2008Effect on incomeIncrease/decrease before tax Effect on equityin basis points Increase (decrease) Increase (decrease)(In Thousand Pesos)USD +200 bps (P29,780) P27,412-200 bps 30,815 (28,606)PHP +100 bps (63,938) (1,790)-100 bps 63,840 1,818The impact to equity is caused by the change in marked to market value of derivatives classifiedas hedges.28.2.1.2 Foreign Exchange RiskThe <strong>Globe</strong> Group’s foreign exchange risk results primarily from movements of thePHP against the USD with respect to USD-denominated financial assets, USDdenominatedfinancial liabilities and certain USD-denominated revenues. Majority ofrevenues are generated in PHP, while substantially all of capital expenditures are inUSD. In addition, 15%, 14% and 12% of debt as of December 31, 2010, 2009 and2008, respectively, are denominated in USD before taking into account any swap andhedges.Information on the <strong>Globe</strong> Group’s foreign currency-denominated monetary assetsand liabilities and their PHP equivalents are as follows:2010 2009 2008US Peso US Peso US PesoDollar Equivalent Dollar Equivalent Dollar Equivalent(In Thousands)AssetsCash and cash equivalents $41,573 P1,821,337 $45,684 P2,120,901 $40,776 P1,943,159Receivables 58,257 2,552,308 50,359 2,337,915 68,004 3,240,744Prepayments and othercurrent assets – – – 5 14 66199,830 4,373,645 96,043 4,458,821 108,794 5,184,564LiabilitiesAccounts payable and accruedexpenses 197,586 8,656,460 155,085 7,199,819 92,464 4,406,395Long-term debt 170,011 7,448,357 148,133 6,877,090 101,696 4,846,310367,597 16,104,817 303,218 14,076,909 194,160 9,252,705Net foreign-currency denominatedliabilities $267,767 P11,731,172 $207,175 P9,618,088 $85,366 P4,068,141* This table excludes derivative transactions disclosed in Note 28.3The following tables demonstrate the sensitivity to a reasonably possible change in thePHP to USD exchange rate, with all other variables held constant, of the <strong>Globe</strong> Group’sincome before tax (due to changes in the fair value of financial assets and liabilities).2010Increase/decreasein Peso to Effect on income before tax Effect on equityUS Dollar exchange rate Increase (decrease) Increase (decrease)(In Thousand Pesos)+.40 (P106,051) (P14,181)-.40 106,051 14,1812009Increase/decreasein Peso to Effect on income before tax Effect on equityUS Dollar exchange rate Increase (decrease) Increase (decrease)(In Thousand Pesos)+.40 (P81,857) (P278)-.40 81,857 278160

