effects of financial and non-financial information disclosure on prices

effects of financial and non-financial information disclosure on prices

effects of financial and non-financial information disclosure on prices

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Accounting <str<strong>on</strong>g>and</str<strong>on</strong>g> Management Informati<strong>on</strong> SystemsVol. 12, No. 1, pp. 76–100, 2013EFFECTS OF FINANCIAL AND NON-FINANCIALINFORMATION DISCLOSURE ON PRICES’MECHANISMS FOR EMERGENT MARKETS:THE CASE OF BUCHAREST STOCK EXCHANGEABSTRACTBogdan DIMAWest University <str<strong>on</strong>g>of</str<strong>on</strong>g> Timişoara, RomaniaIoan CUZMAN <str<strong>on</strong>g>and</str<strong>on</strong>g> Ştefana DIMA (CRISTEA) 1Vasile Goldiş Western University <str<strong>on</strong>g>of</str<strong>on</strong>g> Arad, RomaniaOtilia ŞĂRĂMĂTWest University <str<strong>on</strong>g>of</str<strong>on</strong>g> Timişoara, RomaniaThis paper investigates the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> publicly disclosed informatio<str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g> market values for Romanian companies listed <strong>on</strong> Bucharest StockExchange, using as benchmark a more developed market, the MadridStock Exchange. The study is motivated by the European Uni<strong>on</strong>’sdecisi<strong>on</strong> to require the use <str<strong>on</strong>g>of</str<strong>on</strong>g> the Internati<strong>on</strong>al Financial ReportingSt<str<strong>on</strong>g>and</str<strong>on</strong>g>ards for the c<strong>on</strong>solidated <str<strong>on</strong>g>financial</str<strong>on</strong>g> statements <str<strong>on</strong>g>of</str<strong>on</strong>g> all listedcompanies (Regulati<strong>on</strong> EC 1606/2002) <str<strong>on</strong>g>and</str<strong>on</strong>g> by the 2007 Romanianadopti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the Markets <str<strong>on</strong>g>and</str<strong>on</strong>g> Financial Instruments Directive (MiFID)- which is the cornerst<strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the European Commissi<strong>on</strong>’s FinancialServices Acti<strong>on</strong> Plan. Thus, we compare the value relevance <str<strong>on</strong>g>of</str<strong>on</strong>g>Internet disclosed <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> provided by annual <str<strong>on</strong>g>and</str<strong>on</strong>g> interim<str<strong>on</strong>g>financial</str<strong>on</strong>g> reports <str<strong>on</strong>g>and</str<strong>on</strong>g> other <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> news in the decisi<strong>on</strong> makingprocess <str<strong>on</strong>g>of</str<strong>on</strong>g> investors. In order to evaluate the overall impact <str<strong>on</strong>g>of</str<strong>on</strong>g><str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g>, we built a global <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> indicatoraccording to the so-called Principal Comp<strong>on</strong>ents Analysis byincluding individual <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> dummies. Empirical tests support ourresearch hypothesis according to which there is a relative incrementalvalue <str<strong>on</strong>g>of</str<strong>on</strong>g> a higher volume <str<strong>on</strong>g>and</str<strong>on</strong>g> a better quality <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>,reflecting <strong>prices</strong>’ overreacti<strong>on</strong>s even in the case <str<strong>on</strong>g>of</str<strong>on</strong>g> a market withimperfect trading mechanisms.Disclosure, Valuati<strong>on</strong>, Bucharest Stock Exchange, Madrid StockExchange.1 Corresp<strong>on</strong>dence address: Ştefana Dima (Cristea), Faculty <str<strong>on</strong>g>of</str<strong>on</strong>g> Ec<strong>on</strong>omics, Vasile Goldiş WesternUniversity <str<strong>on</strong>g>of</str<strong>on</strong>g> Arad, 15 Mihai Eminescu St., Arad 310086, Romania, stefana_cristea@yahoo.it.

Effects <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g><strong>on</strong> <strong>prices</strong>’ mechanisms for emergent markets: the case <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest stock exchangeINTRODUCTIONThis study is motivated by the European Uni<strong>on</strong>’s (EU) decisi<strong>on</strong> to require the use<str<strong>on</strong>g>of</str<strong>on</strong>g> the Internati<strong>on</strong>al Financial Reporting St<str<strong>on</strong>g>and</str<strong>on</strong>g>ards (IFRSs) for the c<strong>on</strong>solidated<str<strong>on</strong>g>financial</str<strong>on</strong>g> statements <str<strong>on</strong>g>of</str<strong>on</strong>g> all listed companies (Regulati<strong>on</strong> EC 1606/2002) <str<strong>on</strong>g>and</str<strong>on</strong>g> by the2007 Romanian adopti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the Markets <str<strong>on</strong>g>and</str<strong>on</strong>g> Financial Instruments Directive(MiFID) - which is the cornerst<strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the European Commissi<strong>on</strong>’s FinancialServices Acti<strong>on</strong> Plan. Since MiFID requires listed companies to publish the price,volume <str<strong>on</strong>g>and</str<strong>on</strong>g> time <str<strong>on</strong>g>of</str<strong>on</strong>g> all trades in listed shares, even if executed outside <str<strong>on</strong>g>of</str<strong>on</strong>g> aregulated market, unless certain requirements are met to allow for deferredpublicati<strong>on</strong>, this regulati<strong>on</strong> implies, inter alia, the <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> a larger quantity <str<strong>on</strong>g>of</str<strong>on</strong>g><str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> for the listed companies in order to support the investors <str<strong>on</strong>g>and</str<strong>on</strong>g> to ensurea regular <str<strong>on</strong>g>and</str<strong>on</strong>g> transparent decisi<strong>on</strong>al base.Several studies (Ferrarini & Recine; 2006, Mol<strong>on</strong>ey, 2007; Chiu, 2007; Jacks<strong>on</strong>,2009; Posner & Vér<strong>on</strong>, 2010; Armstr<strong>on</strong>g et al., 2007; Agostino et al., 2008;Beneish et al., 2009) assess the potential impact <str<strong>on</strong>g>of</str<strong>on</strong>g> IFRSs adopti<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> MiFIDimplementati<strong>on</strong> <strong>on</strong> market efficiency <str<strong>on</strong>g>and</str<strong>on</strong>g> investors’ protecti<strong>on</strong>. Still, <strong>on</strong>ly a limitednumber <str<strong>on</strong>g>of</str<strong>on</strong>g> these examine the value relevance <str<strong>on</strong>g>effects</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> MiFID implementati<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g><str<strong>on</strong>g>of</str<strong>on</strong>g> the m<str<strong>on</strong>g>and</str<strong>on</strong>g>atory adopti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> IFRSs by the European Uni<strong>on</strong>’s Member States,especially in the case <str<strong>on</strong>g>of</str<strong>on</strong>g> the new emergent markets (see Ahar<strong>on</strong>y et al., 2010).Thus, the goal <str<strong>on</strong>g>of</str<strong>on</strong>g> our study is to investigate the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> public <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g><str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <strong>on</strong> market values for the Romanian companies listed <strong>on</strong> Bucharest StockExchange. We achieve this by relating Prices to Earnings Ratios (PER) to a set <str<strong>on</strong>g>of</str<strong>on</strong>g>dummies designed to reflect the <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> publiclydisclosed through the companies’ websites. Following previous studies, we viewthe value relevance <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> as an associati<strong>on</strong>between this <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> stock market values.In order to have a benchmark for our results, we compare these outcomes with the<strong>on</strong>es specific to a developed market, the Madrid Stock Exchange. It is a countryspecificstudy <str<strong>on</strong>g>and</str<strong>on</strong>g>, c<strong>on</strong>sequently, it has <strong>on</strong>ly a limited analytical objective withoutproviding a broader overview. However, the results obtained can be generalized,with some limitati<strong>on</strong>s, to other developing markets, if some comm<strong>on</strong>characteristics like rigid <strong>prices</strong>’ mechanisms, low liquidity, incomplete trademechanisms <str<strong>on</strong>g>and</str<strong>on</strong>g> limited set <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> assets available for trade apply.We are particularly interested in comparing the value relevance <str<strong>on</strong>g>of</str<strong>on</strong>g> Internetdisclosed <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> provided by annual <str<strong>on</strong>g>and</str<strong>on</strong>g> interim <str<strong>on</strong>g>financial</str<strong>on</strong>g> reports <str<strong>on</strong>g>and</str<strong>on</strong>g> other<str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> news in order to highlight the behaviour <str<strong>on</strong>g>of</str<strong>on</strong>g> the investors in respect tothis type <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>. C<strong>on</strong>sistent with the literature, we anticipate a positive <str<strong>on</strong>g>and</str<strong>on</strong>g>significant incremental relevance <str<strong>on</strong>g>of</str<strong>on</strong>g> such <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> items even if an important<str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-uniformity <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>prices</strong>’ adjustments can be expected.Vol. 12, No. 1 77

