Infrastructure investor May 2008 - Simon Griffiths

Infrastructure investor May 2008 - Simon Griffiths

Infrastructure investor May 2008 - Simon Griffiths

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

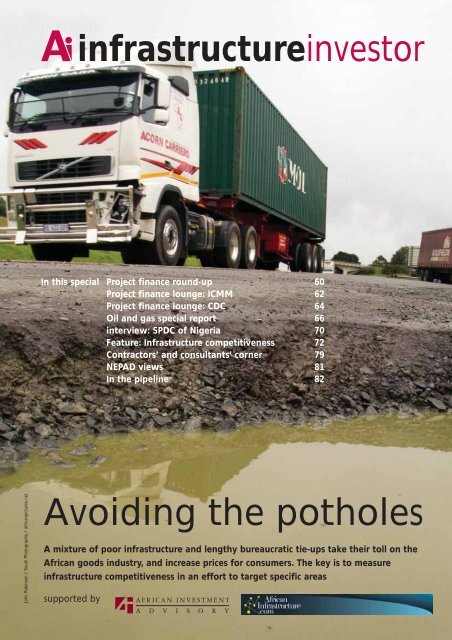

infrastructure<strong>investor</strong>In this special Project finance round-up 60Project finance lounge: ICMM 62Project finance lounge: CDC 64Oil and gas special report 66interview: SPDC of Nigeria 70Feature: <strong>Infrastructure</strong> competitiveness 72Contractors’ and consultants’ corner 79NEPAD views 81In the pipeline 82John Robinson / South Photographs / africanpictures.netAvoiding the potholesA mixture of poor infrastructure and lengthy bureaucratic tie-ups take their toll on theAfrican goods industry, and increase prices for consumers. The key is to measureinfrastructure competitiveness in an effort to target specific areassupported by

infrastructure <strong>investor</strong>project finance round-upThis year’s slow economic start does not mean African project finance has suddenly comeoff the rails, argues <strong>Simon</strong> <strong>Griffiths</strong>, who says the continent is safe from the credit crunchProject finance boomed in 2007, but<strong>2008</strong> started slowly with no new projectfinance deals closing in the first twomonths of the year. Has Africasuccumbed to the global credit crunch?Unlikely, says Paul Eardley-Taylor, a SeniorVice-President with HSBC Africa: “Deals closingnow would probably have been underwrittenbefore the market tightened, so shouldn’t beimpacted by the crunch.”Deal volumes in Africa are still low by globalstandards and so a hiatus of two months isn’tcause for concern, and there is a long pipeline oftransactions waiting in the wings. Dealogic hasidentified 23 African project finance deals atvarious stages of development: not all of thosewill close this year, and some of those at preapprovalstage may not progress as hoped, butthere are a handful of deals already in finance thatshould hit the market soon.Three of those deals are mining projects,reflecting the continued strength of commoditiesmarkets. Orezone, a Toronto-listed junior miningcompany, wants to raise US $250 million of debtfinancing to develop operations at its Essakanegold mine project in Burkina Faso. Essakane,330km northeast of the capital Ouagadougou, isBurkina Faso’s largest known gold resource,holding an estimated four million ounces of theprecious metal. In January, Orezone appointedUniCredit Group and Standard Bank as mandatedlead arrangers for the deal.Also in west Africa, the Australian companyMineral Deposits Limited (MDL) plans to raise$172m to begin operations on the massiveGrande Côte zircon project in Senegal. Theproject entails the dredging of mineral sands from445.7km sq of dunes stretching 80km alongSenegal’s north-west coast. Zircon is a mineralused, among other things, for making abrasivesand insulating materials. The company saysmining should start in mid-to-late 2009 andoperations could continue for several decades.In South Africa, Wesizwe Platinum Limited hasappointed ABSA Capital, Deutsche Securities andthe Development Bank of South Africa to act aslead equity and debt arrangers for its Frisch-Gewaagd-Ledig project. Wesizwe is a blackempowermentmining company with ambitions togrow through mergers and acquisitions, using theproject as a catalyst. A bankable feasibility studyon the project is due to be delivered shortly.Other projects waiting in the wings includeseveral liquefied natural gas (LNG) and oil refineryprojects in Libya and Nigeria, and a massivepower project in South Africa.Unclogging transportIn the development finance sector, the AfricanDevelopment Bank (AfDB) Group and Cameroonsigned a $76.5m loan agreement to finance theDouala-Bangui and Douala-Ndjamena roadcorridor, linking Cameroon, the Central AfricanRepublic (CAR) and Chad. The objective, in linewith NEPAD’s goals, is to “create commerciallyand economically viable corridors devoid ofbarriers, formalities and unnecessary road blocksthat cause undue delays and high transactioncosts,” says Mandla Gantsho, the AfDB’s ViceDealogic has identified 23African project financedeals at various stagesof developmentPresident in charge of infrastructure, privatesector and regional integration. The project willalso support railway developments.In Ghana, the AfDB is putting $44m intoreinforcing the country’s power system. Theproject aims to reduce electricity losses, improvereliability and expand access to power in theKumasi area.“Unreliable power supply is a major constrainton the country’s economic growth,” says a Bankspokesperson.Business managers should be pleased: poortransport and electricity infrastructure is a majorheadache for them (see our feature oninfrastructure competitiveness).Elsewhere in the infrastructure section weask the International Council on Mining Metals(ICMM) what governments and other stakeholderscan do to avoid the so-called “resource curse”and ensure they benefit from the exploitation ofminerals.We have an interview with Richard Laing, CEOof CDC Group, about CDC’s recent investment inthe Actis <strong>Infrastructure</strong> 2 Fund, and why mobilepower is so promising. We also reveal howEurope’s contractors’ organisation is working toget European contractors to look seriously atopportunities in Africa. Finally, in our NEPADcorner we publish an interview with ProfessorEmmanuel Nnadozie of the United NationsEconomic Commission for Africa (UNECA),looking at how his organisation promotesinfrastructure development.African infrastructure projects in financeProject name Amount (US $m) Country SectorEgypt VCM/PVC Chemical Plant 868 Egypt Petrochemical/Chemical PlantEssakane Gold Mine Project 250 Burkina Faso MiningFrisch-gewaagd-Ledig Platinum Mine 483 South Africa MiningGrande Cote Zircon Project 172 Senegal MiningSource: Dealogic Chris Ryan/Dreamstime60

