Goldrush Resources Ltd. (TSXV: GOD) â Initiating Coverage; Gold ...

Goldrush Resources Ltd. (TSXV: GOD) â Initiating Coverage; Gold ...

Goldrush Resources Ltd. (TSXV: GOD) â Initiating Coverage; Gold ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

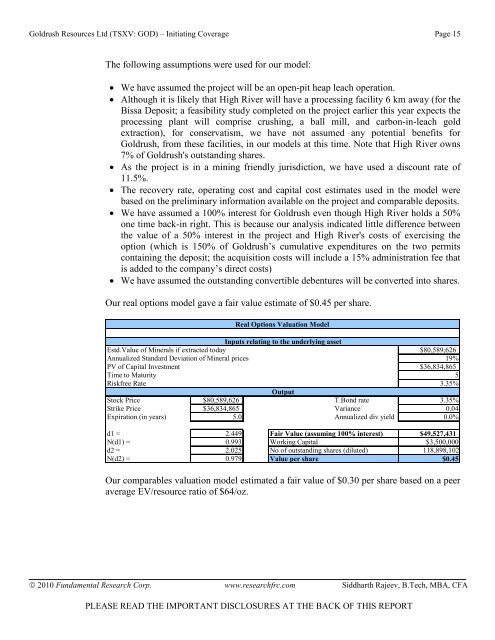

<strong><strong>Gold</strong>rush</strong> <strong>Resources</strong> <strong>Ltd</strong> (<strong>TSXV</strong>: <strong>GOD</strong>) – <strong>Initiating</strong> <strong>Coverage</strong> Page 15The following assumptions were used for our model:• We have assumed the project will be an open-pit heap leach operation.• Although it is likely that High River will have a processing facility 6 km away (for theBissa Deposit; a feasibility study completed on the project earlier this year expects theprocessing plant will comprise crushing, a ball mill, and carbon-in-leach goldextraction), for conservatism, we have not assumed any potential benefits for<strong><strong>Gold</strong>rush</strong>, from these facilities, in our models at this time. Note that High River owns7% of <strong><strong>Gold</strong>rush</strong>'s outstanding shares.• As the project is in a mining friendly jurisdiction, we have used a discount rate of11.5%.• The recovery rate, operating cost and capital cost estimates used in the model werebased on the preliminary information available on the project and comparable deposits.• We have assumed a 100% interest for <strong><strong>Gold</strong>rush</strong> even though High River holds a 50%one time back-in right. This is because our analysis indicated little difference betweenthe value of a 50% interest in the project and High River's costs of exercising theoption (which is 150% of <strong><strong>Gold</strong>rush</strong>’s cumulative expenditures on the two permitscontaining the deposit; the acquisition costs will include a 15% administration fee thatis added to the company’s direct costs)• We have assumed the outstanding convertible debentures will be converted into shares.Our real options model gave a fair value estimate of $0.45 per share.Real Options Valuation ModelInputs relating to the underlying assetEstd.Value of Minerals if extracted today $80,589,626Annualized Standard Deviation of Mineral prices 19%PV of Capital Investment $36,834,865Time to Maturity 5Riskfree Rate 3.35%OutputStock Price $80,589,626 T.Bond rate 3.35%Strike Price $36,834,865 Variance 0.04Expiration (in years) 5.0 Annualized div yield 0.0%d1 = 2.449 Fair Value (assuming 100% interest) $49,527,431N(d1) = 0.993 Working Capital $3,500,000d2 = 2.025 No of outstanding shares (diluted) 118,898,102N(d2) = 0.979 Value per share $0.45Our comparables valuation model estimated a fair value of $0.30 per share based on a peeraverage EV/resource ratio of $64/oz.© 2010 Fundamental Research Corp. www.researchfrc.com Siddharth Rajeev, B.Tech, MBA, CFAPLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT