THE NEW BANK - Yapı Kredi

THE NEW BANK - Yapı Kredi

THE NEW BANK - Yapı Kredi

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

YAPI KREDİ: Post-Legal Merger Overviewİstanbul, December 20061

AGENDA• MACROECONOMIC & <strong>BANK</strong>ING ENVIRONMENT• <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong>• SHAREHOLDING AND ORGANIZATIONAL STRUCTURE• VISION & STRATEGY• STATUS OF <strong>THE</strong> INTEGRATION• 3Q 2006 RESULTS• PEER COMPARISON• ANNEX – SELECTED HISTORICAL AND RECENT FINANCIALS2

TURKISH ECONOMY HAS BEEN RECOVERING FROM <strong>THE</strong>FINANCIAL TURMOILS IN RECENT YEARS, ACHIEVING HIGHGROWTH RATES AND SINGLE DIGIT INFLATION7,0006,0005,0004,0003,0002,0001,00001098765432104035302,64520027.9200229.7GDP PER CAPITA (USD)5,0183,417 4,234200320042005GDP GROWTH (%)8.97.45.8200320042005INFLATION (CPI, %)5,381 5,9982006F2007F5.2 5.42006F2007F• After decades of instability, Turkey hasbeen enjoying high growth rates in theaftermath of 2001 crisis• Turkey is expected to continue growingabove 5% in 2006 and 2007.• The impressive decline in inflation duringthe last 3 years paused in 2006 due tothe financial turmoil in May and June,which affected all emerging markets.• However, inflation seems to havereturned to a declining path recently.2520151018.49.35 7.7 9.3 6.5• Disinflation process is expected tocontinue in 2007 and beyond.5020022003200420052006F2007F4

GROWING CURRENT ACCOUNT DEFICIT REMAINS <strong>THE</strong>MAJOR RISK1801601401201008060402000.0-1.0-2.0-3.0-4.0-5.0-6.0-7.0-8.0-9.0ANNUAL FOREIGN TRADE (USD BILLION)13611698738369 6352 47362002200320042005Exports Imports2006FCURRENT ACCOUNT BALANCE/GDP(%)-0.8-3.3-5.2-6.4-8.520022003200420052006F153922007F-7.82007F• Current account deficit has been themajor concern lately in the economy.• The current account deficit reached6.4% of the GDP in 2005 and is expectedto increase in 2006.• However, captial inflows, especially inthe form of FDI also increasedsignificantly during this period.• Meanwhile, the share of long termcapital inflow financing the currentaccount deficit increased considerably...• ...which helped to ease the concernsregarding sustainability of high currentaccount deficits.5

TIGHT FISCAL POLICY SINCE 2002 HAS RESULTED INA CONSIDERABLE REDUCTION OF <strong>THE</strong> BUDGETDEFICIT AND <strong>THE</strong> PUBLIC DEBT STOCK1050-5-10-15-2014012010080604020CONSOLIDATED BUDGET BALANCE/GDP (%)7.44.6 5.2 6.1 6.9 5.7-14.102002932002-11.22003-7.02004Budget Balance-2.0 -1.3 -1.920052006FPrimary BalancePUBLIC SECTOR DEBT STOCK / GDP (%)832003772004Domestic722005682006FExternal2007F652007F• Keeping high primary surplus in theconsolidated budget has been one ofthe main pillars of the economicprogram after the 2001 crisis.• These targets were attained successfullyso far. As a result, the budget deficit,which was one of the major concernsabout Turkey’s economy, declined evenbelow the Maastricht criteria as of2005,...• ...and the strong performance of theconsolidated budget is expected tocontinue in 2006 and 2007.• Budgetary discipline, as well as thedecline in real interest rates helped toreduce considerably the public debtstock, the sustainability of which hasbeen the major concern in the past.6

<strong>THE</strong> OUTCOME OF SOUND ECONOMIC POLICIES,SUCCESSFUL DISINFLATION AND CONSISTENT GROWTH WEREREFLECTED POSITIVELY IN <strong>THE</strong> FINANCIAL MARKETS50%40%30%20%10%1601501401301201101000%Oca.02REAL INTEREST RATES (%)Jan-03Apr-03Jul-03Oct-03Jan-04Apr-04Jul-04Oct-04Jan-05Apr-05Jul-05Oct-05Jan-06Apr-06Jul-06Oct-06Tem.02Oca.03REAL EXCHANGE RATE(PPI BASED)Tem.03Oca.04Tem.04Oca.05Tem.05Oca.06Tem.0614%• The economic program implemented since2002 improved confidence in Turkey’seconomy – also reflected in fin. markets.• The huge capital inflow led to aconsiderable appreciation of the YTL in therecent years.• Meanwhile, lower borrowing requirement ofthe Treasury thanks to the improvement inbudget balances, and increasedconfidence in Turkey’s economy led to asignificant decline in real interest rates...• ...which is an indication of reduced riskperception for the country.• Though the turmoil which began in May ledto some depreciation of the YTL andincrease in real interest rates, balancesseem to be restored once again.7

<strong>THE</strong> TURKISH <strong>BANK</strong>ING SYSTEM HAS BECOME HEALTHIERAND MORE COMPETITIVE IN <strong>THE</strong> LAST THREE YEARS2000 - 2001 2002 2003 - 20042005 - 2006• Economic crisis led bypolitical conflicts:– 33% depreciation inTL– Short-term interestrates around 95%level– Rapid increase ininflation• Aggravated problems inthe banking sector• The takeover of 20 banksby the SDIF• IMF reform program• Restructuring in thebanking sector:– Tight regulatory andsupervisory rules– Triple supervisionprocess– Sale or liquidation oftroubled banks– Strengthening ofcapital structure ofbanks– Istanbul Approach• Single party government• Sale and merging processof SDIF-managed banks• Robust capital structure• More efficient riskmanagement systems(BASEL II)• Improvement in assetquality• Rapid change in thestructure of the sector in adeclining interest rate &inflation environment• Privatization of stateownedbanks• Increase in banks’ capital• Increase in mergers andportfolio investments• Foreign partnerships• Increase in real sectorfinancing in thedisinflationaryenvironment8

<strong>THE</strong> SECTOR IS AMONG <strong>THE</strong> MOST ATTRACTIVE IN <strong>NEW</strong>EUROPE IN TERMS OF SIZE AND GROWTH PROSPECTS...Branches per mlninhabitants540(Loans+Deposits)/GDP275%• Today financial intermediation role of Turkishbanking sector is significantly low• Banks are rapidly recovering from the recentfinancial crises that led to significant lossesEurozone200587Turkey2005Eurozone200568%Turkey2005• The crises served as filter: total number of banks inthe sector declined to 47 from 81 at the end of1999, while that of privately owned commercialbanks declined to 18 from 35Loans growth (1) , %Deposits growth (1) ,%Rate on Loans (2) , %Rate on Dep. (2) , %Spread (2) , %200452262005512717.5 15.49.8 8.07.7 7.32006F402115.09.45.62007F241613.59.04.5• Strong performing loan growthwith the restructuring of the loanportfolio starting from 2003 andstable macroeconomic growth• Deposit growth to be parallel toGDP growth• Spread expected to stay around5.6% in 2006 and 4.5% in 2007Source: NE research network(1) Nominal Growth9(2) End-of-period Banking System data; compound rates calculated on average of FX and LC Loans and Deposits

DUE TO EXISTING LOW PENETRATION, HIGH GROWTHPOTENTIAL IN SPECIFIC CONSUMER <strong>BANK</strong>ING AREAS,PARTICULARLY MORTGAGES• 2005 +368% yoy, but only 2.5% of the GDP (in 2006, 113% yoy growth as of October, 4% ofGDP expected for the year-end)• Room for further growth vs GDP ratio of CEE benchmarks: 5.5% in Poland, 7.6% in CzechRepublic, 9.6% in Hungary, and 46% for EU-25• The New Law, although still expected to be approved in the parliament, introduces flexiblerates, deduction of interests from individual tax base and promotion of asset backedsecurities business5.04.03.02.01.0Mortgage Loans / GDP (%)0.02004 2005 2006E 2007F10