infrastructure <strong>investor</strong>project finance lounge: cleaning up miningStop the hand-wringing: the resource curse can be avoided. Kathryn McPhail, SeniorProgramme Director at the International Council on Mining and Metals (ICMM), explainsOne of the most significant challengesfacing the mining and metals industrytoday is demonstrating togovernments in emerging economiesthe social and economic benefits that foreigndirect investment in the mining sector can bring,not just to their societies generally butspecifically to local communities. It is especiallyimportant to make this case when commodityprices are rising and where perceptions prevailthat benefits are not shared equitably.In 2007 we moved to phase three of ICMM’sResource Endowment initiative. The objective ofthis multi-stakeholder initiative, which began in2004, was to identify the critical factors thathave allowed some countries to benefit from theirsubstantial resource endowments, and thepractical steps that might be taken by theindustry and others, such as governments, localcommunities and development agencies, toenhance the positive impacts of mineral resourceinvestments.Some international NGOs raise fundamentalquestions about the poverty reduction anddevelopment benefits of mining investments. TheBank Information Center and Oxfam International,in a September 2006 report, cited theexperience at IFC-supported gold mines in Peru,Ghana, Guatemala, and Kyrgyzstan, as well asthe World Bank’s own research in miningdependentcountries, which indicate that thecosts to local communities affected by miningoften exceed the benefits they receive.Escaping the resource curseThe “resource curse” theory broadly states thatan economy blessed with abundant but finitenatural resources that bring in large earningsbecomes less competitive in other sectors. Also,dependence on such earnings is problematic ifthe prices of the minerals in question are volatilein the short-term or subject to sustained declinein the long-term.In the first phase of the ICMM’s ResourceEndowment initiative, a framework of analysiswas developed, in part based on a review of thelong-term performance of 33 countries with ahigh dependence on minerals against sixeconomic and social factors. This resulted in atoolkit being developed for assessing the positiveand negative local, regional and national socioeconomicimpacts of mining in a given country.Phase two of this work applied the toolkit to fourcountries – Peru, Chile, Ghana and Tanzania –and resulted in country-specific as well as crosscuttingfindings and recommendations.The most common problems found acrossthe four case studies were: theadequacy/fairness of the tax regime for mining inAn economy blessed withabundant but finite naturalresources that bring in largeearnings becomes lesscompetitive in other sectorsthe host country; the revenue allocation system,particularly when it constrains the efficient andeffective use of public resources; conflicts overland use and property rights; environmentaldamage and concerns; conflicts between largescaleand artisanal mining; and the problemsassociated with mine closure.Countries that had successfully avoided theresource curse had embarked on an economicrecovery reform programme – often with theWorld Bank or the IMF, which in turn had broughtmacro-economic stability; had revised theirminerals code, which had attracted foreign directinvestment; and had shown some improvementsin governance, for example on transparency oraccountability.Reforms neededHowever, a key finding was that more attentionneeds to be given to strengthening capacity atthe sub-national level. Where such governance isweak, collaborative approaches involvingcompanies, governments, inter-governmentalorganisations, <strong>investor</strong>s, NGOs and communities,can help fill these gaps and attain significant andlasting benefits for developing economies.Collectively, these organisations need todetermine development priorities and ensure thatCountries that hadsuccessfully avoided theresource curse had embarkedon an economic recoveryreform programmeenlarged public revenues from mining are used tomeet them.A practical step that governments anddonors can take reflects the experience of theChad-Cameroon pipeline, which showed thatstate and community capacity building oftentakes longer than expected, while infrastructureconstruction is often completed ahead ofschedule. Thus not only does capacity buildingneed to start early, innovative approaches needto be found to fund such activities, as national(and thus local) governments receive few taxes orroyalties at the beginning of the constructionperiod.So there is an opportunity for governmentsto monetise the assets and bring the cash flowsforward by using, for example, the long-termloans and guarantees offered by the World Bankto transform future project revenue flows intocurrent capital funding for social andinfrastructure investments in local communities,while reserving sufficient funds to deal withsubsequent mine closure.Locally based non-governmentalorganisations can work with local communitiesand indigenous peoples’ organisations to helpbuild consensus for how the benefits areequitably shared. They could also help to ensurethat the voice of the marginalised is betterrepresented. Governments and companiesshould ensure that effective grievanceprocedures are in place within a wider decisionmakingframework, involving local communitiesand other stakeholders.What is ICMM?ICMM is a CEO-led industry group thatcomprises many of the world’s leadingmining and metals companies as well asregional, national and commodityassociations, all of which are committed toimproving their sustainable developmentperformance and to the responsibleproduction of the mineral and metalresources society needs.Contact Kathryn McPhail atkathryn.mcphail@icmm.comFor toolkit see: www.icmm.com/publications/1251REtoolkit.pdfBucky_za | Dreamstime.com62

infrastructure <strong>investor</strong>project finance lounge: from mobile phones to mobile powerSmart equity <strong>investor</strong>s are putting more money into African infrastructure. <strong>Simon</strong> <strong>Griffiths</strong>spoke to Richard Laing, CDC Group’s CEO, to hear why it needs to keep on its toesCould mobile power be the next big thingin Africa? With many African countriesgrowing at breakneck pace, demandfor electricity has soared across thecontinent. But often governments have failed toplan for this upsurge, leaving businesses andconsumers to cope with erratic supplies. EvenMobile power is the perfectstop-gap solution whilewaiting for conventionalpower to come onstreamSouth Africa has tripped up. The problem won’tdisappear quickly; conventional power stationstake years to plan, design, finance and build. ButActis <strong>Infrastructure</strong> Fund 2 - key factsa solution may be at hand in the form of mobilepower.Richard Laing certainly thinks the idea haspotential. “Mobile power consists essentially ofpre-fabricated generator sets that can be shippedand operational within months. They are theperfect stop-gap solution while waiting forconventional power to come onstream.”As CEO of CDC Group – the UK governmentowned,US $5 billion emerging markets fund offunds invested across South Asia, Latin Americaand Africa – Laing is in a position to back up hisbeliefs with considerable sums of money.Earlier this year, CDC committed $750m to anew infrastructure fund run by Actis, a specialistprivate equity <strong>investor</strong> and AI2 has put part of itsnew funds into Empower – a start-up companydedicated to mobile power generation (see boxfor details). “The primary advantage ofEmpower’s mobile generators is speed. Because• Target size of fund: ~$1.25 billion• Fund life: up to 15 years• Target net returns: ‘high teens’• Investment strategy: power sector plus selective investments in transport,telecommunications and energy in Africa and South and South-East Asia• Investment types: asset-intensive involving long-term contracts and usually generating stableand predictable cash flowsKeeping the lights on in TanzaniaUntil July 2004, Tanzania relied almost entirelyon hydropower, but drought that year broughtthe turbines to a halt and threatened to plungethe country into darkness. It would have doneif the 180MW Songas project hadn’t come onstream at almost exactly the same time.Songas is an integrated gas-to-electricityHow mobile power generation worksEmergency power, in the form of transportablehigh-speed diesel generating sets, has beenaround for years. These generating setsnormally run on premium automotive diesel fueland with the current high oil prices, they areextremely expensive to operate for anythingmore than a short-term requirement.Empower has developed the concept byusing medium-speed engines running on heavyfuel oil, which is currently approximately halfthe cost. While unsuitable for very short-termprojects, the solution is designed to providecontinuous base-load power on a medium-termbasis (anything from one to five years). Theproject managed by Globeleq.It includes a gas processing facility,pipeline and power plant, with outputcontracted to the Tanzania Electricity SupplyCompany (Tanesco) for a 20-year contract.Songas was one of the CDC assets seeded tothe Actis <strong>Infrastructure</strong> Fund 2.fuel cost differential is such that significantsavings can be made when running Empowerplants for base-load generation, in comparisonto typical high-speed diesel systems.Initially we are concentrating on Africa.Already there is a great deal of interest frommines, heavy industrial users and utilitycompanies. We currently have a total capacityof 72MW on order from our suppliers fordelivery during <strong>2008</strong>, and plan to grow ourfleet to around 500MW within five years.Dan Croft is Director of BusinessDevelopment at Empowerby Dan Croftof pent-up demand for power in Africa there is ahuge opportunity for these systems,” says Laing.Speed comes at a price, however, andconventional fixed power stations are moreefficient than their mobile cousins. Isn’t there adanger that “interim” becomes permanent andInvesting in Africa is nolonger simply a play on rawmaterials. The continent’sgrowing consumer base hasbecome increasinglyattractive to businessesAfricans end up paying more than they need forelectricity?“Ideally, mobile generation should only beused as part of a long-term plan with theexpectation it will be replaced by conventionalpower stations in the future,” says Laing. “Mobileunits are ideally suited to areas where the maingrid is not yet in place.”Africa’s virtuous circlesThe Actis fund will, of course, also be investing inconventional power generation. In fact, as well ascash, CDC seeded three existing power sectorassets to the fund, all of which are in Africa.These included an interest in the Tsavo powerstation in Kenya. Is he worried about the currentsituation in that country?“You always, obviously, have to be alert to therisks, but our experience is businesses have a goodtrack record of keeping going through politicaldisturbances. Communities still need power.”Generally, Laing is optimistic about Africa’sprogress and future. “Investing in Africa is nolonger simply a play on raw materials. Thecontinent’s growing consumer base has becomeincreasingly attractive to businesses. As thosebusinesses invest they create jobs and furtheropportunities and hence expand the consumerbase further. It’s one of two virtuous circles I seegoing on in Africa just now.”The second concerns governance: “We – bywhich I mean the private equity industry – havebeen very vigorous in insisting on investing only inproperly run businesses.” As a result professionalmanagers now run an ever increasing proportionof African businesses. This attracts moreexternal <strong>investor</strong>s who in turn insist on goodgovernance. Once good governance becomes acompetitive advantage – particularly in terms ofbringing in funding – it becomes entrenched.64

