ARC Capital Holdings Ltd

ARC Capital Holdings Ltd

ARC Capital Holdings Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

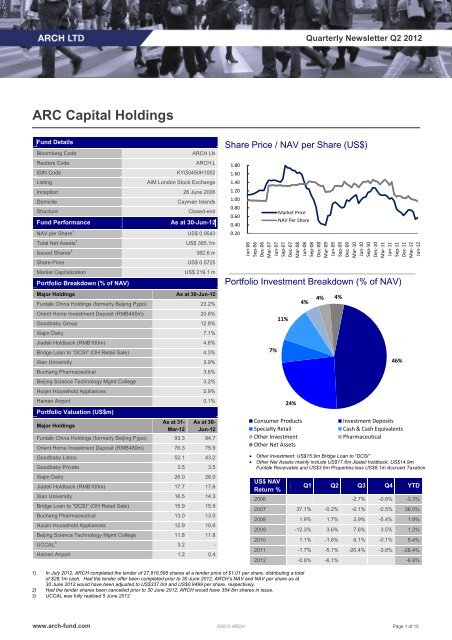

<strong>ARC</strong> <strong>Capital</strong> <strong>Holdings</strong><br />

Fund Details<br />

Bloomberg Code <strong>ARC</strong>H LN<br />

Reuters Code <strong>ARC</strong>H.L<br />

ISIN Code KYG0450H1002<br />

Listing AIM London Stock Exchange<br />

Inception 26 June 2006<br />

Domicile Cayman Islands<br />

Structure Closed-end<br />

Fund Performance As at 30-Jun-12<br />

NAV per Share 1 US$ 0.9543<br />

Total Net Assets 1 US$ 365.1m<br />

Issued Shares 2 382.6 m<br />

Share Price US$ 0.5725<br />

Market <strong>Capital</strong>ization US$ 219.1 m<br />

Portfolio Breakdown (% of NAV)<br />

Major <strong>Holdings</strong> As at 30-Jun-12<br />

Funtalk China <strong>Holdings</strong> (formerly Beijing Pypo) 23.2%<br />

Orient Home Investment Deposit (RMB480m) 20.8%<br />

Goodbaby Group 12.8%<br />

Xiajin Dairy 7.1%<br />

Jiadeli Holdback (RMB100m) 4.8%<br />

Bridge Loan to “DCSI” (OH Retail Sale) 4.3%<br />

Xian University 3.9%<br />

Buchang Pharmaceutical 3.6%<br />

Beijing Science Technology Mgmt College 3.2%<br />

Huiyin Household Appliances 2.9%<br />

Hainan Airport 0.1%<br />

Portfolio Valuation (US$m)<br />

Major <strong>Holdings</strong><br />

As at 31-<br />

Mar-12<br />

As at 30-<br />

Jun-12<br />

Funtalk China <strong>Holdings</strong> (formerly Beijing Pypo) 93.3 84.7<br />

Orient Home Investment Deposit (RMB480m) 76.3 75.9<br />

Goodbaby Listco 52.1 43.2<br />

Goodbaby Private 3.5 3.5<br />

Xiajin Dairy 26.0 26.0<br />

Jiadeli Holdback (RMB100m) 17.7 17.6<br />

Xian University 16.5 14.3<br />

Bridge Loan to “DCSI” (OH Retail Sale) 15.9 15.9<br />

Buchang Pharmaceutical 13.0 13.0<br />

Huiyin Household Appliances 12.9 10.6<br />

Beijing Science Technology Mgmt College 11.8 11.8<br />

UCCAL 3 3.2 -<br />

Hainan Airport 1.2 0.4<br />

Quarterly Newsletter Q2 2012<br />

Share Price / NAV per Share (US$)<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 1 of 10<br />

1.80<br />

1.60<br />

1.40<br />

1.20<br />

1.00<br />

0.80<br />

0.60<br />

0.40<br />

0.20<br />

Portfolio Investment Breakdown (% of NAV)<br />

7%<br />

11%<br />

24%<br />

4% 4% 4%<br />

46%<br />

Consumer Products Investment Deposits<br />

Specialty Retail Cash & Cash Equivalents<br />

Other Investment Pharmaceutical<br />

Other Net Assets<br />

� Other Investment: US$15.9m Bridge Loan to “DCSI”<br />

� Other Net Assets mainly include US$17.6m Jiadeli holdback, US$14.9m<br />

Funtalk Receivable and US$3.6m Properties less US$8.1m Accrued Taxation<br />

US$ NAV<br />

Return %<br />

Market Price<br />

NAV Per Share<br />

1) In July 2012, <strong>ARC</strong>H completed the tender of 27,816,595 shares at a tender price of $1.01 per share, distributing a total<br />

of $28.1m cash. Had the tender offer been completed prior to 30 June 2012, <strong>ARC</strong>H’s NAV and NAV per share as at<br />