Accounting <str<strong>on</strong>g>and</str<strong>on</strong>g> Management Informati<strong>on</strong> SystemsWe focus <strong>on</strong> the third quarter <str<strong>on</strong>g>of</str<strong>on</strong>g> 2010 data, c<strong>on</strong>sidering that the 2007-2010 timespan is large enough to allow us to observe some noticeable <str<strong>on</strong>g>effects</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> MiFIDimplementati<strong>on</strong>. We assume that investors react to new <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> by taking intoaccount not <strong>on</strong>ly the recent <strong>prices</strong>’ history, but also some fundamental descriptors<str<strong>on</strong>g>of</str<strong>on</strong>g> issuers’ activity. Specifically, we base our approach <strong>on</strong> the large framework <str<strong>on</strong>g>of</str<strong>on</strong>g>valuati<strong>on</strong> literature extended with the idea that next to the <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>,the <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> shocks should be c<strong>on</strong>sidered in the descripti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g>investors’ portfolio related decisi<strong>on</strong>s.To evaluate the overall impact <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g>, we built a global<str<strong>on</strong>g>disclosure</str<strong>on</strong>g> indicator according to the so-called Principal Comp<strong>on</strong>ents Analysis byincluding individual <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> dummies. The involved methodology implies thatcloser the global indicator to <strong>on</strong>e, higher the level <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> specific to therespective company. This indicator is used to assess the <str<strong>on</strong>g>effects</str<strong>on</strong>g> induced by global<str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <strong>on</strong> <strong>prices</strong> (adjusted to issuers’ performances).The c<strong>on</strong>tributi<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> the study are subsumed to several analytical directi<strong>on</strong>s.Firstly, we examine the value relevance <str<strong>on</strong>g>effects</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> the <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> disclosed bylisted companies <strong>on</strong> an emergent market. Sec<strong>on</strong>dly, we provide a benchmarkevaluati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> our results. Thirdly, we find that there is a significant degree <str<strong>on</strong>g>of</str<strong>on</strong>g>heterogeneity for investors’ decisi<strong>on</strong>s to new <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> arrived <strong>on</strong> the market.Furthermore, we show that the proposed global <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> indicator is associatedwith <strong>prices</strong>’ adjustments, even if the c<strong>on</strong>sidered market cannot be characterized asan efficient <strong>on</strong>e.The remainder <str<strong>on</strong>g>of</str<strong>on</strong>g> the paper is organized as follows. In Secti<strong>on</strong> 1, we briefly reviewthe <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> literature <str<strong>on</strong>g>and</str<strong>on</strong>g> we develop our research hypothesis. In Secti<strong>on</strong> 2 wepresent the data <str<strong>on</strong>g>and</str<strong>on</strong>g> the methodological approach. Secti<strong>on</strong> 3 discuss the results <str<strong>on</strong>g>and</str<strong>on</strong>g>provides additi<strong>on</strong>al robustness tests <str<strong>on</strong>g>and</str<strong>on</strong>g> last secti<strong>on</strong> c<strong>on</strong>cludes.1. PRIOR RESEARCH AND HYPOTHESES DEVELOPMENT1.1 Literature reviewThe <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> has been for l<strong>on</strong>g the subject <str<strong>on</strong>g>of</str<strong>on</strong>g> animportant stream <str<strong>on</strong>g>of</str<strong>on</strong>g> literature. Underst<str<strong>on</strong>g>and</str<strong>on</strong>g>ing investors’ reacti<strong>on</strong> to new<str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> is an important questi<strong>on</strong> that many managers are facing in the process<str<strong>on</strong>g>of</str<strong>on</strong>g> decisi<strong>on</strong> making. Zhang (2006) shows that <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> uncertainty c<strong>on</strong>tributesto investors’ underreacti<strong>on</strong> to new <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>. Hirshleifer (2001) <str<strong>on</strong>g>and</str<strong>on</strong>g> Daniel et al.(1998; 2001) argue that uncertainty intensifies psychological biases. Dum<strong>on</strong>tier &Raffournier (2002) c<strong>on</strong>siders that companies release more frequently voluntary<str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>. Bessiere &Sentis (2007) examines the link between uncertainty <str<strong>on</strong>g>and</str<strong>on</strong>g>investors reacti<strong>on</strong> to goodwill write-<str<strong>on</strong>g>of</str<strong>on</strong>g>fs (GWWos). They study a sample <str<strong>on</strong>g>of</str<strong>on</strong>g> French78Vol. 12, No. 1

Effects <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g><strong>on</strong> <strong>prices</strong>’ mechanisms for emergent markets: the case <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest stock exchangefirms during 2001-2004, based <strong>on</strong> the framework <str<strong>on</strong>g>of</str<strong>on</strong>g> Daniel et al. (1998) whichposits that overc<strong>on</strong>fidence leads to an overreacti<strong>on</strong> to private <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>, followedby short adjustments when the <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> becomes public <str<strong>on</strong>g>and</str<strong>on</strong>g>, then, a l<strong>on</strong>gadjustment which reduces slowly the mispricing in the l<strong>on</strong>g run. Their testsc<strong>on</strong>firmed the overc<strong>on</strong>fidence effect <strong>on</strong> investors’ reacti<strong>on</strong>: the high-uncertaintysample was characterized by str<strong>on</strong>gly negative abnormal returns during the periodpreceding GWWos announcement, associated with high volatility. They c<strong>on</strong>cludedthat in the l<strong>on</strong>g run the overreacti<strong>on</strong> to private <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> was corrected <str<strong>on</strong>g>and</str<strong>on</strong>g> therewere observed positive abnormal returns, creating a reversal. Their results <str<strong>on</strong>g>of</str<strong>on</strong>g>fernew perspectives about informativeness <str<strong>on</strong>g>and</str<strong>on</strong>g> timeliness <str<strong>on</strong>g>of</str<strong>on</strong>g> corporate voluntary<str<strong>on</strong>g>disclosure</str<strong>on</strong>g>.The release <str<strong>on</strong>g>of</str<strong>on</strong>g> Regulati<strong>on</strong> (EC) 1606/2002 motivated Ahar<strong>on</strong>y et al. (2010) ininvestigating the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> IFRSs adopti<strong>on</strong> in 14 European countries. Bycomparing the price <str<strong>on</strong>g>and</str<strong>on</strong>g> return-based value relevance models, they assessed howswitching from domestic st<str<strong>on</strong>g>and</str<strong>on</strong>g>ards affects the informativeness <str<strong>on</strong>g>of</str<strong>on</strong>g> accountingnumbers to investors. Ahar<strong>on</strong>y et al. (2010) found that, in the pre-IFRS m<str<strong>on</strong>g>and</str<strong>on</strong>g>atoryadopti<strong>on</strong> year, three items - goodwill, research <str<strong>on</strong>g>and</str<strong>on</strong>g> development expenses (R&D)<str<strong>on</strong>g>and</str<strong>on</strong>g> revaluati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> property, plant <str<strong>on</strong>g>and</str<strong>on</strong>g> equipment (PPE) - had greater incrementalvalue relevance to investors in equity securities, when domestic st<str<strong>on</strong>g>and</str<strong>on</strong>g>ards werecompatible with IFRSs; <str<strong>on</strong>g>and</str<strong>on</strong>g> that investors benefited most from implementingIFRSs for these accounting items in EU countries where local st<str<strong>on</strong>g>and</str<strong>on</strong>g>ards deviatedmore from IFRSs.Daske et al. (2008) argues that the capital market <str<strong>on</strong>g>effects</str<strong>on</strong>g> - in the case <str<strong>on</strong>g>of</str<strong>on</strong>g> m<str<strong>on</strong>g>and</str<strong>on</strong>g>atoryIFRS adopters - are str<strong>on</strong>ger in countries that have bigger differences between localGAAP <str<strong>on</strong>g>and</str<strong>on</strong>g> IFRSs <str<strong>on</strong>g>and</str<strong>on</strong>g> that these capital market <str<strong>on</strong>g>effects</str<strong>on</strong>g> <strong>on</strong>ly occur in countries withrelatively str<strong>on</strong>g legal <str<strong>on</strong>g>and</str<strong>on</strong>g> enforcement regimes <str<strong>on</strong>g>and</str<strong>on</strong>g> where the instituti<strong>on</strong>alenvir<strong>on</strong>ment provides str<strong>on</strong>g incentives for transparent reporting.Reporting according to IFRSs increases transparency <str<strong>on</strong>g>and</str<strong>on</strong>g> improves the quality <str<strong>on</strong>g>of</str<strong>on</strong>g><str<strong>on</strong>g>financial</str<strong>on</strong>g> reporting. IFRS are more fair value oriented <str<strong>on</strong>g>and</str<strong>on</strong>g> more comprehensive,especially with respect to <str<strong>on</strong>g>disclosure</str<strong>on</strong>g>s, than most local GAAP (Ahar<strong>on</strong>y et al.,2010). In additi<strong>on</strong>, Daske <str<strong>on</strong>g>and</str<strong>on</strong>g> Gebhardt (2006) provides evidences that thepercepti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> quality increases around voluntary IFRSs adopti<strong>on</strong>; <str<strong>on</strong>g>and</str<strong>on</strong>g>Barth et al. (2008) reports an increase in earnings’ quality for a sample <str<strong>on</strong>g>of</str<strong>on</strong>g> firmsthat adopted IFRSs voluntarily. Recent studies indicate that accounting st<str<strong>on</strong>g>and</str<strong>on</strong>g>ardsal<strong>on</strong>e play a limited role in determining observed reporting quality; rather, firms’reporting incentives are pivotal in this respect (Ball et al., 2000; Ball &Shivakumar, 2005; Burgstahler et al., 2006). C<strong>on</strong>sequently, changing the st<str<strong>on</strong>g>and</str<strong>on</strong>g>ardsal<strong>on</strong>e is not sufficient to improve the informativeness <str<strong>on</strong>g>of</str<strong>on</strong>g> the reported accountingnumbers. For example, Ball (2006) <str<strong>on</strong>g>and</str<strong>on</strong>g> Daske et al. (2007) suggests that firmsopposing the transiti<strong>on</strong> to IFRSs or towards more transparency are unlikely tomake material changes to their reporting policies.Vol. 12, No. 1 79