indexserieswww.africa-<strong>investor</strong>.comAi Roundtable with the Cairo and AlexandriaStock Exchange (CASE) 24th June <strong>2008</strong>, CairoFollowing the successful events at the London Stock Exchange in June, 2007 and theJohannesburg Stock Exchange in October, 2007, Africa <strong>investor</strong> is co-hosting seniorexecutives from Egypt and the Middle East at the Cairo Stock Exchange to meet with agroup of pre-qualified professional <strong>investor</strong>s and investment banks from across Egyptand the Middle East.This represents an unprecedented opportunity for the senior management ofEgyptian & Middle Eastern companies to engage MENA’s largest institutionalemerging market <strong>investor</strong>s.The roundtable with Cairo Alexandria Stock Exchange represents an unparalleledopportunity to showcase your company and network with North African and MiddleEastern Fund managers and brokers in a closed door invitation only setting.For further information on how to attend this event, please contact either:Jacquie Muhati: Tel: +44 (0) 207 189 8318, email: Jmuhati@africa-<strong>investor</strong>.com orPatrick: Tel: +27 11 783 2431, email: Pkhumalo@africa-<strong>investor</strong>.com

infrastructure <strong>investor</strong>oil and gas specialReutersRenewed energy forhydrocarbonsOil and gas reserves continue to dominate Africa’s export industry. Bénédicte Châtel revealsthe extent of large-scale exploration and development on every corner of the continentBenita Ferrero-Waldner’s “top priority” isdiversifying the European Union’s sourceof energy. The EU’s External RelationsCommissioner wants to start with gas,and with good reason: Europe today sources onequarter of its needs from Russia.If one does not look east for hydrocarbons,then one needs to search south, and north Africais the first port of call. In Algeria, work on themuch-delayed, eight billion cubic feet per yeargas Medgas pipeline to Spain started in March. Itis scheduled to begin transporting gas from BeniSaf by 2009. Algeria’s state-run Sonatrach, has a36% stake in Medgas, Spanish energy companyCepsa 20%, Spanish utilities Iberdrola andEndesa 20% and 12% respectively, and Gaz deFrance 12%.Neighbouring Libya launched in December itsfirst gas-focused exploration licensing round. Itaims to raise production to 3bn cubic feet perday (cfd) by 2010, with a potential for 3.8bn cfdby 2015, up from 2.7bn cfd now. It awardedpermits to Russia’s Gazprom, Algeria’s Sonatrachand Poland’s PGNiG. Royal Dutch Shell,Occidental Petroleum and United Arab Emiratesfirm Liwa, will undertake seismic surveys in theSirte Basin.And after a 30-year absence (and a year oftalks), BP made a comeback with an initialexploration budget of US $900m, while Germanenergy firm RWE will spend $76m to drill twoexploration wells.Sub-Sahara sniffs opportunityFurther south, the smell of gas persists. Nigeriahas the world’s seventh-largest reserves ofnatural gas (180tr cubic feet), of which much(2.5bn cubic feet) is being flared. PresidentUmaru Yar’Adua is in talks with his Algerian andNigerien counterparts to build a pipe transportinggas from Nigeria to Algeria and across theMediterranean, although <strong>investor</strong>s still have to befound. But Nigeria is very much under pressurefrom Russia’s Gazprom, which is pushing hard forWith a barrel above thehistoric level of $100, thescramble for African crudeoil is greater than evera way into the market so as to keep a dominantgrip on Europe’s gas supplies: it hopes to finalisea $1-2.5bn gas exploration deal with Nigeria bythe end of <strong>May</strong>.Production-wise, a sixth unit at Nigeria’slargest natural gas export plant was inauguratedin January <strong>2008</strong>, lifting annual shipments by afifth to 22m tonnes. The $1.6bn unit, controlledby Shell, Total, Eni unit Agip and state-run NigeriaNational Petroleum Corp (NNPC), took threeyears to build and should raise annual sales ofliquefied natural gas (LNG) from the wholecomplex on Bonny Island to about $6bn.Equatorial Guinea has just reached anagreement with Texas-based Marathon Oil, andJapan’s Mitsui and Marubeni to push ahead withexpansion of the Punta Europa gas plant, justoutside of Malabo. Germany’s E.ON and Spain’sUnion Fenosa are to be included in theconstruction of a second train at the $1.5bnplant, which shipped its first LNG cargo last yearand currently produces some 3.4m tonnes a yearof LNG, which is sold exclusively to the UK’s BGGas Marketing under a 17-year agreement.Even further south, in Angola, Chevron, Total,BP, Eni and Sonangol will build a LNG project thatwill treat 5.2m tonnes per year of LNG andproduce approximately 300bn cubic meters ofgas per year for export to the Gulf LNG Energyregasification terminal, which will be built inMississippi, USA.Nigerian crude sets the agendaWith a barrel above the historic level of $100, thescramble for African crude oil is greater thanever. At an energy conference in Cape Town inMarch the executive president of China Petroleumand Petrochemical Industry Association, ZhimingZhao, talked of wanting “to increase the imports,the oil and gas from Africa, from 35% to 40% inthe next five to 10 years”. Since 2004, $30bnhas been spent by Beijing in Africa’s oil and gasindustries: in Nigeria, where the three majorChinese companies are currently operating66

infrastructure <strong>investor</strong>(CNPC, Sinopec and CNOOC), in Sudan, inEquatorial Guinea (where CNPC has invested inits first overseas deep-water exploration project)and in Egypt, with China Honghua setting up ajoint venture with the Egyptian Ministry of Oil. Asfor the US, the Gulf of Guinea already providessome 17 % of American oil imports.In Nigeria, giant deepwater discoveriesinclude Shell’s Bonga, ExxonMobil’s Erha,Chevron’s Agbami and Total’s Akpo fields. Bongacost $3.6bn to develop and has been pumping225,000 barrels per day (bpd) since it cameonstream in November 2005. The other fields areall of a similar scale and together will produce800,000 bpd by the end of <strong>2008</strong>.Total signed in March a new agreement withNigeria’s Conoil to farm the deep offshore OPL257 license. For the French group, developing itsNigerian deep offshore resources is one of themain growth drivers in Africa, along with Angolaand Congo. Chevron Africa announced recentlythe green light on the Usan Field, which isexploited in a co-venture with Elf, Esso andNexen. First production is expected in late 2011with peak production of 180,000 bpd.Nigeria is also key to west Africanneighbours. The gas pipeline supposed toprovide Benin, Togo and Ghana has beenrepeatedly delayed, although officials remainoptimistic. In March, Lagos agreed to raise itscrude oil supplies to Ghana’s Tema Oil Refinery by50% to 60,000 bpd.Angola remains in touchAccording to Syanga Abilio, vice-president ofAngolan state oil giant Sonangol, the company isChina wants to increaseAfrican oil and gas importsto 40% in the nextfive to 10 yearsdoing its “best to maintain our plateau of 2m bpd,probably until 2014. Our production profile doesindicate normal decline (after 2014), which wewill be fulfilling with our exploration programme”,Africa’s second largest oil producer has becomethe largest supplier of oil to China, shipping arecord 900,000 bpd in December.For the first time last December, Angola gaveoil exploration licences to a consortium thatincludes a Russian company, diamond producerAlrosa. Along with Sonangol and Dark Oil, it willexplore onshore deposits in areas of the LowerCongo, Upper Kwanza, Etosha, Okavango,Kassanje, and will also work offshore.Total recently made a new oil discovery withthe 14th exploration well, Alho-1, and continuesdevelopment of the deepwater Pazflor field. EssoExploration Angola started production from theMarimba North project, designed to develop 80mbarrels of oil. And Australian producer Roc Oil,unsuccessful so far, said it would drill moreonshore wells in Cabinda. Construction of a newrefinery capable of processing 200,000 bpd, inthe southern port town of Lobito, will start thisyear, with a completion date of 2012. At a costof $4.5bn, it will be the government’s biggestproject yet, and would depend on the port ofLobito and the Benguela railway, most of whichhas yet to be reconstructed. Currently, thecountry relies on its Luanda refinery, whichproduces less than 40,000 bpd.Minor players look for openingsWith a crude oil output of 1.45m bpd, AlgeriaEXPERT INSIGHTWe have interests in 14 different countries inAfrica and have producing interests inapproximately six of those. Our maininvestments for the future are in Uganda andGhana but we also have producing interests inIvory Coast, quite extensively in Gabon, inEquatorial Guinea, in Mauritania and untilrecently in Congo Brazzaville. We are exploringfor oil and gas in Senegal, Madagascar,Tanzania and Angola. The contribution fromAfrica currently stands at almost 60% of Groupproduction. Both Uganda and Ghana have beensuch successes that we are going to bespending quite a bit of our resources ondeveloping these.We are particularly proud of the efforts weare making in Uganda. Uganda is a landlockedcountry but we have been successful in findingoil on the shores of Lake Albert, which is in alaunched in <strong>2008</strong> an energy exploration andproduction licensing round, the first since April2005. With plans to reach 2m bpd by 2010,some 40 international oil firms already haveacreage in Algeria, according to WoodMackenzie. Foreign firms are also coming onstrong to Libya, which wants to nearly doublecrude oil production by 2012 with a substantialinvestment outlay.“From now to 2012 there would beinvestments of around $30-$40bn. We arelooking mainly for foreign investments but theNational Oil Corporation of Libya will also invest,”says Shokri Ghanem, head of Libya’s National OilCorporation. A South Korean consortium, with SKEnergy and Korea National Oil, is partneringItaly’s Eni. In late February, Exxon agreed toinvest $97m and pay a signature bonus of $72mto drill exploration wells and do seismicsurveying. Canadian Verenex has made its fifth oildiscovery in the Ghadames Basin, as Petro-Canada was finishing off renegotiating itsby Andrew Windhampretty remote location. We have been doing alot, for example, to help the local fishingcommunities by providing them with lifeboatsand swimming training; we have also beenteaching them to use life vests properly, andthese are now manufactured by the localpeople. We feel that we do need to improvethe lives of those who are affected directly bywhat we do.I would like to see some of the benefitsthat are possible for the people of Uganda andGhana to come to fruition. There is a lot ofwork to fully develop the explorationdiscoveries we have made, but we would liketo see these projects really start to benefitpeople in Ghana and Uganda by 2010.Andrew Windham is Managing Director,Africa Region, Tullow OilReutersMAY - JUNE <strong>2008</strong> africa<strong>investor</strong> |67

