Ready to Go Simply Stated Product Guide - Union Bank

Ready to Go Simply Stated Product Guide - Union Bank

Ready to Go Simply Stated Product Guide - Union Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

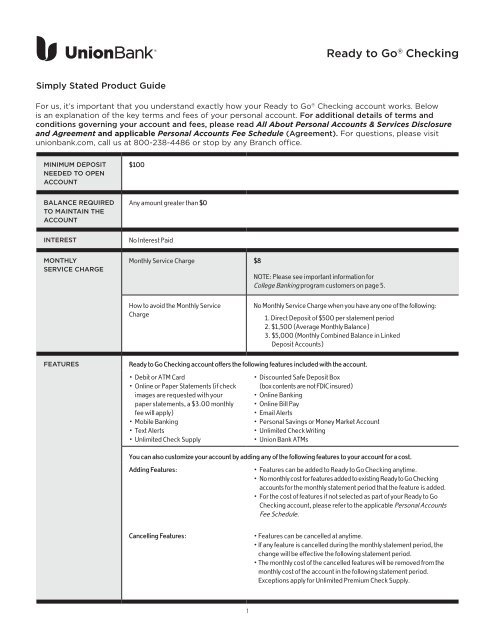

<strong>Ready</strong> <strong>to</strong> <strong>Go</strong> ® Checking<strong>Simply</strong> <strong>Stated</strong> <strong>Product</strong> <strong>Guide</strong>For us, it’s important that you understand exactly how your <strong>Ready</strong> <strong>to</strong> <strong>Go</strong> ® Checking account works. Belowis an explanation of the key terms and fees of your personal account. For additional details of terms andconditions governing your account and fees, please read All About Personal Accounts & Services Disclosureand Agreement and applicable Personal Accounts Fee Schedule (Agreement). For questions, please visitunionbank.com, call us at 800-238-4486 or s<strong>to</strong>p by any Branch office.MINIMUM DEPOSITNEEDED TO OPENACCOUNT$100BALANCE REQUIREDTO MAINTAIN THEACCOUNTAny amount greater than $0INTERESTMONTHLYSERVICE CHARGENo Interest PaidMonthly Service Charge $8NOTE: Please see important information forCollege <strong>Bank</strong>ing program cus<strong>to</strong>mers on page 5.How <strong>to</strong> avoid the Monthly ServiceChargeNo Monthly Service Charge when you have any one of the following:1. Direct Deposit of $500 per statement period2. $1,500 (Average Monthly Balance)3. $5,000 (Monthly Combined Balance in LinkedDeposit Accounts)FEATURES<strong>Ready</strong> <strong>to</strong> <strong>Go</strong> Checking account offers the following features included with the account.• Debit or ATM Card• Online or Paper Statements (if checkimages are requested with yourpaper statements, a $3.00 monthlyfee will apply)• Mobile <strong>Bank</strong>ing• Text Alerts• Unlimited Check Supply• Discounted Safe Deposit Box(box contents are not FDIC insured)• Online <strong>Bank</strong>ing• Online Bill Pay• Email Alerts• Personal Savings or Money Market Account• Unlimited Check Writing• <strong>Union</strong> <strong>Bank</strong> ATMsYou can also cus<strong>to</strong>mize your account by adding any of the following features <strong>to</strong> your account for a cost.Adding Features:• Features can be added <strong>to</strong> <strong>Ready</strong> <strong>to</strong> <strong>Go</strong> Checking anytime.• No monthly cost for features added <strong>to</strong> existing <strong>Ready</strong> <strong>to</strong> <strong>Go</strong> Checkingaccounts for the monthly statement period that the feature is added.• For the cost of features if not selected as part of your <strong>Ready</strong> <strong>to</strong> <strong>Go</strong>Checking account, please refer <strong>to</strong> the applicable Personal AccountsFee Schedule.Cancelling Features:• Features can be cancelled at anytime.• If any feature is cancelled during the monthly statement period, thechange will be effective the following statement period.• The monthly cost of the cancelled features will be removed from themonthly cost of the account in the following statement period.Exceptions apply for Unlimited Premium Check Supply.1