Accounting <str<strong>on</strong>g>and</str<strong>on</strong>g> Management Informati<strong>on</strong> SystemsDang <str<strong>on</strong>g>and</str<strong>on</strong>g> Hakenes (2010) showed that a policy <str<strong>on</strong>g>of</str<strong>on</strong>g> partial <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> (<str<strong>on</strong>g>and</str<strong>on</strong>g>, hence, <str<strong>on</strong>g>of</str<strong>on</strong>g>intertemporal risk sharing) can maximize, but surprisingly also minimize, themarket value <str<strong>on</strong>g>of</str<strong>on</strong>g> the firm. Disclosure regulati<strong>on</strong> needs to be fine-tuned, <str<strong>on</strong>g>and</str<strong>on</strong>g> it c<str<strong>on</strong>g>and</str<strong>on</strong>g>iffer between firms or assets with different ownership structures, different riskstructures, different pay<str<strong>on</strong>g>of</str<strong>on</strong>g>f pr<str<strong>on</strong>g>of</str<strong>on</strong>g>iles, <str<strong>on</strong>g>and</str<strong>on</strong>g> different degree <str<strong>on</strong>g>of</str<strong>on</strong>g> liquidity.The superior forecast ability <str<strong>on</strong>g>of</str<strong>on</strong>g> the two-year residual income valuati<strong>on</strong> (RIV)model <str<strong>on</strong>g>of</str<strong>on</strong>g> Ohls<strong>on</strong> (1995) over the two -year Ohls<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> Juetnner-Nauroth model(2005) (the so -called „OJ” model) is documented in Penman (2005) <str<strong>on</strong>g>and</str<strong>on</strong>g> Brief(2007). They cast doubt <strong>on</strong> the preference <str<strong>on</strong>g>of</str<strong>on</strong>g> OJ model over RIV model inproviding more accurate forecast <str<strong>on</strong>g>of</str<strong>on</strong>g> firm valuati<strong>on</strong>.Dalley (2007) examined regulatory <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> systems in US, using the securitieslaws as a paradigm, in an effort to determine when <str<strong>on</strong>g>and</str<strong>on</strong>g> how <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> systemswork <str<strong>on</strong>g>and</str<strong>on</strong>g> to provide guidelines for the use <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> by regulators. The authorc<strong>on</strong>cluded that every <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> scheme must have an articulated purpose; anidentified mechanism through which it can accomplish that purpose; a design thattakes into account the operati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> that mechanism; <str<strong>on</strong>g>and</str<strong>on</strong>g> a careful analysis showingthat the benefits <str<strong>on</strong>g>of</str<strong>on</strong>g> the system outweigh its costs. For EU Member States, MiFID isapplied, representing a paradigm shift in the EU process <str<strong>on</strong>g>of</str<strong>on</strong>g> building a securitiesmarket. MiFID aims at removing the obstacles faced by companies in using theEuropean ‘passport’ for investment, encouraging competiti<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> ensuring a highlevel <str<strong>on</strong>g>of</str<strong>on</strong>g> investors’ protecti<strong>on</strong> across Europe. The <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> behaviour <str<strong>on</strong>g>of</str<strong>on</strong>g> a sample<str<strong>on</strong>g>of</str<strong>on</strong>g> listed Swedish <str<strong>on</strong>g>and</str<strong>on</strong>g> UK pharmaceutical companies was investigated by Gray <str<strong>on</strong>g>and</str<strong>on</strong>g>Skovsik (2004). They found that in both countries the companies have providedsubstantial <str<strong>on</strong>g>disclosure</str<strong>on</strong>g>s relevant for the assessment <str<strong>on</strong>g>of</str<strong>on</strong>g> competitive advantages,especially with regard to research <str<strong>on</strong>g>and</str<strong>on</strong>g> development activities. However,<str<strong>on</strong>g>disclosure</str<strong>on</strong>g>s c<strong>on</strong>cerning business growth, dividend policy <str<strong>on</strong>g>and</str<strong>on</strong>g> earnings persistencehave been more prevalent am<strong>on</strong>g the Swedish companies.Since the purpose <str<strong>on</strong>g>of</str<strong>on</strong>g> the present paper is to study the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> publicly disclosed<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <strong>on</strong> market values for Romanian listedcompanies, we must address the relevant literature in the c<strong>on</strong>text <str<strong>on</strong>g>of</str<strong>on</strong>g> IFRSs adopti<strong>on</strong>by companies trading <str<strong>on</strong>g>financial</str<strong>on</strong>g> instruments <strong>on</strong> Bucharest Stock Exchange.Primary, the predispositi<strong>on</strong> to adopt IFRSs <str<strong>on</strong>g>and</str<strong>on</strong>g>, thus, to embark in a quest for moretransparent, reliable <str<strong>on</strong>g>and</str<strong>on</strong>g> comparable <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>, may be linked to the perceivedbenefits <str<strong>on</strong>g>of</str<strong>on</strong>g> this adopti<strong>on</strong>. Munteanu (2011) examines the views <str<strong>on</strong>g>of</str<strong>on</strong>g> chief <str<strong>on</strong>g>financial</str<strong>on</strong>g><str<strong>on</strong>g>of</str<strong>on</strong>g>ficers (CFOs) <str<strong>on</strong>g>of</str<strong>on</strong>g> Romanian listed companies, with regard to IFRS adopti<strong>on</strong> bytheir companies, <str<strong>on</strong>g>and</str<strong>on</strong>g> in general. The survey reveals that the majority <str<strong>on</strong>g>of</str<strong>on</strong>g> thecompanies do not provide voluntarily IFRSs related <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>, but are forced bynati<strong>on</strong>al regulati<strong>on</strong>. Most do not indend to access internati<strong>on</strong>al <str<strong>on</strong>g>financial</str<strong>on</strong>g> markets<str<strong>on</strong>g>and</str<strong>on</strong>g>/or there is no management or shareholders initiative. The excepti<strong>on</strong> isrepresented by <str<strong>on</strong>g>financial</str<strong>on</strong>g> instituti<strong>on</strong>s (as required by Nati<strong>on</strong>al Bank <str<strong>on</strong>g>of</str<strong>on</strong>g> Romania)80Vol. 12, No. 1

