guidelines - Marketing Index File

guidelines - Marketing Index File

guidelines - Marketing Index File

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

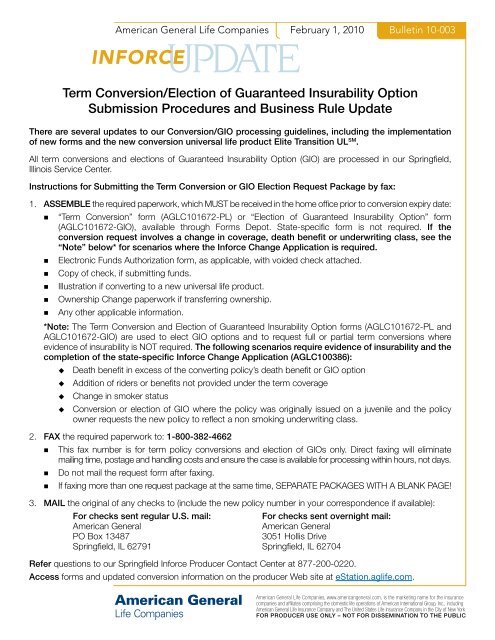

American General Life CompaniesINFORCEUPDATEFebruary 1, 2010Term Conversion/Election of Guaranteed Insurability OptionSubmission Procedures and Business Rule UpdateBulletin 10-003There are several updates to our Conversion/GIO processing <strong>guidelines</strong>, including the implementationof new forms and the new conversion universal life product Elite Transition UL SM .All term conversions and elections of Guaranteed Insurability Option (GIO) are processed in our Springfield,Illinois Service Center.Instructions for Submitting the Term Conversion or GIO Election Request Package by fax:1. ASSEMBLE the required paperwork, which MUST be received in the home office prior to conversion expiry date:• “Term Conversion” form (AGLC101672-PL) or “Election of Guaranteed Insurability Option” form(AGLC101672-GIO), available through Forms Depot. State-specific form is not required. If theconversion request involves a change in coverage, death benefit or underwriting class, see the“Note” below* for scenarios where the Inforce Change Application is required.• Electronic Funds Authorization form, as applicable, with voided check attached.• Copy of check, if submitting funds.• Illustration if converting to a new universal life product.• Ownership Change paperwork if transferring ownership.• Any other applicable information.*Note: The Term Conversion and Election of Guaranteed Insurability Option forms (AGLC101672-PL andAGLC101672-GIO) are used to elect GIO options and to request full or partial term conversions whereevidence of insurability is NOT required. The following scenarios require evidence of insurability and thecompletion of the state-specific Inforce Change Application (AGLC100386): Death benefit in excess of the converting policy’s death benefit or GIO option Addition of riders or benefits not provided under the term coverage Change in smoker status Conversion or election of GIO where the policy was originally issued on a juvenile and the policyowner requests the new policy to reflect a non smoking underwriting class.2. FAX the required paperwork to: 1-800-382-4662• This fax number is for term policy conversions and election of GIOs only. Direct faxing will eliminatemailing time, postage and handling costs and ensure the case is available for processing within hours, not days.• Do not mail the request form after faxing.• If faxing more than one request package at the same time, SEPARATE PACKAGES WITH A BLANK PAGE!3. MAIL the original of any checks to (include the new policy number in your correspondence if available):For checks sent regular U.S. mail:For checks sent overnight mail:American GeneralAmerican GeneralPO Box 134873051 Hollis DriveSpringfield, IL 62791 Springfield, IL 62704Refer questions to our Springfield Inforce Producer Contact Center at 877-200-0220.Access forms and updated conversion information on the producer Web site at eStation.aglife.com.American General Life Companies, www.americangeneral.com, is the marketing name for the insurancecompanies and affiliates comprising the domestic life operations of American International Group, Inc., includingAmerican General Life Insurance Company and The United States Life Insurance Company in the City of New York.FOR PRODUCER USE ONLY – NOT FOR DISSEMINATION TO THE PUBLIC

