Infrastructure investor March 200 - Simon Griffiths

Infrastructure investor March 200 - Simon Griffiths

Infrastructure investor March 200 - Simon Griffiths

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

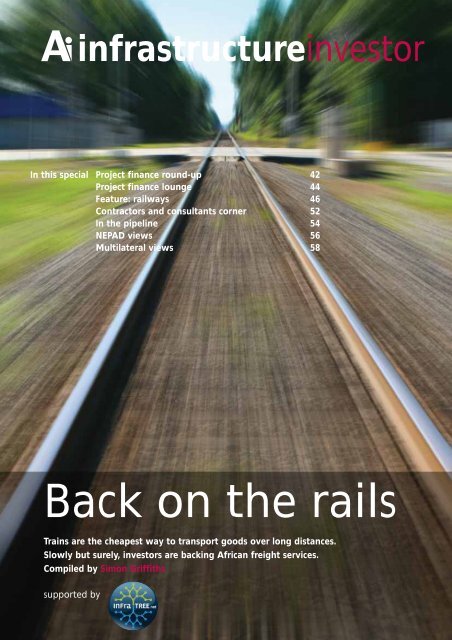

infrastructure<strong>investor</strong>In this special Project finance round-up 42Project finance lounge 44Feature: railways 46Contractors and consultants corner 52In the pipeline 54NEPAD views 56Multilateral views 58Back on the railsTrains are the cheapest way to transport goods over long distances.Slowly but surely, <strong>investor</strong>s are backing African freight services.Compiled by <strong>Simon</strong> <strong>Griffiths</strong>supported by

infrastructure <strong>investor</strong>project finance round-up<strong>Simon</strong> <strong>Griffiths</strong> sees significant changes in the Africa project finance league tablesStandard Chartered Bank moved into topspot in the league table of mandatedarrangers of African project financeloans in <strong>200</strong>6, up from fourth a yearago. The bank acted as mandated arranger onfive major deals, including Sonangol Sinopec,Kwale Titanium Mineral Sands and the LumwanaCopper Project. “The results are a reflection ofour execution capability and clear focus onAfrica,” says Ade Adeola, Regional Head of Sales& Business Development for Africa with StandardChartered Bank.South Africa’s Standard Bank is a new entryat number four, with three project finance deals.Jonathan Wood, a director of project finance withStandard Bank, confesses <strong>200</strong>6 was “a verybusy year across all sectors, but particularly inmining and infrastructure”.This is reflected by the presence of threemining projects in the top ten African deals of<strong>200</strong>6, all of which have featured in this columnpreviously.The power sector features three projects inthe top ten, although Sidi Krir was a refinancing.At number two on the projects list, the Hadjret EnNouss independent power plant (IPP) will add1,227MW to Algeria’s electricity supplies. Calyon,an investment bank that advised on thestructuring of the deal, says “the US $640 millondebt package represents the largest limitedrecourse project financing in Algeria funded indinars through Algerian banks.” The Caimanproject refers to Tanjong Plc’s acquisition of thePort Said and Suez Gulf Independent PowerStations in Egypt.Shifting landscapeThe growing influence of China in Africa’s projectfinance market is clear from the league table ofproviders of project finance loans. The ChinaDevelopment Bank and the Export-Import Bank ofChina take up the top two slots. However, thisrepresents their investment in just onetransaction, the massive Sonangol/Sinopec deal.Other banks have been more active in terms ofnumbers of deals.The legal advisors’ table is alsocharacterised by new entrants. Norton Rose andJones Day, with three deals apiece, pushed lastyear’s number one, Allen & Overy, into thirdplace. Arman Galledari, a partner specialising inproject finance at Jones Day, cautions that “Africahas always had great potential but it is clear thatthere is an imbalance between demand forinfrastructure and supply of funds to financeprojects – at least at rates acceptable to<strong>investor</strong>s.” Nevertheless, growing interest fromprivate equity <strong>investor</strong>s should help to bring downthe cost of debt financing.Standard Bank’s Jonathan Wood is optimisticfor another good year, starting off with theGautrain project (see page 49). “Given currentcommodity prices, mining will continue to begood,” he says. In telecommunications we arelikely to see continued consolidation with severalsmaller operators as possible takeover targets.We should also see more IPPs and toll roads.However, “governments are still not fully on top ofpublic-private partnerships (PPPs) and in SouthAfrica, PPPs have stalled.”Part of the problem lies in limitedgovernment resources to structure solid PPPproposals. Second, the perception continues thatpublic finance is quicker and cheaper.This is especially the case for the largeAfrican parastatals that continue to use theirbalance sheets to fund infrastructuredevelopment.Local project finance takes rootStandard Chartered’s Adeola says increasedappetite from banks to lend into African projectfinance transactions has encouraged sponsors topush forward with their infrastructure deals. “Weare currently advising on major projects in oil andgas, minerals and power, which are likely tocome to market in <strong>200</strong>7 or <strong>200</strong>8,” he says.“Some of these projects will be seeking in excessof $1 billion.” When asked about significanttrends, Adeola mentions improving Asia-Africatrade and investment flows and the recognition ofAfrican deals as a viable asset class byinternational banks and ratings agencies. Therewill also be increased use of hedging products forpartial risk mitigation.Vishal Agarwal, Head of <strong>Infrastructure</strong>Finance (sub-Saharan Africa), with PricewaterhouseCoopers,is also bullish on Africa’sprospects for <strong>200</strong>7. “Higher savings andincreasing strength of Africa’s capital marketsmean more money is becoming available forinfrastructure. Also, there is increasedparticipation in infrastructure from localinvestment funds, sponsors and businesses,which means we are seeing the development of arobust project finance market.”Agarwal cautions that African project financedeals still take a long time to get done and atremendous amount of driving of deals on theground is needed. “You cannot do these deals byflying in from London every now and then.”Top ten African project finance deals <strong>200</strong>6Project Name Borrower Amt (US $m) Sector Country Financial close dateSonangol Sinopec International Sonangol Sinopec International 2111.0 Oilfield exploration and development Angola 12-May-06Hadjret En Nouss Project Shariket Kahraba Hadjret En Nouss SpA 920.0 Power Algeria 10-Oct-06Bonny Gas Refinancing Bonny Gas Transport Ltd - BGT 680.0 Oil Refinery/LNG and LPG Plants Nigeria 29-Sep-06Lumwana Copper Project Equinox Copper Ventures 583.8 Mining Zambia 1-Dec-06N4 Maputo Corridor Toll Road Refinancing Trans African Concessions (Pty) Ltd 478.0 Road South Africa 29-Mar-06Caiman Project Kuasa Nusajaya Ltd 476.0 Power Egypt 2-Mar-06Ahafo Gold Project Newmont Ghana Gold Ltd 470.0 Mining Ghana 14-Jul-06Calabar Cement & Power Plant United Cement Co of Nigeria Ltd - UNICEM 428.0 Processing plant Nigeria 21-Sep-06Sidi Krir Thermal Power Refinancing Sidi Krir Generating Co Ltd 251.0 Power Egypt 28-Apr-06Kwale Titanium Mineral Sands Tiomin Kenya Ltd 226.0 Mining Kenya 31-Jul-06Source: Dealogic42