infrastructure <strong>investor</strong>production sharing-agreement. Libya’s NationalOil Corporation (NOC) also signed a 20-yearaccord to supply Indonesia’s Pertamina with aminimum of 50,000 bpd beginning in April. TheJapanese are also in Tripoli: a consortium of fiveFor Total, developing itsdeep offshore resources inNigeria is one of the Group’smain growth driversin Africafirms (Nippon Oil, Inpex, Japan PetroleumExploration, JGC and Nippon Yusen KK) is in talksto build an oil refinery (200,000 bpd), at a totalcost of $4.5bn.Total Gabon plans a $2bn redevelopment ofits Anguille oil field, while French energy companyMaurel & Prom declared its Onal field on target tostart production in Q4 of <strong>2008</strong>. In Ivory Coast,the national oil company Petroci is to build a385km pipeline in the next 19 months, at a costof $249.3m, that will connect the port of Abidjanwith the northern city of Bouake, enablingdeliveries to landlocked neighbours Mali andBurkina Faso. Ivory Coast, which has a small butgrowing offshore oil output but imports crudefrom other big regional producers such asNigeria, already has one oil refinery in Abidjan andprivate developers this month announced plansto build a second one. The second refinery will bea 60,000 bpd unit to be built in a $1.4bn jointproject between Petroci and US firms EnergyAllied International and WCW International HoldingCompany.African crude production(thousands barrels a day)2004 2005Algeria 1,946 2,015Angola 966 1,242Cameroon 62 58Chad 168 173Congo 240 253Egypt 721 696Equatorial Guinea 329 355Gabon 235 234Libya 1,607 1,702Nigeria 2,502 2,580Sudan 325 379Tunisia 72 74Other 75 72Total Africa 9,266 9,835Total World 80,198 81,088Source: BP Statistical Review of World Energy 2006SPONSORED ADVERTORIALNigerian banks have historically been restrictedto involvement in the downstream sector of theenergy industry, but today most of the seriousbanks have shareholder funds of up to US $1billion, so they have the capital to becomeinvolved in upstream deals.By some estimates the annual businessavailable, both downstream and upstream, isabout $20 billion, so there’s significant scopeto increase deal size. Today, I believe thepotential deal size for a serious bank would befrom around N25 billion ($213m) up to N75billion ($639m) for some of the top-tierNigerian banks. The most important thing, is toidentify the right transactions and structurethem properly, while also being able to sellthem down into the secondary market. Thisfrees up your balance sheet to take on newthings, and keeps your deal pipeline open.FCMB stepped into this arena with ourrecently concluded Afren Plc deal. It was a realtrailblazer in this market, as we providedreserve-based lending in the form of a $50mloan with $12m of warrants supporting thedeal.Nigeria’s offshore deep water operationstend to be foreign-owned, but the moreSPONSORED ADVERTORIALWillbros has operated in Nigeria for 45 years,and across Nigeria and west Africa is theleading company providing and implementingproject partnering solutions. We are 100%Nigerian-owned and local content compliant,with approximately 1,900 staff of which atleast 1,500 are Nigerian.In February 2007, Willbros was bought bya group of Nigerian core <strong>investor</strong>s under theumbrella of Ascot Offshore Nigeria Limited.Ascot boasts a solid track record and strongtechnical capability, and we will be rebrandingto Ascot within the next few months.Willbros/Ascot operates internationallyfrom regional offices in Togo, Benin and Ghana,and has the capabilities to match every sectorof oil and gas service in the region. Thesecapabilities include landline, dredging,fabrication, offshore, coating, and themanufacture and installation of concrete matslocally in Nigeria, as opposed to the currentpractice of importing them. Our facilities aresuperbly equipped to manage these services:we have two excellent fabrication facilities inChoba and Isiodu, which have large acreagesand waterfronts in Rivers State, and 80 vesselsby Peter Obasekimarginal onshore shallow water facilities tendto be Nigerian-owned and serve as a trainingground for local companies. It is creatingopportunities for local banks to participate inthese transactions, such as the acquisition oftwo of Shell’s oil blocs by Oando. We wereinvolved in writing some of the guarantees thatbacked up the winning bid. The fields are quitelarge, up to 20,000 bpd, so we are very proudof our participation and expecting follow-ondeals from this transaction.Unfortunately, the risks in the Niger Deltaare still very real, and you have to be prepared.Because of the size of these transactions it isadvisable to act in concert for large deals soyou can co-finance and risk-share. Where youneed leadership is in the ability to structure.We are currently involved in a $250m deal withBNP Paribas, which is structured uniquely tomitigate risks. We’ve ensured the transactionhas an international scope, and that some ofthe assets being invested in are not in theNiger Delta.Peter Obaseki is Senior Vice Presidentand Head of Corporate Banking at FirstCity Monument Bankby Steve Juddfor use in onshore and offshore work.We’re aware that the Niger Delta is unsafeat present, and we treat safety, health andsecurity as the number one priority. At the endof each shift our staff must return home safe,and we’re pleased that we recently exceededone million man-hours on one of our projectswithout a lost-time-accident or securityincident.We’re also deeply committed to trainingour staff – we don’t just believe in feedingpeople fish but teaching them how to fish. Oneproject we’re currently carrying out is on oneof our swamp projects, where we had theoption of buying potable water for the short-lifeof the project, but decided to drill numerousboreholes in the area to provide the communitywith much-needed potable water for the longterm. We also award scholarships to about 60students from our host communities at Chobaand Isiodu, across the various disciplines, andhave an internal Engineering Graduate TrainingScheme in place.Steve Judd is Managing Director ofWillbros Nigeria/Ascot Offshore Nigeria Ltd68