DESPITE AN ESTABLISHED MARKET, <strong>THE</strong>RE IS FUR<strong>THE</strong>RROOM FOR GROWTH FOR CREDIT CARDS• Developed business comparable to those in developed countries (UK)• 30 million credit cards, 0.4 cards per inhabitant (2.4 in U.K, 1.3 in Germany, 1.2 in Italy, 0.7 inFrance), average ROE is about 50%, driven by card number302520151050Credit Card Expenditures / Total PrivateConsumption Expenditures (%)2002 2003 2004 2005 2006E11

STRONG GROWTH OPPORTUNITY IN MUTUAL FUNDS WILLBE REALIZED IN LINE WITH CONTINUED STABILITY ANDDISINFLATIONARY TREND• Size: USD 15 billion as of October 2006,• Financial turmoil in May/June caused a sharp drop in the volume of mutual funds (24% dropfrom the year-end value). However, their share in total financial assets of households isexpected to increase gradually in 2007-2008 period.• Bring stability to earnings for the banksMutual Funds1210864202001 2002 2003 2004 2005 2006EShare in Total Financial Assets of Households (%) Ratio to GDP (%)12

PENSION FUNDS IS ANO<strong>THE</strong>R UNDERPENETRATEDRETAIL <strong>BANK</strong>ING AREA OFFERING STRONG GROWTHPROSPECTS• New business rapidly growing with 1,078,000 plan owners (October 2006), up 67% yoy• Volume USD 1,739 million (October 2006) with a 113% growth YTD (in YTL terms)Pension Funds Assets / GDP (%)0.60.40.202004 2005 2006E13

INCREASING INTEREST FROM ABROAD FOR TURKISH <strong>BANK</strong>S2004• Confidence in macroeconomicstability and healthy growthopportunities in the sector spurred theinterest of foreign players for Turkishbanks• TEB - BNP Paribas2005• Dışbank – Fortis• Three state banks will be privatized;one of these (Vakıfbank) alreadylaunched the privatization process byan IPO in November 2005, as a resultof which a total of 25.18% of theBank’s shares are now publicly traded• Privatization of the other state banksare also on the agenda• Garanti – GE Consumer Finance• YKB – Unicredit & Koç (KFS)2006• Denizbank- Dexia• Finansbank – National Bank of Greece• Akbank - Citibank14

OUTLOOK: BUSINESS TO INCREASINGLY SHIFT FROM FINANCIALMARKET OPERATIONS TO PROPER INTERMEDIATION. PRESSURESON MARGINS FROM FALLING RATES• Structural transformation to continue, withprivatisation of state banks and additionalforeign entries. Further mergers and acquisitionsmight follow so as to make use of economies ofscale and increase efficiency• Profitability will be key in a low inflation, stablemacroeconomic environment• Business to increasingly shift towardsintermediation and related services. Pressurefrom decreasing margins. Fee incomegeneration will be crucial• We expect loan and deposit growth to remainhigh in the next years, even if graduallydecelerating• Introduction of the mortgage system andmortgage backed securities is expected tostimulate housing loans further and presentan alternative instrument for investors in 2006• Small and medium sized enterprises (SME)segment is and will continue be anotherimportant area of competition. Banks willcompete to find creditworthy SME’s thatwere “under banked” in the previous years.This will increase the importance of riskmanagement and credit scoring systems• Efficiency increasing efforts (such as POSsharing,ATM-sharing) expected to continue16

AGENDA• MACROECONOMIC & <strong>BANK</strong>ING ENVIRONMENT• <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong>• SHAREHOLDING AND ORGANIZATIONAL STRUCTURE• VISION & STRATEGY• STATUS OF <strong>THE</strong> INTEGRATION• 3Q 2006 RESULTS• PEER COMPARISON• ANNEX – SELECTED HISTORICAL AND RECENT FINANCIALS17

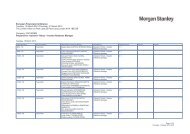

YAPI KREDİ MERGER IS <strong>THE</strong> BIGGEST M&A PROJECT IN<strong>THE</strong> HISTORY OF <strong>THE</strong> TURKISH <strong>BANK</strong>ING SECTORFINANCIAL HIGHLIGHTS-PROFORMA MERGED <strong>BANK</strong>(BRSA Bank-Only Figures in YTL, September 2006)Total Assets (bln(bln) 45.3Performing Loans (net, bln) 22.5(1)Deposits (bln) 28.9Mutual Funds (bln) 4.9Number of Credit Cards (mln) 4.9Number of Customers (mln) 13.1Number of Branches 598Number of ATMs 1,724Number of Employees 13,445Paid-in in Capital (mln(mln) 3,143(1) At combined level, includes consolidation adjustments.• Creation of one of the most dynamic and experiencedinstitutions in Turkey• Moved up to fourth largest position among private banks interms of total assets• Market leader in credit cards with 26% share in issuingvolume and 27% share in outstanding balance• Leading position in non-cash loans, assets undermanagement, leasing and factoring• Customer-focused strategy and service model• Strong multi-channel distribution network• Management expertise combining best of local andinternational talent and experience• Strong & committed shareholders*: Koç Holding, UniCredit18* As per new ownership structure, 80.27% of Yapı <strong>Kredi</strong> is owned by Koç Financial Services A.Ş.(“KFS”) -- the 50/50% joint venture between UniCredit and Koç Group - while minorities’ stakein the Bank is 19.73%.

STRATEGIC RATIONALEDIMENSIONALGROWTH• Significant scale increase, building one of the top four banking groups inTurkey, with Euro 28 billion of consolidated assets, Euro 13.6 billion ofcustomer loans and over 13 million clients(1)STRATEGICPOSITIONING• Creation of a group with strong distribution/production platforms andleadership position in most business lines• Strong market coverage with 598 bank branches, 9% market share atnational level– Significant concentration, with over 12% market share in top 10 citiesof the countryPERFORMANCEIMPROVEMENT• Significant value creation opportunities through revenue and cost synergies• Potential for leveraging other strategic advantages (critical mass, growthspeed) due to increased size and market presence of the combined group19(1) Unaudited IFRS figures for KFS as of 30 September 2006

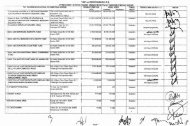

MAIN STEPS OF <strong>THE</strong> MERGER• 16 JANUARY 2005 Exclusive Negotiations• 31 JANUARY 2005 Share Transfer Agreement• 8 MAY 2005 Share Purchase Agreement• 28 SEPTEMBER 2005 Transfer of 57.4% of Yapı <strong>Kredi</strong> Shares to Koçbank• 23 FEB.- 9 MAR. 2006 Tender Offer Process for Yapı <strong>Kredi</strong> Minority Shares (completed with0.0050% shareholding acceptance)• APRIL 2006 Acquisition of Additional 9.9% of Yapı <strong>Kredi</strong> Shares by Koçbank• 20 APRIL 2006 Decision by the Boards of Both Banks on Merging Two Banks• JUNE 2006 Announcement of Merger Ratio of 19.73%• 3 AUGUST 2006 CMB Approval for the Merger• 18 AUGUST 2006 BRSA Approval for the Merger• 21 SEPTEMBER 2006 Approval of the Merger by Extraordinary Shareholders’ Assemblies of Yapı<strong>Kredi</strong> and Koçbank• 2 OCTOBER 2006 Legal Merger – Dissolution of Koçbank as a legal entity20

