes (or) 80115-00 XXXXXXXXXBalance for Support of Municipal Budget (or) 80116-00 2,598,245.93 XXXXXXXXX* Excess Non-Budget Revenue (see footnote) 80117-00 XXXXXXXXX* Deficit Non-Budget Revenue (see footnote) 80118-00 XXXXXXXXX1 uese Hems are appllcaVle amy wuen were IS no ",-mOun, La oeRaised by Taxation" in the "Budget" column of the statement at the 'top of this sheet. In such instances, any excess or deficit in the aboveallocation would apply to "Non-Budget Revenue" only. 25,466,713.45 25,466,713.45Sheet 17

ISTATEMENT OF GENERAL BUDGET REVENUES <strong>2010</strong>(Continued)Miscell ........"'................. R, _._........._... Anticioated: Added Bv N.J.S 40 A:4-87Source181RealizedIExcess orDeficitAlcohol, Education and Rehabilitation Fund 251.37 251.37.;Total (Sheet 17) 251.37 251.37Sheet 17a

STATEMENT OF GENERAL BUDGET APPROPRIATIONS <strong>2010</strong><strong>2010</strong> Budget as Adopted 80012-01 5,184,000.00<strong>2010</strong> Budget - Added byN.J.S. 40A:4-87 80012-02 251.37Appropriated for <strong>2010</strong> (Budget Statement Item 9) 80012-03 5,184,251.37Appropriated for <strong>2010</strong> by Emergency Appropriation (Budget Statement Item 9)80012-04 85,000.00Total General Appropriations (Budget Statement Item 9) 80012-05 5,269,251.37Add: Overexpenditures (see footnote) 80012-06Deduct Expenditures:Total Appropriations and Overexpenditures 80012-07 5,269,251.37Paid or Charged [Budget Statement Item (L) 1 80012-08 4,181,941.23Paid or Charged - Reserve for Uncollected Taxes 80012-09 872,572.69Reserved 80012-10 214,712.21Total Expenditures 80012-11 5,269,226.13Unexpended Balances Canceled (see footnote) 80012-12 25.24FOOTNOTES - RE: OVEREXPENDITURES:Every appropriation overexpended in the budget document must be marked with an * and must agree in the aggregate with this item.RE: UNEXPENDED BALANCES CANCELED:Are not to be shown as "Paid or Charged" in the budget document. In all instances "Total Appropriations" and "Overexpenditures"must equal the sum of the "Total Expenditures" and "Unexpended Balances Canceled".SCHEDULE OF EMERGENCY APPROPRIATIONS FORLOCAL DISTRICT SCHOOL PURPOSES(EXCEPT FOR TYPE I SCHOOL DEBT SERVICE)20 I 0 AuthorizationsN.J.S. 40A:4-46 (After adoEtion of Budget)NJ.S. 40A:4-20 (Prior to adoption of Budget)Total AuthorizationsDeduct EXEenditures:Paid or ChargedReservedTotal EXEendituresSheet 18

RESULTS OF <strong>2010</strong> OPERATIONCURRENT FUNDIIIExcess of anticipated Revenues:Debit18XXXXXXXXXXMiscellaneous Revenues anticipated 80013-01 XXXXXXXXXX 136,591.84Delinquent Tax Collections 80013-02 XXXXXXXXXX 17,898.18XXXXXXXXXXRequired Collection of Current Taxes 80013-03 XXXXXXXXXX 683,178.90Unexpended Balances of 20 I 0 Budget Appropriations 80013-04 XXXXXXXXXX 25.24Miscellaneous Revenue Not Anticipated 81113- XXXXXXXXXX 131,980.28ivHsceuaneous Kevenue i~OI fillUclpateo: J:'ToceeuSof Sale of Foreclosed Property (Sheet 27) 81114- XXXXXXXXXXPayments in Lieu of Taxes on Real Property 81120- XXXXXXXXXXSale of Municipal AssetsXXXXXXXXXXUnexpended Balances of 2009 Appropriation Reserves 80013-05 XXXXXXXXXX 224,100.26Prior Years Interfunds Returned in <strong>2010</strong> 80013-06 XXXXXXXXXX 3,046.19Refund of Prior Year Expenditures XXXXXXXXXX 169,246.65Cancellation of Grant Reserve XXXXXXXXXX 348.76XXXXXXXXXXDeferred School Tax Revenue: (See School Taxes, Sheets 13&14)XXXXXXXXXX \.XX.Balance January 1,<strong>2010</strong> 80013-07 8,713,935.87 \.XX.Balance December 31, <strong>2010</strong> 80013-08 XXXXXXXXXX 9,266,913.12Deficit in Anticipated Revenues:XXXXXXXXXX I\.XJI..Miscellaneous Revenues Anticipated 80013-09 UO

SCHEDULE OF MISCELLANEOUS REVENUESNOT ANTICIPATEDISourceIAmountRealizedClerk- Licenses, Fees and PermitsPlanning Board FeesZoning Board FeesHealth Officer - Fees and PermitsTax Assessor - Fees and PermitsCable Franchise FeesCollector - Tax Search FeesAdministrative Fee for Senior Citizen and Veterans DeductionsCell Tower LeaseRecycling FeesMiscellaneous ReimbursementsFarmland LeaseDiscovery FeesMiscellaneous - Other7,934.081,725.00850.0013,020.00150.0023,120.9810.001,150.0038,829.429,400.2119,076.448,460.00310.217,943.94.Total Amount of Miscellaneous Revenues Not Anticipated (Sheet 19)131,980.28Sheet 20

