guidelines - Marketing Index File

guidelines - Marketing Index File

guidelines - Marketing Index File

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

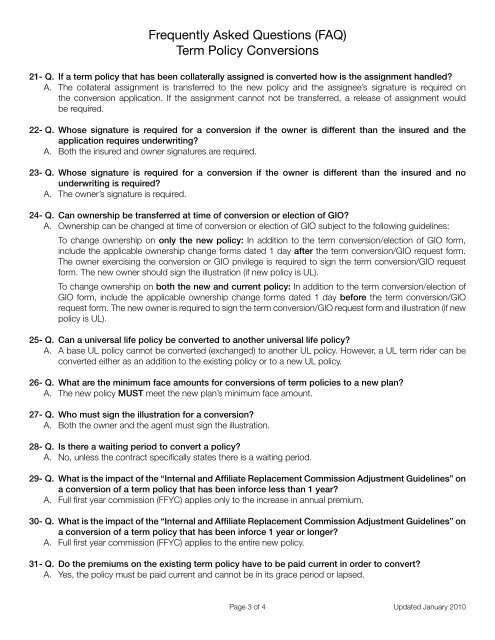

Frequently Asked Questions (FAQ)Term Policy Conversions21- Q. If a term policy that has been collaterally assigned is converted how is the assignment handled?A. The collateral assignment is transferred to the new policy and the assignee’s signature is required onthe conversion application. If the assignment cannot not be transferred, a release of assignment wouldbe required.22- Q. Whose signature is required for a conversion if the owner is different than the insured and theapplication requires underwriting?A. Both the insured and owner signatures are required.23- Q. Whose signature is required for a conversion if the owner is different than the insured and nounderwriting is required?A. The owner’s signature is required.24- Q. Can ownership be transferred at time of conversion or election of GIO?A. Ownership can be changed at time of conversion or election of GIO subject to the following <strong>guidelines</strong>:To change ownership on only the new policy: In addition to the term conversion/election of GIO form,include the applicable ownership change forms dated 1 day after the term conversion/GIO request form.The owner exercising the conversion or GIO privilege is required to sign the term conversion/GIO requestform. The new owner should sign the illustration (if new policy is UL).To change ownership on both the new and current policy: In addition to the term conversion/election ofGIO form, include the applicable ownership change forms dated 1 day before the term conversion/GIOrequest form. The new owner is required to sign the term conversion/GIO request form and illustration (if newpolicy is UL).25- Q. Can a universal life policy be converted to another universal life policy?A. A base UL policy cannot be converted (exchanged) to another UL policy. However, a UL term rider can beconverted either as an addition to the existing policy or to a new UL policy.26- Q. What are the minimum face amounts for conversions of term policies to a new plan?A. The new policy MUST meet the new plan’s minimum face amount.27- Q. Who must sign the illustration for a conversion?A. Both the owner and the agent must sign the illustration.28- Q. Is there a waiting period to convert a policy?A. No, unless the contract specifically states there is a waiting period.29- Q. What is the impact of the “Internal and Affiliate Replacement Commission Adjustment Guidelines” ona conversion of a term policy that has been inforce less than 1 year?A. Full first year commission (FFYC) applies only to the increase in annual premium.30- Q. What is the impact of the “Internal and Affiliate Replacement Commission Adjustment Guidelines” ona conversion of a term policy that has been inforce 1 year or longer?A. Full first year commission (FFYC) applies to the entire new policy.31- Q. Do the premiums on the existing term policy have to be paid current in order to convert?A. Yes, the policy must be paid current and cannot be in its grace period or lapsed.Page 3 of 4 Updated January 2010