Frequently Asked Questions (FAQ)Term Policy ConversionsNEW or UPDATED FAQs1 - Q. What form should be completed to request a term conversion or Guarantee Insurability Option (“GIO”)election?A. If no underwriting is required, submit a fully completed, signed “Term Conversion” Form (AGLC101672-PL)or “Election of Guarantee Insurability Option” Form (AGLC101672-GIO). If underwriting is required, submita fully completed, signed state-specific In-Force Change Application (AGLC100386).2 - Q. What products can a term product NOT be converted to?A. Survivorship ProductsROP term or other term products, unless the contract provides otherwise(NOTE: Effective with the version introduced in August 2009, AG Select-a-Term provides a conversionprivilege within the first 24 months to an AG ROP Select-a-Term policy.)3 - Q. What products can a term product be converted to beyond the 5th policy anniversary date?A. For face amounts of $50,000 and higher, Elite Transition UL is the only product available for conversionbeyond the 5th policy anniversary. For face amounts below $50,000, American Elite Whole Life SM is the onlyproduct available for conversion beyond the 5th policy anniversary4 - Q. Is there a grace period for submitting conversion paperwork beyond the conversion expiry date orthe 5th policy anniversary date?A. No. Paperwork must be received in the Home Office prior to the expiry/anniversary date.5 - Q. What benefits are automatically transferred from the old policy to the new policy without evidence ofinsurability?A. The two benefits that can be automatically transferred are Waiver of Premium (WP) (if available on theproduct converting to) and Child Rider.6 - Q. Can an increase in the death benefit or additions of riders be made to the policy?A. Yes, any increase in the death benefit and/or additions of riders will require completion of an application,evidence of insurability and Underwriting Department approval.7 - Q. What products are available for Guaranteed Insurability Options?A. American Elite Whole Life is the only product available when exercising Guaranteed Insurability Options.8 - Q. Can a term policy be converted to another term policy?A. A term product cannot be converted to another term product unless the contract language specificallyprovides a conversion to term privilege. There are some current AG Select-a-Term products that provide aconversion privilege within the first 2 policy years to the equivalent AG ROP Select-a-Term policy. (NOTE:Effective with the version introduced in August 2009, AG Select-a-Term provides a conversion privilegewithin the first 24 months to an AG ROP Select-a-Term.)9 - Q. How do I verify whether a term policy has the endorsement to convert to AG ROP Select-a-Termduring the first 24 months?A. Contact the Producer Call Team at 1-877-200-0220. Policies issued prior to August 1, 2009 will not havethis endorsement.10 - Q. Will commissions be adjusted on conversions from AG Select-a-Term to AG ROP Select-a-Term?A. First year commissions will be paid on the increase in premium only.Page 1 of 4 Updated January 2010

Frequently Asked Questions (FAQ)Term Policy ConversionsEXISTING FAQs11- Q. Can the cash value of a return of premium term policy be distributed to the owner when convertingto a permanent plan?A. Yes. The policy owner can take the cash value in cash or roll it into the new permanent plan.12- Q. Can you retain the balance of the face amount on a return of premium term policy if completing apartial conversion?A. No. Face decreases cannot be processed on ROP term policies. You can request a partial conversion;however, the remaining balance will be terminated.13- Q. How do I obtain a UL illustration for a conversion?A. Use your regular new business illustration software or contact your <strong>Marketing</strong> Support staff for assistance.14- Q. How do I verify the conversion privilege and underwriting class for a policy?A. Contact the Producer Call Team at 1-877-200-0220.15- Q. What product is available if the converting term policy’s face amount is less than the UL policyminimum required?A. American Elite Whole Life16- Q. Can a conversion policy be backdated?A. Yes. A conversion can be backdated 6 months from the application received date under the followingconditions:• To save issue age but NOT to save conversion eligibility. A new policy cannot be backdated to saveconversion eligibility if the conversion period has expired. This includes the 60 month eligibility guidelineproducts other than the Elite Transition UL.• Policy must be paid current• Conversion privilege with respect to age and duration must be in effect• New policy is not an indexed ULNote: New policies issued as a result of the policy owner exercising the GIO cannot be backdated.17- Q. Can a policy be converted if the policy is still within the conversion period but the insured is past themaximum conversion age?A. In order to convert, the insured must be at or younger than the maximum conversion age AND the policyconversion period cannot have expired.18- Q. Can a policy be converted if the insured’s age has not exceeded the maximum conversion age but theanniversary is beyond the conversion period.A. In order to convert, the insured must be at or younger than the maximum conversion age AND the policyconversion period cannot have expired.19- Q. Can a policy be converted that is currently being paid by premium waiver?A. The policy CANNOT be converted unless the policy states that the policy can be converted while premiumsare being paid by premium waiver.20- Q. Can a partial conversion be processed if it reduces the face amount of the old policy below theminimum?A. The existing term policy must remain at or above the minimum plan death benefit required.Page 2 of 4 Updated January 2010