30 June 2012 would have been adjusted to US$337.0m and US$0.9499 per share, respectively.<br />

2) Had the tender shares been cancelled prior to 30 June 2012, <strong>ARC</strong>H would have 354.8m shares in issue.<br />

3) UCCAL was fully realised 5 June 2012<br />

Jun-06<br />

Sep-06<br />

Dec-06<br />

Mar-07<br />

Jun-07<br />

Sep-07<br />

Dec-07<br />

Mar-08<br />

Jun-08<br />

Sep-08<br />

Dec-08<br />

Mar-09<br />

Jun-09<br />

Sep-09<br />

Dec-09<br />

Mar-10<br />

Jun-10<br />

Sep-10<br />

Dec-10<br />

Mar-11<br />

Jun-11<br />

Sep-11<br />

Dec-11<br />

Mar-12<br />

Jun-12<br />

Q1 Q2 Q3 Q4 YTD<br />

2006 -2.7% -0.6% -3.3%<br />

2007 37.1% -0.2% -0.1% -0.5% 36.0%<br />

2008 1.9% 1.7% 3.9% -5.4% 1.9%<br />

2009 -12.3% 3.6% 7.6% 3.5% 1.2%<br />

2010 1.1% -1.6% 6.1% -0.1% 5.4%<br />

2011 -1.7% -5.1% -20.4% -3.6% -28.4%<br />

2012 -0.8% -6.1% -6.8%

Investment Objective<br />

<strong>ARC</strong> <strong>Capital</strong> <strong>Holdings</strong> Limited (<strong>ARC</strong>H) is a private equity fund<br />

focused on investing in retail and consumer products companies<br />

primarily in Greater China. <strong>ARC</strong>H is traded on the AIM market of<br />

the London Stock Exchange.<br />

Since inception, <strong>ARC</strong>H has developed a portfolio of 16<br />

investments and has realised 10 to date. <strong>ARC</strong>H continues to be<br />

focused on enhancing the operational capabilities and value of its<br />

remaining investee companies as it realises its portfolio.<br />

Management Update<br />

During the second quarter of 2012, <strong>ARC</strong>H held its first annual<br />

general meeting (“AGM”) on 25 April 2012, where the following<br />

resolutions were passed:<br />

� Resolution 1 – ordinary resolution to adopt a permanent<br />

share buy-back authority for the Board of Directors: To<br />

facilitate the return of capital and income to shareholders,<br />

<strong>ARC</strong>H proposed to establish a permanent share buy-back<br />

authority. This authority would give the Board the ongoing<br />

ability to make both on-market and off-market purchases of<br />

ordinary shares, including by way of a capital reduction, and<br />

the flexibility and discretion to set the parameters for such<br />

purchases.<br />

� Resolution 2 – ordinary resolution to adopt the Board’s<br />

Discount Control Policy for 2012: To distribute all net<br />

proceeds under <strong>ARC</strong>H’s investment policy in a way that<br />

reduces the share discount to net asset value per share.<br />

Such distributions are expected to be made using tender<br />

offers and/or capital reductions, or a combination of these<br />

methods, together with share buy backs if they are<br />

considered by the Board to be highly accretive to the net<br />

asset value per share.<br />

Following the newly adopted realisation strategy, <strong>ARC</strong>H<br />

distributed a shareholder circular on 6 June 2012 detailing a<br />

tender offer to purchase up to 7.27% of the issued and<br />

outstanding ordinary shares of <strong>ARC</strong>H at a price of US$1.01 per<br />

share. The tender offer closed on 6 July 2012, representing<br />

approximately US$28.1 million (US$25 million from <strong>ARC</strong>H’s cash<br />

reserves plus US$3.1 million final payment from the UCCAL<br />

portfolio investment received on 5 June 2012). Together with<br />

previous distributions, <strong>ARC</strong>H has distributed a total of US$92.8<br />

million to date.<br />

On 7 June 2012, <strong>ARC</strong>H announced the appointment of Mr. Tian-<br />

Cho (TC) Chu as an Independent Non-Executive Director of the<br />

Board. Mr. Chu was formerly at McKinsey & Company, Inc. as a<br />

Senior Partner and the leader of its Greater China Healthcare,<br />

Consumer and Retail practices. Mr. Chu had been with McKinsey<br />

for over 27 years and has held numerous leadership positions<br />

within the firm’s Hong Kong and Greater China offices. Further<br />

details of Mr. Chu’s biography are available on the <strong>ARC</strong>H website.<br />