infrastructure <strong>investor</strong>project finance round-upAfrica project finance rankings <strong>200</strong>6Top 10 Mandated Arrangers of African Project Finance LoansFinancial Close between 1 Jan <strong>200</strong>6 - 31 Dec <strong>200</strong>6Pos. Mandated Arranger Amount($m.) No. %share1 Standard Chartered plc 366.2 5 7.542 Investec Ltd & plc 354.0 3 7.293 Citigroup Inc 299.1 3 6.164 Standard Bank Group Ltd 299.0 3 6.165 BNP Paribas SA 290.5 3 5.986 Societe Generale 179.5 3 3.707 ING Groep NV 169.5 2 3.498 Banque Exterieure d'Algerie 160.0 1 3.298 Banque Nationale d'Algerie - BNA 160.0 1 3.298 Caisse Nationale d'Epargne et de Prevoyance Banque 160.0 1 3.298 Credit Populaire d'Algerie 160.0 1 3.29Top 10 Providers of African Project Finance LoansFinancial Close between 1 Jan <strong>200</strong>6 - 31 Dec <strong>200</strong>6Pos. Provider Loan Amt ($m.) No. %share1 China Development Bank 205.0 1 5.112 Export-Import Bank of China <strong>200</strong>.0 1 4.983 Societe Generale 187.0 3 4.664 BNP Paribas SA 176.8 2 4.404 ING Groep NV 176.8 2 4.406 Standard Chartered plc 176.8 4 4.407 Banque Exterieure d'Algerie 160.0 1 3.997 Banque Nationale d'Algerie - BNA 160.0 1 3.997 Caisse Nationale d'Epargne et de Prevoyance Banque 160.0 1 3.997 Credit Populaire d'Algerie 160.0 1 3.99Top 10 Legal Advisors of African Project Finance DealsFinancial Close between 1 Jan <strong>200</strong>6 - 31 Dec <strong>200</strong>6Pos. Legal Adviser name Proj. Amt ($m) No. %Share1 Norton Rose 1,773.0 3 26.462 Jones Day 1,251.7 3 18.683 Allen & Overy 1,045.0 2 15.594 Bell Dewar & Hall 315.2 2 4.705 Clifford Chance LLP 284.2 2 4.245 Shearman & Sterling 284.2 2 4.247 White & Case LLP 266.3 2 3.978 Chadbourne & Parke 235.0 1 3.518 Fulbright & Jaworski 235.0 1 3.5110 Deneys Reitz 159.3 1 2.38Source: DealogicMARCH - APRIL <strong>200</strong>7 africa<strong>investor</strong> |43

infrastructure <strong>investor</strong>Project finance loungeNedbank Capital’s Mike Peo and Orville Cachia argue that getting the debt-equity mixright, and staying in for the long-haul, are key for successful African railway dealsAt first sight, investing in railways inAfrica looks like a fool’s game. With theexception of major urban centres, manyrailways around the world are lossmakingenterprises that survive throughgovernment subsidies. How could anyone profitfrom running a railway in Africa?The answer is to distinguish betweenpassenger and freight services. Passengerservices very often require government subsidies,but it is entirely feasible to run profitable freightservices. The combination in Africa of mineralwealth in remote locations, a weak roadinfrastructure and surging world commodityprices make a particularly strong case forinvesting in railways.Historic under-investment in governmentownedrail-links has resulted in unreliable,inefficient services. But with the spread of publicprivatepartnerships, the time is ripe for privatesector operators to rehabilitate Africa’s railwaysand profit from their efforts.Getting structure rightNedbank Capital has owned and invested inrailway infrastructure in Africa since 1996. Themost significant railway assets it has financed orinvested in are situated along the route betweenDurban, South Africa, to Ndola, on theZambia/DRC border. Fifteen years ago it took upto six weeks for freight to travel from Ndola toDurban. It now takes five days.The Ndola-Durban railway comprises threelinks. National Railways of Zimbabwe awarded thefirst 30-year concession on the Bulawayo-Beitbridge link in 1996. Nedbank Capital,alongside other <strong>investor</strong>s, took 85% of the equity.It has been a hugely successful investment.Railways System of Zambia, conceded in <strong>200</strong>4,and NLPI Logistics, (between Bulawayo and VictoriaFalls), make up the rest of the railway system.When looking at railway investments, dealstructure is essential. In simple terms, twomodels exist: total privatisation, and strategicequity investment where the government sells upto 51% of the concession to a private operatorFifteen years ago it took upto six weeks for freight totravel from Ndola to Durban.Now it takes five daysand its partners. In both cases, rehabilitatingrailways, let alone reforming entrenchedoperational inefficiencies, is time consuming andexpensive. Investors need long concessions,typically 20 to 30 years, in order to make the dealworthwhile. A reasonable debt-to-equity structure,typically 70/30, is required to generate therequired returns on equity.The amount of debt a project can raisedepends on revenue projections. Investors willdemand a financial model showing expectedfreight tonnage and operational cost efficienciesgained against the capital expenditure needed forany upgrades. In most PPP deals the operatordoes not ask for revenue guarantees fromgovernments, but it seeks off-take agreements tosupport the funding. The government gets fixedand variable fees as well as tax receipts out of thedeal. Depending on the nature of the transaction,other terms may be added.Managing expectationsThe project structure must allocate and mitigaterisks appropriately. These principally includedemand, operational and “expectations” risks.Obviously, a railway that isn’t used will not makemoney and so a proper and realistic market studyis a prerequisite to raising financing. A PPP doesnot give the government an instant fix; thetonnage will not go from one to 50 million in ayear. Operational risk is addressed throughensuring high quality management andestablishing a thorough understanding of thenetwork.Finally, in order for a project to succeed,promoters have to ensure all parties understandthe challenges of running a railway concession.Managing the expectations of thegovernment that has concessioned out therailway is critical. In certain cases the concessionrisks failing where the government’s expectationsof the revenue growth have not been properlymanaged.Given the right contracts and appropriate riskmitigation strategies, commercial banks willconsider lending for up to ten years on Africanrailway projects. The development financeinstitutions can sometimes extend to 15 years.Africa’s export competitiveness suffersbecause of high transportation costs, both forraw materials and manufactured goods. Railwaysoffer Africa’s mining and other export-orientedbusinesses a reliable and efficient solution togetting their products to market. Consequently,they offer <strong>investor</strong>s attractive opportunities. Weare likely to see a big expansion in Africa’srailways over the coming years.Mike Peo is Head of Public & <strong>Infrastructure</strong>Project Finance, and Orville Cachia isRailways Finance Specialist, at NedbankCapital in South Africa44