ISURPLUS-CURRENTFUNDYEAR <strong>2010</strong>IIDEBIT1. Balance January I, <strong>2010</strong> 80014-01 XXXXXXXXXX2. XXXXXXXXXX3. Excess Resulting From <strong>2010</strong> Operations 80014-02 XXXXXXXXXX4. Amount Appropriated in the 20 I 0 Budget - Cash 80014-03 1,740,000.005. Amount Appropriated <strong>2010</strong> Budget - with Prior WrittenConsent of Director of Local Government Services 80014-046.7. Balance December 31, 20 I 0 80014-05 2,482,955.844,222,955.84IICREDIT2,375,542. I I1,847,413.73xx:x:xxxxxx4,222,955.84ANALYSIS OF BALANCE DECEMBER 31,<strong>2010</strong>(FROM CURRENT FUND - TRIAL BALANCE)Cash 80014-06Investments 80014-073,397,155.42Sub TotalDeduct Cash Liabilities Marked with "c" on Trial Balance 80014-08Cash Surplus 80014-09Deficit in Cash Surplus 80014-10Other Assets Pledged to Surplus: *I. Due from State of N.J.Senior Citizens and VeteransDeduction 80014-16Deferred Charges # 80014-12 145,000.00Cash Deficit # 80014-133,397,155.421,059,199.582,337,955.84Total Other Assets 80014-14* IN THE CASE OF A "DEFICIT IN CASH SURPLUS", "OTHER ASSETS" WOULD ALSO BEPLEDGED TO CASH LIABILITIES.# MAY NOT BE ANTICIPATED AS NON-CASH SURPLUS IN 201 1 BUDGET.(I) MAY BE ALLOWED UNDER CERTAIN CONDITIONS.NOTE: Deferred charges for authorizations under N.J.S. 40A:4-55 (Tax Map, etc.), N.J.S. 40A:4-55 (Flood Damage,etc.), N.J.S. 40A:4-55.1 (Roads and Bridges, etc.), N.J.S. 40A:4-55.13 (Public Exigencies, etc.) to the extent ofemergency notes issued and outstanding for such purposes, together with such emergency notes, may be omitted fromthis analysis.Sheet 211 S145,000.00II2,482,955.84 ,

(FOR MUNICIPALITIES ONLy)CURRENT TAXES - <strong>2010</strong> LEVY1. Amount of Levy as per Duplicate (Analysis) # 82101-00 $24,729,409.61or2. Amount of Levy Special District Taxes(Abstract ofRatables) 82113-0082102-00-----3. Amount Levied for Omitted Taxes underN.J.S.A. 54:4-63.12 et. seq.4. Amount Levied for Added Taxes underN.J.S.A. 54:4-63.1 et. seq.5a. Subtotal <strong>2010</strong> Levy5b. Reductions due to tax appeals**5c. Total <strong>2010</strong> Tax Levy6. Transferred to Tax Title Liens7. Transferred to Foreclosed Property8. Remitted, Abated or Canceled9. Discount Allowed25,085,492.6682103-0082104-00 356,083.0582106-00 $25,085,492.6682107-00 41,377.0582108-00------82109-00 102,241.2482110-00-----10. Collected in Cash: In 2009In <strong>2010</strong> *State's Share of 20 1 0 Senior Citizens and VeteransDeductions AllowedR.E.A.P RevenueTotal To Line 1482121-00 $ 159,901.6382122-00 24,373,845.9882123-00 $60,393.1582124-0082111-00 $ 24,594,140.7611. Total Credits12. Amount Outstanding, December 31, <strong>2010</strong>24,737,759.0583120-00 347,733.6113. Percentage of Cash Collections to Total <strong>2010</strong>Levy, (item 10 divided by item 5c) is 98.04 %82112-00NOTE: If municipality conducted Accelerated Tax Sale or Tax Levy Sale check hereand complete Sheet 22a.14. Calculation of Current Taxes Realized in Cash:Total of Line 10Less: Reserve for Tax Appeals Pending State Division ofTax AppealsTo Current Taxes Realized in Cash (Sheet 17)D24,594,140.7624,594,140.76Note A:In showing the above percentage the following should be noted:Where Item 5 shows $1,500,000.00, and item 10 shows $1,049,977.50, the percentagerepresented by the cash collections would be $1,049,977.50 + $1,500,000.00, or.699985. The correct percentage to be shown as Item 13 is 69.99%, and not 70.00%,nor 69.999%# Note: On item 1 if Duplicate (Analysis) Figure is used; be sure to include Senior Citizens and Veterans Deductions.* Include overpayments applied as a part of 20 1 0 collections.** Tax appeals pursuant to R.S. 54:3-21 et seq and/or R.S. 54:48-1 et seq approved by resolution of the governing bodyprior to introduction of municipal budget.Sheet 22

ACCELERATEDTAXSALE/TAXLEVYSALE-CHAPTER99To Calculate Underlying Tax Collection Rate for <strong>2010</strong>Utilize this sheet only if you conducted an Accelerated Tax Sale or Tax Levy Sale pursuant toChapter 99, P.L. 1997(1) Utilizing Accelerated Tax SaleTotal of Line 10 Collected in Cash (sheet 22)LESS: Proceeds from Accelerated Tax SaleNET Cash CollectedLine 5c (sheet 22) Total <strong>2010</strong> Tax LevyPercentage of Collection Excluding Accelerated Tax Sale Proceeds(Net Cash Collected divided by item 5c) is(2) utilizing Tax Levy SaleTotal of Line 10 Collected in Cash (sheet 22)LESS: Proceeds from Tax Levy Sale (excluding premium)Net Cash CollectedLine 5c (sheet 22) Total <strong>2010</strong> Tax LevyPercentage of Collection Excluding Tax Levy Sale Proceeds(Net Cash Collected divided by Item 5c) isSheet22a

SCHEDULE OF DUE FROM / TO STATE OF NEW JERSEYFOR SENIOR CITIZENS AND VETERANS DEDUCTIONS1. Balance January 1, <strong>2010</strong>Due From State of New JerseyDue To State of New Jersey2. Sr. Citizens Deductions Per Tax Billings3. Veterans Deductions Per Tax Billings4. Sr. Citizens Deductions Allowed by Tax Collector5.6.7. Sr. Citizens Deductions Disallowed by Tax Collector8. Sr. Citizens Deductions Disallowed by Tax Collector 2009 Taxes9. Received in Cash from State10.11.12. Balance December 31,<strong>2010</strong>Due From State of New JerseyDue To State of New JerseyIIIEDEBITXXXXXXXXXX IX-XXXXXXXXXXXXXXXXXX 8,335.974,250.00 XXXXXXXX53,500.00 XXXXXXXX3,000.00 XXXXXXXXXXXXXXXXXX 356.85XXXXXXXXXX 750.00XXXXXXXXXX 57,500.00,XXXXXXXXXX!,XXXXXXXXXX6,192.8266,942.82 66,942.82Calculation of Amount to be included on Sheet 22, Item 10 -<strong>2010</strong> Senior Citizens and Veterans Deductions AllowedLine 2Line 3Line4Line 5Line 6Sub-TotalLess: Line 7To Item 10, Sheet 224,250.0053,500.003,000.0060,750.00356.8560,393.15Sheet 23

