2012 Copy of Budget - Upper Freehold Township

2012 Copy of Budget - Upper Freehold Township

2012 Copy of Budget - Upper Freehold Township

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

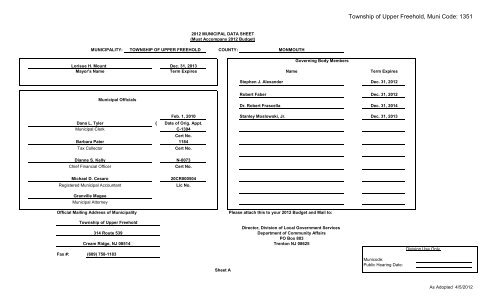

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351<strong>2012</strong> MUNICIPAL DATA SHEET(Must Accompany <strong>2012</strong> <strong>Budget</strong>)MUNICIPALITY: TOWNSHIP OF UPPER FREEHOLD COUNTY:MONMOUTHGoverning Body MembersLorisue H. MountDec. 31, 2013Mayor's Name Term Expires Name Term ExpiresStephen J. Alexander Dec. 31, <strong>2012</strong>Municipal OfficialsRobert Faber Dec. 31, <strong>2012</strong>Dr. Robert Frascella Dec. 31, 2014Dana L. Tyler{ Date <strong>of</strong> Orig. Appt.Municipal Clerk C-1394Barbara PaterTax CollectorFeb. 1, 2010 Stanley Moslowski, Jr. Dec. 31, 2013Cert No.1184Cert No.Dianne S. KellyChief Financial OfficerMichael D. CesaroRegistered Municipal AccountantN-0073Cert No.20CR000504Lic No.Granville MageeMunicipal AttorneyOfficial Mailing Address <strong>of</strong> MunicipalityPlease attach this to your <strong>2012</strong> <strong>Budget</strong> and Mail to:<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>314 Route 539Cream Ridge, NJ 08514Fax #: (609) 758-1183Sheet ADirector, Division <strong>of</strong> Local Government ServicesDepartment <strong>of</strong> Community AffairsPO Box 803Trenton NJ 08625Municode:Public Hearing Date:Division Use OnlyAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351MUNICIPAL BUDGET NOTICESection 1.Municipal <strong>Budget</strong> <strong>of</strong> the <strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong> , County <strong>of</strong> Monmouthfor the Calendar Year <strong>2012</strong>Be it Resolved, that the following statements <strong>of</strong> revenues and appropriations shall constitute the Municipal <strong>Budget</strong> for the Year <strong>2012</strong>Be it Further Resolved, that said <strong>Budget</strong> be published in theMessenger Pressin the issue <strong>of</strong> March 8 , <strong>2012</strong>The Governing Body <strong>of</strong> the <strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong> does hereby approve the following as the <strong>Budget</strong> for the year <strong>2012</strong>.RECORDED VOTE(INSERT LAST NAME) Ayes NaysAbstainedAbsentNotice is hereby given that the <strong>Budget</strong> and Tax Resolution was approved by the<strong>Township</strong> Committee<strong>of</strong> the<strong>Township</strong><strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong> , County <strong>of</strong> Monmouth , on March 1, <strong>2012</strong>A Hearing on the <strong>Budget</strong> and Tax Resolution will be held at <strong>Township</strong> Building, on April 5 , <strong>2012</strong> at7:00o'clock (P.M.) at which time and place objections to said <strong>Budget</strong> and Tax Resolution for the year <strong>2012</strong> may be presented by taxpayers or otherinterested persons.Sheet 2As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351EXPLANATORY STATEMENTSUMMARY OF CURRENT FUND SECTION OF APPROVED BUDGETYEAR <strong>2012</strong>General Appropriations For:(Reference to item and sheet number should be omitted in advertised budget)xxxxxxxxxxx1. Appropriations within "CAPS"- xxxxxxxxxxx(a) Municipal Purposes {(item H-1, Sheet 19)(N.J.S. 40A:4-45.2)} 2,368,561.002. Appropriations excluded from "CAPS" xxxxxxxxxxx(a) Municipal Purposes {item H-2, Sheet 28)(N.J.S. 40A:4-45.3 as amended)} 1,834,552.67(b) Local District School Purposes in Municipal <strong>Budget</strong>(item K, Sheet 29) -Total General Appropriations excluded from "CAPS"(item O, sheet 29) 1,834,552.673. Reserve for Uncollected Taxes (item M, Sheet 29) Based on Estimated 96.78% Percent <strong>of</strong> Tax Collections 840,886.33Building Aid Allowance <strong>2012</strong> - $4 Total General Appropriations (item 9, Sheet 29) for Schools-State Aid 2011 - $ 5,044,000.005. Less: Anticipated Revenues Other Than Current Property Tax (item 5, Sheet 11)(i.e. Surplus, Miscellaneous Revenues and Receipts from Delinquent Taxes) 2,874,945.676. Difference: Amount to be Raised by Taxes for Support <strong>of</strong> Municipal <strong>Budget</strong> (as follows) xxxxxxxxxxx(a) Local Tax for Municipal Purposes Including Reserve for Uncollected Taxes (item 6(a), Sheet 11) 2,169,054.33(b) Addition to Local District School Tax (item 6(b), Sheet 11) -(c) Minimum Library Tax -Sheet 3As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351EXPLANATORY STATEMENT - (Continued)SUMMARY OF 2011 APPROPRIATIONS EXPENDED AND CANCELEDGeneral <strong>Budget</strong> Water Utility N/A N/A Explanations <strong>of</strong> Appropriations forUtility Utility "Other Expenses"<strong>Budget</strong> Appropriations - Adopted <strong>Budget</strong> 5,080,500.00 The amounts appropriated under the<strong>Budget</strong> Appropriation Added by N.J.S 40A:4-87 24,089.61 title <strong>of</strong> "Other Expenses" are for operatingEmergency Appropriations 110,000.00 costs other than "Salaries & Wages."Total Appropriations 5,214,589.61 - - -Expenditures: Some <strong>of</strong> the items included in "OtherPaid or Charged (Including Reserve for Uncollected Taxes) 4,989,141.01 Expenses" are:Reserved 197,947.36Unexpended Balances Canceled 27,501.24 Materials, supplies and non-bondableTotal Expenditures and Unexpended Balances Cancelled 5,214,589.61 - - - equipment;Overexpenditures* - - - - Repairs and maintenance <strong>of</strong> buildings,*See <strong>Budget</strong> Appropriation items so marked to the right <strong>of</strong> column (Expended 2011 Reserved.)equipment, roads, etc.,Contractual services for garbage andtrash removal, fire hydrant service, aid tovolunteer fire companies, etc;Sheet 3aPrinting and advertising, utilityservices, insurance and many other itemsessential to the services rendered by municipalgovernment.As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351EXPLANATORY STATEMENT - (CONTINUED)BUDGET MESSAGELevy CAP CalculationChapter 62 <strong>of</strong> the Laws <strong>of</strong> 2007 imposed a Property Tax Levy CAP which was amended by P.L. 2008, Chapter 6 and further amended by P.L. 2010, Chapter 44 (S-29 R1) approved July 13, 2010.The law (N.J.S.A. 40A:4-45.44 through 45.47) establishes a formula that limits increases in the local unit amount to be raised by taxation for each local unit budget. The budget containedherewith is within the limits imposed by this law and for the <strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong> is calculated as follows:Prior Year Amount to be Raised by Taxation for Municipal Purposes $ 1,953,360.19 Balance (carried forward) 2,124,427.39Cap Base Adjustment (+/-)Less: Prior Year Deferred Charges to Future Taxation Unfunded Less - Cancelled or Unexpended Exclusions 1.00Less: Prior Year Deferred Charges - EmergenciesLess: Prior Year Recycling Tax Adjusted Tax Levy After Exclusions 2,124,426.39Less: Changes in Service Provider - Transfer <strong>of</strong> Service/ FunctionNet Prior Year Tax Levy for Municipal Purpose Tax for Cap Calculation 1,953,360.19 Additions:Plus: 2% Cap increase 39,067.20 New Ratables - Increased in Valuations $ 6,629,199.00Adjusted Tax Levy 1,992,427.39 Prior Year's Local Municipal Purpose Tax Rate (per $100) 0.166Plus: Assumption <strong>of</strong> Service/ Function Net Ratable Adjustment to Levy 11,004.47Adjusted Tax Levy Prior to Exclusions 1,992,427.39 CY 2011 Cap Bank Utilized in CY <strong>2012</strong> 33,623.47Exclusions:Amounts Approved by ReferendumAllowable Shared Service Agreements IncreaseAllowable Health Insurance Cost Increase Maximum Allowable Amount to be Raised by Taxation $ 2,169,054.33Allowable Pension Obligations IncreaseAllowable LOSAP Increase Amount to be Raised by Taxation for Municipal Purposes $ 2,169,054.33Allowable