Small Business Survival Guide - Union Bank

Small Business Survival Guide - Union Bank

Small Business Survival Guide - Union Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

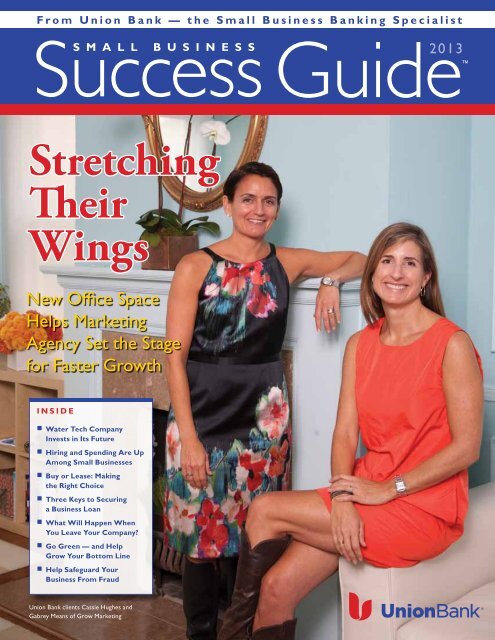

From <strong>Union</strong> <strong>Bank</strong> — the <strong>Small</strong> <strong>Business</strong> <strong>Bank</strong>ing SpecialistSuccessS M A L L B U S I N E S S<strong>Guide</strong>2013StretchingTheirWingsNew Office SpaceHelps MarketingAgency Set the Stagefor Faster GrowthINSIDE• Water Tech CompanyInvests in Its Future• Hiring and Spending Are UpAmong <strong>Small</strong> <strong>Business</strong>es• Buy or Lease: Makingthe Right Choice• Three Keys to Securinga <strong>Business</strong> Loan• What Will Happen WhenYou Leave Your Company?• Go Green — and HelpGrow Your Bottom Line• Help Safeguard Your<strong>Business</strong> From Fraud<strong>Union</strong> <strong>Bank</strong> clients Cassie Hughes andGabrey Means of Grow Marketing

ContentsWelcome.........................................................................................................................................1Room to Grow............................................................................................................................2COVER STORYStretching Their Wings............................................................................................................4Buy or Lease: Making the Right Choice........................................................................6Three Keys to Securing a <strong>Business</strong> Loan......................................................................8Pure Gold.....................................................................................................................................10What Will Happen When You Leave Your Company?................................... 12Go Green — and Help Grow Your Bottom Line............................................... 14Help Safeguard Your <strong>Business</strong> From Fraud.............................................................. 16About <strong>Union</strong> <strong>Bank</strong>Headquartered in San Francisco, <strong>Union</strong>BanCal Corporation is a financial holding companywith assets of $102.3 billion at June 30, 2013. Its primary subsidiary, <strong>Union</strong> <strong>Bank</strong>, N.A., is afull-service commercial bank providing an array of financial services to individuals, smallbusinesses, middle-market companies and major corporations. The bank operates 422branches in California, Washington, Oregon, Texas, New York and Illinois, as well as twointernational offices.<strong>Union</strong>BanCal Corporation is a wholly-owned subsidiary of The <strong>Bank</strong> of Tokyo-MitsubishiUFJ, Ltd., which is a subsidiary of Mitsubishi UFJ Financial Group, Inc. <strong>Union</strong> <strong>Bank</strong> is a proudmember of the Mitsubishi UFJ Financial Group (MUFG, NYSE:MTU), one of the world’slargest financial organizations. Visit www.unionbank.com for more information.Neither <strong>Union</strong> <strong>Bank</strong> nor <strong>Union</strong>BanCal Corporation assumes any liability resulting fromactions taken based on the information included in this magazine. Mention of a product orservice does not constitute endorsement. Some contributors to the <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong><strong>Business</strong> Success <strong>Guide</strong> may have active positions in companies discussed in this issue.Welcome to the <strong>Union</strong> <strong>Bank</strong><strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong><strong>Small</strong> business owners are growing more upbeat as the economy continues to recover. The moodis one of optimism balanced by prudent caution, according to the most recent <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong><strong>Business</strong> Economic Survey. While entrepreneurs are still grappling with lingering effects of therecession, their prospects are steadily brightening as sales, capital spending and hiring all improve.This trend is especially pronounced on the West Coast. Improved exchange rates have madearea companies more competitive with those in other Pacific Rim countries, and the region has alsobenefited from the gradual migration of manufacturing back to the United States.<strong>Business</strong> owners’ growing optimism is shared by their banking partners. Available credit forsmall companies has grown tremendously in the past few years, and entrepreneurs have respondedby taking advantage of bank financing to help grow their operations.<strong>Union</strong> <strong>Bank</strong> has been at the forefront of this development. Our lending to small businesseshas almost quadrupled in the past two years, while our loans backed by the <strong>Small</strong> <strong>Business</strong>Administration have tripled in the same period. We also have added new technology that hasshortened loan processing time by almost a third.Another way we are helping small businesses succeed is by rolling out this year’sissue of the <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong>. It provides insights and advice to helpyou make the most of increasing economic opportunities, including:• Details from our small business economic survey, which sheds light on the experiences andplans of small businesses on the West Coast and across the country• Profiles of two companies, Grow Marketing and AXEON Water Technologies, that aretaking advantage of credit to help expand their operations• A look at the most important questions you need to answer when you prepare a loanapplication package• How making your business more environmentally friendly can actually improve yourbalance sheet• A checklist to help guard your company against cybercrime and other types of fraudHelping your business grow<strong>Union</strong> <strong>Bank</strong> offers all the products and services you need to help your business prosper backedby uniquely personal attention. In the coming months, we will accelerate our efforts to help smallbusinesses even more. We will broaden our geographic footprint, enhance our technology andexpand our small business programs to help you better manage your finances and gain the fundingyou need. As the economy continues to improve, we can serve as a trusted partner to help you seizethe opportunities ahead.Todd HollanderExecutive Vice President, <strong>Business</strong> <strong>Bank</strong>ing Group, <strong>Union</strong> <strong>Bank</strong>