SCHEDULE OF RESERVE FOR TAX APPEALS PENDING -(N.J.S.A. 54:3-27)IBalance January 1,<strong>2010</strong>Taxes Pending Appealsfuterest Eatned on Taxes Pending AppealsContested Amount of<strong>2010</strong> Taxes Collected which arePending State Appeal (Item 14, Sheet 22)futerest Earned on Taxes Pending State AppealsIIDEBITXXXXXXXXXXII~XXXXXXXXXXXXXXXXXXXXE,ICash Paid to Appelants (fucluding 5% futerest from the Date of Payment)Closed to Results of Operations (portion of Appeal won by Municipality,including futerest)IIXXXXXXXXXi ,xxxxxxxxxiBalance December 31, <strong>2010</strong>Taxes Pending Appeals*futerest Earned on Taxes Pending Appeals* fucludes State Tax Court and County Board of TaxationAppeals Not Adjusted by December 31,<strong>2010</strong>IIIIXXXXXXXXXXXXXXXXXXXXII I,Signature of Tax CollectorLicense #DateSheet 24

COMPUTATION OF APPROPRIATION:RESERVE FOR UNCOLLECTED TAXES ANDAMOUNT TO BE RAISED BY TAXATIONIN 2011 MUNICIPAL BUDGETII II YEAR 201111 YEAR <strong>2010</strong> I1. Total General Appropriations for 2011 Municipal BudgetStatement Item 8 (L) (Exclusive of Reserve for Uncollected Taxes) 80015- 4,205,522.81 XXXXXXXXXX2. Local Disttict School Tax Actual 80016-Estimate _. 80017- XXXXXXXXXX3. Regional School Disttict Tax Actual 80025- 18,533,826.83Estimate • 80026- 19,180,000.00 XXXXXXXXXX4. Regional High School Tax - Actual 80018-School Budget Estimate - 80019- XXXXXXXXXX5. County Tax Actual 80020- 3,496,407.48Estimate • 80021- 3,600,000.00 XXXXXXXXXX6. Special Disttict Taxes Actual 80022-Estimate - 80023- XXXXXXXXXX7. Municipal Open Space Tax Actual 80027- 786,822.72Estimate - 80028- 705,425.00 XXXXXXXXXX8. Total General Appropriations & Other Taxes 80024-01 27,690,947.819. Less: Total Anticipated Revenues from 2011 in MunicipalBudget (Item 5) 80024-02 3,127,139.8110. Cash Required from 2011 Taxes to Support LocalMunicipal Budget and Other Taxes 80024-03 24,563,808.00II. Amount ofItem 10 Divided by 96.56% [820074-04] EqualsAmount to be Raised by Taxation (Percentage used must not exceedthe applicable percentage shown by Item 13, Sheet 22) 80024-05 25,438,785.19Analysis ofItem 11:Local District School Tax(Amount Shown in Line 2• May not be stated in an amount lessAbove) than "actual" Tax of year <strong>2010</strong>Regional School DisttictTax (Amount •• Must be stated in the amount ofShown in Line 3 Above)19,180,000.00 the proposed budget submitted by theRegional High School TaxLocal Board of Education to the(Amount Shown in Line 4Commissioner of Education onAbove) January 15, 2011(Chap. 136, P.L.1978). ConsiderationCounty Tax (Amount must be given to calendar yearShown in Line 5 Above)"peClal JJISmCr 1 ax3,600,000.00 calculation.(Amount Shown in Line 6Above)IVlunlclpal vpen "pace I ax(Amount Shown in Line 7Above) 705,425.00Tax m Local MunlClpalBudget 1,953,360.19Total Amount (See Line 11) 25,438,785.1912. Appropriation: Reserve for Uncollected Taxes (BudgetStatement, Item 8 (M) (Item 11, Less Item 10) 80024-06 874,977.19 iNote:Comllutation of "Tax in Local Municillal Budget"Item 1 - Total General AppropriationsItem 12 - Appropriation: Reserve for Uncollected TaxesSub-TotalLess: Item 9 - Total Anticipated Revenues 3,127,139.81Amount to be Raised by Taxation in Municipal Budget 80024-07 1,953,360.19Sheet 25The amount of4,205,522.81 anticipated revenues(Item 9)874,977.19 may neverexceed the total5,080,500.00 ofItems 1 and12.

ACCELERATED TAX SALE - CHAPTER 99Calculation to Utilize Proceeds In Current Budget As DeductionTo Reserve For Uncollected Taxes AppropriationNote: This sheet should be completed only if you are conducting an accelerated tax sale for the first time inthe current year.A. Reserve for Uncollected Taxes (sheet 25, Item 12)B. Reserve for Uncollected Taxes Exclusion:Outstanding Balance of Delinquent Taxes(sheet 26, Item 14A) x % ofcollection (Item 16)C. TIMES: % of increase of Amount to beRaised by Taxes over Prior Year[(2011 Estimated Total Levy - <strong>2010</strong> Total Levy) / <strong>2010</strong> Total Levy]D. Reserve for Uncollected Taxes Exclusion Amount[(B x C) + B]E. Net Reserve for Uncollected TaxesAppropriation in Current Budget(A-D)2011 Reserve for Uncollected Taxes Appropriation Calculation (Actual)1. Subtotal General Appropriations (item 8(L) budget sheet 29)2. Taxes not Included in the Budget (AFS 25, items 2 thru 7)Total3. Less: Anticipated Revenues (item 5, budget sheet 11)4. Cash Required5. Total Required at % (items 4 + 6)6. Reserve for Uncollected Taxes (item E above)$$$$$$$Sheet25a