<strong>THE</strong> MERGER CREATES <strong>THE</strong> BASIS FOR COMPLEMENTARITYALLOWING BOTH <strong>BANK</strong>S TO COMBINE <strong>THE</strong>IR STRONGCOMPETITIVE ADVANTAGES• Dedicated service model for each segment• Large private/affluent customer base• Excellence in mutual fund business• Effective cost and risk management• Restructuring and profitability track record• Strong reputation of Koç brand• Strong and rooted franchise• Pioneer in retail banking and innovation• Market leader in credit card business• Large retail customer base• Widespread and powerful branch, ATM and POSnetwork• Strong heritage and recognized brand• Continuous contribution to society with social andcultural activities• Customer-focused strategy• World class customer service• Strong capital base• Sound balance sheet management based onsustainable value creation and growth• Focus on operational efficiency and costmanagement• Outstanding risk management• High qualified human capital• Strong brand recognition22

EXTENSIVE DISTRIBUTION NETWORK OF 598 BRANCHESWITH OVER 12% MARKET SHARE IN TOP 10 CITIES INTURKEYAs of 30 September 2006.24

KEY ISSUES & MAJOR ACCOMPLISHMENTS SO FARWrite-offs• Adjustments envisaged during the due diligence process have beenreflected in YKB’s post acquisition opening accountsTurkcell• On 25 November 2005, shares of Turkcell Holding and Turkcell İletişimwere sold with a value of YTL 1,638 million. The sale profit of YTL 1,144million has been added into the capital of YKBFiskobirlik• On 30 December 2005, the receivable, which was determined in YTL152 million nominal value, has been collected in the form of a 3-yearspecial type government bond based on the protocol signed with theUndersecretariat of TreasuryFintur &Digiturk• On 5 January 2006, shares of Fintur and Digitürk, that were owned byYKB, were sold with a value of YTL 174 millionA-TEL• On 9 August 2006, YKB sold its share in A-Tel to Turkcell with a value ofUSD 150 million.25

MAJOR WRITE-OFFS REPORTED DURING 3Q 2005YTL 399 MnYTL 475 Mn• Related to the credit exposure against Çukurova Group• Announced on 28 September 2005 as part of the Share Purchaseagreement signed between Koçbank and Çukurova Group• Impairment on Fiskobirlik receivableYTL 450 Mn• Provisions stemming from the prudent view of the Bank’s majorexposures and credit risk policiesYTL 355 Mn• Impairment on the value of Yapı <strong>Kredi</strong>’s 50% stake in A-TelYTL 660 Mn• Impairment on the real estate portfolioYTL 140 Mn• Impairment based on the alignment of the useful life of the Bank’s fixedassets in line with the current best practice in the Turkish banking sector26Figures based on BRSA unconsolidated financial statements

MAJOR ADJUSTMENTS REPORTED DURING 4Q 2005YTL 331 Mn• Provision recognized for the Pension Fund deficit -- 60% of the totaltechnical deficit of YTL 551 million• The remaining to be recognized until end of 2007YTL 293 Mn• Loss recognized due to change in accounting policy -- the Bankcommenced measuring subsidiaries and investments using the equitymethod, previously measured at fair value or restated cost+ YTL 36 Mn• Income recognized due to reversal of the provision booked at 30September 2005 associated with Çukurova non-core assets option• KFS released a commitment letter guaranteeing the Bank from anypossible disbursement27Figures based on BRSA unconsolidated financial statements

AGENDA• MACROECONOMIC & <strong>BANK</strong>ING ENVIRONMENT• <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong>• SHAREHOLDING AND ORGANIZATIONAL STRUCTURE• VISION & STRATEGY• STATUS OF <strong>THE</strong> INTEGRATION• 3Q 2006 RESULTS• PEER COMPARISON• ANNEX – SELECTED HISTORICAL AND RECENT FINANCIALS28

KOÇ FINANCIAL SERVICES (KFS) IS AN INTEGRATED ANDWELL CAPITALIZED FINANCIAL SERVICES PROVIDER€ billion, Unaudited IFRS Consolidated FiguresSeptember 2006Total Assets 28.0Deposits 17.8Net Cash Loans 13.6Loans/Deposits, % 76AuM (1) 3.2Total Revenues 1.3Net Consolidated Profit (mln) 268Credit Cards (#, mln) 4.9Customers (#, mln) (2) 13.3Branches (3) 648Employees 15,83850% 50%PARTNERS SHARE A COMMON VISION AND GOALKFS significantly grows its financial operations,network and market share as a result of a focusedcommercial growth plan and a conservative riskprofile approach, under the guidance of a stronglocal management team and with the dedicatedstrategic support of UniCreditValue creation will be driven by revenuegrowth, cost and risk controlNote: Exch. rate YTL/EUR 1.849629(1) Including mutual funds, pension funds and other DPM(2) Excluding subsidiaries(3) Of which Koçbank 180, Yapı <strong>Kredi</strong> 418 (including 3 rep offices), YKB Subs 46, other KFS subs 4

… WITH STRONG AND DEDICATED SUPPORT OF ITSSHAREHOLDERSKoç Holding Turkey’s largest industrialand services group with leading positionsin the main driving sectorsUniCredit International banking group,leader in Central and Eastern Europe (CEE)with presence in 20 countries30 September 2006 30 September 2006Market capitalization$ 4.1 billionMarket capitalization~ € 68 billionGross turnover *$ 21.2 billionRevenues / Turkish GDP*14%Exports / Turkish Exports*12%Total assetsTotal revenues (9M06)Number of customers€ 823 billion€ 17.6 billion> 28 millionServices network > 14,000Personnel number ~ 82,000(*) As of June 2006 including Tüpraş.Branch network > 7,200Personnel number ~ 132,00030

KOÇ HOLDING IS TURKEY’S LEADING INDUSTRIAL ANDSERVICES GROUP WITH STRONG POSITIONS IN <strong>THE</strong> MAINDRIVING SECTORS OF <strong>THE</strong> TURKISH ECONOMYRanks #358 (1) in Fortune Global 500 as the only Turkish CompanyUS$bn2006EYoY D2005-20062005YoY D2004-20052004Combined Revenues / GDP*Koç Exports / Turkey’s Exports*14%12%Total Revenues*(Combined)Total Revenues*(Consolidated)50.133.561%85%31.218.110%9%28.316.6Koç Group Share in ISE MarketCap.**18%InternationalRevenues*12.345%8.513%7.5EBITDA3.0 104% 1.52% 1.5* As of 1H06, including Tüpraş** Share in ISE-100 as of 1H06(1) Following recent acquisitions, expected to move from 358thplace into the first 200 in Fortune 500 by year-end 2006* Tüpraş will be included as of 2006. Unauditedfigures.Leading Positionsin 5 Lucrative and High-Growth Sectors: Automotive Consumer Durables Retail Energy FinanceStrong Franchise with Well Established & ProminentBrands / Unparalleled Distribution Network : 14,000 Independent Dealers & Agencies 755 Retail Outlets 595 Bank Branches31

KOÇ GROUP FORMED HEALTHY ALLIANCES WITH STRONGINTERNATIONAL PARTNERS TARGETING GROWTH ANDSUSTAINABILITY• International partnerships for growth that involve new capabilities,• New channels and new geographies while mitigating riskAutomotiveFinanceConsumer Durables Retailing Energy32

<strong>THE</strong> GROUP HAS BEEN INCREASING ITS GLOBAL REACHTHROUGH EXPANSION INTO MARKETS WITH HIGH GROWTHPOTENTIALStrategy• To position Koç Group companies among the largest and most rapidly growing companies in Europe• To generate at least 50% of revenues outside Turkey and lessen dependence on domestic economyRussiaChina,Hong KongAustria,Bulgaria,England,France,Germany,Ireland, Italy,Macedonia,Netherlands,Poland,Romania, Spain,SwitzerlandU.S.A.Bahrain, IraqAzerbaijan,Kazakhstan,Uzbekistan,KyrgyzstanAlgeriaLargest International Network of Turkish Origin in 24 Countries33

