k88nFi

k88nFi

k88nFi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

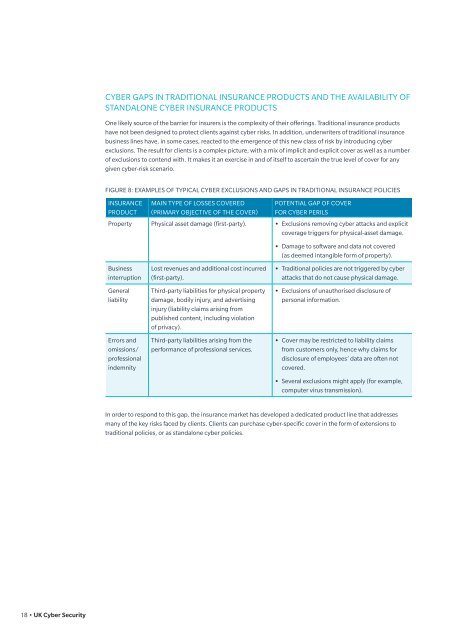

CYBER GAPS IN TRADITIONAL INSURANCE PRODUCTS AND THE AVAILABILITY OFSTANDALONE CYBER INSURANCE PRODUCTSOne likely source of the barrier for insurers is the complexity of their offerings. Traditional insurance productshave not been designed to protect clients against cyber risks. In addition, underwriters of traditional insurancebusiness lines have, in some cases, reacted to the emergence of this new class of risk by introducing cyberexclusions. The result for clients is a complex picture, with a mix of implicit and explicit cover as well as a numberof exclusions to contend with. It makes it an exercise in and of itself to ascertain the true level of cover for anygiven cyber-risk scenario.FIGURE 8: EXAMPLES OF TYPICAL CYBER EXCLUSIONS AND GAPS IN TRADITIONAL INSURANCE POLICIESINSURANCEPRODUCTMAIN TYPE OF LOSSES COVERED(PRIMARY OBJECTIVE OF THE COVER)POTENTIAL GAP OF COVERFOR CYBER PERILSProperty Physical asset damage (first-party). ••Exclusions removing cyber attacks and explicitcoverage triggers for physical-asset damage.••Damage to software and data not covered(as deemed intangible form of property).BusinessinterruptionGeneralliabilityErrors andomissions/professionalindemnityLost revenues and additional cost incurred(first-party).Third-party liabilities for physical propertydamage, bodily injury, and advertisinginjury (liability claims arising frompublished content, including violationof privacy).Third-party liabilities arising from theperformance of professional services.••Traditional policies are not triggered by cyberattacks that do not cause physical damage.••Exclusions of unauthorised disclosure ofpersonal information.••Cover may be restricted to liability claimsfrom customers only, hence why claims fordisclosure of employees’ data are often notcovered.• • Several exclusions might apply (for example,computer virus transmission).In order to respond to this gap, the insurance market has developed a dedicated product line that addressesmany of the key risks faced by clients. Clients can purchase cyber-specific cover in the form of extensions totraditional policies, or as standalone cyber policies.18 • UK Cyber Security