ISCHEDULE OF DELINQUENT TAXES AND TAX TITLE LIENSI.Balance January I, <strong>2010</strong>IIIE671,029.78 xxxxxxxxxxxxxxDebitA Taxes 83102-00 436,047.25 xxxxxxxxxxxxxxx xxxxxxxxxxxxxxB. Tax Title Liens 83103-00 234,982.53 xxxxxxxxxxxxxxx xxxxxxxxxxxxxx2. Canceled: xxxxxxxxxxxxxxx xxxxxxxxxxxxxxA: Taxes 83105-00 xxxxxxxxxxxxxxx 25775.22B. Tax Title Liens 83106-00 xxxxxxxxxxxxxxx3. Transferred to Foreclosed Tax Title Liens: xxxxxxxxxxxxxxx xxxxxxxxxxxxxxA Taxes83108-00 xxxxxxxxxxxxxxxB. Tax Title Liens 83109-00 xxxxxxxxxxxxxxx4. Added Taxes 83110-00 750.00 xxxxxxxxxxxxxx5. Added Tax Title Liens 83111-00 xxxxxxxxxxxxxx6. Adjustment between Taxes (Other than Current Year) andTax Title Liens:xxxxxxxxxxxxxxx xxxxxxxxxxxxxxA Taxes - Transfers to Tax Title Liens 83104-00 xxxxxxxxx 19,804.19B. Tax Title Liens - Transfers from Taxes 83107-00 19,804.19 xxxxxxxxx7. Balance Before Cash Payments xxxxxxxxxxxxxxx 646,004.568. Totals 691583.97 691 583.979. Balance Brought Down 646004.56 xxxxxxxxxxxxxx10. Collected: xxxxxxxxxxxxxxx 392 898.18A Taxes 83116-00 391,217.84 xxxxxxxxxxxxxxx xxxxxxxxxxxxxxB. Tax Title Liens 83117-00 1,680.34 xxxxxxxxxxxxxxx xxxxxxxxxxxxxxII. Interest and Costs - 20 I 0 Tax Sale 83118-00 15,821.03 xxxxxxxxxxxxxx12.<strong>2010</strong> Taxes Transferred to Liens 83119-00 41,377.05 xxxxxxxxxxxxxx13.<strong>2010</strong> Taxes 83123-00 347,733.61 xxxxxxxxxxxxxx14. Balance December 31, 20 I 0 xxxxxxxxxxxxxxx 658038.07A Taxes 83121-0011 347,733.61 xxxxxxxxxxxxxxx xxxxxxxxxxxxxxB. Tax Title Liens 83122-0011 310,304.46 xxxxxxxxxxxxxxx xxxxxxxxxxxxxx15. Totals 1050936.25 1050936.2516. Percentage of Cash Collections to Adjusted AmountOutstanding (Item #10 divided by Item #9) 60.81 %17. Item #14 multiplied by percentage shown above is $ 400152.95 [83125-00] and represents themaximum amount that may be anticipated in 20 II.(See Note A on Sheet 22 - Current Taxes)(1) These amounts will always be the same.Sheet 26

ISCHEDULE OF FORECLOSED PROPERTY--1. Balance January I, 20 I 0 84101-00 12. Foreclosed or Deeded in <strong>2010</strong>3. Tax Title Liens 84103-004. Taxes Receivable 84104-005A. 84102-005B. 84105-006. Adjustment to Assessed Valuation 84106-007. Adjustment to Assessed Valuation 84107-008. Sales9. Cash* 84109-0010. Contract 84110-0011. Mortgage 84111-0012. Loss on Sales 84112-0013. Gain on Sales 84113-0014. Balance December 31, <strong>2010</strong> 84114-00CONTRACT SALES------ ------ -_.- _ ..IIDEBITII CREDIT11,600.0011 XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX!XXXXXXXXXXXXXXXXXXXXXXXXXXXXX 11,600.0011,600.00 11,600.00IIII15. Balance January I, <strong>2010</strong> 84115-0016. <strong>2010</strong>Sales from Foreclosed Property 84116-0017. Collected* 84117-00.18. 84118-0019. Balance December 31, <strong>2010</strong> 84119-00DEBITIIXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXCREDIT IXXXXXXXXXMORTGAGE SALESI20. Balance January I, <strong>2010</strong>21. <strong>2010</strong> Sales from Foreclosed Property22. Collected*23.24. Balance December 31, <strong>2010</strong>84120-0084121-0084122-0084123-0084124-00IIDEBITXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXI CREDITXXXXXXXXXAnalysis of Sale of Property:* Total Cash CoIIected in <strong>2010</strong>(84125-00)Realized in <strong>2010</strong> BudgetTo Results of Operation(Sheet 19)Sheet 27

DEFERRED CHARGES-MANDATORY CHARGES ONLY-CURRENT, TRUST, AND GENERAL CAPITAL FUNDS(Do not include the emergency authorizations pursuant to N.J.S. 40A:4-55,N.J.S. 44A:4-5S.1 or N.J.S. 40A:4-55.13 listed on Sheets 29 and 30.)Caused ByAmountDec. 31, 2009Per AuditReportAmount in<strong>2010</strong>BudgetAmountResultingfrom <strong>2010</strong>Balanceas atDec. 31. <strong>2010</strong>1. Emergency Authorization -Municipal *2. Emergency Authorizations -Schools3.4.5.Subtotal6. Deficit from OperationsTotal Current7. Trust - Other8. Trust - Dog9. Trust- Assessment10. Capital-* Do not include items funded or refunded as listed below.15,000.0015,000.0015,000.0015,000.0015,000.0015,000.00EMERGENCY AUTHORIZATIONS UNDER N.J.S. 40A:4-47 WHICH HAVE BEENFUNDED OR REFUNDED UNDER N.J.S. 40A:2-3 OR N.J.S. 40A:2-51Date Purpose AmountI.2.3.4.5.JUDGMENTS ENTERED AGAINST MUNICIPALITY AND NOT SATISFIEDIn Favor ofOn Account ofDate EnteredAmountAppropriated forin Budget ofYear 2011I.2.3.4.Sheet 28