Quarterly Newsletter Q2 2012<br />

Management Update (continued)<br />

With the appointment of Mr. Chu, Mr. Michael Guy Hilliard Heald<br />

stepped down as an Independent Non-Executive Director and Mr.<br />

Steven Feniger was appointed as Chairman of the Board and Ms.<br />

Helen Wong was appointed as Vice Chair.<br />

Economy<br />

During the second quarter of 2012, China’s YoY GDP grew 7.6%,<br />

slowing from the previous quarter’s YoY GDP growth of 8.1%.<br />

Despite being in line with analyst expectations, this growth figure<br />

was the slowest in three years, increasing concerns of a slowdown<br />

in China’s economy. Fixed asset investment increased 20.4% YoY<br />

during the first half of 2012. The Chinese government’s monetary<br />

policies to control inflation have shown results as inflation rose only<br />

2.9% YoY during the quarter. Retail sales reported 13.9% YoY<br />

growth during the second quarter of 2012 as domestic consumption<br />

remained steady.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 2 of 10

FUNTALK<br />

Date of Investment: November 2007<br />

Initial Investment Cost: US$90.0 million<br />

Investment Instrument: Common Equity<br />

Shareholding: 18% (1)<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$84.7 million (2)<br />

1. On a fully diluted basis after privatisation<br />

2. As at 30 June 2012<br />

Note: A share placement of US$22m was completed in December 2009<br />

upon the successful transfer to NASDAQ, subsequently the company was<br />

privatised in August 2011<br />

Brief Description<br />

• Funtalk is a leading independent retailer of mobile<br />

handsets and related accessories and services, operating<br />

1,116 retail stores across China. In addition, Funtalk<br />

operates a national wholesale business, distributing mobile<br />

handsets to over 12,000 retail outlets. Until August 2011,<br />

Funtalk was listed on NASDAQ and was subsequently<br />

privatized by a consortium of its original investors including<br />

<strong>ARC</strong>H, Funtalk management and Golden Meditech.<br />

• PAG <strong>Capital</strong> invested an initial US$150m in August 2011 to<br />

