Database Management Systems Appendix: Projects - Jerry Post

Database Management Systems Appendix: Projects - Jerry Post

Database Management Systems Appendix: Projects - Jerry Post

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

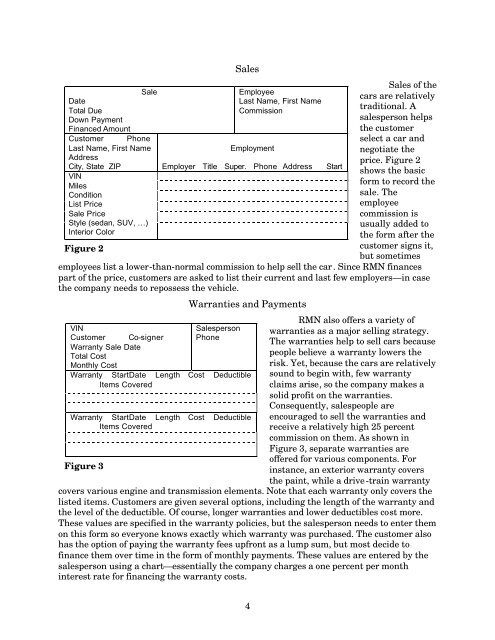

SaleDateTotal DueDown PaymentFinanced AmountCustomer PhoneLast Name, First NameAddressCity, State ZIPVINMilesConditionList PriceSale PriceStyle (sedan, SUV, …)Interior ColorFigure 2SalesEmployeeLast Name, First NameCommissionEmploymentEmployer Title Super. Phone AddressSales of thecars are relativelytraditional. Asalesperson helpsthe customerselect a car andnegotiate theprice. Figure 2shows the basicform to record thesale. Theemployeecommission isusually added tothe form after thecustomer signs it,but sometimesemployees list a lower-than-normal commission to help sell the car. Since RMN financespart of the price, customers are asked to list their current and last few employers—in casethe company needs to repossess the vehicle.Warranties and PaymentsVINCustomer Co-signerSalespersonPhoneWarranty Sale DateTotal CostMonthly CostWarranty StartDate Length Cost DeductibleItems CoveredWarranty StartDate Length Cost DeductibleItems CoveredFigure 3RMN also offers a variety ofwarranties as a major selling strategy.The warranties help to sell cars becausepeople believe a warranty lowers therisk. Yet, because the cars are relativelysound to begin with, few warrantyclaims arise, so the company makes asolid profit on the warranties.Consequently, salespeople areencouraged to sell the warranties andreceive a relatively high 25 percentcommission on them. As shown inFigure 3, separate warranties areoffered for various components. Forinstance, an exterior warranty coversthe paint, while a drive-train warrantycovers various engine and transmission elements. Note that each warranty only covers thelisted items. Customers are given several options, including the length of the warranty andthe level of the deductible. Of course, longer warranties and lower deductibles cost more.These values are specified in the warranty policies, but the salesperson needs to enter themon this form so everyone knows exactly which warranty was purchased. The customer alsohas the option of paying the warranty fees upfront as a lump sum, but most decide tofinance them over time in the form of monthly payments. These values are entered by thesalesperson using a chart—essentially the company charges a one percent per monthinterest rate for financing the warranty costs.Start4