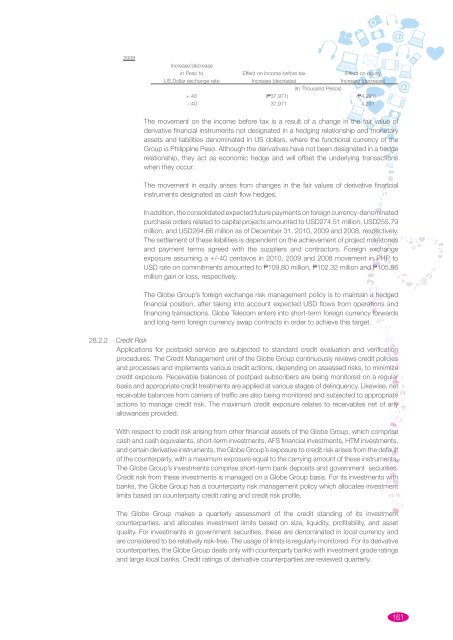

2008Increase/decreasein Peso to Effect on income before tax Effect on equityUS Dollar exchange rate Increase (decrease) Increase (decrease)(In Thousand Pesos)+.40 (P37,971) (P4,291)-.40 37,971 4,291The movement on the income before tax is a result of a change in the fair value ofderivative financial instruments not designated in a hedging relationship and monetaryassets and liabilities denominated in US dollars, where the functional currency of theGroup is Philippine Peso. Although the derivatives have not been designated in a hedgerelationship, they act as economic hedge and will offset the underlying transactionswhen they occur.The movement in equity arises from changes in the fair values of derivative financialinstruments designated as cash flow hedges.In addition, the consolidated expected future payments on foreign currency-denominatedpurchase orders related to capital projects amounted to USD274.51 million, USD255.79million, and USD264.66 million as of December 31, 2010, 2009 and 2008, respectively.The settlement of these liabilities is dependent on the achievement of project milestonesand payment terms agreed with the suppliers and contractors. Foreign exchangeexposure assuming a +/-40 centavos in 2010, 2009 and 2008 movement in PHP toUSD rate on commitments amounted to P109.80 million, P102.32 million and P105.86million gain or loss, respectively.The <strong>Globe</strong> Group’s foreign exchange risk management policy is to maintain a hedgedfinancial position, after taking into account expected USD flows from operations andfinancing transactions. <strong>Globe</strong> Telecom enters into short-term foreign currency forwardsand long-term foreign currency swap contracts in order to achieve this target.28.2.2 Credit RiskApplications for postpaid service are subjected to standard credit evaluation and verificationprocedures. The Credit Management unit of the <strong>Globe</strong> Group continuously reviews credit policiesand processes and implements various credit actions, depending on assessed risks, to minimizecredit exposure. Receivable balances of postpaid subscribers are being monitored on a regularbasis and appropriate credit treatments are applied at various stages of delinquency. Likewise, netreceivable balances from carriers of traffic are also being monitored and subjected to appropriateactions to manage credit risk. The maximum credit exposure relates to receivables net of anyallowances provided.With respect to credit risk arising from other financial assets of the <strong>Globe</strong> Group, which comprisecash and cash equivalents, short-term investments, AFS financial investments, HTM investments,and certain derivative instruments, the <strong>Globe</strong> Group’s exposure to credit risk arises from the defaultof the counterparty, with a maximum exposure equal to the carrying amount of these instruments.The <strong>Globe</strong> Group’s investments comprise short-term bank deposits and government securities.Credit risk from these investments is managed on a <strong>Globe</strong> Group basis. For its investments withbanks, the <strong>Globe</strong> Group has a counterparty risk management policy which allocates investmentlimits based on counterparty credit rating and credit risk profile.The <strong>Globe</strong> Group makes a quarterly assessment of the credit standing of its investmentcounterparties, and allocates investment limits based on size, liquidity, profitability, and assetquality. For investments in government securities, these are denominated in local currency andare considered to be relatively risk-free. The usage of limits is regularly monitored. For its derivativecounterparties, the <strong>Globe</strong> Group deals only with counterparty banks with investment grade ratingsand large local banks. Credit ratings of derivative counterparties are reviewed quarterly.161

- Page 3:

Contents1 About the Report3 Our Com

- Page 9 and 10:

Message from the ChairpersonsGlobe

- Page 11 and 12:

in mind; networks that support new

- Page 13 and 14:

Message from the President and CEOS

- Page 15 and 16:

Our accomplishments in 2010 also re

- Page 17 and 18:

will continue to grow, but likely a

- Page 19 and 20:

We used the best featuresof Globe t

- Page 21 and 22:

Our CustomersMaking it Your Way: Gl

- Page 23 and 24:

The cutting-edge designof the Globe

- Page 25 and 26:

The front of the card is highly cus

- Page 27 and 28:

Enjoy Your Globe, Your WayIt’s a

- Page 29 and 30:

Globe also recognized the wealth of

- Page 31 and 32:

Globe Telepresenceenables a life-si

- Page 33 and 34:

special interest group or organizat

- Page 37 and 38:

Benefits provided to full time empl

- Page 39 and 40:

• Key talents and other executive

- Page 41 and 42:

Accident Summary ReportingIn 2010,

- Page 43 and 44:

Hui Weng CheongMr. Hui, 56, Singapo

- Page 45 and 46:

AG Holdings, AI North America, Inc.

