Goldrush Resources Ltd. (TSXV: GOD) â Initiating Coverage; Gold ...

Goldrush Resources Ltd. (TSXV: GOD) â Initiating Coverage; Gold ...

Goldrush Resources Ltd. (TSXV: GOD) â Initiating Coverage; Gold ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

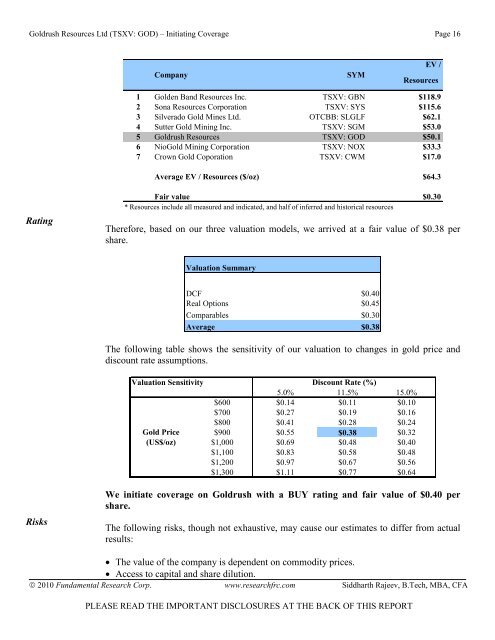

<strong><strong>Gold</strong>rush</strong> <strong>Resources</strong> <strong>Ltd</strong> (<strong>TSXV</strong>: <strong>GOD</strong>) – <strong>Initiating</strong> <strong>Coverage</strong> Page 16CompanySYMEV /<strong>Resources</strong>1 <strong>Gold</strong>en Band <strong>Resources</strong> Inc. <strong>TSXV</strong>: GBN $118.92 Sona <strong>Resources</strong> Corporation <strong>TSXV</strong>: SYS $115.63 Silverado <strong>Gold</strong> Mines <strong>Ltd</strong>. OTCBB: SLGLF $62.14 Sutter <strong>Gold</strong> Mining Inc. <strong>TSXV</strong>: SGM $53.05 <strong><strong>Gold</strong>rush</strong> <strong>Resources</strong> <strong>TSXV</strong>: <strong>GOD</strong> $50.16 Nio<strong>Gold</strong> Mining Corporation <strong>TSXV</strong>: NOX $33.37 Crown <strong>Gold</strong> Coporation <strong>TSXV</strong>: CWM $17.0Average EV / <strong>Resources</strong> ($/oz) $64.3RatingFair value $0.30* <strong>Resources</strong> include all measured and indicated, and half of inferred and historical resourcesTherefore, based on our three valuation models, we arrived at a fair value of $0.38 pershare.Valuation SummaryDCF $0.40Real Options $0.45Comparables $0.30Average $0.38The following table shows the sensitivity of our valuation to changes in gold price anddiscount rate assumptions.Valuation Sensitivity Discount Rate (%)0.381056854 5.0% 11.5% 15.0%$600 $0.14 $0.11 $0.10$700 $0.27 $0.19 $0.16$800 $0.41 $0.28 $0.24<strong>Gold</strong> Price $900 $0.55 $0.38 $0.32(US$/oz) $1,000 $0.69 $0.48 $0.40$1,100 $0.83 $0.58 $0.48$1,200 $0.97 $0.67 $0.56$1,300 $1.11 $0.77 $0.64RisksWe initiate coverage on <strong><strong>Gold</strong>rush</strong> with a BUY rating and fair value of $0.40 pershare.The following risks, though not exhaustive, may cause our estimates to differ from actualresults:• The value of the company is dependent on commodity prices.• Access to capital and share dilution.© 2010 Fundamental Research Corp. www.researchfrc.com Siddharth Rajeev, B.Tech, MBA, CFAPLEASE READ THE IMPORTANT DISCLOSURES AT THE BACK OF THIS REPORT