Roomto GrowHiring and spending are up among small businesses, <strong>Union</strong> <strong>Bank</strong>’s 13th annual survey finds.Encouraged by the improving also taking cues from the economy and plan to increase their capital expenditureseconomy, many smallbalancing their increased optimism this year, a three-point increase frombusinesses are taking cautious with caution.”2012, while 15% expect to hire more staff,steps to grow, according toup six points from last year.the 2013 <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong>Economy Survey. More owners planto increase hiring and capital spendingcompared to 2012, and more are gainingaccess to the credit they need to buildtheir businesses.The survey, which covered 200 smallbusiness principals in California and 500nationwide, indicates that these leadersremain mindful of the hardships theyhave faced in recent years. Thoughoptimism is rising, the sales pictureremains mixed, and many continue tograpple with the effects of layoffs.“This survey demonstrates theOutlook brightensThe recovery has been slow for manysmall businesses. Nearly half say theclimate for their business worsenedover the past two years. Still, a growingnumber of respondents are hopeful aboutthe future: 44% say the country is on theright track, a 14-point increase from 2012,and 31% feel upbeat about the economy, asix-point increase from last year.Keeping with this sunnier outlook, morebusinesses plan to increase their spendingand staffing. Nearly one in four (23%)Credit remains strongThe credit picture has improved alongwith the economy. More respondentsapplied for a loan or access to credit in2012 than in 2011 (14% compared with10%). Of these, 62% were approved, aslight uptick from 2011. Californiabusiness owners fared particularly well:64% were approved for a loan in 2012,compared with 47% the previous year.“These findings reflect what we areseeing firsthand as more small businessresilience and perseverance of smallbusiness owners,” says Executive ViceDirection of Country and Economy2013 2012President Todd Hollander, head of the<strong>Business</strong> <strong>Bank</strong>ing Group at <strong>Union</strong> <strong>Bank</strong>.Think country is on right track 44% 30%“Entrepreneurs have become experts at Think national economy is on right track 31% 25%gauging the business climate and adapting Think state/local economy is headed in right direction 41% 34%their course accordingly. While confidentin the direction of their businesses, they’reThink their business is headed in right direction 83% 80%owners apply for conventional orgovernment loans to grow theirbusiness,” says Heather Endresen,Senior Vice President and manager ofthe SBA and Government Lending Unitat <strong>Union</strong> <strong>Bank</strong>. “Because our 150-yearlegacy of responsible banking hasenabled us to have credit available toqualified candidates through alleconomic cycles, our business bankingand government lending groupscontinue to grow to meet the needs ofsmall businesses.”<strong>Business</strong>es seektax incentives<strong>Small</strong> business owners point to severalactions they would like the Obamaadministration to tackle in the monthsahead. Four in 10 would like more smallbusiness tax incentives, while about30% want regulators to reduce thehurdles around small business financing.A small percentage (15%) would likethe government to expand and simplifythe Affordable Care Act tax credit forsmall businesses, which is meant tooffset the cost of providing insuranceto employees.Job Growth and LayoffsCalifornia2013California2012Still, a growing number ofrespondents say they have benefitedfrom government actions taken since theeconomic downturn began. Specifically,17% report positive impacts from the<strong>Small</strong> <strong>Business</strong> Jobs Act, up from 7%last year. This legislation encourageslending to small businesses, provides$12 billion in tax incentives and expandsSBA loan programs.These changes, along with larger shiftsin the economy, give smaller companiesgood reason to be hopeful.“More manufacturing is moving backto the United States, and improvingexchange rates are making U.S. companiesmore competitive,” Hollander says. “Asthe economic picture improves, banks areaggressively looking for ways to help theirsmall business customers grow.” •CaliforniaOther StatesApplied for credit in 2012 17% 14%Received credit (if applied) 64% 62%Says it has been harder to obtaincredit over past two yearsOther States2013Access to CreditOther States2012Plan to add staff in 2013 16% 7% 15% 11%Expect to keep staffing levels steady 78% 86% 76% 83%Laid off staff in 2012 22% 25% 25% 20%Do not expect layoffs in 2013 94% 92% 91% 94%43% 41%About the2013 <strong>Union</strong> <strong>Bank</strong><strong>Small</strong> <strong>Business</strong>Economy SurveyFor 13 years, <strong>Union</strong> <strong>Bank</strong> hasconducted an annual survey ofsmall businesses to gain a betterunderstanding of their concerns,needs and goals. In January 2013,<strong>Union</strong> <strong>Bank</strong> worked with its surveypartner Kenexa to conduct anonline poll of small businessprincipals (200 in California and500 nationally). The companies allpost $15 million or less in annualsales and have been in business forat least two years. The nationalsurvey results reflect a +/- 4%margin of error 95% of the time;California results reflect a +/- 7%margin of error 95% of the time.2 | <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong><strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong> | 3