fund the buyout of Funtalk’s public shareholders and the<br />

company’s continued growth. PAG <strong>Capital</strong> invested an<br />

additional US$100m in December 2011 to further expand<br />

the company’s operations.<br />

Financial Performance<br />

• April 2012 (FYE March 2012)<br />

– YoY Sales: +40%<br />

– YoY EBITDA: -7%<br />

– YoY Net Profit: -9%<br />

Business Update<br />

Quarterly Newsletter Q2 2012<br />

• FY2012 financials exceeded expectations having reported<br />

30% YoY growth in revenue and 26% YoY growth in net<br />

profit. Management accounts for the month of April 2012<br />

reported 40% YoY growth in revenue, exceeding<br />

management’s budget for the month, however gross<br />

margins were lower than expected due to an under-accrual<br />

for carrier-related business income and lower margins from<br />

the sale of mobile devices. This resulted in a 7% and 9%<br />

YoY drop in EBITDA and net profit, respectively, for the<br />

month.<br />

• Despite April 2012’s lower net profit figures, the<br />

management’s budget for FY2013 is still on target<br />

forecasting US$1.8b in revenue and US$65m in net profit,<br />

mainly driven by the opening of new stores and carrier<br />

contract sales growth.<br />

• Store count growth is still expected to double by year end<br />

FY2013, from its current retail store count of 1,116 stores,<br />

mainly focused on carrier-related business service stores.<br />

Opportunistic acquisitions will also be considered.<br />

• Due to ongoing negotiations on the value of Funtalk<br />

shares, there was a delay in settling the US$14.9m<br />

outstanding valuation adjustment balance (US$13.7m<br />

warrant agreements and US$1.2m repayment of a loan to<br />

Funtalk’s management). <strong>ARC</strong>H will set a deadline for<br />

Funtalk’s management to settle on the valuation<br />

adjustment and will try to complete the transaction as<br />

quickly as possible. <strong>ARC</strong>H may receive Funtalk shares<br />

and/or cash to settle the valuation adjustment. This<br />

settlement is between <strong>ARC</strong>H and the personal accounts of<br />

Funtalk’s management and therefore does not affect<br />

Funtalk’s issued share capital or cash position.<br />

• Exit strategy still 2-3 years as either a trade sale or IPO.<br />

Valuation<br />

• Market approach using EV/EBITDA<br />

• A derivative pricing model was applied in June 2012 to<br />

quantify the value of the redemption option of PAG<br />

<strong>Capital</strong>’s structured securities, should the option be<br />

exercised.<br />

• Decrease in valuation from Q1 2012 mainly due to a drop<br />

in comparables.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 3 of 10

GOODBABY (Listco + Private)<br />

Date of Investment: June 2006<br />

Initial Investment Cost: US$28.4 million<br />

Investment Instrument: Common Equity<br />

Shareholding Listco: 15% (1)<br />

Shareholding Private: 14%<br />

Date of Exit: November 2010 (2)<br />

Exit Type: HKSE IPO<br />

Current Value Listco Hldg: US$43.2 million (3)<br />

Current Value Private Hldg: US$3.5 million (3)<br />

1. Listco ownership on a fully diluted basis<br />

2. IPO on 24 November 2010 with a small realisation and shareholder loan<br />

repayment with interest totalling US$17.7m<br />

3. As at 30 June 2012<br />

Brief Description<br />

• Goodbaby Listco is one of the world’s leading durable<br />

juvenile products companies. It is the leading supplier of<br />

strollers in the US and Europe, and it has the largest<br />

market share of stroller sales and retail value in China. As<br />

at 31 December 2011, Goodbaby Listco sold its products<br />

through its extensive distribution network of 505<br />

distributors, with an end distribution network of 10,894<br />

maternity and childcare specialty stores, 1,667<br />

hypermarket outlet and 952 department store outlets.<br />

• Goodbaby Private is a leading integrated baby and children<br />

distribution and retail company in China. It holds the bestknown<br />

brand of children’s products in China – Goodbaby.<br />

Goodbaby Private also has a 70% equity interest in a joint<br />

venture with Mothercare UK to open and operate<br />

Mothercare retail stores in China. As of 29 February 2012,<br />

Goodbaby Private had nearly 5,000 outlets in China,<br />

including 18 Mothercare, and various Goodbaby-branded<br />

products and third party brands stores.<br />

Financial Performance<br />

• Listco (2011)<br />

– YoY Sales: +6%<br />

– YoY EBITDA: -16%<br />

– YoY Net Profit: -12%<br />

• Private (May 2012)<br />

– YoY Sales: +29%<br />

– YoY EBITDA: +200%<br />

– YoY Net Profit: +105%<br />

Quarterly Newsletter Q2 2012<br />

� Goodbaby Listco Share Price (as of 2 August 2012): HK$1.80<br />

� 63.3% decrease in IPO price<br />

Business Update<br />

• On 8 July 2012, Goodbaby Listco issued a profit warning<br />

announcement stating that based on the preliminary review<br />

of the unaudited management account, it is expected the<br />

company will experience a YoY decline in its net profit for<br />

the first half of 2012. This decline in profitability is primarily<br />

attributable to losses arising from the change in value of<br />

the company’s derivative financial instruments in 1H 2012<br />

caused by fluctuation in the RMB. These derivative<br />

financial instruments are forward currency contracts<br />

denominated in USD which were entered into by the<br />

company to manage its risk exposure against appreciation<br />

in the RMB.<br />

• Since the release of the profit warning, Goodbaby Listco’s<br />

share price has declined by over 15%.<br />

• <strong>ARC</strong>H will continue to monitor the company’s share price<br />

to optimise realisation, keeping in mind its director blackout<br />

periods.<br />

• Goodbaby Listco’s 1H 2012 financials are expected to be<br />

released in August 2012.<br />

• Goodbaby’s Private business continued its growth<br />

throughout the year with May 2012 figures reporting<br />

positive EBITDA and net profit, exceeding management<br />

budgets.<br />

Valuation<br />

• Listco is marked-to-market on a monthly basis with no<br />

discount applied since the expiration of the lock-up.<br />

• Private is marked at net asset value with a 30%<br />

marketability discount and management earn-out dilution.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 4 of 10

XIAJIN DAIRY<br />

Date of Investment: April 2007<br />

Initial Investment Cost: US$18.1 million<br />

Investment Instrument: Common Equity<br />

Shareholding: 46%<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$26.0 million (1)<br />

1. As at 30 June 2012<br />

Brief Description<br />

• Xiajin Dairy has been engaged in the manufacture and<br />

distribution of dairy products in China for 19 years. It is the<br />

largest regional dairy product enterprise in Ningxia<br />

province. Its self-owned brand, “XIAJIN”, has more than a<br />

50% market share in Ningxia province, and also distributes<br />

to nearby provinces and Beijing. It has extensive access to<br />

high quality local raw milk resources in Ningxia. Xiajin<br />

Dairy’s major products are UHT milk, flavoured milk and<br />

yogurt which account for more than 90% of sales.<br />

XIAN UNIVERSITY<br />

Date of Investment: August 2008<br />

Initial Investment Cost: US$42.7 million<br />

Investment Instrument: Common Equity<br />

Shareholding: 27%<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$14.3 million (1)<br />