UNICREDIT, O<strong>THE</strong>R SHAREHOLDER OF KFS, IS A UNIQUELYAND RESOLUTELY EUROPEAN <strong>BANK</strong>…• ~70 bn market cap (#3 among Eurozone banks) (1)• More than 28 million customers• Over 7,000 branches• Banking operations in 20 countries• Over 132,000 FTE• Over 430 bn euros of customer loans• Strong market positioning:‣#2 in Italy with 10% market share (2)‣#2 in Germany with 5% market share (2)‣#1 in Austria with 18% market share (2)• Leader in fast growing CEE markets much larger thanclosest competitor(1) Prices as of November 23 rd , 2006; other figures in the box as ofSeptember 2006.(2) Ranking measured in terms of total assets, 2005 data. For market sharecalculations UniCredit and HVB may apply different definitions as far asthe underlying data is concerned. Market share and ranking in Italy referto customer loans.• High growth potential:‣ Significant opportunities in the local networks aswell as in the global businesses34

…WITH A SOLID TRACK RECORD SUSTAINED OVER TIMEGROWTHINTERNATIONALIZATIONUniCredit EPS and Mkt. Cap. Evolution (Euro)1994-2005 CAGR: 30%0.28 0.280.260.290.190.050.021994 1995 1996 1997 1998 1999 2000 2001 20020.3120030.3420040.37 (1)2005Country weights onGroup gross op. profit100%PROFITABILITY21%19%11%49%1994 2005ROE, %19.0CEEGERATITMkt. Cap. (2)1994 20052.5 bn 60 bn1.41994200535(1) 2005 stated EPS(2) Calculated using the yearly average price for 1994 and price as of 30.12.2005 for 2005

CLEAR REORGANIZATION PATH OF GROUP LEGAL ENTITIESCurrent Group StructureTarget StructureUCIItalianBanksHVBUCI CEE(incl.Bph)UCI IB(UBM)UCI AM(PGAM)UCIItalianBanksHVB BA-CA PekaoAssetMgmt.(PGAM)BA-CAInvestmentBank (1)BABank (2)HVB CEEBA-CACEEUCI IB(UBM)UCI CEEHVB AMHVB IBBA-CA IBHVB IBBA-CACEEBA-CAAMHVB AMKey features ofthe process:BA-CAAM• Aimed at simplification, facilitating the corporate governance of each entity, the management of theGroup’s business divisions and the achievement of cost and revenue synergies• Quick: expected to be largely executed within the Plan timeframe• Tax efficient• All transactions at arm’s lengthBA-CA IBHVB CEE(1)In the long term UniCredit willgain full ownership(2) Newco including all the commercial banking activities in Austria; in accordance withReBoRA signed last March, to be realised not before March 201136

CEE STRATEGY OF UNICREDIT GROUP :A UNIQUE FRANCHISE IN <strong>THE</strong> CEE REGION WITH PRESENCEIN 17 COUNTRIESIntegration countries (1) Turkey (3)Merger countriesRanking on 2005 Total Assets(TA) – TA in Euro bnSloveniaNo. 5 – 1.9Czech. Rep.No. 4 – 8.4Croatia (2)No. 1 – 9.7BosniaNo. 1 – 1.4SerbiaNo. 5 – 0.5PolandNo. 1 - 31.1EstoniaNo. 6 – 0.1LatviaNo. 10 – 0.4LithuaniaNo. 8 – 0.4SlovakiaNo. 5 – 3.4No. 5 – 27.5RussiaNo. 8 – 4.7UkraineNo. 13 – 0.3HungaryNo. 7 – 4.1RomaniaNo. 3 – 3.3BulgariaNo. 1 – 3.4AzerbaijanNo. 9 – 0.05CEE region (4)~84Euro bnTotal Assets~ 3,000Branches~ 64,700Employees~17mlnCustomers~ 400 mlnInhabitants37(1) Defined as countries to be integrated in the new CEE Division of BA-CA, including the transferof assets, (2) Excluding Splitska banka, (3) 100% of total assets(4) CEE Region total considering Turkey pro-quota for total assets and at 100% for other items

LEADING PLAYER AMONG INTERNATIONAL COMPETITORS IN<strong>THE</strong> CEE REGIONProforma 2005, as of perimeter May 2006 iConsolidated Assets(Euro bln) iTotal Revenues(Euro mln)Net Profit before min. int.(Euro mln) iiCountries ofPresence iiiUniCredit84.5 (1) 4,196 (1)17(2)Erste39.4(3)(3) (3)48.7 (4) 1,744 2,406 (4) 530 711 (4)56 (4)KBC42.71,9285565RZB40.742.3 (5) 1,898 2,026 (5) 460 481 (5)15(11)SocGen26.91,4354909531 (6) 9 (8)10 (6)IntesaOTP19.1 (10)30.1 (6) 1,561 (10)1,551 (6) 609 (10)20.1(7)22.1 (8)(7)1,212 (8)(9)(7)1,083301 326 (8)19.0(1)Excluding Splitska Banka including pro-forma NBB, Tiriac and Hebros, and with Turkey at pro-quota;(2) Including Azerbaijan; (3) Including proforma Erste Serbia; (4) Including proforma BCR; (5) Including proforma Impexbank; Bank Avalfully consolidated since 1 st Oct 2005; (6) Including proforma Splitska Banka; (7) Including proforma KMB and Intesa Beograd;1,5456081,405 (1) 576 (10)Source: Unicredit-NE Research Network; numbers converted using avg and eop ex. rates from UIC for P&L and BL figures, respectively. Datafor UniCredit may differ from the applied methodology to be in line with 3YP figures(i) 100% of total assets, revenues and profit after tax (before minorities) for controlled Companies (stake > 50%) and share owned for(ii)non controlled companies; proforma results include also banks acquired during 2005 and 2006;After tax, before minority interests38(iii) Including direct and indirect presence in the 21 CEE countries, excluding representative offices (1)Excluding Splitska Banka including pro-forma NBB, Tiriac and Hebros, and with Turkey at pro-quota;(2)Including Azerbaijan; (3) Including proforma Erste Serbia; (4) Including proforma BCR;(5) Including proforma Impexbank; Bank Aval fully consolidated since 1 st Oct 2005;(6) Including proforma Splitska Banka; (7) Including proforma KMB and Intesa Beograd;(8) Including proforma Ukrsotsbank and UPI Banka (as of Sep ’05); (9) Revenues for KMB and UPI Banka n.a.;(10) Including proforma Niska Banka and Zepter Banka; profits are before tax; P&L of OTP Hrvatska doesn’t include Q1 2005(11) Excluding Kosovo

<strong>THE</strong> CEE REGION IS A LARGE MARKET WHERE UNICREDIT ISWELL POSITIONEDPopulation, mlnGDP, Euro bnPer Capita GDP, EuroYear 2005 dataReal GDP Growth (%)EU 15 CEE 16 (1)385 (2)10,26426,6553861,6684,324Inflation (%) 2.1 4.6 (3)2002-05(avg) 1.32006-08F (avg)1.75.25.7CEE (4)EurozoneCountriesPolandCroatiaTurkeyRussiaHungaryCzech RepublicBulgariaRomaniaSlovakiaBiHSloveniaS&MUkraineEstoniaLatviaLithuania% Net ProfitUniCreditCEE Banks49.0%10.9%9.3%6.6%5.9%5.4%4.9%3.9%2.5%0.8%0.8%0.5%0.5%0.3%Weight onGDP of CEE%14,4%1,9%17,4%36,9%5,3%5,9%1,3%4,8%2,2%0,5%1,6%1,3%3,9%0,6%0,8%1,2%Real. GDPgrowth(avg 06-08)4.3%4.0%5.5%5.6%4.0%4.9%5.7%5.3%6.1%5.8%3.9%5.2%3.9%8.8%7.7%6.3%Note: Data 2005. Countries are ranked in terms of net profit beforeUniCredit’s minorities generated by UniCredit CEE banks. Turkey figuresare pro-quota and pro-formed.(1) CEE 16 aggregate includes PL, HU, CZ, SK, SI, EE, LV,LIT,HR,BG,RO,TK,RU,Serbia,BiH,UA, (2) Population for UK as of 2004,(3) Excluding Turkey and Russia, (4) The aggregate refers to CEE16 + Macedonia39