Stretchingneighborhood!’ We visited it the nextmorning and fell in love. Inside was a big“The SBA made the loan affordable,but the process is complicated,” Means“We’re learning how theTheir WingsNew office space helps marketing agency set the stage for faster growth.raw space that was perfect for us. The onlyquestion was, could we afford it?”Close partnershipEnter Mary Moran. About a yearearlier, Grow Marketing’s accountanthad introduced the pair to Moran, VicePresident and <strong>Business</strong> Client Advisor at<strong>Union</strong> <strong>Bank</strong>. They immediately thoughtnotes. “There are lots of hoops and redtape. Mary was always accessible andresponsive, and she helped guide usthrough what could have been a verycomplicated process.”The team kicked into even higher gearwhen it came time for the build out.“The construction costs came tomore than expected, but Cassie andbank can help us on allfronts, including treasuryservices and onlinefinancial management.We’re also planning to takeadvantage of its financingfor working capital.”— Gabrey Means, Co-founderand I gottogether over abottle of wine,”“Cassiereminiscesof her when it came time to seek acommercial real estate loan.“When your accountants and attorneystell you this is a great person to work with,you listen,” Hughes says. “Mary had manyGabrey didn’t want to skimp,” Moranrecalls. “I worked with a <strong>Union</strong> <strong>Bank</strong>credit officer to devise four options, andthey chose one that allowed them tofinance some of the expense. There wereand Creative Director,Grow Marketing“Gabrey and I never thought we’d beGabrey Means about the day she andyears of experience and was fast, efficientsome late-night conference calls andable to do this. We were always confidentCassie Hughes decided to launch theand patient. We knew we could trust her.”emails, but we got it done.”in the future, but we weren’t aware of allmarketing and public relationsA close relationship proved especiallythe options we had,” Hughes explains.agency Grow Marketing in 2001.important when they decided to pursue aGreat results“Mary and <strong>Union</strong> <strong>Bank</strong> opened our“We realized we shared a vision. We<strong>Small</strong> <strong>Business</strong> Administration (SBA) loanThe pair ended up getting an excellentminds to the different ways we can growboth had strong experience withfor the property.deal on the space. “Mary alerted us whenour business. That’s important — formarketing strategy. We wanted tointerest rates were hitting bottom,” MeansGabrey and myself, our employees andcouple it with powerful creative andsays. “<strong>Union</strong> <strong>Bank</strong> offered us an amazingour families.” •flawless execution.”The two partners originally werecompetitors. Hughes managedpublicity for Levi’s, while Means wasthe experiential marketing director forBanana Republic. Once they gottogether, clients rushed to sign up.“Cut to 10 years later,” Means says,“and we’re working with some trulyMary Moran, Vice President and <strong>Business</strong> Client Advisor at <strong>Union</strong> <strong>Bank</strong>, left, helped Hughes andMeans get their SBA loanFast startThat rapid growth posed some challenges.a Victorian building nearby, but it didn’tleave room for growth,” Means says.“When your accountantsand attorneys tell you thisis a great person to workwith, you listen. Mary hadmany years of experienceand was fast, efficient andpatient. We knew wecould trust her.”90-day lock, and we jumped on it. Thelow rate produced a huge difference inour monthly spend.”Since then, Grow Marketing hasdecided to move all of its banking to<strong>Union</strong> <strong>Bank</strong>. “It makes sense,” Meanssays. “We’re learning how the bank canhelp us on all fronts, including treasuryservices and online financial management.world-class brands, including GeneralThe agency’s leased walkup in San Francisco’sHughes remembers the day they— Cassie Hughes, Co-founderWe’re also planning to take advantage ofElectric, Google and Pernod Ricard. Wereally feel lucky to be living the smallbusiness dream.”Cow Hollow district was soon burstingat the seams. The partners rented anotheroffice, but it also filled up. “We consideredfound their dream space. “Gabrey textedme a photo and said, ‘Look at what Ifound in the historic Jackson Squareand Strategy Director,Grow Marketingits financing for working capital.”The future is now an open door forthe Grow Marketing team.Grow Marketing’s new office space is in SanFrancisco’s Jackson Square neighborhood4 | <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong><strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong> | 5

“If it appreciates, buy it.If it depreciates, lease it.”This may sound likesensible advice, but youshould consider other factors whenmaking a buy-lease decision. For example,purchasing may allow you to earnsignificant tax breaks, while leasingcan help you conserve valuableworking capital.“What’s best for your company atone point in time may not be best thenext time you need to buy equipment,”explains Paul Knowlton, Vice Presidentand Sales Team Lead for EquipmentFinance at <strong>Union</strong> <strong>Bank</strong>.Help determine which choice is rightfor you by answering these five questions:1. How long doyou plan to usethe equipment?If you need an asset for just two orthree years or if it has a short lifespan,such as computers, leasing may be theright choice. If the equipment you areconsidering has a long, useful life andyou expect to hold on to it for more than6 | <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong>Buy or Lease:Making the Right ChoiceWeigh your options carefully to help decidewhat’s best for your business.five years, purchasing or financing it maybe the better choice. Office furnitureand certain manufacturing equipmenttypically fall into this category.2. What makes the mostfinancial sense?Buying equipment can tie up capitalthat might be used to meet otherexpenses. Even if you plan to use a loanfor the purchase, making the downpayment — typically 20% of theitem’s cost — can squeeze your cashflow, Knowlton says. Leasing mayrequire no down payment, whichcan help spread your costs more evenly.Many lease agreements include thefinancing of delivery, installation andmaintenance costs, which you wouldneed to pay out of pocket if youwere purchasing.3. How soon do youneed the equipment?Securing a lease can be faster thanreceiving a bank loan. This is helpfulfor companies that need a piece ofequipment quickly.“Leases of $250,000 or less inparticular are generally underwrittenmore simply than a conventional bankloan,” Knowlton says. “Leasingcompanies generally make quickerdecisions with less information.”4. What are the taximplications?Purchasing equipment or securing acapital lease, which gives lessees thebenefits and risks of ownership, canprovide significant depreciationdeductions. Through the end of 2013,IRS section 179 allows companies todeduct up to $500,000 for someequipment. 