OUTSTANDING IDEASSHARED SUCCESSWHAT CAN MILLIONS OF IDEAS, thousands of patents, and hundreds ofnationalities deliver? Success. Listening to the ideas of our clients and colleagues around theglobe has made Schlumberger the world’s leading technical services company. Your experiencesare catalysts for our innovation.Schlumberger invests in a worldwide community of research and development centers—fromBoston to Dhahran, Beijing to Moscow, Stavanger to Cambridge—encouraging our brightestminds to find new ways to improve efficiency, productivity, and safety, every day.Through our commitment to technology research and the support of our global network of localexperts, Schlumberger is leading the way into the future.Main Office Angola:Address: Rua Cristiano dos Santos, 5MiramarLuanda, AngolaTel: 244 222 430 254 Fax: 244 222 430 168www.slb.com© <strong>2008</strong> Schlumberger. 08-EAF-010

infrastructure <strong>investor</strong>interviewHome truthsMutiu Sunmonu, MD of the Shell Petroleum Development Company of Nigeria (SPDC),believes in the country’s value as a source and market for oil and gasQWhat is your investmentstrategy for the oil industry inNigeria?First, we want to focus on our heartlands, areaswhere we have invested in the past and where westill believe that there is value to be extracted. Wewant to sweat our existing assets and maximisevalue from them. On the other hand, while we areputting emphasis on the upstream sector, we arecontinuously looking at where we can haveprofitable economic returns downstream. That iswhy you see us investing aggressively in LNG,and looking at the domestic gas market so that ifit’s a profitable market we can be a big playerthere.QDo you practice a sustainableinvestment strategy?As the operator of the joint venture between TheNigerian National Petroleum Company, Shell, Elfand Agip, our strategy is about maximising ourhydrocarbon production and reserves towardssupporting the economic development of theNigerian nation.In terms of measurement, we start with afive-year plan, endorsed by all joint venturepartners, especially NNPC. Performance is soimportant because it influences how muchfunding is secured from government. Ifgovernment believes that joint venture funds arenot put to good use, they certainly have a reasonto cut back.External agencies help us appraise some ofour activities, especially on the social investmentside. We conduct opinion surveys to look at ourreputation, and for every project we do anEnvironmental Impact Assessment; for everyclean-up exercise, we invite third parties andgovernment to actually assess how well we havedone, to be certain that we are not operating todifferent standards in Nigeria from the Shellgroup worldwide.QWhat is your take on thecurrent escalation of world oilprices?Looking at the growing demand for energy; weshouldn’t be surprised at the prices. If we take aglobal view we see that wealth is increasing – aspeople get wealthier, the demand for energyincreases. We shouldn’t look at the hike in pricesas something negative, and for us as a companywe want to be a key player in that, making surewe can continue to meet those demands, but in acost-effective way.Economic alternative sources of fuel is stillfar away. We cannot get enough to actually startto depress the price of oil today, so I would sayit’s still a long shot. The technology would need along time to mature. Also new technology is nowreadily available to produce more oil than we everthought we had in the world. So oil will continueto be a major player.QWhat are your views on EITI(Extractive IndustriesTransparency Initiative)?It’s a noble initiative, which we identify with. Whenthe initiative was formulated, there was an auditdone, between 1999 and 2004, and wesubscribed to it. I feel proud that the auditshowed Shell as the largest taxpayer or royaltypayer in the country – US $8.5 billion. Wepublished how much revenue we payed to thegovernment, the first to have done that in theindustry. This concept should be extended tostates and local government so that at the end ofthe day our nation can actually get the benefit ofthe initiative. It is part of our strategy to have fulldisclosure of all our activities, both core andrelated.QIn what ways is Shell profferingsolutions to Nigeria’sconsiderable energy problem?I get calls nearly every week from the specialadviser to the president on power, so I can seethere’s a lot of focus on it. Government itself hascome to the realisation that we cannot have anymeaningful development if we are still in this eraof very low power output. I think that governmentwould need to probably take additional steps tomake sure the energy industry is deregulated. Italso needs to make sure that there are good andattractive incentives for private entrepreneurs towant to get into the power generation business.For example, we are building a brand newpower plant in Afam, which would add some 20%to our generating capacity. It will be managed bySPDC, and supplied to the Power HoldingCompany of Nigeria for distribution.QWith the unbundling of the stateenergy corporation, Nigeriansexpected better servicedelivery in this sector. Is thatrealistic?Those who are going to supply the gas to fuelthese power plants must be allowed to get acompetitive rate for the gas supplied. Gas pricingis also very important; we need to ensure thatpeople who invest in this strategic sector canhedge their investment against equitable returns.Gathering gas costs a lot of money – we havespent more than $3bn to gather gas over theyears in the areas of our operation – and themarket has got to offset this expense. Thereforethe theory of gas being freely available togenerate cheap electricity is fallacious.Mutiu Sunmonu talked to Ndiana UkpePrior to his current post, Sunmonu wasSPDC’s Executive Director Production, withoverall accountability for the company’s oiland gas production activities and delivery. Hehas also held the senior positions ofExecutive Director, Corporate Affairs, andGeneral Manager Production for SPDCEastern operations. He has worked for Shellsince 1978, with overseas stints at globalheadquarters in The Hague, and Scotland.70

FDI Expo <strong>2008</strong> - the global eventfor corporate expansion24-25 June <strong>2008</strong> ExCeL LondonFDI Expo <strong>2008</strong> - the ultimate one-stop marketplace for senior corporate decision makersto source the help and information to progress their international expansion programme.Register now at www.fdi-expo.comfor discounted fast track entry.Main Event SupporterFDI is published byOther EventSupportersTo Exhibit at FDI Expo or Tradexcall + 44 (0)20 8230 0066email sales@fdi-expo.comor click through to www.fdi-expo.comTradex is co-located with FDI Expo

infrastructure <strong>investor</strong>Countingthe costof failedinfrastructureReutersIt takes two hours to clear goods in Singapore and up to 15 days in Mombasa. <strong>Simon</strong><strong>Griffiths</strong> says the answer is to measure infrastructure competitiveness and then prioritiseEverywhere you go on the continent, thesame cry is taken up by businessmenfrom Dakar to Durban: inadequateinfrastructure saps a firm’s competitiveedge. Resources that could be used for growingthe business are diverted to cope with theproblems rotten infrastructure throws up.“Whereas we pay US $50 to ship somethingfrom Asia to Mombasa, it costs us an additional$150 to transport that same item from Mombasato Kampala. A large portion of that cost resultsfrom poor infrastructure,” says Vimal Shah, CEOof Bidco, the east African manufacturer andmarketer of edible oils, fats and hygieneproducts.Multinationals fare no better than homegrowncompanies. “It costs about $1,000 to ship acontainer to Africa and a further $2,000-$3,000to bring it inland,” says Richard Morgan,Corporate Relations and CommunicationsWhereas we pay $50 to shipsomething from Asia toMombasa, it costs us anadditional $150 to transportthat same item fromMombasa to KampalaDirector for Africa, the Middle East and Turkeywith Unilever, a company with worldwideexperience of delivering products to consumers.The costs start mounting the moment shipsarrive. “Ports are jammed because they don’twork on a 24-hour basis. It takes 10-15 days toclear goods in Mombasa, compared with twohours in Singapore,” says Shah.Then, because of road conditions, goodsneed additional packaging to ensure they arrive inone piece. On top of that, transport vehicles rackup high maintenance costs due to the constantbattering they take from potholes. Moving thingsaround also takes longer than necessary. “Ittakes ten days to move a truck from Tema inGhana to Lagos in Nigeria – a relatively shortjourney that could be done in three days,” saysMorgan.Unfortunately, there are no savings to bemade by shifting goods onto the railways.“Railway pricing is not competitive because it’s72

