ANNUAL REPORT 2011 - Horse Racing Ireland

ANNUAL REPORT 2011 - Horse Racing Ireland

ANNUAL REPORT 2011 - Horse Racing Ireland

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

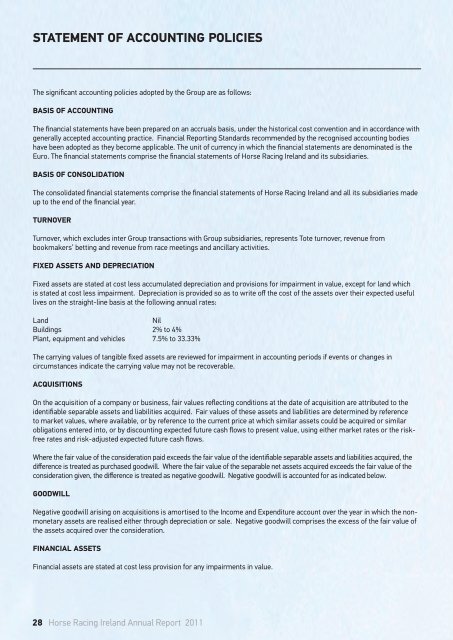

STATEMENT OF ACCOUNTING POLICIESThe significant accounting policies adopted by the Group are as follows:Basis of accountingThe financial statements have been prepared on an accruals basis, under the historical cost convention and in accordance withgenerally accepted accounting practice. Financial Reporting Standards recommended by the recognised accounting bodieshave been adopted as they become applicable. The unit of currency in which the financial statements are denominated is theEuro. The financial statements comprise the financial statements of <strong>Horse</strong> <strong>Racing</strong> <strong>Ireland</strong> and its subsidiaries.Basis of consolidationThe consolidated financial statements comprise the financial statements of <strong>Horse</strong> <strong>Racing</strong> <strong>Ireland</strong> and all its subsidiaries madeup to the end of the financial year.TurnoverTurnover, which excludes inter Group transactions with Group subsidiaries, represents Tote turnover, revenue frombookmakers’ betting and revenue from race meetings and ancillary activities.Fixed assets and depreciationFixed assets are stated at cost less accumulated depreciation and provisions for impairment in value, except for land whichis stated at cost less impairment. Depreciation is provided so as to write off the cost of the assets over their expected usefullives on the straight-line basis at the following annual rates:LandNilBuildings 2% to 4%Plant, equipment and vehicles 7.5% to 33.33%The carrying values of tangible fixed assets are reviewed for impairment in accounting periods if events or changes incircumstances indicate the carrying value may not be recoverable.AcquisitionsOn the acquisition of a company or business, fair values reflecting conditions at the date of acquisition are attributed to theidentifiable separable assets and liabilities acquired. Fair values of these assets and liabilities are determined by referenceto market values, where available, or by reference to the current price at which similar assets could be acquired or similarobligations entered into, or by discounting expected future cash flows to present value, using either market rates or the riskfreerates and risk-adjusted expected future cash flows.Where the fair value of the consideration paid exceeds the fair value of the identifiable separable assets and liabilities acquired, thedifference is treated as purchased goodwill. Where the fair value of the separable net assets acquired exceeds the fair value of theconsideration given, the difference is treated as negative goodwill. Negative goodwill is accounted for as indicated below.GoodwillNegative goodwill arising on acquisitions is amortised to the Income and Expenditure account over the year in which the nonmonetaryassets are realised either through depreciation or sale. Negative goodwill comprises the excess of the fair value ofthe assets acquired over the consideration.Financial assetsFinancial assets are stated at cost less provision for any impairments in value.28 <strong>Horse</strong> <strong>Racing</strong> <strong>Ireland</strong> Annual Report <strong>2011</strong>