Waste Management Strategy - full version - City of Whittlesea

Waste Management Strategy - full version - City of Whittlesea

Waste Management Strategy - full version - City of Whittlesea

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

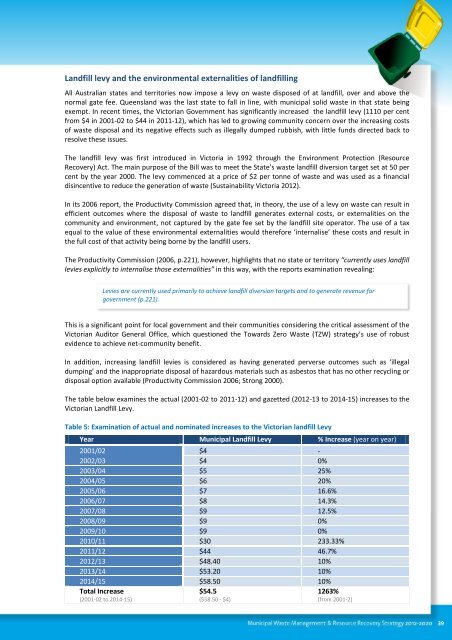

Landfill levy and the environmental externalities <strong>of</strong> landfillingAll Australian states and territories now impose a levy on waste disposed <strong>of</strong> at landfill, over and above thenormal gate fee. Queensland was the last state to fall in line, with municipal solid waste in that state beingexempt. In recent times, the Victorian Government has significantly increased the landfill levy (1110 per centfrom $4 in 2001-02 to $44 in 2011-12), which has led to growing community concern over the increasing costs<strong>of</strong> waste disposal and its negative effects such as illegally dumped rubbish, with little funds directed back toresolve these issues.The landfill levy was first introduced in Victoria in 1992 through the Environment Protection (ResourceRecovery) Act. The main purpose <strong>of</strong> the Bill was to meet the State’s waste landfill di<strong>version</strong> target set at 50 percent by the year 2000. The levy commenced at a price <strong>of</strong> $2 per tonne <strong>of</strong> waste and was used as a financialdisincentive to reduce the generation <strong>of</strong> waste (Sustainability Victoria 2012).In its 2006 report, the Productivity Commission agreed that, in theory, the use <strong>of</strong> a levy on waste can result inefficient outcomes where the disposal <strong>of</strong> waste to landfill generates external costs, or externalities on thecommunity and environment, not captured by the gate fee set by the landfill site operator. The use <strong>of</strong> a taxequal to the value <strong>of</strong> these environmental externalities would therefore ‘internalise’ these costs and result inthe <strong>full</strong> cost <strong>of</strong> that activity being borne by the landfill users.The Productivity Commission (2006, p.221), however, highlights that no state or territory “currently uses landfilllevies explicitly to internalise those externalities” in this way, with the reports examination revealing:Levies are currently used primarily to achieve landfill di<strong>version</strong> targets and to generate revenue forgovernment (p.221).This is a significant point for local government and their communities considering the critical assessment <strong>of</strong> theVictorian Auditor General Office, which questioned the Towards Zero <strong>Waste</strong> (TZW) strategy’s use <strong>of</strong> robustevidence to achieve net-community benefit.In addition, increasing landfill levies is considered as having generated perverse outcomes such as ‘illegaldumping’ and the inappropriate disposal <strong>of</strong> hazardous materials such as asbestos that has no other recycling ordisposal option available (Productivity Commission 2006; Strong 2000).The table below examines the actual (2001-02 to 2011-12) and gazetted (2012-13 to 2014-15) increases to theVictorian Landfill Levy.Table 5: Examination <strong>of</strong> actual and nominated increases to the Victorian landfill LevyYear Municipal Landfill Levy % Increase (year on year)2001/02 $4 -2002/03 $4 0%2003/04 $5 25%2004/05 $6 20%2005/06 $7 16.6%2006/07 $8 14.3%2007/08 $9 12.5%2008/09 $9 0%2009/10 $9 0%2010/11 $30 233.33%2011/12 $44 46.7%2012/13 $48.40 10%2013/14 $53.20 10%2014/15 $58.50 10%Total Increase(2001-02 to 2014-15)$54.5($58.50 - $4)1263%(from 2001-2)39