Effects <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g><strong>on</strong> <strong>prices</strong>’ mechanisms for emergent markets: the case <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest stock exchange<str<strong>on</strong>g>and</str<strong>on</strong>g> companies which are wholly or majority owned by foreign investors. I<strong>on</strong>aşcuet al. (2008) discusses the link between <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> quality <str<strong>on</strong>g>and</str<strong>on</strong>g> cost <str<strong>on</strong>g>of</str<strong>on</strong>g> capital,whereas a latter versi<strong>on</strong>, Mihai et al. (2012), identifies possible ec<strong>on</strong>omic benefits<str<strong>on</strong>g>of</str<strong>on</strong>g> IFRSs adopti<strong>on</strong>, such as increase transparency, diminish <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> asymmetry<str<strong>on</strong>g>and</str<strong>on</strong>g> risk <str<strong>on</strong>g>and</str<strong>on</strong>g>, c<strong>on</strong>sequently, reduce the cost <str<strong>on</strong>g>of</str<strong>on</strong>g> capital. The paper shows that theaverage cost <str<strong>on</strong>g>of</str<strong>on</strong>g> equity did decrease after the IFRSs were adopted.Based <strong>on</strong> a survey am<strong>on</strong>g the Research Departments <str<strong>on</strong>g>of</str<strong>on</strong>g> the brokerage firmsoperating <strong>on</strong> BSE, I<strong>on</strong>aşcu <str<strong>on</strong>g>and</str<strong>on</strong>g> I<strong>on</strong>aşcu (2012) hypothesizes that <str<strong>on</strong>g>financial</str<strong>on</strong>g> analystsrely more <strong>on</strong> simple valuati<strong>on</strong> models <str<strong>on</strong>g>and</str<strong>on</strong>g> that accounting variables are perceivedas less important compared to macroec<strong>on</strong>omic factors when it comes to forecastaccuracy.However, the literature regarding the m<str<strong>on</strong>g>and</str<strong>on</strong>g>atory /voluntary <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g><str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <strong>on</strong> the websites <str<strong>on</strong>g>of</str<strong>on</strong>g> the Romanian listed companiesreveals a lack <str<strong>on</strong>g>of</str<strong>on</strong>g> adequate or c<strong>on</strong>sistent <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> in the case <str<strong>on</strong>g>of</str<strong>on</strong>g>these companies (Tir<strong>on</strong> Tudor, 2006). Popa et al. (2008) detects a poor use <str<strong>on</strong>g>of</str<strong>on</strong>g>internet advantages for investor relati<strong>on</strong>s, while Popa et al. (2009) suggests thatthere is a reduced <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> CSR <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> within the annual reports, evenfor the companies operating in sectors with great envir<strong>on</strong>mental impact. Usingannual reports from 2005-2007 for the <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> companies listed <strong>on</strong> BSE, Popet al. (2009) shows that pr<str<strong>on</strong>g>of</str<strong>on</strong>g>itability, auditor type, IFRSs, bank debt <str<strong>on</strong>g>and</str<strong>on</strong>g> privateownership structure positively affects the extent <str<strong>on</strong>g>of</str<strong>on</strong>g> voluntary <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> choices <str<strong>on</strong>g>of</str<strong>on</strong>g>sampled Romanian listed companies. The reas<strong>on</strong> found for the low level <str<strong>on</strong>g>of</str<strong>on</strong>g>voluntary <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> is explained by authors in c<strong>on</strong>necti<strong>on</strong> with the functi<strong>on</strong>ing <str<strong>on</strong>g>and</str<strong>on</strong>g>development <str<strong>on</strong>g>of</str<strong>on</strong>g> BSE.1.2 HypothesisWhile the impact <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <strong>on</strong> companies’ market valuesis largely analysed for developed countries, fever studies have been carried out inthe case <str<strong>on</strong>g>of</str<strong>on</strong>g> emerging markets (Reddy, 2001; Internati<strong>on</strong>al Valuati<strong>on</strong> St<str<strong>on</strong>g>and</str<strong>on</strong>g>ardsCommittee, 2003; Prasad, 2009).Our study focuses <strong>on</strong> the <str<strong>on</strong>g>effects</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> disclosed <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g><str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <strong>on</strong> stock <strong>prices</strong> in the case <str<strong>on</strong>g>of</str<strong>on</strong>g> an emergent market as the Romania<str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>e. In particular, we study if the publicly disclosed <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> via companies’websites is able to affect investors’ decisi<strong>on</strong>s even for markets with low liquidity,sticky <strong>prices</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> incomplete functi<strong>on</strong>al <str<strong>on</strong>g>and</str<strong>on</strong>g> instituti<strong>on</strong>al development. The choice<str<strong>on</strong>g>of</str<strong>on</strong>g> the Romanian case is motivated by that Bucharest Stock Exchange clearlydisplays such characteristics. This market is characterized by <strong>on</strong>e <str<strong>on</strong>g>of</str<strong>on</strong>g> the lowestcapitalizati<strong>on</strong> am<strong>on</strong>g the Central <str<strong>on</strong>g>and</str<strong>on</strong>g> Easter European countries, with relativelyinefficient market allocati<strong>on</strong> mechanisms <str<strong>on</strong>g>and</str<strong>on</strong>g> a reduced set <str<strong>on</strong>g>of</str<strong>on</strong>g> tradable <str<strong>on</strong>g>financial</str<strong>on</strong>g>assets.Vol. 12, No. 1 81