N.J.S. 40A:4-53 SPECIAL EMERGENCY -TAX MAP; REVALUATION; MASTERPLAN; REVISION AND CODIFICATION OF ORDINANCES; DRAINAGEMAPS FOR FLOOD CONTROL; PRELIMINARY ENGINEERING STUDIES, ETC. FOR SANITARY SEWERSYSTEM; MUNICIPAL CONSOLIDATION ACT; FLOOD OR HURRICANE DAMAGE.DateIPurposeIAmount Not Less Than Balance Reduced in <strong>2010</strong> BalanceAuthorized 115 of Amount Dec. 31,2009 By <strong>2010</strong> Budget Canceled by Dec. 31,<strong>2010</strong>Authorized*Resolution11-28-2006Preparation and Revision of the Master Plan 300,000.00 60,000.00 120,000.00 60,000.00 60,000.009-2-<strong>2010</strong>lReassessment Program 70,000.00 14,000.00 70,000.00'" [~N'DII Totals 120,000.00 60,000.00 130,000.0080025-00 80026-00It is hereby certified that all outstanding "Special Emergency" appropriations have been adopted by the governing body in full compliance with N.J.S. 40A:4-53 et seq. and arerecorded on this pageChief Financial Officer* Not less than one-fifth (115) of amount authorized but not more than the amount shown in the column "Balance Dec. 31, <strong>2010</strong>" must be entered here and then raised in the 2011budget.

N.J.S. 40A:4-55.1, ET SEQ., SPECIAL EMERGENCY - DAMAGE CAUSED TO ROADS OR BRIDGES BY SNOW, ICE, FROST OR FLOOD.. , ..................... .a.•• ...,..., .......... , ........................ x., ................. '-' ....L~ ......................."'-................. '-' .... ..... ___ ..,..........'" """1."""' .................. '-'A............ '-'........................ JlJ.., ... '-'..L ........... JlJ ............. ..........'-A..O'L"""1J..'-' ............DateIPurposeIAmount Not Less Than Balance Reduced in 20 I 0 BalanceAuthorized 113 of Amount Dec. 31,2009 By <strong>2010</strong> Budget Canceled by Dec. 31, <strong>2010</strong>Authorized'Resolution1rg.woIITotals80027-00 80028-00It is hereby certified that all outstanding "Special Emergency" appropriations have been adopted by the governing body in full compliance with N.J.S. 40A:4-55.1 et seq. and N.J.S.40A:4-55.13 and are recorded on this pageChief Financial Officer'Not less than one-third (113) of the amount authorized but not more than the amount shown in the column 'Balance Dec. 31,<strong>2010</strong> must be entered here and then raised in the 2011 budget.

SCHEDULE OF BONDS ISSUED AND OUTSTANDINGAND 2011 DEBT SERVICE FOR BONDS1 10Credit\ .....""'-'.1."1 ....... J \.l..... .....,.1. , ............. r1L..rJ ~.a!./.l '1.a!1....'-£"'1L.j '-'£'1.L ...... ~ ~'-'J.. ,~U"Outstanding January 1, <strong>2010</strong> 80033-01 XXXXXXXXX 23,425,000.00Issued 80033-02Paid 80033-03 850,000.00 XXXXXXXXXX2011Debt ServiceOutstanding December 31, <strong>2010</strong> 80033-04 22,575,000.00 XXXXXXXXXX23,425,000.00 23,425,000.002011 Bond Maturities - General Capital Bonds 80033-05 $ 950,000.002011 Interest on Bonds * 80033-0611 869,793.76ASSESSMENT SERIAL BONDSOutstanding January 1, <strong>2010</strong>80033-07 XXXXXXXXXIssued 80033-08Paid 80033-09 XXXXXXXXXXOutstanding December 31, <strong>2010</strong> 80033-10 XXXXXXXXXX2011 Bond Maturities - Assessment Bonds 80033-112011 Interest on Bonds * 80033-12Total "Interest on Bonds- ])e1>tService" (* Items) 80033-d 869,793.76LIST OF BONDS ISSUED DURING <strong>2010</strong>1Assessment:Purpose12011 Maturity Amount Issued Date of Issue Interest RateSubtotal80033-14 80033-15Sheet 31

LIST OF BONDS ISSUED DURING <strong>2010</strong>IPurposeI2011 Maturity Amouut Issued Date oflssue Interest RateGeneral Capital:•SubtotalTotal80033-14 80033-15Sheet 31i

ISCHEDULE OF LOANS ISSUED AND OUTSTANDINGAND 2011 DEBT SERVICE FOR LOANS(MUNICIPAL) GREEN ACRES TRUST LOANIIDebitIICreditOutstanding January 1, <strong>2010</strong>80033-01 XXXXXXXXXIssued80033-02 XXXXXXXXXPaid 80033-03 XXXXXXXXXXI2011Debt ServiceOutstanding December 31, <strong>2010</strong> 80033-04 XXXXXXXXXX2011 Loan Maturities 80033-052011 Interest on Loans 80033-06Total 2011 Debt Service for Loan 80033-13LOANOutstanding January 1,<strong>2010</strong>80033-07 XXXXXXXXXIssued80033-08 XXXXXXXXXPaid 80033-09 XXXXXXXXXXOutstanding December 31, <strong>2010</strong> 80033-10 XXXXXXXXXX2011 Loan Maturities 80033-112011 Interest on Loans 80033-12Total 2011 Debt Service for Loan 80033-13LIST OF LOANS ISSUED DURING <strong>2010</strong>IAssessment:PurposeII2011 Maturity II Amount Issued I Date oflssueIIuterest RateISubtotal80033-14 80033-15Sheet 31a