1. As at 30 June 2012<br />

Brief Description<br />

• Shaanxi Dade is an education holding company<br />

specialising in higher vocational education in China with a<br />

portfolio of three schools and colleges, including Xian<br />

International University, one of the largest private<br />

universities in China. Shaanxi Dade offers accredited<br />

bachelor and associate degree programs, non-degree<br />

post-secondary education programs and vocational training<br />

programs with a wide range of facilities including foreign<br />

language, nursing, accounting, information technology and<br />

hotel management.<br />

Financial Performance<br />

• 1H 2012<br />

– YoY Sales: +16%<br />

– YoY EBITDA: +23%<br />

– YoY Net Profit: +59%<br />

Business Update<br />

Quarterly Newsletter Q2 2012<br />

• 1H 2012 reported strong growth despite increasing raw milk and<br />

raw material costs. Overall market consumption of dairy<br />

products and liquid milk sales raised 1H 2012 YoY sales by 16%<br />

with EBITDA and net profit increasing YoY 23% and 59%,<br />

respectively, due to product mix shifts which sold higher margin<br />

products.<br />

• YoY gross margins and EBITDA margins increased by 4.4% and<br />

3.4% compared to the same period in 2011.<br />

• Management expects continued growth in sales and profitability<br />

throughout 2012 from an increase in total sales volume in liquid<br />

milk and higher margin products.<br />

• <strong>ARC</strong>H has engaged a domestic investment bank to initiate a<br />

sale process.<br />

Valuation<br />

• Market approach using EV/EBITDA<br />

Financial Performance<br />

• Q1 2012<br />

– YoY Sales: -4%<br />

– YoY Net Profit: -6%<br />

– YoY Student Number: -4%<br />

Business Update<br />

• Discussions with potential buyers are still ongoing. Due to<br />

commercial sensitivities surrounding the sale process, details<br />

cannot be provided at this time.<br />

• Due to the nature of its business, the university has cyclical cash<br />

inflows concentrated in August and September of each year<br />

(new academic year). As a result, the university’s cash balance<br />

has currently dropped and is expected to remain at low levels<br />

until the start of the new academic year.<br />

Valuation<br />

• Market approach using EV/EBITDA<br />

• Decline in valuation was due to the current drop in cash balance<br />

of the university and increased leverage taken by the university.<br />

These loans were taken by the university to fund the<br />

construction of new academic buildings on the campus. The<br />

cash balance is expected to recover at the start of the new<br />

academic year.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 5 of 10

JIADELI HOLDBACK<br />

Due Date of Payment: October 2011<br />

Initial Investment Cost: US$17.7 million<br />

Investment Instrument: Holdback Payment<br />

Shareholding: n/a<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$17.6 million (1)<br />

1. As at 30 June 2012. Difference in value versus cost due to RMB<br />

fluctuation.<br />

Transaction Description<br />

• As part of the sale of Jiadeli Supermarkets to HNA Group on 11<br />

October 2010 for a total consideration of RMB1.1 billion<br />

(equivalent to US$164.8 million), it was agreed that a holdback<br />

of RMB100 million was to be paid to <strong>ARC</strong>H 12 months after<br />

closing, subject to completion of a post closing audit.<br />

• In March 2011, the audit was completed by RSM China, a<br />

domestic accounting firm appointed by HNA Group, which<br />

indicated a net loss of RMB34m compared to a net profit of<br />

RMB34m as audited by Deloitte & Touche (Jiadeli’s auditors). As<br />

a result, HNA Group has not released the holdback.<br />

• In August 2011, <strong>ARC</strong>H and HNA Group engaged Ernst & Young<br />

as the mediator to review the alleged discrepancies.<br />

BRIDGE LOAN TO “DCSI”<br />

Date of Investment: December 2011<br />

Initial Investment Cost: US$15.9 million<br />

Investment Instrument: Debt<br />

Shareholding: n/a<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$15.9 million (1)<br />

1. As at 30 June 2012<br />

Transaction Update<br />

Transaction Description<br />

Quarterly Newsletter Q2 2012<br />

• In late June 2012, E&Y reported that its work was inconclusive<br />

due to certain discrepancies found in the figures presented by<br />

HNA Group.<br />

• On 25 July 2012, <strong>ARC</strong>H met with HNA’s management to<br />

discuss the settlement. Negotiations are ongoing however HNA<br />

and <strong>ARC</strong>H may agree to a compromise to facilitate an early<br />

settlement.<br />

• The Manager will keep shareholders updated on any<br />

developments.<br />

Valuation<br />

• The holdback is valued at cost. <strong>ARC</strong>H’s Valuation Committee<br />

will review the situation and make appropriate adjustments as<br />

necessary, pending progress of ongoing discussions with HNA’s<br />

management.<br />

• As part of the sale of Orient Home Retail to a domestic Chinese<br />

strategic investor (“DCSI”), <strong>ARC</strong>H provided DCSI with a oneyear,<br />