1 For purchases over $500,000,companies may be able to deduct 50% ofthe overage, in addition to the standarddepreciation deduction. “Some companiesmay already be in a non-taxable situation,so additional depreciation wouldn’t helpthem much,” Knowlton says.A second type of lease, called anoperating lease, does not offerdepreciation benefits but may let youdeduct monthly payments as operatingexpenses. This type of lease generallyoffers lower monthly payments and mayhelp companies that cannot utilizeadditional tax credits or write-offs.5. What if I’ve purchasedequipment and nowneed working capital?If you have bought equipment withinthe past six months and tied up fundsthat could be used for other purposes, youmight benefit from leaseback financing.Under this type of arrangement, yousell the new equipment to a financialinstitution and then lease it back for aspecified period of time.“Companies may purchase equipmentat the end of the year to receive a taxwrite-off and later realize they couldreally use the cash back in their checkingFlexible Choices to MeetYour NeedsWorking with Marlin Leasing Corporation, <strong>Union</strong> <strong>Bank</strong>provides a range of financing options all with flexible leaseterms to help you buy or lease equipment 2 , including:• $1.00 buy-out. This common type of capital lease issuited for businesses that are fairly certain they want toown the equipment at the end of the lease. Once the termends, companies can purchase the equipment for $1.• Fair market value. This type of operating lease offersrelatively low monthly payments and gives a choice toextend the term, return the equipment or buy it at fairmarket value at the end of the agreement.• 10% purchase option. This also provides three options atthe end of the term: Companies can continue to finance theaccount,” Knowlton says. “Leasing backrecently acquired equipment can be a2Equipment financing is provided by Marlin Leasing Corporation. <strong>Union</strong> <strong>Bank</strong> and MarlinLeasing Corporation are separate legal entities, which are not affiliated with each other inany way by common ownership, management, control, or otherwise. <strong>Union</strong> <strong>Bank</strong> makes norepresentations or warranties as to the suitability, accuracy, completeness or timeliness ofthe information provided by third parties. Marlin Leasing Corporation’s equipment financingsubject to lessee credit, collateral, and vendor approval. Restrictions may apply.When considering new equipment that can be used a long time, purchasing may be better than leasingequipment, return it or buy it at 10% of the original cost.Monthly payments are generally higher than for fair marketvalue leases but lower than for $1.00 buy-out leases.<strong>Union</strong> <strong>Bank</strong> also offers conventional and 7(a) loans to helppurchase new equipment or refinance used equipment: 3• Conventional loan for new equipment. Repay the loanwithin 60 months.• Conventional loan for refinancing used equipment.Repay the loan within 48 months.good option in those cases.” •1As always, consult your tax advisor for anytax implications.• SBA 7(a) loan. Receive financing for amounts between$250,000 and $5 million and repayment terms of up to10 years. SBA loans can provide more flexibility thanconventional loans but may come with higher fees.Your <strong>Union</strong> <strong>Bank</strong> <strong>Business</strong> <strong>Bank</strong>er can provide more detailsand help determine the right fit for your business.3Financing subject to credit and collateral approval by <strong>Union</strong> <strong>Bank</strong>. <strong>Small</strong> <strong>Business</strong>Administration financing is subject to credit and collateral approval by the <strong>Small</strong> <strong>Business</strong>Administration. Financing available for businesses and collateral located in CA, OR, orWA. A due diligence fee may be required upon approval. Other fees and restrictionsmay apply. Terms and conditions subject to change.<strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong> | 7

Three Keys toCredit is loosening as theeconomy continues torecover. Experts predictthat the amount of creditextended to small businesses will increasethis year, according to the ProfessionalRisk Managers’ International Association. 1<strong>Union</strong> <strong>Bank</strong> is helping to lead this trend,as it nearly doubled its lending to smallbusinesses in both 2011 and 2012.When a bank evaluates your loanapplication, it looks for answers to somekey questions. These three are typicallyamong the most important, says DianaHallal, Vice President of <strong>Business</strong>Development at <strong>Union</strong> <strong>Bank</strong>.1. Why do you needa loan?Securing a <strong>Business</strong> LoanAnswer these critical questions to help gain the financing you need.“You have a much better chance of gettinga loan if you define your purpose clearly,”Hallal says. “For example, you mightwant to upgrade equipment to becomemore competitive or expand your offeringsto better meet customer demand. Be asspecific as you can.”State the amount you think you’llrequire and detail how you plan tospend the money. Include cost estimates,documentation and other relevantinformation. But don’t be surprised if yourbanker comes back with a smaller number,Hallal warns. “Part of an underwriter’sjob is to form an opinion about what’sneeded,” she says. “A certain amount ofback and forth is normal.”2. How will you repay?To be truly bankable, you shouldunderstand your financial statements andbe able to show why you are a good risk,Hallal says. Your application packageshould cover:• Cash flow. “You need to show a lenderyou have enough income to meet thedebt and can keep payments comingover time,” she says. Cash flowprojections can provide concrete datato help assess risk.• Collateral. This may not be required,depending on the type of loan youwant. Still, it’s a good idea to outlinethe value of property or other assets thatcould be used to secure the loan.• Future prospects. If possible, showhow the loan will strengthen yourcompany’s balance sheet. For example,if buying commercial real estate mayopen up a new market, describe theextra business you expect to gain.3. Is your companywell managed?