Capital Improvements Increase 110,000.00Allowable Debt Service and Capital Leases Increase Unused CY <strong>2012</strong> Tax Levy Available for Banking (CY 2013 - CY 2015) $0.00Recycling Tax AppropriationDeferred Charges to Future Taxation Unfunded Unused CY 2011 Tax Levy Available for Banking (CY 2013 - CY 2014) $ 47,891.53Current Year Deferred Charges - Emergencies 22,000.00Add Total Exclusions 132,000.00Balance (carried forward) 2,124,427.39Sheet 3cAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351EXPLANATORY STATEMENT (CONTINUED)BUDGET MESSAGE - STRUCTURAL BUDGET IMBALANCESRevenues at RiskNon-recurring current appropriationsFuture Year Appropriation IncreasesStructural Imbalance OffsetsLine Item.Put "X" in cell to the left thatcorresponds to the type <strong>of</strong> imbalance.AmountComment/ExplanationX Sale <strong>of</strong> Municipal Assets 24,000.00 The <strong>Township</strong> conducted an on-line sale <strong>of</strong> assets and will utilize funds for equipment replacementand not for general operations. The <strong>Township</strong> does not anticipate this revenue to be recurring.X Interest on Investments and Deposits 26,600.00 The <strong>Township</strong> expects interest earnings to decrease due to the reduction in rates from its currentbanking arrangements. The <strong>Township</strong> will continue to monitor for the most advantageous rates.X Reserve for Payment <strong>of</strong> Debt Service - Current Fund 150,000.00 The <strong>Township</strong> is methodically using reserves to pay debt service to ensure a stable tax rate to thecommunity. The <strong>Township</strong> will utilize the remaining Current Fund reserve in the 2013 budget.Sheet 3dAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351EXPLANATORY STATEMENT - (CONTINUED)BUDGET MESSAGESplit Function Appropriations:The following appropriation(s) are appropriated inside and outside <strong>of</strong> theappropriation CAP:Health Insurance Appropriation Recap:The following is a recap <strong>of</strong> Health Insurance Costs for the Current <strong>Budget</strong> Year:None Total Health Insurance Cost $ 255,000.00Less: Employee Contributions 18,000.00Net Costs Appropriated $ 237,000.00Current Fund <strong>Budget</strong> Inside CAP $ 237,000.00Current Fund <strong>Budget</strong> Outside CAPUtility Fund <strong>Budget</strong> Appropriation$237,000.00Sheet 3eAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351Explanatory Statement - (Continued)<strong>Budget</strong> MessageOrganization/Individuals Eligible for BenefitAnalysis <strong>of</strong> Compensated Absence LiabilityGross Days <strong>of</strong>AccumulatedAbsenceValue <strong>of</strong> CompensatedAbsencesApprovedLaborAgreementLegal basis for benefit(check applicable items)LocalOrdinanceIndividualEmploymentAgreementsAll Employees $ 50,064.09XTotals - days $50,064.09Total Funds Reserved as <strong>of</strong> end <strong>of</strong> 2011NoneTotal Funds Appropriated in <strong>2012</strong>NoneSheet 3fAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUESGENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20111. Surplus Anticipated 08-101 1,225,000.00 1,625,000.00 1,625,000.002. Surplus Anticipated with Prior Written Consent <strong>of</strong> Director <strong>of</strong> Local Government Services 08-102Total Surplus Anticipated 08-100 1,225,000.00 1,625,000.00 1,625,000.003. Miscellaneous Revenues - Section A: Local Revenues xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxLicenses: xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxAlcoholic Beverages 08-103Other 08-104Fees and Permits 08-105Fines and Costs:xxxxxxxMunicipal Court 08-110 31,600.00 38,000.00 31,694.16Other 08-109Interest and Costs on Taxes 08-112 70,000.00 71,000.00 74,960.21Interest and Costs on Assessments 08-115Parking Meters 08-111Interest on Investments and Deposits 08-113 26,600.00 75,000.00 109,063.42Anticipated Utility Operating Surplus 08-114Recreation Fees 08-116 15,800.00 15,000.00 15,860.00Sheet 4As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUESGENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section A: Local Revenues (continued): xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTotal Section A: Local Revenues 08-001 144,000.00 199,000.00 231,577.79Sheet 4aAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section B: State Aid Without Offsetting Appropriations xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTransitional Aid 09-212Consolidated Municipal Property Tax Relief Act 09-200Energy Receipts Tax (P.L. 1997, Chapters 162 & 167) 09-202 511,391.00 511,391.00 511,391.00Garden State Preservation Fund 09-206 7,090.00 7,090.00 7,090.00Total Section B: State Aid Without Offsetting Appropriations 09-001 518,481.00 518,481.00 518,481.00Sheet 5As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section C: Dedicated Uniform ConstructionCode Fees Offset with Appropriations(N.J.S. 40A:4-36 & N.J.A.C 5:23-4.17) xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxUniform Construction Code Fees 08-160 90,780.00 85,000.00 131,102.23Special Item <strong>of</strong> General Revenue Anticipated with Prior WrittenConsent <strong>of</strong> Director <strong>of</strong> Local Government Services: xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxAdditional Dedicated Uniform Construction Code Fees Offset with xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxAppropriations (NJS 40A:4-45.3h and NJAC 5:23-4.17) xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxUniform Construction Code Fees 08-160Total Section C: Dedicated Uniform Construction Code Fees Offset with Appropriations 08-002 90,780.00 85,000.00 131,102.23Sheet 6As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section D:Special Items <strong>of</strong> General Revenue AnticipatedWith Prior Written Consent <strong>of</strong> the Director <strong>of</strong> Local Government Services -Shared Service Agreements Offset with Appropriations xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTotal Section D: Shared Service Agreements Offset With Appropriations 11-001 - - -Sheet 7As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenue - Section E: Special Items <strong>of</strong> General Revenue Anticipated WithPrior Written Consent <strong>of</strong> Director <strong>of</strong> Local Government services - AdditionalRevenue Offset with Appropriations (N.J.S. 40A:4-445.3h) xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxUniform Fire Safety Act Fees:State 08-161 6,200.00 6,200.00 7,213.70Local 08-161 600.00 600.00 1,090.00Total Section E: Special Item <strong>of</strong> General Revenue Anticipated with Prior WrittenConsent <strong>of</strong> Director <strong>of</strong> Local Government Services - Additional Revenues 08-003 6,800.00 6,800.00 8,303.70Sheet 8As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section F: Special Items <strong>of</strong> General RevenueAnticipated with Prior Written Consent <strong>of</strong> Director <strong>of</strong> Local GovernmentServices - Public and Private Revenues Offset with Appropriations: xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxRecycling Tonnage Grant 10-171 6,126.26 6,126.26Clean Communities Grant 10-770 21,190.67 21,128.16 21,128.16Municipal Alliance on Alcoholism and Drug Abuse 10-703 39,694.00 39,694.00 39,694.00Sheet 9As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section F: Special Items <strong>of</strong> General RevenueAnticipated with Prior Written Consent <strong>of</strong> Director <strong>of</strong> Local GovernmentServices - Public and Private Revenues Offset with Appropriations (Continued): xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxSheet 9aAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section F: Special Items <strong>of</strong> General RevenueAnticipated with