POST-MERGER OWNERSHIP STRUCTUREPRE-MERGER OWNERSHIP STRUCTUREPOST-MERGER OWNERSHIP STRUCTURE50%50%KFS Subsidiaries (1) (2)KFS Subsidiaries80.27%19.73%MinoritiesYapı <strong>Kredi</strong> and Koçbankformally merged on 2 October2006 by virtue of dissolution ofKoçbank and transfer of all itsrights, receivables, liabilities andobligations to Yapı <strong>Kredi</strong>Yapı <strong>Kredi</strong>Subsidiaries(1) Subsidiaries in asset management, brokerage, leasing, factoring businesses plus subsidiary banks in the Netherlands and Azerbaijan.(2) Subsidiaries in asset management, brokerage, leasing, factoring, insurance and pension fund businesses plus subsidiary banks in the Netherlands, Germany and Russia.Core subsidiaries (asset management, brokerage, leasing, factoring) of KFS and Yapı <strong>Kredi</strong> are targeted to merge in January 2007.40

<strong>NEW</strong> GROUP STRUCTURE% ownership% 2005 revenues % 2006 bdg net profitL50%100 100L50%LListed(1)80.3 84.6 64.0 99.9 1.5 3.999.9 0.8 1.4 99.0 3.2 12.5 99.9 0.8 2.0 100.0 1.1 2.5 99.8 0.2 0.3NVAzerbaijanL**L(2)94.3 0.2 0.4 99.9 1.6 2.9 98.4 0.8 3.0 99.9 0.3 1.0(3)100.0 0.9 1.0(4)97.5 0.6 0.71. Through Koç Yatırım(6) (7)(5)93.9 93.9 2. 30% YKB, 15% YKY, 52.5% YKE1001.5 -0.7 2.1 2.63. Through YK Holding BV (NV) fully owned by YKB4. 62.92% YKB, 34.58% YKH BV5. 99.8% YKB, 0.2% YKLL 6. Through Sigorta 99.927%, YKF 0.038%7. 74.01% YKB, 7.95% YKF, 11.9% YKY(*) Local offical approvals yet to be received forthe new logos of YK Nederland and YK Deutschland0.7 1.441

EFFICIENT <strong>NEW</strong> ORGANIZATIONAL STRUCTURE WITHOUTSTANDING LOCAL AND INTERNATIONAL MANAGERIALTALENTBoard ofDirectorsCEO/GMKemal Kaya*COOFederico Ghizzoni*PRIVATE<strong>BANK</strong>ING ANDWEALTHMANAGEMENTRETAIL<strong>BANK</strong>INGCORPORATEIDENTITY ANDCOMMUNICATIONCREDIT CARDSANDCONSUMERLENDINGCORPORATEANDCOMMERCIAL<strong>BANK</strong>INGINTERNATIONALTREASURYOPERATIONSALTERNATIVEDISTRIBUTIONCHANNELSHRORGANIZATIONFINANCIALPLANNING, ADMIN.AND CONTROL(CFO)LOGISTICS ANDCOSTMANAGEMENT** Position covered by Executive Board Member** Position covered at KFS group level onlyCREDIT AND RISKMANAGEMENT(CRO)**RISKMANAGEMENTCREDITMANAGEMENTIT ITLEGAL42

AGENDA• MACROECONOMIC & <strong>BANK</strong>ING ENVIRONMENT• <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong>• SHAREHOLDING AND ORGANIZATIONAL STRUCTURE• VISION & STRATEGY• STATUS OF <strong>THE</strong> INTEGRATION• 3Q 2006 RESULTS• PEER COMPARISON• ANNEX – SELECTED HISTORICAL AND RECENT FINANCIALS43

YAPI KREDİ AIMS AT BECOMING MARKET LEADER INTERMS OF ACHIEVING SUSTAINABLE PROFITABILITY ANDGROWTHMISSIONTo become the perceived leader in the marketin terms of sustainable value creation andgrowth, being the first choice of customers andemployeesKEYSTRATEGICOBJECTIVES• Leader in the segment/business with higherreturn on capital/growth potential• Leanest player in the market:– Best cost/income– Most effective sales force– Outstanding risk management44

2008 KEY STRATEGIC TARGETS BASED ON ENSURINGGROWTH, EFFICIENCY AND PROFITABILITYKEY STRATEGIC GUIDELINES• Focus on 5 main business targets: Consolidate leadership in cards and becomeleader in consumer finance Become leader in Asset Gathering and 1 stchoice for High Net Worth Individuals Bring mass segment towards profitability Selective growth in Commercial andCorporate Banking Growth in Small Business through a profitablebusiness model• Execution of cost management measures• Excellence in credit and market risk management• Integration of the 2 banks and core financialsubsidiariesKEY 2008 TARGETSTotal Revenues ~13%AUM (Mutual Funds) ~14%Average RWA ~20%Cost of Risk ~0.9%ROE >20%Cost / Income 12%# of Branches ~745(1) 2005-2008 CAGR.Targets at KFS level.(1)(1)(1)45

KEY PRIORITIES FOR BUSINESS STRATEGY & INTEGRATION /REORGANIZATION ARE EXPECTED TO FINETUNE; COMMON TARGETTO HAVE <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong> AT FULL SPEED STARTING FROM 20072005 – 4Q20062007-2008Businessstrategy• 3y plan approval and 1 st commonbudget process• Pricing alignment andcommercial focus on keyproducts: Cards (World cardthrough KB) Retail / Private (AuMand mortgages), Corporate (cashloans volumes)• Treasury / Market risks: FX positionon control, cost of fundingdecrease• Cost management principles inplace (1 st cut)• Focus on the key segments / products: Cards(consolidate leadership), Retail (upper mass,positioning in consumer lending/mortgages,decrease Mass cost to serve), Private (AuM /asset gathering), Small Business (newprofitable service model to be defined), Mid-Large Corporate (selective growth + valueadded service)• New service model: piloting / implementation• Align monitoring and risk managementfunctions to KFS standards• MBO system in place• Bank at full speed with fulldeployment of newservice model• Expansion of productoffering• Reinforce presence inSmall Business• Further decrease cost toserve in massIntegration /restructuring• Post acquisition: tender offer,sub loan• Mandatory activities per legalintegration• New organisation in place• Re-branding & communication• Definition of segmentation rulesand new service model• Legal Merger of the 2 banks (target 2H)• IT integration (to be completed within 4Q) +training• Head quarters consolidation• Operational engine rationalisation (includingback-office / operation centres / call centres)• Banks’ branch reorganisation + new openings• Subs integration / merger (only key financialsubs)• Operational fine tuning inorder to reach 3 yearsplan efficiency targets• New branch openings (upto a total of 70)• Complete therationalisation ofsubsidiaries46

AGENDA• MACROECONOMIC & <strong>BANK</strong>ING ENVIRONMENT• <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong>• SHAREHOLDING AND ORGANIZATIONAL STRUCTURE• VISION & STRATEGY• STATUS OF <strong>THE</strong> INTEGRATION• 3Q 2006 RESULTS• PEER COMPARISON• ANNEX – SELECTED HISTORICAL AND RECENT FINANCIALS47

