Common Key Information Memorandum cum Application Form

Common Key Information Memorandum cum Application Form

Common Key Information Memorandum cum Application Form

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

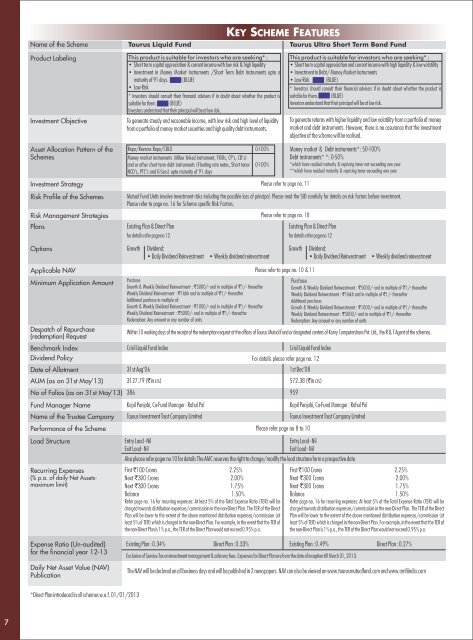

Name of the SchemeTaurus Liquid FundKEY SCHEME FEATURESTaurus Ultra Short Term Bond FundProduct LabelingInvestment ObjectiveThis product is suitable for investors who are seeking* :• Short term capital appreciation & current income with low risk & high liquidity• Investment in Money Market Instruments /Short Term Debt Instruments upto amaturity of 91 days. (BLUE)• Low Risk* Investors should consult their financial advisers if in doubt about whether the product issuitable for them. (BLUE)Investors understand that their principal will be at low risk.To generate steady and reasonable income, with low risk and high level of liquidityfrom a portfolio of money market securities and high quality debt instruments.This product is suitable for investors who are seeking* :• Short term capital appreciation and current income with high liquidity & low volatility• Investment in Debt/ Money Market Instruments• Low Risk (BLUE)* Investors should consult their financial advisers if in doubt about whether the product issuitable for them. (BLUE)Investors understand that their principal will be at low risk.To generate returns with higher liquidity and low volatility from a portfolio of moneymarket and debt instruments. However, there is no assurance that the investmentobjective of the scheme will be realised.Asset Allocation Pattern of theSchemesInvestment StrategyRisk Profile of the SchemesRisk Management StrategiesPlansRepo/Reverse Repo/CBLO 0-100%Money market instruments (Mibor linked instrument, T-Bills, CP’s, CD’s)and or other short term debt instruments (Floating rate notes, Short tenor 0-100%NCD’s, PTC’s and G-Secs) upto maturity of 91 daysPlease refer to page no. 11Mutual Fund Units involve investment risks including the possible loss of principal. Please read the SID carefully for details on risk factors before investment.Please refer to page no. 16 for Scheme specific Risk Factors.Existing Plan & Direct Planfor details refer page no 12Please refer to page no. 18Money market & Debt instruments*: 50-100%Debt instruments* *: 0-50%*which have residual maturity & repricing tenor not exceeding one year**which have residual maturity & repricing tenor exceeding one yearExisting Plan & Direct Planfor details refer page no 12OptionsGrowthDividend:• Daily Dividend Reinvestment• Weekly dividend reinvestmentGrowthDividend:• Daily Dividend Reinvestment• Weekly dividend reinvestmentApplicable NAVMinimum <strong>Application</strong> AmountDespatch of Repurchase(redemption) RequestBenchmark IndexDividend PolicyDate of AllotmentAUM (as on 31st May’13)No of Folios (as on 31st May’13)Fund Manager NameName of the Trustee CompanyLoad StructureRecurring Expenses(% p.a. of daily Net Assetsmaximumlimit)PurchaseGrowth & Weekly Dividend Reinvestment : `5000/- and in multiple of `1/- thereafterWeekly Dividend Reinvestment : `1lakh and in multiple of `1/- thereafterAdditional purchase in multiple of:Growth & Weekly Dividend Reinvestment : `1000/- and in multiple of `1/- thereafterWeekly Dividend Reinvestment : `5000/- and in multiple of `1/- thereafterRedemption: Any amount or any number of unitsPlease refer to page no. 10 & 11Within 10 working days of the receipt of the redemption request at the offices of Taurus Mutual Fund or designated centers of Karvy Computershare Pvt. Ltd., the R & T Agent of the schemes.Crisil Liquid Fund Index31st Aug'063127.79 (`in crs)386Kapil Punjabi, Co-Fund Manager : Rahul PalTaurus Investment Trust Company LimitedEntry Load - NilExit Load - NilFor details please refer page no. 12Performance of the Scheme Please refer page no 8 to 10Also please refer pager no 10 for details The AMC reserves the right to change/modify the load structure form a prospective dateFirst `100 Crores 2.25%Next `300 Crores 2.00%Next `300 Crores 1.75%Balance 1.50%Refer page no. 16 for recurring expenses: At least 5% of the Total Expense Ratio (TER) will becharged towards distribution expenses/commissioin in the non-Direct Plan. The TER of the DirectPlan will be lower to the extent of the above mentioned distribution expenses/commission (atleast 5% of TER) which is charged in the non-Direct Plan. For example, in the event that the TER ofthe non-Direct Plan is 1% p.a., the TER of the Direct Plan would not exceed 0.95% p.a.PurchaseGrowth & Weekly Dividend Reinvestment : `5000/- and in multiple of `1/- thereafterWeekly Dividend Reinvestment : `1lakh and in multiple of `1/- thereafterAdditional purchase:Growth & Weekly Dividend Reinvestment : `1000/- and in multiple of `1/- thereafterWeekly Dividend Reinvestment : `5000/- and in multiple of `1/- thereafterRedemption: Any amount or any number of unitsCrisil Liquid Fund Index1st Dec'08572.38 (`in crs)959Kapil Punjabi, Co-Fund Manager : Rahul PalTaurus Investment Trust Company LimitedEntry Load - NilExit Load - NilFirst `100 Crores 2.25%Next `300 Crores 2.00%Next `300 Crores 1.75%Balance 1.50%Refer page no. 16 for recurring expenses: At least 5% of the Total Expense Ratio (TER) will becharged towards distribution expenses/commissioin in the non-Direct Plan. The TER of the DirectPlan will be lower to the extent of the above mentioned distribution expenses/commission (atleast 5% of TER) which is charged in the non-Direct Plan. For example, in the event that the TER ofthe non-Direct Plan is 1% p.a., the TER of the Direct Plan would not exceed 0.95% p.a.Expense Ratio (Un-audited)for the financial year 12-13Daily Net Asset Value (NAV)PublicationExisting Plan : 0.34% Direct Plan : 0.33% Existing Plan : 0.49% Direct Plan : 0.27%Exclusive of Service Tax on investment management & advisory fees. Expenses for Direct Plan are from the date of inception till March 31, 2013.The NAV will be declared on all business days and will be published in 2 newspapers. NAV can also be viewed on www.taurusmutualfund.com and www.amfiindia.com*Direct Plan introduced in all schemes w.e.f. 01/01/20137