Ecclesiastical Investment Funds annual report and accounts - long ...

Ecclesiastical Investment Funds annual report and accounts - long ...

Ecclesiastical Investment Funds annual report and accounts - long ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

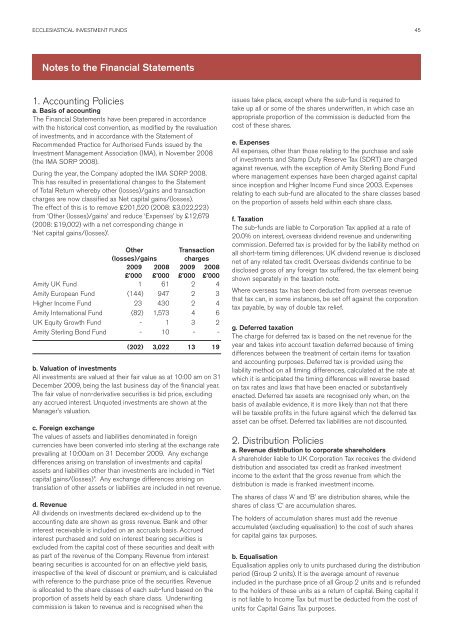

ECCLESIASTICAL <strong>Investment</strong> <strong>Funds</strong> 45Notes to the Financial Statements1. Accounting Policiesa. Basis of accountingThe Financial Statements have been prepared in accordancewith the historical cost convention, as modified by the revaluationof investments, <strong>and</strong> in accordance with the Statement ofRecommended Practice for Authorised <strong>Funds</strong> issued by the<strong>Investment</strong> Management Association (IMA), in November 2008(the IMA SORP 2008).During the year, the Company adopted the IMA SORP 2008.This has resulted in presentational changes to the Statementof Total Return whereby other (losses)/gains <strong>and</strong> transactioncharges are now classified as Net capital gains/(losses).The effect of this is to remove £201,520 (2008: £3,022,223)from ‘Other (losses)/gains’ <strong>and</strong> reduce ‘Expenses’ by £12,679(2008: £19,002) with a net corresponding change in‘Net capital gains/(losses)’.OtherTransaction(losses)/gains charges2009 2008 2009 2008£’000 £’000 £’000 £’000Amity UK Fund 1 61 2 4Amity European Fund (144) 947 2 3Higher Income Fund 23 430 2 4Amity International Fund (82) 1,573 4 6UK Equity Growth Fund - 1 3 2Amity Sterling Bond Fund - 10 - -(202) 3,022 13 19b. Valuation of investmentsAll investments are valued at their fair value as at 10:00 am on 31December 2009, being the last business day of the financial year.The fair value of non-derivative securities is bid price, excludingany accrued interest. Unquoted investments are shown at theManager’s valuation.c. Foreign exchangeThe values of assets <strong>and</strong> liabilities denominated in foreigncurrencies have been converted into sterling at the exchange rateprevailing at 10:00am on 31 December 2009. Any exchangedifferences arising on translation of investments <strong>and</strong> capitalassets <strong>and</strong> liabilities other than investments are included in “Netcapital gains/(losses)”. Any exchange differences arising ontranslation of other assets or liabilities are included in net revenue.d. RevenueAll dividends on investments declared ex-dividend up to theaccounting date are shown as gross revenue. Bank <strong>and</strong> otherinterest receivable is included on an accruals basis. Accruedinterest purchased <strong>and</strong> sold on interest bearing securities isexcluded from the capital cost of these securities <strong>and</strong> dealt withas part of the revenue of the Company. Revenue from interestbearing securities is accounted for on an effective yield basis,irrespective of the level of discount or premium, <strong>and</strong> is calculatedwith reference to the purchase price of the securities. Revenueis allocated to the share classes of each sub-fund based on theproportion of assets held by each share class. Underwritingcommission is taken to revenue <strong>and</strong> is recognised when theissues take place, except where the sub-fund is required totake up all or some of the shares underwritten, in which case anappropriate proportion of the commission is deducted from thecost of these shares.e. ExpensesAll expenses, other than those relating to the purchase <strong>and</strong> saleof investments <strong>and</strong> Stamp Duty Reserve Tax (SDRT) are chargedagainst revenue, with the exception of Amity Sterling Bond Fundwhere management expenses have been charged against capitalsince inception <strong>and</strong> Higher Income Fund since 2003. Expensesrelating to each sub-fund are allocated to the share classes basedon the proportion of assets held within each share class.f. TaxationThe sub-funds are liable to Corporation Tax applied at a rate of20.0% on interest, overseas dividend revenue <strong>and</strong> underwritingcommission. Deferred tax is provided for by the liability method onall short-term timing differences. UK dividend revenue is disclosednet of any related tax credit. Overseas dividends continue to bedisclosed gross of any foreign tax suffered, the tax element beingshown separately in the taxation note.Where overseas tax has been deducted from overseas revenuethat tax can, in some instances, be set off against the corporationtax payable, by way of double tax relief.g. Deferred taxationThe charge for deferred tax is based on the net revenue for theyear <strong>and</strong> takes into account taxation deferred because of timingdifferences between the treatment of certain items for taxation<strong>and</strong> accounting purposes. Deferred tax is provided using theliability method on all timing differences, calculated at the rate atwhich it is anticipated the timing differences will reverse basedon tax rates <strong>and</strong> laws that have been enacted or substantivelyenacted. Deferred tax assets are recognised only when, on thebasis of available evidence, it is more likely than not that therewill be taxable profits in the future against which the deferred taxasset can be offset. Deferred tax liabilities are not discounted.2. Distribution Policiesa. Revenue distribution to corporate shareholdersA shareholder liable to UK Corporation Tax receives the dividenddistribution <strong>and</strong> associated tax credit as franked investmentincome to the extent that the gross revenue from which thedistribution is made is franked investment income.The shares of class ‘A’ <strong>and</strong> ‘B’ are distribution shares, while theshares of class ‘C’ are accumulation shares.The holders of accumulation shares must add the revenueaccumulated (excluding equalisation) to the cost of such sharesfor capital gains tax purposes.b. EqualisationEqualisation applies only to units purchased during the distributionperiod (Group 2 units). It is the average amount of revenueincluded in the purchase price of all Group 2 units <strong>and</strong> is refundedto the holders of these units as a return of capital. Being capital itis not liable to Income Tax but must be deducted from the cost ofunits for Capital Gains Tax purposes.