- Page 47 and 48:

Rebecca V. EclipseHead - Office of

- Page 49 and 50:

Our Key Consultants and Internal Au

- Page 51 and 52:

Sustainability & Corporate SocialRe

- Page 53 and 54:

Management Approach Commitments Our

- Page 55 and 56:

Management Approach Commitments Our

- Page 57 and 58:

connections also enable data-intens

- Page 59 and 60:

ICT-enabled community programs led

- Page 61 and 62:

to support the recovery and rehabil

- Page 63 and 64:

John B Cena (RoxasFoundation)Lord E

- Page 65 and 66:

The MDGs How telecommunications can

- Page 67 and 68:

Doing More with LessIn 2010, we lau

- Page 69 and 70:

Summary of Environmental Gains from

- Page 71 and 72:

Reviving the Marilao-Meycauayan-Oba

- Page 73 and 74:

Corporate GovernanceWe strive to ad

- Page 75 and 76:

Board RemunerationIn accordance wit

- Page 77 and 78:

• The Committee reviews the finan

- Page 79:

In 2010, the Executive Committee me

- Page 82 and 83:

typhoon Juan (international name, M

- Page 84 and 85:

Last August 2010, Globe Internal Au

- Page 86 and 87:

Information showing the performance

- Page 90 and 91:

Globe closed the year with a cumula

- Page 92 and 93:

subscribers now account for 76% of

- Page 94 and 95:

Report of the Audit Committee to th

- Page 96 and 97:

Independent Auditors’ ReportThe S

- Page 98 and 99:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 100 and 101:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 102 and 103:

GLOBE TELECOM, INC. AND SUBSIDIARIE

- Page 104 and 105:

occurs, and future reported results

- Page 106 and 107:

• Amendment to PAS 32, Financial

- Page 108 and 109:

of services with the construction m

- Page 110 and 111:

2.6.1.3 OthersInterest income is re

- Page 112 and 113: 2.6.4.1.3 HTM investmentsHTM invest

- Page 114 and 115: 2.6.4.1.7 Derivative Instruments2.6

- Page 116 and 117: 2.6.4.1.7.4 Other Derivative Instru

- Page 118 and 119: 2.6.4.2.2 AFS investments carried a

- Page 120 and 121: The amount of ARO is accrued and su

- Page 122 and 123: For assessing impairment of goodwil

- Page 124 and 125: 2.6.18 Pension CostPension cost is

- Page 126 and 127: determined. All foreign exchange di

- Page 128 and 129: 3.2 Estimates• whether the Globe

- Page 130 and 131: The EUL of property and equipment o

- Page 132 and 133: measurement were determined using v

- Page 134 and 135: 5. Inventories and SuppliesThis acc

- Page 136 and 137: 2008CostBuildings andTelecommunicat

- Page 138 and 139: 2009TotalLicenses and Total Intangi

- Page 140 and 141: 10.2 Investment in Bridge Mobile Pt

- Page 142 and 143: 14. Notes Payable and Long-term Deb

- Page 144 and 145: 16. Related Party TransactionsGlobe

- Page 146 and 147: These related parties are either co

- Page 148 and 149: On February 4, 2010, the BOD approv

- Page 150 and 151: A summary of the Globe Group’s ES

- Page 152 and 153: The assumptions used to determine p

- Page 154 and 155: 23. Impairment Losses and OthersThi

- Page 156 and 157: 25. Agreements and Commitments25.1

- Page 158 and 159: In return, Pacnet will compensate G

- Page 160 and 161: The policies are not intended to el

- Page 164 and 165: Following are the Globe Group expos

- Page 166 and 167: 2010Neither past-due nor impairedHi

- Page 168 and 169: The following tables show comparati

- Page 170 and 171: 2008Debt Carrying2013 and Total Tot

- Page 172 and 173: 2009Other Financial Liabilities:Les

- Page 174 and 175: 28.2.4 Hedging Objectives and Polic

- Page 176 and 177: 20081-2-3-4-

- Page 178 and 179: • Embedded Currency ForwardsAs of

- Page 180 and 181: The fair values of interest rate sw

- Page 182 and 183: 2009MobileWirelineCommunications Co

- Page 184 and 185: 29.1 Mobile Communications Services

- Page 186 and 187: Global Reporting Initiative (GRI) I

- Page 188 and 189: 4.14 List of stakeholder groups eng

- Page 190 and 191: Social: Human RightsPerformance Ind

- Page 192 and 193: Our Store DirectoryNorth GMAGMA REG

- Page 194 and 195: North LuzonCANDONKanPing Commercial

- Page 196 and 197: OZAMIZB-5 G/F Gaisano OzamisCity Ma

- Page 198 and 199: I Love PlayingI am passionate about

- Page 200: GLOBE TELECOM, INC.Globe Telecom Pl