downing text 2012_Layout 1 - Downing College - University of ...

downing text 2012_Layout 1 - Downing College - University of ...

downing text 2012_Layout 1 - Downing College - University of ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

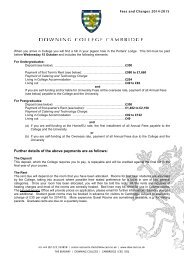

DOWNING COLLEGE ASSOCIATIONHow does current student finance differ from previous generations?The need for the type <strong>of</strong> supplementary grants provided by the Fund has increaseddramatically in recent years. As the number <strong>of</strong> students in Higher Education inthe UK has grown, public finance has sought to control expenditure. As a result,an ever increasing proportion <strong>of</strong> the costs <strong>of</strong> education is being borne by thestudent (see table below). Most members <strong>of</strong> the Association will considerthemselves generously funded compared with those entering <strong>College</strong> thisSeptember and those who studied pre-1990 will simply not recognise the concept<strong>of</strong> loans or tuition fees with which current students are faced.Evolution <strong>of</strong> Student Funding in EnglandPre-1962 Private funds or Scholarships from the State, Local Authorities, industryand education.1962 Local Authorities pay tuition fees and a mandatory maintenance grantto cover living costs.1980 Student grants increased from £380 to £1,430.1990 Grants are frozen and student loans introduced. Means-tested grants <strong>of</strong>up to £2,265 remain; loans <strong>of</strong> up to £420 are on <strong>of</strong>fer to all.1998 An annual tuition fee <strong>of</strong> £1,000 is introduced. Means testing means athird <strong>of</strong> students will not pay anything.2006 Universities are allowed to set their own tuition fees up to a cap<strong>of</strong> £3,000 a year. Loans are to be repaid once graduates earn above£15,000. Loans are accompanied by a means-tested package <strong>of</strong> support.<strong>2012</strong> Tuition fees rise to a maximum <strong>of</strong> £9,000 a year. Loans are available tocover fees and maintenance.For students from England, if the household income is £25,000 orless, bursaries <strong>of</strong> £3,250 are available from the government. If thehousehold income is below £42,600 then Cambridge Bursaries <strong>of</strong> upto £3,500 are available. No grants are available if the household incomeis more than £42,600.The maximum maintenance loan for Cambridge undergraduates is£5,500. Loans are not due for repayment until students have graduatedand their income reaches £21,000; repayments are calculated at 9% <strong>of</strong>gross income. Loans are cancelled 30 years after the April in which theybecome eligible for repayment.Arrangements for students from Scotland, Wales and NorthernIreland will differ.13