Guide to depreciating assets 2013 - Australian Taxation Office

Guide to depreciating assets 2013 - Australian Taxation Office

Guide to depreciating assets 2013 - Australian Taxation Office

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

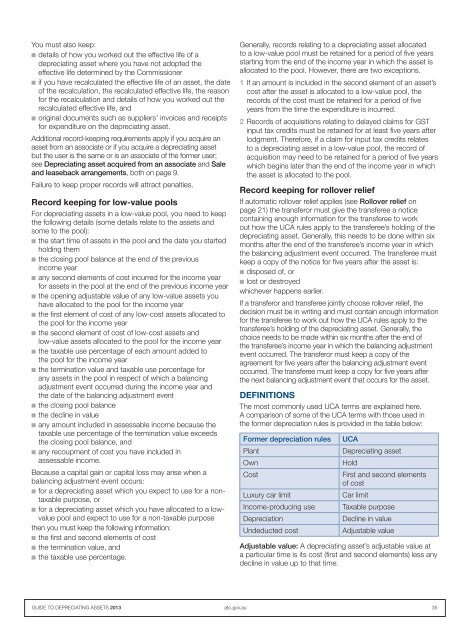

You must also keep:n details of how you worked out the effective life of a<strong>depreciating</strong> asset where you have not adopted theeffective life determined by the Commissionern if you have recalculated the effective life of an asset, the dateof the recalculation, the recalculated effective life, the reasonfor the recalculation and details of how you worked out therecalculated effective life, andn original documents such as suppliers’ invoices and receiptsfor expenditure on the <strong>depreciating</strong> asset.Additional record-keeping requirements apply if you acquire anasset from an associate or if you acquire a <strong>depreciating</strong> assetbut the user is the same or is an associate of the former user;see Depreciating asset acquired from an associate and Saleand leaseback arrangements, both on page 9.Failure <strong>to</strong> keep proper records will attract penalties.Record keeping for low-value poolsFor <strong>depreciating</strong> <strong>assets</strong> in a low-value pool, you need <strong>to</strong> keepthe following details (some details relate <strong>to</strong> the <strong>assets</strong> andsome <strong>to</strong> the pool):n the start time of <strong>assets</strong> in the pool and the date you startedholding themn the closing pool balance at the end of the previousincome yearn any second elements of cost incurred for the income yearfor <strong>assets</strong> in the pool at the end of the previous income yearn the opening adjustable value of any low-value <strong>assets</strong> youhave allocated <strong>to</strong> the pool for the income yearn the first element of cost of any low-cost <strong>assets</strong> allocated <strong>to</strong>the pool for the income yearn the second element of cost of low-cost <strong>assets</strong> andlow‐value <strong>assets</strong> allocated <strong>to</strong> the pool for the income yearn the taxable use percentage of each amount added <strong>to</strong>the pool for the income yearn the termination value and taxable use percentage forany <strong>assets</strong> in the pool in respect of which a balancingadjustment event occurred during the income year andthe date of the balancing adjustment eventn the closing pool balancen the decline in valuen any amount included in assessable income because thetaxable use percentage of the termination value exceedsthe closing pool balance, andn any recoupment of cost you have included inassessable income.Because a capital gain or capital loss may arise when abalancing adjustment event occurs:n for a <strong>depreciating</strong> asset which you expect <strong>to</strong> use for a nontaxablepurpose, orn for a <strong>depreciating</strong> asset which you have allocated <strong>to</strong> a lowvaluepool and expect <strong>to</strong> use for a non-taxable purposethen you must keep the following information:n the first and second elements of costn the termination value, andn the taxable use percentage.Generally, records relating <strong>to</strong> a <strong>depreciating</strong> asset allocated<strong>to</strong> a low-value pool must be retained for a period of five yearsstarting from the end of the income year in which the asset isallocated <strong>to</strong> the pool. However, there are two exceptions.1 If an amount is included in the second element of an asset’scost after the asset is allocated <strong>to</strong> a low-value pool, therecords of the cost must be retained for a period of fiveyears from the time the expenditure is incurred.2 Records of acquisitions relating <strong>to</strong> delayed claims for GSTinput tax credits must be retained for at least five years afterlodgment. Therefore, if a claim for input tax credits relates<strong>to</strong> a <strong>depreciating</strong> asset in a low-value pool, the record ofacquisition may need <strong>to</strong> be retained for a period of five yearswhich begins later than the end of the income year in whichthe asset is allocated <strong>to</strong> the pool.Record keeping for rollover reliefIf au<strong>to</strong>matic rollover relief applies (see Rollover relief onpage 21) the transferor must give the transferee a noticecontaining enough information for the transferee <strong>to</strong> workout how the UCA rules apply <strong>to</strong> the transferee’s holding of the<strong>depreciating</strong> asset. Generally, this needs <strong>to</strong> be done within sixmonths after the end of the transferee’s income year in whichthe balancing adjustment event occurred. The transferee mustkeep a copy of the notice for five years after the asset is:n disposed of, orn lost or destroyedwhichever happens earlier.If a transferor and transferee jointly choose rollover relief, thedecision must be in writing and must contain enough informationfor the transferee <strong>to</strong> work out how the UCA rules apply <strong>to</strong> thetransferee’s holding of the <strong>depreciating</strong> asset. Generally, thechoice needs <strong>to</strong> be made within six months after the end ofthe transferee’s income year in which the balancing adjustmentevent occurred. The transferor must keep a copy of theagreement for five years after the balancing adjustment even<strong>to</strong>ccurred. The transferee must keep a copy for five years afterthe next balancing adjustment event that occurs for the asset.DEFINITIONSThe most commonly used UCA terms are explained here.A comparison of some of the UCA terms with those used inthe former depreciation rules is provided in the table below:Former depreciation rulesPlantOwnCostLuxury car limitIncome-producing useDepreciationUndeducted costUCADepreciating assetHoldFirst and second elementsof costCar limitTaxable purposeDecline in valueAdjustable valueAdjustable value: A <strong>depreciating</strong> asset’s adjustable value ata particular time is its cost (first and second elements) less anydecline in value up <strong>to</strong> that time.GUIDE TO DEPRECIATING ASSETS <strong>2013</strong> a<strong>to</strong>.gov.au 35