infrastructure <strong>investor</strong>Putting African railwaysOnce considered a drain on resources, railways in Africa have been neglected for decades.<strong>Simon</strong> <strong>Griffiths</strong> investigates why the private sector is now taking a second look, and howdeals are being structured to deliver returnsAfrican railways are due for arenaissance. Strong commodity prices,economic growth and growingconfidence in the continent’s futurehave revitalised interest in railways as anessential component of what ought to be acontinent-wide, multi-modal transportinfrastructure.Primarily built between 1852 and the 1920sto serve European interests in trade, naturalresource extraction or military control, they oftenbrought little to local populations. As tools of thecolonial powers, railways helped define andmaintain Africa’s unnatural divisions, whichperhaps explains their later neglect and decline.Many of Africa’s railways have languished in stateownership for decades while much-neededinvestment has been diverted to competing roadand air transport projects.Yet a recently published World Bank reporton railway concessions in Africa states: “Railwaysstill offer the most economical solution totransporting non time-sensitive bulk freight ondistances over 500km.” Mindful of this, both newconstruction and rehabilitation are taking placeacross the continent with funding from a mixtureof public and private sources.“We are very positive about the prospects forAfrican railways,” says Roger Lambson, SalesDirector for the Middle East and Africa with GETransportation. GE has an installed base of aboutRailways are the mosteconomical solution totransporting non timesensitivebulk freight ondistances over 500km1,<strong>200</strong> locomotives in Africa and expects to sellor upgrade many more. The growth is driven bythe expansion of public-private partnerships(PPPs) and increased mining activity.The major obstacle to railways achievingtheir potential, says NEPAD, is their current poorstate across much of Africa, which means hugeinvestment is needed in infrastructure, rollingstock and signalling. At the same time,governments are keen to relieve themselves ofheavy expenditure on railways, which historically– unlike ports – have represented a drain onnational budgets. The hope, of course, is that theprivate sector can roll in, plug the funding gapand reverse the flow of public money towardsrailway operations. Recognising this, NEPAD hasprioritised providing institutional support for theconcessioning of railways in its Short Term ActionPlan for infrastructure. The World Bank agreesthe revival of railways through concessioning iswarranted if the business fundamentalssupporting it are sound.A tale of two concessionsAfrican experience with railway concessioning islimited but gaining pace. Last year saw the awardof contracts on Gautrain in South Africa and theMombasa to Kampala railway line, two hugelydifferent projects. Gautrain is a new-buildpassenger link between Tshwane (Pretoria) and46

infrastructure <strong>investor</strong>Consequently, the poolof bidders for railwayconcessions in sub-Saharan Africa tends to besmall, particularly from nonintegratedoperators.However, they do exist.One non-integratedoperator active in Africa isthe Indian consultancy andproject managementcompany RITES, which hasa 26% stake in the Beirarailway concession inMozambique. The 670kmline was sabotaged in 1984and the area was heavilyland-mined. The line hasnow been de-mined withfunding from the USA.RITES was also namedpreferred bidder for taking over the operations ofTanzania Railway Corporation and is carrying out48FAST FACTS• Africa’s first railway connecting Alexandrato Cairo was completed in 1856• The East African Railway reached Uganda in1901 and reduced the price of transportingcotton to the coast from £<strong>200</strong> to £2.40per tonne• South Africa has the continent’s largest railnetwork with more than 20,000km of track• Nigeria has taken out a concessionary loanof $2.5bn from China and signed an $8bncontract with the China Civil EngineeringConstruction Company for the rehabilitationof the 1,315km Lagos to Kano line, firstcompleted in 1912a feasibility study for a proposed Ziguinchor toDakar railway in Senegal.African railway concessionsLocation Concessionaire Starting Initial Initial capital Total investment, Commercial bank/date concession contribution first five years private equitylength (yrs) ($m) ($m) financing (%)Mozambique CCFB (Beira) <strong>200</strong>4 25 19.7 152.5 12.3Cameroon Camrail 1999 20 18.5 89.6 44.4Tanzania TRC <strong>200</strong>6 25 10.0 88.0 62.9Burkina Faso- Sitarail 1996 20 8.8 63.3 19.7Ivory CoastMali-Senegal Transrail <strong>200</strong>3 25 17.2 55.4 61.0Kenya-Uganda URC/KRC <strong>200</strong>6 25 20.0 55 100.0Madagascar Madarail <strong>200</strong>3 25 5.0 36.1 40.9Zambia RSZ <strong>200</strong>2 20 6.1 14.8 100Source: World BankOther optionsConcessioning, however, isnot a universal solution.NEPAD says weakinfrastructure and low trafficvolumes will prevent theprivatisation of some railnetworks in the short tomedium term. Other Africanrailways are simply toosmall to be commerciallyviable. In these cases,subsidies may be needed ifthe private sector is to beengaged.NEPAD is looking atprojects to improve existingnetworks and extendinterconnections betweenrailways using alternativesources of funding to theprivate sector. Some governments have alsoadopted this approach.For example, Nigeria has suspended itsconcessioning programme and opted first torehabilitate its railways through direct financing.Nigeria has taken out a concessionary loan of$2.5bn from China and has signed an $8bncontract with the China Civil EngineeringConstruction Company for the rehabilitation ofthe 1,315 km Lagos to Kano line, first completedin 1912. Angola is looking at similararrangements with the Chinese. However, thistype of direct financing has “so far beenrestricted to countries endowed with substantialmineral resources,” says Pierre Pozzo di Borgo,a Senior Transport Specialist at the World Bank.Ongoing and prospective African railway projectsProject/LocationDescriptionFrancistown-Bulawayo Passenger Rail Link Botswana Railways hopes to reduce its losses with the re-opening of the Francistown-Bulawayo Passenger Rail Link.Botswana/ZimbabweA modern locomotive with eight luxury carriages will be linked to the currently operating freight train.Isaka-Kigali Rail LineThe African Development Bank (AfDB) and the governments of Rwanda and Tanzania are funding the feasibility study for theBurundi/Rwanda/TanzaniaIsaka-Kigali Rail Line. Total funding for the project is $2.6m.Lubumbashi-Kindu Rail LineThe national rail utility SNCC is reporting serious difficulties in maintaining traffic flow on the 1,470km Lubumbashi-Kindu RailDemocratic Republic of CongoLine. SNCC has nevertheless managed to acquire 14 locomotives and trucks as a result of an agreement between itself andSpoornet of South Africa.Belinga Iron Ore Project, GabonThe Belinga Iron Ore Project should be operational within the next four years. It will be managed by a majority Chineseconsortium, with the state holding an undisclosed participation. The total required investment is estimated at $3bn with about66% spent on support infrastructure including the extension of the Trans-Gabonese Rail.Zouerate-Nouadhibou Rail Link, Mauritania The National Industrial and Mining Company of Mauritania (SNIM) has decided to invest $85m between <strong>200</strong>6 and 2010 toincrease iron exports from the country. Much of the funding will be allocated to the reinforcement of the 600km Zouerate-Nouadhibou rail link and for the modernisation of rail equipment.Moatize Coking Coal Project,An estimated $2bn is be disbursed on this coal processing plant project. This includes a rail link as well as the upgrading ofZambezi Valley, Mozambiqueport facilities.Source: Africa Project Access