<strong>Bank</strong>ers need to know your business isbuilt on a firm foundation. “Make it clearyou’re a capable manager and have a goodlong-term plan,” Hallal advises. “The moreyou go beyond the standard applicationand build confidence in your skills, thelikelier you are to get to ‘yes.’”Did You Know?SBA loans reached nearly$18.3 billion in 2012, close tothe level just before the U.S.economic recession.Source: Congressional ResearchService, http://digitalcommons.ilr.cornell.edu/cgi/viewcontent.cgi?article=2113&context=key_workplaceGather Your DocumentsSecuring a loan requires strong documentation. This showsyou have a solid understanding of your company’s finances andcan maintain the cash flow required to repay the debt. Yourapplication package should include the following, says DianaHallal, Vice President of <strong>Business</strong> Development at <strong>Union</strong> <strong>Bank</strong>:• <strong>Business</strong> financial statements. Gather business taxreturns for the past three years, a balance sheet for thecurrent year and supporting documents such as accountsreceivable and accounts payable aging reports.• Personal financial documents. Provide personaltax returns for the past three years and personalfinancial statements.Be prepared to provide thefollowing information:• Company overview. “Paint apicture of your business, clients,suppliers and company history,” Hallalsays. “Give an idea of your futureneeds — a financial projection cancome in handy.”• Personal and professionalbackground. Provide informationincluding previous addresses,educational background and militaryservice, if applicable. Include résumésfor you and any top managers, sincelenders might want evidence of businessor management experience.• Key employee roles. Describe yourmost critical employees and whatwould happen if one were to leave. Alsoexplain who would take over if youstepped down.Ideally, the process of applying for a loanstarts before you need financing. Having astrong banking relationship already in placecan make it easier to learn about the optionsbest suited for your needs. Talk with yourbusiness banker or visit www.unionbank.com/smallbusiness to find out more. 2 •• <strong>Business</strong> plan. Note the products or services youprovide, the size and characteristics of your market, acompetitive analysis and other key information. “This isn’talways required, but it’s definitely needed for an SBA loan,”Hallal says.• Property information. If your company owns property,describe what it was used for in the past and how you use itnow. Also explain your reasons for choosing the location.• <strong>Business</strong> legal documents. These may include articlesof incorporation, licenses and registrations, contracts andcommercial leases. Depending on your business, you mayalso need to provide documents such as appraisals, permitsand environmental reports.1U.S. Consumer Credit Risk: Trends andExpectations, First Quarter 2013, ProfessionalRisk Managers’ International Association,www.slideshare.net/FICO/us-consumer-credit-risktrends-and-expectations-q1-20132Financing subject to credit and collateral approval.Financing available for businesses and collaterallocated in CA, OR or WA. Other fees and restrictionsmay apply. Terms and conditions subject to change.8 | <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong><strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong> | 9

PureGoldWith a decisive new chief, water tech company invests in its future.ACalifornia success story water is used to wash windows) and“We occupied two leased buildingshas sprouted in the wine Universal Studios (where it is sprayed on in Fallbrook, California, and the setupcountry between Los squealing park visitors).was cumbersome,” Pavel says. “We foundAngeles and San Diego. CEO Augustin R. Pavel has expanded it hard to control inventory, and thereAXEON Water Technologies, amanufacturer of water purificationequipment, has grown steadily since itslaunch in 1989.The company specializes in reverseosmosis, or hyper filtration, a process toproduce clean drinking water. The wateris used for more than quenching thirst,though. These days, AXEON serves aroster of clients, including the HotelWynn Las Vegas (where hyper-filteredoperations aggressively in recent years. Hisstory demonstrates how a decisive leadercan use smart investments to help a smallbusiness reach the top of its game.Finding new spacePavel joined the family-owned businessas Vice President in 2003 and was namedCEO in 2011. Almost immediately upontaking the reins, he decided the companyshould move.was no room for growth. I didn’t plan tobuy a building, but when I saw one forsale that had double our space, wecontacted a broker.”Pavel reached out to <strong>Union</strong> <strong>Bank</strong>.AXEON has worked with <strong>Union</strong> <strong>Bank</strong>since its founding in 1989 by AugustinPavel Sr. under the name R.O. UltraTec.In recent years, Thrapp has helped thecompany secure a line of credit andfinance equipment purchases.“It was clear AXEON should seek aFinancing the moveloan guaranteed by the <strong>Small</strong> <strong>Business</strong>“It was clear AXEON should seek aAdministration. An SBA 504 loan wouldloan guaranteed by the <strong>Small</strong> <strong>Business</strong>Administration,” recalls Kelly Kline,reduce the down payment from 25% to<strong>Business</strong> <strong>Bank</strong>ing Regional Vice10% — a big difference, given the sizePresident at <strong>Union</strong> <strong>Bank</strong>. “An SBAof the purchase.”504 loan would reduce the down— Kelly Kline, <strong>Business</strong> <strong>Bank</strong>ing RegionalVice President, <strong>Union</strong> <strong>Bank</strong>payment from 25% to 10% — abig difference, given the size ofthe purchase.”The application process was daunting,and the deal itself was complex. “Theproperty had 12 owners spread aroundthe globe, and we had to get signaturesfrom all of them,” Pavel says. “But theteam at <strong>Union</strong> <strong>Bank</strong> walked us througheverything. They visited us regularly andbrought the SBA partner to meet with uspersonally. We were in touch just aboutevery day.”“It’s fairly unusual to bring an SBArepresentative to a client meeting,”adds Kline. “This speaks to the team’swillingness to go the extra mile forclients. It helps them understand aninvestment quickly so they can go backto focusing on their business.”Upping the investmentAXEON moved into the new buildingin March 2012. As this occurred, <strong>Union</strong><strong>Bank</strong> almost doubled the company’s lineSaving Water and Money“We’re a small business,but <strong>Union</strong> <strong>Bank</strong> doesn’ttreat us like one. We canreach out to people thereat any time, and theyrespond immediately.That’s rare in today’sworld, especially if you’renot a big corporation.”