<strong>Ready</strong> <strong>to</strong> <strong>Go</strong> ® Checking<strong>Simply</strong> <strong>Stated</strong> <strong>Product</strong> <strong>Guide</strong>Features at a cost per monthNON-UNION BANKATM TRANSACTIONS(2 per statementperiod)$3.00 Use any non-<strong>Union</strong> <strong>Bank</strong> ATM worldwide for any transaction.No <strong>Union</strong> <strong>Bank</strong> ATM fees and we’ll rebate non-<strong>Union</strong> <strong>Bank</strong>fees for the first two transactions per statement period.If non-<strong>Union</strong> <strong>Bank</strong> ATM transactionsexceed two per statement period,both <strong>Union</strong> <strong>Bank</strong> fee and non-<strong>Union</strong><strong>Bank</strong> ATM providers’ charge willapply. The <strong>Union</strong> <strong>Bank</strong> fee for usage ofnon-<strong>Union</strong> <strong>Bank</strong> ATM is $2.00 withinthe US and $5.00 outside the 50 UnitedStates. Additional fee charged bynon-<strong>Union</strong> <strong>Bank</strong> ATM providers mayvary. Monthly feature cost of $3.00will apply even if the service was notused during the statement period.INCOMING WIRETRANSFERS$1.00 Receive unlimited wire transfers in<strong>to</strong> your <strong>Ready</strong> <strong>to</strong> <strong>Go</strong>Checking account.Monthly feature cost of $1.00 willapply even if the service was notused during the statement period.Incoming Wire Fees only. Outgoingwire fees still apply. Please seePersonal Accounts Fee Schedule formore information.CASHIER’S CHECKS &MONEY ORDERS$1.00 Get unlimited Cashier’s Checks and Money Orders. Monthly feature cost of $1.00 willapply even if the service was notused during the statement period.EXPEDITED CARDDELIVERY$1.00 Have a replacement ATM or Debit Card sent <strong>to</strong> you within twodays from the time you request it.Monthly feature cost of $1.00 willapply even if the service was notused during the statement period.UNLIMITED PREMIUMCHECK SUPPLY$1.75 Receive an unlimited supply of personalized checks in any style.For many cus<strong>to</strong>mers, this feature is a money-saver compared <strong>to</strong>the standard cost of check printing.If cancelled within 12 months and acheck order was processed withinthe last 6 months, your account willbe debited the $1.75 monthly cost foreach of the remaining months.ATM FEES <strong>Union</strong> <strong>Bank</strong> ATM $0 When using a <strong>Union</strong> <strong>Bank</strong> ATM <strong>to</strong> complete deposits, withdrawals, and transfersbetween linked <strong>Union</strong> <strong>Bank</strong> accounts.$1 When using a <strong>Union</strong> <strong>Bank</strong> ATM <strong>to</strong> obtain a mini statement.Non-<strong>Union</strong> <strong>Bank</strong> ATM $2 For any Inquiries, Transfers, or Withdrawals while using a domestic non-<strong>Union</strong><strong>Bank</strong> ATM, plus any fees the ATM owner or opera<strong>to</strong>r may charge.$5 For any Inquiries, Transfers, or Withdrawals while using a non-<strong>Union</strong> <strong>Bank</strong> ATMoutside of the U.S., including Puer<strong>to</strong> Rico and the U.S., plus any fees the ATMowner may charge.These fees apply in the following situations:1) If you do not choose the non-<strong>Union</strong> <strong>Bank</strong> ATM Transactions Feature.2) If you select the feature but exceed 2 non-<strong>Union</strong> <strong>Bank</strong> ATM Transactions per month.2