infrastructure <strong>investor</strong>African luxury: the world famous Blue Train ploughs through Hex River Valley in the Western Cape South African TourismIn other cases, cross-border connectionscould help to boost traffic volumes and helpmake investments more attractive to theprivate sector. NEPAD is promoting studies toassess the practicality of interconnecting variousnational railways within the ECOWAS countries ofwest Africa.However, many issues need to be tackledbefore this becomes widespread. These includethe lack of harmonised and regulatoryEXPERT INSIGHTAfrican railways have considerable potential aspublic-private partnerships (PPPs). The Gautrainproject in South Africa shows what can bedone. With a total investment of $3bn, theproject is currently the biggest transport PPP inthe world. The Bombela consortium was able toraise the necessary $500m (rand equivalent) ofdebt in the commercial bank market based onthe consortium’s patronage forecasts and therevenue support provided by Gauteng Province.However, we are not seeing as manybankable projects as we would like. A numberof PPP deals have not progressed as hoped,principally because the deal structures are notbankable.Railway PPPs face similar issues toprojects such as toll roads and airports. Allthese projects need to be thought out andplanned in detail if they are to succeed. In theframeworks between countries, technicalproblems and commercial factors, such asticketing and timetabling.The British once dreamt of building a rail linkfrom Cairo to the Cape. They never succeeded.But modern Africa might. However, it is not just acase of laying down parallel lines of steel. Crossbordercooperation is essential to ensure freemovement of goods and there are numeroustechnical, commercial and political problems tolong-term, investing time and money in theearlier stages will result in smoother andultimately cheaper privatisation or PPPprocesses.Railways typically do better financially whentransporting freight rather than carrying people.Passenger railways have more unpredictablerevenue streams and, in emerging markets,face the challenge of cost recovery. Gautrain isan exception because the provincialgovernment has agreed to underpin a certainlevel of traffic volumes, and this gave comfortto the lenders. The province also provided asubstantial part of the capital cost by way of anupfront grant.On freight services the underlying corebusiness must be predictable and sustainable.An export orientation also helps to generatehard-currency cash flows. This means railwaysovercome. It should be worth the effort. Railwaysare cost effective for moving heavy, non timesensitivegoods but in order to attract privatesector investment, concessions need to bestructured to give operators a fair return onequity commensurate with their risks, particularlyif more non-integrated operators are to bid. It’stime to put painful memories aside and look to aprosperous and healthier future for Africa’srailways.by Jonathan Woodlinking mines or main cities to ports are usuallygood candidates. These projects become evenmore bankable if they are linked to a strategicexport or import or have a quasi-monopolisticstatus.Lenders typically finance rail concessionson a non-recourse basis and will carry out bothdetailed technical and financial due diligence. Incase of default they will want to know theassets they hold as security are valuable. Theywill need to see concession documents thatproperly and fairly allocate risks and they wantto see an experienced operator running therailway. On the financial side, a variableconcession fee is preferable to fixed.Jonathan Wood is Director of ProjectFinance, Standard Bank. Standard Bank isJoint Lead Arranger on the Gautrain ProjectMARCH - APRIL <strong>200</strong>7 africa<strong>investor</strong> |49