LEGAL MERGER OF TWO <strong>BANK</strong>S REALIZED ON 2 OCTOBER2006 WHILE IT SYSTEMS MIGRATION MERGING TWONETWORKS COMPLETED AT <strong>THE</strong> END OF OCTOBERMAJOR INTEGRATION TIMELINELegal Full Core Subs2005 2006 Merger integration Mergers 2007DEC JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC JAN FEB MARMandatory fulfillments for legal mergerOrga structure finalizationTodayHeadquarter relocationUnification macro offer & pricingCommon clientsanalysisImplementcommonclients policiesNew segmentation definitionVirtual re-flaggingof clientsServicemodelroll-outService modelset-upRun field pilotMajor divisionalprocess designOperation Modules Roll OutSales Modules Roll-outTuning ntwk coverageBranches rationalization and new openingsNew Brand & CommunicationIT system integration - fill the gap and migration set upTraining (phase 1)Core Subs. Organization & business alignmentSystem migrationTraining (phase 2)Legal Merger Today ProcessFine tuningFine Tuning48

MAJOR INTEGRATION ACCOMPLISHMENTS SO FAR• New organizational structure of both banks has been established• New service model piloting phase to increase efficiency has been completed in 7 branches• Relocation plan has been defined and almost completed the implementation (Main HQ, Assetmanagement companies have moved into the same estate, Plans for Gebze/Çamlıca are beingprepared)• Centralization of different activities has started (e.g. FX Outgoing transfers) and centralization of 3regional operation center has been already finalized• Launched a conversion plan of the staff from HQ – NW• Macro offer and pricing alignment for the most important products and services has been completed.Cross product sales on both networks has started• Control functions and policies (credit, risk, cost mgnt, etc.) have been aligned in both banks• New branches opening and relocations have started• Training process has started following the completion of Pilot task force training• Koçbank cardholders’ conversion to Worldcard clients completed• Legal merger process completed• IT systems integration completed• Defined integration legal path for core subsidiaries49

AGENDA• MACROECONOMIC & <strong>BANK</strong>ING ENVIRONMENT• <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong>• SHAREHOLDING AND ORGANIZATIONAL STRUCTURE• VISION & STRATEGY• STATUS OF <strong>THE</strong> INTEGRATION• 3Q 2006 RESULTS• PEER COMPARISON• ANNEX – SELECTED HISTORICAL AND RECENT FINANCIALS50

TOTAL ASSETS OF <strong>THE</strong> MERGED <strong>BANK</strong> UP 21% YTD, 48% OF ITSASSETS CONSTITUTE LOANS WHILE SECURITIES’ SHARE AT 29%Unaudited IFRS figures, billion YTL30 September 2006 KoçbankYKBConsolidatedPro-formaMergedBank*YTD %ChangeTotal Assets 19.3 30.5 48.1 20.7%Loans 8.0 15.2 23.2 21.5%Securities Portfolio 5.3 8.6 13.9 28.1%Trading 0.1 0.5 0.6 -64.0%Available For Sale 0.2 0.9 1.1 -12.0%Held to Maturity 5.0 7.2 12.3 52.6%Deposits 12.3 19.9 32.1 17.8%Equity 3.1 1.7 3.3 -4.3%Loans/Assets 41.4% 49.9% 48.2% 0.3Securities/Assets 27.4% 28.2% 28.9% 1.7Deposits/Assets 64.0% 65.1% 66.8% -1.7Loans/Deposits 64.7% 76.7% 72.2% 2.251(*) Including consolidation adjustments and goodwill of approx. 1 bln YTL.YTD changes for the merged bank calculated taking Koçbank IFRS consolidated adjustedfinancials as of 31.12.2005 as a proxy.

REVENUES UP 6.5% YOY MAINLY DRIVEN BY STRONG FEEAND COMMISSION GROWTH; COST/INCOME AT 58%Unaudited IFRS figures, million YTL30 September 2006 KoçbankYKBConsolidatedPro-formaMergedBank*YoY %Change * *Total Revenues 594 1,696 2,249 6.5%of which net interest income 348 1,032 1,359 0.3%of which net fees and commissions 171 513 683 25.4%Total Costs -308 -1,059 -1,309 -52.6%Provisions -549 -300 -291 -86.7%Pre-tax Profit 285 337 650 n.mNet Profit 313 39 385 n.mNet Interest Income/Total Revenues 58.6% 60.9% 60.4% -3.7Net Fee and Com./Total Revenues 28.7% 30.2% 30.4% 4.6Net Fee and Com./Total Costs 55.3% 48.4% 52.2% 32.5Cost/Income 51.9% 62.4% 58.2% -72.552(*) Including consolidation adjustments.(**) If calculated based on normalized Sept 2005 figures, growth in costs, provisions and pretaxprofit would be 3%, 31% and 6% respectively.

CAPITAL ADEQUACY RATIO OF PRO-FORMA MERGED <strong>BANK</strong>AT 12%KOÇ<strong>BANK</strong>YAPI KREDİYTL mln2005 3Q06 2005 3Q06CAR (%) 11.6 13.9 7.3 10.5Supervisory Capital 906 1,275 1,415 2,38531 MARCH 2006YKB receiveda Euro 500 mlnsubordinatedloanTier 1 Capital 2,721 3,050 1,525 1,602Tier 2 Capital 191 1,488 648 1,572Deductions (2,006) (3,263) (758) (789)Total Risks 7,827 9,165 19,541 22,648RWA 7,446 8,551 18,775 21,987Market Risk 381 614 766 66128 APRIL 2006Koçbankreceived a Euro350 mlnsubordinatedloan• Thanks to those two actions CARs of both Banks have been well positioned within the regulatoryrequirements• CAR of the pro-forma of merged bank at 12%Source: BRSA Report53

AGENDA• MACROECONOMIC & <strong>BANK</strong>ING ENVIRONMENT• <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong>• SHAREHOLDING AND ORGANIZATIONAL STRUCTURE• VISION & STRATEGY• STATUS OF <strong>THE</strong> INTEGRATION• 3Q 2006 RESULTS• PEER COMPARISON• ANNEX – SELECTED HISTORICAL AND RECENT FINANCIALS54

YAPI KREDİ ACCORDING TO INTERNATIONAL <strong>BANK</strong>ANALYSTS“…a strong franchise in many areas and backed by some deep and committed pockets.”MERRILL LYNCH, August 2006“Awakening a sleeping beauty? We expect YKB to undergo significant restructuringunder the steer of new management, leading to a substantial improvement in returns.”GOLDMAN SACHS, April 2006“ We see the merged Yapı <strong>Kredi</strong> earning above-industry average returns on its equityin both the current year and 2007.”ING, June 2006“We think Yapı <strong>Kredi</strong> will adopt the “most conservative” crown, which we applaud…Webelieve the new management structure will act in a rational, somewhat risk-averse andlong-term way. This means Yapı is likely to be the bank least exposed to yield curve and FXposition risk.”MERRILL LYNCH, August 200655

HIGH SHARE OF CASH LOANS TO TOTAL ASSETS IN LI<strong>NEW</strong>ITH REAL <strong>BANK</strong>ING – PROFITABLE GROWTHCONCENTRATED ON HIGH MARGIN BUSINESSESCash Loans / Total Assets - 30.9.2006 Composition of Cash Loans -30.9.2006TL Commercial LoansFX Commercial LoansConsumer LoansCredit CardsShare of cons.loans + creditcards in totalloans: 37%33.8%46.3%32.6%26.2%46.6%54.8%48.6%39.8%29.6%24.2%16.9%34.9% 43.9%16.7% 10.9% 8.7%12.4%20.0% 21.6% 21.2%YK (CE) Garanti Akbank İşbankYK (CE) Garanti Akbank İşbank57Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