Accounting <str<strong>on</strong>g>and</str<strong>on</strong>g> Management Informati<strong>on</strong> SystemsAlthough the Capital Market Law no. 297/2004 has introduced someimprovements related to OECD corporate governance principles in accordancewith the White Paper <strong>on</strong> Corporate Governance in South East Europe, we find therecommendati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> the BSE Code <str<strong>on</strong>g>of</str<strong>on</strong>g> Corporate Governance <str<strong>on</strong>g>and</str<strong>on</strong>g> itsImplementati<strong>on</strong> Guide (available at http://www.bvb.ro/About/Publicati<strong>on</strong>s.aspx) asproviding more support for our research hypothesis.Explicitly, “the company must use in communicating with shareholders anadequate foreign language” (7 th Recommendati<strong>on</strong>, Implementati<strong>on</strong> Guide) <str<strong>on</strong>g>and</str<strong>on</strong>g> itmust provide an accessible <str<strong>on</strong>g>and</str<strong>on</strong>g> easily identifiable separate secti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> their websitec<strong>on</strong>cerning investor relati<strong>on</strong>s – providing a wide range <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>(8 th Recommendati<strong>on</strong>, BSE Code <str<strong>on</strong>g>of</str<strong>on</strong>g> Corporate Governance). Moreover,“the issuers will prepare <str<strong>on</strong>g>and</str<strong>on</strong>g> disclose periodical <str<strong>on</strong>g>and</str<strong>on</strong>g> c<strong>on</strong>tinuous relevant<str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>, according to the highest quality <str<strong>on</strong>g>financial</str<strong>on</strong>g> reporting st<str<strong>on</strong>g>and</str<strong>on</strong>g>ards –Internati<strong>on</strong>al Financial Reporting St<str<strong>on</strong>g>and</str<strong>on</strong>g>ards (IFRSs) – <str<strong>on</strong>g>and</str<strong>on</strong>g> other Envir<strong>on</strong>ment,Social <str<strong>on</strong>g>and</str<strong>on</strong>g> Governance st<str<strong>on</strong>g>and</str<strong>on</strong>g>ards. The <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> will be disclosed both inRomanian <str<strong>on</strong>g>and</str<strong>on</strong>g> English - as this is the lingua franca <str<strong>on</strong>g>of</str<strong>on</strong>g> the <str<strong>on</strong>g>financial</str<strong>on</strong>g> envir<strong>on</strong>ment”(25 th Recommendati<strong>on</strong>, BSE Code <str<strong>on</strong>g>of</str<strong>on</strong>g> Corporate Governance).Thus, we c<strong>on</strong>sider that the entire discussi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the relevant literature to thefollowing research hypothesis:H: In caeteris paribus c<strong>on</strong>diti<strong>on</strong>s, there will be a relative incremental value <str<strong>on</strong>g>of</str<strong>on</strong>g> ahigher volume <str<strong>on</strong>g>and</str<strong>on</strong>g> a better quality <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> reflecting <strong>prices</strong>’ overreacti<strong>on</strong>seven for a market with imperfect trading mechanisms. Still, less sophisticatedinvestors’ behaviours <str<strong>on</strong>g>and</str<strong>on</strong>g> a greater heterogeneity <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>prices</strong>’ adjustments under theimpact <str<strong>on</strong>g>of</str<strong>on</strong>g> the disclosed <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> is expected for such a market in comparis<strong>on</strong>with more developed <strong>on</strong>es.2. DATA AND METHODOLOGY2.1 Using Spanish Capital Market as BenchmarkIn order to provide a benchmark for our results, we are comparatively analyzing thecase <str<strong>on</strong>g>of</str<strong>on</strong>g> companies listed <strong>on</strong> the Spanish capital market. There are severalarguments for such a choice. Firstly, there are some recent functi<strong>on</strong>al similaritiesfor both capital markets in the c<strong>on</strong>text <str<strong>on</strong>g>of</str<strong>on</strong>g> current <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> ec<strong>on</strong>omic turmoil,despite their large structural, functi<strong>on</strong>al <str<strong>on</strong>g>and</str<strong>on</strong>g> instituti<strong>on</strong>al differences.82Vol. 12, No. 1

Effects <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g><strong>on</strong> <strong>prices</strong>’ mechanisms for emergent markets: the case <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest stock exchangeTable 1. Key data <str<strong>on</strong>g>of</str<strong>on</strong>g> Romanian <str<strong>on</strong>g>and</str<strong>on</strong>g> Spanish capital markets <str<strong>on</strong>g>and</str<strong>on</strong>g> ec<strong>on</strong>omiesMarket capitalizati<strong>on</strong>(USD milli<strong>on</strong>s)Number<str<strong>on</strong>g>of</str<strong>on</strong>g> listedcompaniesGDP per capita(curent USD)FDI net inflows(BoP, current USDmilli<strong>on</strong>s)RO SP RO SP RO SP RO SP1995 100.37 150914.23 9 - 1564 15151 419 80861996 60.81 241028.10 17 - 1563 15766 263 96231997 632.43 290354.80 76 - 1565 14467 1215 89371998 357.14 399847.60 126 - 1872 15126 2031 142821999 316.81 431649.20 127 - 1585 15476 1041 185232000 415.96 504221.90 114 - 1651 14422 1037 388352001 1228.52 468203.21 65 - 1816 14958 1157 281642002 2717.51 461559.57 65 - 2102 16611 1144 399932003 3710.22 726243.37 62 - 2737 21037 1844 256072004 11937.56 940672.88 60 - 3481 24461 6443 247922005 18184.81 959910.39 64 - 4572 26042 6482 245732006 28204.04 1322915.30 58 3378 5681 27989 11393 311722007 35326.04 1781132.66 59 3537 7856 32105 9925 666822008 16272.56 948352.29 68 3576 9300 35000 13883 742262009 27455.68 1434540.46 69 3472 7500 31774 6310 6451Source <str<strong>on</strong>g>of</str<strong>on</strong>g> data: Bucharest Stock Exchange (2010) for Romanian market (RO) <str<strong>on</strong>g>and</str<strong>on</strong>g> WorldFederati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> Exchanges (2010) for Spanish market (SP); For ec<strong>on</strong>omicdata: World Bank (2010).Since it has reopened in 1995, the Romanian capital market with the maincomp<strong>on</strong>ent - the Bucharest Stock Exchange (BSE) - has registered different phases<str<strong>on</strong>g>of</str<strong>on</strong>g> evoluti<strong>on</strong>: 1) the rec<strong>on</strong>structi<strong>on</strong> phase (1995 -1996) with the development <str<strong>on</strong>g>of</str<strong>on</strong>g>instituti<strong>on</strong>al <str<strong>on</strong>g>and</str<strong>on</strong>g> functi<strong>on</strong>al infrastructure; 2) the first instability phase (1997-2000),when the BSE experienced a generalized instability, insufficient liquidity <str<strong>on</strong>g>and</str<strong>on</strong>g>severe fricti<strong>on</strong>s at the level <str<strong>on</strong>g>of</str<strong>on</strong>g> the insufficient developed mechanisms; 3) thesustainable evoluti<strong>on</strong> phase (2001 -2005) characterized by a dominant upwardtrend, significant increase in market capitalizati<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> higher correlati<strong>on</strong>s withother internati<strong>on</strong>al markets; 4) the first uncertainty phase (2006 -2007) withimportant peaks in volatility <str<strong>on</strong>g>and</str<strong>on</strong>g> frequent changes in trends; 5) the turbulencephase when in the c<strong>on</strong>text <str<strong>on</strong>g>of</str<strong>on</strong>g> internati<strong>on</strong>al real <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> instability, theRomanian market was characterized between 2007- first part <str<strong>on</strong>g>of</str<strong>on</strong>g> 2009 by persistentdownward trends <str<strong>on</strong>g>and</str<strong>on</strong>g> the increase <str<strong>on</strong>g>of</str<strong>on</strong>g> the market intrinsic volatility as an expressi<strong>on</strong><str<strong>on</strong>g>of</str<strong>on</strong>g> the unbalanced bid/ask ratio due to higher risks in the transacti<strong>on</strong>al envir<strong>on</strong>ment;6) the sec<strong>on</strong>d actual uncertainty phase when a new upward trend starts to developbut in an not yet c<strong>on</strong>solidated manner.Comparatively, as Biscarri <str<strong>on</strong>g>and</str<strong>on</strong>g> Gracia (2004) have found, the Spanish stock markethas become increasingly similar to those <str<strong>on</strong>g>of</str<strong>on</strong>g> the more developed countries, althoughVol. 12, No. 1 83