Nigerian PortsLAGOS PORT COMPLEXLOCATION/TERMINAL(S)• Apapa Bulk Terminals Limited (Subsidiary of Flour Mills of Nig.Plc) Terminals A&B (Berths1-5)Tel: 234-1-5803370-9, 5453960-9, 5452667, 5450972Fax: 234-1-5872749, 5870395, 5452667, 5871602.Address: 2 Old Dock Road, P.O. Box 341, Apapa, Lagos.• ENL Consortium Container Terminals C& D (Berths 6-14)Tel: 0803-787-6125Fax: 234-9-3144238Address: 26, Burma Road, Apapa, Lagos.• A.P. Moller. Container Terminal, Berth 15-18a & Lilypond CFSTel: 234-1-262,6430, 0803979 0219.Fax: 234-1-2626428Website: www.apmterminals.com.E-Mail: appapmtmng @ apmterminals.com.Address: Maerks House, 121 Louis Solomon close, P O Box 72554, Victoria Island.• Green View Development Nig. Ltd. (Dangote Group) Terminal E (Berths 18b-19)Tel: 234-1-2671810, 234-1-2695108, 234-1-2695109, 234-1-2695118Fax: 234-1-2695009, 234-1-2695314Address: No 1 Kingsway Road Falomo, Ikoyi, Lagos.TIN--CAN ISLAND PORTS• Five Star Logistics Limited. (Comet Shipping) RoRo TerminalTel: 234-1-7748516, 7740143 234-1-5871873, 5566858Fax: 234-1-5453214Email: info@cometshipping.com.Address: 4, Balogun Omidiora Road (Formerly Hinderer Road) PMB 1001, Apapa, Lagos.• Grimaldi Group Greenfield DevelopmentTel: 234-1-5453433, 234-1-5872311 (Build Operate and Transfer- RoRo Port)Address: 17 Burma Road Apapa, Lagos.• Josephdam & Sons (Nig) Ltd.(JOSDAM Nig Ltd) Terminals ATel: 234-1-4523739Fax: 234-1-2880848, 234-1-4528209.Address: 19, Fatai Atere Way, Matori Lagos, Nigeria.• Tincan Island Container Terminal Ltd. Terminals BTel: 234-1-5873075Fax: 234-1-5874163Email: ykotik@netvision.net.il, chidilogu@yahoo.comAddress: 4, Creek Road, P.O.Box 192 Apapa, Lagos• Ports and Cargo Handling Services Ltd. (SIFAX) Terminals CTel: 08033036341Address: 41, Calcutta crescent Apapa, Lagos, Nigeria.WORLD CLASS EFFICIENCY. GUARANTEEDWith exceptional technology, professional staff and 8 strategically located seaports, the Nigerian Ports Authority (NPA) is the driving forcebehind the country’s expanding economy. Boasting first-class international ports operators such as Grimaldi (roll on, roll off), AP Moller(container terminal) and ENL Consortium (general cargo) while top indigenous Nigerian shipping firms such as Sifax, Comet, Dangote andFlour Mills operate other terminals, the NPA has been working hard to further improve its already state-of-the-art facilities. Now, havingcompleted port reforms in record time, it is attracting even more international operators to Nigeria, and playing an extraordinarily vitalrole in the nation’s bright future.

AuthorityRIVERS PORT, PORT HARCOURTLOCATION/TERMINAL(S)• Ports and Terminal Operators (NIG) Ltd. Terminals ATel: 234-1-7936365, 0803 302-2666Email: porterminalnig@excite.com.Address: Mogfo House, 17 Int. Airport Rd. Ajao Estate, Lagos State.• BUA International Limited Terminal BTel: 234-1-5558971-2, Fax: 234-1-5558972, Email: www.bua.comAddress: 7th Floor, AIB Plaza, Adeyemo Alakija Street, Victoria Island, Lagos.ONNE PORT -Federal Lighter Terminal (FLT) and Federal Ocean Terminal (FOT)• Brawal Oil Services Limited Terminals A FLT, OnneTel: 234-1-5872491, 5872582, 5871684, Fax: 234-1-5876355Address: Aeromarine Compound Phase 1, Apapa-Oshodi Expressway P.M.B 1193 Apapa.• Intels Nigeria Limited. Terminals A FOT and B FLT OnneTel: 234-84-230921, 232888, 235933, Fax: 234-84-610552-3, Email: www.intelservices.comAddress: Km 16, Port Harcourt Aba Expressway P.M.B 6034, Port Harcourt.CALABAR PORTTerminal Coordinator’s OfficeTel: 234-87-210131, Fax: 234-87-210132, 234-87-210151, 234-87-210132Address: P.M.B. 1014 Calabar, Cross-River State, Nigeria.• Intels Nigeria Limited New Terminal AContact Terminal Coordinator’s Office• Ecomarine Consortium New Terminal BTel: +23415457312-14, +23415871748-15, Fax: +23415457307, Email: info@ecomarinegroup.comAddress: 9 Wharf road, Apapa, Lagos• Addax Petroleum Development Nig. Ltd Calabar old PortContact Terminal Coordinator’s OfficeDELTA PORTS WARRIWarri Pilotage District Terminal Coordinator’s OfficeTel: 234-53-251080Address: Delta Port, Warri, Delta State Nigeria• Intels Nigeria Limited Warri Old Port, Terminal AContact Terminal Coordinator’s OfficeWarri New Port, Terminal B• Gulftainer Bel Consortium Koko Port• Contact Terminal Coordinator’s Office• Associated Maritime Services Warri Old Port, Terminal BContact Terminal Coordinator’s Office• Julius Berger Nigeria Plc Warri Canal BerthContact Terminal Coordinator’s OfficeNIGERIAN PORTS AUTHORITYGateway to the nation’s economyHead Office: Lagos Marina Office, 26/28 Marina Lagos, Tel: +234 (0)102600620-12, Fax: +234 (0)12636719,Email: info@nigerian-ports.netLondon Office: 2nd Floor, Allenby House, 1A Temple Road, NW2 6PJ, Tel: +44 (0)1814503101-3, Fax: +44 (0)181452 8062Website: www.nigerian-ports.netEmail: npax@nigerian-ports.net, londonoffice@nigerian-ports.net