Prior Written Consent <strong>of</strong> Director <strong>of</strong> Local GovernmentServices - Public and Private Revenues Offset with Appropriations (Continued): xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxSheet 9bAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section F: Special Items <strong>of</strong> General RevenueAnticipated with Prior Written Consent <strong>of</strong> Director <strong>of</strong> Local GovernmentServices - Public and Private Revenues Offset with Appropriations (Continued): xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTotal Section F: Special Items <strong>of</strong> General Revenue Anticipated with Prior WrittenConsent <strong>of</strong> Director <strong>of</strong> Local Government Services - Public and Private Revenues 10-001 60,884.67 66,948.42 66,948.42Sheet 9cAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section G: Special Items <strong>of</strong> General Revenue Anticipatedwith Prior Written Consent <strong>of</strong> Director <strong>of</strong> Local Government Services - Other Special Items xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxUtility Operating Surplus <strong>of</strong> Prior Year 08-116Uniform Fire Safety Act 08-106Reserve for Payment <strong>of</strong> Bonds - Current Fund 08-107 150,000.00Reserve for Payment <strong>of</strong> Bonds - General Capital Fund 08-107 250,000.00 250,000.00 250,000.00General Capital Surplus 08-108 75,000.00 75,000.00 75,000.00Sale <strong>of</strong> Municipal Assets 08-109 24,000.00Sheet 10As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 20113. Miscellaneous Revenues - Section G: Special Items <strong>of</strong> GeneralRevenue Anticipated with Prior Written Consent <strong>of</strong> Director <strong>of</strong> LocalGovernment Services - Other Special Items (continued): xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTotal Section G: Special Items <strong>of</strong> General Revenue Anticipated with Prior WrittenConsent <strong>of</strong> Director <strong>of</strong> Local Government Services - Other Special Items 08-004 499,000.00 325,000.00 325,000.00Sheet 10aAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND- ANTICIPATED REVENUES-(continued)GENERAL REVENUES FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 2011Summary <strong>of</strong> Revenuesxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx1. Surplus Anticipated (Sheet 4, #1) 08-101 1,225,000.00 1,625,000.00 1,625,000.002. Surplus Anticipated with Prior Written Consent <strong>of</strong> Director <strong>of</strong> Local Government Services(sheet 4, #2) 08-102 - - -3. Miscellaneous Revenues xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTotal Section A: Local Revenues 08-001 144,000.00 199,000.00 231,577.79Total Section B: State Aid Without Offsetting Appropriations 09-001 518,481.00 518,481.00 518,481.00Total Section C: Dedicated Uniform Construction Code Fees Offset with Appropriations 08-002 90,780.00 85,000.00 131,102.23Special items <strong>of</strong> General Revenue Anticipated with Prior Written Consent <strong>of</strong>Total Section D: Director <strong>of</strong> Local Government Services - Shared Service Agreements 11-001 - - -Special items <strong>of</strong> General Revenue Anticipated with Prior Written Consent <strong>of</strong>Total Section E:Director <strong>of</strong> Local Government Services-Additional Revenues 08-003 6,800.00 6,800.00 8,303.70Special items <strong>of</strong> General Revenue Anticipated with Prior Written Consent <strong>of</strong>Total Section F:Director <strong>of</strong> Local Government Services-Public and Private Revenues 10-001 60,884.67 66,948.42 66,948.42Special items <strong>of</strong> General Revenue Anticipated with Prior Written Consent <strong>of</strong>Total Section G:Director <strong>of</strong> Local Government Services-Other Special Items 08-004 499,000.00 325,000.00 325,000.00Total Miscellaneous Revenues 13-099 1,319,945.67 1,201,229.42 1,281,413.144. Receipts from Delinquent Taxes 15-499 330,000.00 325,000.00 339,487.875. Subtotal General Revenues (Items 1,2,3 and 4) 13-199 2,874,945.67 3,151,229.42 3,245,901.016. Amount to be Raised by Taxes for Support <strong>of</strong> Municipal <strong>Budget</strong>: xxxxxxxa) Local Tax for Municipal Purposes Including Reserve for Uncollected Taxes 07-190 2,169,054.33 1,953,360.19 xxxxxxxxxxxb) Addition to Local District School Tax 07-191 - xxxxxxxxxxxc) Minimum Library Tax 07-192 -Total Amount to be Raised by Taxes for Support <strong>of</strong> Municipal <strong>Budget</strong> 07-199 2,169,054.33 1,953,360.19 2,478,785.317. Total General Revenues 13-299 5,044,000.00 5,104,589.61 5,724,686.32Sheet 11As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedGENERAL GOVERNMENTGeneral AdministrationSalaries and Wages 20-100-1 96,350.00 91,700.00 91,700.00 91,186.71 513.29Other Expenses 20-100-2 30,050.00 30,850.00 50,850.00 44,921.53 5,928.47Human ResourcesOther Expenses 20-105-2 15,000.00 23,000.00 23,000.00 13,681.00 9,319.00Education Programs for Employees 20-105-2 7,500.00 7,500.00 7,500.00 3,818.75 3,681.25Mayor and <strong>Township</strong> CommitteeSalaries and Wages 20-110-1 19,150.00 18,800.00 18,800.00 15,020.88 3,779.12Other Expenses 20-110-2 500.00 500.00 500.00 349.80 150.20Sheet 12As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedGENERAL GOVERNMENT (continued)<strong>Township</strong> ClerkSalaries and Wages 20-120-1 62,600.00 61,855.00 61,855.00 60,833.88 1,021.12Other Expenses:Printing and Legal Advertising 20-120-2 2,500.00 3,000.00 3,000.00 2,458.85 541.15Codification and Revision <strong>of</strong> Ordinance 20-120-2 6,000.00 6,000.00 6,000.00 5,354.10 645.90Miscellaneous Other Expenses 20-120-2 3,245.00 3,400.00 3,400.00 2,689.74 710.26Financial AdministrationSalaries and Wages 20-130-1 80,700.00 88,500.00 88,500.00 78,776.29 723.71Other Expenses 20-130-2 25,440.00 22,670.00 22,670.00 20,686.60 1,983.40Audit Services 20-135-2 30,600.00 29,000.00 29,000.00 29,000.00 -Collection <strong>of</strong> TaxesSalaries and Wages 20-145-1 53,650.00 51,800.00 51,800.00 51,615.73 184.27Other Expenses 20-145-2 9,355.00 10,750.00 10,750.00 7,235.75 2,014.25Sheet 13As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedGENERAL GOVERNMENT (continued)Assessment <strong>of</strong> TaxesSalaries and Wages 20-150-1 90,600.00 86,560.00 86,560.00 86,557.31 2.69Other Expenses:Revision <strong>of</strong> Tax Map 20-150-2 8,000.00 8,000.00 6,000.00 4,021.20 1,978.80Miscellaneous Other Expenses 20-150-2 7,175.00 6,375.00 6,375.00 6,033.65 341.35Legal Services and CostsOther Expenses 20-155-2 107,500.00 91,000.00 116,000.00 101,472.83 14,527.17Engineering Services and CostsOther Expenses 20-165-2 8,000.00 10,000.00 10,000.00 5,561.96 4,438.04Sheet 14As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedGENERAL GOVERNMENT (continued)Municipal CourtSalaries and Wages 43-490-1 55,040.00 65,700.00 61,700.00 60,581.29 1,118.71Other Expense 43-490-2 17,000.00 17,500.00 17,500.00 12,833.76 4,666.24Public DefenderOther Expense 43-495-2 2,000.00 2,500.00 2,500.00 1,140.00 1,360.00InsuranceGeneral Liability 23-210-2 41,000.00 47,500.00 47,500.00 46,855.66 644.34Workers Compensation 23-215-2 42,500.00 34,400.00 34,400.00 34,400.00 -Employee Group Health 23-220-2 237,000.00 266,000.00 247,500.00 224,979.98 22,520.02Employee Group Health Waivers 23-221-2 20,000.00 16,500.00 16,500.00 13,793.25 2,706.75Unemployment/Disability Insurances 23-225-2 6,000.00 27,000.00 7,000.00 5,685.43 1,314.57Sheet 15As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedLAND USE ADMINISTRATIONPlanning BoardSalaries and Wages 21-180-1 24,700.00 24,210.00 24,210.00 24,207.86 2.14Other Expenses:Engineering 21-180-2 3,000.00 3,000.00 3,000.00 467.34 2,532.66Legal 21-180-2 3,700.00 3,700.00 3,700.00 193.05 3,506.95Pr<strong>of</strong>essional