Accounting <str<strong>on</strong>g>and</str<strong>on</strong>g> Management Informati<strong>on</strong> Systemssome differences still persist. The Stock Market Law enacted in July 1989 set anew instituti<strong>on</strong>al market framework. A new m<strong>on</strong>itoring instituti<strong>on</strong> (the Nati<strong>on</strong>alStock Market Commissi<strong>on</strong>) was created, <str<strong>on</strong>g>and</str<strong>on</strong>g> more detailed <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>alrequirements were specified, especially for primary markets participants. Othersec<strong>on</strong>dary markets, most noticeably those for <str<strong>on</strong>g>financial</str<strong>on</strong>g> derivatives, were addedshortly afterwards. The C<strong>on</strong>tinuous Market began to functi<strong>on</strong> in April <str<strong>on</strong>g>of</str<strong>on</strong>g> 1989.This instituti<strong>on</strong>al c<strong>on</strong>structi<strong>on</strong> was ensuring a corresp<strong>on</strong>ding degree <str<strong>on</strong>g>of</str<strong>on</strong>g> liquidity <str<strong>on</strong>g>and</str<strong>on</strong>g>openness. Still, there are some particularities which are differentiating the Spanishcapital market from other developed <strong>on</strong>es. For instance, Biscarri <str<strong>on</strong>g>and</str<strong>on</strong>g> Gracia (2004)documents that average durati<strong>on</strong> for both bull <str<strong>on</strong>g>and</str<strong>on</strong>g> bear phases are greater in thecase <str<strong>on</strong>g>of</str<strong>on</strong>g> Spain comparing with others developed markets despite the fact that post-2001 this durati<strong>on</strong> was shorter. Also, the amplitude for the bull phase remains, aftera substantial diminuti<strong>on</strong>, somehow larger for Spanish market. As for Romanianmarket, it displays all the characteristic features <str<strong>on</strong>g>of</str<strong>on</strong>g> an emergent <strong>on</strong>e, with slow<strong>prices</strong>’ adjustment mechanisms <str<strong>on</strong>g>and</str<strong>on</strong>g> their <str<strong>on</strong>g>effects</str<strong>on</strong>g> <strong>on</strong> l<strong>on</strong>ger market cycles.Sec<strong>on</strong>dly, there are some recent evidences <str<strong>on</strong>g>of</str<strong>on</strong>g> an increased cointegrati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> theRomanian capital market with the European <strong>on</strong>es. Thus, it can be argued that, atleast for the most liquid stocks, there should be a certain degree <str<strong>on</strong>g>of</str<strong>on</strong>g> synchr<strong>on</strong>izati<strong>on</strong>in market dynamics with individual European markets. In order to evaluate thishypothesis, we are testing the cointegrati<strong>on</strong> between the Romanian market ROTXindex <str<strong>on</strong>g>and</str<strong>on</strong>g> the Spanish market IBEX35 index. ROTX is a free float weightedcapitalizati<strong>on</strong> index <str<strong>on</strong>g>and</str<strong>on</strong>g> reflects in real time the <strong>prices</strong>’ movements <str<strong>on</strong>g>of</str<strong>on</strong>g> "blue chip"companies traded <strong>on</strong> the Bucharest Stock Exchange. Being calculated also inEURO <str<strong>on</strong>g>and</str<strong>on</strong>g> disseminated in real time by the Wiener Borse, this index is suitable forcross-countries analyses.Since overall Kwiatkowski et al. (1992) unit root tests tend to reject the null <str<strong>on</strong>g>of</str<strong>on</strong>g>returns’ stati<strong>on</strong>arity, we are performing a cointegrati<strong>on</strong> analysis between theindexes returns by involving the Engle <str<strong>on</strong>g>and</str<strong>on</strong>g> Granger (1987) <str<strong>on</strong>g>and</str<strong>on</strong>g> Phillips <str<strong>on</strong>g>and</str<strong>on</strong>g>Ouliaris (1990) cointegrati<strong>on</strong> tests. Table 2 report the results.Table 2. Testing the cointegrati<strong>on</strong> between Romanian ROTX <str<strong>on</strong>g>and</str<strong>on</strong>g> SpanishIBEX market indexes’ returnsA) Kwiatkowski, Phillips, Schmidt, <str<strong>on</strong>g>and</str<strong>on</strong>g> Shin unit root testsLM-StatisticROTX 0.60IBEX 0.19Notes: Null hypothesis: The return series is stati<strong>on</strong>ary; Critical values: 1%- 0.74; 5%- 0.46;10%- 0.35; C<strong>on</strong>stant included; B<str<strong>on</strong>g>and</str<strong>on</strong>g>width: 2 (Newey -West (1987) procedureselecti<strong>on</strong>) using Bartlett kernel84Vol. 12, No. 1

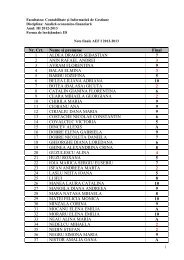

Effects <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g><strong>on</strong> <strong>prices</strong>’ mechanisms for emergent markets: the case <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest stock exchangeB) Engle-Granger <str<strong>on</strong>g>and</str<strong>on</strong>g> Phillips-Ouliaris cointegrati<strong>on</strong> testsTau-statisticEngle-Granger testROTX -3.67[-39.63](0.00)IBEX -30.96[-826.82](0.00)Phillips-Ouliaris test-27.53[-719.74](0.00)-32.00[-731.94](0.00)Notes: z-statistics in [] <str<strong>on</strong>g>and</str<strong>on</strong>g> probabilities in ();Null hypothesis: Series are not cointegrated;Cointegrating equati<strong>on</strong> deterministics: c<strong>on</strong>stant;For Engle-Granger test: Lagsspecificati<strong>on</strong>s based <strong>on</strong> Modified Hannan-Quinn Info Criteri<strong>on</strong>; For Phillips-ouliaristest:L<strong>on</strong>g-run variance estimate (Bartlett kernel, Newey-West fixed b<str<strong>on</strong>g>and</str<strong>on</strong>g>width).It appears that both tests are rejecting the null hypothesis <str<strong>on</strong>g>of</str<strong>on</strong>g> no cointegrati<strong>on</strong>between the two indexes. Of course, such a result should be c<strong>on</strong>sidered withcauti<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g> a more detailed analysis <str<strong>on</strong>g>of</str<strong>on</strong>g> the driving mechanisms for such a possiblerelati<strong>on</strong>ship between the Romanian <str<strong>on</strong>g>and</str<strong>on</strong>g> Spanish markets’ phases is required. But,at least, it can be argued that some functi<strong>on</strong>al c<strong>on</strong>necti<strong>on</strong>s between these marketsare starting to be in place driven by the Romanian integrati<strong>on</strong> in European Uni<strong>on</strong>process.2.2 The sampleWe have gathered our data regarding the Prices / Earnings Ratio directly from thewebsites <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest Stock Exchange (http://www.bvb.ro/) <str<strong>on</strong>g>and</str<strong>on</strong>g> Bolsa de Madrid(http://www.bolsamadrid.es/) for a cumulative sample <str<strong>on</strong>g>of</str<strong>on</strong>g> 80 companies.Companies were surveyed during the third quarter <str<strong>on</strong>g>of</str<strong>on</strong>g> 2010.In determining the existence <str<strong>on</strong>g>of</str<strong>on</strong>g> a website in at least <strong>on</strong> foreign language (English),the <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> annual as well as interim <str<strong>on</strong>g>financial</str<strong>on</strong>g> reports <str<strong>on</strong>g>and</str<strong>on</strong>g> the inclusi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> anews secti<strong>on</strong> in the respective website, we have accessed the individual websites <str<strong>on</strong>g>of</str<strong>on</strong>g>each company in the sample. We have included in the final sample <strong>on</strong>ly companiesthat have identifiable <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <strong>on</strong> Prices/Earnings Ratio (PER) <str<strong>on</strong>g>and</str<strong>on</strong>g> othercomplete data for all variables used in our models. In order to test our workinghypothesis, we have c<strong>on</strong>structed four dummy variables (see Table 3). All thevalues are corresp<strong>on</strong>ding to the third quarter <str<strong>on</strong>g>of</str<strong>on</strong>g> 2010.Table 4 summarizes the sample selecti<strong>on</strong> process, showing the number <str<strong>on</strong>g>of</str<strong>on</strong>g>observati<strong>on</strong>s excluded from the initial sample, <str<strong>on</strong>g>and</str<strong>on</strong>g> the resulting final sample. Ofthe initial sample <str<strong>on</strong>g>of</str<strong>on</strong>g> 72 companies listed <strong>on</strong> Bucharest Stock Exchange, 27 areexcluded due to the absence <str<strong>on</strong>g>of</str<strong>on</strong>g> PER <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g>, resulting in a sample <str<strong>on</strong>g>of</str<strong>on</strong>g> 45<str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> companies <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> instituti<strong>on</strong>s. From the companies included inthe structure <str<strong>on</strong>g>of</str<strong>on</strong>g> IBEX 35 Bolsa de Madrid index, all are c<strong>on</strong>sidered.Vol. 12, No. 1 85