infrastructure <strong>investor</strong>contractors and consultants corner<strong>Infrastructure</strong> investment requires top-quality consultants. For Jonathan Horn, DivisionalDirector International of Kwezi V3 Engineers, it presents new challenges and new opportunitiesKwezi V3 is a 600-strong South Africanmulti-disciplinary engineering consultancywith offices in Mozambique, Zambia,Namibia, the Democratic Republic of Congoand Abu Dhabi. The firm works in allinfrastructure sectors and is particularlyactive in municipal engineering work.Arne Hoel/World BankQWhat is driving change in theengineering consultancybusiness in Africa?Better governance is leading to economic growthand greater investment. For example, we see thatgovernments are financially rewarded forimproved governance by the development financeinstitutions and a portion of this money goes intoinfrastructure.Another positive trend is the increasedwillingness of governments to invest their ownmoney (as opposed to donor funds) ininfrastructure. For example, we are working onprojects in South Sudan funded by theautonomous government out of its oil revenues.QWhat about the increasing useof public-private partnerships(PPPs)?PPPs have up-ended the traditional wayengineering consultants carry out their businessand we have had to adapt accordingly.Traditionally we designed a project for a client,managed the tender process and supervised thecontractor during construction. With PPPs,consortia bid to design, build and operateprojects on a long-term concession basis. Theseconsortia are typically contractor-led and employconsultant engineers as designers. We thereforeprovide our services to contractors rather thanproject sponsors and have had to develop goodworking relationships with them. Benefits includeincreased contractor input into design. On theother hand, some of the checks and balances oftraditional procurement methods are lost. Thishas led to new opportunities for consultants towork with project sponsors as primary advisors.The other big change is risk allocation andmitigation. With PPPs there is the possibility thatdesigners end up shouldering significant projectrisk out of proportion with their share ofresponsibilities or revenues. Consultants will needto spend more money on risk management andlegal advice to ensure they are properlyprotected. As yet, we have seen very fewexamples of consultants entering consortia asequity partners where they stand to benefit if aproject exceeds expectations. In most casesconsultants work as service providers but it willbe interesting to see if and how this changes inthe future.QWhat sectors are going to dowell over the next few years?Mining could really take off as the award ofexploratory licenses leads to feasibility studiesand development. Railways and transportinfrastructure should boom on the back of miningin order to move minerals to the coast for export.There are many plans in place to build newrailways and we are already engaged on railwayfeasibility studies.However, a note of caution is needed here.Transport infrastructure, and particularly railways,works best when it is regionally integrated. Forexample, railways need consistent cross-bordersignalling systems and cooperation on timetablingand access. We see a big role for NEPAD in thisas perhaps the only institution with the politicalclout to influence governments to work together.QWhat is the impact of theChinese on your business?The Chinese tend to work within a differentbusiness model. For example, state-ownedChinese firms are active in Angola on railwayrehabilitation, funded directly by the Angolangovernment as part of a bilateral tradeagreement. It is good for Angola to rehabilitate itsrailways but by acting alone it has precluded thepossibility of a coordinated approach with Zambiaand the Democratic Republic of Congo, both ofwhich could benefit from improved rail links withAngola. The other impact is that the consultantsthat carried out the original feasibility study –which included proposals for privatisation andlinks to neighbouring countries – lost out on thedetailed design work.QWhat are the greatest threatsand opportunities to yourbusiness right now?We know the World Bank and European Union arekeen to invest heavily in African infrastructure andthat improved economic prospects will similarlyinspire further investment in infrastructure. Thereis no doubt the work will be there and this is afantastic opportunity for African consultants.However, international consultants have smelledthe money too and are paying greater attention togrowing their businesses here.We need the international players to operatein Africa. The ever-increasing size of projectsmeans they cannot be done without engagingthem. Still, local knowledge will remain essentialand international firms will need the experience andconnections of local operators. We must therefore“internationalise” ourselves in order to worksuccessfully with the international competition.Finally, there is often a huge demand forinfrastructure development but too often anunstable political situation and failure to tacklepoor governance and corruption leads someconsultants to face difficult decisions on how bestto pursue project opportunities withoutcompromising their good business practice andethical values. The eventual outcome of this couldbe a mafia-type business model, which is innobody’s interest, and local communities wouldsuffer the most as a result. A concerted effort byboth the public and private sectors is required toprevent such a business model from thriving intoday’s booming economy.Jonathan Horn talked to <strong>Simon</strong> <strong>Griffiths</strong>52

Soon we’ll be flying to the airport.Standard Bank has what it takes to successfully complete landmark projects, such asthe Gautrain. Our financial capacity and expertise enabled us to act as joint leadarranger and underwriter of the debt funding to this project, the biggest everPublic Private Partnership in Africa. We look forward to having a world class transportsystem in Gauteng and are committed to its success, from now to the end of the line.Corporate and Investment BankingInspired. Motivated. Involved.Authorised financial services providerThe Standard Bank of South Africa Limited (Reg.No.1962/000738/06). SBSA 80174401/07

