Certification of Trust Form - LPL Financial

Certification of Trust Form - LPL Financial

Certification of Trust Form - LPL Financial

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

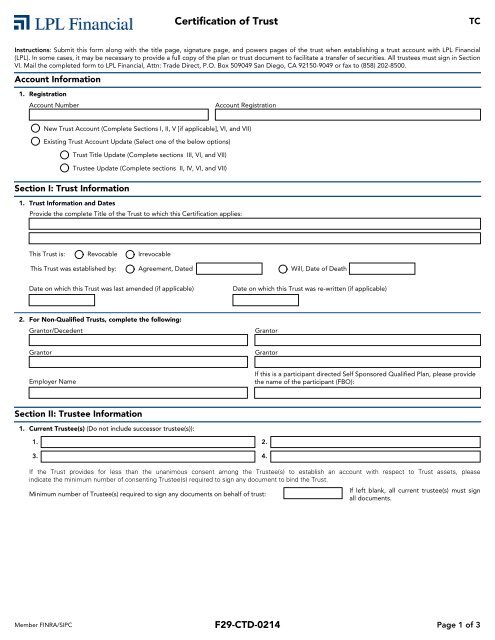

<strong>Certification</strong> <strong>of</strong> <strong>Trust</strong>TCInstructions: Submit this form along with the title page, signature page, and powers pages <strong>of</strong> the trust when establishing a trust account with <strong>LPL</strong> <strong>Financial</strong>(<strong>LPL</strong>). In some cases, it may be necessary to provide a full copy <strong>of</strong> the plan or trust document to facilitate a transfer <strong>of</strong> securities. All trustees must sign in SectionVI. Mail the completed form to <strong>LPL</strong> <strong>Financial</strong>, Attn: Trade Direct, P.O. Box 509049 San Diego, CA 92150-9049 or fax to (858) 202-8500.Account Information1.RegistrationAccount NumberAccount RegistrationNew <strong>Trust</strong> Account (Complete Sections I, II, V [if applicable], VI, and VII)Existing <strong>Trust</strong> Account Update (Select one <strong>of</strong> the below options)<strong>Trust</strong> Title Update (Complete sections III, VI, and VII)<strong>Trust</strong>ee Update (Complete sections II, IV, VI, and VII)Section I: <strong>Trust</strong> Information1.<strong>Trust</strong> Information and DatesProvide the complete Title <strong>of</strong> the <strong>Trust</strong> to which this <strong>Certification</strong> applies:This <strong>Trust</strong> is: Revocable IrrevocableThis <strong>Trust</strong> was established by:Agreement, DatedWill, Date <strong>of</strong> DeathDate on which this <strong>Trust</strong> was last amended (if applicable)Date on which this <strong>Trust</strong> was re-written (if applicable)2.For Non-Qualified <strong>Trust</strong>s, complete the following:Grantor/DecedentGrantorGrantorGrantorEmployer NameIf this is a participant directed Self Sponsored Qualified Plan, please providethe name <strong>of</strong> the participant (FBO):Section II: <strong>Trust</strong>ee Information1.Current <strong>Trust</strong>ee(s) (Do not include successor trustee(s)):1. 2.3. 4.If the <strong>Trust</strong> provides for less than the unanimous consent among the <strong>Trust</strong>ee(s) to establish an account with respect to <strong>Trust</strong> assets, pleaseindicate the minimum number <strong>of</strong> consenting <strong>Trust</strong>ee(s) required to sign any document to bind the <strong>Trust</strong>.If left blank, all current trustee(s) must signMinimum number <strong>of</strong> <strong>Trust</strong>ee(s) required to sign any documents on behalf <strong>of</strong> trust:all documents.Member FINRA/SIPCF29-CTD-0214Page 1 <strong>of</strong> 3

<strong>LPL</strong> Account NumberTCSection III: <strong>Trust</strong> Title Update1.Changing <strong>Trust</strong> Title / Plan NameChanging <strong>Trust</strong> Title/Plan Name Due to:New <strong>Trust</strong> Title/Plan Name:Amendment (Include copy <strong>of</strong> amendment)Court Order (Include copy <strong>of</strong> courtorder)Plan Minute Notes (Include copy <strong>of</strong> signed Planminute notes)Converting from Revocable to Irrevocable (Include copy<strong>of</strong> <strong>Trust</strong> amendment or other legal document to convertto irrevocable under the provisions <strong>of</strong> the <strong>Trust</strong>)Section IV: <strong>Trust</strong>ee Update1.<strong>Trust</strong>ee UdpateRemove a co-trustee without replacement due to:Death(Include copy <strong>of</strong> death certificate and instructions to remove trustee)Resignation(Include copy <strong>of</strong> resignation letter(s) or Plan meeting notes and instructions to remove trustee)Removal(Include copy <strong>of</strong> <strong>Trust</strong> amendments or Plan meeting notes and instructions to remove trustee)Incapacitation(Include copy <strong>of</strong> letter(s) <strong>of</strong> medical opinion or court order and instructions to remove trustee)Replace a trustee/co-trustee due to death(Include copy <strong>of</strong> death certificate and updated New Account <strong>Form</strong>/Confidential Client Pr<strong>of</strong>ile)Replace a trustee/co-trustee due to resignation(Include copy <strong>of</strong> resignation letter(s) or Plan meeting notes and updated New Account <strong>Form</strong>/Confidential Client Pr<strong>of</strong>ile)Replace a trustee/co-trustee due to incapacitation(Include copy <strong>of</strong> letter(s) <strong>of</strong> medical opinion or court order and updated New Account <strong>Form</strong>/Confidential Client Pr<strong>of</strong>ile)Replace a trustee/co-trustee due to other circumstances(Include copy <strong>of</strong> updated New Account <strong>Form</strong>/Confidential Client Pr<strong>of</strong>ile)Explanation (Provide copy <strong>of</strong> the supporting documentation):Section V: Beneficial Owner Information (Optional)1. Beneficial Owner InformationProvide the names <strong>of</strong> all beneficial owners <strong>of</strong> the <strong>Trust</strong> (if applicable).Beneficial OwnerDate <strong>of</strong> BirthBeneficial OwnerDate <strong>of</strong> BirthBeneficial OwnerDate <strong>of</strong> BirthBeneficial OwnerDate <strong>of</strong> BirthMember FINRA/SIPCF29-CTD-0214Page 2 <strong>of</strong> 3