— Augustin R. Pavel, CEO,AXEON Water Technologiesof credit. After the purchase, their credit The company takes advantage ofline was increased a second time. AXEON other <strong>Union</strong> <strong>Bank</strong> services, includingalso secured a five-year term loan to help investment assistance and cashaccelerate its expansion.management tools like remote deposit.“We’re doing well financially, but like <strong>Union</strong> <strong>Bank</strong> also helps Pavel with hismost small businesses, we need capital personal wealth management.to invest in growth,” Pavel says. “Rather “We’re a small business, but <strong>Union</strong>than recruit outside partners, I turned to <strong>Bank</strong> doesn’t treat us like one,” Pavel<strong>Union</strong> <strong>Bank</strong>. The financing has allowed us says. “We can reach out to people there atto upgrade our manufacturing equipment, any time, and they respond immediately.build inventory, do more marketing and That’s rare in today’s world, especially ifdevelop new product lines.”you’re not a big corporation.” •AXEON is just one business becoming more environmentally friendly. Thecompany recently took advantage of a line of credit from <strong>Union</strong> <strong>Bank</strong> to reclaimthe water it uses for product testing. It now uses about a quarter of the water itonce required and slashed its water bill by $2,500 per month. The new systemshould pay for itself in 18 months. Learn how going green can help boostyour bottom line, pages 14-15.10 | <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong><strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong> | 11

What Will HappenWhen YouYour <strong>Bank</strong>erCan HelpSmooth theTransitionYour business banker can beLeave Your Company?a key ally as you craft yoursuccession plan by helping youclarify goals for your companyand ensure a smooth transitionwhen you leave.Your banker can also connectIf you haven’t planned for your succession, now’s the time to start.you with experts to help withyour succession planning, such asa business appraiser, accountant,financial advisor and attorney.If you are like many smallbusiness owners, you probablyspend most of your time focusingon the day-to-day details ofhelp ensure the business continuesaccording to your wishes.It’s never too early to begin planning foryour succession. Even if your exit seems farexplains some of the strategies fortransferring ownership, such as gifts,trusts and family limited partnerships.• Sell the business. If your company hasThis team can help you develop aplan that aligns with your needsand goals. Whether you decideto sell your business or transferit to others, ask your businessrunning your company. But if you wouldlike your business to continue after youleave — perhaps by transferring it to afamily member or selling it to anemployee — you need a succession plan.off, an unexpected event such as death ordisability could force immediate changes.Planning can also help you maximize yourfinancial future and minimize the taxburdens for your successors.multiple owners, you may need a buysellagreement that establishes the valueof each partner’s share and how youcould sell your share to your partners.If you don’t have business partners orbanker and other team membersto help you:• Create a plan to help makesure you’ll have the cash flowrequired to live comfortablyin retirementHaving a carefully developed plan canConsider your optionsanother obvious successor, you mightconsider selling to an outsider.Lay the groundworkgive you time to document key• Manage other aspects ofyour financial strategy, such asHere are three of the most common• Transfer it to employees. You mightOnce you have considered your optionsprocesses and procedures to help theinsurance or college planningchoices for transferring ownership:consider an ownership-sharing tool suchfor transferring ownership, take a fewbusiness run smoothly once you’re gone• Minimize the taxDid You Know?• Pass onto family members. If youras an employee stock ownership planbasic steps to build the foundation for aand to train your successor as youconsequences of your planThe number of small businessesfor sale jumped 62% in the secondquarter of 2013 compared to thesame period in 2012.Source: BizBuySell, www.bizbuysell.com/news/media_insight.htmlspouse, children or other familymembers work in the business and havethe skills to keep it going after youleave, having a plan can help you defineroles and responsibilities and pass onthe business in an equitable way. The(ESOP), which allows a company togradually buy out its existing owners.These plans may not be right for allsmall businesses since they can be costlyto set up and complex to maintain. Youmight also wish to transfer control to asuccession plan. Arrange for a businessvaluation from an appraiser to understandwhat your company is worth. If you planto sell, this can help you increase its valueand understand what your tax liabilitymay be.gradually pull back. It will also allow youto incorporate your succession strategyinto a broader wealth management planthat includes your retirement and estateplanning. Your business banker can helpyou begin to build a plan that helps• Make sure the successionplan integrates smoothlywith your overall wealthmanagement strategy• Develop a plan that ensurescontinuity if you expect totransfer the company to familyAmerican Institute of CPAs ® has putkey employee and begin thinking aboutYou also need to establish a timelinesecure the future for you, your familymembers or employeestogether a report at www.aicpa.org thathow to structure the sale.for when you expect to exit. This willand your company. •12 | <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong><strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong> | 13