infrastructure <strong>investor</strong>in the pipelineIn his regular round-up of selected infrastructure projects in sub-Saharan Africa, Paul Rungeof INFRATREE finds the Karofina dry port open for business and much morePORTSThere is considerable pressure on Dar es Salaamto cope with increased freight traffic and therequirements of the central developmentcorridor. The port authorities are implementing aspecial corporate plan to improve productivity atthe port. The cost of the project for theenlargement of Djibouti Port is estimated at US$400m. It includes the construction of a newcontainer terminal at Doraleh, 10km fromDjibouti.The presidents of Mali, Burkina Faso andSenegal have inaugurated the Karofina dry port,situated north of the Mali capital of Bamako. Thesite covers six hectares and includes 14 hangars,two of which are refrigerated, as well asadministration buildings. The cost of the projectwas 8.3bn CFA francs ($16.3m). The projectforms part of a programme linking the port ofDakar to Mali, Burkina Faso and Niger.Meanwhile, the West African DevelopmentBank (BOAD) has approved a loan of CFA8bn($15.8m) for infrastructure rehabilitation at LoméPort in Togo.Further rehabilitation of Beira Port is due tocommence in April <strong>200</strong>7, with the relevanttenders launching in <strong>March</strong> <strong>200</strong>7. This wasannounced by Dutch firm Cornelder Moçambique.Exports through Beira registered 150,000 tons in<strong>200</strong>6, which was a 10% increase on the previousyear. The Zambezi Valley Programme and notablythe Moatize Coking Coal Project should improvethroughput at the port, although many feel thatthe natural deepwater site of Nacala would bemore appropriate._________________________________________AIRPORTSThe recent increase in airport projects continues.In Nigeria, the Abuja Gateway Consortium haswon a contract to enlarge Abuja Airport andmanage it for 25 years. Three contracts havebeen awarded for the 20-year Entebbe AirportDevelopment Programme. New work includes aVIP terminal, a general aviation block andpassenger bridges.The Zanzibar authorities have stated thatthere are a number of companies that haveexpressed interest in the expansion andrenovation of the tourist-heavy Zanzibar Airport.The project cost is estimated at $30m._________________________________________RAILChinese engineering company CCECC has beenappointed for the construction of the Lagos-Kanoline in Nigeria and hopes to complete the firstphase of the project within five years (see page48). The Nigerian President has made referencesto a large-scale programme that would link thecapitals of all 36 states by rail.54Senegal has purchased five locomotives and20 passenger wagons from India as part of therenovation of the 27km Dakar-Rifisque rail line._________________________________________ROADSThe AfDB is engaging in roads projects in theDemocratic Republic of the Congo. Two suchprojects are the Nsele-Lufimi and Kwanza-Kengeroads. The World Bank is funding theLubumbashi-Kasemeno road that will helpintegrate the copper producing areas of DRC’sKatanga Province. The proposed Lagos toll roadin Nigeria is receiving increasing attention. Thereare references to the use of smart-cardtechnology for the project._________________________________________POWERNew power projects are being proposed, largelyto meet the requirements of growing resourcesexploitation. The Zambian government isattempting to satisfy the electricity demandgenerated from the copper mining industry andhas listed a number of new and expansionprojects. Proposed projects include thedevelopment of a 750MW hydropower station onthe lower Kafue Gorge.Guinea has major bauxite reserves that haveled to the planning of large-scale aluminiumproduction projects. However, an essentialcomponent that is missing is electricity supply.The Guinea government has responded by listing14 new hydropower projects that are at variouspre-feasibility and feasibility study stages.The troubled Congolese power utility, SociétéNationale d’Electricité (SNEL), is calling on thegovernment to install a second transmission linelinking the Inga Hydro Plant to Kinshasa. Thecapital is experiencing serious power shortageswith the current deficit estimated at 170MW. Theshortage has been made worse by a recent theftof more than a kilometre of cable from theKinshasa-Matadi connection.The cost of the transmission line would be anestimated $300m.Investment is still being sought for theBatoka Hydro Power Project, situated some50km downstream of Victoria Falls. The Projectwould have the potential to produce 800MW. Theimplementing agency is the Zambezi RiverAuthority, which is a joint venture of Zambia andZimbabwe. It was hoped that the Project wouldbe launched early in <strong>200</strong>7._________________________________________WATER & SANITATIONExpressions of interest are being invited fromconsultants for the Malawi Water SupplyProgramme. Zambia has received funding fromthe Arab Bank for the Economic Development ofAfrica (BADEA) for water supply rehabilitationprojects in six districts. Technical assistancefunding has also been raised for the country’swater distribution companies._________________________________________CONSTRUCTIONMulti-disciplinary firms and architects are beinginvited to pre-qualify for a new hospital in PortLouis, Senegal. The consulting firms must beexperienced in hospital construction projects.The contact e-mail is moh-piu@mail.gov.mu.There are plans for the development ofXefina Island in Maputo Bay. More than$250m will be invested in the island for theestablishment of hotels, restaurants and sportscentres. It is hoped that a bridge will beconstructed to link the island with the mainland atCosta do Sol.Comprehensive Africa Visit Reports compiledby Paul Runge are available. For moreinformation on these as well as otherproducts such as Project Databases andGuides to Donor Agencies, contact Paul at+27 11 4656770 or e-mail:afric.projs@pixie.co.za

infrastructure <strong>investor</strong>NEPAD viewsAfrican infrastructure projects need funding for pre-feasibility studies. NEPAD’s deputy CEO,Ambassador Olukorede Willoughby, enthuses about NEPAD’s role in this areaQWhy is infrastructure soimportant to NEPAD?To unlock Africa’s development potential we haveto facilitate the movement of people andproducts. You have to be able to improvepeople’s quality of life; they have to have accessto schools and education; they have to haveaccess to hospitals. And that’s only at a sociallevel. From an economic point of view you haveto be able to put productive inputs together tomove raw materials to a point of production andthen to markets. This makes transportation veryimportant for access and movement.QDo you think infrastructure hashad a low profile over the lastfew decades?It’s not exactly been low profile; it’s just thatAfrican governments have had to go it alonebecause it’s not been easy to attract funding. Dueto privatisations and public-private partnerships(PPPs), infrastructure investments are becomingmore interesting and bankable and that hasrenewed interest. At NEPAD we have 124projects, of which a sizeable proportion arephysical projects. It has not been easy: we havea lot of projects at concept level but in order tomove them to the feasibility stage we have to dopre-feasibility studies. These can consume about10% of a project’s cost and that is a lot of moneyfor most Africans to be able to muster. So we aretrying to make the African Development Bank(AfDB) pay a lot more attention. Currently wehave a US $10 million fund to facilitate projects,and we’re trying to expand that and make it moremulti-donor. We also need to increase the scopeof coverage of the fund and make conditions lessstringent and more flexible in order to allow moreAfrican access to the funds. We think ouractivities in the area of infrastructure investmentcan really accelerate because it is so important.because opportunities have not been madeexplicit enough either to the private sector orfunding institutions. Now that we havegovernments realising they cannot go it alone inthe area of infrastructural development, they aretaking a closer look at bankable projects. Theyare coming up with the regulatory frameworksthat allow for PPPs in those areas and on thatbasis private sector operators are invited or canplay a part and jointly make an approach tobanks. But for us to deal with multi-countryprojects they must be both economic andbankable because of the criteria we use.Additionally, projects must promote regionalintegration. Sometimes viable projects are stalledbecause of political or other reasons so weintervene to make sure that the projects getmoving.QWhat specific support do youprovide to make sure projectsget the funding andcoordination they need?NEPAD is a facilitating agency. We do not getdirectly involved in the projects. Indeed, the AfDBhandles our project investments. We assist theregional economic communities on a policy andpolitical level and assistto identify thoseviable bankableprojects, whichare then submitted,with oursupport, tothe AfDB.QDo you see those projectstaking off? Do you think thatthis infrastructure gap will bebridged?We’ve started bridging the gaps because there’sa lot more open-mindedness on the part ofeverybody. Take the Eastern Africa SubmarineCable System project, where there were a lot ofissues and problems. NEPAD, being centrallyplaced, played a neutral and objective role inputting the project together. At one point it wasfeared that we were maybe not on the side of theprivate sector operators but on the side of theregulators. But at the end of the day the roleshave been clearly understood and we are movingforward with this project. We were also able tohost a multi-stakeholder dialogue on the Inga 3project in the Democratic Republic of Congo. Wewere able to get both the national stakeholderand the international interested parties to discusshow to move the project forward, and we feelsure that we have succeeded. There is a lot morethe new <strong>Infrastructure</strong> Consortium for Africa isable to provide in identifying areas ofcomparative advantage of external partners, andto pool these advantages together in support ofAfrican infrastructure projects. We are veryoptimistic there will be an acceleration of projectimplementation, especially with private sectorinitiatives such as the NEPAD infrastructureinvestment facility (NIIF).Olukorede Willoughby talked toAlison LockQCan the private sector play arole in putting forward fundingfor African infrastructureprojects?The private sector has always had a roleto play. It’s simply that the role has notbeen clearly determined56

