Capital Link Shipping Forum Analyst & Investor Day

Capital Link Shipping Forum Analyst & Investor Day

Capital Link Shipping Forum Analyst & Investor Day

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Greek <strong>Shipping</strong> a Global Leader<br />

A REVIEW OF THE GLOBAL SHIPPING MARKETS<br />

Despite the cyclical character of shipping, Greek shipowners have managed to<br />

survive in weak freight markets and turn losses into profits when markets<br />

improved. The global shipping and investment communities continue to look<br />

at the behavior of Greek shipowners during peaks and troughs, as they have<br />

been consistently able to prove their success in one of the most significant,<br />

difficult and unpredictable professions of the world.<br />

Greece, a country of about 11 million people, controls by far the biggest share,<br />

between 15% and 20%, of the world's shipping fleet in terms of carrying capacity<br />

measure in deadweight tonnage (dwt) making the country a top player in<br />

world trade. It controls 20.5% of the tanker fleet, 19.5% of the dry bulk fleet,<br />

13.5% chemical tankers, and 5.9% of containerships.<br />

After pouring $4.5 billion in 2009 buying 229 vessels, in 2010, Greek<br />

shipowners topped the global list ahead of the Chinese as the most aggressive<br />

buyers of second hand and newbuilding vessels. According to John Cotzias of<br />

N. Cotzias <strong>Shipping</strong> Consultants, until the end of April 2010, Greek shipowners<br />

committed to buy 98 vessels investing $2.6 billion, with the Chinese<br />

coming second with 111 vessels and $1.75 billion. This included 55 dry bulk<br />

vessels ($1.44 billion), 24 tankers ($919 million) and 14 containers ($260<br />

million).<br />

<strong>Shipping</strong> A Global Business<br />

The shipping sector is the second largest pillar of Greece’s 240 billion Euro<br />

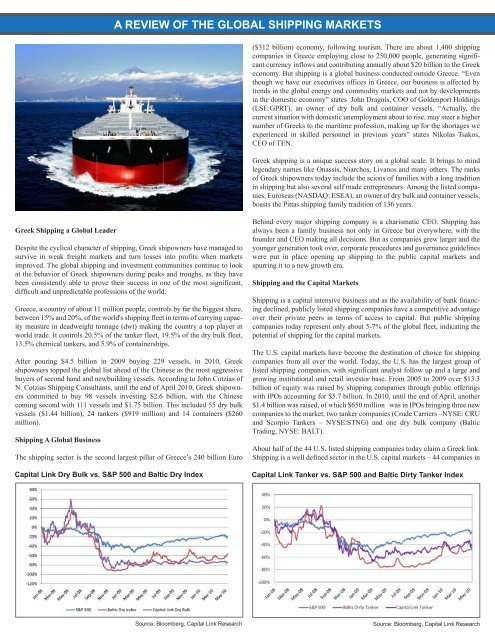

<strong>Capital</strong> <strong>Link</strong> Dry Bulk vs. S&P 500 and Baltic Dry Index<br />

Source: Bloomberg, <strong>Capital</strong> <strong>Link</strong> Research<br />

($312 billion) economy, following tourism. There are about 1,400 shipping<br />

companies in Greece employing close to 250,000 people, generating significant<br />

currency inflows and contributing annually about $20 billion to the Greek<br />

economy. But shipping is a global business conducted outside Greece. “Even<br />

though we have our executives offices in Greece, our business is affected by<br />

trends in the global energy and commodity markets and not by developments<br />

in the domestic economy” states John Dragnis, COO of Goldenport Holdings<br />

(LSE:GPRT), an owner of dry bulk and container vessels. “Actually, the<br />

current situation with domestic unemployment about to rise, may steer a higher<br />

number of Greeks to the maritime profession, making up for the shortages we<br />

experienced in skilled personnel in previous years” states Nikolas Tsakos,<br />

CEO of TEN.<br />

Greek shipping is a unique success story on a global scale. It brings to mind<br />

legendary names like Onassis, Niarchos, Livanos and many others. The ranks<br />

of Greek shipowners today include the scions of families with a long tradition<br />

in shipping but also several self made entrepreneurs. Among the listed companies,<br />

Euroseas (NASDAQ: ESEA), an owner of dry bulk and container vessels,<br />

boasts the Pittas shipping family tradition of 136 years.<br />

Behind every major shipping company is a charismatic CEO. <strong>Shipping</strong> has<br />

always been a family business not only in Greece but everywhere, with the<br />

founder and CEO making all decisions. But as companies grew larger and the<br />

younger generation took over, corporate procedures and governance guidelines<br />

were put in place opening up shipping to the public capital markets and<br />

spurring it to a new growth era.<br />

<strong>Shipping</strong> and the <strong>Capital</strong> Markets<br />

<strong>Shipping</strong> is a capital intensive business and as the availability of bank financing<br />

declined, publicly listed shipping companies have a competitive advantage<br />

over their private peers in terms of access to capital. But public shipping<br />

companies today represent only about 5-7% of the global fleet, indicating the<br />

potential of shipping for the capital markets.<br />

The U.S. capital markets have become the destination of choice for shipping<br />

companies from all over the world. Today, the U.S. has the largest group of<br />

listed shipping companies, with significant analyst follow up and a large and<br />

growing institutional and retail investor base. From 2005 to 2009 over $13.3<br />

billion of equity was raised by shipping companies through public offerings<br />

with IPOs accounting for $5.7 billion. In 2010, until the end of April, another<br />

$1.4 billion was raised, of which $650 million was in IPOs bringing three new<br />

companies to the market, two tanker companies (Crude Carriers –NYSE: CRU<br />

and Scorpio Tankers – NYSE:STNG) and one dry bulk company (Baltic<br />

Trading, NYSE: BALT).<br />

About half of the 44 U.S. listed shipping companies today claim a Greek link.<br />

<strong>Shipping</strong> is a well defined sector in the U.S. capital markets – 44 companies in<br />

<strong>Capital</strong> <strong>Link</strong> Tanker vs. S&P 500 and Baltic Dirty Tanker Index<br />

Source: Bloomberg, <strong>Capital</strong> <strong>Link</strong> Research