Ecclesiastical Investment Funds annual report and accounts - long ...

Ecclesiastical Investment Funds annual report and accounts - long ...

Ecclesiastical Investment Funds annual report and accounts - long ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

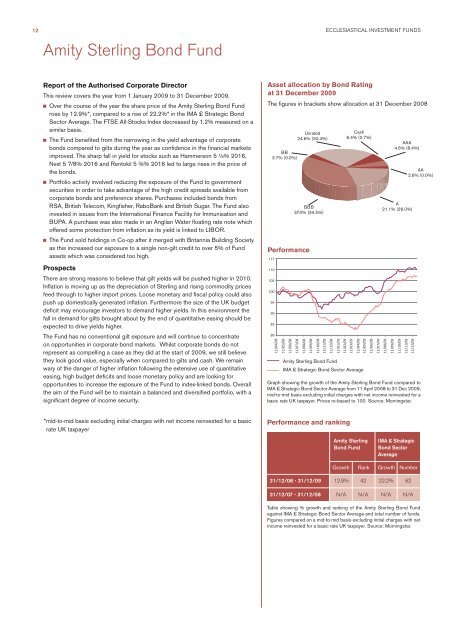

12Amity Sterling Bond FundECCLESIASTICAL <strong>Investment</strong> <strong>Funds</strong>Report of the Authorised Corporate DirectorThis review covers the year from 1 January 2009 to 31 December 2009.g Over the course of the year the share price of the Amity Sterling Bond Fundrose by 12.9%*, compared to a rise of 22.2%* in the IMA £ Strategic BondSector Average. The FTSE All-Stocks Index decreased by 1.2% measured on asimilar basis.g The Fund benefited from the narrowing in the yield advantage of corporatebonds compared to gilts during the year as confidence in the financial marketsimproved. The sharp fall in yield for stocks such as Hammerson 5 ¼% 2016,Next 5 7/8% 2016 <strong>and</strong> Rentokil 5 ¾% 2016 led to large rises in the price ofthe bonds.g Portfolio activity involved reducing the exposure of the Fund to governmentsecurities in order to take advantage of the high credit spreads available fromcorporate bonds <strong>and</strong> preference shares. Purchases included bonds fromRSA, British Telecom, Kingfisher, RaboBank <strong>and</strong> British Sugar. The Fund alsoinvested in issues from the International Finance Facility for Immunisation <strong>and</strong>BUPA. A purchase was also made in an Anglian Water floating rate note whichoffered some protection from inflation as its yield is linked to LIBOR.g The Fund sold holdings in Co-op after it merged with Britannia Building Societyas this increased our exposure to a single non-gilt credit to over 5% of Fundassets which was considered too high.ProspectsThere are strong reasons to believe that gilt yields will be pushed higher in 2010.Inflation is moving up as the depreciation of Sterling <strong>and</strong> rising commodity pricesfeed through to higher import prices. Loose monetary <strong>and</strong> fiscal policy could alsopush up domestically generated inflation. Furthermore the size of the UK budgetdeficit may encourage investors to dem<strong>and</strong> higher yields. In this environment thefall in dem<strong>and</strong> for gilts brought about by the end of quantitative easing should beexpected to drive yields higher.The Fund has no conventional gilt exposure <strong>and</strong> will continue to concentrateon opportunities in corporate bond markets. Whilst corporate bonds do notrepresent as compelling a case as they did at the start of 2009, we still believethey look good value, especially when compared to gilts <strong>and</strong> cash. We remainwary of the danger of higher inflation following the extensive use of quantitativeeasing, high budget deficits <strong>and</strong> loose monetary policy <strong>and</strong> are looking foropportunities to increase the exposure of the Fund to index-linked bonds. Overallthe aim of the Fund will be to maintain a balanced <strong>and</strong> diversified portfolio, with asignificant degree of income security.Asset allocation by Bond Ratingat 31 December 2009The figures in brackets show allocation at 31 December 2008BB3.7% (0.0%)Performance1151101051009590858011/04/200811/04/0811/05/200811/05/0811/06/200811/06/08Unrated24.6% (30.4%)BBB37.0% (34.5%)11/07/200811/07/0811/08/200811/08/0811/09/200811/09/08Amity Sterling Bond Fund11/10/200811/10/0811/11/200811/11/08Cash6.4% (0.7%)IMA £ Strategic Bond Sector Average11/12/200811/12/0811/01/200911/01/0911/02/200911/03/200911/02/09<strong>Ecclesiastical</strong>AmitySterlingBondAAA4.6% (8.4%)A21.1% (26.0%)AA2.6% (0.0%)Graph showing the growth of the Amity Sterling Bond Fund compared toIMA £ Strategic Bond Sector Average from 11 April 2008 to 31 Dec 2009,mid-to-mid basis excluding initial charges with net income reinvested for abasic rate UK taxpayer. Prices re-based to 100. Source: Morningstar.11/03/0911/04/200911/04/0911/05/200911/05/0911/06/200911/06/09(IMA)£StrategicBond11/07/200911/07/0911/08/200911/08/0911/09/200911/09/0911/10/200911/10/0911/11/200911/11/0911/12/200911/12/09* mid-to-mid basis excluding initial charges with net income reinvested for a basicrate UK taxpayerPerformance <strong>and</strong> rankingAmity SterlingBond FundIMA £ StrategicBond SectorAverageGrowth Rank Growth Number31/12/08 - 31/12/09 12.9% 42 22.2% 6231/12/07 - 31/12/08 N/A N/A N/A N/ATable showing % growth <strong>and</strong> ranking of the Amity Sterling Bond Fundagainst IMA £ Strategic Bond Sector Average <strong>and</strong> total number of funds.Figures compared on a mid-to-mid basis excluding initial charges with netincome reinvested for a basic rate UK taxpayer. Source: Morningstar.