Consultants-Planning 21-180-2 3,500.00 4,000.00 4,000.00 3,250.00 750.00Miscellaneous Other Expenses 21-180-2 2,150.00 2,350.00 2,350.00 1,499.66 850.34Zoning Board <strong>of</strong> AdjustmentsSalaries and Wages 21-185-1 5,925.00 5,680.00 5,680.00 5,571.73 108.27Other Expenses:Engineering 21-185-2 300.00 250.00 250.00 61.65 188.35Legal 21-185-2 1,500.00 5,500.00 7,500.00 6,310.50 1,189.50Miscellaneous Other Expenses 21-185-2 650.00 700.00 700.00 601.06 98.94Planner 21-185-2 250.00 400.00 400.00 400.00Sheet 15aAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedPUBLIC SAFETYPoliceSalaries and Wages 25-240-1 100.00 100.00 100.00 100.00911 Emergency Telecommunications SystemOther Expenses 25-250-2 16,000.00 15,865.00 15,865.00 15,864.79 0.21Office <strong>of</strong> Emergency ManagementSalaries and Wages 25-252-1 9,130.00 11,460.00 11,460.00 11,456.52 3.48Other Expenses 25-252-2 2,010.00 1,975.00 1,975.00 519.29 1,455.71Aid to Hope Volunteer Fire Company 25-255-2 84,000.00 84,000.00 84,000.00 84,000.00Sheet 15bAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedPUBLIC SAFETY (continued)First Aid Organization ContributionsAllentown 25-260-2 64,000.00 64,000.00 64,000.00 64,000.00New Egypt 25-260-2 - 7,000.00 7,000.00 7,000.00FireSalaries and Wages 25-265-1 203,000.00 204,500.00 204,500.00 184,843.14 13,656.86Other Expense 25-265-2 7,200.00 7,500.00 7,500.00 4,912.49 2,587.51Municipal ProsecutorOther Expense 25-275-2 26,100.00 26,100.00 26,100.00 26,100.00Sheet 15cAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedPUBLIC WORKSRoad Repairs and MaintenanceSalaries and Wages 26-290-1 98,000.00 128,000.00 128,000.00 109,533.34 11,466.66Other Expenses 26-290-2 52,700.00 54,600.00 110,000.00 164,600.00 157,460.64 7,139.36Maintenance <strong>of</strong> Traffic Light - Contractual 26-300-2 1,700.00 1,700.00 1,700.00 936.36 763.64Trash CollectionOther Expenses 26-305-2 9,000.00 9,500.00 9,500.00 8,400.00 1,100.00RecyclingSalaries and Wages 26-305-1 10,225.00 10,020.00 10,020.00 9,982.48 37.52Other Expenses 26-305-2 14,000.00 14,000.00 14,000.00 12,432.05 1,567.95Public Buildings and GroundsSalaries and Wages 26-310-1 100.00 100.00 100.00 100.00Other Expenses 26-310-2 20,250.00 14,750.00 16,250.00 15,287.60 962.40Sheet 15dAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedPUBLIC WORKS (continued)Vehicle MaintenanceOther Expenses 26-315-2 28,000.00 25,000.00 25,000.00 24,946.87 53.13HEALTH AND HUMAN SERVICESBoard <strong>of</strong> HealthSalaries and Wages 27-330-1 25,550.00 25,600.00 25,600.00 24,949.96 650.04Other Expenses 27-330-2 1,600.00 1,150.00 3,150.00 2,528.61 621.39Senior Citizens' TransportationOther Expenses 27-330-2 4,100.00 4,500.00 4,500.00 3,042.00 1,458.00Housing InspectionSalaries and Wages 27-330-1 1,760.00 1,725.00 1,725.00 1,672.03 52.97Sheet 15eAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedHEALTH AND HUMAN SERVICES (CONTINUED)Employee ImmunizationOther Expenses 27-330-2 50.00 50.00 50.00 50.00Environmental CommitteeOther Expenses 27-335-2 830.00 730.00 730.00 730.00Dog RegulationOther Expenses 27-340-2 4,400.00 8,080.00 4,080.00 1,951.17 2,128.83PARKS AND RECREATIONRecreationSalaries and Wages 28-370-1 21,000.00 26,320.00 26,320.00 26,320.00Other Expenses 28-370-2 400.00 600.00 600.00 144.97 455.03EDUCATIONAid to Allentown Public Library Association 29-390-2 4,000.00 4,000.00 4,000.00 4,000.00Sheet 15fAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedOTHER OPERATING EXPENSESInterest on Tax Appeals 30-426-2 1,000.00 1,000.00 1,000.00 1,000.00UTILITY EXPENSES AND BULK PURCHASESElectricity 31-435-2 29,000.00 29,000.00 29,000.00 27,267.39 1,732.61Street Lighting 31-435-2 33,000.00 33,000.00 33,000.00 30,216.96 2,783.04Telephone 31-440-2 17,000.00 21,000.00 21,000.00 15,616.38 5,383.62Fuel oil 31-447-2 8,500.00 8,000.00 8,000.00 7,714.02 285.98Gas 31-446-2 6,000.00 6,500.00 6,500.00 4,855.00 1,645.00Gasoline 31-460-2 32,000.00 25,000.00 32,000.00 26,320.92 5,679.08LANDFILL / SOLID WASTE DISPOSAL COSTS 32-465-2 20,700.00 22,500.00 22,500.00 5,957.19 16,542.81Sheet 15gAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedUniform Construction Code - Appropriations xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxOffset by Dedicated Revenues (N.J.A.C. 5:23-4.17) xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxState Uniform Construction CodeConstruction OfficialSalaries and Wages 22-195-1 42,900.00 55,600.00 45,600.00 44,952.07 647.93Other Expenses 22-195-2 3,525.00 4,350.00 4,350.00 2,526.53 1,823.47Sub-Code Officials:Building Sub-Code OfficialSalaries and Wages 22-195-2 29,200.00 28,000.00 28,000.00 27,856.05 143.95Building InspectorSalaries and Wages 22-195-1 9,420.00 9,025.00 9,025.00 8,914.42 110.58Plumbing Sub-Code OfficialSalaries and Wages 22-195-1 18,110.00 17,960.00 17,960.00 17,385.50 574.50Electrical Sub-Code OfficialSalaries and Wages 22-195-1 17,360.00 17,225.00 17,225.00 16,892.54 332.46Fire Protection Sub-Code OfficialSalaries and Wages 22-195-1 5,500.00 5,760.00 5,760.00 5,241.34 518.66Sheet 16As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedUNCLASSIFIED: xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxSheet 17As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - within "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedUNCLASSIFIED (CONTINUED): xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTotal Operations {item 8(A)} within "CAPS" 34-199 2,112,550.00 2,214,995.00 110,000.00 2,323,995.00 2,110,709.40 189,785.60B. Contingent 35-470Total Operations Including Contingent-within "CAPS" 34-201 2,112,550.00 2,214,995.00 110,000.00 2,323,995.00 2,110,709.40 189,785.60Detail:Salaries and Wages 34-201-1 980,070.00 1,036,200.00 - 1,022,200.00 964,351.07 35,848.93Other Expenses (Including Contingent) 34-201-2 1,132,480.00 1,178,795.00 110,000.00 1,301,795.00 1,146,358.33 153,936.67Sheet 17aAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers Charged(E) Deferred Charges and Statutory Expenditures- xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxMunicipal within "CAPS" xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx(1) DEFERRED CHARGES xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxEmergency Authorizations 46-870 xxxxxxxxxxx xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxSheet 18As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers Charged(E) Deferred Charges and Statutory Expenditures- xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxMunicipal within "CAPS"(continued) xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx(2) STATUTORY EXPENDITURES: xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxContribution to:Public Employees' Retirement System 36-471 104,746.00 118,335.00 118,335.00 118,335.00Social Security System (O.A.S.I) 36-472 80,300.00 85,000.00 85,000.00 78,357.14 2,642.86Consolidated Police and Firemen's Pension Fund 36-474Police and Firemen's Retirement System <strong>of</strong> N.J. 36-475 68,465.00 71,558.00 71,558.00 71,558.00Defined Contribution Retirement Program 36-477 2,500.00 1,000.00 2,000.00 1,813.00 187.00Total Deferred Charges and StatutoryExpenditures - Municipal within "CAPS" 34-209 256,011.00 275,893.00 - 276,893.00 270,063.14 2,829.86(F) Judgments 37-480 -(G) Cash Deficit <strong>of</strong> Preceding Year 46-855 -(H-1)Total General Appropriations for MunicipalPurposes within "Caps" 34-299 2,368,561.00 2,490,888.00 110,000.00 2,600,888.00 2,380,772.54 192,615.46Sheet 19As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - Excluded from "CAPS" FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedSheet 20As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - Excluded from "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedTotal Other Operations - Excluded from "CAPS" 34-300 - - - - - -Sheet 20aAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - Excluded