CONSISTENTLY IMPROVING ASSET QUALITY ANDBUILDING COVERAGEYAPI KREDİ – NPL Ratio and CoverageGARANTİ - NPL Ratio and Coverage118.3% 119.1%124.2%122.9%80.7%82.5%95.8%100.0%80.7% 81.2% 81.7%79.6%66.8%67.6%73.7%76.0%7.3% 7.4% 6.1% 6.4%4.1% 3.7% 2.6% 2.4%Q405 Q106 Q206 Q306Q405 Q106 Q206 Q306NPL RatioAK<strong>BANK</strong> - NPL Ratio and CoverageİŞ<strong>BANK</strong> - NPL Ratio and CoverageSpecific CoverageSpecific + General134.9%100.0%134.0%100.0%134.4%100.0%130.3%100.0%114.2% 113.8% 117.6%100.0% 100.0% 100.0%117.1%100.0%Coverage1.6% 1.6% 1.6% 1.8%Q405 Q106 Q206 Q3064.8% 4.4% 3.6% 3.8%Q405 Q106 Q206 Q30658Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

GENERAL PROVISIONS-TO-PERFORMING LOANS RATIOCOVERING COST OF RISK; WELL ABOVE <strong>THE</strong> REGULATORYREQUIREMENTYAPI KREDİ - General Loan Provisions /Performing LoansGARANTİ - General Loan Provisions /Performing Loans3.0% 3.0%2.7%3.0%0.6% 0.6% 0.6% 0.6%Q405 Q106 Q206 Q306AK<strong>BANK</strong> - General Loan Provisions /Performing LoansQ405 Q106 Q206 Q306İŞ<strong>BANK</strong> - General Loan Provisions /Performing Loans0.6% 0.6% 0.6% 0.6%0.7% 0.6% 0.7% 0.7%Q405 Q106 Q206 Q306Q405 Q106 Q206 Q30659Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

LOW LEVEL OF RELATED PARTY LENDINGYAPI KREDİ - Related Party LendingGARANTİ - Related Party Lending4.7% 4.5%5.0%1.3%30.09.2006AK<strong>BANK</strong> - Related Party Lending12.0%30.09.2006İŞ<strong>BANK</strong> - Related Party Lending8.1%Related party cashLoans / total cashloansRelated partynon-cash loans / totalnon-cash loans3.6%1.3%30.09.200630.09.200660Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

OF TOTAL DEPOSITS, 53% CONSTITUTED BY TL DEPOSITSWHILE 1/5TH IS DEMANDYAPI KREDİ - 30.9.2006 GARANTİ - 30.9.200619.5%53.0%23.0%49.0%Loans/Deposits:Yapı <strong>Kredi</strong>: 79.4%Garanti: 95.3%Akbank: 79.5%80.5%Dem. vs Time Deposits47.0%TL vs FX DepositsFXSecurities/FX Dep.:50.8%77.0%Dem. vs Time DepositsAK<strong>BANK</strong> - 30.9.2006 İŞ<strong>BANK</strong> - 30.9.200651.0%TL vs FX DepositsFXSecurities/FX Dep.:43.9%Demand DepositsTime DepositsTL Depositsİşbank: 66.5%16.3%18.8%FX Deposits57.2%60.9%83.7%42.8%FXSecurities/FX Dep.:64.5%81.2%39.1%FXSecurities/FX Dep.:67.5%Dem. vs Time DepositsTL vs FX DepositsDem. vs Time DepositsTL vs FX Deposits61Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

RELATIVELY LOW LEVEL OF REPO FUNDINGYAPI KREDİ - 30.9.2006, YTLGARANTİ - 30.9.2006, YTLTotal Repos:3,057,120Total Repos:3,993,5922,680,0622,908,328377,058TL vs FX Repos1,085,264TL vs FX ReposTL ReposAK<strong>BANK</strong> - 30.9.2006, YTL İŞ<strong>BANK</strong> - 30.9.2006, YTLFX ReposTotal Repos:3,544,882Total Repos:2,888,4173,544,8821,036,7861,851,6310TL vs FX ReposTL vs FX Repos62Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

REVENUE GENERATION DEPENDENT ON LOANS RA<strong>THE</strong>RTHAN SECURITIES INCOME – HIGHEST SHARE OF INCOMEFROM LOANS IN INTEREST INCOMEYAPI KREDİ - 30.9.2006 GARANTİ - 30.9.20065.8%25.6%9.3%32.6%68.6%58.0%Breakdown of Int. IncomeBreakdown of Int. IncomeInterest on LoansAK<strong>BANK</strong> - 30.9.2006 İŞ<strong>BANK</strong> - 30.9.2006Interest on SecuritiesOther Int. Income*3.4%37.6%6.0%40.3%59.1%53.8%Breakdown of Int. IncomeBreakdown of Int. Income63* Includes interest on bank placements and other interest income.Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

CONSISTENTLY INCREASING INTEREST EARNING ASSETSMAINLY DRIVEN BY SUCCESSFUL AND ACCELERATED ASSETRESTRUCTURINGYAPI KREDİ - Ave. IEAs / Ave. IBLsGARANTİ - Ave. IEAs / Ave. IBLs99.4%102.2%104.8%106.9%105.2%101.1% 101.9%102.6%102.9%104.1%Q305 Q405 Q106 Q206 Q306Q305 Q405 Q106 Q206 Q306AK<strong>BANK</strong> - Ave. IEAs / Ave. IBLsİŞ<strong>BANK</strong> - Ave. IEAs / Ave. IBLs114.8%115.1%114.3%111.1%111.0%105.8% 106.6% 107.3% 105.6% 106.8%Q305 Q405 Q106 Q206 Q306Q305 Q405 Q106 Q206 Q30664Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

WELL POSITIONED TO DEFEND NIM DUE TO FOCUS ON HIGHYIELDING INSTRUMENTS AND LUCRATIVE BUSINESS LINES --HIGHEST NIM AS OF END-SEPTEMBERYAPI KREDİ - Net Interest MarginGARANTİ - Net Interest Margin6.0%5.4%6.2%7.3%5.7%6.7%5.6%5.2% 5.3%4.5%3Q05 4Q05 1Q06 2Q06 3Q063Q05 4Q05 1Q06 2Q06 3Q06AK<strong>BANK</strong> - Net Interest MarginİŞ<strong>BANK</strong> - Net Interest Margin6.0%5.2% 5.2%4.8% 4.5%5.6%5.1%4.5%4.9%3.7%3Q05 4Q05 1Q06 2Q06 3Q063Q05 4Q05 1Q06 2Q06 3Q0665NIMs annualized from quarterly P&L figures; unadjusted .Analysis based on BRSA bank-only financialsYK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

INCREASING CONCENTRATION ON SUSTAINABLE SOURCESOF REVENUE – ALMOST 1/3RD OF TOTAL OPERATINGINCOME GENERATED BY FEES & COMMISSIONSYAPI KREDİ - Net F&C/Oper. IncomeGARANTİ - Net F&C/Oper. Income28.2%32.6%30.09.2006AK<strong>BANK</strong> - Net F&C/Oper. Income30.09.2006İŞ<strong>BANK</strong> - Net F&C/Oper. Income20.3%21.2%30.09.200630.09.200667Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

HIGHEST POSITIVE FX POSITIONNet Open Positions After Hedge / Total EquitySeptember 2006%3.12.5 2.50.90.1-2.4-3.3-5.0YK (CE) Deniz Vakıf Garanti Akbank Finans İşbank68Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

HEALTHIER B/S DUE TO ASSET RESTRUCTURING WITHFUR<strong>THE</strong>R ROOM TO IMPROVE; PRUDENT LENDING POLICYWITH FOCUS ON HIGH TURNOVER LENDING ACTIVITIESFixed Assets / Total AssetsSeptember 2006Accrued Interest on Loans / Gross LoansSeptember 20064.8%2.9%2.6% 2.6%2.2%1.6% 1.6%1.3% 1.2%2.8%1.8% 1.7% 1.6%1.3% 1.2% 1.1%YK (CE) İşbank Vakıf Garanti Fortis Finans Deniz Akbankİşbank Deniz Garanti Akbank Vakıf YK (CE) Finans Fortis69Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

RANKING BY INTEREST EARNED ON LOANS AND INTERESTPAID OUT TO DEPOSITORSEffective Interest Earned On LoansSeptember 2006Effective Interest Paid Out On DepositsSeptember 200616.8% 16.2% 16.0% 15.2% 15.2%12.9%10.5% 9.9% 9.2% 9.2% 9.0% 8.4%Vakıf İşbank YK (CE) Akbank Fortis GarantiVakıf Fortis İşbank YK (CE) Akbank Garanti70Analysis based on BRSA bank-only financials.YK (Combined Entity) figures include Yapı <strong>Kredi</strong> + Koçbank.

