The Nation's 50 Largest Apartment Owners And 50 Largest

The Nation's 50 Largest Apartment Owners And 50 Largest

The Nation's 50 Largest Apartment Owners And 50 Largest

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

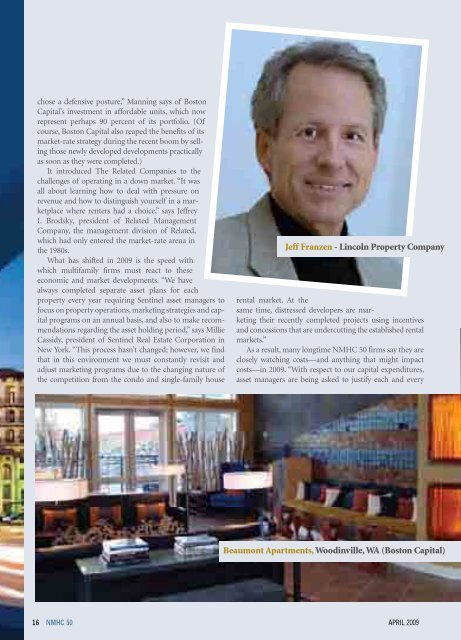

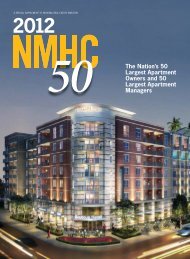

A special Supplement to national real estate investorchose a defensive posture,” Manning says of BostonCapital’s investment in affordable units, which nowrepresent perhaps 90 percent of its portfolio. (Ofcourse, Boston Capital also reaped the benefits of itsmarket-rate strategy during the recent boom by sellingthose newly developed developments practicallyas soon as they were completed.)It introduced <strong>The</strong> Related Companies to thechallenges of operating in a down market. “It wasall about learning how to deal with pressure onrevenue and how to distinguish yourself in a marketplacewhere renters had a choice,” says JeffreyI. Brodsky, president of Related ManagementCompany, the management division of Related,which had only entered the market-rate arena inthe 1980s.What has shifted in 2009 is the speed withwhich multifamily firms must react to theseeconomic and market developments. “We havealways completed separate asset plans for eachproperty every year requiring Sentinel asset managers tofocus on property operations, marketing strategies and capitalprograms on an annual basis, and also to make recommendationsregarding the asset holding period,” says MillieCassidy, president of Sentinel Real Estate Corporation inNew York. “This process hasn’t changed; however, we findthat in this environment we must constantly revisit andadjust marketing programs due to the changing nature ofthe competition from the condo and single-family houseJeff Franzen - Lincoln Property Companyrental market. At thesame time, distressed developers are marketingtheir recently completed projects using incentivesand concessions that are undercutting the established rentalmarkets.”As a result, many longtime NMHC <strong>50</strong> firms say they areclosely watching costs—and anything that might impactcosts—in 2009. “With respect to our capital expenditures,asset managers are being asked to justify each and everyBeaumont <strong>Apartment</strong>s, Woodinville, WA (Boston Capital)16 NMHC <strong>50</strong> APRIL 2009