Infrastructure investor May 2008 - Simon Griffiths

Infrastructure investor May 2008 - Simon Griffiths

Infrastructure investor May 2008 - Simon Griffiths

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

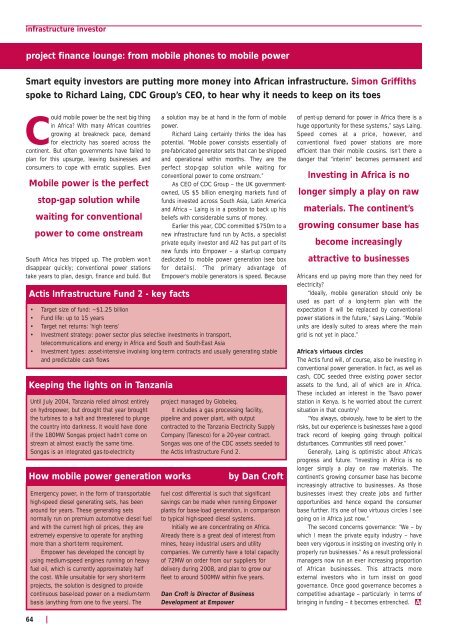

infrastructure <strong>investor</strong>project finance lounge: from mobile phones to mobile powerSmart equity <strong>investor</strong>s are putting more money into African infrastructure. <strong>Simon</strong> <strong>Griffiths</strong>spoke to Richard Laing, CDC Group’s CEO, to hear why it needs to keep on its toesCould mobile power be the next big thingin Africa? With many African countriesgrowing at breakneck pace, demandfor electricity has soared across thecontinent. But often governments have failed toplan for this upsurge, leaving businesses andconsumers to cope with erratic supplies. EvenMobile power is the perfectstop-gap solution whilewaiting for conventionalpower to come onstreamSouth Africa has tripped up. The problem won’tdisappear quickly; conventional power stationstake years to plan, design, finance and build. ButActis <strong>Infrastructure</strong> Fund 2 - key factsa solution may be at hand in the form of mobilepower.Richard Laing certainly thinks the idea haspotential. “Mobile power consists essentially ofpre-fabricated generator sets that can be shippedand operational within months. They are theperfect stop-gap solution while waiting forconventional power to come onstream.”As CEO of CDC Group – the UK governmentowned,US $5 billion emerging markets fund offunds invested across South Asia, Latin Americaand Africa – Laing is in a position to back up hisbeliefs with considerable sums of money.Earlier this year, CDC committed $750m to anew infrastructure fund run by Actis, a specialistprivate equity <strong>investor</strong> and AI2 has put part of itsnew funds into Empower – a start-up companydedicated to mobile power generation (see boxfor details). “The primary advantage ofEmpower’s mobile generators is speed. Because• Target size of fund: ~$1.25 billion• Fund life: up to 15 years• Target net returns: ‘high teens’• Investment strategy: power sector plus selective investments in transport,telecommunications and energy in Africa and South and South-East Asia• Investment types: asset-intensive involving long-term contracts and usually generating stableand predictable cash flowsKeeping the lights on in TanzaniaUntil July 2004, Tanzania relied almost entirelyon hydropower, but drought that year broughtthe turbines to a halt and threatened to plungethe country into darkness. It would have doneif the 180MW Songas project hadn’t come onstream at almost exactly the same time.Songas is an integrated gas-to-electricityHow mobile power generation worksEmergency power, in the form of transportablehigh-speed diesel generating sets, has beenaround for years. These generating setsnormally run on premium automotive diesel fueland with the current high oil prices, they areextremely expensive to operate for anythingmore than a short-term requirement.Empower has developed the concept byusing medium-speed engines running on heavyfuel oil, which is currently approximately halfthe cost. While unsuitable for very short-termprojects, the solution is designed to providecontinuous base-load power on a medium-termbasis (anything from one to five years). Theproject managed by Globeleq.It includes a gas processing facility,pipeline and power plant, with outputcontracted to the Tanzania Electricity SupplyCompany (Tanesco) for a 20-year contract.Songas was one of the CDC assets seeded tothe Actis <strong>Infrastructure</strong> Fund 2.fuel cost differential is such that significantsavings can be made when running Empowerplants for base-load generation, in comparisonto typical high-speed diesel systems.Initially we are concentrating on Africa.Already there is a great deal of interest frommines, heavy industrial users and utilitycompanies. We currently have a total capacityof 72MW on order from our suppliers fordelivery during <strong>2008</strong>, and plan to grow ourfleet to around 500MW within five years.Dan Croft is Director of BusinessDevelopment at Empowerby Dan Croftof pent-up demand for power in Africa there is ahuge opportunity for these systems,” says Laing.Speed comes at a price, however, andconventional fixed power stations are moreefficient than their mobile cousins. Isn’t there adanger that “interim” becomes permanent andInvesting in Africa is nolonger simply a play on rawmaterials. The continent’sgrowing consumer base hasbecome increasinglyattractive to businessesAfricans end up paying more than they need forelectricity?“Ideally, mobile generation should only beused as part of a long-term plan with theexpectation it will be replaced by conventionalpower stations in the future,” says Laing. “Mobileunits are ideally suited to areas where the maingrid is not yet in place.”Africa’s virtuous circlesThe Actis fund will, of course, also be investing inconventional power generation. In fact, as well ascash, CDC seeded three existing power sectorassets to the fund, all of which are in Africa.These included an interest in the Tsavo powerstation in Kenya. Is he worried about the currentsituation in that country?“You always, obviously, have to be alert to therisks, but our experience is businesses have a goodtrack record of keeping going through politicaldisturbances. Communities still need power.”Generally, Laing is optimistic about Africa’sprogress and future. “Investing in Africa is nolonger simply a play on raw materials. Thecontinent’s growing consumer base has becomeincreasingly attractive to businesses. As thosebusinesses invest they create jobs and furtheropportunities and hence expand the consumerbase further. It’s one of two virtuous circles I seegoing on in Africa just now.”The second concerns governance: “We – bywhich I mean the private equity industry – havebeen very vigorous in insisting on investing only inproperly run businesses.” As a result professionalmanagers now run an ever increasing proportionof African businesses. This attracts moreexternal <strong>investor</strong>s who in turn insist on goodgovernance. Once good governance becomes acompetitive advantage – particularly in terms ofbringing in funding – it becomes entrenched.64