RMB100m bridge loan.<br />

• The loan was to be used by DCSI to meet Orient Home Retail’s<br />

urgent short term working capital needs during the transition of<br />

ownership.<br />

• DCSI will repay this loan once it has successfully renewed Orient<br />

Home Retail’s bank loans and has injected additional capital into<br />

the company.<br />

• The interest rate for the loan is 8% per annum<br />

• No material changes have occurred.<br />

Valuation<br />

• The loan is valued at cost.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 6 of 10

HUIYIN<br />

Date of Investment: November 2007<br />

Initial Investment Cost: US$42.3 million<br />

Investment Instrument: Common Equity<br />

Shareholding: 19% (1)<br />

Date of Exit: n/a (2)<br />

Exit Type: n/a<br />

Current Value: US$10.6 million (3)<br />

1. On a fully diluted basis<br />

2. HKSE IPO on 25 March 2010 with no realisation<br />

3. As at 30 June 2012<br />

Brief Description<br />

• Huiyin is a leading retail chain operator and distributor of<br />

home appliances and consumer electronic products in the<br />

3 rd and 4 th tier cities of China. As at 31 December 2011,<br />

Huiyin had 61 self-managed stores and 157 franchise<br />

stores in Jiangsu and Anhui provinces.<br />

Financial Performance<br />

• 2011<br />

– YoY Sales: +59%<br />

– YoY EBITDA: -51%<br />

– YoY Net Profit: -83%<br />

Business Update<br />

• On 15 June 2012, the company issued a profit warning<br />

announcement stating that it expected a significant YoY<br />

decline in its net profit for the first half of 2012. This decline<br />

in profitability is primarily due to the government macro<br />

policy and the increasing cost pressure in the home<br />

appliance industry in China. The announcement also stated<br />

that profitability may further be adversely affected by<br />

potential provisions to be made by the company, in respect<br />

of the amounts due from suppliers, which could result in<br />

lower rebate offerings.<br />

� Share Price (as of 2 August 2012): HK$0.36<br />

� 79.0% decrease in IPO price<br />

Business Update (cont’d)<br />

Quarterly Newsletter Q2 2012<br />

• The company’s margins continued to suffer due to<br />

diminishing rebates from suppliers and expiry of central<br />

government support policies for electrical appliance<br />

purchases.<br />

• Since the release of its profit warning, Huiyin’s share price<br />

has declined by over 16%.<br />

• On 30 June 2012, <strong>ARC</strong>H resigned its directorship on<br />

Huiyin’s Board.<br />

• On 20 July 2012, the company announced that it would<br />

issue medium-term notes totaling RMB390m. The<br />

company explained that the proceeds from the issue of the<br />

notes would be used to expand the sales network and<br />

repay part of the company’s bank debt.<br />

• <strong>ARC</strong>H will continue to monitor the company’s share price<br />

and will realise its holdings in an orderly fashion when the<br />

opportunity arises.<br />

Valuation<br />

• Marked-to-market on a monthly basis with no discount<br />

applied since expiration of lock-up.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 7 of 10

BUCHANG PHARMACEUTICAL<br />

Date of Investment: June 2011<br />

Initial Investment Cost: US$13.0 million<br />

Investment Instrument: Common Equity<br />

Shareholding: 0.3%<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$13.0 million (1)<br />

1. As at 30 June 2012<br />

Brief Description<br />

• Buchang is a leading non-SOE (state owned enterprise)<br />

pharmaceutical company in China and the largest TCM<br />

(Traditional Chinese Medicine) company in China by net<br />

profit in 2009. The company is mainly engaged in the R&D,<br />

production and sales of TCM for cardiovascular disease,<br />

holding the largest number of patents, a large product<br />

portfolio, leading market share (7%), the largest number of<br />

sales staff and a leading sales network amongst all the<br />

pharmaceutical companies in China.<br />

BEIJING SCIENCE TECHNOLOGY<br />

Date of Investment: December 2007<br />

Initial Investment Cost: US$21.9 million<br />

Investment Instrument: Debt<br />

Shareholding: n/a<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$11.8 million (1)<br />