SCHEDULE OF BONDS ISSUED AND OUTSTANDINGAND 2011 DEBT SERVICE FOR BONDSTYPE I SCHOOL TERM BONDSIGICreditOutstanding Januarv 1,<strong>2010</strong>80034-01 XXXXXXXXXPaid 80034-02 XXXXXXXXXXII2011 DebtServiceOutstanding December 31, <strong>2010</strong> 80034-03 XXXXXXXXXX2011 Bond Maturities - Term Bonds 80034-042011 Interest on Bonds * 80034-05TYPE I SCHOOL SERIAL BONDOutstanding January 1, <strong>2010</strong>80034-06 XXXXXXXXXIssued 80034-07Paid.80034-08 XXXXXXXXXXOutstandingDecember 31, <strong>2010</strong> 80034-09 XXXXXXXXXX2011 Interest on Bonds * 80034-102011 Bond Maturities - Serial Bonds 80034-11Total "Interest on Bonds - Type I School Debt Service" {* Items) 80034-121LIST OF BONDS ISSUED DURING <strong>2010</strong>1Purpose 12011 Maturity -01Amount Issued-02Date oflssueInterest RateTotal 80035-2011 INTEREST REQUIREMENT -CURRENT FUND DEBT ONLY1. Emergency Notes2. Special Emergency Notes3. Tax Anticipation Notes4. Interest on Unpaid State and County Taxes5.6.OutstandingDec. 31<strong>2010</strong>2011 InterestRequirement80036-_____ -+ ____ _80037-_____ -+ ____ _80038-_____ -j _____ _80039-_____ -+ ____ _Sheet 32

---- --- ------. --- ------ --- -- ---- .... , - --- --- ........ ,,- -- ------------ --- ------............ , .... --- ....... - .................... ------..... --- ..... - -----JTitle or Purpose ofIssue Original Original Date Amount of Note Date of Rate of 20 II Budget RequirementOutstandingAmount Issued of Issue*Maturity Interest For Principal For Interest'-n, 11 omomeres, Lompmeuto(Insert Date)[~wI234567891011121314TotalMemo: Designate all "Capital Notes" issued under N.J.S. 40A:2-8(b) with "C". Such notes must be retired at the rate of 20% of the original amount issued annually.Memo: Type I School Notes should be separately listed and totaled.- "Original Date ofIssue" refers to the date when the fIrst money was borrowed for a particular improvement, not the renewal date of subsequent notes which were issued.All notes with an original date of issue of 2008 or prior require one legally payable installment to be budgeted if it is contemplated thatsuch notes will be renewed in 2011 or written intent of permanent financing submitted with statement.** If interest on notes is financed by ordinance, designate same, otherwise an amount must be included in this colwnn.80051-0180051-02(Do Not Crowd - add additional sheets)I!

DEBT SERVICE SCHEDULE FOR ASSESSMENT NOTESInterest ComputedTitle or Purpose ofIssue Original Original Date Amount of Note Date of Rate of 20 II Budget Requirement toAmount Issued ofIssue*Outstandingne~ 11 7010MaturityInterest For Principal For Interest ** (Insert Date)I23456ft~w-I>78910II121314Total80051-01 80051-02MEMO: * See Sheet 33 for clarification of "Original Date of Issue"Assessment Notes with an original date of issue of December 31,2008 or prior must be appropriated in full in the 2011 Dedicated Assessment Budget or written intent of permanent financing submitted withstatement.** Interest on Assessment Notes must be included in the Current Fund Budget Appropriation "Interest on Notes"(Do Not Crowd - add additional sheets»

PurposeLeases approved by LFB after July 1,2007123Schedule of Capital Lease Pro2ram Obli2ationsIAmount ofLease Obligation OutstandingFor PrincipalDec 31, <strong>2010</strong>20 II Budget RequirmentFor InterestIF eesf?~w ..,.'"456Leases approved by LFB prior July 1, 2007I23456Total~~~-~ ~~ """ _. ",...(Do not crowd-add additional sheets)

- _. - - . - --- - -- - - - - - - - _. __ .. _--- - - - .Improvements Balance - January 1, <strong>2010</strong> <strong>2010</strong>SpecifY each authorization by purpose. Donot merely designate by code number. Funded Unfunded Authorizations Other- - . - ----- ----- - - - .Expended Authorizations Balance - December 31, <strong>2010</strong>Canceled Funded UnfundedI!iSchedule Attached 1,213,107.71 265,668.45 1,240,000.00 2,693,351.463,030,035.93 1,038,923.24 -1,343,168.45~~wV>Place an * before each item of "Improvement" which represents a fimding or refunding of an emergency authorization.

TOWNSHIP OF UPPER FREEHOLDGENERAL CAPITAL FUNDStatement of Improvement AuthorizationsFor the Year Ended December 31,<strong>2010</strong><strong>2010</strong> AuthorizationsDeferredChargesBalance Other to Future Transfer from BalanceOrdinance Ordinance Dec.31 2009 Financing Taxation Reserve for Paid or Dec.31 <strong>2010</strong>Number Improvement Description Date Amount Funded Unfunded Sources Unfunded Encumbrances Charged Funded UnfundedGeneral Improvements:95-6 Acquisition of a Fire Truck and Related Equipment 7-6-95 $ 250,000.00 $ 24,713.76 $ 24,713.762000-72 Acquisition of a Fire Truck and Related Equipment 10-23-00 350,000.00 $ 8,031.13 $ 2,500.00 $ 5,531.132000-74; Engineering, Construction of Improvements and Equipping 12-21-00;2002-102 of Bryon Johnson Memorial Park and Other Recreational Facilities 10-2-02 1,500,000.00 13,687.56 13,687.562002-98 Various Road Improvements 8-21-02 2,000,000.00 76,502.56 1,900.00 74,602.5602-100; 03-119; Acquisition and Development of Lands for Outdoor Recreation 9-18-02; 10-23-03172-06;182-06 and Conservation Purposes 6-1-06;11-28-06 12,580,000.00 142,716.21 $ 2,557,931.75 2,576,822.85 123,825.11en~m!!'. 02-105; 05-148; Construction of New Municipal Offices and Improvements to 1-2-03;2-17-05w~ 06-171 the Existing Municipal Buildings 5-18-06 2,600,000.00 5,536.18 2,000.00 5,536.18 2,000.00•2003-116 Purchase of Computer Systems 8-21-03 25,000.00 1,465.46 1,401.90 63.562004-143 Purchase of Fire Fighting Equipment 12-16-04 195,000.00 1,767.00 1,767.0005-157;07-19108-212 Various Road Improvements 9-8-05 3,200,000.00 246.43 2,124.80 2,371.232005-159 Various Road Improvements 10-6-05 20,000.00 16,500.00 16,500.0006-164;08-195 Acquisition with the State of New Jersey of CertainProperty for Conservation and Open Space and theDevelopment of Outdoor Recreation 2-27-06 5,450,000.00 22,502.88 53,875.00 111,768.40 26,079.90 108,191.38 53,875.002008-198 Various Capital Improvements 5-1-08 535,000.00 428,519.09 1,250.00 4,931.00 12,767.50 420,682.59 1,250.002008-211 Acquisition of Fire Fighting Equipment 10-16-08 107,000.00 63,329.13 7,346.80 19,059.47 51,616.462009-220 Removal of Underground Storage Tank and Installation of Replacement 3-5-09 5,000.00 705.10 705.1009-231;10-239 Road Improvements 9-3-09;10-21-10 640,000.00 414,916.35 200,512.32 9,248.71 387,812.37 36,352.69 200,512.32<strong>2010</strong>-238 Improvements to Sharon Station Road and Chambers Road 10-7-10 1,240,000.00 $ 160,000.00 $ 1,080,000.00 1,691.94 158,308.06 1,080,000.00$1,213,107.71 $ 265,668.45 $ 160,000.00 $ 1,080,000.00 $ 2,693,351.46 $ 3,030,035.93 $ 1,038,923.24 $ 1,343,168.45