infrastructure <strong>investor</strong>worked out on the basis of what the equivalentroad transportation costs would be,” says Shah.On top of these transport costs, manufacturersface additional challenges. Erratic electricitysupplies force many firms in Africa to operatetheir own generators. “These are not onlyinefficient compared to centralised powersystems, they often stand idle. This means a lotof capital is tied up that could be used forbusiness expansion,” says Shah. Morganestimates that running generators can cost fivetimes the price of power from the grid, and thatUnilever loses 45 minutes of productivityPoor infrastructure meansmany African countries runlow-wage, high-costeconomiesrecalibrating its machines every time the lightsgo out. Firms also need to deal with unreliablewater supplies (which means they have to installtheir own tanks), and they can wait months fortelephone line connections.The net result of all this is that consumers inAfrica end up paying much more for goods thannecessary. “Poor infrastructure means manyAfrican countries run low-wage, high-costeconomies,” says Shah.Measuring the impactMeasuring these costs to businesses across acountry gives an indication of its infrastructurecompetitiveness. The World Bank’s EnterpriseAnalysis Unit collects a mass of data on factorsimpacting the ability of firms to do business indeveloping countries. These include access tofinance, security and, of course, infrastructure.Much of the data comes from questionnairespresented to businesses of all sizes, and backsup Shah’s assertions about the scale of theproblem. In Kenya for example, more than 70% offirms surveyed state they own or share agenerator, nearly 50% identify electricity as amajor constraint to doing business, and 37%have gripes about transportation (see chart). Thedata can also be used to identify Africa’s worstperformers (see tables).It is not only relative performance withinAfrica that is important. If the continent wants tocompete in the global marketplace it needscomparable levels of infrastructure to similarcountries. The current evidence suggests ithasn’t achieved these levels. In a paper oninfrastructure performance in southern Africa,Îeljko Bogetiç from the World Bank and JohannesFedderke from the University of Cape Townevaluated South Africa, Botswana, Namibia,Lesotho and Swaziland against comparableincomecountries from around the world. Theconclusion? “Overall, these countries, onaverage, lag behind their comparator groups ofcountries in several major indicators of access tobasic infrastructure services.”Norman Anderson, CEO of consultancy firmCG/LA <strong>Infrastructure</strong>, has spent a number ofyears looking at infrastructure competitiveness inSouth America. He recently turned his attentionto Africa and his firm will publish a survey ofAfrican infrastructure competitiveness later thisyear. The aim is to go beyond the enterprisesurveys and put a value on a country’sinfrastructure.“We look at infrastructure from the point ofview of managers of a mid-sized business andask: how much do you pay for access toinfrastructure and what do you get for yourmoney,” says Anderson. CG/LA assesses around40 variables, assigns weightings to each andcomes up with country rankings. “It's a totallypractical approach and a fantastic way toprioritise projects.”The data can be used to measure whichparts of the infrastructure equation cause thebiggest bottlenecks to business, how onecountry compares with another and whatgovernments should target if they want thebiggest impact per dollar spent.The overall aim, says Anderson, is to getpeople to talk and think about strategicinfrastructure investment.“When you take on 15-20 years of debt tobuild a piece of infrastructure, you have to ensureyou get 20 years of competitive advantage out ofit,” says Anderson. “It’s time to stop treatinginfrastructure as public works, stop interdepartmentalbudgetary squabbles overresources and get people to work together onkey strategic projects identified throughmeasuring infrastructure competitiveness.”Political will requiredIt’s not only the lack of physical infrastructure thatcauses problems. Delays at ports result frompoor management as much as low capacity;Measuring infrastructurecompetitiveness is a totallypractical approach, and afantastic way to prioritiseprojectscross-border overland travel takes so much timebecause of hold-ups at borders. “It’s a question ofwill. A lot of places still don’t have a tradefacilitation philosophy,” says Morgan.So what’s the solution? For the most partbusinesses have to take things as they find themand adjust their operations accordingly. Unileversells stock cubes across Africa, for example. Itused to make them with corn starch but importcosts made this an expensive ingredient; now ituses locally available cassava starch. Whentransporting goods, Bidco finds it needs toenhance packaging to resist dust and reduceSource: World Bank Enterprise SurveysMAY - JUNE <strong>2008</strong> africa<strong>investor</strong> |73

infrastructure <strong>investor</strong>damage. “We also need to lengthen our planningcycles and hold large inventories to allow forvagaries in delivery times,” says Shah.In some cases firms are pulled in opposingdirections. In order to contain costs it makessense to utilise economies of scale andcentralise manufacturing. But this may meangoods are produced far from the end consumer,and the additional transportation costs wipeout the savings made in manufacturing. And itseems that regional economic communities’ freetrade agreements are not working as well asthey could be.In theory, it should be possible to movegoods freely within ECOWAS (the EconomicCommunity of West African States), but Unileverstill finds it is being charged a 20% tariff totransport some products from Ivory Coast toNigeria because of a bilateral dispute betweenthe two countries.Governments and authorities can do more,and using infrastructure competitiveness as ayardstick to inform their investment decisionsshould ensure they receive maximum economicbenefits for their money.Most important of all, attitudes to themovement of goods need to change. NEPAD hasbeen working in this area for some time with itsone-stop border crossing projects andprogrammes to streamline documentation forcross-border transport. These efforts mustcontinue. Privatisation programmes can alsomake a difference: Morgan notes that sinceApapa Port in Lagos came under privatemanagement, efficiency has improved.Failing infrastructure means doing businessin Africa results in a high level of wastage:damaged goods, underused generators,additional packaging, bloated inventories and lostafrica-<strong>investor</strong>.comwww.bidco-oil.comwww.cg-la.comwww.enterprisesurveys.orgwww.unilever.comtime. Africa’s growing consumer classes bear thebrunt of the costs, but it is those consumers –through earning, spending and saving – who aredriving Africa’s growing economies.Governments owe it to their citizens tofacilitate business and trade so people can buythe goods they need. In some cases, investmentin physical infrastructure will be the way forward;at other times, gains could be made by adoptinga trade facilitation culture: improving efficiency atports and border crossings and reducingroadblocks.In both cases, measuring infrastructurecompetitiveness should help guide investmentdecisions.Key points• Poor infrastructure is a drag on businesscompetitiveness• Africa scores badly on a number ofmeasures and results vary widelybetween countries• Measuring infrastructurecompetitiveness is a valuable projectprioritisation tool• Problems are not limited to physicalinfrastructure. Burdensome bureaucracyadds days to journeysJohn Robinson / South Photographs / africanpictures.net74

NIGERIAN ELECTRICITY REGULATORY COMMISSIONPlot 1099 First Avenue, Central Business District, Adamawa Plaza - PMB 136, Garki, Abuja, NIGERIATel: 234-09-6700991 Web site: www.nercng.orgOUR MANDATETo Ensure Adequate, Safe, Reliable and Affordable Electricity for All ConsumersHOW?• Simplifies Application Process (download at www.nercng.org)• Uniform Licencing and Enforcement• Transparent and Consultative Rulemaking• Consumer Protection• Non-discriminatory Market Rules, Standards and Operating Codes• Regulatory Certainty and Stable Legal Framework• Respect for the Sanctity of Contracts• Working on Targeted Incentives to Lower Transaction Costs• Multi-Year Tarif for Cost Recovery, Profit and Affordable Tariff• Developing Service-Performing Standards and ReliabilityHOW TO BECOME AN INDEPENDENT POWERPRODUCER (IPP)1 REQUEST APPLICATION FROM NERC or www.nercng.org2 Define Your Business Plan,(Technical, Financial, Project Bankability)3 Provide All Requirements to NERC4 Nigerian Investment Promotion Commission (NIPC) One Stop Shopping -Fast Approvals to setup Companies5 Standard Power Vesting Contracts for IPP6 Power Generation has no Geographic Restrictions7 Place Public Notice in a Local & National Paper for 21 days8 Applications process must conclude within six months by lawPlease Visit Us or E-mail Us at: info@nercng.org

nigeriainfrastructureThis year’s Nigeria <strong>Infrastructure</strong> Investor Projects Summit will bringtogether institutional <strong>investor</strong>s, project financiers, contractors, regulatorsand government officials to discuss infrastructure development andfinancing across Nigeria.The summit will also address sector specific issues in transport, oil & gas, energy,telecommunications & ICT, power and energy, as well as having governmentalsessions and workshops dedicated to the projects processRegister now for the opportunity to network with Governmental representativeswho are profiling their projects, showcase your project to Chinese and MiddleEastern Investors, exchange ideas with contractors and project developers and getreal insight into the project process with workshops from industry leaders.Platinum sponsors:Yes, please register me as a delegate 2 day event @ £999.98 + VAT per person 1 day event @ £499.98 + VAT per personPlease complete & fax back immediately to Michael on: +44 (0) 207 189 8323 or mndinisa@africa-<strong>investor</strong>.comNamePositionE-mailOrganisationAddressCity Phone FaxPayment is required within 7 working days. VAT is charged at 17.5% and the fee is inclusive of programme materials, luncheon and refreshmentsnigeriainfrastructure<strong>investor</strong>projectssummit– where deals get done