Go Green — and Help Grow• Federal and state incentives. Loans,Your Bottom Linegrants and other incentives may beavailable through the U.S. governmentand individual states. Blagbroughrecommends checking the Databasefor State Incentives for Renewables &Fast-Track YourGreen ProjectThe SBA’s <strong>Small</strong> Loan AdvantageProgram can help provide quickaccess to funds for launching anBe good to the environment and to your company.Many small business controls that let you adjust the speed ofowners go green out ventilation fans based on cooling needs.of concern for the • Lighting. Up to one-fifth of a smallenvironment, but company’s energy bill can come fromthere’s also another reason: environmentally lighting, according to the Commercialfriendly practices can add to profits.Energy Auditing Reference Handbook, so“Green retrofits require an investment, finding ways to automate when lightsbut they often pay for themselves quickly,” go on and off can help save money. Forsays Paul Blagbrough, Sustainabilityexample, install occupancy sensors soSpecialist at <strong>Union</strong> <strong>Bank</strong>.rooms are lit only when someone isA recent Office Depot survey shows inside, or use a time clock so lights turnthat 20% of small and midsize businesses off when your business is closed.are more energy efficient than last year, • Water. Making upgrades such asEfficiency at www.dsireusa.org.• PACE financing. Some municipalgovernments offer Property AssessedClean Energy (PACE) loans to helpwith green retrofits.• Utility support. Many utility providersoffer rebates for installing greenequipment, as well as on-bill financing,which lets you pay for an upgrade overtime through your utility bill. Almostall offer free audits to help youidentify energy saving opportunities.“Going green is basically about notwasting things,” Blagbrough says. “Ifyou waste something, you lose money,so energy efficiency can do a lot for yourenergy-efficiency project or otherpurposes. <strong>Union</strong> <strong>Bank</strong> can helparrange this financing.The <strong>Small</strong> Loan AdvantageProgram offers financing up to$50,000 during phase one and upto $350,000 once the programis fully rolled out. High SBAguarantees — 85% for loan amountsup to $100,000 — make it easier tosecure approval.“For a business, using an SBA smallloan advantage loan to fund energyefficiencyimprovements is a simpleway to permanently reduce energycosts,” says Heather Endresen,Senior Vice President and managerof the SBA and GovernmentLending Unit at <strong>Union</strong> <strong>Bank</strong>.and 34% plan to make their companiesinstalling water aerators on faucets orAs with any initiative, do a cost-benefitsee opportunities you haven’t and canbottom line. <strong>Union</strong> <strong>Bank</strong> is committed to<strong>Union</strong> <strong>Bank</strong> participates in thegreener this year. 1Potential cost savingsThe time is right to go green, saysreplacing toilets with high-efficiencymodels can help reduce your water bill.Blagbrough suggests using the EPA’sEnergy Star ® Portfolio Manager toolanalysis first. “Look for the projects withthe fastest payback,” Blagbrough suggests.“Lighting and cooling upgrades usuallypay off quickly. Projects with a fastersuggest ways to fund them,” Blagbroughsays. Programs from the <strong>Small</strong> <strong>Business</strong>Administration may be used to pay forgreen projects.going green — that’s why I’m here. And<strong>Union</strong> <strong>Bank</strong> is very interested in helpingsmall business owners do the same.”If you are looking to make yourprogram as part of a “third look” plan.“Third Look streamlines the loanprocess and helps us offer a varietyof lending options for customers,”Endresen explains. “Those customersBlagbrough, who points to four areaswhere businesses can make some changesand help save money:• Heating and cooling. An HVACto identify other ways to reduce waterconsumption and energy use. Learnmore at www.energystar.gov.• Waste. Look to reduce waste, of course,payback can be carried out with morecostly upgrades to give a bigger benefitthat is still cost effective.”• Lease or lease-purchase. Leasingprograms can help businesses reducetheir upfront expenses for energyefficientequipment. They generallybusiness more energy efficient, <strong>Union</strong><strong>Bank</strong> can help with financing options,including traditional and SBA loans. 2Contact your business banker or visitwho may not qualify for a <strong>Union</strong><strong>Bank</strong> loan will automatically bereferred to the SBA <strong>Small</strong> LoanAdvantage program, and those whomay not qualify for the <strong>Small</strong> Loansystem can account for half a company’senergy expenses. An inefficient systemcan be costly. Check that thermostats(with a thermometer) are workingproperly and that coolant levels in airconditioners and refrigerators arecorrect. You might also considerbut also consider how you manage it.“We did an audit at <strong>Union</strong> <strong>Bank</strong> andfound we were collecting recyclingmaterials when bins were half full,”Blagbrough reports. “The result wasa reduction in the number of pickupsneeded and smaller receptacles.”Expanded financingoptionsAs interest in energy efficiency hasgrown, so has how to pay for theseprojects. Options include:• Conventional and SBA loans. “Workwith an experienced banker who mayrequire little or no down payment, soyou can conserve your cash for coreparts of your business.• ESCO performance contract. Acontract with an Energy ServiceCompany (ESCO) can guarantee savingsin exchange for installing equipment.www.unionbank.com/small-business. •1Office Depot <strong>Small</strong> <strong>Business</strong> Index Finds SMBs AreMotivated to Go Green to Save Money, April 22,2013, http://investor.officedepot.com/phoenix.zhtml?c=94746&p=irol-newsArticle&id=18090902Financing subject to credit and collateral approval by<strong>Union</strong> <strong>Bank</strong>. <strong>Small</strong> <strong>Business</strong> Administration financing issubject to credit and collateral approval by the <strong>Small</strong><strong>Business</strong> Administration. Financing available forbusinesses and collateral located in CA, OR, or WA.A due diligence fee may be required upon approval.Other fees and restrictions may apply. Terms andconditions subject to change.Advantage will be referred to oneof our community-based financingpartners for a third look.”To learn more about the program,talk with your business banker orvisit www.sba.gov/content/small-loan-advantage.14 | <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong><strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong> | 15