AGENDA• MACROECONOMIC & <strong>BANK</strong>ING ENVIRONMENT• <strong>THE</strong> <strong>NEW</strong> <strong>BANK</strong>• SHAREHOLDING AND ORGANIZATIONAL STRUCTURE• VISION & STRATEGY• STATUS OF <strong>THE</strong> INTEGRATION• 3Q 2006 RESULTS• PEER COMPARISON• ANNEX – SELECTED HISTORICAL AND RECENT FINANCIALS71

2005 IFRS FINANCIAL RESULTS OF <strong>THE</strong> GROUP : <strong>THE</strong> <strong>NEW</strong>DIMENSIONYTL mln2005 KFSGroup (1)2005 KFSpro-forma (2)2005 KFSpro-formanormalizedof which‘’old’’ KFSof whichYK Groupnormalized (4)Total Revenues (3) 1,533 3,053 3,053 1,066 1,987Operating Expenses (873) (3,371) (1,880) (493) (1,388)Gross Operating Profit 660 (318) 1,173 574 599Pre - tax Profit 502 (2,587) 872 490 382Combined Profit 365 (2,410) 662 360 302Consolidated Net Profit 360 3601) Yapı <strong>Kredi</strong> Group consolidated for 3 months2) Yapi <strong>Kredi</strong> consolidated for 12 months3) Including monetary gain4) Excluding adjustments and Turkcell gain72

KFS (*) FIRST 4 YEARS RESULTS ARE VERY POSITIVE...47% 46%NET INCOME (YTL mln)ROE35836%24%23%(2)26%+3pp2002 (1) 2003 2004 20052002 (1) 2003 2004 200523126391%2002 (1) 2003 2004 20052002 (1) 2003 2004 2005NPL RATIO %COST / INCOME RATIO % (3)11.711.166%8.348%4.9-3.4pp-1pp73(*) Old perimeter excluding Yapı <strong>Kredi</strong> acquisition (IFRS)(1) Pro-forma; NPL adjusted for a transfer done in May 2003(2) Based on normalised Equity (net of 1 bln Euro for Yapi<strong>Kredi</strong> acquisition)(3) Revenues netted by monetary loss

…WHILE FOR YAPI KREDI <strong>THE</strong>RE IS A CLEAR ROOM FORIMPROVEMENTIFRSmln YTL2004 2005 Adjustments (1) Ordinary20052004- 2005Without Adj.(%)Revenues (2) 1,798 3,144 (1,157) 1,987 + 11Costs (1,471) (2,879) 1,491 (1,388) - 6Provisions (430) (2,186) 1,968 (217) -49Tax 70 307 (388) (81) n.aNet Income (31) (1,617) 1,915 298 n.aCost / Income 82% 92% 70%(1) Including Turkcell gain(2) Including monetary gain74

TOTAL ASSETS GA<strong>THE</strong>RED FROM CUSTOMERS UP BY 20.5%YTD THANKS TO INFLOW OF <strong>NEW</strong> DEPOSITS AND MUTUALFUNDSIFRS ResultsKOÇ FINANCIAL SERVICES (‘’old’’) – YTL blnYAPI KREDİ GROUPIndirectAUMAUC16.63.35.119.24.25.0+25.5%24.12.98.028.92.18.231.63.210.537.1 +17.4%3.0 AUM14.2AUCIndirectDirect8.210.013.218.617.919.9Direct2004 20053Q062004 20053Q0675

SECURITIES PORTFOLIO FOCUSED ON HELD-TO-MATURITYAIMING AT STABLE REVENUE GENERATIONKOÇ FINANCIAL SERVICES (‘’old’’) – bln YTLYAPI KREDİ GROUPBln YTLHFTAFS4.43 4.87 4.64 6.257.528.126.94Bln YTL100% 100% 100% 100%100% 100% 100%3%3%1%1%23%4%3% 3%55% 37%7%HFT16%8.30100%6%10%HTM90%93% 96%96%AFS42%40%61%84%2004 3Q0520053Q06HTM3%23%2004 3Q05 20053Q06New Investment policy: general principles• No proprietary or directional risk on the market or performing transactions with speculative intent• Derivatives allowed for hedging purpose; options allowed only for client driven transactions immediately fullyhedged• No FX speculative open positions are allowed• VaR limits, stop loss, max open position monitored on a daily basis77

ASSET QUALITY IN A CONSTANTLY IMPROVING TRENDWITH DECREASING NPL RATIO AND ADEQUATEPROVISIONING LEVELKOÇ FINANCIAL SERVICES (“old”)YAPI KREDİ GROUPNPL76.3%77.3%Coverage 70.8%Ratio (1) 8.3%5.8%NPL Ratio5.0%71.6%4.6%79.6% 80.8% 78.4%10.0%8.6%6.8%80.0%7.2%NPLCoverageRatio (1)NPL Ratio20043Q0520053Q0620043Q0520053Q06Watch26.7%14.3%25.9%13.6%Coverage18.6% 0.8%9.4% WatchCoverageRatio (2) 11.5%Ratio (2)2004 3Q05 2005 3Q062004 3Q05 2005 3Q061.8% StandardCoverage1.5% 1.4%Ratio (3)1.3%780.6%2.2% 2.1%2004 3Q05 2005 3Q062004 3Q05 2005(1) Specific provisions for NPL / NPL(2) Specific Provisions for Watch Loans / Watch Loans(3) General Provisions / Standard Loans2.4%3Q06StandardCoverageRatio (3)

ASSET QUALITY: IMPORTANT ACTIONS TAKEN IN ORDER TOMAINTAIN CREDIT ACTIVITY UNDER EFFICIENT CONTROL• Implementation of Credit Risk Policies and Credit Tableau de Board in both KB & YKB,• Implementation of Credit Underwriting tools (ACE for Corporate & Commercial, SMilE for Micro & SmallBusiness) completed in Koçbank, to be implemented in YKB in 1Q07• Implementation of Credit Monitoring tool (C-mon) completed in Koçbank (for YKB in 1Q07)• Revision (and increase) of the authority levels for both banks, in accordance with new workflows andthe new Banking Law• Basel-II Assessment and Gap Analysis conducted, Master Plan being defined to reach alignment withthe Basel-II IRB approaches• Monthly monitoring and submission of the largest 25/50 exposures to the CRO and Board• Group consolidation in accordance with banking regulation and S/H’s agreement, monthlymonitoring of related parties’ exposure• Calculation of cost of credit risk by segments, alignment of generic provisioning to the CoR• Revision and monthly monitoring on classified loans and underlying provisions• Centralized approvals of international large exposures79

ENQUIRIES:Yapı <strong>Kredi</strong> Investor Relations Teamyapikredi_investorrelations@yapikredi.com.trHüseyin İmeceExecutive Vice PresidentTel. +90 212 339 7368E-mail: huseyin.imece@yapikredi.com.trHale TunaboyluHead of Investor RelationsTel. +90 212 339 7647E-mail: hale.tunaboylu@yapikredi.com.tr80

DISCLAIMERThis presentation contains forward-looking statements that reflect the Companymanagement’s current views with respect to certain future events. Although it isbelieved that the expectations reflected in these statements are reasonable, theymay be affected by a variety of variables and changes in underlying assumptionsthat could cause actual results to differ materially.Neither Koç Finansal Hizmetler nor Yapı <strong>Kredi</strong> Bankası nor any of its directors,managers or employees nor any other person shall have any liability whatsoever forany loss arising from the use of this presentation.81