ARC Capital Holdings Ltd

ARC Capital Holdings Ltd

ARC Capital Holdings Ltd

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

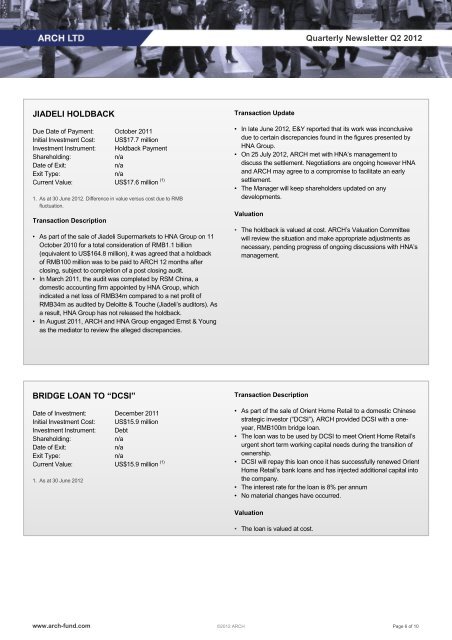

JIADELI HOLDBACK<br />

Due Date of Payment: October 2011<br />

Initial Investment Cost: US$17.7 million<br />

Investment Instrument: Holdback Payment<br />

Shareholding: n/a<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$17.6 million (1)<br />

1. As at 30 June 2012. Difference in value versus cost due to RMB<br />

fluctuation.<br />

Transaction Description<br />

• As part of the sale of Jiadeli Supermarkets to HNA Group on 11<br />

October 2010 for a total consideration of RMB1.1 billion<br />

(equivalent to US$164.8 million), it was agreed that a holdback<br />

of RMB100 million was to be paid to <strong>ARC</strong>H 12 months after<br />

closing, subject to completion of a post closing audit.<br />

• In March 2011, the audit was completed by RSM China, a<br />

domestic accounting firm appointed by HNA Group, which<br />

indicated a net loss of RMB34m compared to a net profit of<br />

RMB34m as audited by Deloitte & Touche (Jiadeli’s auditors). As<br />

a result, HNA Group has not released the holdback.<br />

• In August 2011, <strong>ARC</strong>H and HNA Group engaged Ernst & Young<br />

as the mediator to review the alleged discrepancies.<br />

BRIDGE LOAN TO “DCSI”<br />

Date of Investment: December 2011<br />

Initial Investment Cost: US$15.9 million<br />

Investment Instrument: Debt<br />

Shareholding: n/a<br />

Date of Exit: n/a<br />

Exit Type: n/a<br />

Current Value: US$15.9 million (1)<br />

1. As at 30 June 2012<br />

Transaction Update<br />

Transaction Description<br />

Quarterly Newsletter Q2 2012<br />

• In late June 2012, E&Y reported that its work was inconclusive<br />

due to certain discrepancies found in the figures presented by<br />

HNA Group.<br />

• On 25 July 2012, <strong>ARC</strong>H met with HNA’s management to<br />

discuss the settlement. Negotiations are ongoing however HNA<br />

and <strong>ARC</strong>H may agree to a compromise to facilitate an early<br />

settlement.<br />

• The Manager will keep shareholders updated on any<br />

developments.<br />

Valuation<br />

• The holdback is valued at cost. <strong>ARC</strong>H’s Valuation Committee<br />

will review the situation and make appropriate adjustments as<br />

necessary, pending progress of ongoing discussions with HNA’s<br />

management.<br />

• As part of the sale of Orient Home Retail to a domestic Chinese<br />

strategic investor (“DCSI”), <strong>ARC</strong>H provided DCSI with a oneyear,<br />

RMB100m bridge loan.<br />

• The loan was to be used by DCSI to meet Orient Home Retail’s<br />

urgent short term working capital needs during the transition of<br />

ownership.<br />

• DCSI will repay this loan once it has successfully renewed Orient<br />

Home Retail’s bank loans and has injected additional capital into<br />

the company.<br />

• The interest rate for the loan is 8% per annum<br />

• No material changes have occurred.<br />

Valuation<br />

• The loan is valued at cost.<br />

www.arch-fund.com ©2012 <strong>ARC</strong>H Page 6 of 10