1. As at 30 June 2012<br />

Transaction Description<br />

Brief Description<br />

• <strong>ARC</strong>H completed arbitration with the company and its founder<br />

• The Beijing court Science approved Technology <strong>ARC</strong>H’s Management asset preservation College application to<br />

freeze was established certain assets in 1985 of the and company is the third and largest its founder during the<br />

arbitration private university in Beijing.<br />

• <strong>ARC</strong>H received a favorable arbitration award in December 2011<br />

for the full investment amount plus interest at the prevailing 1<br />

year bank savings rate<br />

• A judge has been designated to handle the auction of the frozen<br />

assets (Sanyimiao campus).<br />

Financial Performance<br />

• 2011<br />

– YoY Sales: +45%<br />

– YoY Net Profit: +5%<br />

Business Update<br />

Quarterly Newsletter Q2 2012<br />

• The company completed its conversion to a joint stock company<br />

in March 2012, which is required for an eventual A-share IPO.<br />

• <strong>ARC</strong>H attended a shareholder meeting at the end of June 2012<br />

where the company’s management indicated IPO progress is on<br />

track.<br />

• <strong>ARC</strong>H maintains a positive outlook for the company in<br />

preparation for its a-share IPO, however is wary that certain<br />

delays may occur during the filing process.<br />

Valuation<br />

• The investment is valued at cost.<br />

Transaction Update<br />

• At the end of June 2012, the court appointed an appraiser to<br />

conduct the valuation assessment of the frozen assets. It is<br />

expected that the valuation of the assets will take approximately<br />

3 months to complete. <strong>ARC</strong>H has requested that the court and<br />

the appraiser release the valuation report as soon as possible.<br />

• Following the courts administrative procedures leading to the<br />

auction, <strong>ARC</strong>H expects the auction process to start in late<br />

September 2012, if there are no further delays. The auction<br />

process could still be frustrated by the school’s owner as he will<br />

have the right to challenge the valuation stated in the valuation<br />

report. Barring any disputes to the valuation, the court will<br />

proceed to auction the properties.<br />

• <strong>ARC</strong>H will continue to focus its efforts to expedite the legal<br />

process to ensure repayment of the loan, which may be in 2013<br />

based on conservative estimates.<br />

Valuation<br />

• There has been no change to the valuation of the loan which is<br />

valued at 0.5x cost.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 8 of 10

UCCAL<br />

Date of Investment: December 2006<br />

Initial Investment Cost: US$10.8 million<br />

Investment Instrument: Debt<br />

Shareholding: n/a<br />

Date of Exit: June 2012<br />

Exit Type: Trade Sale<br />

Current Value: US$0.0 million (1)<br />

1. As at 30 June 2012. Fully realised on 5 June 2012.<br />

Brief Description<br />

• UCCAL is principally engaged in the business of<br />

international apparel brand retailing, wholesaling<br />

and distribution in China.<br />

ORIENT HOME INVESTMENT DEPOSIT<br />

Date of Investment: December 2010<br />

Initial Investment Cost: US$72.1 million<br />

Investment Instrument: Investment Deposit<br />

Shareholding: n/a<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$75.9 million (1)<br />

1. As at 30 June 2012. Difference in value versus cost due to RMB<br />

fluctuation.<br />

Brief Description<br />

• Orient Home Retail is a home improvement retailer<br />

founded in China in 1999. As of June 2011, Orient Home<br />

Retail had 24 chain stores in cities including Beijing,<br />

Shenyang and Chengdu.<br />

Transaction Update<br />

• In January 2012, following the sale of Orient Home Retail,<br />

<strong>ARC</strong>H issued, an official demand letter to Orient Home Co,<br />

the holding company of Orient Home’s property portfolio,<br />

requiring the full repayment of the RMB480m investment<br />

deposit made in December 2010. Orient Home Co then<br />

issued a formal confirmation letter to KPMG (<strong>ARC</strong>H’s<br />

auditors) on 26 March 2012, acknowledging its outstanding<br />

liability. Since then, <strong>ARC</strong>H entered a tri-party agreement<br />

with Orient Group on 15 May 2012 which acknowledges<br />

<strong>ARC</strong>H’s right to the RMB480m investment deposit and<br />

outlines an arrangement for <strong>ARC</strong>H to recover the deposit,<br />

either in the form of a pro rata equity interest in OH<br />

Property or installment payments from OH Property cash<br />

flows for the full amount of the deposit.<br />

Transaction Description<br />

Quarterly Newsletter Q2 2012<br />

• Originally structured as an equity and non-interest-bearing loan<br />

• Equity was sold to a third party in December 2009 and loan was<br />

converted into an interest-bearing loan<br />

• To date, all principal and interest has been paid.<br />

Business Update<br />

• On 5 June 2012, <strong>ARC</strong>H received the final outstanding payment<br />