<strong>Ready</strong> <strong>to</strong> <strong>Go</strong> ® Checking<strong>Simply</strong> <strong>Stated</strong> <strong>Product</strong> <strong>Guide</strong>Fees for using your account when funds are not availableOVERDRAFTFEESCONTINUEDOVERDRAFT FEEOVERDRAFTPROTECTIONTRANSFER ORADVANCE FEE(if you are enrolled)$33 For each Item received for payment when you do not have enough money in your account or through anOverdraft Protection service. The fee is charged when the Item is paid (Overdraft Item Paid) or returned(Overdraft Item Returned). There is a maximum of 5 Overdraft Fees per day. We will not charge this fee ifyour account is overdrawn less than $5.00.$6 Daily fee is charged for up <strong>to</strong> 5 business days beginning the 7th calendar day the account has beencontinuously overdrawn. The 1st calendar day is the day the overdraft occurred. No more than $30 will becharged for each period of continued overdraft.$10 Each day a transfer or advance of Available Funds is made through Deposit Overdraft Protection, Cash ReserveAccount, or Overdraft Protection linked <strong>to</strong> a <strong>Union</strong> <strong>Bank</strong> credit card.Please see All About Personal Accounts & Services Disclosure and Agreement for details.STANDARDOVERDRAFTCOVERAGEAND FEES(Please seeOverdraft Feesabove)• We may au<strong>to</strong>matically add Standard Overdraft Coverage <strong>to</strong> your account approximately 30 calendar days afteraccount opening.• Whether we authorize or pay an Item depends upon several fac<strong>to</strong>rs, including your account-related behavior.Once we add Standard Overdraft Coverage <strong>to</strong> your account, we may choose <strong>to</strong> authorize and pay overdrafts for thefollowing types of transactions: Checks, Bill Payments, ACH debits and recurring debit card transactions (such asgym membership payments).• You can choose <strong>to</strong> cancel Standard Overdraft Coverage. However, if you cancel your Standard Overdraft Coverage,any Debit Card Overdraft Coverage (see below) you may have will au<strong>to</strong>matically be cancelled.• If you cancel Standard Overdraft Coverage and you do not have enough money in your account or through a linkedoverdraft protection service, and we return an Item, you will be charged an Overdraft Fee and possibly additionalfees by the merchant.DEBIT CARDOVERDRAFTCOVERAGEAND FEES(Please seeOverdraft Feesabove)You can choose how we treat your ATM withdrawals and one-time ATM/Debit Card purchases when you don’t haveenough money available in your account.Please Note: Regardless of which option you choose for Debit Card Overdraft Coverage, you may also want <strong>to</strong>consider an Overdraft Protection service.Option #1 (Yes):Option #2 (No):You ask us <strong>to</strong> add <strong>Union</strong> <strong>Bank</strong> Debit Card Overdraft Coverage <strong>to</strong> your account.This means you want <strong>Union</strong> <strong>Bank</strong> <strong>to</strong> approve and pay your ATM withdrawals and one-timeATM/Debit Card purchases, at our discretion, when you don’t have enough money available.Overdraft Fees will apply.You do not want <strong>Union</strong> <strong>Bank</strong> Debit Card Overdraft Coverage. (If you don’t choose an optionwhen you open your account, Option #2 (No) is au<strong>to</strong>matically selected for you.)This means you do not want <strong>Union</strong> <strong>Bank</strong> <strong>to</strong> approve and pay your ATM withdrawals andone-time ATM/Debit Card purchases when you don’t have enough money available in youraccount for the transaction. Since these transactions will be declined when there is not enoughmoney available, you will not be charged Overdraft Fees.You may enroll, cancel and/or re-enroll in this service at any time through Online <strong>Bank</strong>ing or by contacting us.3

