Yapı Kredi Investor Presentation

Yapı Kredi Investor Presentation

Yapı Kredi Investor Presentation

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

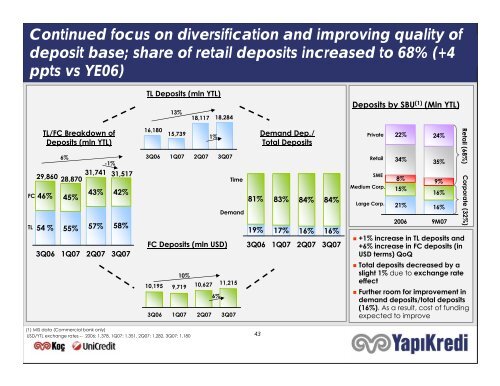

Continued focus on diversification and improving quality ofdeposit base; share of retail deposits increased to 68% (+4ppts vs YE06)TL Deposits (mln YTL)13%18,117 18,284Deposits by SBU (1) (Mln YTL)FCTLTL/FC Breakdown ofDeposits (mln YTL)6%-1%31,74129,860 31,51728,87046%54 %45%55%43%57%42%58%3Q06 1Q07 2Q07 3Q0716,180 15,7391%3Q06 1Q07 2Q07 3Q07TimeDemandFC Deposits (mln USD)10%10,195 9,71910,627 11,2156%3Q06 1Q07 2Q07 3Q07Demand Dep./Total Deposits81% 83% 84% 84%19% 17% 16% 16%3Q06 1Q07 2Q07 3Q07PrivateRetailSMEMedium Corp.Large Corp.22% 24%34% 35%8%15%9%16%21% 16%2006 9M07Retail (68%) Corporate (32%)• +1% increase in TL deposits and+6% increase in FC deposits (inUSD terms) QoQ• Total deposits decreased by aslight 1% due to exchange rateeffect• Further room for improvement indemand deposits/total deposits(16%). As a result, cost of fundingexpected to improve(1) MIS data (Commercial bank only)USD/YTL exchange rates -- 2006: 1.378, 1Q07: 1.351, 2Q07: 1.282, 3Q07: 1.18043