<strong>investor</strong>projectssummitFollowing the success of the 2007 <strong>Infrastructure</strong> <strong>investor</strong> ProjectsSummit whose speakers included Mr Rotimi Oyekan, John LouisEkra, Jonathan Wood, Cecilia Ibru, Jim Ovia, Andrew Cornthwaite,and Nkosana Moyo, amongst many others;Ai have launched the Nigeria infrastructure <strong>investor</strong> projectssummit to be held on 16-17 June, Abuja, Nigeria.Jim OviaCEO, Zenith BankOther confirmed speakers include:Dr. Ken Kwaku, Special Advisor to Former President MkapaBrian Molefe, CEO of OPICTrevor J Ward, MD, W Hospitalityamongst many othersChuka EsekaCEO of VetivaOpuiyo OforiokumaCEO/ of LekkiConcession CompanyEndorsed by:Media Partner:Early bird offer 10% discount!• Book before 29th <strong>May</strong> for 10% discount• To register more than three delegates contact Michael for special discounts■ Summit: 2 day event fee - £ 999.98 + vat■ Summit: 1 day event fee - £ 499.98 + vatConnects Market Leaders, Decision makers & Financiers. Can you afford to miss it?nigeriainfrastructure<strong>investor</strong>projectssummit– where deals get done

infrastructure <strong>investor</strong>contractors’ and consultants’ cornerMichel Démarre, a Senior International Advisor with Colas and a board member of EIC,argues what’s needed for European contractors to return to AfricaThe European International Contractors(EIC) represents the interests of theEuropean construction industry oninternational construction issues and inrecent years it has become increasinglyactive in Africa. Michel Démarre works withdevelopment finance institutions (DFIs),governments and other stakeholders toaddress issues faced by Europeancontractors working in Africa. EIC found avariety of reasons why Europeancontractors determined Africa was “toodifficult” and have concentrated onopportunities elsewhere. In Colas’ case amanager was murdered in Nigeria during aburglary at his house.Genocide and war drove the company out ofBurundi and Rwanda and civil unrest terminatedtheir operations in Ivory Coast. As Abidjan was aregional hub, this also affected their work inneighbouring countries.Less traumatic but widespread across Africa,late payment of fees “is a real pain” for manycontractors. But late payment is only a symptomof an underlying problem – bad procurementpractice can really make a mess of a project, andis one of Africa’s biggest headaches when itcomes to developing infrastructure.Get it right from the off“In general we see much less spent on designand feasibility studies in Africa than we do inEurope, and it should be the other way around,”says Démarre. Shortcomings at the design andfeasibility stage typically result in variations andBad procurement practicecan really make a messof a projectdelays during construction, and push up costs.For example, when building a road in Europe,Colas would know exactly where to obtain stoneof the right quality and how much it would cost.Démarre has seen studies for African roads thatsay stone can be found at a certain quarry onlyto find later the quarry doesn’t exist or is rundownor the stone is sub-standard.Another problem is out-of-date studies. Areport says a road to be rehabilitated is in acertain condition, but when the contractor getsonsite he finds it is much worse because so muchtime has passed since the initial survey. Thecontractor needs to do more work than heexpected and bills the client for it. These changescause arguments, delays in payment and createpossibilities for corruption.Levelling the playing fieldEnsuring fairness is also on EIC’s agenda. Inparticular, where European contractors havepulled back the Chinese have stepped forward.Démarre has no problem with Chinese fundingbeing used to pay Chinese contractors; however,on international tenders he would like to insistChinese bidders are “real companies with realbalance sheets and not supported by the Chinesegovernment”. Otherwise they can bid below cost,knowing they’ll be bailed out of any loss-makingcontract. Démarre has raised the issue withseveral DFIs, which acknowledge the problem butsay it is very difficult to check.Another complaint with some DFIs is the lackof clarity in their specifications, particularly thoserelating to enforcement of health and safetystandards, living conditions for workers andenvironmental standards. It’s all very well to havevague wording about contractors treating theirstaff well, but unless the standards are properlyspelt out they leave too much room forunscrupulous contractors to cut costs byneglecting these issues. Currently, “some DFIsare not as good as they think they are in thisarea”.Démarre also believes the private sectordoes better than the DFIs in this respect becauseof scrutiny from non-governmental organisationsand shareholders.Scale factor“Although the above changes would helpconsiderably, they do not address the ‘scale’problem,” says Démarre.Currently there is not enough regular work inmany African countries to justify establishing apermanent physical presence there. UnlikeChinese companies, which import scores of theirown people, European contractors work (and areoften compelled to work) with local businessesand employees. “This is in fact a sound businessmodel and one we employ around the world. Weare ‘local’ everywhere we work.”The problem in Africa is a lack of long-termregular financing, which makes developing thistype of business model difficult. Projects get builtbut no one is paid to look after the investment.Roads disintegrate too quickly; power stationsbreak down.The solution, Démarre suggests, againcomes down to procurement. He would like tosee the widespread adoption of more innovativeprocurement methods that include allowances forthe long-term maintenance of assets.Contractors would be incentivised to build betterin the first place, knowing they’d have to maintainthe asset afterwards. Second, a mechanismwould be in place to keep the new infrastructureup to scratch. Third, local construction capacitywould leap forward. Contractors would bemotivated to work with indigenous firms as themost cost-effective way of fulfilling theircontractual obligations and local firms would findit easier to raise financing with the backing oflong-term maintenance contractors.“Many European contractors could do greatwork in Africa if the right contracts and tenderSome DFIs are not as goodas they think they areprocedures were put in place. Africa’s localconstruction industry would also benefit,” saysDémarre.Michel Démarre talked to <strong>Simon</strong> <strong>Griffiths</strong>Key points• Invest in detailed and up-to-datefeasibility studies to minimise variationsduring construction• Ensure all bidders for constructioncontracts are ‘real’ companies• Tighten up specifications, particularlythose relating to health and safety,welfare and environmental standards• Adopt contracts that provide for longtermmaintenance of assetsMAY - JUNE <strong>2008</strong> africa<strong>investor</strong> |79

T E C H N O L O G I E SA new generationdrilling fluids company.Drilling & Completion FluidsProduction/ Treating ChemicalsMud Engineering & DrillingSupport Services.MethanolHamilton...Consistent Quality Environmentally Sensitive Customer FocusedPlot 226, Block ‘C’, Phase IITrans Amadi Industrial Layout, Port Harcourt.Onne Base: Federal Lighter Terminal Onne Port,Onne Port Harcourt.sobere.diri@hamiltontechnologies.com+234 84 231 416 [fax]+234 84 231 418www.hamiltontechnologies.comPrince on +234 803 302 4670 & +234 803 407 0714Charles on +234 802 321 3444

infrastructure <strong>investor</strong>NEPAD cornerProfessor Emmanuel Nnadozie, NEPAD Unit Chief at the United Nations EconomicCommission for Africa (UNECA), singles out collaboration on air liberalisationUNECA, as part of its role to promoteeconomic and social development inAfrica, has established a NEPAD andRegional Integration Division (NRID).Professor Nnadozie talks about the division’splans for delivering on the NEPAD actionplan and supporting regional integrationand economic development.QWhat does UNECA see as itsrole in developing infrastructurein Africa and how is it linked toNEPAD’s infrastructure agenda?Although UNECA’s role is much wider than simplyinfrastructure, in this area the NRID promotessub-regional, regional and inter-regionalcooperation in transport, energy,communications and water resourcesdevelopment and management. Additionally, weassist member states in mobilising resources forthe financing of transport and communicationsinfrastructure. Specifically on infrastructure,through our sub-regional offices we have workedclosely with stakeholders in preparing actionplans, programmes and policy briefs and we haveassisted in identifying bankable projects.QMany organisations both insideand outside Africa are alreadyinvolved in its infrastructuredevelopment. What value doesUNECA add?UNECA’s strength derives from its role as the onlyUN agency mandated to operate at the regionaland sub-regional level to harness resources andbring them to bear on Africa’s priorities. This isparticularly important because the perspectivesof the AU and NEPAD are also primarily regionaland sub-regional. This advantage is reflected inUNECA’s leadership role in coordinating UN interagencysupport to NEPAD. Our convening powerallows us to mobilise stakeholders to discuss,make decisions and implement actions in relationto Africa’s development agenda.QHow do you collaborate withthe NEPAD Division in theAfrican Development Bank(AfDB) and other NEPADconstituents?We collaborate in many areas, particularly withthe NEPAD Secretariat. Key projects in theinfrastructure sector include: building institutionalcapacity within the regional economiccommunities (RECs) and at national level toimplement and follow up on regional integrationprogrammes; providing support to theimplementation of the Yamoussoukro Decisionfor Air Transport Liberalization in the context ofthe NEPAD Short Term Action Plan; partneringwith the African Forum for Utility Regulators(AFUR), the NEPAD Secretariat and the AfDB todevelop African codes of conduct, standards andguidelines for the exploitation of naturalresources; conducting training workshops onintegrated resources planning for minerals,energy/electricity and water resourcesmanagement.We also partner with other regionalinstitutions in the implementation of a UnitedNations Development Account (UNDA) project on“Public-Private Partnership Alliance for CapacityBuilding in <strong>Infrastructure</strong> Development andProvision of Basic Services”. We’re implementingthe Alma Tay Programme for land-lockedcountries through providing knowledgemanagement, especially in the establishment of apeer-learning group on natural resourcesmanagement. The purpose of this programme isto enable land-locked countries to reducetransport costs through access to coastal ports,enhancing trade through the transit countries andimproving cooperation between landlocked andtransit countries. We’re also conducting a fiveyearreview of the NEPAD Short-Term Action Planand the status of energy and transportdevelopment in Africa, to be completed in 2009.QCan you provide an update onUNECA’s strategic support toNEPAD’s infrastructureactivities?In its efforts to share knowledge for theeconomic development of Africa, UNECA hasplanned a series of training workshops, seminarsand conferences. A regional workshop onNEPAD’s Spatial Development Programme is totake place in South Africa in April or <strong>May</strong> thisyear; it will focus on the role of Public PrivatePartnerships (PPPs) in boosting the links betweennatural resources and infrastructuredevelopment. Other workshops include capacitybuilding in the strategic management of PPPprogrammes, new developments in PPPs andcapacity building for inter-regional electricityaccess and supply. We’re also planning a bigconference on investment in infrastructure andnatural resources development in Africa for2009.QShould NEPAD focus itsresources on socialinfrastructure and leavecommercial projects to theprivate sector?In line with NEPAD’s principles, and given Africa’sresource constraints, exploring public-privatepartnership is one of the ways to advanceinfrastructure development both socially andcommercially. Experience from the rest of theworld shows that PPPs are no panacea; there arerisks. However, the private sector’s comparativeadvantages – skills and resources – can be usedto complement government expenditure.The challenge is to develop strategies thatreduce the risk of failure of private infrastructureschemes. In this regard, organisations supportingNEPAD can build a consensus for PPPs, enhancegovernment capacity to plan, negotiate, design,implement and monitor PPP projects, developsound regulatory regimes and strengthenregulatory capacity, improve efficiency andaccountability of service provision, ensuretransparency of privatisation or awardprocesses, develop local financial markets, andreduce time of negotiation process and biddingcosts for infrastructure projects.Professor Nnadozie talked to EmmanuelNgwainmbi, a Communications andMarketing Consultant at the RegionalIntegration and Trade Department of theAfrican Development BankJoerg Humpe/Dreamstime.comMAY - JUNE <strong>2008</strong> africa<strong>investor</strong> |81