of US$3.2m, fully realising its investment in the company.<br />

Together with the US$792K partial payment received on 27 April<br />

2012, a total of US$3.3m was included for distribution to <strong>ARC</strong>H’s<br />

shareholders through a tender offer.<br />

Valuation<br />

• Fully realised as of 5 June 2012.<br />

Transaction Update (cont’d)<br />

• Up to RMB600m in debt may be attributed to OH Property but<br />

has not been transferred from the Orient Group’s balance sheet.<br />

<strong>ARC</strong>H’s RMB480m investment deposit has been acknowledged<br />

to receive its full credit and the value of any OH Property shares<br />

received by <strong>ARC</strong>H will have already taken into account a<br />

maximum of RMB600m in transferred debt.<br />

• KPMG have qualified their audit opinion in respect of the<br />

RMB480m investment deposit in Orient Home Co as highlighted<br />

in <strong>ARC</strong>H’s 2011 Annual Report.<br />

• The tri-party agreement is still in effect as OH Group continues to<br />

work with the third party purchaser of the properties. <strong>ARC</strong>H has<br />

started a parallel effort to negotiate directly with OH Group on<br />

possibly selling the properties individually to recover the<br />

investment deposit. <strong>ARC</strong>H met with OH Group on 25 July 2012<br />

to discuss alternative procedures to sell the properties directly<br />

with OH Group, if the sale to the third party (as per the tri-party<br />

agreement) is delayed or fails to complete.<br />

• <strong>ARC</strong>H has started discussions with independent valuers to<br />

assess the properties and expects to appoint a valuer shortly.<br />

Valuation<br />

• As there have been no major developments since the signing of<br />

the tri-party agreement, <strong>ARC</strong>H’s Valuation Committee will<br />

continue to value the investment deposit at cost unless any new<br />

developments have a material affect on the recovery of the<br />

investment deposit.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 9 of 10

China Economic Indicators<br />

GDP (YOY 2012 Q2) 7.6%<br />

Industrial Output (YOY 2012 Q2) 9.5%<br />

CPI (YOY 2012 Q2) 2.9%<br />

Exports (YOY 2012 Q2) 10.5%<br />

Imports (YOY 2012 Q2) 6.5%<br />

Retail Sales (YOY 2012 Q2) 13.9%<br />

Exchange Rate (30 June 2012) RMB6.36 : US$ 1<br />

Source: National Bureau of Statistics of China<br />

Important Information<br />

Quarterly Newsletter Q2 2012<br />

The information contained in this Quarterly Update has been prepared solely by <strong>ARC</strong> <strong>Capital</strong> Partners Limited (“the Manager”). None of the information contained in this Quarterly Update is<br />

intended as financial, investment or professional advice and should not be taken as such by any party receiving it or obtaining it through any means. Nothing in this Quarterly Update should<br />

be construed as an offer to sell or a solicitation of an offer to buy any security or to participate in any trading strategy. Contents are based on sources which the Manager believes to be<br />

reliable, however no warranty or representation, express or implied is given as to accuracy and completeness. You should rely on independent confirmation of any information contained<br />

herein before relying on that information for any purpose whatsoever. Any forward looking statement included in this Quarterly Update is based on the opinions or expectations of the<br />

Manager, and actual results could differ materially. Historical performance is not an indicator of future performance and should not be assumed or construed as such. Finally, all the<br />

information contained herein including market data and prices are subject to change without notice. The information contained herein is being made available to institutional investors and<br />

investment professionals only as defined in the Financial Services and Markets Act 2000.<br />

<strong>ARC</strong> <strong>Capital</strong> Partners Limited is the investment manager of <strong>ARC</strong> <strong>Capital</strong> <strong>Holdings</strong> Limited. The Manager is not regulated by the Financial Services Authority.<br />

www.arch-fund.com<br />

Portfolio Manager<br />

Rachel Y. Chiang<br />

Investment Manager<br />

<strong>ARC</strong> <strong>Capital</strong> Partners Limited<br />

T: (86) 21 6113 5818 F: (86) 21 6113 5806<br />

arch@arccapitalchina.com<br />

Broker<br />

Numis Securities Limited<br />

David Benda / Hugh Jonathan<br />

T: (44) 20 7260 1000 F: (44) 20 7260 1001<br />

d.benda@numiscorp.com www.numiscorp.com<br />

Nominated Adviser<br />

Grant Thornton Corporate Finance<br />

Philip Secrett<br />

T: (44) 20 7383 5100 philip.j.secrett@uk.gt.com<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 10 of 10