Prices /Earnings RatioAccounting <str<strong>on</strong>g>and</str<strong>on</strong>g> Management Informati<strong>on</strong> SystemsTable 3. Dependent <str<strong>on</strong>g>and</str<strong>on</strong>g> explanatory variablesVariable Descripti<strong>on</strong> SourceIs a measure <str<strong>on</strong>g>of</str<strong>on</strong>g> the price paid for a sharerelative to the annual net income or pr<str<strong>on</strong>g>of</str<strong>on</strong>g>itearned by the firm per shareWebsite in atleast <strong>on</strong>foreignlanguage(English)Disclosure<str<strong>on</strong>g>of</str<strong>on</strong>g> annual<str<strong>on</strong>g>financial</str<strong>on</strong>g>reportsDisclosure<str<strong>on</strong>g>of</str<strong>on</strong>g> interim<str<strong>on</strong>g>financial</str<strong>on</strong>g>reportsNewsDummy variable which takes value <str<strong>on</strong>g>of</str<strong>on</strong>g> “1” ifthere is a company’ website in at least <strong>on</strong>eforeign language (from <str<strong>on</strong>g>of</str<strong>on</strong>g>ficial EUlanguages) <str<strong>on</strong>g>and</str<strong>on</strong>g> “0” otherwise. If there arewebsite versi<strong>on</strong>s in more than <strong>on</strong>e foreignlanguage, the variable takes the value “1”Dummy variable which takes value <str<strong>on</strong>g>of</str<strong>on</strong>g> “1” if<strong>on</strong> company’ website are <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> theannually <str<strong>on</strong>g>financial</str<strong>on</strong>g> reports <str<strong>on</strong>g>and</str<strong>on</strong>g> “0” otherwiseDummy variable which takes value <str<strong>on</strong>g>of</str<strong>on</strong>g> “1” if<strong>on</strong> company’ website are <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> theinterim <str<strong>on</strong>g>financial</str<strong>on</strong>g> reports <str<strong>on</strong>g>and</str<strong>on</strong>g> “0” otherwiseDummy variable which takes value <str<strong>on</strong>g>of</str<strong>on</strong>g> “1” if<strong>on</strong> company’ website are <str<strong>on</strong>g>disclosure</str<strong>on</strong>g><str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> with potential impact <strong>on</strong>ec<strong>on</strong>omic <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> performances <str<strong>on</strong>g>and</str<strong>on</strong>g>“0” otherwiseTable 4. Sample c<strong>on</strong>structi<strong>on</strong>Bucharest StockExchange (2010)<str<strong>on</strong>g>and</str<strong>on</strong>g> Bolsa de Madrid(2010)Coded by authorsbased <strong>on</strong> companies’websitesCoded by authorsbased <strong>on</strong>companies’ websitesCoded by authorsbased <strong>on</strong> companies’websitesCoded by authorsbased <strong>on</strong> companies’websitesROMANIANumber N<strong>on</strong> N<strong>on</strong> available /Total number<str<strong>on</strong>g>of</str<strong>on</strong>g> companies available <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g> functi<strong>on</strong>al<str<strong>on</strong>g>of</str<strong>on</strong>g> companiesin final sample PER data websiteFirst tier 22 22 (100%) - -Sec<strong>on</strong>d Tier 49 23 (47%) 26 (53%) -Third tier 1 0 (0%) 1 (100%) -Total 72 45 (62.5%) 27 (37.5%) -SPAINIBEX 35 35 35 - -2.3 MethodologyIn order to carry out our analysis, we appeal to the Generalized Linear Models(GLM) estimati<strong>on</strong> framework. This methodology allows flexible specificati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g>the model <str<strong>on</strong>g>and</str<strong>on</strong>g> ‘for <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-normal data without clustering, generalized linear modelsare an appropriate alternative to linear models’ (Tuerlinckx et al., 2006: 225).86Vol. 12, No. 1

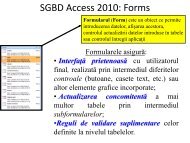

Effects <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g><strong>on</strong> <strong>prices</strong>’ mechanisms for emergent markets: the case <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest stock exchangeSuch flexibility is required since the estimati<strong>on</strong> procedure must be robust enough inorder to deal with at least two sources <str<strong>on</strong>g>of</str<strong>on</strong>g> variables heterogeneity: a) theimperfecti<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>prices</strong>’ mechanisms for the Romanian market <str<strong>on</strong>g>and</str<strong>on</strong>g> b) the <str<strong>on</strong>g>effects</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g>the differences between IFRSs <str<strong>on</strong>g>and</str<strong>on</strong>g> Romanian GAAP.The strategy <str<strong>on</strong>g>of</str<strong>on</strong>g> the baseline model formulati<strong>on</strong> is based <strong>on</strong> a stepwise additi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g>several explanatory variables to the GLM framework with the lowest ρ-value at theten percent level. Such a bottom-up approach has several advantages, since we areassuming the existence <str<strong>on</strong>g>of</str<strong>on</strong>g> various relati<strong>on</strong>s am<strong>on</strong>g the involved variables (see forarguments Lütkepohl, 2007). Thus, we start by analyzing the relevance <str<strong>on</strong>g>of</str<strong>on</strong>g>individual <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> dummies in order to retain <strong>on</strong>ly the relevant <strong>on</strong>es.Furthermore, the <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> dummies are aggregated in order to produce a global<str<strong>on</strong>g>disclosure</str<strong>on</strong>g> indicator by using the so-called principal comp<strong>on</strong>ents analysis. Thisprocedure models the variance structure <str<strong>on</strong>g>of</str<strong>on</strong>g> a set <str<strong>on</strong>g>of</str<strong>on</strong>g> observed variables using linearcombinati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> the variables. These linear combinati<strong>on</strong>s ( comp<strong>on</strong>ents) may beused in subsequent analysis, <str<strong>on</strong>g>and</str<strong>on</strong>g> the combinati<strong>on</strong> coefficients ( loadings) can beused for a subsequent interpretati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the comp<strong>on</strong>ents. The global indicator isc<strong>on</strong>structed by weighting the individual <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> dummies with these loadings.We are involving such approach since: (a) this is a procedure <str<strong>on</strong>g>of</str<strong>on</strong>g> reduci ng thenumber <str<strong>on</strong>g>of</str<strong>on</strong>g> observed variables to a smaller number <str<strong>on</strong>g>of</str<strong>on</strong>g> principal comp<strong>on</strong>ents, whichaccount for most <str<strong>on</strong>g>of</str<strong>on</strong>g> the variance <str<strong>on</strong>g>of</str<strong>on</strong>g> the observed variables; (b) we are expecting thedummies to be highly correlated; (c) comp<strong>on</strong>ent scores are a linear combinati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g>the observed variables weighted by eigenvectors <str<strong>on</strong>g>and</str<strong>on</strong>g>, so, it allows for c<strong>on</strong>sideringthe relative importance <str<strong>on</strong>g>of</str<strong>on</strong>g> individual variables. Such global indicator is designed tobe use for an overall assessment <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> impact <strong>on</strong> PER ratios.The general specificati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the model is <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-linear <str<strong>on</strong>g>of</str<strong>on</strong>g> the form: I F R S s P E R e x p D i s c l o s u r e X i i i i ~ P o i s, 1i i iHere, PER is Prices to Earnings ratio for individual company i, Disclosurerepresent the <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> dummies <str<strong>on</strong>g>and</str<strong>on</strong>g> X are the otherexplanatory variables c<strong>on</strong>sidered in the robustness check.Such a specificati<strong>on</strong> falls into the GLM framework with a log link functi<strong>on</strong> <str<strong>on</strong>g>and</str<strong>on</strong>g>Poiss<strong>on</strong> family distributi<strong>on</strong>. Disclosure represents other explanatory variablesincluded together with the <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> dummies. The specificati<strong>on</strong> can be justifiedby the complexity <str<strong>on</strong>g>of</str<strong>on</strong>g> involved associati<strong>on</strong>s between the <strong>prices</strong>’ mechanisms <str<strong>on</strong>g>and</str<strong>on</strong>g><str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g>. Indeed, it seems implausible that the <str<strong>on</strong>g>effects</str<strong>on</strong>g> induced by this<str<strong>on</strong>g>disclosure</str<strong>on</strong>g> can affect the PER ratios <strong>on</strong>ly in a linear fashi<strong>on</strong>.Vol. 12, No. 1 87