Over-preparationis a mythAfrica <strong>investor</strong> understands that successful performance depends on finding the rightopportunities. That’s why our online portal provides all the insight you need to identify themost lucrative investment strategieswww.africa-<strong>investor</strong>.com is designed to challenge, prepare and inform all those engaged in business in Africa.Up-to-the minute news, investment analysis, financial market data, country risk ratings and performancetracking give readers a razor edge on your competitors and business environment.www.africa-<strong>investor</strong>.com

infrastructure <strong>investor</strong>multilateral viewsIn the second part of his exclusive interview with Africa <strong>investor</strong>, Mandla Gantsho, VicePresident at the African Development Bank, defends the <strong>Infrastructure</strong> Consortium for AfricaQHow does your vision for theAfDB align with the goals ofNEPAD?I think in future you will see increased activity fromthe AfDB on larger projects with the potential tosupport regional integration – a key goal ofNEPAD. As you know, we are the lead agency forNEPAD’s infrastructure programme and we havespent the last few years working on the NEPADShort-Term Action Plan (STAP). We are nowdeveloping the Medium to Long-Term StrategicFramework (MLTSF).Our support on NEPAD STAP projects hasscaled up from US $630 million between <strong>200</strong>2 to<strong>200</strong>5 to $324m for <strong>200</strong>6 alone. However, simplyinvesting in projects is not enough. What we aretrying to do is optimise the synergies betweenprojects – making sure the plans of the differentregions and countries are co-ordinated andconnected. This thinking underpins the MLTSF,which will provide a coherent, strategicframework that will serve as the basis fordefining, implementing and monitoringinfrastructure development on the continent.Preparation of the MLTSF will involve the definitionof sub-regional strategies as well as a continentalstrategy for the sustainable development ofinfrastructure in the five sub-regions of thecontinent.We are financing the MLTSF study alongsidethe Nigerian Technical Co-operation Fund. It willcost about $3.9m and should be completedabout the end of <strong>200</strong>7. The study will be carriedout in close collaboration with the World BankfinancedAfrican <strong>Infrastructure</strong> Country DiagnosticStudy (AICD) that was commissioned by the<strong>Infrastructure</strong> Consortium for Africa (ICA).QHow else are you supporting theNEPAD infrastructure agenda?First, we recognise the importance of Africa’sRegional Economic Communities (RECs) indeveloping infrastructure projects. We thereforeprovide targeted technical support to RECs in thepreparation, packaging, financing andimplementation of infrastructure projects andprogrammes and in the monitoring of programmeimplementation. Our technical support alsoextends to the NEPAD Secretariat where weassist with the coordination and monitoring ofprogramme implementation. Second, we valueour role as a centre of knowledge and informationin infrastructure development. Finally, we areactively pushing five big infrastructure projects,one per region, which are in line with the NEPADvision.QWhy do we need the<strong>Infrastructure</strong> Consortium forAfrica in addition to NEPAD andthe AfDB?The objective of the Consortium is to build astrategic partnership among donors andstakeholders to facilitate the development ofinfrastructure in Africa as prioritised by the AU,NEPAD and national governments in support ofeconomic growth and poverty reduction. It isintended to make its members more effective atsupporting infrastructure in Africa by poolingefforts in selected areas (such as informationsharing, project development, and good practice)without necessarily pooling financing decisions.Although the Consortium is not a financingagency, it acts as a platform to broker moredonor financing of infrastructure projects andprogrammes in Africa.QSo what has the ICA done, interms of pushing forward newinfrastructure projects?ICA members agreed that there was a needfor greater coherence of donor efforts toreduce transaction costs and ensure moreeffective and efficient delivery of fundingconsistent with the commitments made onharmonisation.As such, ICA looks on an ongoing basis atways to scale up financing and increasecooperation at project level, but not exclusively.More broadly, ICA is working to identify andovercome project development, financing,capacity and business environment constraints, ina new cooperative spirit that recognises thecomparative advantages of different donors.ICA attempts to address both nationaland regional constraints to infrastructuredevelopment, with an emphasis onregional infrastructure, recognisingthe particular challenges at thisscale.The ICA is respondingto country priorities andICA members haveincreased their investmentin regional andnational infrastructureprojects.For example, fromOctober <strong>200</strong>5 toJune <strong>200</strong>6,Consortium members committed $3.44bn tocountry-level projects.Given the scale of the investment required,both the AfDB and the ICA will continue toadvocate for more public and private resources toinfrastructure.As one of the first key actions in thatdirection, we supported an ICA conference inDecember <strong>200</strong>6 on “Financing Electricity forGrowth in Africa”, which sensitised key energy,investment and legal companies to potentialelectricity infrastructure projects requiringimmediate financing in Africa.It is hoped that the meeting will result in theopening of new dialogues with private sectorcompanies on selected projects, with a view tofuture participation in financing. The meeting alsohelped information flow to the private sector andhelped decide how best to maintain high levels ofcommunication between public and privatesectors.Mandla Gantshotalked to<strong>Simon</strong><strong>Griffiths</strong>Mandla Gantsho joined the AfricanDevelopment Bank (AfDB) in May <strong>200</strong>6 asVice President, Operations III: <strong>Infrastructure</strong>,Private Sector & Regional Integrationfollowing a stellar career at the DevelopmentBank of Southern Africa, where he held thetitle of CEO and MD since <strong>200</strong>1. Accordingto Trevor Manuel, South Africa’s financeminister, Gantsho ‘played a pivotal role intransforming the DBSA into a leading andwidely respected regional development bank’.58