Help Safeguard Your <strong>Business</strong>From FraudFraud can cripple a small company. Use this checklist to help keep yours safe.Asingle act of fraud can devastate a small business. Still, many owners don’t implement fraud controls that could savethem from costly losses. For example, only around 20% of businesses with fewer than 100 employees conduct fraudprevention training, compared to almost60% of larger companies, according to theDid You Know?Association of Certified Fraud Examiners. 1This checklist can help you assess your defenses againstthree common types of fraud. Review the following itemsand check each that applies to your business. When youfinish, review the items you haven’t checked and consider31% of all cyber crimes in 2012 were committed against companieswith fewer than 250 employees, up from 18% in 2011.Source: 2013 Internet Security Threat Report, Symantec,www.symantec.com/security_response/publications/threatreport.jspadding them to the measures you currently take.1 Cyber fraudHelp protect your data and funds from online theft.2 Payment fraudMinimize the risk of losing revenue to bad checks or fraudulent3 Employee fraudHelp guard against fraud from within your company.q My staff and I use complex, hard-to-guess passwords forour computers and mobile devices, and we change themregularly.q I have instructed employees to avoid downloadingfiles from unknown sources.q We do not open unsolicited links and attachmentsin emails, even if they appear to come fromreputable sources.q Employees do not give account information online orover the telephone, unless they are authorized to do so.q We use a hardware firewall or have software firewallsinstalled on our computers.q Anti-virus and anti-spyware software is installed oneach computer, and it is up-to-date.q We use a secure connection, such as a virtual privatenetwork, to access company files remotely.credit card transactions.q We require photo identification and make sure the signature onthe ID matches the one on the card or check.q Customer checks must be signed in a staff member’s presence.q I tell my employees to look for signs of tampering, such as alterednumbers on credit cards or missing addresses on checks.q We ask for the card security code — the three- or four-digit numbernear the signature strip — for transactions not conducted in person.q We request telephone numbers for credit card orders in which theshipping and billing addresses do not match.q My staff verifies large overnight orders by calling the customeror the card-issuing bank.q I keep company checks in a secure location and monitor thesupply regularly.q I verify information on checks presented for payment througha positive pay service.q I conduct pre-employment checks, including verification of pastemployment and education, and calling references.q I have a clear anti-fraud policy and communicate it to new employees.q I have implemented a confidential reporting system so employees canreport abuse by others.q Accounting roles are separated — e.g., the employee handlingcustomer payments does not reconcile the bank account.q I review the company’s finances and inventory regularly.q I restrict who can access bank accounts online.q The company updates passwords and other access methods whenpersonnel changes.<strong>Union</strong> <strong>Bank</strong> is committed to the security of its customers’ accounts.Its fraud prevention services include text and email alerts of bankingactivity and blocking of unauthorized electronic withdrawals. To learnmore, visit www.unionbank.com/small-business/checking-savings/bank-securely/index.jsp. •Help Fight Fraud inYour Medical PracticeMedical care providers tend to be especiallyvulnerable to employee fraud. The complexityinvolved with handling billing, copayments anddeductibles often discourages busy practitionersfrom taking more active roles in accountingand bookkeeping. This can make it easier forunscrupulous staff members to siphon off fundsand cover up their actions.Take these steps to help reduce your risk:• Divide financial tasks. Split up accountingfunctions as much as possible. For example, thestaff member who enters charges and paymentsinto your billing software should not also makebank deposits. Ideally, anyone who accepts cashor check copayments is supervised by acolleague who records the transactions.• Review financial documents. Examine bankreconciliations, bank statements and expensereports at least every few months. Inquireabout any unusual transactions. This letsemployees know that you are watching.• Monitor practice results. Prepare a budgeteach year and compare it to your actual results.This can help ensure that financial statementsare being produced regularly and may help youdetect anomalies more quickly.• Enforce vacations. Not taking time off maybe a red flag, since an employee who is stealingfunds may not want to risk being discovered.Requiring vacations and cross-training staffmembers can help prevent these schemes.Ultimately, the best defense against fraud ishaving a trustworthy and well-trained staff.Check applicants’ backgrounds, teach anti-fraudpractices to new employees and review theirperformance regularly.1Association of Certified Fraud Examiners, Report to the Nationson Occupational Fraud and Abuse: 2012 Global Fraud Study,www.acfe.com/rttn.aspx16 | <strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong><strong>Union</strong> <strong>Bank</strong> <strong>Small</strong> <strong>Business</strong> Success <strong>Guide</strong> | 17

NEXTORDER OFBUSINESS:OWN THEBUILDING.If you’ve ever thought of owning your building, now is anideal time to take the next step. Financing rates are athistorically low levels. If you already own your building andare paying more than 5.00% on an existing commercialmortgage, it’s definitely time to refinance.Either way, <strong>Union</strong> <strong>Bank</strong>® lets you lock in your interest ratefor 90 days, and provides up to a 20-year term and a 25-yearamortization period to help lower your monthly payments.<strong>Union</strong> <strong>Bank</strong> provides conventional real estate financing,and we are a Preferred Lender with the <strong>Small</strong> <strong>Business</strong>Administration for their 504 and 7(a) Loan Programs. For nearly150 years, we’ve been helping clients make more of theirbusinesses. The way we see it, it’s just the right thing to do.To learn more, visit unionbank.com/smallbusiness orstop by your local branch to speak with an experiencedbusiness specialist.Not a commitment to lend. Financing subject to credit and collateral approval by <strong>Union</strong> <strong>Bank</strong>. <strong>Small</strong> <strong>Business</strong> Administration financing is subject to credit and collateralapproval by the <strong>Small</strong> <strong>Business</strong> Administration. Financing available for businesses and collateral located in CA, OR, or WA. A due diligence fee may be required uponapproval. Other fees and restrictions may apply. Terms and conditions subject to change.©2013 <strong>Union</strong> <strong>Bank</strong>, N.A. All rights reserved. 8910107 (10/13)