GENERAL CAPITAL FUNDSCHEDULE OF CAPITAL IMPROVEMENT FUNDIIBalance January I, 20 I 0 80031-01Received from <strong>2010</strong> Budget Appropriation * 80031-02DEBIT I CREDITXXXXXXXXXX 944,777.52XXXXXXXXXXXXXXXXXXXXImprovement AuthorizationsCanceled (financed in whole bythe Capital Improvement Fund) 80031-03XXXXXXXXXXList by Improvements - Direct Charges Made for Preliminary Costs:XXXXXXXXXXAppropriated to Finance Improvement Authorizations 80031-04Balance December 31, <strong>2010</strong> 80013-05 944,777.52944,777.52.:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx:xxxxxxxxx944,777.52* The full amount of the <strong>2010</strong> budget appropriation should be transferred to this account unless the balance ofthe appropriation is to be permitted to lapse.Sheet 36

GENERAL CAPITAL FUNDSCHEDULE OF DOWN PAYMENTS ON IMPROVEMENTSIBalance January 1, <strong>2010</strong>ReceivedFrom <strong>2010</strong> Budget Appropriation *Received From <strong>2010</strong> Emergency Appropriation *IDebit80030-01 xxxxx:xxxxx80030-02 xxxxx:xxxxx80030-03 xxxxx:xxxxxCreditAppropriated to Finance Improvement Authorizations 80030-04 XXXXXXXXXXXXXXXXXXBalance December 31, <strong>2010</strong> 80030-05 XXXXXXXXX* The full amount of the <strong>2010</strong> appropriation should be transferred to this account unless the balance of theappropriation is permitted to lapseCAPITAL IMPROVEMENTS AUTHORIZED IN <strong>2010</strong>AND DOWN PAYMENTS (N.J.S. 40A:2-11)------PurposeGENERAL CAPITAL FUND ONLY-[-------- ------Amounts of DownDown PaymentAmount Total Obligations Payment in BudgetProvided byAppropriated Authorizedof<strong>2010</strong> or PriorOrdinanceYearsImprovements to Sharon Station Roadand Chambers Road 1,240,000.00 1,080,000.00 160,000.00 (I).(1) Funded by NJ Transportation GrantTotal 80032-00 1,240,000.00 1,080,000.00 160,000.00NOTE - Where amount in column "Down Payment Provided By Ordinance" is LESS than 5% of the amount in column"Total Obligations Authorized", explanation must be made part of or attached to this sheet.Sheet 37

III ___ nGENERAL CAPITAL FUNDSTATEMENT OF CAPITAL SURPLUSYear-20lO- DEBIT IEBalance January 1,<strong>2010</strong> 80029-01 xxxxxx:xxxx 237,488.29Premium on Sale of BondsFunded hnprovement Authorizations Canceledxxxxxx:xxxxxxxxxx:xxxxAppropriated to Finance hnprovement Authorizations 80029-02 XXXXXXXXXAppropriated to <strong>2010</strong> Budget Revenue 80029-03 75,000.00 XXXXXXXXXBalance December 31, <strong>2010</strong> 80029-04 162,488.29237,488.29 237,488.29BONDS ISSUED WITH A COVENANT OR COVENANTS1. Amount of Serial Bonds Issued Under Provisions of Chapter 233, P.L. 1944, Chapter 268, P.L.1944, Chapter 428, P.L. 1943 or Chapter 77, Article VI-A, P.L. 1945, with Covenant or Covenants;Outstanding December 31, <strong>2010</strong>2. Amount of Cash in Special Trust Fund as of December 31, <strong>2010</strong> (Note A)3. Amount of Bonds Issued Under Item IMaturing in 20114. Amount of Interest on Bonds with a Covenant -2011 Requirement5. Total of 3 and 4 - Gross Appropriation6. Less Amount of Special Trust Fund to be Used7. Net Appropriation RequiredNote A: - This amount to be supported by confirmation from bank or banksFootnote: Any formula other than the one shown above and required to be used by covenant or covenants is to beattached hereto.Item 5 must be shown as an item of appropriation, short extended, with Item 6 shown directly following as a deductionand with the amount ofItem 7 extended into the <strong>2010</strong> appropriation colunm.Sheet 38