from "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedUniform Construction Code Appropriations xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxOffset by Increased Fee Revenues (NJAC 5:23-4.17) xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTotal Uniform Construction Code Appropriations 22-999 - - - - - -Sheet 21As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - Excluded from "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedShared Service Agreements xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxLocal Health ServicesOther Expenses 27-330-2 59,113.00 59,113.00 59,113.00 59,113.00Other Expenses - Epidemiology 27-330-2 3,705.00 4,377.00 4,377.00 4,377.00Other Expenses - Services <strong>of</strong> Visiting Nurse 27-330-2 3,067.00 3,066.00 3,066.00 3,066.00Total Shared Service Agreements 42-999 65,885.00 66,556.00 - 66,556.00 66,556.00Sheet 22As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - Excluded from "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedAdditional Appropriations Offset by xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxRevenues (N.J.S. 40A:4-45.3h) xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxUniform Fire Safety ActFire OfficialOther Expenses 25-267-2 6,800.00 6,800.00 6,800.00 2,468.10 4,331.90Total Additional Appropriations Offset byRevenues (N.J.S. 40A:4-45.3h) 34-303 6,800.00 6,800.00 - 6,800.00 2,468.10 4,331.90Sheet 23As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - Excluded from "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedPublic and Private Programs Offset by Revenues xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxRecycling Tonnage Grant 41-701 6,126.26 6,126.26 6,126.26Clean Communities Grant 41-770 21,190.67 21,128.16 21,128.16 21,128.16Municipal Alliance on Alcoholism and Drug Abuse 41-703 39,694.00 39,694.00 39,694.00 39,694.00Municipal Alliance on Alcoholism and Drug Abuse - Local Match 41-703 3,000.00 3,000.00 3,000.00 3,000.00Matching Funds for Grants 41-715 1,000.00 1,000.00 1,000.00Sheet 24As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(A) Operations - Excluded from "CAPS" (Continued) FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedPublic and Private Programs Offset by Revenues xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx(Continued) xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxTotal Public and Private Programs Offsetby Revenues 40-999 63,884.67 70,948.42 - 70,948.42 69,948.42 1,000.00-Total Operations - Excluded from "CAPS" 34-305 136,569.67 144,304.42 - 144,304.42 138,972.52 5,331.90Detail:Salaries & Wages 34-305-1 - - - - - -Other Expenses 34-305-2 136,569.67 144,304.42 - 144,304.42 138,972.52 5,331.90Sheet 25As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(C) Capital Improvements - Excluded from "CAPS" FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedDown Payments on Improvements 44-902Capital Improvement Fund 44-901Reserve for Emergency Vehicles and Appurtenances 44-903 110,000.00Acquisition <strong>of</strong> Public Works Equipment 44-904 24,000.00Sheet 26As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(C) Capital Improvements - Excluded from "CAPS" FCOA Emergency As Modified By Paid or Reserved(Continued) for <strong>2012</strong> for 2011 Appropriation All Transfers ChargedPublic and Private Programs Offset by Revenues: xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxNew Jersey DOT Trust Fund Authority Act 41-865Total Capital Improvements Excluded from "CAPS" 44-999 134,000.00 - - - - -Sheet 26aAs Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(D)Municipal Debt Service - Excluded from "CAPS" FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedPayment <strong>of</strong> Bond Principal 45-920 950,000.00 800,000.00 800,000.00 800,000.00 xxxxxxxxxxxPayment <strong>of</strong> Bond Anticipation Notes and Capital Notes 45-925 xxxxxxxxxxxInterest on Bonds 45-930 577,983.00 705,420.00 705,420.00 705,418.76 xxxxxxxxxxxInterest on Notes 45-935 xxxxxxxxxxxGreen Trust Loan Program: xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxLoan Repayments for Principal and Interest 45-940 xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxCapital Lease Obligations 45-941 xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxTotal Municipal Debt Service-Excluded from "CAPS" 45-999 1,527,983.00 1,505,420.00 - 1,505,420.00 1,505,418.76 xxxxxxxxxxxSheet 27As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011(E) Deferred Charges - Municipal FCOA Emergency As Modified By Paid or ReservedExcluded from "CAPS" for <strong>2012</strong> for 2011 Appropriation All Transfers Charged(1) DEFERRED CHARGES: xxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxEmergency Authorizations 46-870 15,000.00 xxxxxxxxxxx 15,000.00 15,000.00 xxxxxxxxxxxSpecial Emergency Authorizations- xxxxxxxxxxx xxxxxxxxxxx5 Years(N.J.S.40A:4-55) 46-875 36,000.00 74,000.00 xxxxxxxxxxx 74,000.00 74,000.00 xxxxxxxxxxxSpecial Emergency Authorizations- xxxxxxxxxxx xxxxxxxxxxx3 Years (N.J.S. 40A:4-55.1 & 40A:4-55.13) 46-871 xxxxxxxxxxx xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxTotal Deferred Charges - Municipal- xxxxxxxxxxx xxxxxxxxxxxExcluded from "CAPS" 46-999 36,000.00 89,000.00 xxxxxxxxxxx 89,000.00 89,000.00 xxxxxxxxxxx(F) Judgments (N.J.S.A. 40A:4-45.3cc) 37-480 xxxxxxxxxxx xxxxxxxxxxx(N)Transferred to Board <strong>of</strong> Education for Use <strong>of</strong> xxxxxxxxxxx xxxxxxxxxxxLocal Schools (N.J.S.A. 40:48-17.1 & 17.3) 29-405 xxxxxxxxxxx xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx(G)With Prior Consent <strong>of</strong> Local Finance Board: xxxxxxxxxxx xxxxxxxxxxxCash Deficit <strong>of</strong> Preceding Year 46-885 xxxxxxxxxxx xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx(H-2) Total General Appropriations for Municipal xxxxxxxxxxx xxxxxxxxxxxPurposes Excluded from "CAPS" 34-309 1,834,552.67 1,738,724.42 - 1,738,724.42 1,733,391.28 5,331.90Sheet 28As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedFor Local District School Purposes-Excluded from "CAPS" xxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx(1) Type 1 District School Debt Service xxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxPayment <strong>of</strong> Bond Principal 48-920 xxxxxxxxxxxPayment <strong>of</strong> Bond Anticipation Notes 48-925 xxxxxxxxxxxInterest on Bonds 48-930 xxxxxxxxxxxInterest on Notes 48-935 xxxxxxxxxxxTotal <strong>of</strong> Type 1 District School Debt Service-Excluded from "CAPS" 48-999 - - - - - xxxxxxxxxxx(J) Deferred Charges and Statutory Expenditures-Local School - Excluded from "CAPS" xxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxEmergency Authorizations - Schools 29-406 xxxxxxxxxxx xxxxxxxxxxxCapital Project for Land, Building or Equipment N.J.S. 18A:22-20 29-407 xxxxxxxxxxxTotal <strong>of</strong> Deferred Charges and Statutory Expendditures-Local School- Excluded from "CAPS" 29-409 - - - - - xxxxxxxxxxx(K)Total Municipal Appropriations for Local District SchoolPurposes {(item (1) and (j)- Excluded from "CAPS" 29-410 - - - - - xxxxxxxxxxx(O) Total General Appropriations - Excluded from "CAPS" 34-399 1,834,552.67 1,738,724.42 - 1,738,724.42 1,733,391.28 5,331.90(L)Subtotal General Appropriations {items (H-1) and (O)} 34-400 4,203,113.67 4,229,612.42 110,000.00 4,339,612.42 4,114,163.82 197,947.36(M) Reserve for Uncollected Taxes 50-899 840,886.33 874,977.19 xxxxxxxxxxx 874,977.19 874,977.19 xxxxxxxxxxx9. Total General Appropriations 34-499 5,044,000.00 5,104,589.61 110,000.00 5,214,589.61 4,989,141.01 197,947.36Sheet 29As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CURRENT FUND - APPROPRIATIONS8. GENERAL APPROPRIATIONSAppropriated Expended 2011for 2011 by Total for 2011Summary <strong>of</strong> Appropriations FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers Charged(H-1) Total General Appropriations forMunicipal Purposes within "CAPS" 34-299 2,368,561.00 2,490,888.00 110,000.00 2,600,888.00 2,380,772.54 192,615.46xxxxxxx(A) Operations- Excluded from "CAPS" xxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxx xxxxxxxxxxxOther Operations 34-300 - - - - - -Uniform Construction Code 22-999 - - - - - -Shared Service Agreements 42-999 65,885.00 66,556.00 - 66,556.00 66,556.00 -Additional Appropriations Offset by Revs. 34-303 6,800.00 6,800.00 - 6,800.00 2,468.10 4,331.90Public & Private Progs Offset by Revs. 40-999 63,884.67 70,948.42 - 70,948.42 69,948.42 1,000.00Total Operations- Excluded from "CAPS" 34-305 136,569.67 144,304.42 - 144,304.42 138,972.52 5,331.90(C) Capital Improvements 44-999 134,000.00 - - - - -(D) Municipal Debt Service 45-999 1,527,983.00 1,505,420.00 - 1,505,420.00 1,505,418.76 xxxxxxxxxxx(E) Total Deferred Charges (sheet 28) 46-999 36,000.00 89,000.00 xxxxxxxxxxx 89,000.00 89,000.00 xxxxxxxxxxx(F) Judgements 37-480 - - xxxxxxxxxxx - - xxxxxxxxxxx(G) Cash Deficit 46-885 - - xxxxxxxxxxx - - xxxxxxxxxxx(K) Local District School Purposes 24-410 - - - - - xxxxxxxxxxx(N) Transferrred to Board <strong>of</strong> Education 29-405 - - xxxxxxxxxxx - - xxxxxxxxxxx(M) Reserve for Uncollected Taxes 50-899 840,886.33 874,977.19 xxxxxxxxxxx 874,977.19 874,977.19 xxxxxxxxxxxTotal General Appropriations 34-499 5,044,000.00 5,104,589.61 110,000.00 5,214,589.61 4,989,141.01 197,947.36Sheet 30As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351DEDICATED WATER UTILITY BUDGETDEDICATED REVENUES FROM WATER UTILITY FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 2011Operating Surplus Anticipated 08-501Operating Surplus Anticipated with Prior WrittenConsent <strong>of</strong> Director <strong>of</strong> Local Government Services 08-502Total Operating Surplus Anticipated 08-500 - - -Rents 08-503Fire Hydrant Service 08-504 * Note:Use pages 31, 32 and 33 forMiscellaneous 08-505 water utility onlyAll other utilities use sheets 34, 35and 36Special Items <strong>of</strong> General Revenue Anticipated with PriorWritten Consent <strong>of</strong> Director <strong>of</strong> Local Government Services xxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxDeficit (General <strong>Budget</strong>) 08-549Total Water Utility Revenues 08-599 - - -Sheet 31As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351DEDICATED WATER UTILITY BUDGET - (CONTINUED) * Note: Use sheet 32 for Water Utility only.AppropriatedExpended 2011for 2011 Total for 2011 Paid or Reserved11. APPROPRIATIONS FOR WATER UTILITY FCOA By Emergency As Modified Byfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedOperating: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxSalaries & Wages 55-501Other Expenses 55-502Capital Improvements: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxDown Payments on Improvements 55-510Capital Improvement Fund 55-511Capital Outlay 55-512Debt Service xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxPayment <strong>of</strong> Bond Principal 55-520 xxxxxxxxxxPayment <strong>of</strong> Bond Anticipation Notes andCapital Notes 55-521 xxxxxxxxxxInterest on Bonds 55-522 xxxxxxxxxxInterest on Notes 55-523 xxxxxxxxxxxxxxxxxxxxSheet 32As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351DEDICATED WATER UTILITY BUDGET - (CONTINUED)* Note: Use sheet 33 for Water Utility only.AppropriatedExpended 2011for 2011 Total for 2011 Paid or Reserved11. APPROPRIATIONS FOR WATER UTILITY FCOA By Emergency As Modified Byfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedDeferred Charges and Statutory Expenditures: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxDEFERRED CHARGES: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxEmergency Authorizations 55-530 xxxxxxxxxx xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxSTATUTORY EXPENDITURES: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxContribution To:Public Employees' Retirement System 55-540Social Security System (O.A.S.I) 55-541Unemployment Compensation Insurance(N.J.S.A. 43:21-3 et. seq.) 55-542Judgments 55-531Deficits in Operations in Prior Years 55-532 xxxxxxxxxx xxxxxxxxxxSurplus (General <strong>Budget</strong>) 55-545 xxxxxxxxxx xxxxxxxxxxTotal Water Utility Appropriations 55-599 - - - - - -Sheet 33As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351DEDICATED N/A UTILITY BUDGET10. DEDICATED REVENUES FROM N/A UTILITY FCOA AnticipatedRealized in Cash<strong>2012</strong> 2011 in 2011Operating Surplus Anticipated 08-501Operating Surplus Anticipated with Prior WrittenConsent <strong>of</strong> Director <strong>of</strong> Local Government Services 08-502Total Operating Surplus Anticipated 08-500 - - -Use a separate set <strong>of</strong> sheets foreach separate Utility.Special Items <strong>of</strong> General Revenue Anticipated with PriorWritten Consent <strong>of</strong> Director <strong>of</strong> Local Government Services xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxDeficit(General <strong>Budget</strong>) 08-549Total N/A Utility Revenues 08-599 - - -Sheet 34As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351DEDICATED N/A UTILITY BUDGET - (CONTINUED)Appropriated Expended 2011for 2011 by Total for 201111. APPROPRIATIONS FOR N/A UTILITY FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedOperating: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxSalaries & Wages 55-501Other Expenses 55-502Capital Improvements: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxDown Payments on Improvements 55-510Capital Improvement Fund 55-511 xxxxxxxxxxCapital Outlay 55-512Debt Service xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxPayment <strong>of</strong> Bond Principal 55-520 xxxxxxxxxxPayment <strong>of</strong> Bond Anticipation Notes andCapital Notes 55-521 xxxxxxxxxxInterest on Bonds 55-522 xxxxxxxxxxInterest on Notes 55-523 xxxxxxxxxxxxxxxxxxxxSheet 35As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351DEDICATED N/A UTILITY BUDGET - (CONTINUED)Appropriated Expended 2011for 2011 by Total for 201111. APPROPRIATIONS FOR N/A UTILITY FCOA Emergency As Modified By Paid or Reservedfor <strong>2012</strong> for 2011 Appropriation All Transfers ChargedDeferred Charges and Statutory Expenditures: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxDEFERRED CHARGES: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxEmergency Authorizations 55-530 xxxxxxxxxx xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxSTATUTORY EXPENDITURES: xxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxx xxxxxxxxxxContribution to:Public Employees' Retirement System 55-540Social Security System (O.A.S.I.) 55-541Unemployment Compensation Insurance(N.J.S.A. 43:21-3 et. seq.) 55-542Judgments 55-531Deficits in Operation in Prior Years 55-532 xxxxxxxxxx xxxxxxxxxxSurplus(General <strong>Budget</strong>) 55-545 xxxxxxxxxx xxxxxxxxxxTotal N/A Utility Appropriations 55-599 - - - - - -Sheet 36As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351DEDICATED ASSESSMENT BUDGETAnticipatedRealized in Cash14. DEDICATED REVENUES FROM FCOA <strong>2012</strong> 2011 2011Assessment Cash 51-101Deficit (General <strong>Budget</strong>) 51-885Total Assessment Revenues 51-899 - - -Appropriated Expended 201115. APPROPRIATIONS FOR ASSESSMENT DEBT <strong>2012</strong> 2011 Paid or ChargedPayment <strong>of</strong> Bond Principal 51-920Payment <strong>of</strong> Bond Anticipation Notes 51-925Total Assessment Appropriations 51-999 - - -DEDICATED WATER UTILITY ASSESSMENT BUDGETAnticipatedRealized in Cash14. DEDICATED REVENUES FROM FCOA <strong>2012</strong> 2011 2011Assessment Cash 52-101Deficit Water Utility <strong>Budget</strong> 52-885Total Water Utility Assessment Revenues 52-899 - - -Appropriated Expended 201115. APPROPRIATIONS FOR ASSESSMENT DEBT FCOA <strong>2012</strong> 2011 Paid or ChargedPayment <strong>of</strong> Bond Principal 52-920Payment <strong>of</strong> Bond Anticipation Notes 52-925Total Water Utility Assessment Appropriations 52-999 - - -Sheet 37As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351DEDICATED ASSESSMENT BUDGETUTILITYRealized In Cash14. DEDICATED REVENUE FROM FCOA <strong>2012</strong> 2011 2011Assessment Cash 53-101Deficit ( _________________________) 53-885Total ___________________ Assessment Revenues 53-899 - - -Expended 201115. APPROPRIATIONS FOR ASSESSMENT DEBT FCOA <strong>2012</strong> 2011 Paid or ChargedPayment <strong>of</strong> Bond Principal 53-920Payment <strong>of</strong> Bond Anticipation Notes 53-925Total ________________________ UtilityAssessment Appropriations 53-999 - - -Dedication by Rider- (N.J.S. 40a:4-39) The dedicated revenues anticipated during the year <strong>2012</strong> from Animal Control;, State or Federal Aid for Maintenance <strong>of</strong> Libraries,Bequest, Escheat; Federal Grant; Construction Code Fees Due Hackensak Meadowlands Development Commission;Outside Employment <strong>of</strong> Off-Duty Municipal PoliceOfficers; Unemployment Compensation Insurance; Reimbursement <strong>of</strong> Sale <strong>of</strong> Gasoline to State Automobiles; State Training Fees - Uniform Construction Code Act:Older Americans Act - Program Contributions; Municipal Alliance on Alcoholism and Drug Abuse - Program Income;Housing and Community Development Act Of 1974; Municipal Public Defender Trust; Open Space, Recreation, Farmland andHistoric Preservation Trust; Developer's Escrow; Affordable Housing Trust; Recreation Trust, Snow Removal Trust and Uniform Fire Act Penalty Moniesare hereby anticipated as revenue and are hereby appropriated for the purposes to which said revenue is dedicated by statute or other legal requirement.(Insert additional appropriate titles in space above when applicable, if resolution for rider has been approved by the Director)Sheet 38As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351APPENDIX TO BUDGET STATEMENTCURRENT FUND BALANCE SHEET - DECEMBER 31, 2011ASSETSCOMPARATIVE STATEMENT OF CURRENT FUND OPERATIONS AND CHANGE IN CURRENT SURPLUSYEAR 2011 YEAR 2010Cash and Investments 1110100 2,961,762.06 Surplus Balance, January 1st 2310100 2,482,955.84 2,375,542.11Due from State <strong>of</strong> N.J.(c20,P.L. 1971) 1111000 CURRENT REVENUE ON A CASH BASISCurrent TaxesFederal and State Grants Receivable 1110200 20,084.88 *(Percentage collected: 2011 98.26%, 2010 98.04%) 2310200 25,075,237.26 24,594,140.76Receivables with Offsetting Reserves: xxxxxxxxx xxxxxxxxxxxx Delinquent Taxes 2310300 339,487.87 392,898.18Taxes Receivable 1110300 386,791.87 Other Revenues and Additions to Income 2310400 1,616,657.34 1,819,498.32Tax Title Liens Receivable 1110400 352,177.76 Total Funds 2310500 29,514,338.31 29,182,079.37Property Acquired by Tax Title LienEXPENDITURES AND TAX REQUIREMENTS:Liquidation 1110500 11,600.00 Municipal Appropriations 2310600 4,312,111.18 4,396,653.44Other Receivables 1110600 129,677.00 School Taxes (Including Local and Regional) 2310700 18,817,933.57 17,980,849.58Deferred Charges Required to be in <strong>2012</strong> <strong>Budget</strong> 1110700 36,000.00 County Taxes(Including Added Tax Amounts) 2310800 3,660,813.54 3,547,817.97Deferred Charges Required to be in <strong>Budget</strong>sSubsequent to <strong>2012</strong> 1110800 130,000.00 Special District Taxes 2310900 708,575.29 786,822.72Total Assets 1110900 4,028,093.57 Other Expenditures and Deductions from Income 2311000 4,780.10 71,979.82LIABILITIES, RESERVES AND SURPLUSTotal Expenditures and Tax Requirements 2311100 27,504,213.68 26,784,123.53*Cash Liabilities 2110100 1,054,862.13 Less: Expenditures to be Raised by Future Taxes 2311200 110,000.00 85,000.00Reserves for Receivables 2110200 853,106.81 Total Adjusted Expenditures and Tax Requirements 2311300 27,394,213.68 26,699,123.53Surplus 2110300 2,120,124.63 Surplus Balance - December 31st 2311400 2,120,124.63 2,482,955.84*Nearest even percentage may be usedTotal Liabilities, Reserves and Surplus 4,028,093.57Proposed Use <strong>of</strong> Current Fund Surplus in <strong>2012</strong> <strong>Budget</strong>School Tax Levy Unpaid 2220110 9,551,019.86 Surplus Balance December 31, 2011 2311500 2,120,124.63Less School Tax Deferred 2220200 9,551,019.86 Current Surplus Anticipated in <strong>2012</strong> <strong>Budget</strong> 2311600 1,225,000.00*Balance Included in Above"Cash Liabilities" 2220300 - Surplus Balance Remaining 2311700 895,124.63(Important:This appendix must be included in advertisement <strong>of</strong> budget.)Sheet 39As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351<strong>2012</strong>CAPITAL BUDGET AND CAPITAL IMPROVEMENT PROGRAMThis section is included with the Annual <strong>Budget</strong> pursuant to N.J.S.C. 5:30-4. It does not in itself confer any authorization to raise or expendfunds. Rather it is a document used as part <strong>of</strong> the local unit's planning and management program. Specific authorization to expend funds for purposesdescribed in this section must be granted elsewhere, by a separate bond ordinance, by inclusion <strong>of</strong> a line item in the Capital Improvement Section <strong>of</strong> thisbudget, by an ordinance taking the money from the Capital Improvement Fund, or other lawful means.CAPITAL BUDGET - A plan for all capital expenditures for the current fiscal year.If no Capital <strong>Budget</strong> is included, check the reason why:Total capital expenditures this year do not exceed $25,000, including appropriations for Capital Improvement Fund,Capital Line Items and Down Payments on Improvements.No bond ordinances are planned this year.CAPITAL IMPROVEMENT PROGRAM - A multi-year list <strong>of</strong> planned capital projects, including the current year.Check appropriate box for number <strong>of</strong> years covered, including current year:X 3 years. (Population under 10,000)6 years. (Over 10,000 and all county governments)_____years. (Exceeding minimum time period)Check if municipality is under 10,000, has not expended more than $25,000 annually for capital purposes in immediatelyprevious three years, and is not adopting CIP.Sheet 40 C-1As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351The Capital Projects identified herein reflect the plans <strong>of</strong> the governing body.NARRATIVE FOR CAPITAL IMPROVEMENT PROGRAMSheet 40a C-2As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351CAPITAL BUDGET (Current Year Action)Local Unit4 61 2 3 AMOUNTS PLANNED FUNDING SERVICES FOR CURRENT YEAR - <strong>2012</strong> TO BEPROJECT ESTIMATED RESERVED 5a 5b 5c 5d 5e FUNDED INPROJECT TITLE NUMBER TOTAL IN PRIOR <strong>2012</strong> <strong>Budget</strong> Capital Im- Capital Grants in Aid Debt FUTURECOST YEARS Appropriations provement Fund Surplus and Other Funds Authorized YEARSReserve for Emergency Vehicles and Appurtenances 110,000.00 110,000.00Acquisition <strong>of</strong> Public Works Equipment 24,000.00 24,000.00---------------------<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>TOTAL - ALL PROJECTS 33-199 134,000.00 - 134,000.00 - - - - -Sheet 40bC-3As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 13513 YEAR CAPITAL PROGRAM <strong>2012</strong> - 2014Anticipated Project Schedule and Funding RequirementsLocal Unit<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>2 3 4PROJECT ESTIMATED ESTIMATED 5a 5b 5c 5d 5e 5fPROJECT TITLE NUMBER TOTAL COMPLETION <strong>2012</strong> 2013 2014 2015 2016 2017COSTS TIMEReserve for Emergency Vehicles and Appurtenances 110,000.00 110,000.00Acquisition <strong>of</strong> Public Works Equipment 24,000.00 24,000.00---------------------TOTAL - ALL PROJECTS 33-299 134,000.00 134,000.00 - - - - -Sheet 40cC-4As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 13513 