You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

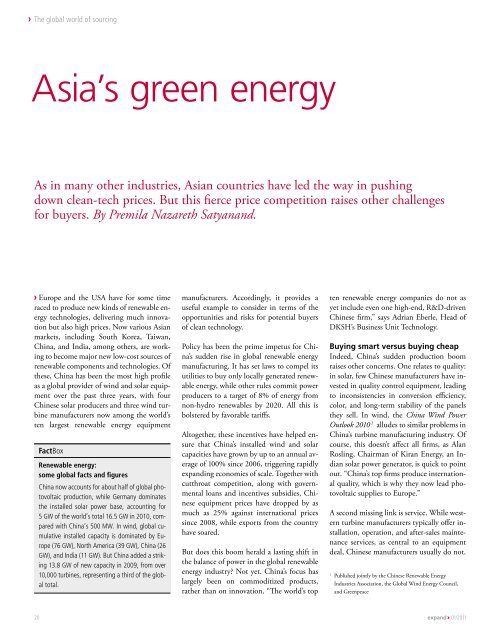

The global world of sourcingAsia’s green energyAs in many other industries, Asian countries have led the way in pushingdown clean-tech prices. But this fierce price <strong>com</strong>petition raises other challengesfor buyers. By Premila Nazareth Satyanand.Europe and the USA have for some timeraced to produce new kinds of renewable energytechnologies, delivering much innovationbut also high prices. Now various Asianmarkets, including South Korea, Taiwan,China, and India, among others, are workingto be<strong>com</strong>e major new low-cost sources ofrenewable <strong>com</strong>ponents and technologies. Ofthese, China has been the most high profileas a global provider of wind and solar equipmentover the past three years, with fourChinese solar producers and three wind turbinemanufacturers now among the world’sten largest renewable energy equipmentFactBoxRenewable energy:some global facts and figuresChina now accounts for about half of global photovoltaicproduction, while Germany dominatesthe installed solar power base, accounting for5 GW of the world’s total 16.5 GW in 2010, <strong>com</strong>paredwith China’s 500 MW. In wind, global cumulativeinstalled capacity is dominated by Europe(76 GW), North America (39 GW), China (26GW), and India (11 GW). But China added a striking13.8 GW of new capacity in 2009, from over10,000 turbines, representing a third of the globaltotal.manufacturers. Accordingly, it provides auseful example to consider in terms of theopportunities and risks for potential buyersof clean technology.Policy has been the prime impetus for China’ssudden rise in global renewable energymanufacturing. It has set laws to <strong>com</strong>pel itsutilities to buy only locally generated renewableenergy, while other rules <strong>com</strong>mit powerproducers to a target of 8% of energy fromnon-hydro renewables by 2020. All this isbolstered by favorable tariffs.Altogether, these incentives have helped ensurethat China’s installed wind and solarcapacities have grown by up to an annual averageof 100% since 2006, triggering rapidly<strong>expand</strong>ing economies of scale. Together withcutthroat <strong>com</strong>petition, along with governmentalloans and incentives subsidies, Chineseequipment prices have dropped by asmuch as 25% against international pricessince 2008, while exports from the countryhave soared.But does this boom herald a lasting shift inthe balance of power in the global renewableenergy industry? Not yet. China’s focus haslargely been on <strong>com</strong>moditized products,rather than on innovation. “The world’s topten renewable energy <strong>com</strong>panies do not asyet include even one high-end, R&D-drivenChinese firm,” says Adrian Eberle, Head of<strong>DKSH</strong>’s Business Unit Technology.Buying smart versus buying cheapIndeed, China’s sudden production boomraises other concerns. One relates to quality:in solar, few Chinese manufacturers have investedin quality control equipment, leadingto inconsistencies in conversion efficiency,color, and long-term stability of the panelsthey sell. In wind, the China Wind PowerOutlook 2010 1 alludes to similar problems inChina’s turbine manufacturing industry. Ofcourse, this doesn’t affect all firms, as AlanRosling, Chairman of Kiran Energy, an Indiansolar power generator, is quick to pointout. “China’s top firms produce internationalquality, which is why they now lead photovoltaicsupplies to Europe.”A second missing link is service. While westernturbine manufacturers typically offer installation,operation, and after-sales maintenanceservices, as central to an equipmentdeal, Chinese manufacturers usually do not.1Published jointly by the Chinese Renewable EnergyIndustries Association, the Global Wind Energy Council,and Greenpeace20 <strong>expand</strong> 01/2011