<strong>LPL</strong> Account NumberTCSection VI: <strong>Certification</strong>1.<strong>Certification</strong> and <strong>Trust</strong>ee SignaturesTo: <strong>LPL</strong> <strong>Financial</strong> LLC, 4707 Executive Drive, San Diego, CA 92121I/We, the <strong>Trust</strong>ee(s), acknowledge that I/we have received and reviewed thoroughly all account documentation, agreements and riskdisclosure forms.I/We, the <strong>Trust</strong>ee(s), hereby certify that I/we have the power under the <strong>Trust</strong> and applicable law to (1) open all types <strong>of</strong> accounts, (2) invest,reinvest and enter into transactions, both purchases and sales, in all types <strong>of</strong> securities unless noted below, and (3) appoint <strong>LPL</strong> <strong>Financial</strong>LLC as Investment Adviser, pay the adviser reasonable compensation and give such adviser discretionary powers to invest <strong>Trust</strong>assets as agreed to in writing.Specify the types <strong>of</strong> securities not permitted in this <strong>Trust</strong>:I/We, the <strong>Trust</strong>ee(s), jointly and severally agree to indemnify and hold harmless <strong>LPL</strong> <strong>Financial</strong> LLC, its agents and employees fromany liability that may result from relying on this <strong>Certification</strong> when opening accounts or effecting transactions <strong>of</strong> the type specified above,pursuant to instructions given by any <strong>of</strong> the <strong>Trust</strong>ee(s) listed in Section II. This indemnification shall survive termination <strong>of</strong> the <strong>Trust</strong> or <strong>of</strong> the account(s).I/We, the <strong>Trust</strong>ee(s), agree at all times to retain the sole power to vote any corporate stock by proxy, to execute general or unrestricted proxies as to oneor more nominees, and to exercise any options or rights issued in connection with bonds or stocks as held as part <strong>of</strong> the <strong>Trust</strong> property unless otherwiseagreed in writing by all parties. I/We certify that if this is an account for a self-sponsored qualified retirement plan and the plan instructs the trustee todeliver all proxies to another party having investment authority or discretion, we have amended the client agreement to authorize the IAR to place tradeson a non-discretionary basis only by executing the Non-Discretionary Amendment to Client Agreement (form A1D). I/We certify that if this is an advisoryOptimum Market Portfolios (OMP) account for a self-sponsored qualified retirement plan, the plan does not instruct the trustee to deliver proxies to anyother party having investment authority or discretion.I/We certify that each Fiduciary <strong>of</strong> the Plan or <strong>Trust</strong> described herein, and each person who handles funds or other property <strong>of</strong> the Plan or<strong>Trust</strong>, shall be bonded as provided in ERISA Section 412 and the regulations thereunder. No further bonding shall be required other than asdescribed by ERISA Section 412.I/We, the <strong>Trust</strong>ee(s), certify that this <strong>Trust</strong> is still in full force and effect as <strong>of</strong> the date signed below.In consideration <strong>of</strong> your accepting one or more <strong>Trust</strong> accounts, the undersigned <strong>Trust</strong>ee(s), jointly and severally, warrant and agree that all<strong>of</strong> the information contained in this <strong>Certification</strong> is accurate and correctly details the terms <strong>of</strong> the <strong>Trust</strong> defined above. I/We further warrant and agree thatthis <strong>Certification</strong> shall remain in full force and effect until such time as you are notified in writing <strong>of</strong> any change in the information or authority containedherein. I/We hereby certify that the above information is correct and that the undersigned are all current <strong>Trust</strong>ees. I/We further certify that this <strong>Certification</strong>represents an amendment to the original <strong>Trust</strong> document or that we have taken all actions necessary to so amend the original <strong>Trust</strong> document to conformwith this <strong>Certification</strong>.Note: All current trustees must sign this document.<strong>Trust</strong>ee's Signature Date <strong>Trust</strong>ee's Signature Date<strong>Trust</strong>ee's Signature Date <strong>Trust</strong>ee's Signature DateMember FINRA/SIPCF29-CTD-0214Page 3 <strong>of</strong> 3