<strong>Ready</strong> <strong>to</strong> <strong>Go</strong> ® Checking<strong>Simply</strong> <strong>Stated</strong> <strong>Product</strong> <strong>Guide</strong>HOW DEPOSITS ANDWITHDRAWALSWORKThe Order inWhich Deposits andWithdrawals areProcessedFor each business day we will:1. Add deposits <strong>to</strong> your account, then2. Subtract Items in the following order: <strong>Union</strong> <strong>Bank</strong> Items, transactions, and fees,followed by ATM/Debit Card transactions, within each category in ascendingorder (lowest <strong>to</strong> highest) by amount, then3. Subtract all other Items such as checks, bill payments, electronic debits(like ACH) in descending order (highest <strong>to</strong> lowest) by amount.When Your DepositsAre Available(Please refer <strong>to</strong> the AllAbout Personal Accounts& Services Disclosureand Agreement for fullFunds Availability details)• Cash –by the 1st Business Day after deposit.• Checks – generally the 1st Business Day after deposit, but sometimes longer• Electronic direct deposit - same Business DayA “business day” is a non-holiday weekday generally ending at 5 p.m., even thoughwe may be open Saturday or Sunday.If you make a deposit before the close of business on a Business Day that we are open,or as posted, we will consider that day <strong>to</strong> be the day of your deposit.• In most cases, the first $200 of your deposit will be available by the1st Business day.• If we are not going <strong>to</strong> make all deposited funds available by the 1st BusinessDay, we will notify you of the hold reason and when your funds will be available(generally no later than the 7th Business Day after the day of deposit).Additional servicesSOME OTHER FEES S<strong>to</strong>p Payment Fee $30 Per Item, or range of Items if the s<strong>to</strong>p payment is placed through Telephone<strong>Bank</strong>ing Personal Service or at a <strong>Bank</strong>ing Office.$15 Per Item, if the s<strong>to</strong>p payment order is placed through Online <strong>Bank</strong>ing orTelephone <strong>Bank</strong>ing Direct Service at 800-238-4486.Deposited ItemReturned Fee$6 For each Item you deposit or each check cashed that is returned unpaid.Example: You deposit a check from someone who didn’t have enough money in theiraccount. The amount of the deposit will be subtracted from your balance and you willbe charged the Deposited Item Returned Fee.STATEMENTSERVICESSnapshot Statement (without checks):Lists all activity for your account since the beginning of the statementperiod; ordered through Telephone <strong>Bank</strong>ing or at a branch.$5 per statementStatement Copy:Providing additional copies of your statement.$3 per statement (Telephone<strong>Bank</strong>ing Direct Service)$5 per statement4

<strong>Ready</strong> <strong>to</strong> <strong>Go</strong> ® Checking<strong>Simply</strong> <strong>Stated</strong> <strong>Product</strong> <strong>Guide</strong>WIRE TRANSFERS Outgoing Domestic Wires $20 (Direct Access)$25 (Branch) -In Person$45 (Cus<strong>to</strong>mer Service-Phone/Fax)Outgoing International Wires – USD$45 (Direct Access)$50(Branch) -In Person$65 (Cus<strong>to</strong>mer Service-Phone/Fax)Outgoing International Wires – Foreign Currency$35 (Direct Access)$40 (Branch) -In Person$55 (Cus<strong>to</strong>mer Service-Phone/Fax)Fees for other services not listed here may be assessed-see applicable Personal Accounts Fee Schedule.College <strong>Bank</strong>ing program cus<strong>to</strong>mers: No Monthly Service Charge when you present your valid college ID at account openingand each year (up <strong>to</strong> 5 consecutive years). If you do not present your valid college ID each year, or after year 5, you canavoid the Monthly Service Charge by meeting the requirements listed in the How <strong>to</strong> avoid the Monthly Service Charge sectionof this <strong>Product</strong> <strong>Guide</strong>.©2015 MUFG <strong>Union</strong> <strong>Bank</strong>, N.A. All rights reserved. Member FDIC.<strong>Union</strong> <strong>Bank</strong> is a registered trademark and brand name of MUFG <strong>Union</strong> <strong>Bank</strong>, N.A. unionbank.com5807002-002 (12/13/14)