YEAR CAPITAL PROGRAM <strong>2012</strong> - 2014SUMMARY OF ANTICIPATED FUNDING SOURCES AND AMOUNTSLocal Unit<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>1 2 3a 3b 4 5 6 7a 7b 7c 7dCapitalGrants-in-PROJECT TITLE Estimated Current Year Improve- Capital Aid and SelfTotal Cost <strong>2012</strong> Future Years ment Fund Surplus Other Funds General Liquidating Assessment SchoolReserve for Emergency Vehicles and Appurtenances 110,000.00 110,000.00Acquisition <strong>of</strong> Public Works Equipment 24,000.00 24,000.00---------------------TOTAL - ALL PROJECTS 33-399 134,000.00 134,000.00 - - - - - - - -Sheet 40dC-5As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351SECTION 2 - UPON ADOPTION FOR YEAR <strong>2012</strong>(Only to be Included in the <strong>Budget</strong> as Finally Adopted)RESOLUTIONBe it Resolved by the <strong>Township</strong> Committee <strong>of</strong> the <strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>,County <strong>of</strong> Monmouth , that the budget hereinbefore set forth is hereby adopted andshall constitute an appropriation for the purposes stated <strong>of</strong> the sums therein set forth as appropriations, and authorization <strong>of</strong> the amount <strong>of</strong>:(a)$2,169,054.33 (Item 2 below) for municipal purposes, and(b)$ - (Item 3 below) for school purposes in Type I School District only (N.J.S. 18A:9-2) to be raised by taxation and,(c)$ - (Item 4 below) to be added to the certificate <strong>of</strong> amount to be raised by taxation for local school purposes inType II School Districts only (N.J.S. 18A:9-3) and certification to the County Board <strong>of</strong> Taxation <strong>of</strong>the following summary <strong>of</strong> general revenues and appropriations.(d)$705,286.64 (Sheet 43) Open Space, Recreation, Farmland and Historic Preservation Trust Fund Levy(e)$ - (Item 5 below) Minimum Library TaxRECORDED VOTE(Insert last name)Ayes { Nays {SUMMARY OF REVENUESAbstained {Absent {1. General RevenuesSurplus Anticipated 08-100 1,225,000.00Miscellaneous Revenues Anticipated 13-099 1,319,945.67Receipts from Delinquent Taxes 15-499 330,000.002. AMOUNT TO BE RAISED BY TAXATION FOR MUNICIPAL PURPOSES (Item 6(a), Sheet 11) 07-190 2,169,054.333. AMOUNT TO BE RAISED BY TAXATION FOR _SCHOOLS IN TYPE I SCHOOL DISTRICTS ONLY:Item 6, Sheet 42 07-195-Item 6(b), Sheet 11 (N.J.S. 40A:4-14) 07-191-Total Amount to be Raised by Taxation for Schools in Type I School Districts Only -4. To Be Added TO THE CERTIFICATE FOR AMOUNT TO BE RAISED BY TAXATION FOR _SCHOOLS IN TYPE II SCHOOL DISTRICTS ONLY:Item 6(b), Sheet 11 (N.J.S. 40A:4-14) 07-191 -5. AMOUNT TO BE RAISED BY TAXATION MINIMUM LIBRARY LEVY 07-192 -Total Revenues 13-299 5,044,000.00Sheet 41As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351SUMMARY OF APPROPRIATIONS5. GENERAL APPROPRIATIONS xxxxxxxxx xxxxxxxxxxxxxxxWithin "CAPS" xxxxxxxxx xxxxxxxxxxxxxxx(a&b) Operations including Contingent 34-201 $ 2,112,550.00(e) Deferred Charges and Statutory Expenditures - Municipal 34-209 $ 256,011.00(g) Cash Deficit 46-885 $ -Excluded from "CAPS" xxxxxxxxx xxxxxxxxxxxxxxx(a) Operations - Total Operations Excluded from "CAPS" 34-305 $ 136,569.67(c) Capital Improvements 44-999 $ 134,000.00(d) Municipal Debt Service 45-999 $ 1,527,983.00(e) Deferred Charges - Municipal 46-999 $ 36,000.00(f) Judgments 37-480 $ -(n) Transferred to Board <strong>of</strong> Education for Use <strong>of</strong> Local Schools (N.J.S. 40:48-17.1 &17.3) 29-405 $ -(g) Cash Deficit 46-885 $ -(k) For Local District School Purposes 29-410 $ -(m) Reserve for Uncollected Taxes (Include Other Reserves if Any) 50-899 $ 840,886.336. SCHOOL APPROPRIATIONS - TYPE I SCHOOL DISTRICTS ONLY (N.J.S. 40A:4-13) 07-195 $Total Appropriations 34-499 $ 5,044,000.00It is hereby certified that the within budget is a true copy <strong>of</strong> the budget finally adopted by resolution <strong>of</strong> the Governing Body on the ___________________ day <strong>of</strong>____________________________ ,<strong>2012</strong>. It is further certified that each item <strong>of</strong> revenue and appropriation is set forth in the same amount and by the sametitle asappeared in the <strong>2012</strong> approved budget and all amendments thereto, if any, which have been previously approved by the Director <strong>of</strong> Local GovernmentServices.Certified by me this___________ day <strong>of</strong>________________, <strong>2012</strong> _______________________________, ClerksignatureSheet 42As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351LOCAL UNIT<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>COUNTY/MUNICIPAL OPEN SPACE, RECREATION, FARMLAND AND HISTORIC PRESERVATION TRUST FUNDDEDICATED REVENUES AnticipatedRealized in Cash APPROPRIATIONSFROM TRUST FUND FCOA <strong>2012</strong> 2011 2011 FCOA <strong>2012</strong> 2011 Paid or Charged ReservedAmount To Be Raised ByTaxationAppropriatedExpended 201154-190 705,286.64 705,425.00 708,575.29 Development <strong>of</strong> Lands for Recreation and Conservation:xxxxxxxx xxxxxxxx xxxxxxxxx xxxxxxxxSalaries & Wages 54-385-1 -Interest Income 54-113 2,564.90 Other Expenses 54-385-2 50,000.00 125,000.00 121,591.78 3,408.22Maintenance <strong>of</strong> Lands for Recreation and Conservation:xxxxxxxx xxxxxxxx xxxxxxxxx xxxxxxxxReserve Funds: 287,353.98 142,560.53 142,560.53 Salaries & Wages 54-375-1 127,000.00 124,300.00 121,457.02 2,842.98Other Expenses 54-375-2 52,500.00 43,725.00 38,855.42 4,869.58Historic Preservation: xxxxxxxx xxxxxxxx xxxxxxxxx xxxxxxxxSalaries & Wages 54-176-1 -Other Expenses 54-176-2 --Acquisition <strong>of</strong> Lands for Recreation and Conservation54-915-2 -Total Trust Fund Revenues: 54-299 992,640.62 847,985.53 853,700.72 Acquisition <strong>of</strong> Farmland54-916-2 426,765.62 240,585.53 30.83 240,554.70Year Referendum Passed/Implemented:Summary <strong>of</strong> ProgramDown Payments on Improvements54-906-2 -Nov. 2000; Nov.2007; Nov. 2008 Debt Service:xxxxxxxx xxxxxxxx xxxxxxxxx xxxxxxxxRate Assessed: $ 0.04; 0.06 Payment <strong>of</strong> Bond Principal 54-920-2 175,000.00 150,000.00 150,000.00 xxxxxxxxTotal Tax Collected to date $ 5,232,711.34Payment <strong>of</strong> Bond Anticipation Notes and CapitalNotes 54-925-2 xxxxxxxxTotal Expended to date: $ 5,124,026.77 Interest on Bonds 54-930-2 161,375.00 164,375.00 164,375.00 xxxxxxxxTotal Acreage Preserved to date 8,801.47 Interest on Notes 54-935-2 xxxxxxxxRecreation land preserved in 2011: Reserve for Future Use 54-950-2 -Farmland preserved in 2011: 400.97 Total Trust Fund Appropriations: 54-499 992,640.62 847,985.53 596,310.05 251,675.48Sheet 43As Adopted 4/5/<strong>2012</strong>

<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong>, Muni Code: 1351Annual List <strong>of</strong> Change Orders ApprovedPursuant to N.J.A.C. 5:30-11Contracting Unit:<strong>Township</strong> <strong>of</strong> <strong>Upper</strong> <strong>Freehold</strong> Year Ending:12/31/2011The following is a complete list <strong>of</strong> all change orders which caused the originally awarded contract price to be exceeded by more than 20 percent. For regulatory detailsplease consult N.J.A.C. 5:30-11.1 et. Seq. Please identify each change order by name <strong>of</strong> the project.1234For each change order listed above, submit with introduced budget a copy <strong>of</strong> the governing body resolution authorizing the change order and an Affidavit <strong>of</strong> Publication forthe newspaper notice required by N.J.A.C. 5:30-11.9(d). (Affidavit must include a copy <strong>of</strong> the newspaper notice.)If you have not had a change order exceeding the 20 percent threshold for the year indicated above, please check here and certify below.DateClerk <strong>of</strong> the Governing BodySheet 44As Adopted 4/5/<strong>2012</strong>