Spring 1984 – Issue 31 - Stanford Lawyer - Stanford University

Spring 1984 – Issue 31 - Stanford Lawyer - Stanford University

Spring 1984 – Issue 31 - Stanford Lawyer - Stanford University

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

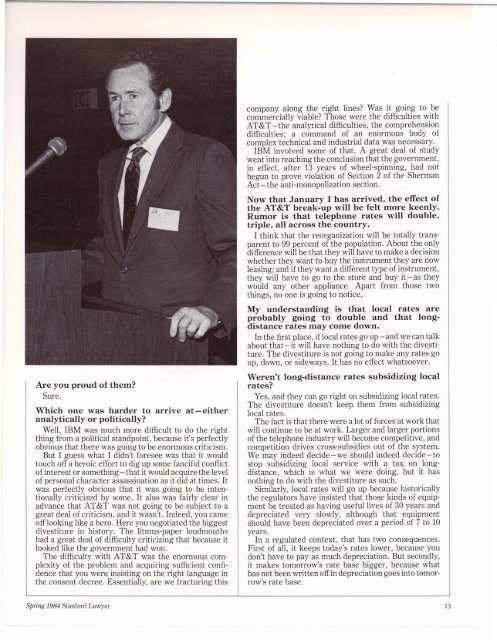

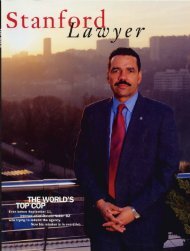

Are you proud of them?Sure.Which one was harder to arrive at-eitheranalytically or politically?Well, IBM was much more difficult to do the rightthing from a political standpoint, because it's perfectlyobvious that there was going to be enormous criticism.But I guess what I didn't foresee was that it wouldtouch offa heroic effort to dig up some fanciful conflictof interest or something-that it would acquire the levelof personal character assassination as it did at times. Itwas perfectly obvious that it was going to be intentionallycriticized by some. It also was fairly clear inadvance that AT&T was not going to be subject to agreat deal of criticism, and it wasn't. Indeed, you cameofflooking like a hero. Here you negotiated the biggestdivestiture in history. The litmus-paper loudmouthshad a great deal of difficulty criticizing that because itlooked like the government had won.The difficulty with AT&T was the enormous complexityof the problem and acquiring sufficient confidencethat you were insisting on the right language inthe consent decree. Essentially, are we fracturing thiscompany along the right lines? Was it going to becommercially viable? Those were the difficulties withAT&T-the analytical difficulties, the comprehensiondifficulties; a command of an enormous body ofcomplex technical and industrial data was necessary.IBM involved some of that. A great deal of studywent into reaching the conclusion that the government,in effect, after 13 years of wheel-spinning, had notbegun to prove violation of Section 2 of the ShermanAct-the anti-monopolization section.Now that January 1 has arrived, the effect ofthe AT&T break-up will be felt more keenly.Rumor is that telephone rates will double,triple, all across the country.I think that the reorganization will be totally transparentto 99 percent of the population. About the onlydifference will be that they will have to make a decisionwhether they want to buy the instrument they are nowleasing; and if they want a different type of instrument,they will have to go to the store and buy it - as theywould any other appliance. Apart from those twothings, no one is going to notice.My understanding is that local rates areprobably going to double and that longdistancerates may come down.In the first place, if local rates go up - and we can talkabout that-it will have nothing to do with the divestiture.The divestiture is not going to make any rates goup, down, or sideways. It has no effect whatsoever.Weren't long-distance rates subsidizing localrates?Yes, and they can go right on subsidizing local rates.The divestiture doesn't keep them from subsidizinglocal rates.The fact is that there were a lot of forces at work thatwill continue to be at work. Larger and larger portionsof the telephone industry will become competitive, andcompetition drives cross-subsidies out of the system.We may indeed decide-we should indeed decide-tostop subsidizing local service with a tax on longdistance,.which is what we were doing, but it hasnothing to do with the divestiture as such.Similarly, local rates will go up because historicallythe regulators have insisted that those kinds of equipmentbe treated as having useful lives of 30 years anddepreciated very slowly, although that equipmentshould have been depreciated over a period of 7 to 10years.In a regulated context, that has two consequences.First of all, it keeps today's rates lower, because youdon't have to pay as much depreciation. But secondly,it makes tomorrow's rate base bigger, because whathas not been written offin depreciation goes into tomorrow'srate base.<strong>Spring</strong> <strong>1984</strong> <strong>Stanford</strong> <strong>Lawyer</strong>13