Accounting <str<strong>on</strong>g>and</str<strong>on</strong>g> Management Informati<strong>on</strong> SystemsIt must be noticed that we are choosing as dependent variable the PER ratios, sincethese reflect the <strong>prices</strong> adjusted with the issuers’ ec<strong>on</strong>omic <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g>performances. Thus, this variable is supposed to capture not <strong>on</strong>ly the efficiency <str<strong>on</strong>g>of</str<strong>on</strong>g>the <strong>prices</strong>’ mechanisms, but also their alignment to market values <str<strong>on</strong>g>of</str<strong>on</strong>g> companies asthese are based <strong>on</strong> the fundamental determinants related to issuers’ activity.2.4 Descriptive statisticsTable 5 presents the number <str<strong>on</strong>g>of</str<strong>on</strong>g> sample companies <str<strong>on</strong>g>and</str<strong>on</strong>g> the mean, maximum,minimum <str<strong>on</strong>g>and</str<strong>on</strong>g> st<str<strong>on</strong>g>and</str<strong>on</strong>g>ard deviati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> PER <str<strong>on</strong>g>and</str<strong>on</strong>g> individual explanatory variables forboth capital markets. The figures in the first row for each country are PER values(2010 reference) computed based <strong>on</strong> net pr<str<strong>on</strong>g>of</str<strong>on</strong>g>it for the last 4 quarters / last annualreport issued according to the local GAAP. If the starting trade date is smaller than4 quarters, the values are computed accordingly, by c<strong>on</strong>sidering the last availablequarters reports.The other rows are the individual <str<strong>on</strong>g>disclosure</str<strong>on</strong>g> dummies. The values <str<strong>on</strong>g>of</str<strong>on</strong>g> dispersi<strong>on</strong>,significantly larger in the Romanian case, are suggesting the existence <str<strong>on</strong>g>of</str<strong>on</strong>g> someoutliers in variables especially for the PER ratios. More exactly, for 14 Romaniancompanies (31%) the values <str<strong>on</strong>g>of</str<strong>on</strong>g> the PER are greater than 20 <str<strong>on</strong>g>and</str<strong>on</strong>g> 6 (13%) are higherthan 40.Table 5. Summary statistics <str<strong>on</strong>g>of</str<strong>on</strong>g> PER <str<strong>on</strong>g>and</str<strong>on</strong>g> Disclosure IndicatorsMean Maximum Minimum St<str<strong>on</strong>g>and</str<strong>on</strong>g>arddeviati<strong>on</strong>RO SP RO SP RO SP RO SPPrices / Earnings Ratio 18.68 12.82 61.00 31.74 1.94 4.07 14.43 7.11Website in at least <strong>on</strong> 0.78 0.91 1.00 1.00 0.00 0.00 0.42 0.29foreign language(English)Disclosure <str<strong>on</strong>g>of</str<strong>on</strong>g> annual 0.73 1.00 1.00 1.00 0.00 1.00 0.45 0.00<str<strong>on</strong>g>financial</str<strong>on</strong>g> reportsDisclosure <str<strong>on</strong>g>of</str<strong>on</strong>g> interim 0.76 1.00 1.00 1.00 0.00 1.00 0.43 0.00<str<strong>on</strong>g>financial</str<strong>on</strong>g> reportsNews 0.76 1.00 1.00 1.00 0.00 1.00 0.43 0.00These outliers are especially located in petroleum, transports <str<strong>on</strong>g>and</str<strong>on</strong>g> c<strong>on</strong>structi<strong>on</strong>s’sectors <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest Stock Exchange. 9 companies (20%) do not have websites inforeign languages <str<strong>on</strong>g>and</str<strong>on</strong>g> 12 companies (26, 7%) are not reporting annual or interim<str<strong>on</strong>g>financial</str<strong>on</strong>g> situati<strong>on</strong>s <strong>on</strong> their websites. Finally, 11 companies (24, 4) do not have anexplicit or implicit news secti<strong>on</strong>. For IBEX35 companies, the outliers are locatedespecially in energy, industry <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> sectors. 3 companies (8.57%) from thedataset do not provide a versi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> their websites in any foreign language.88Vol. 12, No. 1

Effects <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>and</str<strong>on</strong>g> <str<strong>on</strong>g>n<strong>on</strong></str<strong>on</strong>g>-<str<strong>on</strong>g>financial</str<strong>on</strong>g> <str<strong>on</strong>g>informati<strong>on</strong></str<strong>on</strong>g> <str<strong>on</strong>g>disclosure</str<strong>on</strong>g><strong>on</strong> <strong>prices</strong>’ mechanisms for emergent markets: the case <str<strong>on</strong>g>of</str<strong>on</strong>g> Bucharest stock exchange2.5 Principal Comp<strong>on</strong>ents AnalysisTable 6 <str<strong>on</strong>g>and</str<strong>on</strong>g> Table 7 report the results <str<strong>on</strong>g>of</str<strong>on</strong>g> the principal comp<strong>on</strong>ent analyses forRomanian <str<strong>on</strong>g>and</str<strong>on</strong>g> Spanish markets. The first secti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> these tables summarizes theeigenvalues, showing the values, the forward difference in the eigenvalues <str<strong>on</strong>g>and</str<strong>on</strong>g> theproporti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> total variance explained. Since we are performing principalcomp<strong>on</strong>ents <strong>on</strong> a correlati<strong>on</strong> matrix, the sum <str<strong>on</strong>g>of</str<strong>on</strong>g> the scaled variances for the fourdummies is equal to 4. The first principal comp<strong>on</strong>ent accounts for 87% <str<strong>on</strong>g>of</str<strong>on</strong>g> the totalvariance <str<strong>on</strong>g>of</str<strong>on</strong>g> Romanian companies PER ratios (98% in the case <str<strong>on</strong>g>of</str<strong>on</strong>g> Spanishcompanies), while the sec<strong>on</strong>d accounts for 9% (2%) <str<strong>on</strong>g>of</str<strong>on</strong>g> the total. The first twocomp<strong>on</strong>ents account for over 96% (100%) <str<strong>on</strong>g>of</str<strong>on</strong>g> the total variati<strong>on</strong>.Table 6. Principal Comp<strong>on</strong>ents Analysis (Romania)Number Value Difference Proporti<strong>on</strong> Cumulative Value1 3.46 3.11 0.87 3.462 0.35 0.18 0.09 3.813 0.17 0.16 0.04 3.994 0.01 --- 0.00 4.00Variable PC 1 PC 2 PC 3 PC 4Website in at least <strong>on</strong> foreign language (English) 0.47 0.69 0.54 0.02Disclosure <str<strong>on</strong>g>of</str<strong>on</strong>g> annual <str<strong>on</strong>g>financial</str<strong>on</strong>g> reports 0.51 -0.49 0.16 0.69Disclosure <str<strong>on</strong>g>of</str<strong>on</strong>g> interim <str<strong>on</strong>g>financial</str<strong>on</strong>g> reports 0.52 -0.44 0.13 -0.72News 0.50 0.30 -0.82 0.03Notes: Included observati<strong>on</strong>s: 45; Computed using: Ordinary (uncentered) correlati<strong>on</strong>s;Extracting 4 <str<strong>on</strong>g>of</str<strong>on</strong>g> 4 possible comp<strong>on</strong>ents.Table 7. Principal Comp<strong>on</strong>ents Analysis (Spain)Number Value Difference Proporti<strong>on</strong> Cumulative Value1 3.93 3.86 0.98 3.932 0.07 0.07 0.02 4.003 0.00 0.00 0.00 4.004 0.00 --- 0.00 4.00Variable PC 1 PC 2 PC 3 PC 4Website in at least <strong>on</strong> foreign language (English) 0.49 0.87 0.00 0.00Disclosure <str<strong>on</strong>g>of</str<strong>on</strong>g> annual <str<strong>on</strong>g>financial</str<strong>on</strong>g> reports 0.50 -0.28 0.00 0.82Disclosure <str<strong>on</strong>g>of</str<strong>on</strong>g> interim <str<strong>on</strong>g>financial</str<strong>on</strong>g> reports 0.50 -0.28 -0.71 -0.41News 0.50 -0.28 0.71 -0.41Notes: Included observati<strong>on</strong>s: 33; Computed using: Ordinary (uncentered) correlati<strong>on</strong>s;Extracting 4 <str<strong>on</strong>g>of</str<strong>on</strong>g> 4 possible comp<strong>on</strong>ents.Vol. 12, No. 1 89