Frequently Asked Questions (FAQ)Term Policy Conversions21- Q. If a term policy that has been collaterally assigned is converted how is the assignment handled?A. The collateral assignment is transferred to the new policy and the assignee’s signature is required onthe conversion application. If the assignment cannot not be transferred, a release of assignment wouldbe required.22- Q. Whose signature is required for a conversion if the owner is different than the insured and theapplication requires underwriting?A. Both the insured and owner signatures are required.23- Q. Whose signature is required for a conversion if the owner is different than the insured and nounderwriting is required?A. The owner’s signature is required.24- Q. Can ownership be transferred at time of conversion or election of GIO?A. Ownership can be changed at time of conversion or election of GIO subject to the following <strong>guidelines</strong>:To change ownership on only the new policy: In addition to the term conversion/election of GIO form,include the applicable ownership change forms dated 1 day after the term conversion/GIO request form.The owner exercising the conversion or GIO privilege is required to sign the term conversion/GIO requestform. The new owner should sign the illustration (if new policy is UL).To change ownership on both the new and current policy: In addition to the term conversion/election ofGIO form, include the applicable ownership change forms dated 1 day before the term conversion/GIOrequest form. The new owner is required to sign the term conversion/GIO request form and illustration (if newpolicy is UL).25- Q. Can a universal life policy be converted to another universal life policy?A. A base UL policy cannot be converted (exchanged) to another UL policy. However, a UL term rider can beconverted either as an addition to the existing policy or to a new UL policy.26- Q. What are the minimum face amounts for conversions of term policies to a new plan?A. The new policy MUST meet the new plan’s minimum face amount.27- Q. Who must sign the illustration for a conversion?A. Both the owner and the agent must sign the illustration.28- Q. Is there a waiting period to convert a policy?A. No, unless the contract specifically states there is a waiting period.29- Q. What is the impact of the “Internal and Affiliate Replacement Commission Adjustment Guidelines” ona conversion of a term policy that has been inforce less than 1 year?A. Full first year commission (FFYC) applies only to the increase in annual premium.30- Q. What is the impact of the “Internal and Affiliate Replacement Commission Adjustment Guidelines” ona conversion of a term policy that has been inforce 1 year or longer?A. Full first year commission (FFYC) applies to the entire new policy.31- Q. Do the premiums on the existing term policy have to be paid current in order to convert?A. Yes, the policy must be paid current and cannot be in its grace period or lapsed.Page 3 of 4 Updated January 2010

Frequently Asked Questions (FAQ)Term Policy Conversions32- Q. What products can the residents of New York state convert to?A. The residents of the state of New York can only convert to a United States Life policy in the current productportfolio. For face amounts of $50,000 and higher, Elite Transition UL is the only product available forconversion beyond the 5th policy anniversary. For face amounts below $50,000, American Elite Whole Lifeis the only product available for conversion beyond the 5th policy anniversary.33- Q. How is the contractual conversion credit, if applicable, applied to the new policy?A. Some older term products marketed in the past offer a conversion credit. When converting to a UL, theconversion credit, if any, will be applied as a non commissionable pour-in deposit to the policy. The targetpremium will be reduced by the amount of the conversion credit applied to the policy.Example:Target Premium $10,000Conversion Credit- $4,000 (Non Commissionable Pour-in Deposit)Adjusted Target Premium$6,000 (First Year Commissionable Premium)When converting to a whole life policy, the conversion credit, if any, will be applied to the modal premium ofthe new policy up to, but not in excess of the allowable conversion credit. Commissions will be adjusted ona pro-rata basis.Page 4 of 4 Updated January 2010