MUNICIPALITIES ONLYIMPORTANT!!This Sheet Must Be Completely Filled in or the Statement Will Be Considered Incomplete(N.J.S.A. 52:27BB-55 as Amended by Chap. 211, P.L. 1981)A.I. Total Tax Levy for the Year <strong>2010</strong> was25,085,492.662. Amount ofItem 1 Collected in<strong>2010</strong> (*)24,594,140.763. Seventy (70) percent ofItern 117,559,844.86(*) Including prepayments and overpayments applied.B.1. Did any maturities of bonded obligations or notes fall due during the year 20 I O?Answer YES or NOYES2. Have payments been made for all bonded obligations or notes due on or beforeDecember 31, 20 I O?Answer YES or NO YES If answer is "NO" give detailsNOTE: If answer to Item Bl is YES, then Item B2 must be answeredC. Does the appropriation required to be included in the 20 II budget for the liquidation of all bonded obligationsor notes exceed 25% of the total of appropriations for operating purposes in the budget for the year just ended?Answer YES or NONOD.1. Cash Deficit in 2009. 2. 4% of2009 Tax Levy for all purposes:Levy--3. Cash Deficit <strong>2010</strong>4. 4% of<strong>2010</strong> Tax Levy for all purposes:Levy --E. Unpaid 2009 <strong>2010</strong> TotalI. State Taxes2. County Taxes 51,410.49 51,410.493. Amounts due Special Districts4. Amounts due School District for Local School TaxSheet 39

1&la&lbIeId2.3&3a&3b4.5.6&6b.6a.7.8.9 & 9a.10.11 &lla.12.13.14.15.16.17 & 17a.17.18.18.19.20.21.22.22a.23.24.25.INSTRUCTIONS IN PREPARATION OFANNUAL FINANCIAL STATEMENT OF <strong>2010</strong>The arrangement of the schedules is shown by the index appearing at the bottom hereof. The statementis prepared on a full cash basis. Any variations from a full cash basis must be taken up with the Division inadvance of the preparation of the statement and the budget.Summary statements only of debt service are required. The use of summarized forms is permitted toconserve time. Responsibility for the supporting detail is placed on the chief financial officer who must be in aposition to support the summarized figures.No sheets should be eliminated, except utility fund sheets under the conditions stipulated on Sheet 2.Those sheets not filled in should be marked "Not Applicable",INDEXCertification and AffidavitMunicipal Budget Local Examination CertificationReport of Federal & State Financial Assistance Expenditures of AwardsInstructions and CertificationTrial Balance--Current FundTrial Balance--Public Assistance FundTrial Balance--Federal and State FundTrial Balance--Trust Funds / Schedule of Trust Fund Deposits & ReservesMunicipal Public Defender Certification - P.L. 1997, C.256Analysis of Trust Assessment Cash and Investments Pledged to Liabilities and SurplusTrial Balance--Capital FundCash ReconciliationFederal and State Grants ReceivableAppropriated Reserves for Federal and State GrantsUnappropriated Reserves for Federal and State GrantsLocal District School Tax - Municipal Open Space TaxRegional School Tax - Regional High School TaxCounty Taxes Payable - Special District TaxesReserves for State and Federal Aid for Library ServicesGeneral Budget RevenuesAllocation of Current Tax CollectionsGeneral Budget AppropriationsEmergency Appropriations for Local District School PurposesResults of <strong>2010</strong> Operations--Current FundSchedule of Miscellaneous Revenues Not AnticipatedSurplus Account and Analysis of BalanceCurrent Tax LevyAccelerated Tax Sale/Tax Levy Sale Chapter 99 to Calculate Underlyning Tax Collection Rate for <strong>2010</strong>Due from/to State of New Jersey for Senior Citizens and Veterans DeductionsReserve for Tax Appeals Pending (N.J.S.A. 54:3-37)Municipal Budget - Computation of "Reserve for Uncollected Taxes" and "Amount to be Raised by Taxation"2Sa.26.27.28.29.30.31&31a32.33.34 & 34a35 & 35a.36.37.37.38.39.40.41 & 55.42 & 56.43 & 57.44 & 58.45 &59.46 & 60.47 & 61.48 &62.49 &63.49a & 63a50 &64.51 & 65.51a & 65a52 & 66.53 & 67.54 & 68.Accelerated Tax Sale - Chapter 99. Calculation to Utilize Proceeds in Current Budget as Deduction to Reserve for Uncollected Tax AppropriationDelinquent Taxes and Tax Title LiensForeclosed Property; Contract Sales; Mortgage SalesDeferred Charges and List of Judgments - CurrentEmergency - Tax Map; Revaluation; Master Plan; Revisions and Codification of Ordinance; DrainageMaps for Flood Control; Preliminary Studies, etc. for Sanitary Sewer Systems, MunicipalConsolidation Act; Flood or Hurricane DamageEmergency - Damage to Roads and Bridges by Snow, Ice, etc.; Public Exigencies Caused by Civil DisturbancesSummary Statement of Debt Service Requirements - Municipal (or County)Summary Statement of Debt Service Requirements - School- Type I and CurrentDebt Service for Notes (Other than Assessment Notes)Debt Service for Assessment Notes / Schedule of Capital Lease Program Obligationshnprovement AuthorizationsCapital Improvement FundDovm PaymentCapital Improvements Authorized in <strong>2010</strong>General Capital Surplus, Bond ConvenantsRequired Information (N.J.S.A. 52:27BB-55 as amended by Chap. 211, P.L. 1981)UTILITIES ONLYInstructionsTrial Balance - Utility FundTrial Balance - Utility Assessment Trust FundsAnalysis of Utility Assessment Trust Cash and Investments Pledged to Liabilities and SurplusUtility Revenues and Appropriations<strong>2010</strong> Utility OperationsResults of Operations, Operating Surplus and AnalysisUtility Accounts Receivable; Utility LiensDeferred Charges and List of Judgments - UtilitySummary Statement of Debt Service RequirementsSummary Statement of Loan RequirementsDebt Service for Utility Notes (Other than Utility Assessment Notes)Debt Service for Utility Assessment NotesSchedule of Cap it at Lease Program ObligationsImprovement Authorizations (Utility Capital)Capital Improvement Fund and Down PaymentsUtility Capital hnprovements Authorized in <strong>2010</strong>; Utility Capital SurplusSheet 69