Second Quarterly Results Report

Second Quarterly Results Report

Second Quarterly Results Report

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

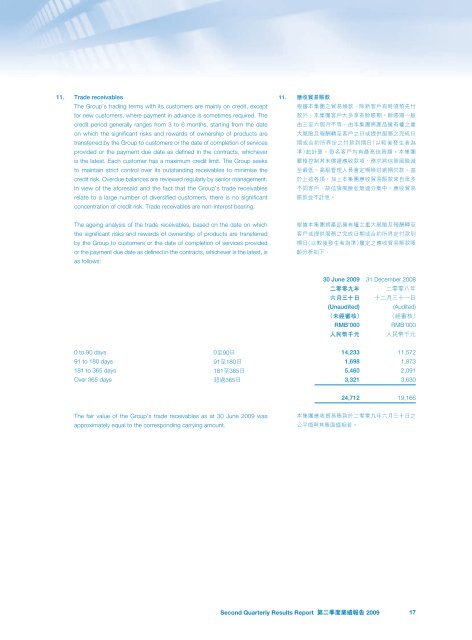

11. Trade receivablesThe Group’s trading terms with its customers are mainly on credit, exceptfor new customers, where payment in advance is sometimes required. Thecredit period generally ranges from 3 to 6 months, starting from the dateon which the significant risks and rewards of ownership of products aretransferred by the Group to customers or the date of completion of servicesprovided or the payment due date as defined in the contracts, whicheveris the latest. Each customer has a maximum credit limit. The Group seeksto maintain strict control over its outstanding receivables to minimise thecredit risk. Overdue balances are reviewed regularly by senior management.In view of the aforesaid and the fact that the Group’s trade receivablesrelate to a large number of diversified customers, there is no significantconcentration of credit risk. Trade receivables are non-interest bearing.11. The ageing analysis of the trade receivables, based on the date on whichthe significant risks and rewards of ownership of products are transferredby the Group to customers or the date of completion of services providedor the payment due date as defined in the contracts, whichever is the latest, isas follows:30 June 2009 31 December 2008 (Unaudited)(Audited) RMB’000RMB’000 0 to 90 days 090 14,233 11,57291 to 180 days 91180 1,698 1,873181 to 365 days 181365 5,460 2,091Over 365 days 365 3,321 3,63024,712 19,166The fair value of the Group’s trade receivables as at 30 June 2009 wasapproximately equal to the corresponding carrying amount.<strong>Second</strong> <strong>Quarterly</strong> <strong>Results</strong> <strong>Report</strong> 2009 17