infrastructure <strong>investor</strong>in the pipelinePaul Runge inspects progress of selected current and upcoming infrastructure projects insub-Saharan Africa, finding oil, mining and power among those at the foreGENERALThe correlation between infrastructure projectsand resource-based programmes remainsmarked. At the Lake Albert Rift Basin oil projectin Uganda, Tullow Oil and Heritage Oil, currentlyengaged in prospecting activities, have alreadyembarked on support infrastructure projects suchas access roads, air strips, clinics and schools.The Belinga iron ore project in Gabon is oneof the most significant of its kind in the world.China has approved a preferential loan to Gabonfor the improvement of the Poubara hydro dam inthe Haute-Ogouee Province, and the additionalpower will be used for the Belinga Project. Thepower stations being constructed by the miningcompany Sherritt International, operating inMadagascar, are another example. They provideproduction capacity of 40MW for the AmbatovyMoramanga nickel and cobalt project, and 5MWfor the Toliara mining operations in the south.POWERAs the subcontinent faces up to its electricitysupply problems, power projects, notably hydropowerinitiatives, continue to dominate. InZambia, the government has launched its US $1billion Itezhi Tezhi hydro plant that will produce750MW. In Burundi, a new 60MW hydro plant willbe constructed on the Kagera River near theTanzanian border, costing about $100m withfunding from the World Bank, the AfricanDevelopment Bank (AfDB), Norway and Sweden.Swaziland faces disruptions in power supply fromSouth Africa and a feasibility study is underwayfor the construction of a 1,000MW power stationat Mpaka. Madagascar’s Andekaleka hydro powerstation has issued tenders for installation of twonew turbines.In evidence of stronger regional cooperation,a major NEPAD-accredited programme is theOrganisation for the Implementation of theGambia River Initiative (OMVG). Guinea has beenable to raise $800m (70%) of the total cost of theprogramme, which will be utilised for theconstruction of the Sambagalou Hydro Dam inSenegal and the Kaleta Hydro Dam in Guinea. Theheads of state of Ivory Coast and Mali haveinaugurated work on the Côte d’Ivoire-Mali H-Ttransmission line. Costing $198m, the work willtake 13 months, with India providing about 50%of the funding.AIRPORTSIn Swaziland, a second international airport atSekhuphe is planned. A 3.5km runway iscomplete and the rest of the project entails theresettling of the populace and the construction ofterminal and maintenance buildings. UK companyVector Management International has beeninvolved in the studies. Work on the extension ofOuagadougou International Airport in BurkinaFaso has been launched, at a cost of about 3.6meuros ($5.7m). It is hoped that the passengercapacity will triple from 300,000 per annum oncompletion in June 2009. Funding is from thestate and the French airport managementcompany ASECNA. The authorities are alsopreparing to construct a new CFA 360bn($867m) international airport at Donsin, 35kmfrom Ouagadougou.ROADSThe South African consulting engineering firm PDNaidoo & Associates (PDNA) is involved in theLugela bridge project in northern Mozambique.Completion of the 270m bridge section of thedual carriageway is expected in April <strong>2008</strong>. TheSwaziland transport authorities will soon beissuing an international tender for a toll roadcontract for the country. The award will be madeto a private entity under a Public-Private-Partnership (PPP) arrangement. The rehabilitationof the Nairobi-Thika autoroute northeast ofNairobi (financed by the African DevelopmentBank) could be seriously delayed because of thecountry’s current political crisis. The project wasdue to commence in January <strong>2008</strong> for a durationof three years, with an estimated cost of 172.5meuros ($273m).PORTSNigeria’s National Ports Agency has signedagreements with Costain West Africa and TreviNigeria for the significant extension of PortHarcourt port. The cost of construction will beabout 34.7m euros ($55m), and the expansionwill benefit companies wishing to export liquefiednatural gas (LNG) to Europe, America and Asia.WATER & SANITATIONAngola has for some time now been the focus forwater and sanitation projects. An affiliate of theIsraeli group Tahal, the company Kardan hassigned a 34m euro ($54m) agreement with thenational water utility for the installation of watertreatment infrastructure. The EuropeanInvestment Bank (EIB) has allocated ZAR 3.2m($395,000) towards a project that will pipe waterfrom the Maguga dam to Goleb in Swaziland. Thewater will irrigate 10,000 to 15,000ha in thedrought-ridden area of the country and theimplementing agency is the Komati Basin WaterAuthority (KOBWA).CONSTRUCTION/COMMERCIAL PROPERTYConstruction of the $4.5bn, Chinese-fundedAl-Morgan commercial complex in Khartoum,Sudan, has begun. Situated on the confluenceof the two Niles, the first phase includesconstruction of offices for petroleumcompanies, banks, telecommunications centresand ten upmarket hotels. The second phasecomprises 1,100 villas and 6,700 high classapartments.The Intercontinental Hotels and ResortsGroup has announced an agreement with LateralHoldings for the development of a new luxuryhotel complex in Mauritius. The IntercontinentalMauritius Resort Balaclava Fort will have 210rooms and 10 suites and will be situated on theseafront 20km north of Port Louis. The Italiangroup Preatoni Investment will be investing$2.2bn in an ecotourism hotel and marina projectin the Tabarka-Ain Draham area of northwestTunisia.Paul Runge is managing director of consultancyfirm Africa Project Access and Head of AfricaBusiness at the research and strategy companyEmerging Markets. For details on his reports andother services, tel: +27 11 465 6770 or email:afric.projs@pixie.co.uk.Lorna/Dreamstime.com82

AFRICA CUP POLO TOURNAMENT25-27 JULY <strong>2008</strong>INANDA CLUB, JOHANNESBURG, SOUTH AFRICARelax and socialize with Africa’s business and government leaders at one of thecontinents leading corporate sporting events at the prestigious Inanda PoloClub, in the heart of Sandton. The Africa Cup attracts players and dignitariesfrom all over Africa and will be broadcast on DSTV Channel SuperSport.For further information contact:Caroline Rose +27 (0) 83 571 7818 caroline@plu.co.zaFor sponsorship opportunities please contact:Melanie Hardiman +27 (0) 11 783 4043 mhardiman@africa-<strong>investor</strong>.comSponsored by:africa<strong>investor</strong>